UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment

No. 4

to

Schedule TO

Tender

Offer Statement under Section 14(d)(1) or 13(e)(1)

Of the Securities Exchange Act of 1934

H&R BLOCK, INC.

(Name of Subject Company (Issuer) and Filing Person (Offeror))

Common Stock, no par value per share

(Title of Class of Securities)

093671105

(CUSIP Number

of Class of Securities)

Thomas A. Gerke, Esq.

Chief Legal Officer

One

H&R Block Way

Kansas City, Missouri 64105

(816) 854-3000

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of the Filing Persons)

With a

copy to:

|

|

|

| Raymond O. Gietz, Esq.

Weil, Gotshal & Manges LLP

767 Fifth Avenue New

York, New York 10153 (212) 310-8000 |

|

John A. Granda, Esq.

Jack Bowling, Esq. B.

Scott Gootee, Esq. Stinson Leonard Street LLP

1201 Walnut Street, Suite 2900

Kansas City, Missouri 64106

(816) 842-8600 |

CALCULATION OF FILING FEE

|

|

|

| Transaction Valuation* |

|

Amount of Filing Fee** |

| $1,500,000,000 |

|

$174,300 |

| |

| * |

The transaction value is estimated only for purposes of calculating the filing fee. This amount is based on the offer to purchase shares of common stock, no par value, for an aggregate purchase price of up to

$1,500,000,000 at the minimum tender offer price of $32.25 per share. |

| ** |

The amount of the filing fee, calculated in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, as modified by Fee Rate Advisory No. 1 for fiscal year 2015, equals $116.20 per million

dollars of the value of the transaction. |

| x |

Check the box if any part of the fee is offset as provided by Rule 0–11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

|

|

|

| Amount Previously Paid: $174,300 |

|

Filing Party: H&R Block, Inc. |

| Form or Registration No.: 005-11636 |

|

Date Filed: September 2, 2015 |

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

¨ |

third-party tender offer subject to Rule 14d–1. |

| |

x |

issuer tender offer subject to Rule 13e–4. |

| |

¨ |

going-private transaction subject to Rule 13e–3. |

| |

¨ |

amendment to Schedule 13D under Rule 13d–2. |

Check the following box if the filing is a

final amendment reporting the results of the tender offer: x

If applicable,

check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

This Amendment No. 4 (“Amendment No. 4”) amends and supplements the Tender

Offer Statement on Schedule TO initially filed with the Securities and Exchange Commission (the “SEC”) by H&R Block, Inc., a Missouri corporation (“H&R Block” or the “Company”), on September 2, 2015, as

amended and supplemented by Amendment No. 1 to the Schedule TO filed with the SEC on September 4, 2015, Amendment No. 2 to the Schedule TO filed with the SEC on September 21, 2015 and Amendment No. 3 to the Schedule TO filed

with the SEC on October 5, 2015 (the “Schedule TO”), pursuant to Rule 13e–4 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in connection with the Company’s offer to purchase for cash

shares of its common stock, no par value per share (the “Shares”), having an aggregate purchase price of up to $1,500,000,000, pursuant to (i) auction tenders at prices specified by the tendering shareholder of not less than $32.25

and not greater than $37.00 per Share (“Auction Tenders”) or (ii) purchase price tenders (“Purchase Price Tenders”), in either case, net to the seller in cash, less any applicable withholding taxes and without interest, upon

the terms and subject to the conditions set forth in the Offer to Purchase, dated September 2, 2015, and in the related Letter of Transmittal (which, as they may be amended or supplemented from time to time, together constitute the

“Offer”).

This Amendment No. 4 is being filed to amend and supplement certain provisions of the Schedule TO as set forth

herein. Except as amended hereby to the extent specifically provided herein, all terms of the Offer and all other disclosures set forth in the Schedule TO and the Exhibits thereto remain unchanged and are hereby expressly incorporated into this

Amendment No. 4 by reference.

| Item 11. |

Additional Information. |

Item 11 of Schedule TO is hereby amended and

supplemented by adding the following:

“On October 8, 2015, the Company issued a press release announcing the final results of

the Offer, which expired at 5:00 P.M., New York City time, on Friday, October 2, 2015. A copy of the press release is filed as Exhibit (a)(5)(F) to the Schedule TO and is incorporated herein by reference.”

Item 12 is hereby amended and supplemented by

adding the following exhibit:

(a)(5)(F) Press Release issued by H&R Block, Inc. on October 8, 2015.

2

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Amendment No. 4 is true,

complete and correct.

|

|

|

| H&R BLOCK, INC. |

|

|

| By: |

|

/s/ Scott W. Andreasen |

| Name: |

|

Scott W. Andreasen |

| Title: |

|

Vice President and Secretary |

Date: October 8, 2015

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| (a)(1)(A) |

|

Offer to Purchase, dated September 2, 2015.* |

|

|

| (a)(1)(B) |

|

Letter of Transmittal (including IRS Form W-9).* |

|

|

| (a)(1)(C) |

|

Notice of Guaranteed Delivery.* |

|

|

| (a)(1)(D) |

|

Letter to Brokers, Dealers, Banks, Trust Companies and Other Nominees.* |

|

|

| (a)(1)(E) |

|

Letter to Clients for use by Brokers, Dealers, Banks, Trust Companies and Other Nominees.* |

|

|

| (a)(1)(F) |

|

Form of Summary Advertisement.* |

|

|

| (a)(2) |

|

None. |

|

|

| (a)(3) |

|

Not applicable. |

|

|

| (a)(4) |

|

Not applicable. |

|

|

| (a)(5)(A) |

|

Press Release issued by H&R Block, Inc. on September 1, 2015, filed as Exhibit 99.2 to the Company’s current report on Form 8-K filed September 1, 2015, file number 1-06089, is incorporated herein by reference. |

|

|

| (a)(5)(B) |

|

Press Release issued by H&R Block, Inc. on September 2, 2015.* |

|

|

| (a)(5)(C) |

|

H&R Block First Quarter 2016 Earnings Conference Call Transcript Excerpts, dated September 1, 2015.* |

|

|

| (a)(5)(D) |

|

Press Release issued by H&R Block, Inc. on September 21, 2015.* |

|

|

| (a)(5)(E) |

|

Press Release issued by H&R Block, Inc. on October 5, 2015.* |

|

|

| (a)(5)(F) |

|

Press Release issued by H&R Block, Inc. on October 8, 2015. |

|

|

| (b)(1) |

|

Credit and Guarantee Agreement dated September 21, 2015, by and among Block Financial LLC, H&R Block, Inc., the lenders party thereto from time to time, and JPMorgan Chase Bank, N.A., as administrative agent, filed as Exhibit

10.1 to the Company’s current report on Form 8-K filed September 21, 2015, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(1) |

|

2013 Long Term Incentive Plan, as amended and restated on March 6, 2013, filed as Exhibit 10.1 to the Company’s quarterly report on Form 10-Q for the quarter ended January 31, 2013, file number 1-06089, is incorporated herein

by reference. |

|

|

| (d)(2) |

|

Form of 2013 Long Term Incentive Plan Award Agreement for Restricted Share Units, as approved on March 6, 2013, filed as Exhibit 10.2 to the Company’s quarterly report on Form 10-Q for the quarter ended January 31, 2013, file

number 1-06089, is incorporated herein by reference. |

|

|

| (d)(3) |

|

Form of 2013 Long Term Incentive Plan Award Agreement for Non-Qualified Stock Options, as approved on March 6, 2013, filed as Exhibit 10.3 to the Company’s quarterly report on Form 10-Q for the quarter ended January 31, 2013,

file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(4) |

|

Form of 2013 Long Term Incentive Plan Award Agreement for Restricted Share Units, as approved on June 19, 2013, filed as Exhibit 10.3 to the Company’s current report on Form 8-K filed June 21, 2013, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(5) |

|

Form of 2013 Long Term Incentive Plan Award Agreement for Non-Qualified Stock Options, as approved on June 19, 2013, filed as Exhibit 10.4 to the Company’s current report on Form 8-K filed June 21, 2013, file number 1-06089, is

incorporated herein by reference. |

|

|

|

| (d)(6) |

|

Form of 2013 Long Term Incentive Plan Award Agreement for Performance Share Units, as approved on June 19, 2013, filed as Exhibit 10.2 to the Company’s current report on Form 8-K filed June 21, 2013, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(7) |

|

Form of 2013 Long Term Incentive Plan Award Agreement for Market Stock Units, as approved on June 19, 2013, filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed June 21, 2013, file number 1-06089,

is incorporated herein by reference. |

|

|

| (d)(8) |

|

Form of 2013 Long Term Incentive Plan Award Agreement for Deferred Stock Units, as approved on September 12, 2013, filed as Exhibit 10.1 to the Company’s quarterly report on Form 10-Q for the quarter ended October 31, 2013,

file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(9) |

|

Alternate Form of Market Stock Units Award Agreement, filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed July 1, 2014, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(10) |

|

Alternate Form of Performance Share Units Award Agreement, filed as Exhibit 10.2 to the Company’s current report on Form 8-K filed July 1, 2014, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(11) |

|

Alternate Form of Restricted Share Units Award Agreement, filed as Exhibit 10.3 to the Company’s current report on Form 8-K filed July 1, 2014, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(12) |

|

The Company’s 2003 Long-Term Executive Compensation Plan, as amended September 30, 2010, filed as Exhibit 10.2 to the Company’s quarterly report on Form 10-Q for the quarter ended October 31, 2010, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(13) |

|

First Amendment to the Company’s 2003 Long-Term Executive Compensation Plan, effective May 10, 2012, filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed May 11, 2012, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(14) |

|

Form of 2003 Long-Term Executive Compensation Plan Grant Agreement for Performance Shares, filed as Exhibit 10.3 to the Company’s quarterly report on Form 10-Q for the quarter ended July 31, 2011, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(15) |

|

Form of 2003 Long-Term Executive Compensation Plan Grant Agreement for Stock Options, filed as Exhibit 10.2 to the Company’s quarterly report on Form 10-Q for the quarter ended July 31, 2011, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(16) |

|

Form of 2003 Long-Term Executive Compensation Plan Grant Agreement for Restricted Shares, filed as Exhibit 10.1 to the Company’s quarterly report on Form 10-Q for the quarter ended July 31, 2011, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(17) |

|

Form of 2003 Long-Term Executive Compensation Plan Grant Agreement for Market Stock Units as approved on June 20, 2012, filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed June 26, 2012, file number 1-06089,

is incorporated herein by reference. |

|

|

| (d)(18) |

|

Form of 2003 Long-Term Executive Compensation Plan Grant Agreement for Performance Share Units as approved on June 20, 2012, filed as Exhibit 10.2 to the Company’s current report on Form 8-K filed June 26, 2012, file

number 1-06089, is incorporated herein by reference. |

|

|

| (d)(19) |

|

Form of 2003 Long-Term Executive Compensation Plan Grant Agreement for Stock Options as approved on June 20, 2012, filed as Exhibit 10.3 to the Company’s current report on Form 8-K filed June 26, 2012, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(20) |

|

Form of 2003 Long-Term Executive Compensation Plan Grant Agreement for Restricted Share Units as approved on June 20, 2012, filed as Exhibit 10.4 to the Company’s current report on Form 8-K filed June 26, 2012, file number

1-06089, is incorporated herein by reference. |

|

|

| (d)(21) |

|

Employment Agreement dated April 27, 2011, between H&R Block Management, LLC and William C. Cobb, filed as Exhibit 10.2 to the Company’s current report on Form 8-K filed April 29, 2011, file number 1-06089, is

incorporated herein by reference. |

|

|

|

| (d)(22) |

|

Letter Agreement between the Company, H&R Block Management, LLC and William C. Cobb, effective January 3, 2013, filed as Exhibit 10.5 to the Company’s quarterly report on Form 10-Q for the quarter ended

January 31, 2013, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(23) |

|

Letter Agreement, dated as of July 15, 2014, by and among the Company, H&R Block Management, LLC, and William C. Cobb, filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed July 17, 2014, file number

1-06089, is incorporated herein by reference. |

|

|

| (d)(24) |

|

Agreement between H&R Block Management, LLC, H&R Block, Inc. and William C. Cobb as of January 3, 2013 in connection with certain corrective actions relating to the June 30, 2011 Option Award, filed as Exhibit 10.1 to the

Company’s current report on Form 8-K filed January 4, 2013, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(25) |

|

H&R Block, Inc. 2013 Long Term Incentive Plan Non-Qualified Stock Option Award Agreement between H&R Block, Inc. and William C. Cobb dated January 4, 2013, filed as Exhibit 10.2 to the Company’s current report on Form

8-K filed January 4, 2013, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(26) |

|

H&R Block, Inc. 2013 Long Term Incentive Plan Restricted Share Units Award Agreement between H&R Block, Inc. and William C. Cobb dated January 4, 2013, filed as Exhibit 10.3 to the Company’s current report on Form 8-K

filed January 4, 2013, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(27) |

|

Grant Agreement between H&R Block, Inc. and William C. Cobb in connection with award of Restricted Shares as of May 2, 2011, filed as Exhibit 10.4 to the Company’s quarterly report on Form 10-Q for the quarter ended July

31, 2011, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(28) |

|

Grant Agreement between H&R Block, Inc. and William C. Cobb in connection with award of Stock Options as of May 2, 2011, filed as Exhibit 10.5 to the Company’s quarterly report on Form 10-Q for the quarter ended July

31, 2011, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(29) |

|

H&R Block Deferred Compensation Plan for Executives, as amended and restated on November 9, 2012, filed as Exhibit 10.4 to the Company’s quarterly report on Form 10-Q for the quarter ended October 31, 2012, file number

1-06089, is incorporated herein by reference. |

|

|

| (d)(30) |

|

The H&R Block Executive Performance Plan, as amended July 27, 2010, filed as Exhibit 10.6 to the Company’s annual report on Form 10-K for the fiscal year ended April 30, 2011, file number 1-06089, is incorporated herein by

reference. |

|

|

| (d)(31) |

|

The Amended and Restated H&R Block Executive Performance Plan, filed as Exhibit 10.1 to the Company’s current report on Form 8-K, filed September 12, 2014, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(32) |

|

The H&R Block, Inc. 2000 Employee Stock Purchase Plan, as amended and restated effective November 7, 2013, filed as Exhibit 10.2 to the Company’s quarterly report on Form 10-Q for the quarter ended October 31, 2013, file

number 1-06089, is incorporated herein by reference. |

|

|

| (d)(33) |

|

The H&R Block, Inc. Executive Survivor Plan (as Amended and Restated January 1, 2001) filed as Exhibit 10.4 to the Company’s quarterly report on Form 10-Q for the quarter ended October 31, 2000, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(34) |

|

First Amendment to the H&R Block, Inc. Executive Survivor Plan (as Amended and Restated) effective as of July 1, 2002, filed as Exhibit 10.9 to the Company’s annual report on Form 10-K for the fiscal year ended

April 30, 2002, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(35) |

|

Second Amendment to the H&R Block, Inc. Executive Survivor Plan (as Amended and Restated), effective as of March 12, 2003, filed as Exhibit 10.12 to the Company’s annual report on Form 10-K for the fiscal year ended

April 30, 2003, file number 1-06089, is incorporated herein by reference. |

|

|

|

| (d)(36) |

|

H&R Block Severance Plan, as amended and restated on March 29, 2013, filed as Exhibit 10.29 to the Company’s annual report on Form 10-K for the fiscal year ended April 30, 2013, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(37) |

|

H&R Block Inc. Executive Severance Plan, as amended and restated effective November 8, 2013, filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed November 8, 2013, file number 1-06089, is incorporated

herein by reference. |

|

|

| (d)(38) |

|

Employment Agreement dated April 27, 2011, between H&R Block Management, LLC and William C. Cobb, filed as Exhibit 10.2 to the Company’s current report on Form 8-K filed April 29, 2011, file number 1-06089, is

incorporated herein by reference |

|

|

| (d)(39) |

|

Separation and Release Agreement between the Company and C. E. Andrews dated March 6, 2012, filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed March 6, 2012, file number 1-06089, is incorporated herein by

reference. |

|

|

| (d)(40) |

|

Severance and Release Agreement between HRB Tax Group, Inc. and Philip L. Mazzini, effective June 12, 2012, filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed June 18, 2012, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(41) |

|

Severance and Release Agreement between HRB Tax Group, Inc. and Susan Ehrlich dated August 16, 2013, filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed August 20, 2013, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(42) |

|

Form of Indemnification Agreement with Directors and Officers, filed as Exhibit 10.2 to the Company’s quarterly report on Form 10-Q for the quarter ended January 31, 2012, file number 1-06089, and Schedule of Parties to

Indemnification Agreement filed as Exhibit 10.2 to the Company’s quarterly report on Form 10-Q for the quarter ended January 31, 2012, file number 1-06089, as updated by the Company’s current report on Form 8-K filed May 11, 2012, file

number 1-06089, and quarterly report on Form 10-Q for the quarter ended January 31, 2013, file number 1-06089, and current report on Form 8-K filed November 8, 2013, file number 1-06089, are incorporated herein by reference. |

|

|

| (d)(43) |

|

2008 Deferred Stock Unit Plan for Outside Directors, as amended on September 14, 2011, filed as Exhibit 10.27 to the Company’s annual report on Form 10-K for the year ended April 30, 2012, file number 1-06089, is incorporated

herein by reference. |

|

|

| (d)(44) |

|

Credit and Guarantee Agreement dated as of August 17, 2012, among Block Financial LLC, H&R Block, Inc., the lenders party thereto from time to time and JPMorgan Chase Bank, N.A., as Administrative Agent, filed as Exhibit 10.1 to

the Company’s current report on Form 8-K filed August 20, 2012, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(45) |

|

Letter Agreement, dated as of June 18, 2015, by and among the Company, H&R Block Management, LLC, and William C. Cobb, filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed June 19, 2015, file number

1-06089, is incorporated herein by reference. |

|

|

| (d)(46) |

|

Form of 2013 Long Term Incentive Plan Award Agreement for Market Stock Units, filed as Exhibit 10.2 to the Company’s current report on Form 8-K filed June 19, 2015, file number 1-06089, is incorporated herein by

reference. |

|

|

| (d)(47) |

|

Form of 2013 Long Term Incentive Plan Award Agreement for Performance Share Units, filed as Exhibit 10.3 to the Company’s current report on Form 8-K filed June 19, 2015, file number 1-06089, is incorporated herein by

reference. |

|

|

| (d)(48) |

|

Alternate Form of 2013 Long Term Incentive Plan Award Agreement for Market Stock Units, filed as Exhibit 10.4 to the Company’s current report on Form 8-K filed June 19, 2015, file number 1-06089, is incorporated herein by

reference. |

|

|

|

| (d)(49) |

|

Alternate Form of 2013 Long Term Incentive Plan Award Agreement for Performance Share Units, filed as Exhibit 10.5 to the Company’s current report on Form 8-K filed June 19, 2015, file number 1-06089, is incorporated

herein by reference. |

|

|

| (d)(50) |

|

Amended and Restated Purchase and Assumption Agreement, dated August 5, 2015, by and among H&R Block Bank, Block Financial LLC and Bofl Federal Bank, filed as Exhibit 10.1 to the Company’s current report on Form 8-K

filed August 5, 2015, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(51) |

|

Program Management Agreement, by and between Emerald Financial Services, LLC and Bofl Federal Bank, filed as Exhibit 10.1 to the Company’s current report on Form 8-K filed September 1, 2015, file number 1-06089, is

incorporated herein by reference. |

|

|

| (d)(52) |

|

Emerald Advance Receivables Participation Agreement, by and among Emerald Financial Services, LLC, Bofl Federal Bank, HRB Participant I, LLC and H&R Block, Inc., filed as Exhibit 10.2 to the Company’s current report on

Form 8-K filed September 1, 2015, file number 1-06089, is incorporated herein by reference. |

|

|

| (d)(53) |

|

Guaranty Agreement, by and between H&R Block, Inc. and Bofl Federal Bank, filed as Exhibit 10.3 to the Company’s current report on Form 8-K filed September 1, 2015, file number 1-06089, is incorporated herein by

reference. |

|

|

| (g) |

|

Not applicable |

|

|

| (h) |

|

Not applicable |

Exhibit (a)(5)(F)

News Release

For

Immediate Release: October 8, 2015

H&R BLOCK ANNOUNCES FINAL RESULTS OF TENDER OFFER

KANSAS CITY, Mo. - H&R Block, Inc. (NYSE: HRB), the world’s largest consumer tax services provider, today announced the final results of its

“modified Dutch auction” tender offer, which expired at 5:00 P.M., New York City time, on Friday, October 2, 2015.

Based on the final

count by the depositary for the tender offer, H&R Block accepted for purchase approximately 40.5 million shares of H&R Block’s common stock at a purchase price of $37.00 per share, for a total cost of approximately

$1.5 billion, excluding fees and expenses related to the tender offer. The repurchased shares represent approximately 14.7% of H&R Block’s common stock outstanding as of September 30, 2015.

The tender offer was oversubscribed. Pursuant to the terms of the tender offer, shares were accepted on a pro rata basis, except for tenders of odd

lots, which were accepted in full. H&R Block has determined that the proration factor for the tender offer, after giving effect to the priority of odd lots, is approximately 83.5%. The depositary will promptly pay for the shares accepted for

purchase and will return all other shares tendered and not purchased.

J.P. Morgan Securities LLC served as dealer manager for the tender offer.

Shareholders who have questions or would like additional information about the tender offer may contact the information agent for the tender offer, Georgeson Inc., at (866) 695-6078 (toll-free) or (781) 575-2137.

About H&R Block, Inc.

H&R Block, Inc. (NYSE:

HRB) is the world’s largest consumer tax services provider. More than 680 million tax returns have been prepared worldwide by and through H&R Block since 1955. In fiscal 2015, H&R Block had annual revenues of nearly $3.1 billion

with 24.2 million tax returns prepared worldwide. Tax return preparation services are provided by professional tax preparers in approximately 12,000 company-owned and franchise retail tax offices worldwide, and through H&R Block Tax

Software products. H&R Block also offers adjacent Tax Plus products and services. For more information, visit the H&R Block Newsroom at http://newsroom.hrblock.com/.

Forward-Looking Statements

This press release may

contain forward-looking statements within the meaning of the securities laws. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variation of words

such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “targets,” “would,”

“will,” “should,” “could” or “may” or other similar expressions. Forward-looking statements provide management’s current expectations or predictions of future conditions, events or results. All statements

that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. They may include estimates of revenues, income, earnings per share, capital expenditures, dividends,

liquidity, capital structure or other financial items, descriptions of management’s plans or objectives for future operations, products or services, or descriptions of assumptions underlying any of the above. All forward-looking statements

speak only as of the date they are made and reflect the company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance or events. Furthermore, the company disclaims any obligation to publicly

update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data or methods, future events or other changes, except as required by law. By their nature, forward-looking

statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of

economic, competitive and regulatory factors, many of which are beyond the company’s control and which are described in our Annual Report on Form 10-K for the fiscal year ended April 30, 2015 and our Quarterly Report on Form 10-Q for the

quarter-ended July 31, 2015 under the caption “Risk Factors,” as well as additional factors we may describe from time to time in other filings with the Securities and Exchange Commission. You should understand that it is not possible

to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

For Further Information

Investor Relations: Colby Brown, (816) 854-4559, colby.brown@hrblock.com

Media Relations: Gene King, (816) 854-4672, gene.king@hrblock.com

2

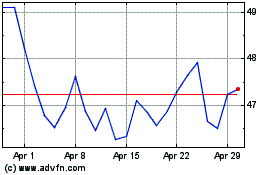

H and R Block (NYSE:HRB)

Historical Stock Chart

From Mar 2024 to Apr 2024

H and R Block (NYSE:HRB)

Historical Stock Chart

From Apr 2023 to Apr 2024