Pierre & Vacances: Growth in Turnover During 2014/2015

October 15 2015 - 11:40AM

Business Wire

Regulatory News:

Pierre & Vacances (Paris:VAC):

1] Turnover

The turnover and financial figures communicated below stem from

operating reporting with the presentation of joint ventures under

proportional integration.

Euro millions 2014/2015

2013/2014 Evolutions

Evolutions excluding

stock effects (*)

Tourism 431.6 409.1

+5.5% - Pierre & Vacances Tourisme Europe 223.4

224.0 -0.2% - Center Parcs Europe 208.2 185.1 +12.5%

o/w

accommodation turnover 289.9 278.1 +4.2%

+3.4% - Pierre & Vacances Tourisme Europe 151.6 153.9

-1.5% +3.6% - Center Parcs Europe 138.3 124.2

+11.4% +3.1%

Property Development 39.2

112.5 -65.1%

Total Q4 470.8

521.5 -9.7% Tourism 1,180.7

1,141.1 +3.5% - Pierre & Vacances Tourisme Europe

594.5 590.4 +0.7% - Center Parcs Europe 586.2 550.7 +6.4%

o/w

accommodation turnover 779.9 763.0 +2.2%

+3.2% - Pierre & Vacances Tourisme Europe 401.6 405.9

-1.1% +3.4% - Center Parcs Europe 378.3 357.1

+5.9% +3.0%

Property Development 255.6

274.4 -6.8%

Total FY 1,436.3 1,415.4

+1.5%

* Pierre & Vacances Tourisme Europe: a net reduction in the

assets operated following withdrawals from loss-making sites

(Adagio Access residences and seaside resorts in particular) and

the non-renewal of leases (seaside locations primarily in Q4).

Center Parcs Europe: growth in network operated prompted by the

opening on 29 June 2015 of the new Domaine des Bois aux Daims in

the Vienne department.

In IFRS accounting:

- Q4 2014/2015 turnover stood at €451.9

million (€424.2 million for the tourism businesses and €27.7

million for property development) compared with €509.2 million in

Q4 2013/2014 (€405.2 million for tourism and €104.0 million for

property development).

- Full-year 2014/2015 turnover totalled

€1,382.5 million (€1,155.7 million for the tourism businesses and

€226.7 million for property development) compared with €1,378.5

million in 2013/2014 (€1,121.3 million for tourism and €257.2

million for property development).

- Tourism turnover

Q4 2014/2015:

Turnover from the tourism businesses rose 5.5%

compared with the year-earlier period to stand at €431.6

million.

Accommodation turnover came in at €289.9 million, showing

an increase of 4.2% (+3.4% adjusted for supply effects),

higher than the nine-month performance. Business during the summer

was boosted by a clear increase in average letting rates in all

destinations and an average occupancy rate of more than 82%.

- Pierre & Vacances Tourisme Europe

contributed €151.6 million to accommodation turnover, showing a

3.6% same-structure increase and an improvement on the trend noted

over the previous three quarters (+3.2% overall increase).The

increase in turnover was primarily driven by healthy performances

from seaside destinations (+6.0%), on the back of both higher net

average letting rates (+4.0%) and occupancy rates (+2.0%). These

performances stemmed especially from momentum in web sales both in

and outside France and reflected the efficiency of the price

animation policy rolled out over the summer.

- Center Parcs Europe contributed €138.3

million, representing growth of +3.1% excluding the impact of the

newly opened Domaine des Bois aux Daims, the commercial success of

which was also confirmed by an occupancy rate of more than 88% over

the summer period.Q4 performances at the domains remained on the

same trends as those already posted over the first nine months of

the year (+3%), with turnover growth of 4.2% at the domains in

Germany, the Netherlands and Belgium and a slight increase in the

French domains.

Supplementary income rose by 8.2%, driven by the success

of marketing mandates, primarily in Spain.

Over 2014/2015:

Turnover from the tourism businesses totalled €1,180.7 million,

up 3.5% relative to the previous year.

Accommodation turnover rose by 2.2%, stemming primarily

from an increase in average letting rates (+2.7%). Adjusted for

supply effects, turnover growth worked out to 3.2%, driven by

better business in all destinations: +5% at seaside resorts, +3% at

mountain resorts and at the Center Parcs domains and +2% at city

residences.International clients represented 55% of the group's

accommodation turnover and sales generated by these clients were

2.7% ahead of the previous year's level.

- Property development

turnover

Q4 2014/2015 property development turnover stood at €39.2

million, primarily in view of contributions from Villages Nature

(€9.7 million), Center Parcs in the Vienne (€2.5 million), the

Premium residence in Flaine (€2.5 million) and Les Seniorales

(€15.1 million).

Full-year 2014/2015 turnover totalled €255.6 million,

close to the €274.4 million reported in 2013/2014.

Property reservations to date with individual and

institutional investors represent turnover of €327 million, vs.

€291 million in the previous year.

2] Outlook

The portfolio of reservations to date for Q1 2015/2016 confirms

ongoing growth in the tourism businesses at both Pierre &

Vacances Tourisme Europe, with an increase in all destinations, and

at Center Parcs Europe (even excluding the impact of the new

Domaine des Bois aux Daims).

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151015006025/en/

Pierre & VacancesInvestor Relations and Strategic

OperationsEmeline Lauté, +33 (0) 1 58 21 54

76infofin@fr.groupepvcp.comorPress RelationsValérie

Lauthier, +33 (0) 1 58 21 54

61valerie.lauthier@fr.groupepvcp.com

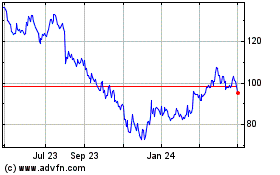

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

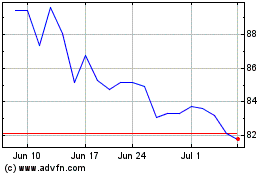

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Apr 2023 to Apr 2024