UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported) October 3, 2015

|

| |

| |

General Electric Company

|

|

| |

(Exact name of registrant as specified in its charter)

|

|

| |

| |

| |

|

New York

|

|

001-00035

|

|

14-0689340

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

3135 Easton Turnpike, Fairfield, Connecticut

|

|

|

|

06828-0001

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

Registrant’s telephone number, including area code (203) 373-2211

|

| |

| |

|

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Attached as Exhibit 99 and incorporated by reference herein is a press release dated October 3, 2015 issued by General Electric Company (“GE”).

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

99 Press release, dated October 3, 2015 issued by GE.

This document contains “forward-looking statements” – that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” or “target.”

Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the Reorganization and the Exchange Offers; our announced plan to reduce the size of our financial services businesses, including expected cash and non-cash charges associated with this plan; expected income; earnings per share; revenues; organic growth; margins; cost structure; restructuring charges; cash flows; return on capital; capital expenditures, capital allocation or capital structure; dividends; and the split between Industrial and GE Capital earnings.

For us, particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include:

| ● |

obtaining (or the timing of obtaining) any required regulatory reviews or approvals or any other consents or approvals associated with our announced plan to reduce the size of our financial services businesses;

|

| |

|

| ● |

our ability to complete incremental asset sales as part of that plan in a timely manner (or at all) and at the prices we have assumed;

|

| |

|

| ● |

changes in law, economic and financial conditions, including interest and exchange rate volatility, commodity and equity prices and the value of financial assets, including the impact of these conditions on our ability to sell or the value of incremental assets to be sold as part of our announced plan to reduce the size of our financial services businesses as well as other aspects of that plan;

|

| |

|

| ● |

the impact of conditions in the financial and credit markets on the availability and cost of GECC’s funding, and GECC’s exposure to counterparties;

|

| |

|

| ● |

the impact of conditions in the housing market and unemployment rates on the level of commercial and consumer credit defaults;

|

| |

|

| ● |

pending and future mortgage loan repurchase claims and other litigation claims in connection with WMC, which may affect our estimates of liability, including possible loss estimates;

|

| |

|

| ● |

our ability to maintain our current credit rating and the impact on our funding costs and competitive position if we do not do so;

|

| |

|

| ● |

the adequacy of our cash flows and earnings and other conditions, which may affect our ability to pay our quarterly dividend at the planned level or to repurchase shares at planned levels;

|

| |

|

| ● |

GECC’s ability to pay dividends to GE at the planned level, which may be affected by GECC’s cash flows and earnings, financial services regulation and oversight, and other factors;

|

| |

|

| ● |

our ability to convert pre-order commitments/wins into orders;

|

| |

|

| ● |

the price we realize on orders since commitments/wins are stated at list prices;

|

| |

|

| ● |

customer actions or developments such as early aircraft retirements or reduced energy demand and other factors that may affect the level of demand and financial performance of the major industries and customers we serve;

|

| |

|

| ● |

the effectiveness of our risk management framework;

|

| |

|

| ● |

the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks, including the impact of financial services regulation and litigation;

|

| |

|

| ● |

adverse market conditions, timing of and ability to obtain required bank regulatory approvals, or other factors relating to us or Synchrony Financial that could prevent us from completing the Synchrony Financial split-off as planned;

|

| |

|

| ● |

our capital allocation plans, as such plans may change including with respect to the timing and size of share repurchases, acquisitions, joint ventures, dispositions and other strategic actions;

|

| |

|

| ● |

our success in completing, including obtaining regulatory approvals for, announced transactions, such as the proposed

|

| |

transactions and alliances with Alstom, Appliances and our announced plan to reduce the size of our financial services businesses, and our ability to realize anticipated earnings and savings;

|

| |

|

| ● |

our success in integrating acquired businesses and operating joint ventures;

|

| |

|

| ● |

the impact of potential information technology or data security breaches;

|

| |

|

| ● |

our actual division of U.S. and international assets, which may not occur as expected; and

|

| |

|

| ● |

the other factors that are described in “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2014.

|

These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. This document includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

General Electric Company

|

|

| |

|

(Registrant)

|

|

| |

|

|

|

|

Date: October 5, 2015

|

|

/s/ Daniel C. Janki

|

|

| |

|

Daniel C. Janki

Senior Vice President and Treasurer

|

|

| |

|

|

|

GE Capital Announces Early Participation Results of Private Exchange Offers

|

·

|

$53.9 billion of Old Notes tendered

|

|

·

|

Upsize of Total New Notes to be issued from $30 billion to $36 billion

|

|

·

|

Upsize of 2016 New Notes Cap from $15 billion to $16.25 billion

|

FAIRFIELD, Conn. – October 3, 2015 – General Electric Capital Corporation (“GECC”) today announced the early participation results of the previously announced private offers commenced by GE Capital International Funding Company (the “Issuer”) to exchange (the “Exchange Offers”) the Issuer’s new senior unsecured notes (collectively, the “New Notes”) for certain outstanding debt securities (collectively, the “Old Notes”).

Based on information provided by D.F. King & Co., Inc. and Lucid Issuer Services Limited, the exchange agents and information agents for the Exchange Offers (the “Exchange Agents”), approximately $53.9 billion principal amount of Old Notes were tendered in the Exchange Offers by the Early Participation Date.

GECC also announced today that:

|

|

(i)

|

the principal amount of New Notes to be issued in the Exchange Offers has increased from $30 billion to $36 billion,

|

|

|

(ii)

|

the principal amount of 2016 New Notes to be issued in the 2016 Market Value Exchange Offers has increased from $15 billion to $16.25 billion (the “2016 New Notes Cap”) and

|

|

|

(iii)

|

the principal amount of New Market Notes to be issued in the 2020/2025/2035 Market Value Exchange Offers will be $36 billion less the principal amount of 2016 New Notes accepted in the 2016 Market Value Exchange Offers.

|

Based on the principal amount of Old Notes tendered in the Exchange Offers, it is anticipated that the 2016 New Notes Cap will permit all Old Notes validly tendered in the 2016 Market Value Exchange Offers to be accepted without proration. No Old Notes tendered in the Par for Par Exchange Offers will be accepted. The Issuer currently expects to return any Old Notes tendered in the Par for Par Exchange Offers on October 6, 2015.

The Exchange Offers are being conducted by the Issuer upon the terms and subject to the conditions set forth in a separate offer to exchange (which is available only to Eligible Holders), as modified by this announcement (the “Offer to Exchange”). Capitalized terms not otherwise defined herein have the meanings set forth in the announcement relating to the Exchange Offers dated September 21, 2015.

The “Early Participation Date” expired at 5:00 p.m., New York City time on October 2, 2015. Holders of Old Notes validly tendered after the Early Participation Date but prior to the Expiration Date and accepted in the Exchange Offers will no longer be entitled to the Total Exchange Consideration, but instead will be entitled to the reduced Exchange Consideration described below. The Withdrawal Deadline has expired. Old Notes tendered for exchange may not be validly withdrawn, unless we determine in the future in our sole discretion to enable withdrawal rights as required by law.

After giving effect to the upsize, and based on the principal amounts of Old Notes tendered by the Early Participation Date and the other assumptions described below in the “Exchange Offers Summary Tables,” a summary of the hypothetical principal amounts of New Notes that would be issued in the Exchange Offers is set

forth below. The actual amounts of New Notes to be issued and corresponding proration factors will vary from those set forth in the tables below and will be based on the actual principal amounts of Old Notes validly tendered in the Exchange Offers at or prior to the Expiration Date and the actual consideration to be paid as determined as of the Price Determination Date.

| |

New Notes

|

Principal Amount of Applicable

Old Notes Tendered by Early

Participation Date (billions

USD equivalent)

|

Hypothetical Principal Amount of

New Notes to be Issued Pursuant to

the Exchange Offers (billions USD

equivalent)

|

|

| |

2016 USD New Notes

|

$14.2

|

$15.0

|

|

| |

2016 GBP New Notes

|

$0.9 (£0.6)

|

$1.1 (£0.7)

|

|

| |

2020 New Notes

|

$7.6

|

$6.3

|

|

| |

2025 New Notes

|

$2.6

|

$2.0

|

|

| |

2035 New Notes

|

$11.8

|

$11.6

|

|

| |

Par for Par Notes

|

$16.7

|

$0.0

|

|

| |

Total

|

$53.9

|

$36.0

|

|

The Exchange Offers will expire at 11:59 p.m., New York City time on October 19, 2015, unless extended by the Issuer (such date and time as they may be extended by the Issuer, the “Expiration Date”).

Eligible Holders of Old Notes validly tendered and accepted after the Early Participation Date will not be entitled to the Total Exchange Consideration, but instead will be entitled to the Exchange Consideration, which for each $1,000 (or £1,000) principal amount of Old Notes tendered and accepted will be New Notes in a principal amount equal to the applicable Total Exchange Consideration minus $50 (or £50). Accordingly, Eligible Holders that tender Old Notes in the Market Value Exchange Offers after the Early Participation Date will receive New Notes in a principal amount that will be less than the principal amount of the New Notes that they would have received had they received the Total Exchange Consideration.

The “Settlement Date” for the Exchange Offers is expected to be five business days following the Expiration Date, must be a business day both in the City of New York and in London and would be October 26, 2015 based on the current Expiration Date.

Any of the Old Notes that are not tendered at or prior to the Expiration Date or are not accepted for exchange will remain outstanding, will mature on their respective maturity dates and will continue to accrue interest in accordance with, and will otherwise be entitled to all the rights and privileges under, the respective instruments governing their terms, including their existing GE guarantee.

As previously announced, the Exchange Offers are intended, among other things, to establish an international holding company (GE Capital International Holdings) with an efficient and simplified capital structure that is satisfactory to GECC’s regulators, a key step in terminating the nonbank systemically important financial institution designation for GECC. In addition, the Exchange Offers seek to align the liabilities of GE Capital International Holdings to its assets from a maturity profile and liquidity standpoint, taking into consideration asset sales, and where appropriate shortening the maturity profile of targeted liabilities.

Exchange Offers Summary Tables

The tables below provide information regarding the principal amount of each series or tranche of Old Notes validly tendered and not validly withdrawn at or prior to the Early Participation Date pursuant to the Exchange Offers, based on information provided by the Exchange Agents. The following tables also set forth the hypothetical principal amounts of Old Notes to be accepted pursuant to the Exchange Offers, the hypothetical proration factors and the hypothetical principal amounts of New Notes to be issued pursuant to the Exchange Offers. These hypothetical amounts are for illustrative purposes only and are not final. They are based on the hypothetical consideration set forth in the Offer to Exchange, which consideration was determined at 11:00 a.m. (New York City

time) (4:00 p.m. (London time)) on September 17, 2015 and corresponding pounds sterling exchange rate determined at 5:00 p.m. (New York City time) on October 2, 2015. They also assume no further tenders of Old Notes in the Exchange Offers after the Early Participation Date.

Market Value Exchange Offers

2016 Market Value Exchange Offers

USD (2019-2021): Market Value Exchange for 2016 USD New Notes

|

Title of Old Notes

|

|

CUSIP Number

|

|

ISIN

|

|

Principal

Amount

Outstanding

(millions)

|

|

Principal Amount

Tendered by Early

Participation

Date

(millions)

|

|

Hypothetical

Principal Amount

to be Accepted

Pursuant to the

Exchange Offer

(millions)

|

|

New Notes(1)(2)

|

|

Hypothetical

Principal Amount to

be Issued Pursuant

to the Exchange

Offer (millions)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.000% Aug 2019

|

|

36962G4D3

|

|

US36962G4D32

|

|

$2,000

|

|

$232.925

|

|

$232.925

|

|

2016 USD New Notes

|

|

$269.897

|

|

2.200% Jan 2020

|

|

36962G7M0

|

|

US36962G7M04

|

|

$2,000

|

|

$395.178

|

|

$395.178

|

|

2016 USD New Notes

|

|

$403.781

|

|

5.500% Jan 2020

|

|

36962G4J0

|

|

US36962G4J02

|

|

$2,000

|

|

$227.268

|

|

$227.268

|

|

2016 USD New Notes

|

|

$261.120

|

|

5.550% May 2020

|

|

36962G2T0

|

|

US36962G2T02

|

|

$1,100

|

|

$156.803

|

|

$156.803

|

|

2016 USD New Notes

|

|

$180.748

|

|

4.375% Sept 2020

|

|

36962G4R2

|

|

US36962G4R28

|

|

$2,150

|

|

$199.154

|

|

$199.154

|

|

2016 USD New Notes

|

|

$220.575

|

|

4.625% Jan 2021

|

|

36962G4Y7

|

|

US36962G4Y78

|

|

$2,250

|

|

$259.737

|

|

$259.737

|

|

2016 USD New Notes

|

|

$291.848

|

|

5.300% Feb 2021

|

|

369622SM8

|

|

US369622SM84

|

|

$2,000

|

|

$206.400

|

|

$206.400

|

|

2016 USD New Notes

|

|

$237.067

|

|

4.650% Oct 2021

|

|

36962G5J9

|

|

US36962G5J92

|

|

$3,150

|

|

$619.334

|

|

$619.334

|

|

2016 USD New Notes

|

|

$696.429

|

_______________

|

(1)

|

Based on the principal amount of Old Notes tendered in the Exchange Offers, it is anticipated that the 2016 New Notes Cap will permit all Old Notes validly tendered in the 2016 Market Value Exchange Offers to be accepted without proration.

|

|

(2)

|

The 2016 USD New Notes will mature on April 15, 2016 and will bear interest at the rate per annum equal to the sum of: (a) the yield of the Eurodollar Synthetic Forward Rate from two business days after the Price Determination Date (as defined below) to the maturity date of the 2016 USD New Notes appearing at the Price Determination Date on the EDSF page displayed on the Bloomberg Pricing Monitor, or any other recognized quotation source selected by the lead dealer managers in their sole discretion if such quotation report is not available or manifestly erroneous, plus (b) 60 basis points, such sum rounded to the third decimal place when expressed as a percentage.

|

USD (2022-2024): Market Value Exchange for 2016 USD New Notes

|

Title of Old Notes

|

|

CUSIP Number

|

|

ISIN

|

|

Principal

Amount

Outstanding

(millions)

|

|

Principal Amount

Tendered by Early

Participation Date

(millions)

|

|

Hypothetical

Principal Amount

to be Accepted

Pursuant to the

Exchange Offer

(millions)

|

|

New Notes(1)(2)

|

|

Hypothetical

Principal Amount to

be Issued Pursuant

to the Exchange

Offer (millions)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.150% Sept 2022

|

|

36962G6F6

|

|

US36962G6F61

|

|

$2,000

|

|

$250.532

|

|

$250.532

|

|

2016 USD New Notes

|

|

$259.441

|

|

3.100% Jan 2023

|

|

36962G6S8

|

|

US36962G6S82

|

|

$2,500

|

|

$289.711

|

|

$289.711

|

|

2016 USD New Notes

|

|

$298.567

|

|

3.450% May 2024

|

|

36962G7K4

|

|

US36962G7K48

|

|

$1,000

|

|

$127.385

|

|

$127.385

|

|

2016 USD New Notes

|

|

$133.181

|

________________

|

(1)

|

Based on the principal amount of Old Notes tendered in the Exchange Offers, it is anticipated that the 2016 New Notes Cap will permit all Old Notes validly tendered in the 2016 Market Value Exchange Offers to be accepted without proration.

|

|

(2)

|

The 2016 USD New Notes will mature on April 15, 2016 and will bear interest at the rate per annum equal to the sum of: (a) the yield of the Eurodollar Synthetic Forward Rate from two business days after the Price Determination Date to the maturity date of the 2016 USD New Notes appearing at the Price Determination Date on the EDSF page displayed on the Bloomberg Pricing Monitor, or any other recognized quotation source selected by the lead dealer managers in their sole discretion if such quotation report is not available or manifestly erroneous, plus (b) 60 basis points, such sum rounded to the third decimal place when expressed as a percentage.

|

|

USD Fixed-Rate (2016-2020): Market Value Exchange for 2016 USD New Notes

|

|

Title of Old Notes

|

|

CUSIP Number

|

|

ISIN

|

|

Principal

Amount

Outstanding

(millions)

|

|

Principal Amount

Tendered by Early

Participation Date

(millions)

|

|

Hypothetical

Principal Amount

to be Accepted

Pursuant to the

Exchange Offer

(millions)

|

|

New Notes(1)(2)

|

|

Hypothetical

Principal Amount to

be Issued Pursuant

to the Exchange

Offer (millions)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.500% Jul 2016

|

|

36962G6Z2

|

|

US36962G6Z26

|

|

$1,250

|

|

$422.462

|

|

$422.462

|

|

2016 USD New Notes

|

|

$426.670

|

|

1.450% Aug 2016

|

|

36962G7B4

|

|

US36962G7B49

|

|

$250

|

|

$0.000

|

|

$0.000

|

|

2016 USD New Notes

|

|

$0.000

|

|

4.575% Aug 2037

|

|

36962G6E9

|

|

US36962G6E96

|

|

$100

|

|

$0.000

|

|

$0.000

|

|

2016 USD New Notes

|

|

$0.000

|

|

3.350% Oct 2016

|

|

36962G5H3

|

|

US36962G5H37

|

|

$1,250

|

|

$515.411

|

|

$515.411

|

|

2016 USD New Notes

|

|

$531.992

|

|

5.375% Oct 2016

|

|

36962GY40

|

|

US36962GY402

|

|

$1,100

|

|

$459.997

|

|

$459.997

|

|

2016 USD New Notes

|

|

$483.139

|

|

2.900% Jan 2017

|

|

36962G5N0

|

|

US36962G5N05

|

|

$1,425

|

|

$624.169

|

|

$624.169

|

|

2016 USD New Notes

|

|

$644.030

|

|

5.400% Feb 2017

|

|

36962G2G8

|

|

US36962G2G80

|

|

$1,500

|

|

$641.111

|

|

$641.111

|

|

2016 USD New Notes

|

|

$681.860

|

|

2.450% Mar 2017

|

|

36962G5S9

|

|

US36962G5S91

|

|

$500

|

|

$328.546

|

|

$328.546

|

|

2016 USD New Notes

|

|

$337.157

|

|

1.250% May 2017

|

|

36962G7J7

|

|

US36962G7J74

|

|

$1,000

|

|

$642.521

|

|

$642.521

|

|

2016 USD New Notes

|

|

$651.439

|

|

2.300% Apr 2017

|

|

36962G5W0

|

|

US36962G5W04

|

|

$2,000

|

|

$844.784

|

|

$844.784

|

|

2016 USD New Notes

|

|

$868.176

|

|

5.625% Sep 2017

|

|

36962G3H5

|

|

US36962G3H54

|

|

$3,000

|

|

$1,152.329

|

|

$1,152.329

|

|

2016 USD New Notes

|

|

$1,256.211

|

|

1.600% Nov 2017

|

|

36962G6K5

|

|

US36962G6K56

|

|

$1,000

|

|

$271.424

|

|

$271.424

|

|

2016 USD New Notes

|

|

$275.311

|

|

1.625% Apr 2018

|

|

36962G6W9

|

|

US36962G6W94

|

|

$1,500

|

|

$379.951

|

|

$379.951

|

|

2016 USD New Notes

|

|

$384.571

|

|

5.625% May 2018

|

|

36962G3U6

|

|

US36962G3U65

|

|

$4,000

|

|

$1,393.870

|

|

$1,393.870

|

|

2016 USD New Notes

|

|

$1,543.697

|

|

4.700% May 2053

|

|

369622394

|

|

US3696223946

|

|

$750

|

|

$0.288

|

|

$0.288

|

|

2016 USD New Notes

|

|

$0.294

|

|

2.300% Jan 2019

|

|

36962G7G3

|

|

US36962G7G36

|

|

$1,000

|

|

$530.844

|

|

$530.844

|

|

2016 USD New Notes

|

|

$543.266

|

|

3.800% Jun 2019

|

|

369668AA6

|

|

US369668AA67

|

|

$700

|

|

$436.838

|

|

$436.838

|

|

2016 USD New Notes

|

|

$467.500

|

|

5.260% Nov 2019

|

|

36962GM43

|

|

US36962GM431

|

|

$75

|

|

$75.000

|

|

$75.000

|

|

2016 USD New Notes

|

|

$83.865

|

|

3.250% Aug 2020

|

|

36962G7C2

|

|

US36962G7C22

|

|

$250

|

|

$0.000

|

|

$0.000

|

|

2016 USD New Notes

|

|

$0.000

|

________________

|

(1)

|

Based on the principal amount of Old Notes tendered in the Exchange Offers, it is anticipated that the 2016 New Notes Cap will permit all Old Notes validly tendered in the 2016 Market Value Exchange Offers to be accepted without proration.

|

|

(2)

|

The 2016 USD New Notes will mature on April 15, 2016 and will bear interest at the rate per annum equal to the sum of: (a) the yield of the Eurodollar Synthetic Forward Rate from two business days after the Price Determination Date to the maturity date of the 2016 USD New Notes appearing at the Price Determination Date on the EDSF page displayed on the Bloomberg Pricing Monitor, or any other recognized quotation source selected by the lead dealer managers in their sole discretion if such quotation report is not available or manifestly erroneous, plus (b) 60 basis points, such sum rounded to the third decimal place when expressed as a percentage.

|

USD Floating Rate (2016-2020): Market Value Exchange for 2016 USD New Notes

|

Title of Old Notes(1)

|

|

CUSIP Number

|

|

ISIN

|

|

Principal

Amount

Outstanding

(millions)

|

|

Principal Amount

Tendered by Early

Participation Date

(millions)

|

|

Hypothetical

Principal Amount

to be Accepted

Pursuant to the

Exchange Offer

(millions)

|

|

New Notes(2)(3)

|

|

Hypothetical

Principal Amount to

be Issued Pursuant

to the Exchange

Offer (millions)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FRNs Jul 2016

|

|

36967FAC5

|

|

US36967FAC59

|

|

$695

|

|

$396.000

|

|

$396.000

|

|

2016 USD New Notes

|

|

$399.960

|

|

FRNs Jul 2016

|

|

36962G7A6

|

|

US36962G7A65

|

|

$1,600

|

|

$462.930

|

|

$462.930

|

|

2016 USD New Notes

|

|

$468.717

|

|

FRNs Jan 2017

|

|

36967FAB7

|

|

US36967FAB76

|

|

$2,000

|

|

$667.640

|

|

$667.640

|

|

2016 USD New Notes

|

|

$674.316

|

|

FRNs May 2017

|

|

36962G7H1

|

|

US36962G7H19

|

|

$500

|

|

$221.644

|

|

$221.644

|

|

2016 USD New Notes

|

|

$223.860

|

|

F-FRNs May 2017

|

|

36962G5Y6

|

|

US36962G5Y69

|

|

$100

|

|

$11.965

|

|

$11.965

|

|

2016 USD New Notes

|

|

$12.234

|

|

F-FRNs Aug 2017

|

|

36962G6B5

|

|

US36962G6B57

|

|

$100

|

|

$16.911

|

|

$16.911

|

|

2016 USD New Notes

|

|

$17.418

|

|

F-FRNs Dec 2017

|

|

36962G6L3

|

|

US36962G6L30

|

|

$100

|

|

$5.500

|

|

$5.500

|

|

2016 USD New Notes

|

|

$5.569

|

|

FRNs Apr 2018

|

|

36962G6X7

|

|

US36962G6X77

|

|

$400

|

|

$179.141

|

|

$179.141

|

|

2016 USD New Notes

|

|

$182.724

|

|

FRNs Jan 2019

|

|

36962G7F5

|

|

US36962G7F52

|

|

$500

|

|

$205.343

|

|

$205.343

|

|

2016 USD New Notes

|

|

$206.883

|

|

FRNs Jan 2020

|

|

36967FAA9

|

|

US36967FAA93

|

|

$500

|

|

$149.426

|

|

$149.426

|

|

2016 USD New Notes

|

|

$152.041

|

________________

|

(1)

|

We refer to floating-rate notes as FRNs and fixed to floating-rate notes as F-FRNs.

|

|

(2)

|

Based on the principal amount of Old Notes tendered in the Exchange Offers, it is anticipated that the 2016 New Notes Cap will permit all Old Notes validly tendered in the 2016 Market Value Exchange Offers to be accepted without proration.

|

|

(3)

|

The 2016 USD New Notes will mature on April 15, 2016 and will bear interest at the rate per annum equal to the sum of: (a) the yield of the Eurodollar Synthetic Forward Rate from two business days after the Price Determination Date to the maturity date of the 2016 USD New Notes appearing at the Price Determination Date on the EDSF page displayed on the Bloomberg Pricing Monitor, or any other recognized quotation source selected by the lead dealer managers in their sole discretion if such quotation report is not available or manifestly erroneous, plus (b) 60 basis points, such sum rounded to the third decimal place when expressed as a percentage.

|

Other Select USD: Market Value Exchange for 2016 USD New Notes

|

Title of Old Notes

|

|

CUSIP Number

|

|

ISIN

|

|

Principal

Amount

Outstanding

(millions)

|

|

Principal Amount

Tendered by Early

Participation Date

(millions)

|

|

Hypothetical

Principal Amount

to be Accepted

Pursuant to the

Exchange Offer

(millions)

|

|

New Notes(1)(2)

|

|

Hypothetical

Principal Amount to

be Issued Pursuant

to the Exchange

Offer (millions)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.250% Nov 2016

|

|

—

|

|

XS0856562797

|

|

$300

|

|

$16.620

|

|

$16.620

|

|

2016 USD New Notes

|

|

$16.780

|

|

4.625% Jan 2043

|

|

—

|

|

XS0880289292

|

|

$700

|

|

$61.193

|

|

$61.193

|

|

2016 USD New Notes

|

|

$61.069

|

|

5.550% Jan 2026

|

|

36962GT95

|

|

US36962GT956

|

|

$500

|

|

$5.275

|

|

$5.275

|

|

2016 USD New Notes

|

|

$6.106

|

|

7.500% Aug 2035

|

|

36959CAA6

|

|

US36959CAA62

|

|

$300

|

|

$90.159

|

|

$90.159

|

|

2016 USD New Notes

|

|

$128.754

|

________________

|

(1)

|

Based on the principal amount of Old Notes tendered in the Exchange Offers, it is anticipated that the 2016 New Notes Cap will permit all Old Notes validly tendered in the 2016 Market Value Exchange Offers to be accepted without proration.

|

|

(2)

|

The 2016 USD New Notes will mature on April 15, 2016 and will bear interest at the rate per annum equal to the sum of: (a) the yield of the Eurodollar Synthetic Forward Rate from two business days after the Price Determination Date to the maturity date of the 2016 USD New Notes appearing at the Price Determination Date on the EDSF page displayed on the Bloomberg Pricing Monitor, or any other recognized quotation source selected by the lead dealer managers in their sole discretion if such quotation report is not available or manifestly erroneous, plus (b) 60 basis points, such sum rounded to the third decimal place when expressed as a percentage.

|

GBP: Market Value Exchange for 2016 GBP New Notes

|

Title of Old Notes

|

|

CUSIP Number

|

|

ISIN

|

|

Principal

Amount

Outstanding

(millions)

|

|

Principal Amount

Tendered by Early

Participation Date

(millions)

|

|

Hypothetical

Principal Amount

to be Accepted

Pursuant to the

Exchange Offer

(millions)

|

|

New Notes(1)(2)

|

|

Hypothetical

Principal Amount to

be Issued Pursuant

to the Exchange

Offer (millions)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.250% Dec 2017

|

|

—

|

|

XS0148124588

|

|

£500

|

|

£149.976

|

|

£149.976

|

|

2016 GBP New Notes

|

|

£165.705

|

|

5.250% Dec 2028

|

|

—

|

|

XS0096298822

|

|

£425

|

|

£100.947

|

|

£100.947

|

|

2016 GBP New Notes

|

|

£126.313

|

|

5.625% Sept 2031

|

|

—

|

|

XS0154681737

|

|

£178

|

|

£48.910

|

|

£48.910

|

|

2016 GBP New Notes

|

|

£63.981

|

|

4.875% Sept 2037

|

|

—

|

|

XS0229561831

|

|

£750

|

|

£219.773

|

|

£219.773

|

|

2016 GBP New Notes

|

|

£251.625

|

|

5.375% Dec 2040

|

|

—

|

|

XS0182703743

|

|

£450

|

|

£99.738

|

|

£99.738

|

|

2016 GBP New Notes

|

|

£130.701

|

________________

|

(1)

|

Based on the principal amount of Old Notes tendered in the Exchange Offers, it is anticipated that the 2016 New Notes Cap will permit all Old Notes validly tendered in the 2016 Market Value Exchange Offers to be accepted without proration.

|

|

(2)

|

The 2016 GBP New Notes will mature on April 15, 2016 and will bear interest at the rate per annum equal to the sum of: (a) the yield of the 2.000% U.K. Gilt Security due January 22, 2016 (the “2016 GBP New Notes Reference Security”), as calculated by the lead dealer managers in accordance with standard market practice, that equates to the price of the 2016 GBP New Notes Reference Security appearing at the Price Determination Date on the DMO2 page displayed on the Bloomberg Pricing Monitor, or any other recognized quotation source selected by the lead dealer managers in their sole discretion if such quotation report is not available or manifestly erroneous, plus (b) 90 basis points, such sum rounded to the third decimal place when expressed as a percentage.

|

2020/2025/2035 Market Value Exchange Offers

USD (2019-2021): Market Value Exchange for 2020 New Notes

|

Title of Old Notes

|

|

CUSIP Number

|

|

ISIN

|

|

Principal Amount

Outstanding

(millions)

|

|

Principal Amount

Tendered by Early

Participation Date

(millions)

|

|

Hypothetical

Principal Amount

to be Accepted

Pursuant to the

Exchange Offer

(millions)

|

|

Hypothetical

Proration

Factor(1)

|

|

New Notes(2)

|

|

Hypothetical

Principal Amount to

be Issued Pursuan

to the Exchange

Offer (millions)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.000% Aug 2019

|

|

36962G4D3

|

|

US36962G4D32

|

|

$2,000

|

|

$774.064

|

|

$576.165

|

|

74.43%

|

|

2020 New Notes

|

|

$666.468

|

|

2.200% Jan 2020

|

|

36962G7M0

|

|

US36962G7M04

|

|

$2,000

|

|

$989.186

|

|

$736.289

|

|

74.43%

|

|

2020 New Notes

|

|

$750.842

|

|

5.500% Jan 2020

|

|

36962G4J0

|

|

US36962G4J02

|

|

$2,000

|

|

$885.894

|

|

$659.405

|

|

74.43%

|

|

2020 New Notes

|

|

$756.185

|

|

5.550% May 2020

|

|

36962G2T0

|

|

US36962G2T02

|

|

$1,100

|

|

$576.167

|

|

$428.863

|

|

74.43%

|

|

2020 New Notes

|

|

$493.355

|

|

4.375% Sept 2020

|

|

36962G4R2

|

|

US36962G4R28

|

|

$2,150

|

|

$956.351

|

|

$711.848

|

|

74.43%

|

|

2020 New Notes

|

|

$786.671

|

|

4.625% Jan 2021

|

|

36962G4Y7

|

|

US36962G4Y78

|

|

$2,250

|

|

$1,086.508

|

|

$808.729

|

|

74.43%

|

|

2020 New Notes

|

|

$906.594

|

|

5.300% Feb 2021

|

|

369622SM8

|

|

US369622SM84

|

|

$2,000

|

|

$885.375

|

|

$659.018

|

|

74.43%

|

|

2020 New Notes

|

|

$755.162

|

|

4.650% Oct 2021

|

|

36962G5J9

|

|

US36962G5J92

|

|

$3,150

|

|

$1,444.049

|

|

$1,074.861

|

|

74.43%

|

|

2020 New Notes

|

|

$1,205.488

|

_______________

|

(1)

|

Proration factor (the percentage of relevant tenders to be accepted) is rounded to the nearest hundredth.

|

|

(2)

|

The 2020 New Notes will mature on November 15, 2020 and will bear interest at the rate per annum equal to the sum of: (a) the yield of the 1.375% U.S. Treasury Security due August 31, 2020 (the “2020 New Notes Reference Security”), as calculated by the lead dealer managers in accordance with standard market practice, that equates to the bid-side price of the 2020 New Notes Reference Security appearing at the Price Determination Date on the FIT1 page displayed on the Bloomberg Pricing Monitor, or any other recognized quotation source selected by the lead dealer managers in their sole discretion if such quotation report is not available or manifestly erroneous, plus (b) 105 basis points, such sum rounded to the third decimal place when expressed as a percentage.

|

USD (2022-2024): Market Value Exchange for 2025 New Notes

|

Title of Old Notes

|

|

CUSIP Number

|

|

ISIN

|

|

Principal Amount

Outstanding

(millions)

|

|

Principal Amount

Tendered by Early

Participation Date

(millions)

|

|

Hypothetical

Principal Amount

to be Accepted

Pursuant to the

Exchange Offer

(millions)

|

|

Hypothetical

Proration

Factor(1)

|

|

New Notes(2)

|

|

Hypothetical

Principal Amount to

be Issued Pursuant

to the Exchange

Offer (millions)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3.150% Sept 2022

|

|

36962G6F6

|

|

US36962G6F61

|

|

$2,000

|

|

$916.965

|

|

$682.532

|

|

74.43%

|

|

2025 New Notes

|

|

$704.632

|

|

3.100% Jan 2023

|

|

36962G6S8

|

|

US36962G6S82

|

|

$2,500

|

|

$1,234.940

|

|

$919.213

|

|

74.43%

|

|

2025 New Notes

|

|

$944.261

|

|

3.450% May 2024

|

|

36962G7K4

|

|

US36962G7K48

|

|

$1,000

|

|

$477.364

|

|

$355.320

|

|

74.43%

|

|

2025 New Notes

|

|

$370.151

|

________________

|

(1)

|

Proration factor (the percentage of relevant tenders to be accepted) is rounded to the nearest hundredth.

|

|

(2)

|

The 2025 New Notes will mature on November 15, 2025 and will bear interest at the rate per annum equal to the sum of: (a) the yield of the 2.000% U.S. Treasury Security due August 15, 2025 (the “2025 New Notes Reference Security”), as calculated by the lead dealer managers in accordance with standard market practice, that equates to the bid-side price of the 2025 New Notes Reference Security appearing at the Price Determination Date on the FIT1 page displayed on the Bloomberg Pricing Monitor, or any other recognized quotation source selected by the lead dealer managers in their sole discretion if such quotation report is not available or manifestly erroneous, plus (b) 135 basis points, such sum rounded to the third decimal place when expressed as a percentage.

|

USD (2032-2039): Market Value Exchange for 2035 New Notes

|

Title of Old Notes

|

|

CUSIP Number

|

|

ISIN

|

|

Principal Amount

Outstanding

(millions)

|

|

Principal Amount

Tendered by Early

Participation Date

(millions)

|

|

Hypothetical

Principal Amount

to be Accepted

Pursuant to the

Exchange Offer

(millions)

|

|

Hypothetical

Proration

Factor(1)

|

|

New Notes(2)

|

|

Hypothetical

Principal Amount to

be Issued Pursuant

to the Exchange

Offer (millions)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.750% Mar 2032

|

|

36962GXZ2

|

|

US36962GXZ26

|

|

$5,000

|

|

$2,842.823

|

|

$2,116.021

|

|

74.43%

|

|

2035 New Notes

|

|

$2,864.310

|

|

6.150% Aug 2037

|

|

36962G3A0

|

|

US36962G3A02

|

|

$2,000

|

|

$1,502.758

|

|

$1,118.560

|

|

74.43%

|

|

2035 New Notes

|

|

$1,441.936

|

|

5.875% Jan 2038

|

|

36962G3P7

|

|

US36962G3P70

|

|

$6,350

|

|

$4,773.773

|

|

$3,553.301

|

|

74.43%

|

|

2035 New Notes

|

|

$4,451.966

|

|

6.875% Jan 2039

|

|

36962G4B7

|

|

US36962G4B75

|

|

$4,000

|

|

$2,700.224

|

|

$2,009.879

|

|

74.43%

|

|

2035 New Notes

|

|

$2,792.567

|

________________

|

(1)

|

Proration factor (the percentage of relevant tenders to be accepted) is rounded to the nearest hundredth.

|

|

(2)

|

The 2035 New Notes will mature on November 15, 2035 and will bear interest at the rate per annum equal to the sum of: (a) the yield of the 3.000% U.S. Treasury Security due May 15, 2045 (the “2035 New Notes Reference Security”), as calculated by the lead dealer managers in accordance with standard market practice, that equates to the bid-side price of the 2035 New Notes Reference Security appearing at the Price Determination Date on the FIT1 page displayed on the Bloomberg Pricing Monitor, or any other recognized quotation source selected by the lead dealer managers in their sole discretion if such quotation report is not available or manifestly erroneous, plus (b) 155 basis points, such sum rounded to the third decimal place when expressed as a percentage.

|

Additional Information

The New Notes have not been and will not be registered under the Securities Act or the securities laws of any jurisdiction and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. The 2016 USD New Notes, the 2020 New Notes, the 2025 New Notes and the 2035 New Notes will be entitled to certain registration rights.

This communication does not constitute an offer to buy or sell or a solicitation of an offer to buy or sell either Old Notes or New Notes in any jurisdiction in which, or to or from any person to or from whom, it is unlawful to make such offer or solicitation under applicable securities laws or otherwise. The distribution of this communication in certain jurisdictions (including, but not limited to, Australia, Canada, China, the European Economic Area, France, Hong Kong, Ireland, Italy, Japan, Korea, Kuwait, Luxembourg, Mexico, Switzerland, the United Kingdom and the United States) and the offering of the New Notes in certain jurisdictions may be restricted by law.

This communication has not been approved by an authorized person for the purposes of section 21 of the Financial Services and Markets Act 2000 (as amended). Accordingly, this communication is only for distribution to and directed at: (i) in the United Kingdom, persons having professional experience in matters relating to investments

falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) (the “Order”)); (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Order; (iii) persons who are outside the United Kingdom; and (iv) any other person to whom it can otherwise be lawfully distributed (all such persons together being referred to as “Relevant Persons”). Any investment or investment activity to which this communication relates is available only to and will be engaged in only with Relevant Persons. Persons who are not Relevant Persons should not take any action based upon this communication and should not rely on it.

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”), with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State, this communication is not being made in that Relevant Member State other than: (a) to any legal entity which is a qualified investor as defined in the Prospectus Directive; (b) to fewer than 150 natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive, subject to obtaining the prior consent of the relevant dealer or dealers nominated by the Issuer for any such offer; or (c) in any other circumstances falling within Article 3(2) of the Prospectus Directive; provided that no such communication referred to in (a) to (c) above shall require the Issuer or any dealer manager, the information agents or the exchange agents to publish a prospectus pursuant to Article 3 of the Prospectus Directive or supplement a prospectus pursuant to Article 16 of the Prospectus Directive. The expression “Prospectus Directive” means Directive 2003/71/EC (as amended, including by Directive 2010/73/EU) and includes any relevant implementing measure in such Relevant Member State.

Forward-Looking Statements

This communication contains “forward-looking statements” —that is, statements related to future, not past, events. In this context, forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” or “target.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the Reorganization and the Exchange Offers; our announced GE Capital Exit Plan to reduce the size of our financial services businesses, including expected cash and non-cash charges associated with the GE Capital Exit Plan; expected income; earnings per share; revenues; organic growth; margins; cost structure; restructuring charges; cash flows; return on capital; capital expenditures, capital allocation or capital structure; dividends; and the split between GE’s industrial business and GECC earnings. For us, particular uncertainties that could cause our actual results to be materially different than those expressed in our forward-looking statements include: obtaining (or the timing of obtaining) any required regulatory reviews or approvals or any other consents or approvals associated with our announced GE Capital Exit Plan to reduce the size of our financial services businesses (including the Merger); our ability to complete incremental asset sales as part of the GE Capital Exit Plan in a timely manner (or at all) and at the prices we have assumed; changes in law, economic and financial conditions, including interest and exchange rate volatility, commodity and equity prices and the value of financial assets, including the impact of these conditions on our ability to sell or the value of incremental assets to be sold as part of the GE Capital Exit Plan as well as other aspects of the GE Capital Exit Plan; the impact of conditions in the financial and credit markets on the availability and cost of GECC’s funding, and GECC’s exposure to counterparties; the impact of conditions in the housing market and unemployment rates on the level of commercial and consumer credit defaults; pending and future mortgage loan repurchase claims and other litigation claims in connection with WMC Mortgage Corporation, which may affect our estimates of liability, including possible loss estimates; our ability to maintain our current credit rating and the impact on our funding costs and competitive position if we do not do so; the adequacy of our cash flows and earnings and other conditions, which may affect our ability to pay our quarterly dividend at the planned level or to repurchase shares at planned levels; GECC’s ability to pay dividends to GE at the planned level, which may be affected by GECC’s cash flows and earnings, financial services regulation and oversight, and other factors; our ability to convert pre-order commitments/wins into orders; the price we realize on orders since commitments/wins are stated at list prices; customer actions or developments such as early aircraft retirements or reduced energy demand and other factors that may affect the level of demand and financial performance of the major industries and customers we serve; the effectiveness of our risk management framework; the impact of regulation and regulatory, investigative and legal proceedings and legal compliance risks, including the impact of financial services regulation and litigation; adverse market conditions, timing of and ability to obtain required bank regulatory approvals, or other factors relating to us or Synchrony Financial that could prevent us from completing the Synchrony Financial split-off as planned; our capital allocation plans, as such plans may change including with respect to the timing and size of share repurchases,

acquisitions, joint ventures, dispositions and other strategic actions; our success in completing, including obtaining regulatory approvals for, announced transactions, such as the proposed transactions and alliances with Alstom, Appliances and the GE Capital Exit Plan, and our ability to realize anticipated earnings and savings; our success in integrating acquired businesses and operating joint ventures; the impact of potential information technology or data security breaches; our actual division of U.S. and international assets, which may not occur as expected; and the other factors that are described in “Risk Factors” in each of GE’s and GECC’s Annual Report on Form 10-K for the year ended December 31, 2014, as such descriptions may be updated or amended in any future report GE or GECC files with the U.S. Securities and Exchange Commission. These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements.

Matt Cribbins, 203.373.2424

Seth Martin, 203.572.3567

seth.martin@ge.com

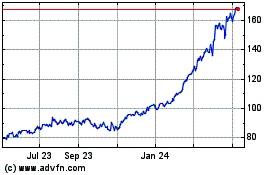

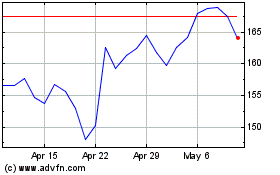

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024