UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant x Filed by a

Party other than the Registrant ¨

Check the appropriate box:

|

|

|

| ¨ |

|

Preliminary Proxy Statement |

|

|

| ¨ |

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| x |

|

Definitive Proxy Statement |

|

|

| ¨ |

|

Definitive Additional Materials |

|

|

| ¨ |

|

Soliciting Materials Under Rule 14a-12 |

ImmunoCellular Therapeutics, Ltd.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

| x |

|

No fee required. |

|

|

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

(5) |

|

Total fee paid:

|

|

|

| ¨ |

|

Fee paid previously with preliminary materials. |

|

|

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount Previously Paid:

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

(3) |

|

Filing Party:

|

|

|

(4) |

|

Date Filed:

|

IMMUNOCELLULAR THERAPEUTICS, LTD.

23622 Calabasas Road, Suite 300

Calabasas, California 91302

October 6, 2015

Dear Stockholder:

You are cordially invited to attend the Special Meeting of Stockholders of ImmunoCellular Therapeutics, Ltd. The Special Meeting will be held

at the Company’s headquarters at 23622 Calabasas Road, Suite 300, Calabasas, California 91302, beginning at 8:00 A.M., local time, on Monday, November 16, 2015, for the following purposes:

| |

1. |

To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the authorized number of shares of common stock from 149,000,000 to 249,000,000 (Proposal One).

|

| |

2. |

To adjourn the Special Meeting, if necessary or appropriate, to establish a quorum or to permit further solicitation of proxies if there are not sufficient votes at the time of the Special Meeting cast in favor of

Proposal One (Proposal Two). |

Whether or not you plan to attend the meeting, please vote at your earliest convenience by

following the instructions in the notice of internet availability of proxy materials or the proxy card you received in the mail.

I hope

you will join us.

|

| Sincerely, |

|

| /s/ Gary S. Titus |

| Gary S. Titus |

| Chairman of the Board |

IMMUNOCELLULAR THERAPEUTICS, LTD.

23622 Calabasas Road, Suite 300

Calabasas, California 91302

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

to be held on November 16, 2015

Notice is hereby given to the holders of common stock, $0.0001 par value per share, of ImmunoCellular Therapeutics, Ltd.

(“ImmunoCellular,” the “Company,” “we” or “our”) that the Special Meeting of Stockholders will be held on Monday, November 16, 2015 at the Company’s headquarters at 23622 Calabasas Road, Suite 300,

Calabasas, California 91302, beginning at 8:00 A.M., local time, for the following purposes:

| |

1. |

To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the authorized number of shares of common stock from 149,000,000 to 249,000,000 (Proposal One).

|

| |

2. |

To adjourn the Special Meeting, if necessary or appropriate, to establish a quorum or to permit further solicitation of proxies if there are not sufficient votes at the time of the Special Meeting cast in favor of

Proposal One (Proposal Two). |

Only those stockholders of record at the close of business on October 1, 2015 are entitled

to notice of and to vote at the Special Meeting or any postponement or adjournment of the Special Meeting. A complete list of stockholders entitled to vote at the Special Meeting will be available at the Special Meeting.

|

|

|

|

|

By Order of the Board of Directors |

|

|

| October 6, 2015 |

|

/s/ Gary S. Titus |

|

|

Gary S. Titus |

|

|

Corporate Secretary |

WHETHER OR NOT YOU EXPECT TO ATTEND THE SPECIAL MEETING, PLEASE FOLLOW THE INSTRUCTIONS IN THE NOTICE OF INTERNET

AVAILABILITY OF PROXY MATERIALS OR THE PROXY CARD YOU RECEIVED IN THE MAIL TO VOTE YOUR SHARES. IF YOU VOTE BY TELEPHONE OR VIA THE INTERNET, YOU NEED NOT RETURN A PROXY CARD. IF YOU ATTEND THE SPECIAL MEETING YOU MAY, IF YOU WISH, REVOKE YOUR PROXY

AND VOTE IN PERSON. IF YOU HOLD YOUR SHARES THROUGH A BROKER OR OTHER CUSTODIAN, PLEASE CHECK THE VOTING INSTRUCTIONS PROVIDED TO YOU BY THAT BROKER OR CUSTODIAN.

Important Notice Regarding the Internet Availability of Proxy Materials for the Special Meeting of Stockholders to be Held on

November 16, 2015 at the Company’s headquarters at 23622 Calabasas Road, Suite 300, Calabasas, California 91302.

This Proxy Statement and the accompanying proxy are available at www.proxyvote.com.

IMMUNOCELLULAR THERAPEUTICS, LTD.

23622 Calabasas Road, Suite 300

Calabasas, California 91302

Special Meeting of Stockholders to be Held on November 16, 2015

PROXY STATEMENT

This

Proxy Statement is furnished to holders of the common stock, $0.0001 par value per share, of ImmunoCellular Therapeutics, Ltd., a Delaware corporation, in connection with the solicitation of proxies by our Board of Directors for use at a Special

Meeting of Stockholders to be held at the Company’s headquarters at 23622 Calabasas Road, Suite 300, Calabasas, California 91302, beginning at 8:00 A.M., local time, on Monday, November 16, 2015, and at any postponement or adjournment of

the Special Meeting.

Pursuant to the rules adopted by the Securities and Exchange Commission, or SEC, we have elected to provide

access to our proxy materials over the Internet. Accordingly, we are sending a Notice Regarding the Availability of Proxy Materials, or Notice, to certain of our stockholders of record, and we are sending a paper copy of the proxy materials and

proxy card to other stockholders of record who we believe would prefer receiving such materials in paper form. Brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar Notice. Stockholders will have

the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on

the website referred to in the Notice, including an option to request paper copies on an ongoing basis. We intend to make this Proxy Statement available on the Internet and to mail the Notice, or to mail the Proxy Statement and Proxy Card, as

applicable, on or about October 6, 2015 to all stockholders of record as of the close of business on October 1, 2015.

What is the purpose of

the Special Meeting?

At the Special Meeting, stockholders will act upon the matters outlined in the attached Notice of Meeting and

described in detail in this Proxy Statement.

Who is entitled to vote at the Special Meeting?

Only stockholders of record at the close of business on October 1, 2015 are entitled to notice of, and to vote at, the Special Meeting or

any adjournment or postponement of the Special Meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial

owner?

Some of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name as

the stockholder of record. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

| |

• |

|

Stockholder of Record — If on October 1, 2015 your shares are registered directly in your name with our Transfer Agent, Computershare Trust Company, N.A., you are considered, with respect to those

shares, the stockholder of record. As the stockholder of record, you have the right to vote your proxy directly with us by sending your proxy to Broadridge or to vote in person at the Special Meeting. If you submit your proxy telephonically or over

the internet, you must vote no later than 11:59 p.m. Eastern Time on November 15, 2015. |

| |

• |

|

Beneficial Owner — If on October 1, 2015 your shares are held in the name of a stock brokerage account or a bank or other nominee, you are considered the beneficial owner of shares held in street name

and your broker or nominee is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker or nominee on how to vote and are also invited to attend the Special Meeting.

However, since you are not the stockholder of record, you may not vote these shares in person at the Special Meeting unless you receive a proxy from your broker or nominee. Your broker or nominee has provided voting instructions for you to use. If

you wish to attend the Special Meeting and vote in person, please contact your broker or nominee so that you can receive a legal proxy to present at the Special Meeting. |

How many votes do I have?

On each matter

to be voted upon, you have one vote for each share of common stock you owned as of the record date.

1

How many votes are needed to approve each proposal?

To be approved, Proposal One, approval of Amendments to our Amended and Restated Certificate of Incorporation, must receive “FOR”

votes from the holders of a majority of the shares of common stock outstanding on the record date. Abstentions will have the same effect as “AGAINST” votes.

Approval of Proposal Two, adjournment of the Special Meeting, if necessary or appropriate, to establish a quorum or to permit further

solicitation of proxies if there are not sufficient votes at the time of the Special Meeting cast in favor of Proposal One, requires “FOR” votes from a majority of the shares present in person or represented by proxy and entitled to vote

at the Special Meeting. Abstentions will have the same effect as “AGAINST” votes.

What constitutes a quorum?

Our Bylaws provide that the presence, in person or by proxy, at our Special Meeting of the holders of a majority of the outstanding shares of

our common stock entitled to vote will constitute a quorum.

For the purpose of determining the presence of a quorum, proxies marked

“abstain” will be counted as present. On the record date of October 1, 2015, there were 90,290,149 shares of our common stock issued and outstanding, and those shares are the only shares that are entitled to vote at the Special

Meeting.

What are the Board’s recommendations?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the

recommendations of our Board of Directors. In summary, our Board of Directors recommends a vote

| |

• |

|

“FOR” approval of an amendment to our Amended and Restated Certificate of Incorporation to increase the authorized number of shares of common stock from 149,000,000 to 249,000,000. |

| |

• |

|

“FOR” adjournment of the Special Meeting, if necessary or appropriate, to establish a quorum or to permit further solicitation of proxies if there are not sufficient votes at the time of the Special Meeting

cast in favor of Proposal One. |

How can I attend the Special Meeting?

You may attend the Special Meeting if you are listed as a stockholder of record as of October 1, 2015 and bring proof of your identity. If

you hold your shares through a broker or other nominee, you will need to provide proof of your share ownership by bringing either a copy of a brokerage statement showing your share ownership as of October 1, 2015, or a legal proxy if you wish

to vote your shares in person at the Special Meeting. In addition to the items mentioned above, you should bring proof of your identity.

How can I

vote my shares in person at the Special Meeting?

| |

• |

|

Shares held directly in your name as the stockholder of record may be voted in person at the Special Meeting. If you choose to do so, please bring proof of your identity to the Special Meeting. Shares beneficially owned

may be voted by you if you receive and present at the Special Meeting a Legal Proxy from your broker or nominee, together with proof of your identity. Even if you plan to attend the Special Meeting, we urge you to vote by telephone, by Internet or

by returning your marked proxy to Broadridge so that your vote will be counted if you later decide not to attend the Special Meeting or are unable to attend. |

| |

• |

|

You may vote over the Internet. Simply follow the instructions on the notice of internet availability or proxy card. If you vote over the Internet, you should not vote by telephone or vote by returning a proxy card.

|

| |

• |

|

You may vote by telephone. Simply follow the instructions on the notice of internet availability or proxy card. If you vote over the telephone, you should not vote by Internet or vote by returning a proxy card.

|

| |

• |

|

You may vote by mail. If you received a proxy card through the mail, simply complete and sign your proxy card and mail it in the enclosed envelope. If you mark your voting instructions on the proxy card, your shares

will be voted as you instruct. If you vote by mail, you should not vote by telephone or over the Internet. |

2

How will my proxy card be voted?

If the proxy card is executed, returned in time and not revoked, the shares represented by the proxy card, telephone vote or Internet vote will

be voted at the Special Meeting and at any postponement or adjournment of the Special Meeting in accordance with the directions indicated on the proxy card. IF NO DIRECTIONS ARE INDICATED, PROXIES MAILED, VOTED VIA TELEPHONE OR VOTED VIA INTERNET

WILL BE VOTED IN ACCORDANCE WITH THE RECOMMENDATION OF OUR BOARD OF DIRECTORS ON ALL OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT, AND AS TO ANY OTHER MATTERS PROPERLY BROUGHT BEFORE THE SPECIAL MEETING OR ANY POSTPONEMENT OR ADJOURNMENT OF

THE SPECIAL MEETING, IN THE SOLE DISCRETION OF THE PERSONS NAMED AS PROXY HOLDERS ON THE PROXY CARD.

How may I revoke the voting instructions

previously given?

A stockholder who returns a proxy card may revoke it at any time prior to its exercise at the Special Meeting by

(1) giving written notice of revocation to our Corporate Secretary, (2) properly submitting to us a duly executed proxy bearing a later date, or (3) appearing at the Special Meeting and voting in person. All written notices of

revocation of proxies should be addressed as follows: ImmunoCellular Therapeutics, Ltd., 23622 Calabasas Road, Suite 300, Calabasas, California 91302, Attention: Corporate Secretary. To revoke a proxy previously submitted by telephone or through the

Internet, you may simply vote again at a later date using the same procedures, in which case your later submitted vote will be recorded and your earlier vote revoked. For shares held beneficially by you, you may change your vote by submitting new

voting instructions to your broker or nominee.

Who is paying for this proxy solicitation?

We will bear the entire cost of proxy solicitation, including the costs of preparing, assembling, printing and mailing this Proxy Statement,

the Notice, the proxy card and any additional solicitation materials furnished to the stockholders. Copies of these materials will be furnished to brokers, banks or other nominees holding shares in their names that are beneficially owned by others

so they may forward these materials to such beneficial owners. In addition, we may reimburse such persons for their reasonable expenses in forwarding the solicitation materials to the beneficial owners. The original solicitation of proxies by mail

may be supplemented by a solicitation by personal contact, telephone, facsimile, email or any other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services.

We have engaged Morrow & Co., LLC to assist in proxy solicitation and collection at a cost of $6,500, plus out-of-pocket expenses.

How may I request multiple sets of proxy materials if two or more stockholders reside in my household?

To minimize our expenses, one Proxy Statement may be delivered to two or more stockholders who share an address unless we have received

contrary instructions from one or more of the stockholders. We will deliver promptly upon written or oral request a separate copy of these documents to a stockholder at a shared address to which a single copy of the documents was delivered. Requests

for additional copies of these documents, and requests that in the future separate documents be sent to stockholders who share an address, should be directed by writing to ImmunoCellular Therapeutics, Ltd., 23622 Calabasas Road, Suite 300,

Calabasas, California 91302, Attention: Corporate Secretary, or by calling our Corporate Secretary at (818) 264-2300.

How may I request a single set of proxy materials for my household?

If you share an address with another stockholder and have received multiple copies of our proxy materials, you may write or call us at the

address set forth in the preceding paragraph to request delivery of a single copy of these materials.

3

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding beneficial ownership of our common stock as of September 15, 2015 (a) by

each person known by us to own beneficially 5% or more of any class of our common stock, (b) by each of our executive officers named in the Summary Compensation Table and our directors and (c) by all executive officers and directors of

this company as a group. As of September 15, 2015, there were 90,254,823 shares of our common stock issued and outstanding. Unless otherwise noted, we believe that all persons named in the table have sole voting and investment power with

respect to all the shares beneficially owned by them.

|

|

|

|

|

|

|

|

|

| Name and Address of Beneficial Owner(1) |

|

Shares

Beneficially

Owned (2) |

|

|

Percent of

Total |

|

| Sabby Healthcare Master Fund, Ltd. and an affiliated entity(3) c/o Ogier Fiduciary Services (Cayman) Limited

89 Nexus Way

Camana Bay, Grand Cayman KY1-9007

Cayman Islands |

|

|

8,325,000 |

|

|

|

9.22 |

% |

|

|

|

| Capital Ventures International(4)

The Harbour Trust Co. Ltd.

Windward 1, Regatta Office Park

West Bay Road

P.O. Box 897

Grand Cayman KY1-1103

Cayman Islands. |

|

|

5,000,000 |

|

|

|

5.54 |

% |

|

|

|

| John S. Yu, M.D. |

|

|

6,422,576 |

(5) |

|

|

6.65 |

% |

|

|

|

| Andrew Gengos |

|

|

880,182 |

(6) |

|

|

* |

|

|

|

|

| Anthony Gringeri, Ph.D. |

|

|

368,250 |

(7) |

|

|

* |

|

|

|

|

| David Fractor |

|

|

209,666 |

(8) |

|

|

* |

|

|

|

|

| Steven Swanson, M.D. |

|

|

— |

|

|

|

— |

|

|

|

|

| Rahul Singhvi, Sc.D. |

|

|

264,110 |

(9) |

|

|

* |

|

|

|

|

| Gary S. Titus |

|

|

93,758 |

(10) |

|

|

* |

|

|

|

|

| All executive officers and directors as a group (7 persons) |

|

|

8,248,541 |

(11) |

|

|

8.42 |

% |

| (1) |

Unless otherwise indicated, the address of each of the persons shown is c/o ImmunoCellular Therapeutics, Ltd., 23622 Calabasas Road, Suite 300, Calabasas, California 91302. |

| (2) |

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock subject to

options, warrants and convertible securities currently exercisable or convertible, or exercisable or convertible within 60 days of September 15, 2015, are deemed outstanding, including for purposes of computing the percentage ownership of the

person holding such option, warrant or convertible security, but not for purposes of computing the percentage of any other holder. |

| (3) |

Based upon a Schedule 13G filed February 19, 2015, reporting beneficial ownership as of February 19, 2015. Sabby Healthcare Master Fund, Ltd. (“Sabby Healthcare”) has shared voting and dispositive

power with respect to 5,000,000 shares. Sabby Volatility Warrant Master Fund, Ltd. (has shared voting and dispositive power with respect to 3,325,000 shares. Sabby Management, LLC (“Sabby Management”) serves as the investment manager of

Sabby Healthcare and Sabby Volatility and has shared voting and dispositive power with respect to 8,325,000 of these shares. Hal Mintz, in his capacity as manager of Sabby Management, has shared voting and dispositive power with respect to 8,325,000

of these shares. The address for Sabby Management is 10 Mountainview Road, Suite 205, Upper Saddle River, New Jersey 07458. The address for Mr. Mintz is c/o Sabby Management, LLC, 10 Mountainview Road, Suite 205, Upper Saddle River, New Jersey

07458. |

4

| (4) |

Based upon a Schedule 13G filed February 20, 2015, reporting beneficial ownership as of February 12, 2015. Capital Ventures International has shared voting and dispositive power with respect to 5,000,000

shares. Heights Capital Management, Inc. is the investment manager of Capital Ventures International and as such may exercise voting and dispositive power over these shares. The address for Heights Capital Management, Inc. is 101 California Street,

Suite 3250, San Francisco, California 94111. |

| (5) |

Includes 6,422,576 shares of our common stock underlying stock options that are exercisable within 60 days of September 15, 2015. |

| (6) |

Includes 622,916 shares of our common stock underlying stock options that are exercisable within 60 days of September 15, 2015. |

| (7) |

Includes 206,250 shares of our common stock underlying stock options that are exercisable within 60 days of September 15, 2015. |

| (8) |

Includes 121,332 shares of our common stock underlying stock options that are exercisable within 60 days of September 15, 2015. |

| (9) |

Includes 259,110 shares of our common stock underlying stock options that are exercisable within 60 days of September 15, 2015. |

| (10) |

Includes 75,758 shares of our common stock underlying stock options that are exercisable within 60 days of September 15, 2015. |

| (11) |

Includes 7,707,941 shares of our common stock underlying stock options that are exercisable within 60 days of September 15, 2015. |

5

PROPOSAL ONE

APPROVAL OF AMENDMENT TO AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION TO INCREASE AUTHORIZED SHARES

On September 1, 2015, our Board of Directors adopted, subject to stockholder approval, an amendment to our Amended and Restated

Certificate of Incorporation to increase our authorized common stock from 149,000,000 shares to 249,000,000 shares.

The complete text of

the amendment to our Amended and Restated Certificate of Incorporation is set forth as Appendix A to this proxy statement.

Purpose and Background

of the Amendment

As of September 15, 2015, we had outstanding 90,254,823 shares of common stock, warrants and options to purchase

a total of 39,032,089 shares of common stock, 4,405,893 shares of common stock reserved for issuance under our Equity Plan and 3,646,959 shares of common stock registered and reserved for issuance under our Controlled Equity OfferingSM Sales Agreement with Cantor Fitzgerald & Co., which equates to 92% of the authorized shares. Accordingly, as of that date, we had only 12,020,236 shares of our authorized common stock

available for issuance that were not previously issued or reserved for issuance.

Because only 8% of the authorized shares remain

available for issuance, our Board of Directors believes it is in the best interests of the Company and our stockholders to increase our authorized shares of common stock in order to have additional authorized shares available for use as our Board of

Directors deems appropriate or necessary. For example, such shares may be needed in the future in connection with acquiring another company or its business or assets, establishing a strategic relationship with a corporate partner or raising

additional capital. The Board of Directors has no present agreement, arrangement, plan or understanding, however, with respect to the issuance of any such additional shares of common stock.

Although, at present, the Board of Directors has no plans to issue the additional authorized shares of common stock, it desires to have the

shares available to provide additional flexibility to use its capital stock for business and financial purposes in the future. The additional shares may be used for various purposes without further stockholder approval. These purposes may include

raising capital; providing equity incentives to employees, officers or directors; establishing strategic relationships with other companies; expanding the Company’s business or product lines through the acquisition of other businesses or

products; and other purposes.

If the amendment to our Amended and Restated Certificate of Incorporation to increase our authorized shares

of common stock is approved by the stockholders, our Board of Directors does not intend to solicit further stockholder approval prior to the issuance of any additional shares of common stock, except as may be required by applicable law or any

exchange on which our shares may be listed at that time. Holders of our common stock as such have no statutory preemptive rights with respect to issuances of common stock and are not entitled to dissenter’s rights with respect to the amendment.

Rights of Additional Authorized Shares

The holders of common stock are entitled to one vote per share on all matters to be voted upon by the stockholders. Subject to preferences that

may be applicable to any outstanding preferred stock, the holders of common stock are entitled to receive ratably such dividends, if any, as may be declared from time to time by the Board of Directors out of funds legally available for that purpose.

In the event of our liquidation, dissolution or winding up, the holders of our common stock are entitled to share ratably in all assets remaining after payment of liabilities, subject to prior distribution rights of preferred stock, if any, then

outstanding. The holders of common stock have no preemptive or conversion rights or other subscription rights. There are no redemption or sinking fund provisions applicable to our common stock.

6

Potential Adverse Effects of the Amendment

Future issuances of common stock or securities convertible into common stock could have a dilutive effect on the earnings per share, book value

per share, voting power and percentage interest of holdings of current stockholders. In addition, the availability of additional shares of common stock for issuance could, under certain circumstances, discourage or make more difficult efforts to

obtain control of the Company. The Board is not aware of any attempt, or contemplated attempt, to acquire control of the Company. This proposal is not being presented with the intent that it be used to prevent or discourage any acquisition attempt,

but nothing would prevent the Board from taking any appropriate actions not inconsistent with its fiduciary duties.

Effectiveness of the Amendment and

Required Vote

If the proposed amendment is adopted, it will become effective upon the filing of a certificate of amendment to the

Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware. However, even if our stockholders approve the proposed amendment, our Board retains discretion under Delaware law not to implement the proposed

amendment. If our Board were to exercise such discretion, the number of authorized shares would remain at the current level. The affirmative vote of the holders of a majority of the outstanding shares of our common stock will be required to approve

the amendment. As a result, abstentions will have the same effect as negative votes.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE

“FOR” APPROVAL OF THE AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION.

7

PROPOSAL TWO

ADJOURNMENT OF THE SPECIAL MEETING

A proposal will be submitted to the stockholders at the Special Meeting to approve adjournment of the Special Meeting, if necessary or

appropriate, to establish a quorum or to solicit additional proxies in the event that there are not sufficient votes at the time of the Special Meeting to approve Proposal One. Any adjournment of the Special Meeting may be made without notice, other

than by an announcement made at the Special Meeting. Any adjournment of the Special Meeting for the purpose of soliciting additional proxies will allow stockholders who have already sent in their proxies to revoke them at any time prior to the time

that the proxies are used.

The affirmative vote of the holders of a majority of the shares of our common stock present or represented and

entitled to vote at the Special Meeting is required for approval.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF

THE ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY OR APPROPRIATE, TO ESTABLISH A QUORUM OR TO SOLICIT ADDITIONAL PROXIES IN THE EVENT THERE ARE NOT SUFFICIENT VOTES AT THE TIME OF THE SPECIAL MEETING TO APPROVE PROPOSAL ONE.

8

OTHER MATTERS

Stockholder Proposals

Any proposal that

a stockholder intends to present in our proxy statement for consideration at our next annual meeting of stockholders, to be held in 2016, must be received by us on or before January 1, 2016, or if the date of the annual meeting is moved more

than 30 days from the anniversary of our 2015 annual meeting, then no later than the close of business on the 60th day prior to such annual meeting and the 10th day following the date on which public announcement of the date of the meeting

is made. If a stockholder desires to present a proposal at our next annual meeting of stockholders but does not desire to include the proposal in our proxy statement, we must receive the proposal no later than January 1, 2016. All proposals

described in this paragraph must comply with the stockholder proposal requirements set forth in our Bylaws and should be sent to ImmunoCellular Therapeutics, Ltd., 23622 Calabasas Road, Suite 300, Calabasas, California 91302, Attention:

Corporate Secretary.

Miscellaneous

Our management does not intend to present any other items of business and is not aware of any matters other than those set forth in this Proxy

Statement that will be presented for action at the Special Meeting. However, if any other matters properly come before the Special Meeting, the persons named in the enclosed proxy intend to vote the shares of our common stock that they represent in

accordance with their best judgment.

|

|

|

|

|

By Order of the Board of Directors |

|

|

| October 6, 2015 |

|

/s/ Gary S. Titus |

|

|

Gary S. Titus |

|

|

Corporate Secretary |

9

APPENDIX A

CERTIFICATE OF AMENDMENT

OF

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION OF

IMMUNOCELLULAR THERAPEUTICS, LTD.

(Under Section 242 of the General Corporation Law of the State of Delaware)

ImmunoCellular Therapeutics, Ltd., a corporation organized and existing under the laws of the State of Delaware, hereby certifies as follows:

FIRST. The name of the corporation is ImmunoCellular Therapeutics, Ltd.

SECOND. The date on which the Certificate of Incorporation of the corporation was originally filed with the Secretary of State of the

State of Delaware is March 20, 1987.

THIRD. The board of directors of the corporation, acting in accordance with the

provisions of Sections 141 and 242 of the General Corporation Law of the State of Delaware, adopted resolutions to amend Section 1 of Article FOURTH so that, as amended, it shall be and read in full as follows:

“FOURTH

Section 1. Authorized Capital Stock. The Company is authorized to issue two classes of capital stock, designated Common Stock and

Preferred Stock. The total number of shares of capital stock that the Company is authorized to issue is 250,000,000 shares, consisting of 249,000,000 shares of Common Stock, par value $0.0001 per share, and 1,000,000 shares of Preferred Stock, par

value $.0001 per share.

FOURTH. This Certificate of Amendment was duly adopted by the stockholders of the corporation in

accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

IN WITNESS WHEREOF, the

corporation has caused this Certificate to be signed by Andrew Gengos, its President and CEO, this ___ day of ____________, 201_.

|

|

|

| ImmunoCellular Therapeutics, Ltd. |

|

|

| By: |

|

|

| Name: |

|

Andrew Gengos |

| Title: |

|

President and CEO |

Appendix A-1

|

|

|

| IMMUNOCELLULAR THERAPEUTICS, LTD.

23622 CALABASAS ROAD, STE. 300 CALABASAS, CA

91302 |

|

VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode

above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before

the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards

and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials

electronically in future years. VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date.

Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL Mark, sign and date your proxy card and return

it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

|

|

|

|

|

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: |

| M96457-S37242 KEEP

THIS PORTION FOR YOUR RECORDS

— — — — — — — —

— — — — — — — — — — — — — —

— — — — — — — — — — — — —

— — — — — — — — — — |

| DETACH AND RETURN THIS PORTION ONLY |

| THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMMUNOCELLULAR THERAPEUTICS, LTD. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

The Board of Directors recommends you vote FOR

the following proposals: |

|

|

|

For |

|

Against |

|

Abstain |

|

|

| |

|

|

|

|

|

|

| |

|

1. |

|

To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the authorized number of shares of common stock from 149,000,000 to 249,000,000. |

|

¨ |

|

¨ |

|

¨ |

|

|

| |

|

|

|

|

|

|

| |

|

2. |

|

To adjourn the Special Meeting, if necessary or appropriate, to establish a quorum or to permit further solicitation of proxies if there are not sufficient votes at the time of the Special Meeting cast in

favor of Proposal One. |

|

¨ |

|

¨ |

|

¨ |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

NOTE: Such other business as may properly come before the meeting or any adjournment thereof. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must

sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Signature [PLEASE SIGN WITHIN BOX] |

|

Date |

|

|

|

Signature (Joint Owners) |

|

|

|

Date |

|

|

|

|

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting:

This Proxy Statement is available at www.proxyvote.com.

— — — — — — — — — — — — —

— — — — — — — — — — — — — — — — — — — —

— — — — — — — — — —

M96457-S37242

IMMUNOCELLULAR THERAPEUTICS, LTD.

Special Meeting of Stockholders

November 16, 2015, 8:00 AM

This proxy is solicited by the Board of Directors

The undersigned hereby appoints Gary S. Titus and Andrew Gengos, or each of them, as proxies, each with full power

of substitution and revocation, to vote all of the shares of stock of IMMUNOCELLULAR THERAPEUTICS, LTD. that the undersigned may be entitled to vote at the Special Meeting of Stockholders of ImmunoCellular Therapeutics, Ltd. to be held

at the offices of ImmunoCellular Therapeutics, Ltd., 23622 Calabasas Road, Suite 300, Calabasas, California 91302, on November 16, 2015 at 8:00 a.m., PST, and at any and all postponements and adjournments thereof, with all powers that

the undersigned would possess if personally present, on the following matters and in accordance with the following instructions, with discretionary authority as to any other business that may properly come before the meeting.

This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy

will be voted in accordance with the Board of Directors’ recommendations.

Continued and to be signed on

reverse side

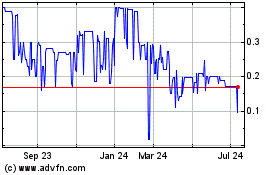

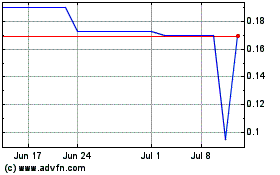

EOM Pharmaceutical (PK) (USOTC:IMUC)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOM Pharmaceutical (PK) (USOTC:IMUC)

Historical Stock Chart

From Apr 2023 to Apr 2024