UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2015

Commission File No. 001-32210

NORTHERN DYNASTY MINERALS

LTD.

(Translation of registrant's name into English)

15th Floor – 1040 West Georgia

Street

Vancouver, British Columbia, V6E 4H8, Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1) [ ]

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7) [ ]

SUBMITTED HEREWITH

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| NORTHERN DYNASTY MINERALS LTD. |

| |

| Date: October 7, 2015 |

| |

| |

| |

| |

| /s/ Trevor Thomas |

| Trevor Thomas |

| Secretary |

Northern Dynasty Closes Second Tranche of

Financing

Proceeds Total C$15 million

September 10, 2015 Vancouver, BC – Northern Dynasty

Minerals Ltd. (TSX: NDM; NYSE MKT: NAK) ("Northern Dynasty" or the "Company")

announces, further to its press releases of August 10 and August 31, 2015, that

it has completed the second tranche closing of the fundraising through a private

placement of 11,975,592 Special Warrants at a price of C$0.399 per Special

Warrant for gross proceeds of C$4.78 million. The Special Warrants will convert

on exercise into common shares of Northern Dynasty on a one-for-one basis.

When combined with the first tranche proceeds of C$10.22

million, total gross proceeds from the Special Warrant non-brokered placement

are just over C$15 million.

Additionally, as previously announced on September 1, 2015, the

definitive agreement with Cannon Point Resources (“Cannon Point”) in respect of

the acquisition of 100% of the outstanding securities of Cannon Point has been

signed. Assuming the timely receipt of shareholder, court and regulatory

approvals, it is expected that this acquisition will close in October 2015.

The securities to be issued pursuant to this transaction have

not been registered under the U.S. Securities Act of 1933, as amended (the “U.S.

Securities Act”), and may not be offered or sold in the United States absent

registration or applicable exemption from the registration requirements. This

press release shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful.

About Northern Dynasty Minerals Ltd.

Northern Dynasty is a mineral exploration and development

company based in Vancouver, Canada. Northern Dynasty's principal asset is the

Pebble Project in southwest Alaska, USA, an initiative to develop one of the

world's most important mineral resources.

For further details on Northern Dynasty and the Pebble Project,

please visit the Company's website at www.northerndynasty.com or contact

Investor services at (604) 684-6365 or within North America at 1-800-667-2114.

Review Canadian public filings at www.sedar.com and U.S. public filings at www.sec.gov.

Ronald W. Thiessen

President & CEO

Forward Looking Information and other

Cautionary Factors

This release includes certain statements that may be deemed

"forward-looking statements". All statements in this release, other than

statements of historical facts, such as those that address the in-progress

financings and plan to complete certain regulatory filings are forward-looking

statements. These statements include expectations about the likelihood of

completing a financing and merger transaction and the ability of the Company to

secure regulatory acceptance for its prospectus and registration statements.

Though the Company believes the expectations expressed in its forward-looking

statements are based on reasonable assumptions, such statements are subject to

future events and third party discretion such as regulatory personnel. For more

information on the Company, and the risks and uncertainties connected with its

business, Investors should review the Company's home jurisdiction filings at

www.sedar.com and its filings with the United States Securities and Exchange

Commission.

FORM 51–102F3

MATERIAL CHANGE REPORT

| Item 1 |

Name and Address of Company

|

Northern Dynasty Minerals Ltd.

15th Floor - 1040 West

Georgia Street

Vancouver, British Columbia

V6E 4H1

| Item 2 |

Date of Material Change

|

September 9, 2015

News releases were issued by Northern Dynasty Minerals Ltd.

(“Northern Dynasty” or the “Company”) on August 31, 2015 and September 10, 2015

and distributed through Canada Newswire and filed on SEDAR.

| Item 4 |

Summary of Material Change

|

The Company announced that it has closed its previously

announced private placement offering of Special Warrants.

| Item 5 |

Full Description of Material Change

|

| 5.1 |

Full Description of Material Change

|

Further to the news release of August 10, 2015, the Company has

completed a private placement of 37,600,000 special warrants (the “Special

Warrants”) at $0.399 per Special Warrant for aggregate gross proceeds of

approximately $15 million. The Special Warrants will convert on exercise into

common shares of Northern Dynasty on a one-for-one basis.

The private placement completed in two tranches. The first

tranche of 25,624,408 Special Warrants completed on August 31, 2015, for gross

proceeds of C$10.2 million. The second tranche of 11,975,592 Special Warrants

completed on September 9, 2015, for gross proceeds of C$4.78 million.

Additionally, as previously announced on September 1, 2015, the

definitive agreement with Cannon Point in respect of the acquisition of 100% of

the outstanding securities of Cannon Point has been signed. Assuming the timely

receipt of shareholder, court and regulatory approvals, it is expected that this

acquisition will close in October 2015.

| 5.2 |

Disclosure for Restructuring

Transactions |

Not applicable.

- 2 -

| Item 6 |

Reliance on subsection 7.1(2) of National

Instrument 51–102 |

Not applicable.

| Item 7 |

Omitted Information |

Not applicable.

Trevor Thomas

Secretary and General Counsel

Tel:

604-684-6365

September 21, 2015

Former US Senator and Secretary of Defense William S. Cohen

releases report on independent investigation into EPA actions at Alaska’s Pebble

Project

October 6, 2015, Vancouver, BC – Northern Dynasty

Minerals Ltd. (TSX: NDM; NYSE MKT: NAK) ("Northern Dynasty" or the "Company")

announces that former US Senator and Secretary of Defense William S. Cohen today

released the report of his investigation into the US Environmental Protection

Agency’s (“EPA”) actions with respect to Alaska’s Pebble Project, and the

agency’s efforts to issue the first-ever ‘pre-emptive’ veto in the 43-year

history of the Clean Water Act.

Entitled, ‘Report of an Independent Review of the United

States Environmental Protection Agency’s Actions in Connection With Its

Evaluation of Potential Mining In Alaska’s Bristol Bay Watershed,’ the

report was commissioned by the Pebble Limited Partnership (“Pebble Partnership”

or “PLP”) and prepared by a team of independent investigators employed by The

Cohen Group and law firm DLA Piper over a period of approximately one year. The

Cohen investigation team reviewed thousands of EPA documents secured through

Freedom of Information Act (“FOIA”) requests, and interviewed some 60

individuals involved with the EPA or its controversial review of the Pebble

Project.

Cohen states: “The decision about whether to build a mine in

this area, as well as the process used to make such a decision, is very

important to Alaska’s environment, economy, people, fish and wildlife. It

requires regulatory authority to be exercised in the fairest way possible. After

a very thorough review, I do not believe EPA used the fairest and most

appropriate process.”

The Cohen report raises a series of concerns about potential

EPA misconduct, including: that EPA may have pre-determined the outcome of its

review before conducting the Bristol Bay Watershed Assessment; and, that

EPA officials may have had inappropriately close relationships with

environmental activists. Cohen urges US Congress and the independent Office of

the EPA Inspector General to use their respective subpoena powers to look

further into the myriad issues of EPA misconduct catalogued in his report.

Cohen concludes by encouraging US lawmakers to consider taking

action to ensure that all major development projects in the US, including

Pebble, are evaluated through the National Environmental Policy Act (“NEPA”)

permitting process. “As we look to the future, I urge policymakers to consider

requiring the use of the Permit/NEPA Process. This process, which entails

compliance with NEPA and other regulatory requirements, an environmental impact

statement (“EIS”), and input from the EPA, other relevant agencies, and the

State of Alaska, will supply the gaps in information which the BBWA left

outstanding. This decision is too important to be made with anything less than

the best and most comprehensive information available.”

An Executive Summary of the 346-page Cohen report (with

attachments) can be viewed at

http://files.cohengroup.net/Final/Final-Executive-Summary.pdf. To access

the complete report, visit

http://files.cohengroup.net/Final/Final-Report-with-Appendices-compressed.pdf.

In addition to the Cohen investigation, EPA actions at Pebble

are being scrutinized by the EPA Inspector General and several Congressional

committees. Last fall, a federal court judge in Alaska approved the Pebble

Partnership’s motion for a Preliminary Injunction that forbids EPA from taking

any further steps to advance its proposed veto pending the outcome of litigation

alleging that the federal agency violated the Federal Advisory Committee

Act.

About Northern Dynasty Minerals Ltd.

Northern Dynasty is a mineral exploration and development

company based in Vancouver, Canada. Northern Dynasty's principal asset is the

Pebble Project in southwest Alaska, USA, an initiative to develop one of the

world's most important mineral resources.

For further details on Northern Dynasty and the Pebble Project,

please visit the Company's website at www.northerndynasty.com or contact

Investor services at (604) 684-6365 or within North America at 1-800-667-2114.

Review Canadian public filings at www.sedar.com and US public filings at

www.sec.gov.

Marchand Snyman

Chief Financial Officer

Forward Looking Information and other

Cautionary Factors

This release includes certain statements that may be deemed

"forward-looking statements". All statements in this release, other than

statements of historical facts, that address exploration drilling, exploitation

activities and events or developments that the Company expects are

forward-looking statements. Although the Company believes the expectations

expressed in its forward-looking statements are based on reasonable assumptions,

such statements should not be in any way construed as guarantees of the ultimate

size, quality or commercial feasibility of the Pebble Project or of the

Company's future performance or the outcome of litigation. Assumptions used by

the Company to develop forward-looking statements include the following: the

Pebble Project will obtain all required environmental and other permits and all

land use and other licenses, studies and development of the Pebble Project will

continue to be positive, and no geological or technical problems will occur. The

likelihood of future mining at the Pebble Project is subject to a large number

of risks and will require achievement of a number of technical, economic and

legal objectives, including obtaining necessary mining and construction permits,

approvals, licenses and title on a timely basis and delays due to third party

opposition, changes in government policies regarding mining and natural resource

exploration and exploitation, the final outcome of any litigation, completion of

pre-feasibility and final feasibility studies, preparation of all necessary

engineering for surface or underground mining and processing facilities as well

as receipt of significant additional financing to fund these objectives as well

as funding mine construction. Such funding may not be available to the Company

on acceptable terms or on any terms at all. There is no known ore at the Pebble

Project and there is no assurance that the mineralization at the Pebble Project

will ever be classified as ore. The need for compliance with extensive

environmental and socio-economic rules and practices and the requirement for the

Company to obtain government permitting can cause a delay or even abandonment of

a mineral project. The Company is also subject to the specific risks inherent in

the mining business as well as general economic and business conditions. For

more information on the Company, Investors should review the Company's filings

with the United States Securities and Exchange Commission and its home

jurisdiction filings that are available at www.sedar.com.

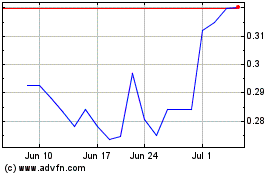

Northern Dynasty Minerals (AMEX:NAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

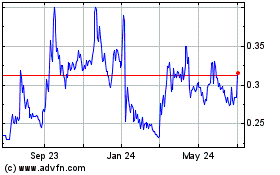

Northern Dynasty Minerals (AMEX:NAK)

Historical Stock Chart

From Apr 2023 to Apr 2024