Finra Sanctions Securities Firms for Withholding UIT Discounts

October 20 2015 - 12:10PM

Dow Jones News

Wall Street's watchdog firm said Tuesday that it settled charges

against a dozen brokerage firms, alleging the firms withheld fee

discounts that customers were entitled to in connection to the

purchase of unit investment trusts.

The Financial Industry Regulatory Authority said it ordered the

firms to pay restitution of more than $4 million and $2.6 million

in fines linked to the sale of the securities, also known as UITs,

which are fixed portfolios of investments as opposed to actively

managed funds.

Among the firms sanctioned were the securities divisions of

Fifth Third Bancorp, MetLife Inc., Comerica Inc. and Huntington

Bancshares Inc.

As part of the settlement, the firms didn't admit or deny fault,

Finra said in a news release announcing the settlement.

"Firms need to ensure that their registered representatives are

providing customers the sales charge discounts to which they are

entitled," said Brad Bennett, Finra's chief of enforcement.

"The firms sanctioned today failed to provide these discounts,

resulting in customer harm in the form of higher costs for which

customers have been or will be reimbursed."

These fixed portfolios usually have low minimums and liquidate

at a mandatory date.

Because UITs aren't actively managed, their annual operating

expenses are low, but they also carry upfront sales charges,

deferred sales charges, creation and development fees, and

organization cost fees.

When one UIT liquidates and an investor rolls assets into

another UIT, a new, though generally reduced, sales charge applies.

Besides these "rollover and exchange," discounts, brokers also

offer "breakpoint" discounts that increase with the size of the

investment.

In March 2004, Finra issued a regulatory notice reminding

brokers that they should implement policies to ensure customers

receive appropriate sales charge discounts for UITs.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 20, 2015 11:55 ET (15:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

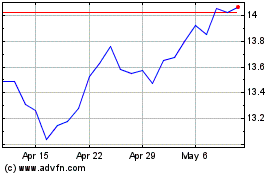

Huntington Bancshares (NASDAQ:HBAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

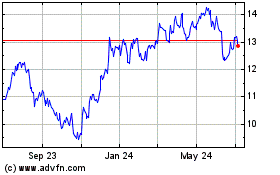

Huntington Bancshares (NASDAQ:HBAN)

Historical Stock Chart

From Apr 2023 to Apr 2024