UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 6, 2015

HAEMONETICS CORPORATION

(Exact name of registrant as specified in its charter)

|

| | | | |

|

Massachusetts | | 1-14041 | | 04-2882273 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

|

| | |

|

400 Wood Road, Braintree MA | | 02184 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code 781-848-7100

(Former name or former address, if changed since last report.)

|

| |

|

| |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

(e)

Brian Concannon and Haemonetics Corporation (“Haemonetics”) have entered into a separation agreement, dated as of October 6, 2015 (the “Separation Agreement”). Under the terms of the Separation Agreement, Haemonetics agreed, subject to Mr. Concannon’s continued compliance with and nonrevocation of the Separation Agreement, to pay commencing on November 1, 2015:

| |

• | to Mr. Concannon, $655,000, his current annual base salary, in equal installments on Haemonetics’s regular payroll schedule; and |

| |

• | for the benefit of Mr. Concannon, the Company portion of the cost of the premium for medical and dental coverage under the Company’s benefit plans during the twelve months ending October 31, 2016. |

Under the Separation Agreement, Mr. Concannon agreed to noncompetition and nonsolicitation provisions restricting his activities for a twelve month post-employment period.

The foregoing summary of the Separation Agreement does not purport to be complete and is qualified in its entirety by reference to the Separation Agreement, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The following Exhibit is attached to this report:

Exhibit No. Description

| |

10.1 | Separation Agreement, dated as of October 6, 2015, by and between Haemonetics Corporation and Brian Concannon. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

|

| | |

| HAEMONETICS CORPORATION |

| (Registrant) |

| | |

| | |

Date: October 8, 2015 | By | /s/ Christopher Lindop |

| | Christopher Lindop, Executive Vice President |

| | and Chief Financial Officer |

Exhibit 10.1

SEPARATION AGREEMENT

This Separation Agreement (“Agreement”) is made and entered into by and between Haemonetics Corporation (“Haemonetics” or the “Company”), and Brian Concannon (the “Executive”) on behalf of himself and his heirs, executors, administrators, personal representatives, successors, agents, and assigns, and shall be effective as of the date of the Executive’s execution of this Agreement (the “Effective Date”). This Agreement also may refer to the Company and/or the Executive as the “Parties” or a “Party”.

1.Resignation; Waiver of Notice. Executive hereby acknowledges and confirms that he resigned effective as of September 29, 2015 (the “CEO Resignation Date”) as the President and Chief Executive Officer of the Company, as a member of the Company’s Board of Directors and from any other office held by the Executive with the Company or its subsidiaries. The Executive shall remain an employee of the Company from the CEO Resignation Date through and including October 31, 2015, at which time the Executive shall and hereby does resign from his employment with the Company (the “Separation Date”). The Executive hereby waives notice of the meetings of the Board of Directors of the Company held on September 18, 2015 and on September 26, 2015.

2. Transition Period/Term Period. The period from the CEO Resignation Date through the Separation Date shall be referred to herein as the “Transition Period Term”. During the Transition Period Term, the Executive (a) shall continue to receive his current base salary and benefits, and (b) shall be available upon request of the Company to assist with the transition of his duties and responsibilities and provide such other services and duties as the Company may reasonably require.

3. Final Pay and Benefits.

(a) Final Pay. The Executive will be paid no later than the next regular payroll date that occurs on or after the Separation Date for all salary earned through the Separation Date, together with (i) payment for any accrued but unused vacation time owed to the Executive as of the Separation Date (which, for the avoidance of doubt, does not include payment for any “compensatory days”), and (ii) payment in the amount of $3,200 in reimbursement for all business related expenses and incidentals owed to the Executive. The Executive agrees that he is not entitled to any other salary, bonus, equity or other compensation from the Company except as expressly set forth herein.

(b) Benefits. For the period subsequent to the Separation Date, the Executive may be eligible to elect continued group medical and dental coverage pursuant to the federal law known as COBRA. Notification of the Executive’s COBRA rights will be sent under separate cover. Effective on the Separation Date, the Executive’s entitlement to participation in any and all other Company benefits, benefit plans, policies or programs shall cease, except as expressly set forth herein.

4. Equity Treatment. Set forth on Exhibit A is a list of all outstanding equity awards held by the Executive with respect to shares of the Company’s common stock. Other than as set forth on Exhibit A, neither the Company nor any subsidiary has any obligation otherwise to issue to the Executive any equity award for or shares of capital stock of the Company or any Subsidiary. For the avoidance of doubt, (a) any such equity awards listed on Exhibit A shall continue to vest through the Separation Date according to the terms of the applicable award agreements and the Company’s 2005

Long-Term Incentive Compensation Plan, (b) the Executive’s resignation does not constitute a “qualifying retirement” for purposes of any market stock unit or performance share unit awards previously made to the Executive, and (c) the Executive’s resignation shall constitute a retirement from the Company in good standing for purposes of any outstanding stock option awards, such that stock options underlying such awards shall remain exercisable at any time on or prior to the earlier of the expiration date of the applicable stock option or the two (2) or five (5)-year anniversary of the Separation Date, as specified in the applicable option agreement.

5. Severance. If on or prior to the Separation Date the Executive signs this Agreement, complies with its terms and does not revoke any portion of this Agreement, the Company agrees:

(a) To pay to the Executive the gross amount of $655,000 (being one (1) year of the Executive’s current gross annual salary) as severance pay (“Severance Pay”). The Company will withhold from this Severance Pay taxes and other authorized deductions, including advances or other amounts due to Haemonetics from the Executive. The Company will pay the Severance Pay in equal installments in accordance with the Company’s regular payroll practices over a period of twelve (12) months (the “Severance Period”). The first installment shall be made as part of the Company’s regular payroll cycle subsequent to the Separation Date; and

(b) If the Executive properly and timely elects to continue his current medical and dental coverage under the Blue Cross Blue Shield Insurance Plan in accordance with the continuation requirements of COBRA, the Company will pay the Company portion of the cost of the premium for such coverage during the Severance Period. Thereafter, the Executive shall be entitled to elect to continue such COBRA coverage for the remainder of the COBRA period, at the Executive’s own expense. If the Company’s payment of the Company’s share of the Executive’s medical and dental insurance premiums would subject the Company to any additional tax or penalty, the Company may instead elect to pay an equal amount in cash to the Executive, without any deduction or set-off and free and clear of and without deduction for or on account of any taxes that may be imposed on the Executive. If the Company makes any cash payment to the Executive on account of medical and dental insurance premiums, it also will pay to the Executive such additional amounts as are necessary to ensure receipt by the Executive of the full amount that the Executive would have received but for any tax obligations.

6. No Consideration Absent Execution of this Agreement. The Executive agrees and understands that the Company has no obligation to pay the consideration in Section 5 unless the Executive signs this Agreement, complies with its terms and does not revoke any portion of this Agreement.

7. Severance Conditions. The Executive acknowledges that (a) if he engages in conduct that is inconsistent with the terms of this Agreement prior to his execution of this Agreement, this offer may be withdrawn; and (b) if he has engaged in conduct which constitutes a violation of the Haemonetics Corporation Code of Conduct or if the Company is required to make an accounting restatement due to a material non-compliance with any financial reporting requirement as a result of the Executive’s misconduct, the Company may require the reimbursement of all, or any portion, of his fiscal year 2015 bonus.

8. Professional Transition. The Executive agrees to cooperate with and assist the Company in a responsible, positive and professional manner with respect to the transition of his

employment duties and responsibilities. The Executive acknowledges that the Company’s obligations under this Agreement are expressly contingent on such cooperation and assistance, and on the Executive dealing with any issues relating to his employment with or separation from the Company in a similarly responsible, positive and professional manner. In this regard, the Executive further agrees not to return to the Company’s offices, or to communicate with employees, investors, lenders, customers, or other third parties concerning the Company and his employment with or separation from the Company, without the prior written approval of the Board; provided that the Executive may state that he resigned from the Company in order to pursue other opportunities in the course of any communications that he did not initiate.

9. General Release of Claims. In consideration of and in exchange for the promises and commitments made by the Company in this Agreement, the Executive hereby irrevocably and unconditionally, knowingly, and voluntarily releases, acquits, and forever discharges, to the maximum extent permitted by law, Haemonetics Corporation, its affiliates, their past and present officers, directors, partners, employees, agents, insurers, reinsurers, attorneys, assigns, and their employee benefit plans and programs and their administrators and fiduciaries (collectively “Releasees”) from each and every cause of action or claim, liability, expense, fee and cost, including attorneys’ fees and costs, which the Executive ever had or now has, whether known or unknown, asserted or unasserted, which the Executive has or may have against Releasees (whether individually or collectively) as of the date of execution of this Agreement, relating to or arising out of the Executive’s employment with and separation from the Company, or any affiliate thereof, including but not limited to any obligation of the Company to issue to the Executive any equity award for or shares of the Company’s capital stock (other than pursuant to the agreements listed on Exhibit A) or any alleged violation of any of the following:

| |

• | Title VII of the Civil Rights Act of 1964; |

| |

• | Sections 1981 through 1988 of Title 42 of the United States Code; |

| |

• | The Immigration Reform and Control Act; |

| |

• | The Americans with Disabilities Act of 1990; |

| |

• | The Family and Medical Leave Act of 1993, as amended; |

| |

• | The Employee Retirement Income Security Act of 1974 ("ERISA") (except for any vested benefits under any tax qualified benefit plan); |

| |

• | The Fair Credit Reporting Act; |

| |

• | The Worker Adjustment and Retraining Notification Act; |

| |

• | The Occupational Safety and Health Act, as amended; |

| |

• | The Massachusetts Plant Closing Laws, M.G.L. c. 151A, § 71A, as amended; |

| |

• | The Massachusetts Fair Employment Practices Act, M.G.L c. 151B, as amended; |

| |

• | The Massachusetts State Wage and Hour Laws, M.G.L., c. 149-151, et seq., including but not limited to, G.L. c. 149, §§ 148, 148A, 148B, 149, 150150A-150C, 151, 152, 152A, et seq., as amended; |

| |

• | The Massachusetts Occupational Safety and Health Laws; |

| |

• | The Massachusetts Equal Rights Act, M.G.L. c. 93, § 102, as amended; |

| |

• | The Massachusetts Equal Pay Act, M.G.L. c. 149, § 105A-C, as amended; |

| |

• | The Massachusetts Maternity Leave Act, M.G.L. c. 149, § 105D, as amended; |

| |

• | The Massachusetts Equal Rights for the Elderly and Disabled Law, M.G.L. c. 93, § 103, as amended; |

| |

• | The Massachusetts AIDS Testing Law, M.G.L. c. 111, § 70F, as amended; |

| |

• | The Massachusetts Civil Rights Act, M.G.L. c. 12, 11H & I, as amended; |

| |

• | The Massachusetts Privacy Law, M.G.L. c. 214, § 1B, as amended; |

| |

• | The Massachusetts Sexual Harassment Statute, M.G.L. c. 214, § 1C, as amended; |

| |

• | The Massachusetts Consumer Protection Act, M.G.L. c. 93A, as amended; |

| |

• | The Massachusetts Small Necessities Leave Act, M.G.L. c. 149, § 52D, as amended; |

| |

• | Any other federal, state or local law, rule, regulation, or ordinance; |

| |

• | Any public policy, contract, tort, or common law; or |

| |

• | Any claim for costs, fees, or other expenses including attorneys’ fees incurred in these matters. |

The Executive agrees and understands that this Agreement provides a full and final general release covering all known and unknown and anticipated and unanticipated injuries, debts, or damages which may have arisen, or which may arise, connected with all matters from the beginning of time to the date of this Agreement, as well as those injuries, debts, claims or damages now known or disclosed which may have arisen, or which may arise, from the Executive’s employment with or separation from the Company as described above or otherwise, provided that this release does not apply to (i) any claims for workers’ compensation benefits (including disability payments), or unemployment insurance benefits, (ii) any rights pursuant to any qualified retirement or welfare benefit plan maintained by the Company, (iii) any rights to be indemnified by the Company pursuant to the Company’s Articles of Organization or bylaws, applicable law, or rights under any Company insurance policy, (iv) the Executive’s rights under this Agreement, or (v) Executive’s rights pursuant to the equity award agreements listed on Exhibit A hereto. Additionally, nothing in this Agreement shall be interpreted to prohibit the Executive from filing a discrimination claim with any anti-discrimination agency, or from participating in a discrimination investigation or proceeding conducted by any such agency. However, by signing this Agreement, the Executive acknowledges that he is waiving any and all rights to money damages and any other relief that might otherwise be available should he or any other entity pursue claims (other than a claim under the Age Discrimination in Employment Act) against the Releasees.

10. Acknowledgments and Affirmations. The Executive affirms that he has been paid or has received all compensation, wages, bonuses, commissions or benefits to which the Executive may be entitled through the date he signs this Agreement. The Executive affirms the Executive was granted any leave to which the Executive was entitled under the Family and Medical Leave Act or related state or local leave or disability accommodation laws. The Executive further affirms that the Executive has no known workplace injuries or occupational diseases that were not already disclose to the company in writing, or adjudicated.

The Executive affirms that all of the Company's decisions regarding the Executive’s pay and benefits through the date of the Executive’s execution of this Agreement were not discriminatory based on age, disability, race, color, sex, religion, national origin or any other classification protected by law.

The Executive further affirms that the Executive has not been retaliated against for reporting any alleged wrongdoing by the Company or its officers, including any allegations of corporate fraud. Both Parties acknowledge that this Agreement does not limit either party’s right, where applicable, to file or participate in an investigative proceeding of any federal, state or local governmental agency. The Executive nevertheless understands that because of the waiver and general release the Executive freely provides by signing this Agreement, the Executive cannot obtain any monetary relief or recovery from Releasees in any such proceeding.

11. Confidential Information.

(a) Protection of Confidential Information. The Executive understands that the Company is engaged in the highly competitive business and industry of blood management solutions, and that the Company creates and supplies a variety of unique and innovative products and services, including equipment, consumable supplies, software and services. The Executive further acknowledges and agrees that during his employment by the Company, he had intimate knowledge of and access to the Company’s trade secret and Confidential Information (as defined in Section 11(b) below). The Executive agrees that the loss or misuse of such information will cause the Company great and irreparable harm. Accordingly, the Executive hereby affirms that the Executive has not divulged any trade secret or confidential information of the Company. The Executive further agrees to continue to keep confidential all such information consistent with the Company’s policies and applicable law and not to directly or indirectly, disclose or divulge, directly or indirectly in any Confidential Information, except as required in connection with the performance of the Executive’s duties for the Company, and except to the extent required by law, subpoena or court order (but only after the Executive has provided the Company with reasonable notice and opportunity to take action against any legally required disclosure).

(b) Confidential Information Defined. As used herein, “Confidential Information” means all trade secrets and all other information of a business, financial, marketing, technical or other nature relating to the business of the Company including, without limitation, any customer or vendor lists, financial statements and projections, know-how, pricing policies, operational methods, methods of doing business, technical processes, formulae, designs and design projects, inventions, computer hardware, software programs, business plans and projects pertaining to the Company and including any information of others that the Company has agreed to keep confidential; provided, that Confidential Information shall not include (i) any information that has entered or enters the public domain through no fault of the Executive, or (ii) the Executive’s prior industry knowledge of technology and applications, including but not limited to knowledge of technology and applications similar to those of the Company.

12. Restrictive Covenants. The Executive acknowledges that the services performed by the Executive are of a special, unique, unusual, extraordinary, and intellectual character and the provisions of this Section 12 are reasonable and necessary to protect the Company’s business, goodwill and Confidential Information. The Executive therefore agrees that during the Executive’s employment with the Company, and for a period of twelve (12) months after the Separation Date:

(a) the Executive will not, directly or indirectly, individually or as a consultant to, or an employee, officer, director, manager, stockholder, partner, member, investor, lender or other owner or participant in any business entity, other than the Company, engage in or assist any other person or entity to engage in any business which competes with any business in which the Company is engaging or in which the Company plans to engage, during or at the time of termination of the Executive’s employment, anywhere in the United States or anywhere else in the world where the Company does business or plans to do business during the Executive’s employment;

(b) the Executive will not, directly or indirectly, (i) solicit, divert or take away, or attempt to solicit, divert or take away, the business or relationship of Company with any of its customers, prospective customers, vendors, or suppliers (collectively, “Business Partners”), (ii) enter into any employment or consulting relationship with any Business Partner, or (iii) otherwise interfere with the Company’s business relationship with any of its Business Partners;

(c) the Executive will not, directly or indirectly, solicit, recruit, hire or engage, or otherwise interfere with the business relationship of the Company with, any current or former employee of the Company, other than any person who ceased to be employed by the Company for a period of at least twelve (12) months; and

(d) the Executive will not, directly or indirectly, assist any person or entity in performing any activity prohibited by Sections 12(a), 12(b) or 12(c).

13. Non-Disparagement. During the Executive’s employment with the Company (including but not limited to employment during the Transition Period), and at all times thereafter, the Executive will not, directly or indirectly, make any disparaging statements, written or oral, about the Company or any of its directors, officers, employees, stockholders, investors, lenders, affiliates, managers, members, partners, agents, attorneys or representatives. The Company will direct its current Directors and the current members of the Company’s Executive Council not to make any disparaging statements, directly or indirectly, written or oral, about the Executive; provided that this provision shall not limit such persons’ right to comment on (a) the Executive’s performance as President and CEO of the Company in communications with each other or in interviews with successor CEO candidates, or (b) the Company’s performance during the period when the Executive served as its President and CEO. This Section shall not prohibit either the Executive or the Company from testifying truthfully as a witness in any court proceeding or governmental investigation.

14. Remedies. Without limiting the remedies available to the Company, the Executive acknowledges that a breach of any of the covenants contained in Sections 11 through 13 herein could result in irreparable injury to the Company for which there might be no adequate remedy at law, and that, in the event of such a breach or threat thereof, the Company shall be entitled to seek a temporary restraining order and/or a preliminary injunction and a permanent injunction restraining the Executive from engaging in any activities prohibited by Sections 11 through 13 herein or such other equitable relief as may be required to enforce specifically any of the covenants of Sections 11 through 13 herein. If the Executive violates Section 12 of this Agreement, the temporal period applicable to that Section shall be extended by the period of time during which such violation occurred.

15. Review of Agreement; Reasonable Restrictions. The Executive (a) has carefully read and understands all of the provisions of this Agreement and has had the opportunity for this Agreement to be reviewed by counsel, (b) acknowledges that the duration, geographical scope and subject matter of

Sections 11 through 13 of this Agreement are reasonable and necessary to protect the goodwill, customer relationships, legitimate business interests, reputation, and Confidential Information of the Company and its affiliates, and (c) will be able to earn a satisfactory livelihood without violating this Agreement.

16. Enforceability. This Agreement shall be interpreted in such a manner as to be effective and valid under applicable law, but if any provision hereof shall be prohibited or invalid under any such law, such provision shall be ineffective to the extent of such prohibition or invalidity, without invalidating or nullifying the remainder of such provision or any other provisions of this Agreement. If any one or more of the provisions contained in this Agreement shall for any reason be held to be excessively broad as to duration, geographical scope, activity or subject, such provisions shall be construed by limiting and reducing it so as to be enforceable to the maximum extent permitted by applicable law.

17. Litigation Cooperation. The Executive agrees to cooperate fully with the Company in the defense or prosecution of any claims, regulatory proceedings or action which already have been brought or which may be brought in the future against or on behalf of the Company or any of its directors, officers, employee, or agents which relate to events or occurrences that transpired during his employment with the Company. The Executive’s full cooperation in connection with such claims or actions shall include, without implication of limitation, being available to meet with counsel to prepare for discovery or trial and to testify truthfully as a witness when reasonably requested by the Company at reasonable times designated in good faith by the Company. The Executive agrees that he will not voluntarily disclose any information to any person or party that is adverse to the Company and he will maintain the confidences and privileges of the Company. The Company agrees to reimburse the Executive for any reasonable out-of-pocket expenses that the Executive incurs in connection with such cooperation, subject to reasonable documentation. The Company will try, in good faith, to exercise its rights under this Section so as not to unreasonably interfere with the Executive’s ability to engage in gainful employment.

18. Return of Property. The Executive affirms that the Executive has returned by the Effective Date (at Haemonetics’ expense, if necessary), all property belonging to the Company including but not limited to computer equipment and accessories, pagers, fax machine, parts, product samples, technical and operators manuals and training materials and records of every kind, supplier and prospective supplier information and files, customer and prospective customer information and files, sales and marketing information and files and analyses, identification cards, the Executive information, credit cards, security cards, keys, passes, and any and all information about products, business or production plans, customers, suppliers, the Executive’s, training materials and training classes regardless of how such information is stored or presented (e.g. hard copy, computer disc, microfilm, etc.) and inclusive of all copies of such information, documents or materials; provided that the Executive may keep the personal mobile device provided to him by the Company.

19. Effect of Breach. the Executive acknowledges that he is entering into this Agreement with the express understanding that his obligations under this Agreement are of unique and extraordinary importance. Consistent with this, the Executive recognizes and agrees that the compensation and benefits offered to him hereunder are in consideration for the Executive’s full and complete compliance with the covenants and provisions of this Agreement. Accordingly, the Executive agrees that if he violates this Agreement, including but not limited to the terms of Sections 8, 9, 11, 12, 13, 17, and 18, the Company may immediately terminate payment of further compensation or benefits

otherwise owed to the Executive hereunder, and may recover the full value of any such compensation and benefits already provided to the Executive to the maximum extent permitted by law. Any such actions in the event of a breach by the Executive will not affect the release set forth in Section 9 above or the Executive’s continuing obligations under this Agreement. The Executive further agrees that the cessation and recovery of such amounts shall be in addition to, and not in lieu of, any other rights or remedies at law or in equity available to the Company, including the right to seek specific performance or an injunction.

20. Severability. If any court finds any part of this Agreement to be invalid, the remaining parts of the Agreement will remain in effect as if no invalid part existed.

21. Entire Agreement. This Agreement is the entire agreement between the Executive and the Company, and supersedes and replaces any other agreements between the Executive and the Company. The Executive acknowledges that the Executive has not relied on any representations, promises, or agreements of any kind made to the Executive in connection with the Executive’s decision to accept this Agreement, except for those set forth in this Agreement.

22. No Waiver. If the Executive or the Company fails to enforce this Agreement or to insist on performance of any term, that failure does not mean a waiver of that term or of the Agreement. The Agreement and all of its terms will remain in full force and effect.

23. Amendments. This Agreement may only be changed in writing signed by the Parties.

24. Governing Law and Interpretation. Massachusetts law, except for Massachusetts’ choice of law rules, shall govern this Agreement. In the event of a breach of any provision of this Agreement, either party may file suit specifically to enforce any term or terms of this Agreement or to seek any damages for breach. Except as otherwise mandated by the context, “Company” shall mean each of the Company and its subsidiaries in each of Sections 6 to 22 hereof.

25. Nonadmission of Wrongdoing. The Parties agree that neither this Agreement nor paying the consideration for this Agreement shall be deemed or construed at any time for any purpose as an admission by the Company of wrongdoing or as evidence of any liability or unlawful conduct of any kind.

26. Voluntary Agreement. The Executive and the Company each agree they have signed this Agreement freely and voluntarily after having read the Agreement and consulted counsel of their choice. The Executive understands the meaning of this Agreement and its releases and that this Agreement is a legal contract that is binding on the Executive and the Company.

27. Counterparts. The Executive and the Company may sign separate copies of this Agreement, but those separate copies will constitute one agreement and each signed copy will be fully effective as if it were a single original document. A facsimile or .pdf copy of this Agreement shall be as effective as an original.

28. Reasonable Attorneys’ Fees. The Company will reimburse the Executive for reasonable attorneys’ fees incurred in connection with this Agreement, up to a maximum of $7,500.

EXECUTIVE IS ADVISED THAT EXECUTIVE HAS UNTIL NOON ON MONDAY, OCTOBER 5, 2015, TO CONSIDER AND SIGN THIS SEPARATION AGREEMENT AND

GENERAL RELEASE, WHICH SHOULD BE SUBMITTED TO SANDRA JESSE, CHIEF LEGAL OFFICER, HAEMONETICS CORPORATION, 400 WOOD ROAD, BRAINTREE, MA 02169. EXECUTIVE ALSO IS ADVISED TO CONSULT WITH AN ATTORNEY BEFORE SIGNING THIS AGREEMENT AND GENERAL RELEASE.

EXECUTIVE VOLUNTARILY, FREELY AND KNOWINGLY, AND AFTER DUE CONSIDERATION, ENTERS INTO THIS CONFIDENTIAL SETTLEMENT AGREEMENT AND GENERAL RELEASE INTENDING TO WAIVE, SETTLE AND RELEASE ALL CLAIMS EXECUTIVE HAS OR MIGHT HAVE AGAINST THE COMPANY AND ANY RELATED PERSONS OR ENTITIES.

The Parties knowingly and voluntarily sign this Agreement as of the date(s) set forth below:

|

| | |

| HAEMONETICS CORPORATION |

/s/ Brian Concannon | By: | /s/ Ronald Gelbman |

BRIAN CONCANNON | Name: | RONALD GELBMAN |

| Title: | Interim Chief Executive Officer |

Date: October 6, 2015 | Date: | October 6, 2015 |

Exhibit A

List of All Outstanding Equity Awards

|

| | | | | |

Grant Date | Number | Type | Price | Granted | Status |

10/22/2014 | 13201 | PSU | $0.00 | 53,956 | Accepted 11/21/2014 |

10/22/2014 | 13170 | NQ | $34.75 | 119,731 | Accepted 11/18/2014 |

10/22/2014 | 13187 | RSU | $0.00 | 26,978 | Accepted 11/18/2014 |

10/23/2013 | 13034 | RSU | $0.00 | 25,204 | Accepted 12/5/2013 |

10/23/2013 | 13026 | NQ | $41.66 | 234,899 | Accepted 12/5/2013 |

07/24/2013 | 12986 | MSU | $0.00 | 50,000 | Accepted 8/17/2013 |

10/24/2012 | 12818 | NQ | $39.06 | 250,382 | Accepted 11/27/2012 |

10/24/2012 | 12828 | RSU | $0.00 | 26,884 | Accepted 11/27/2012 |

10/25/2011 | 12665 | RSU | $0.00 | 24,452 | Accepted 11/29/2011 |

10/25/2011 | 12664 | NQ | $30.67 | 219,572 | Accepted 11/29/2011 |

10/27/2010 | 12540 | RSU | $0.00 | 27,276 | Accepted 12/10/2010 |

10/27/2010 | 12539 | NQ | $27.50 | 236,750 | Accepted 12/10/2010 |

10/27/2009 | 12415 | NQ | $26.47 | 159,350 | Accepted 2/18/2010 |

10/27/2009 | 12424 | RSU | $0.00 | 9,958 | Accepted 2/18/2010 |

04/02/2009 | 12394 | NQ | $27.69 | 65,690 | Accepted 10/28/2011 |

04/02/2009 | 12395 | RSU | $0.00 | 4,106 | Accepted 3/24/2010 |

10/22/2008 | 12260 | NQ | $27.28 | 57,176 | Accepted 11/26/2008 |

10/22/2008 | 12266 | RSU | $0.00 | 3,572 | Accepted 11/26/2008 |

10/24/2007 | 12111 | RSU | $0.01 | 2,860 | Accepted 11/23/2007 |

05/01/2007 | 12079 | RSA | $0.01 | 5,000 | Accepted 6/20/2007 |

05/01/2007 | A012079 | RSA | $0.01 | 15,000 | Accepted 6/20/2007 |

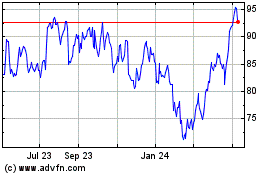

Haemonetics (NYSE:HAE)

Historical Stock Chart

From Mar 2024 to Apr 2024

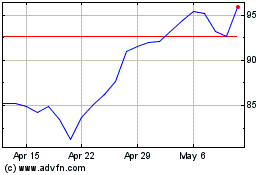

Haemonetics (NYSE:HAE)

Historical Stock Chart

From Apr 2023 to Apr 2024