UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT: September 22, 2015

|

BREATHE ECIG CORP.

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Nevada

|

|

333-178624

|

|

37-1640902

|

|

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION)

|

|

(COMMISSION FILE NO.)

|

|

(IRS EMPLOYEE

IDENTIFICATION NO.)

|

|

322 Nancy Lynn Lane, Suite 7, Knoxville, TN 37919

|

| |

|

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

|

|

(865) 337-7549

|

| |

|

(REGISTRANT’S TELEPHONE NUMBER)

|

| |

| |

|

__________________________________________________________________________________________

(FORMER NAME, IF CHANGES SINC LAST REPORT

|

| |

Check the appropriate box below if the FORM 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

ð

|

Written communications pursuant to Rule 425 under the Securities Act

|

|

ð

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

|

|

ð

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

|

|

ð

|

Pre-commencement communications pursuant to Rule 13c-4(c) under the Exchange Act

|

|

|

Entry into Material Definitive Agreement

|

On September 30, 2015, Breathe Ecig Corp., a Nevada corporation (the “Company”), issued an unsecured Promissory Note to Giovanni Comito (“Comito”) in consideration for gross proceeds to the Company of $400,000 (the “Comito Note”). The Comito Note accrues interest at 4.5% per annum unless there is an Event of Default (as defined in the Comito Note) in which case the interest rate increases to 9.0% per annum. The entire principal amount and all accrued but unpaid interest under the Comito Note will be due and payable by the Company no later than March 31, 2016. The Comito Note contains standard terms of an Event of Default.

On September 22, 2015, Comito purchased 10,400,000 shares of the Company’s common stock, par value $0.001 (“Common Stock”), from Joshua Kimmel (“Kimmel”), the Company’s Chief Executive Officer, Chief Financial Officer and member of the Board of Directors, for an aggregate purchase price of $75,000 (the “Comito Purchase”). All such shares were “restricted securities” at the time of the purchase by Comito and will continue to be “restricted securities” as such term is defined under Rule 144 of the Securities Act of 1933, as amended.

Also on September 22, 2015, the Company issued an unsecured Promissory Note to Kimmel in consideration for gross proceeds to the Company of $75,000 (the “Kimmel Note”) which constitutes all proceeds received by Kimmel as part of the Comito Purchase. The Kimmel Note accrues interest at 4.5% per annum unless there is an Event of Default (as defined in the Kimmel Note) in which case the interest rate increases to 9.0% per annum. The entire principal amount and all accrued but unpaid interest under the Kimmel Note will be due and payable by the Company no later than September 22, 2016. The Kimmel Note contains standard terms of an Event of Default.

This Current Report on Form 8-K (this “Report”) is neither an offer to sell nor the solicitation of an offer to buy any securities.

The foregoing descriptions of the Comito Note and Kimmel Note are qualified in their entirety by reference to the provisions of the form of the Comito Note and Kimmel Note are filed as Exhibits 10.1 and 10.2 to this Report, respectively, which are incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet

Arrangement of a Registrant

The disclosure set forth under Item 1.01 of this Report is incorporated by reference into this Item.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

10.1

|

$400,000 Promissory Note issued by the Company to Giovanni Comito on September 30, 2015.

|

|

10.2

|

$75,000 Promissory Note issued by the Company to Joshua Kimmel on September 22, 2015.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 6, 2015

| |

|

BREATHE ECIG CORP.

/s/ Joshua Kimmel

By: President & Chief Executive Officer

|

Exhibit 10.1

PROMISSORY NOTE

|

$400,000

|

September 30, 2015

|

Knoxville, Tennessee

For Value Received (this “Note”), Breathe eCig Corp. (“Maker”), a Nevada corporation having a principal office address at 322 Nancy Lynn Lane, Suite 7, Knoxville, Tennessee 37919 hereby unconditionally promises to pay to the order of Giovanni Comito (“Note Holder”), a Canadian resident at such address as Note Holder may designate from time to time, in lawful money of the United States of America and in immediately available funds, the principal sum of $400,000 together with accrued and unpaid interest thereon, each due and payable on the date and in the manner set forth below.

1. Principal Repayment. The entire principal amount of this Note shall be due and paid no later than March 31, 2016 (the “Maturity Date”). All payments under this Note shall be applied first to accrued but unpaid interest and then to the outstanding principal.

2. Interest Rate, Default Interest and Late Payment. Maker further promises to pay interest on the outstanding principal amount hereof from the date hereof until payment in full as set forth in Section 1 of this Note, which interest shall be payable at the rate of four and one-half percent (4.5%) per annum and shall be due on the Maturity Date. From the date of the Event of Default then the default interest shall be payable at nine percent (9%) per annum.

3. Event of Default. Each of the following events shall be an “Event of Default” hereunder:

(a) Maker fails to pay timely any of the principal amount due under this Note or any accrued interest or other amounts due under this Note within five (5) business days of the date the same becomes due and payable.

(b) Maker files any petition or action for relief under any bankruptcy, reorganization, insolvency or moratorium law or any other law for the relief of, or relating to, debtors, now or hereafter in effect, or makes any assignment for the benefit of creditors or takes any corporate action in furtherance of any of the foregoing; or

(c) An involuntary petition is filed against Maker (unless such petition is dismissed or discharged within ninety (90) days) under any bankruptcy statute now or hereafter in effect, or a custodian, receiver, trustee, assignee for the benefit of creditors (or other similar official) is appointed to take possession, custody or control of any property of Maker.

Upon an Event of Default, all amounts due and payable not otherwise paid under this Note shall immediately become due and payable.

4. Assignment and Termination. Note Holder may assign this Note at any time after the date hereof. Maker may not assign its obligations under this Note without the prior written consent of Note Holder.

5. Notices.

Any and all notices required or permitted to be given hereunder shall be given to the addresses first set forth above or as otherwise provided in writing by either party to the other.

6. Miscellaneous.

If any payment of principal or interest on this Note shall become due on a Saturday, Sunday, or a public holiday under the laws of the State of Nevada, such payment shall be made on the next succeeding business day and such extension of time shall be included in computing interest in connection with such payment.

Upon payment in full of all aggregate unpaid principal and interest payable hereunder, this Note shall be surrendered to Maker for cancellation.

Maker waives presentment, demand for performance, notice of nonperformance, protest, notice of protest, and notice of dishonor. No delay on the part of Note Holder in exercising any right hereunder shall operate as a waiver of such right under this Note. This Note is being delivered in and shall be construed in accordance with the laws of the State of Nevada. Acceptance of a partial payment shall not act as a cure or waiver of any default but shall be applied as provided in this Note.

If the indebtedness represented by this Note or any part thereof is collected at law or in equity or in bankruptcy, receivership or other judicial proceedings or if this Note is placed in the hands of attorneys for collection after default, Maker agree to pay, in addition to the principal and interest payable hereon, reasonable attorneys’ fees and costs incurred by Note Holder.

The validity and interpretation of this Note shall be governed by the laws of the State of Nevada. The parties agree that any action or proceeding commenced under or with respect to this Note shall be brought only in the county or district courts of City and County of Knoxville, Knox County, Tennessee, and the parties irrevocably consent to the jurisdiction of such courts and waive any right to alter or change venue, including by removal.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, Maker and Note Holder have caused this Promissory Note to be duly executed and delivered on and as of the day and year first written above.

| |

Breathe eCig Corp.

a Nevada corporation

By: /s/ Joshua Kimmel

Name: Joshua Kimmel

Its: Chief Executive Officer

|

| |

|

Agreed to and accepted by:

By: /s/ Giovanni Comito

Giovanni Comito, individually

Exhibit 10.2

PROMISSORY NOTE

|

$75,000

|

September 22, 2015

|

Knoxville, Tennessee

For Value Received (this “Note”), Breathe eCig Corp. (“Maker”), a Nevada corporation having a principal office address at 322 Nancy Lynn Lane, Suite 7, Knoxville, Tennessee 37919 hereby unconditionally promises to pay to the order of Joshua Kimmel (“Note Holder”), a State of Tennessee resident at such address as Note Holder may designate from time to time, in lawful money of the United States of America and in immediately available funds, the principal sum of $75,000 together with accrued and unpaid interest thereon, each due and payable on the date and in the manner set forth below.

1. Principal Repayment. The entire principal amount of this Note shall be due and paid no later than September 22, 2016 (the “Maturity Date”). All payments under this Note shall be applied first to accrued but unpaid interest and then to the outstanding principal.

2. Interest Rate, Default Interest and Late Payment. Maker further promises to pay interest on the outstanding principal amount hereof from the date hereof until payment in full as set forth in Section 1 of this Note, which interest shall be payable at the rate of four and one-half percent (4.5%) per annum and shall be due on the Maturity Date. From the date of the Event of Default then the default interest shall be payable at nine percent (9%) per annum.

3. Event of Default. Each of the following events shall be an “Event of Default” hereunder:

(a) Maker fails to pay timely any of the principal amount due under this Note or any accrued interest or other amounts due under this Note within five (5) business days of the date the same becomes due and payable.

(b) Maker files any petition or action for relief under any bankruptcy, reorganization, insolvency or moratorium law or any other law for the relief of, or relating to, debtors, now or hereafter in effect, or makes any assignment for the benefit of creditors or takes any corporate action in furtherance of any of the foregoing; or

(c) An involuntary petition is filed against Maker (unless such petition is dismissed or discharged within ninety (90) days) under any bankruptcy statute now or hereafter in effect, or a custodian, receiver, trustee, assignee for the benefit of creditors (or other similar official) is appointed to take possession, custody or control of any property of Maker.

Upon an Event of Default, all amounts due and payable not otherwise paid under this Note shall immediately become due and payable.

4. Assignment and Termination. Note Holder may assign this Note at any time after the date hereof. Maker may not assign its obligations under this Note without the prior written consent of Note Holder.

5. Notices.

Any and all notices required or permitted to be given hereunder shall be given to the addresses first set forth above or as otherwise provided in writing by either party to the other.

6. Miscellaneous.

If any payment of principal or interest on this Note shall become due on a Saturday, Sunday, or a public holiday under the laws of the State of Nevada, such payment shall be made on the next succeeding business day and such extension of time shall be included in computing interest in connection with such payment.

Upon payment in full of all aggregate unpaid principal and interest payable hereunder, this Note shall be surrendered to Maker for cancellation.

Maker waives presentment, demand for performance, notice of nonperformance, protest, notice of protest, and notice of dishonor. No delay on the part of Note Holder in exercising any right hereunder shall operate as a waiver of such right under this Note. This Note is being delivered in and shall be construed in accordance with the laws of the State of Nevada. Acceptance of a partial payment shall not act as a cure or waiver of any default but shall be applied as provided in this Note.

If the indebtedness represented by this Note or any part thereof is collected at law or in equity or in bankruptcy, receivership or other judicial proceedings or if this Note is placed in the hands of attorneys for collection after default, Maker agree to pay, in addition to the principal and interest payable hereon, reasonable attorneys’ fees and costs incurred by Note Holder.

The validity and interpretation of this Note shall be governed by the laws of the State of Nevada. The parties agree that any action or proceeding commenced under or with respect to this Note shall be brought only in the county or district courts of City and County of Knoxville, Knox County, Tennessee, and the parties irrevocably consent to the jurisdiction of such courts and waive any right to alter or change venue, including by removal.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, Maker and Note Holder have caused this Promissory Note to be duly executed and delivered on and as of the day and year first written above.

| |

Breathe eCig Corp.

a Nevada corporation

By: /s/Joshua Kimmel

Name: Joshua Kimmel

Its: Chief Executive Officer

|

| |

|

Agreed to and accepted by:

By: /s/ Joshua Kimmel

Joshua Kimmel, individually

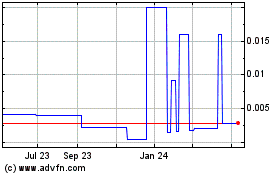

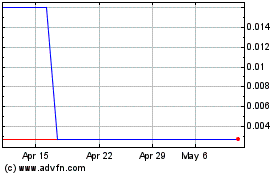

White Fox Ventures (PK) (USOTC:AWAW)

Historical Stock Chart

From Mar 2024 to Apr 2024

White Fox Ventures (PK) (USOTC:AWAW)

Historical Stock Chart

From Apr 2023 to Apr 2024