UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

| [X] |

ANNUAL REPORT

UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

|

| |

For

the fiscal year ended June 30, 2015 |

| |

|

| [ ] |

TRANSITION REPORT

UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT |

| |

|

| |

For

the transition period from _________ to ________ |

| |

|

| |

Commission

file number: 000-55155 |

| Nano

Mobile Healthcare, Inc. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

93-0659770 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification No.) |

| |

|

|

3

Columbus Circle, 15th Floor

New

York, NY |

|

10019 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number: (713) 973-5738

| Securities

registered under Section 12(b) of the Exchange Act: |

| |

| Title

of each class |

|

Name

of each exchange on which registered |

| None |

|

not

applicable |

| |

| Securities

registered under Section 12(g) of the Exchange Act: |

| Title

of each class |

|

|

| Common

Stock, par value of $0.001 |

|

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ]

No [X]

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ]

No [X]

Indicate

by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No

[ ]

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

Large

accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company

[X]

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ]

No [X]

State

the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price

at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day

of the registrant’s most recently completed second fiscal quarter. $406,366

Indicate

the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

162,546,331 shares of common stock as of September 21, 2015

TABLE

OF CONTENTS

PART

I

Item

1. Business

Company

Overview

We

were incorporated in the State of Nevada on April 21, 2010. We were initially in the business of becoming a pharmaceutical manufacturer

with the specific intention of bidding on South African government health care contracts and tenders. We abandoned that business

plan when, on November 7, 2013, Nanobeak, LLC, a Delaware limited liability company (formerly Nanobeak, Inc., a California corporation)

(“Nanobeak”) acquired a majority interest in our company through the stock purchase of a controlling interest in our

company from Bayview Terrace Limited.

Since

the change of control, we have implemented a new business plan. On January 1, 2014, Nanobeak entered into a License Agreement

(the “License Agreement”) with the National Aeronautics and Space Administration (“NASA”) pursuant to

which Nanobeak was granted a royalty-bearing, non-transferable license (the “License”) to certain inventions and patent

rights owned by NASA relating to chemical sensing nanotechnology, for use within the United States and its territories.

The

License is effective as of December 31, 2013 and subject to an initial five year term, during which the License will be exclusive

to Nanobeak. Following the initial five-year term, the License shall automatically convert to a non-exclusive license. Under the

License, Nanobeak is required to develop and commercialize the licensed patents. NASA provided no warranties under the License

Agreement and assumed no responsibility for our use, sale or other disposition of the licensed technology. Nanobeak has agreed

to indemnify NASA against all liabilities arising from such use, sale or other disposition.

Pursuant

to Section 3.1.1 of the License Agreement, Nanobeak is permitted to sublicense its rights under the License Agreement to subcontractors.

Effective as of February 20, 2014, Nanobeak has sublicensed such rights to us as set forth in a Sublicense Agreement.

The

Sublicense Agreement grants patent rights to us on the same terms as such rights have been granted to Nanobeak under the License

Agreement; provided, however, that the field of use for the patent rights granted to us is limited to disease detection.

We

must pay to Nanobeak certain royalties in connection with the Sublicense Agreement, which royalties are equivalent to those owed

by Nanobeak to NASA pursuant to the License Agreement. We must further comply with other obligations of Nanobeak under the License

Agreement as though we were a party thereto, including achievement of practical application of the patent rights and certain reporting

obligations.

The

Sublicense Agreement will terminate upon the earlier of (i) termination of the License Agreement or (ii) termination by either

party to the Sublicense Agreement as set forth therein.

As

a result of the License Agreement and Sublicense Agreement, we are now a mobile health technology company that is developing personalized

and point-of-care screening using applications based upon chemical sensing methods.

We

have been developing a low cost point-of-care screening device that will detect and analyze common components from human breath

and provide an early indication of chronic diseases such as heart failure and various forms of cancer, as well as contagious diseases

such as strep throat. The principles of operation are driven by technology developed by NASA. The sensor can connect via Bluetooth

to any capable smart device running an iOS or Android operating system. Development efforts on the sensor were concluded and the

device is now in a clinical environment. The final development stage for the healthcare sensor will be formal clinical trials

and ultimately to obtain FDA approval.

The

current Breathalyzer has a small footprint and can easily be operated by anyone with minimal instruction. State-of-the art engineering

design techniques, advanced nanotechnology, and bio-informatics have been combined to create the following three main pieces of

the device that is now being used to collect sample data from test patients for certain key biomarkers in a clinical setting:

| 1. | Breath

Capture Device – This component of the device attaches to the sensor module,

captures breath from patient’s mouth, pre-filters the breath, and sends it to the

sensor module at a controlled flow rate. Recent design improvements to the Breath Capture

Device include the capability to simultaneously monitor respiratory rate, lung function,

heart rate, and core body temperature. Iterations of the current design, which were optimized,

using CAD (computer-aided design) and flow simulation tools, will soon be manufactured

and tested using rapid prototyping techniques (3D printing). |

| | | |

| 2. | Sensor

Module – This component of the device contains an array filled with dozens

of micro-fabricated nanomaterial-based chemical sensors, device hardware, and a battery

pack. Each of these individual sensors is coated with specially formulated sensing materials

that will show high sensitivity and specificity towards detecting biomarkers known by

medical experts to be associated with particular diseases. Thus, the device will be used

to simultaneously quantify levels of critical biomarkers exhaled by patients, record

other medically relevant patient data (respiratory rate, core body temperature, and heart

rate), and document experimentally relevant conditions (humidity, temperature, and pressure).

Patient data collected by the Sensor Module will be sent to an iOS or Android smart device

via Bluetooth, where it is collected, further processed, compared to an existing data

library, and analyzed by our iOS/Android app. Design challenges that previously delayed

critical milestones have been solved. Sensor Modules have been delivered to clinical

researchers and preliminary data is being collected and analyzed. This data will be used

to calibrate the device and quantify specific VOC’s known to be associated with

the disease conditions that will be targeted first. |

| | | |

| 3. | App/Software

for the Smart Devices – This essential component of the device communicates

with smart devices using a proprietary iOS/Android app, is used to interpret and present

the results collected by the Sensor Module, and can easily be updated as the medical

team collects more sample calibration data. It can also be calibrated to detect other

diseases when sample data for those are collected. Each time a test is run on the breath

capture device, data received by the app will be seamlessly pre-processed and post-processed

through the algorithm and in nearly real-time a conclusive summary result will be provided

on the device and/or sent/shared with Physicians via phone or Internet connections. |

The

sensor and related devices will ultimately be used to demonstrate an integrated approach that can be used to collect data from

human breath and evaluate it for early disease screening purposes, effectively linking experts in the field, data scientists,

and decision makers with results generated in real-time.

We

have entered into a Strategic Partnership with Scripps Translational Sciences Institute (STSI) to assist in the development, advancement,

and commercialization of the mobile technology. Scripps will also provide the testing, evaluation, and detection of certain combinations

of Volatile Organic Compounds (VOCs) known as the breath signature and will assist in managing our clinical trials in partnership

with several other research hospitals in the United States. These clinical trials will support the 510K that will be submitted

to the FDA. It is expected that the contemplated clinical trials will take approximately four months with another four months

expected for the 510K process within the FDA. We have not yet started the clinical trials. The clinical trials can cost as much

as $5,000,000. We will first have to raise the money to commence the trials.

We

have also entered into a Strategic Partnership with Theranostics Laboratory, a translational research company, with offices in

the USA and New Zealand. Theranostics laboratory was founded at the Cleveland Clinic in 2010 and works on subcontracted research,

in collaboration with the Auckland Bioengineering Institute (ABI), in New Zealand, and with NASA (via NASA Grant NCC 9-58).

The Auckland Bioengineering Institute is recognized

as a world-leader in the field of personalized modeling and is part of the international Virtual Physiologic Human (VPH) project.

The Institute has successfully commercialized numerous mHealth technologies, including wireless telemetry systems, wearable sensors

and a needle-free injectable system into the US market.

The partnership between the Theranostics laboratory

and the Auckland Bioengineering Institute (ABI) is a strategic alliance for us through which the lab will act as principal investigators

for us in the areas of mobile strep detection, mobile virus detection and other related areas including breath sample conditioning

methodologies. The partnership gives us access to world-class expertise and skill in the field of personalized modeling. It also

provides us with cost-efficiencies working across multiple time zones, as well as insight into the Australasian MedTech market.

We have decided to work in conjunction with

our majority shareholder, Nanobeak and NASA, to develop a mobile app to be used in connection with our sensor that will enable

law enforcement to screen for marijuana use and deliver in-the-moment results to the officer’s smartphone, tablet or laptop

in the field. We will not be distracted from our current efforts and resources in continuing to develop early lung cancer detection

and detection for other diseases. The ability to go-to-market will be much faster than the process required for obtaining FDA

approval for our lung cancer screening technology because the marijuana detection sensor for use by law enforcement will be exempt

from the FDA approval process. With our President’s background and relationships, we believe we have an advantage when entering

the law enforcement market with this product.

Regulatory

Approval

Our

products and research and development activities are regulated by numerous governmental authorities, principally the U.S Food

and Drug Administration, or FDA, and corresponding state and foreign regulatory agencies. Any device manufactured or distributed

by us is subject to continuing regulation by the FDA. The Food, Drug and Cosmetics Act, or FDC Act, and other federal and state

laws and regulations govern the clinical testing, design, manufacture, use and promotion of medical devices, such as our chemical

sensor technology.

In

the United States, medical devices are classified into three different classes, Class I, II and III, on the basis of controls

deemed reasonably necessary to ensure the safety and effectiveness of the device. Class I devices are subject to general controls,

such as labeling, pre-market notification and adherence to the FDA’s good manufacturing practices, and quality system regulations.

Class II devices are subject to general as well as special controls, such as performance standards, post-market surveillance,

patient registries and FDA guidelines. Class III devices are those that must receive pre-market approval by the FDA to ensure

their safety and effectiveness, such as life-sustaining, life-supporting and implantable devices, or new devices that have been

found not to be substantially equivalent to existing legally marketed devices. All of our currently available products are classified

as Class II devices.

In

the US, our products will require the filing and approval of Form 510K with the FDA. This filing provides evidence for substantial

equivalence of the medical device with a previously approved device manufactured by another firm. We plan to conduct clinical

trials and then submit the Form 510K. Also, we must contract with a manufacturer that is a capable Class II Medical Device manufacturer

and will pass GMP inspections by the agency. Such inspections require compliance with cGMP (current good manufacturing) guidelines

that stipulate control of traceable manufacturing procedures, including independence of manufacturing and quality control as well

as several other provisions.

We have been in discussions with manufacturers

in the United States and China, but have not as yet come to a definitive agreement.

Competition

Disease

Screening

Following years of research, a number of companies

are now in prototype phase with devices that can test the chemical compounds in a person’s breath and identify the early

stages of disease. Entry to this market is expected to continue and sharply rise as more prototypes emerge and begin to gain market

entry with commercialized products. While companies in development tend to be small and privately owned, there has been entry

by larger publicly owned companies that have greater financial reserves, distribution channels and more experience in commercialization.

Acquisitions and collaborations by and companies seeking a competitive advantage also affect the competitive environment. This

is a global market and we are seeing the emergence of companies bringing competitive solutions from different parts of the world.

So far, we do not have a completed product or an established customer base and we expect to encounter competition as we enter

the market.

To

management’s knowledge, technology similar to our technology is currently in development by other potential competitors.

Management believes that our product will be sufficiently distinguishable from these products in terms of price and platforms

of use such as any smartphone or tablet. The sensor and the app will need FDA approval when used for disease screening and there

is no assurance at this time that the FDA will approve our technology.

Many

competitors in the breath analysis space are focused on everything from bad breath and alcohol screening to finding volatile organic

compounds in the human breath that can screen a disease state at an early stage. Some of the companies focused on disease screening

have been born from years of research testing the various volatile organic compounds in a human breath exhalation that combine

to identify a specific disease. Larger competitors are traditional medical device manufacturers that have disease detection products

in production. Some of these products use blood and others use heat and other technologies.

New

competitors may emerge and may develop products and capabilities which compete directly with our products. No assurance can be

given that we will be successful in competing in the industries identified or in other industries that would benefit from our

technology.

We

intend to compete by offering products that have enhanced value, ease of use, simple functionality, compatibility with various

platforms, reliability, attractive price and high in quality. Management also believes our intellectual property provides an advantage

over current competitors however we cannot be sure that there is not intellectual property that is more advanced than ours. Although

management believes that our products will be well received because of their innovative features, performance characteristics

and cost-effective pricing, there can be no assurance that comparable or superior products incorporating more advanced technology

or other features or having better price or performance characteristics will not be introduced by competitors with greater resources

than ours.

We

also plan to develop the wholesale and distribution channels necessary to make our product available to the healthcare providers

of our technology. We believe that our product’s future capability as both a point of care and a personalized device focused

on early disease screening and monitoring will make it attractive to customers in the managed care space. Health plans, whose

charge is to financially manage the relationship between available benefits and those that execute on the health and wellness

of the patient population, will appreciate some of the more flexible features our product intends to incorporate.

The

end users of the sensor and mobile app will initially be health care providers such as medical doctors, nurse practitioners and

physician assistants. As stated above, we plan to ask the FDA for approval to market our device to the consumer as well as healthcare

providers. We have no assurance that the FDA will approve the sensor.

Narcotics

Screening

There

are currently a variety of breathalyzer smartphone apps which essentially focus on alcohol detection. Our plan is to develop an

app that can be used with any smartphone or tablet that will distinguish between alcohol and narcotics and screen for a variety

of narcotics both legal and illicit.

Making

up the narcotic detection space are both domestic and international organizations that range from small, privately held companies

to larger companies that include an array of diagnostic narcotics solutions. Fewer are those companies focusing on mobile narcotics

detection with devices currently obtainable. Company scale and size of each competitor appears to be mirrored in the range of

price points available.

Although

this market is more developed than disease detection, the space is dominated by a few key players making the possibility for new

entrants feasible. Because toxicology screens are the most common type of narcotics testing products on the market, we believe

that advanced technology that both detects and monitors discrete drug levels in an individual’s system through exhalation

will cause this market to expand. The consumer market for mobile applications which provide detection and ongoing monitoring capabilities

is anticipated to be significant.

So

far, we do not have a completed product or an established customer base and we expect to encounter a high degree of competition

as we enter the market. Management believes that our product will be sufficiently distinguishable from these products in terms

of price, functionality, ease of use and dependability.

New

competitors may emerge and may develop products and capabilities which compete directly with our products. No assurance can be

given that we will be successful in competing in this market space.

We

intend to compete by offering products that have enhanced value, ease of use, simple functionality, compatibility with various

platforms, reliability, attractive price and high in quality. Management also believes our intellectual property provides an advantage

over current competitors however we cannot be sure that there is not intellectual property that is more advanced than ours. Although

management believes that our products will be well received because of their innovative features, performance characteristics

and cost-effective pricing, there can be no assurance that comparable or superior products incorporating more advanced technology

or other features or having better price or performance characteristics will not be introduced by competitors with greater resources

than ours.

Customers

for our product will include the different areas of law enforcement as well as the different areas of professional and amateur

sports. Corporations are also a target area for the narcotics screening technology.

Employees

As of the date of this filing we have 18 employees

and consultants, both full and part time, several of which are shared with NASA. Our employees are not presently covered by any

collective bargaining agreement. We have not experienced any work stoppages and believe that our relations with our employees

are good.

Item

2. Properties

We neither

own nor lease any real or personal property. We maintain our offices at 3 Columbus Circle, 15th Floor New York, NY 10019. The

property has a six month lease agreement ending on June 30, 2015. Under the terms of the lease we pay a fixed fee of $8,795 per

month and the lease automatically renews for a six -month terms upon expiration, with the fixed fee increased by 5%. Future lease

payments related to our office leases as of June 30, 2015 are as follows:

| 2015 | | |

$ | 55,409 | |

| Total | | |

$ | 55,409 | |

Item

3. Legal Proceedings

From

time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business.

However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time

to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have,

individually or in the aggregate, a material adverse effect on our business, consolidated financial condition, or operating results.

Item

4. Mine Safety Disclosures

N/A

PART

II

Item

5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market

Information

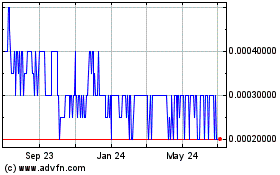

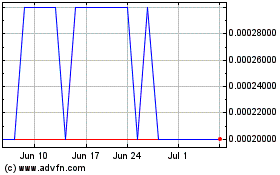

Our

common stock is quoted under the symbol “VNTH” on the OTCQB operated by OTC Markets Group, Inc. Only a limited market

exists for our securities. There is no assurance that a regular trading market will develop, or if developed, that it will be

sustained. Therefore, a shareholder may be unable to resell his securities in our company.

The

following table sets forth the range of high and low bid quotations for our common stock for each of the periods indicated as

reported by the OTCQB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not

necessarily represent actual transactions.

| Fiscal Year Ending June 30, 2015 |

| Quarter Ended | |

High $ | | |

Low $ | |

| June 30, 2015 | |

| .05 | | |

| .019 | |

| March 31, 2015 | |

| .052 | | |

| .0284 | |

| December 31, 2014 | |

| .155 | | |

| .0345 | |

| September 30, 2014 | |

| .2501 | | |

| .055 | |

| Fiscal Year Ending June 30, 2014 |

| Quarter Ended | |

High $ | | |

Low $ | |

| June 30, 2014 | |

| .272 | | |

| .06 | |

| March 31, 2014 | |

| .1401 | | |

| .0603 | |

| December 31, 2013 | |

| .055 | | |

| .0023 | |

| September 30, 2013 | |

| .0086 | | |

| .003 | |

On

September 21, 2015 the last sales price per share of our common stock on the OTCQB was $0.0025.

Penny

Stock

The

SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are

generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities

exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such

securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny

stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature

and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of

the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect

to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description

of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price;

(d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure

document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including

language, type size and format, as the SEC shall require by rule or regulation.

The

broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations

for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares

to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for

such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer’s account.

In

addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the

broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive

the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions

involving penny stocks, and a signed and dated copy of a written suitability statement.

These

disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may

have difficulty selling our securities.

Holders

of Our Common Stock

As

of September 21, 2015, we had 162,546,331 shares of our common stock issued and outstanding, held by sixty-eight (68) shareholders

of record, with others holding shares in street name.

Dividends

There

are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Delaware Revised

Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

| |

1. |

we

would not be able to pay our debts as they become due in the usual course of business, or; |

| |

|

|

| |

2. |

our

total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights

of shareholders who have preferential rights superior to those receiving the distribution. |

We

have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Securities

Authorized for Issuance under Equity Compensation Plans

We

do not have any equity compensation plans.

Unregistered

Sales of Equity Securities

On August 25, 2014, we issued 2,586,206 common

shares for the conversion of Nanobeak, LLC’s (“Nanobeak”) common shares of stock when Nanobeak exercised its

stock warrant and converted its holdings into our common stock in a cashless transaction.

On

August 25, 2015, we entered into an exchange agreement (the “Exchange Agreement”) with Nanobeak, pursuant to which

Nanobeak exchanged 117,366,840 shares of our common stock in exchange for 23,473,368 shares of our Series A Convertible Preferred

Stock.

During the year ended June 30, 2015, we issued

3,683,532 shares of common stock with a conversion price of $71,875 for the conversion of a $71,875 note payable.

During the year ended June 30, 2015, we issued

3,711,969 shares of common stock with a conversion price of $116,943 for the conversion of an $116,943 note payable.

During the year ended June 30, 2015, we issued

1,666,666 shares of common stock with a conversion price of $25,000 for the partial conversion of a note payable issued on May

6, 2014.

During the year ended June 30, 2015, we issued

540,428 shares of common stock for services with a fair value of $21,077.

During the year ended June 30, 2015, we issued

4,616,840 shares of common stock for the settlement of related party debt with a fair value of $461,684.

During the year ended June 30, 2015, we issued

500,000 shares of common stock for services with a fair value of $20,500.

During the year ended June 30, 2015, we issued 1,000,000 shares

of common stock for services with a fair value of $42,600.

During the year ended June 30, 2015, we issued

3,276,915 shares of common stock with a conversion price of $34,827 for the partial conversion of a note payable issued on May

6, 2014.

On

February 27, 2015, we issued 6,000,000 common shares for the conversion of Nanobeak’s common shares of stock when Nanobeak

exercised their stock warrant and converted their holdings into our common stock in a cashless transaction.

On

May 4, 2015, we issued 2,520,307 common shares for the conversion of Nanobeak’s common shares of stock when Nanobeak exercised

their stock warrant and converted their holdings into our common stock in a cashless transaction.

During

the year ended June 30, 2015, we issued 3,789,297 shares of common stock with a conversion price of $56,000 for the partial conversion

of a note payable issued on October 1, 2014.

During

the year ended June 30, 2015, we issued 4,404,515 shares of common stock with a conversion price of $35,000 for the partial conversion

of a note payable issued on November 17, 2014.

On

July 1, 2014, we granted stock warrants for 200,000 shares of common stock for services, which vested immediately. These warrants

had an expiration date of July 1, 2019 and an exercise price is $0.12495/share.

On

July 15, 2014, we granted stock warrants for 291,494 shares of common stock in association with a long-term loan at no cost to

the lender. These warrants have an expiration date of July 15, 2019, and an exercise price of $0.0143/share.

On

October 1, 2014 we granted stock warrants for 320,122 shares of common stock in association with a short-term loan at no cost

to the lender. These warrants have a term of five years, and an exercise price of $0.123/share.

On

November 17, 2014, we granted stock warrants for 807,692 shares of common stock in association with a long-term loan at no cost

to the lender. These warrants have a term of five years, and an exercise price of $0.049/share.

On

December 23, 2014, we granted stock warrants for 1,158,940 shares of common stock in association with a long-term loan at no cost

to the lender. These warrants have a term of five years, and an exercise price of $0.034/share.

On

January 15, 2015, we granted stock warrants for 8,000,000 shares of common stock for services, which vested immediately. These

warrants had an expiration date of January 15, 2020, and an exercise price of $0.05/share.

On

April 15, 2015, we granted stock warrants for 1,185,102 shares of common stock in association with a short-term loan at no cost

to the lender. These warrants have a term of five years, and an exercise price of $0.017/share.

On

June 7, 2015, we granted stock warrants for 2,187,500 shares of common stock in association with a short-term loan at no cost

to the lender. These warrants have a term of five years, and an exercise price of $0.009/share.

On

June 19, 2015, we granted stock warrants for 1,125,000 shares of common stock in association with a short-term loan at no cost

to the lender. These warrants have a term of five years, and an exercise price of $0.009/share.

On

June 28, 2015, we granted stock warrants for 5,357,143 shares of common stock in association with a long-term loan at no cost

to the lender. These warrants have a term of five years, and an exercise price of $0.008/share.

These

securities were issued pursuant to Section 4(2) of the Securities Act and/or Rule 506 promulgated thereunder. The holders represented

their intention to acquire the securities for investment only and not with a view towards distribution. The investors were given

adequate information about us to make an informed investment decision. We did not engage in any general solicitation or advertising.

We directed our transfer agent to issue the stock certificates with the appropriate restrictive legend affixed to the restricted

stock.

Item

6. Selected Financial Data

A

smaller reporting company is not required to provide the information required by this Item.

Item

7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking

Statements

Certain

statements, other than purely historical information, including estimates, projections, statements relating to our business plans,

objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the

words “believes,” “project,” “expects,” “anticipates,” “estimates,”

“intends,” “strategy,” “plan,” “may,” “will,” “would,”

“will be,” “will continue,” “will likely result,” and similar expressions. We intend such

forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those safe-harbor provisions.

Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which

may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual

effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations

and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory

changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties

should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information,

future events or otherwise. Further information concerning our business, including additional factors that could materially affect

our financial results, is included herein and in our other filings with the SEC.

Results

of Operations for the years ended June 30, 2015 and 2014

Revenues

We

have not generated revenues since our inception. We do not expect to earn any revenues until we complete our technology and bring

it to market.

Operating

Expenses

Operating expenses decreased to $2,458,154

for the year ended June 30, 2015 from $6,629,026 for the year ended June 30, 2014. Our operating expenses for the year ended June

30, 2015 consisted mainly of consulting expenses of $913,180, general and administrative expenses of $443,982, professional fees

in the amount of $475,855, warrant compensation to our officers and directors of $321,669, royalty expenses of $133,684 and officer

and director compensation of $85,607. In comparison, our operating expenses for the year ended June 30, 2014 consisted mainly

of other compensation of $4,298,750, consulting expenses of $570,099, other consulting fees of $342,326, office expenses/ salaries

and wages of $186,923, officer and director compensation of $107,057, professional fees of $176,935, royalty expense of $854,251,

and travel and entertainment of $92,594.

We had $3,977,081 less in warrant compensation

to officers and directors in 2015 than in 2014. This along with less spend in royalties was the main reason for our decrease in

operating expenses. For 2016, we anticipate our operating expenses will increase over 2015 as we undertake our plan of operations.

The increase will be attributable to administrative and operating costs associated with developing and commercializing our technology

and our continued reporting obligations with the Securities and Exchange Commission.

Other

Income/Expenses

Other

income was $4,090,344 for the year ended June 30, 2015, as compared with other expenses of $1,003,966 for the year ended June

30, 2014. Other income in 2015 was mainly attributable to a gain in the change in fair value due to derivative warrant liability

of $4,775,161, offset mainly by interest expense of $665,217. Other expenses in 2014 were mainly attributable to interest expenses

of $315,036, derivative loss of $418,930, equity swap loss of $230,000, and unrealized loss on investment of $40,000 incurred

in the year ended June 30, 2014.

Net

Income

We

incurred net income of $1,632,190 for the year ended June 30, 2015, compared to a net loss of $7,910,903 for the year ended June

30, 2014.

Liquidity

and Capital Resources

As

of June 30, 2015, we had total current assets of $291,623, consisting of cash and prepaid expenses. We had current liabilities

of $3,603,189 as of June 30, 2015. Accordingly, we had negative working capital of $3,311,566 as of June 30, 2015.

Operating

activities used $1,807,072 in cash for year ended June 30, 2015, as compared with $2,718,714 for the year ended June 30, 2014.

Our negative operating cash flow for the year ended June 30, 2015 was mainly attributable to a derivative gain, offset mainly

by our net income, the amortization of derivative debt discount, warrants issued for services and gain in prepaid expenses and

accounts payable and accrued expenses.

Investing

activities used $12,149 in cash for the year ended June 30, 2015 associated with the purchase of fixed assets, as compared with

no cash used in investing activities for the year ended June 30, 2014.

Financing

activities for the year ended June 30, 2015 provided $1,834,134 in cash, as compared with cash flows provided by financing activities

of $2,631,260 for the year ended June 30, 2014. Our positive cash flow for the year ended June 30, 2015 was mainly the result

of proceeds from related party debt and convertible notes offset by payments on related party debt.

On

April 18, 2014, we issued a convertible promissory note in which we will be taking tranche payments on pre-defined dates, the

total of these payments cannot exceed $650,000. There is an original discount component of 10% per tranche and an additional expense

fee of $5,000. Therefore, the funds available to us will be $650,000 and the liability (net of interest) will be $750,000 when

we have received all disbursements. Each tranche is accounted for separately with each principal and OID balance becoming due

18 months after receipt. Each tranche bears interest at 8% per annum. The loan is secured by shares of our common stock. Each

portion of the loan becomes convertible 180 days after date of the note. The loan and any accrued interest can then be converted

into shares of our common stock at a rate of 50% multiplied by the market price, which is the lowest quoted price for the common

stock during the 20 trading day period ending on the latest complete trading day prior to the conversion date.

Through

June 30, 2015, we received nine tranche disbursements: $100,000 on April 21, 2014; $50,000 on May 6, 2014; $50,000 on June 11,

2014; $50,000 on July 16, 2014; $100,000 on September 30, 2014; $50,000 on November 3, 2014, $50,000 on December 1, 2014; $50,000

on December 29, 2014; and $50,000 on February 2, 2015.

On

July 20, 2015, we entered into a settlement agreement with the holder of the convertible note entered into on April 18, 2014.

Under the agreement the note holder agreed to not to seek to enforce its rights or remedies under the Note in relation to the

notice of conversion issued to convert a balance of the note amounting to $57,933; to not to exercise its rights of conversion

pursuant to the Note, and if an event of default occurs, the holder agrees not to sell any shares of our common stock having an

aggregate conversion value of $30,000 or more per week until such time as it has sold all of our common stock that it owns.

Under

the agreement we agreed to a penalty in relation to the note in the amount of $95,000 which has been accrued as of June 30, 2015;

to release the holder from its obligation to advance additional funds to us; and to pay or refinance the amount due under the

note plus accrued interest in four installment payments due on July 20, 2015, August 10, 2015, September 14, 2015 and October

12, 2015.

In

respect of prepayment penalties payable to the holder pursuant to the Note, we agreed to issue to the Holder additional convertible

promissory notes with each having the same form, terms, and conditions as the original note. The value of the notes, which are

due by each installment payment date, are equal to 30% of the payment delivered.

After

refinancing the payments due on July 20, 2015 and August 10, 2015, we and the noteholder agreed to allow the note holder to convert

the notes as agreed upon in the original note agreement. As such, in accordance with the agreement we only issued two additional

notes related to the prepayment penalty discussed above.

Subsequent

to year end we issued 10,649,641 shares of common stock in conversion of $37,274 of the note refinanced on July 20, 2015 to the

new note holder.

On

October 1, 2014, we issued a short-term convertible promissory note in the amount of $70,000 for $50,000 cash, an original issue

discount of $12,500, and prepaid interest of $7,500. The note bears interest at a rate of 15% per annum. The loan and any accrued

interest can be converted into shares of our common stock at a rate of 50% multiplied by the market price, which is the lowest

quoted price for the common stock during the 25 trading day period ending on the latest complete trading day prior to the conversion

date. The note matured on March 30, 2015. Through June 30, 2015, the holder of the note exercised his right to convert $56,000

of the note balance into 3,789,297 shares of common stock. On July 31, 2015, we issued 2,222,222 shares for the conversion of

$14,000 of the note payable.

On

November 17, 2014, we issued a short-term convertible promissory note in the amount of $70,000. The note bears interest at a rate

of 15% per annum. The loan and any accrued interest can be converted into shares of our common stock at a rate of 50% multiplied

by the market price, which is the lowest quoted price for the common stock during the 25 trading day period ending on the latest

complete trading day prior to the conversion date. Through June 30, 2015, the holder of the note exercised his right to convert

$35,000 of the note balance into 4,404,515 shares of common stock. Subsequent to year end, we issued 8,695,652 shares for the

conversion of $20,000 of the note payable. The note is due on November 14, 2015.

On

December 23, 2014, we issued a short-term convertible promissory note in the amount of $70,000. The note bears interest at a rate

of 15% per annum. The loan and any accrued interest can be converted into shares of our common stock at a rate of 50% multiplied

by the market price, which is the lowest quoted price for the common stock during the 25 trading day period ending on the latest

complete trading day prior to the conversion date. As of June 30, 2015, the note has not been converted into shares of common

stock. The note is due on December 18, 2015.

On

January 13, 2015, we issued a short-term convertible promissory note in the amount of $74,000. The note is due on October 15,

2015 and bears interest at 8% per annum. The loan is secured by shares of our common stock. The loan becomes convertible 180 days

after date of the note. The loan and any accrued interest can then be converted into shares of our common stock at a rate of 58%

multiplied by the market price, which is the average of the lowest three trading prices for the common stock during the 10 trading

day period ending on the latest complete trading day prior to the conversion date. As of June 30, 2015, the note has not been

converted into shares of common stock. Subsequent to year end, we issued 15,175,260 shares for the conversion of $76,960 of the

note payable and accrued interest.

On

January 26, 2015, we issued a convertible promissory note giving us the option of taking tranche payments based on amounts determined

by the note holder for total payments of not more than $250,000. There is an original discount component of 10% per tranche. Therefore,

the funds available to us will be $225,000 and the liability (net of interest) will be $250,000 when all disbursements have been

received by us. Each tranche is accounted for separately with each principal and OID balance becoming due 24 months after receipt.

Each tranche bears interest at 12% per annum. The loan is secured by shares of our common stock. Each portion of the loan becomes

convertible immediately upon issuance. The loan and any accrued interest can then be converted into shares of our common stock

at a rate of the lesser of $0.045 per share or 60% multiplied by the market price per share, which is the lowest quoted price

for the common stock during the 25 trading day period ending on the latest complete trading day prior to the conversion date.

We have received one tranche disbursements of $75,000 on January 26, 2015. As of June 30, 2015, the note has not been converted

into shares of common stock. Subsequent to year end, we issued 15,500,000 shares for the conversion of $27,720 of the note payable.

On

April 15, 2015, we issued a short-term convertible promissory note in the amount of $70,000 for $50,000 cash, an original issue

discount of $9,500, and prepaid interest of $10,500. The note is due on April 15, 2016 and bears interest at 15% per annum, which

was prepaid by us and is being amortized over the life of the loan. The loan is secured by shares of our common stock. The loan

becomes convertible 180 days after date of the note. The loan and any accrued interest can then be converted into shares of our

common stock at a rate of 50% multiplied by the market price, which is the lowest quoted price for the common stock during the

25 trading day period ending on the latest complete trading day prior to the conversion date. As of June 30, 2015, the note has

not become convertible.

On May 20, 2015, we

issued a convertible promissory note in the amount of $43,000 for $43,000 cash. The note is due on February 22, 2016 and bears

interest at 8% per annum. The loan becomes convertible 180 days after date of the note. The loan can then be converted into shares

of our common stock at a rate of 58% multiplied by the market price, which is the average of the lowest three (3) quoted price

for the common stock during the 10 trading day period ending on the latest complete trading day prior to the conversion date.

As of June 30, 2015, the note has not become convertible.

On June 7, 2015, we

issued a short-term convertible promissory note in the amount of $70,000 for $50,000 cash, an original issue discount of $9,500,

and prepaid interest of $10,500. The note is due on June 8, 2016 and bears interest at 15% per annum, which was prepaid by us

and is being amortized over the life of the loan. The loan is secured by shares of our common stock. The loan becomes convertible

180 days after date of the note. The loan and any accrued interest can then be converted into shares of our common stock at a

rate of 50% multiplied by the market price, which is the lowest quoted price for the common stock during the 25 trading day period

ending on the latest complete trading day prior to the conversion date. As of June 30, 2015, the note has not become convertible.

On June 19, 2015, we

issued a short-term convertible promissory note in the amount of $37,500 for $25,000 cash, an original issue discount of $6,875,

and prepaid interest of $5,625. The note is due on June 19, 2016 and bears interest at 15% per annum, which was prepaid by us

and is being amortized over the life of the loan. The loan is secured by shares of our common stock. The loan becomes convertible

180 days after date of the note. The loan and any accrued interest can then be converted into shares of our common stock at a

rate of 50% multiplied by the market price, which is the lowest quoted price for the common stock during the 25 trading day period

ending on the latest complete trading day prior to the conversion date. As of June 30, 2015, the note has not become convertible.

On June 28, 2015, we

issued a convertible promissory note in the amount of $150,000 for $100,000 cash, an original issue discount of $50,000. The note

is due on December 28, 2016 and bears interest at 15% per annum. The loan becomes convertible 180 days after date of the note.

The loan can then be converted into shares of our common stock at a rate of 50% multiplied by the market price, which is the lowest

quoted price for the common stock during the 25 trading day period ending on the latest complete trading day to the conversion

date. As of June 30, 2015, the note has not become convertible.

On June 29, 2015, we

issued a convertible promissory note in which we will be taking tranche payments based on amounts determined by the note holder

for total payments of not more than $100,000. There is an original discount component of $10,000. Therefore, the funds available

to us will be $90,000 and the liability (net of interest) will be $100,000 when all disbursements have been received by us. Each

tranche is accounted for separately with each principal and OID balance becoming due 24 months after receipt. Each tranche bears

interest at 15% per annum. Each portion of the loan becomes convertible immediately upon issuance. The loan and any accrued interest

can then be converted into shares of our common stock at a rate of the lesser of $0.02 per share or 50% multiplied by the market

price per share, which is the lowest quoted price for the common stock during the 25 trading days immediately preceding the conversion

date. During the period ended June 30, 2015, the Company has received one tranche disbursements of $30,000 on June 29, 2015.

On June 29, 2015, the first trance became convertible at the option

of the holder.

On

August 3, 2015, we issued a convertible promissory note in the amount of $75,000, in which we received $50,000 cash. The note

was due on December 28, 2016 and bears interest at 15% per annum, which was prepaid by us and is being amortized over the life

of the loan. The loan is secured by shares of our common stock. The loan becomes convertible 180 days after date of the note.

The loan and any accrued interest can then be converted into shares of our common stock at a rate of 50% multiplied by the market

price, which is the lowest quoted price for the common stock during the 25 trading day period ending on the latest complete trading

day prior to the conversion date.

On

August 12, 2015, we issued a convertible promissory note in the amount of $50,000, in which we received $48,000 cash. The note

was due on February 12, 2016 and bears interest at 12% per annum. The loan is secured by shares of our common stock. The loan

becomes convertible immediately upon issuance. The loan and any accrued interest can then be converted into shares of our common

stock at a rate of the lower of 50% multiplied by the market price, which is the lowest quoted price for the common stock during

the 20 trading day period ending on the latest complete trading day prior to the conversion date or 50% to the lowest trading

price on the 30th day after the funding of the note.

As

of June 30, 2015, we had $249,986 in cash. Until we are able to sustain our ongoing operations through sales revenue, we intend

to fund operations through debt and/or equity financing arrangements, which may be insufficient to fund our capital expenditures,

working capital, or other cash requirements. We do not have any formal commitments or arrangements for the sales of stock or the

advancement or loan of funds at this time. There can be no assurance that such additional financing will be available to us on

acceptable terms, or at all.

Going

Concern

We

have incurred cumulative net losses of $6,974,666 since our inception and require capital for our contemplated operational and

marketing activities to take place. Our ability to continue as a going concern is dependent on us generating cash from the sale

of our common stock and/or obtaining debt financing and attaining future profitable operations. Management’s plans include

selling our equity securities and obtaining debt financing to fund our capital requirement and ongoing operations; however, there

can be no assurance we will be successful in these efforts. The ability to successfully resolve these factors raise substantial

doubt about our ability to continue as a going concern.

Off

Balance Sheet Arrangements

As

of June 30, 2015, there were no off balance sheet arrangements.

Item

8. Financial Statements and Supplementary Data

Index

to Financial Statements Required by Article 8 of Regulation S-X:

Report

of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders’

of:

Nano Mobile Healthcare, Inc.

New York, NY

We have audited the accompanying balance

sheets of Nano Mobile Healthcare, Inc. (the Company) as of June 30, 2015 and 2014, and the related statements of operations, statements

of other comprehensive income, stockholders' deficit and cash flows for each of the years then ended. These financial statements

are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements

based on our audits.

We conducted our audits in accordance

with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and

perform an audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The

Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our

audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate

in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control

over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence

supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates

made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable

basis for our opinion.

In our opinion, the financial statements

referred to above present fairly, in all material respects, the financial position of Nano Mobile Healthcare, Inc. as of June

30, 2015 and 2014 and the related results of its operations and its cash flows for each of the years then ended, in conformity

with accounting principles generally accepted in the United States of America.

The accompanying financial statements

have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements,

the Company has incurred losses from operations and has a working capital deficit. These conditions raise substantial doubt about

the Company’s ability to continue as a going concern. The financial statements do not include any adjustments that might

result from the outcome of this uncertainty.

| /s/

Malone Bailey, LLP |

|

| www.malonebailey.com |

|

| Houston, Texas |

|

| October 13, 2015 |

|

NANO

MOBILE HEALTHCARE, INC.

BALANCE

SHEETS

AS

OF JUNE 30, 2015 AND 2014

| | |

June

30, 2015 | | |

June

30, 2014 | |

| ASSETS | |

| | | |

| | |

| Current

assets | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 249,986 | | |

$ | 235,073 | |

| Prepaid

expenses and other current assets | |

| 41,637 | | |

| 143,259 | |

| Total

current assets | |

| 291,623 | | |

| 378,332 | |

| | |

| | | |

| | |

| Fixed

Assets | |

| 10,670 | | |

| - | |

| Securities-available

for sale | |

| 400 | | |

| 20,000 | |

| | |

| | | |

| | |

| Total

assets | |

| 302,693 | | |

| 398,332 | |

| | |

| | | |

| | |

| LIABILITIES

AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| Current

liabilities | |

| | | |

| | |

| Accounts

payable and accrued liabilities | |

$ | 366,918 | | |

$ | 114,486 | |

| Convertible

notes payable | |

| 341,585 | | |

| 71,875 | |

| Due

to related parties | |

| 400,450 | | |

| - | |

| Derivative

liabilities | |

| 2,494,236 | | |

| 659,934 | |

| Total

current liabilities | |

| 3,603,189 | | |

| 846,295 | |

| | |

| | | |

| | |

| Convertible

debt | |

| 160,386 | | |

| 221,544 | |

| | |

| | | |

| | |

| Total

liabilities | |

| 3,763,575 | | |

| 1,067,839 | |

| | |

| | | |

| | |

| Stockholders’

deficit | |

| | | |

| | |

Preferred

stock; $0.001 par value; 50,000,000 shares authorized; 0 and 0 shares issued and outstanding

as of June 30, 2015 and 2014, respectively

| |

| - | | |

| - | |

| Common

stock; $0.001 par value; 450,000,000 shares authorized; 227,720,396 and 189,423,721 shares issued and outstanding as of June

30, 2015 and 2014, respectively | |

| 227,721 | | |

| 189,424 | |

| Additional

paid-in capital | |

| 3,286,063 | | |

| 7,747,925 | |

| Accumulated

deficit | |

| (6,974,666 | ) | |

| (8,606,856 | ) |

| Total

stockholders’ deficit | |

| (3,460,882 | ) | |

| (669,507 | ) |

| | |

| | | |

| | |

| Total

liabilities and stockholders’ deficit | |

$ | 302,693 | | |

$ | 398,332 | |

See

accompanying notes to these financial statements

NANO MOBILE HEALTHCARE,

INC.

STATEMENTS

OF OPERATIONS

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

| | |

For the Year Ended | |

| | |

June 30, 2015 | | |

June 30, 2014 | |

| | |

| | |

| |

| Operating expenses | |

| | | |

| | |

| Professional fees | |

| 475,855 | | |

| 176,935 | |

| General and administrative expenses | |

| 443,982 | | |

| 279,608 | |

| Officer and director compensation | |

| 85,607 | | |

| 107,057 | |

| Officer and director compensation - other | |

| 321,669 | | |

| 4,298,750 | |

| Consulting | |

| 913,180 | | |

| 570,099 | |

| Consulting - other | |

| 84,177 | | |

| 342,326 | |

| Royalty expenses | |

| 133,684 | | |

| 854,251 | |

| Total operating expenses | |

| 2,458,154 | | |

| 6,629,026 | |

| | |

| | | |

| | |

| Loss from operations | |

| (2,458,154 | ) | |

| (6,629,026 | ) |

| | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | |

| Interest income (expense) | |

| (665,217 | ) | |

| (315,036 | ) |

| Gain (loss) on derivative | |

| 4,775,161 | | |

| (418,930 | ) |

| Gain (loss) on equity swap | |

| - | | |

| (230,000 | ) |

| Unrealized loss on investment | |

| (19,600 | ) | |

| (40,000 | ) |

| Total other income (expense) | |

| 4,090,344 | | |

| (1,003,966 | ) |

| | |

| | | |

| | |

| Net income (loss) from continuing operations | |

$ | 1,632,190 | | |

$ | (7,632,992 | ) |

| Loss from discontinued operations | |

$ | - | | |

$ | (277,911 | ) |

| Net income (loss) | |

$ | 1,632,190 | | |

$ | (7,910,903 | ) |

| | |

| | | |

| | |

| Net income (loss) per common share from continuing operations: basic and

diluted | |

$ | 0.01 | | |

$ | (0.06 | ) |

| Net income (loss) per common share from discontinued operations: basic

and diluted | |

$ | - | | |

$ | (0.00 | ) |

| Net income (loss) per common share: basic and diluted | |

$ | 0.01 | | |

$ | (0.06 | ) |

| | |

| | | |

| | |

| weighted average common | |

| | | |

| | |

| shares outstanding: basic | |

| 201,005,605 | | |

| 131,638,614 | |

| diluted | |

| 273,745,757 | | |

| 131,638,614 | |

See

accompanying notes to these financial statements

NANO

MOBILE HEALTHCARE, INC.

STATEMENTS

OF OTHER COMPREHENSIVE INCOME (LOSS)

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

| | |

For the Year Ended | |

| | |

June 30, 2015 | | |

June 30, 2014 | |

| | |

| | |

| |

| Net

income (loss) | |

| 1,632,190 | | |

| (7,910,903 | ) |

| | |

| | | |

| | |

| Foreign Currency Translation adjustment | |

| | | |

| | |

| Change in cumulative translation adjustment | |

| - | | |

| - | |

| Change in cumulative translation adjustment from discontinued operations | |

| - | | |

| - | |

| Total | |

| 1,632,190 | | |

| (7,910,903 | ) |

See

accompanying notes to these financial statements

NANO

MOBILE HEALTHCARE, INC.

STATEMENTS

OF STOCKHOLDERS’ DEFICIT

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Accumulated | | |

| | |

| |

| | |

Preferred

Stock | | |

Common

Stock | | |

Additional

Paid-in | | |

Non-Controlling | | |

Other

Comprehensive | | |

Accumulated | | |

Total

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Interest | | |

Income

(loss) | | |

Deficit | | |

Deficit | |

| Balance,

June 30, 2013 | |

| - | | |

$ | - | | |

| 80,125,000 | | |

$ | 80,125 | | |

| 261,585 | | |

| (305,775 | ) | |

| 164,320 | | |

| (695,953 | ) | |

| (495,698 | ) |

| Stock

issued for cash, net | |

| - | | |

| - | | |

| 24,739,555 | | |

| 24,740 | | |

| 1,931,760 | | |

| - | | |

| - | | |

| - | | |

| 1,956,500 | |

| Stock

issued for services | |

| - | | |

| - | | |

| 64,050,000 | | |

| 64,050 | | |

| 965,710 | | |

| - | | |

| - | | |

| - | | |

| 1,029,760 | |

| Stock

issued for intangible asset | |

| - | | |

| - | | |

| 16,905,000 | | |

| 16,905 | | |

| (16,905 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Stock

issued for securities | |

| - | | |

| - | | |

| 2,000,000 | | |

| 2,000 | | |

| 288,000 | | |

| - | | |

| - | | |

| - | | |

| 290,000 | |

| Stock

isued for finders fees | |

| - | | |

| - | | |

| 1,604,166 | | |

| 1,604 | | |

| (1,604 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Warrants

issued for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,538,000 | | |

| - | | |

| - | | |

| - | | |

| 3,538,000 | |

| Spin-off

of subsidiery | |

| - | | |

| - | | |

| - | | |

| - | | |

| 372,494 | | |

| 305,775 | | |

| - | | |

| - | | |

| 678,269 | |

| Contributed

capital | |

| - | | |

| - | | |

| - | | |

| - | | |

| 408,885 | | |

| - | | |

| - | | |

| - | | |

| 408,885 | |

| Other

comprehensive income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (164,320 | ) | |

| - | | |

| (164,320 | ) |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (7,910,903 | ) | |

| (7,910,903 | ) |

| Balance,

June 30, 2014 | |

| - | | |

| - | | |

| 189,423,721 | | |

| 189,424 | | |

| 7,747,925 | | |

| - | | |

| - | | |

| (8,606,856 | ) | |

| (669,507 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common

stock issued to settle debt | |

| - | | |

| - | | |

| 20,532,894 | | |

| 20,534 | | |

| 319,111 | | |

| - | | |

| - | | |

| - | | |

| 339,645 | |

| Common

stock issued to settle related party debt | |

| - | | |

| - | | |

| 4,616,840 | | |

| 4,617 | | |

| 457,067 | | |

| - | | |

| - | | |

| - | | |

| 461,684 | |

| Common

stock issued for services | |

| - | | |

| - | | |

| 2,040,428 | | |

| 2,040 | | |

| 82,137 | | |

| - | | |

| - | | |

| - | | |

| 84,177 | |

| Common

stock issued for for coversion of parent company stock | |

| - | | |

| - | | |

| 11,106,513 | | |

| 11,106 | | |

| (11,106 | ) | |

| - | | |

| - | | |

| - | | |

| - | |

| Warrants

issued for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| 321,669 | | |

| - | | |

| - | | |

| - | | |

| 321,669 | |

| Conversion

of deriviative liability | |

| - | | |

| - | | |

| - | | |

| - | | |

| 526,870 | | |

| - | | |

| - | | |

| - | | |

| 526,870 | |

| Reclassifaction

of tainted warrants to derivitive liability | |

| - | | |

| - | | |

| - | | |

| - | | |

| (6,157,610 | ) | |

| - | | |

| - | | |

| - | | |

| (6,157,610 | ) |

| Net

lncome | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 1,632,190 | | |

| 1,632,190 | |

| Balance,

June 30, 2015 | |

| - | | |

| - | | |

| 227,720,396 | | |

| 227,721 | | |

| 3,286,063 | | |

| - | | |

| - | | |

| (6,974,666 | ) | |

| (3,460,882 | ) |

See

accompanying notes to these financial statements

NANO

MOBILE HEALTHCARE, INC.

STATEMENTS

OF CASH FLOWS

FOR

THE YEARS ENDED JUNE 30, 2015 AND 2014

| | |

For the Year Ended | |

| | |

June 30, 2015 | | |

June 30, 2014 | |

| Cash Flows from Operating Activities | |

| | | |

| | |

| Net income (loss) | |

$ | 1,632,190 | | |

$ | (7,910,903 | ) |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | |

| | | |

| | |

| Unrealized loss on investment | |

| 19,600 | | |

| 40,000 | |

| Amortization of debt discount | |

| 495,185 | | |

| 27,544 | |

| (Gain) loss on derivative liability | |

| (4,775,161 | ) | |

| 418,930 | |

| Loss on equity swap | |

| - | | |

| 230,000 | |

| Shares issued for services | |

| 84,177 | | |

| 760,750 | |

| Non cash interest expense | |

| - | | |

| 241,004 | |

| Warrants issued for services | |

| 321,669 | | |

| 3,538,000 | |

| Depreciation | |

| 1,479 | | |

| - | |

| Changes in assets and liabilities | |

| | | |

| | |

| Prepaid expense | |

| 150,747 | | |

| (143,259 | ) |

| Accounts payable and accrued expenses | |

| 263,042 | | |

| 79,220 | |

| Net cash used in operating activities | |

| (1,807,072 | ) | |

| (2,718,714 | ) |

| | |

| | | |

| | |

| Cash Flows from Investing Activities | |

| | | |

| | |

| Purchase of fixed assets | |

| (12,149 | ) | |

| - | |

| Net cash used in investing activities | |

| (12,149 | ) | |

| - | |

| | |

| | | |

| | |

| Cash Flows from Financing Activities | |

| | | |

| | |

| Proceeds from sales of common stock | |

| - | | |

| 1,956,500 | |

| Contributed capital | |

| - | | |

| 408,885 | |

| Proceeds from related party debt | |

| 1,285,136 | | |

| - | |

| Payments on related party debt | |

| (423,002 | ) | |

| - | |

| Proceeds from convertible notes payable | |

| 972,000 | | |

| 431,875 | |

| Payments on convertible notes payable | |

| - | | |

| (166,000 | ) |

| Net cash from financing activities | |

| 1,834,134 | | |

| 2,631,260 | |

| | |

| | | |

| | |

| CASH FLOWS FROM DISCONTINUED OPERATIONS: | |

| | | |

| | |

| Cash flows from operating activities of discontinued operations | |

| - | | |

| 947,279 | |

| Cash flows from investing activities of discontinued operations | |

| - | | |

| 6,159 | |

| Cash flows from financing activities of discontinued

operations | |

| - | | |

| (555,680 | ) |

| Net Cash (Used by) Provided by Discontinued

Operations | |

| - | | |

| 397,758 | |

| Foreign exchange adjustment | |

| | | |

| (164,320 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash | |

| 14,913 | | |

| 145,984 | |

| | |

| | | |

| | |

| Cash, beginning of period | |

| 235,073 | | |

| 89,089 | |

| | |

| | | |

| | |

| Cash, end of period | |

$ | 249,986 | | |

$ | 235,073 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information | |

| | | |

| | |

| Cash paid for interest | |

$ | 49,125 | | |

$ | - | |

| Cash paid for tax | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Non-Cash investing and financing transactions | |

| | | |

| | |

| Common stock issued to settle related party debt | |

$ | 461,684 | | |

$ | - | |

| Common stock issued for for coversion of parent company

stock | |

$ | 11,106 | | |

$ | 16,905 | |

| Common stock issued to settle debt | |

$ | 339,645 | | |

$ | - | |

| Conversion of derivative liability | |

$ | 526,870 | | |

$ | - | |

| Reclassifaction of tainted warrants to derivitive

liability | |

$ | 6,157,610 | | |

$ | - | |

| Stock issued for available for sale of securities | |

$ | - | | |

$ | 60,000 | |

| Shares issued for finders fees | |

$ | - | | |