Current Report Filing (8-k)

October 06 2015 - 3:56PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2015

______________________________

|

| | | | |

|

| | | | |

LIFEVANTAGE CORPORATION (Exact name of registrant as specified in its charter) |

______________________________

|

| | | | |

|

| | | | |

Colorado | | 001-35647 | | 90-0224471 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

9785 S. Monroe Street, Suite 300, Sandy, UT 84070 |

(Address of Principal Executive Offices and Zip Code) |

| | | | |

Registrant’s telephone number, including area code: (801) 432-9000 |

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

|

| |

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

| |

|

| |

Item 3.01 | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

On September 30, 2015, LifeVantage Corporation (the “Company”) received a determination letter from the staff of the NASDAQ Stock Market LLC (“Nasdaq”) notifying the Company that it has not regained compliance with Nasdaq Listing Rule 5550(a)(2), which requires listed securities to maintain a minimum closing bid price of $1.00 per share. The Company was previously notified of its noncompliance on April 1, 2015, and was provided a period of 180 calendar days to regain compliance with the minimum closing bid price requirement.

The determination letter also notified the Company that it is not eligible for a second 180 calendar day period to regain compliance with the minimum closing bid price requirement because the Company also does not comply with the stockholders’ equity initial listing requirement for the Nasdaq Capital Market.

On October 1, 2015, the Company requested a hearing before the Nasdaq Hearings Panel (the “Panel”) to appeal the determination letter. The Company will be asked to provide the Panel with a plan to regain compliance with the minimum bid price requirement of Listing Rule 5550(a)(2). The Company’s plan will need to include a discussion of the events that the Company believes will enable it to timely regain compliance with such requirement.

As further described in the Company’s definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on September 11, 2015, the Company is seeking shareholder approval of a reverse stock split at the Company’s fiscal 2016 Annual Meeting of Shareholders on October 15, 2015, with the primary intent of increasing the price of the Company’s common stock in order to meet the Nasdaq Capital Market’s criteria for continued listing. If the Company’s shareholders approve the reverse stock split, the Company effectuates the reverse stock split and the closing bid price of the Company’s common stock exceeds $1.00 per share for at least 10 consecutive trading days, the Company will regain compliance with the minimum bid price requirement of Listing Rule 5550(a)(2). There can be no assurance that the reverse stock split will be approved by the Company’s shareholders, or that the reverse stock split, if approved, would be sufficient to permit the Company to regain compliance with the minimum bid price requirement.

While the appeal process is pending, the suspension of trading of the Company’s common stock is stayed, and the Company’s common stock will continue to trade on the Nasdaq Capital Market until the hearing process concludes and the Panel issues a written decision. There can be no assurance that the Panel will grant the Company’s request for a suspension of delisting or continued listing on Nasdaq. If the Company’s common stock ceases to be listed for trading on the Nasdaq Capital Market, the Company expects that its common stock would be traded on the Over-the-Counter Bulletin Board on or about the same day.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| |

|

| |

Date: October 6, 2015 | LIFEVANTAGE CORPORATION

By: /s/ Beatryx Washington Name: Beatryx Washington Title: Vice President Legal Affairs |

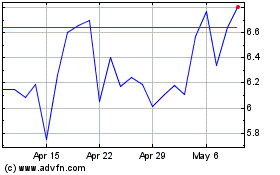

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

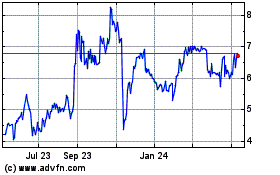

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Apr 2023 to Apr 2024