Report of Foreign Issuer (6-k)

October 05 2015 - 6:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2015

Commission File Number: 001-32210

Northern Dynasty Minerals Ltd.

(Translation of registrant's name into English)

15th Floor - 1040 W. Georgia St., Vancouver, BC, V6E 4H8

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

Northern Dynasty Minerals Ltd. |

| |

(Registrant) |

| |

|

|

| Date: October 2, 2015 |

By: |

/s/ Ronald W. Thiessen |

| |

|

|

| |

|

Ronald Thiessen |

| |

Title: |

President & CEO |

Northern Dynasty signs definitive agreement with Cannon

Point

September 1, 2015 Vancouver, BC – Northern Dynasty

Minerals Ltd. (TSX: NDM; NYSE MKT: NAK) ("Northern Dynasty" or the "Company")

announces, further to its press release of August 10, 2015, that it has entered

into a definitive arrangement agreement (the “Agreement”) with Cannon Point

Resources Ltd. (“Cannon Point”) with respect to the acquisition of 100% of the

outstanding securities of Cannon Point.

The transaction will be implemented by way of a statutory plan

of arrangement and is subject to customary closing conditions, including

approval by the securityholders of Cannon Point by at least 2/3 of the votes

cast, court approval and regulatory approval.

Assuming the timely receipt of such approvals, the transaction

is expected to close in October 2015.

As part of the transaction, Northern Dynasty and Cannon Point

have also entered into definitive agreements with respect to the $4.25 million

secured loan to be provided by Cannon Point to Northern Dynasty upon execution

of the Agreement. The loan would be repayable after 30 days in the event that

the transaction does not complete due to a Northern Dynasty breach and 180 days

from termination if the transaction does not complete for any other reason.

Northern Dynasty has also entered into standard lock-up

agreements with certain security holders of Cannon Point, including with holders

of approximately 21% of the outstanding common shares of Cannon Point to vote in

favour of the transaction.

The Agreement provides for, among other things, a

non-solicitation covenant on the part of Cannon Point, subject to customary

“fiduciary out” provisions that entitle Cannon Point to consider and accept a

superior proposal, a right in favour of Northern Dynasty to match any superior

proposal and, in certain circumstances, the payment of a termination fee.

The transaction is not subject to Northern Dynasty shareholder

approval.

About Northern Dynasty Minerals Ltd.

Northern Dynasty is a mineral exploration and development

company based in Vancouver, Canada. Northern Dynasty's principal asset is the

Pebble Project in southwest Alaska, USA, an initiative to develop one of the

world's most important mineral resources.

For further details on Northern Dynasty and the Pebble Project,

please visit the Company's website at www.northerndynasty.com or contact

Investor services at (604) 684-6365 or within North America at 1-800-667-2114.

Review Canadian public filings at www.sedar.com and U.S. public filings at www.sec.gov.

Marchand Snyman

Chief Financial Officer

Forward Looking Information and other

Cautionary Factors

This release includes certain statements that may be deemed

"forward-looking statements". All statements in this release, other than

statements of historical facts, such as those that address the in-progress

financings and plan to complete certain regulatory filings are forward-looking

statements. These statements include expectations about the likelihood of

completing a financing and merger transaction and the ability of the Company to

secure regulatory acceptance for its prospectus and registration statements.

Though the Company believes the expectations expressed in its forward-looking

statements are based on reasonable assumptions, such statements are subject to

future events and third party discretion such as regulatory personnel. For more

information on the Company, and the risks and uncertainties connected with its

business, Investors should review the Company's home jurisdiction filings at

www.sedar.com and its filings with the United States Securities and Exchange

Commission.

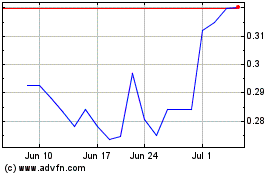

Northern Dynasty Minerals (AMEX:NAK)

Historical Stock Chart

From Mar 2024 to Apr 2024

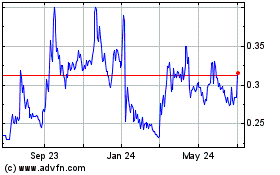

Northern Dynasty Minerals (AMEX:NAK)

Historical Stock Chart

From Apr 2023 to Apr 2024