UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

OPTIMIZERX

CORPORATION

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

760174 10 2

(CUSIP

Number)

WPP plc

27 Farm Street

London,

United Kingdom W1J 5RJ

Telephone: +44(0) 20 7408 2204

Attention: Andrea Harris, Esq.

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

Copies to:

Curt Myers, Esq.

Davis & Gilbert LLP

1740 Broadway

New York,

New York 10019

(212) 468-4800

September 24, 2015

(Date of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ¨

NOTE: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See §§ 240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter the disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be

deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

WPP LUXEMBOURG GAMMA THREE

S.À R.L. |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE

ONLY |

| 4 |

|

SOURCE

OF FUNDS (See Instructions) WC |

| 5 |

|

CHECK IF

DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

LUXEMBOURG |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE VOTING

POWER 0 (SEE ITEMS 2 AND

5) |

| |

8 |

|

SHARED VOTING

POWER 6,011,106 (SEE ITEMS 2

AND 5) |

| |

9 |

|

SOLE DISPOSITIVE

POWER 0 (SEE ITEMS 2 AND

5) |

| |

10 |

|

SHARED DISPOSITIVE POWER

6,011,106 (SEE ITEMS 2 AND 5) |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON 6,011,106 (SEE ITEMS 2

AND 5) |

| 12 |

|

CHECK IF

THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

20.8% (SEE ITEM 5) |

| 14 |

|

TYPE OF

REPORTING PERSON (See Instructions)

OO |

Page 2 of 13 Pages

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

WPP PLC |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE

ONLY |

| 4 |

|

SOURCE

OF FUNDS (See Instructions) AF |

| 5 |

|

CHECK IF

DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

JERSEY |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

|

SOLE VOTING

POWER 0 (SEE ITEMS 2 AND

5) |

| |

8 |

|

SHARED VOTING

POWER 6,011,106 (SEE ITEMS 2

AND 5) |

| |

9 |

|

SOLE DISPOSITIVE

POWER 0 (SEE ITEMS 2 AND

5) |

| |

10 |

|

SHARED DISPOSITIVE POWER

6,011,106 (SEE ITEMS 2 AND 5) |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON 6,011,106 (SEE ITEMS 2

AND 5) |

| 12 |

|

CHECK IF

THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

20.8% (SEE ITEM 5) |

| 14 |

|

TYPE OF

REPORTING PERSON (See Instructions)

CO |

Page 3 of 13 Pages

Item 1. Security and Issuer.

The title of the class of equity securities to which this statement relates is common stock, par value $0.001 per share (the “Common

Stock”), of OptimizeRx Corporation, a Nevada corporation (the “Company”). The address of the principal executive offices of the Company is 400 Water Street, Suite 200, Rochester, MI 48307.

Item 2. Identity and Background.

| |

(a)-(c) |

This Schedule 13D is being filed by WPP Luxembourg Gamma Three S.à r.l., a private limited liability company (société à responsabilité limitée) incorporated under the

laws of the Grand Duchy of Luxembourg (“Lux Gamma Three”), and WPP plc, a corporation formed under the laws of Jersey. WPP plc indirectly holds 100% of the outstanding stock of Lux Gamma Three through a series of intervening holding

companies. Lux Gamma Three and WPP plc are sometimes referred to herein collectively as the “Reporting Persons” and individually as a “Reporting Person.” |

| |

|

WPP plc and its subsidiaries (the “WPP Group”) comprise one of the largest communications services businesses in the world. The WPP Group provides communications services on a national, multinational

and global basis. It operates from over 3,000 offices in 111 countries including associates. The WPP Group organizes its businesses in the following areas: Advertising and Media Investment Management; Data Investment Management; Public

Relations & Public Affairs; Branding & Identity; and Healthcare and Specialist Communications (including direct, digital, promotion and relationship marketing). |

| |

|

The address of the principal office of Lux Gamma Three is 124 boulevard de la Pétrusse, Luxembourg L-2330. The address of the principal office of WPP plc is 27 Farm Street, London, United Kingdom W1J 5RJ.

|

| |

(d) |

During the past five years, none of the Reporting Persons nor, to the knowledge of the Reporting Persons, any of their respective executive officers or directors, has been convicted in a criminal proceeding (excluding

traffic violations and similar misdemeanors). |

| |

(e) |

During the past five years, none of the Reporting Persons nor, to the knowledge of the Reporting Persons, any of their respective executive officers or directors, has been a party to a civil proceeding of a judicial or

administrative body of competent jurisdiction as a result of which such person was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities

laws, or finding any violation with respect to such laws. |

| |

(f) |

The name, citizenship, business address, principal business occupation or employment of each of the directors and executive officers of each of the Reporting Persons are set forth on Annex A hereto.

|

Page 4 of 13 Pages

Item 3. Source and Amount of Funds and Other Consideration.

The source of the cash used by Lux Gamma Three to acquire 6,011,106 shares of Common Stock (the “Shares”) was Lux Gamma

Three’s working capital. Pursuant to a Stock Purchase Agreement dated as of September 24, 2015 by and between Lux Gamma Three (the “Investor”) and the Company (the “Stock Purchase Agreement”), the Investor

purchased the Shares directly from the Company for cash, at a purchase price of $0.7875 per share, or gross proceeds of $4,733,746.

Item 4. Purpose of Transaction.

The Reporting Persons acquired the securities described in Item 3 above for investment purposes. Consistent with such investment purposes,

the Reporting Persons may engage in communications with, without limitation, management of the Company, one or more members of the board of directors of the Company (the “Board”), other shareholders of the Company and other relevant

parties, and may make suggestions concerning the business, assets, capitalization, financial condition, operations, governance, management, prospects, strategy, strategic transactions, financing strategies and alternatives, and future plans of the

Company, and such other matters as the Reporting Persons may deem relevant to their investment in the Company, which communications may include proposing or considering one or more of the actions described in subsections (a) through (j) of

Item 4 of Schedule 13D under the Securities Exchange Act of 1934, as amended.

In connection with the Stock Purchase Agreement,

on September 24, 2015 the Company entered into an Investor Rights Agreement with the Investor (the “Investor Rights Agreement”), pursuant to which the Company agreed to the following:

| |

• |

|

Demand Registration Rights. The Company granted the Investor registration rights for the Shares and any securities acquired in connection with an Amended and Restated Co-Marketing Agreement (described in

Item 6) after a period of two years. |

| |

• |

|

Inspection Rights. So long as the Investor owns not less than 25% of the Shares, the Investor will have an annual right to inspect the Company’s books and records. |

| |

• |

|

Observer Rights. So long as the Investor owns not less than 25% of the Shares, the Company will allow the Investor to choose a representative to attend the Company’s board meetings as a nonvoting observer.

|

| |

• |

|

Board Seat. So long as the Investor owns not less than 25% of the Shares, the Company will appoint a nominee of the Investor as a member of the Company’s Board. The Company will have a five member Board

provided that it is not prohibited by the rules and regulations of an exchange on which the Company trades. The Company also entered into an indemnity agreement with the nominee. |

| |

• |

|

Budget Review. So long as the Investor owns not less than 25% of the Shares, the Company will review the Company’s budget plans with the Investor’s nominee prior to submission to the Board, at the

request of the Investor. |

Page 5 of 13 Pages

| |

• |

|

Right of First Refusal. The Company agreed that, in the event that it proposes to sell new securities, it will first offer such new securities to the Investor. |

| |

• |

|

Special Approval Matters. So long as the Investor owns not less than 25% of the Shares, and provided that it is not prohibited by the rules and regulations of an exchange on which the Company trades, the Company

agreed that 80% Board approval will be required for certain decisions, including: |

| |

• |

|

the incurrence of any indebtedness in excess of $1.5 million in the aggregate during any fiscal year; |

| |

• |

|

the sale, transfer or other disposition of all or substantially all of the assets of the Company; |

| |

• |

|

the acquisition of any assets or properties (in one or more related transactions) for cash or otherwise for an amount in excess of $1.5 million in the aggregate during any fiscal year; |

| |

• |

|

capital expenditures in excess of $1.5 million individually (or in the aggregate if related to an integrated program of activities) or in excess of $1.5 million in the aggregate during any fiscal year;

|

| |

• |

|

making, or permitting any subsidiary to make, loans to, investments in, or purchasing, or permitting any subsidiary to purchase, any stock or other securities in another corporation, joint venture, partnership or other

entity; |

| |

• |

|

the commencement or settlement of any lawsuit, arbitration or other legal proceeding related to the intellectual property of the Company or involving an amount in controversy greater than $1.5 million; and

|

| |

• |

|

the issuance of new securities, except for securities issued under an equity incentive plan and any issuance of common stock to vendors, advisors, financial institutions, suppliers or joint venturers that do not exceed,

individually or in the aggregate 5% of then issued and outstanding capital stock of the Company. |

The foregoing descriptions

of the Stock Purchase Agreement and the Investor Rights Agreement are qualified in their entirety by reference to the full text of the Stock Purchase Agreement and the Investor Rights Agreement, copies of which are filed as Exhibits 10.1 and

10.2, respectively, to the Company’s Current Report on Form 8-K, filed on September 30, 2015.

The Reporting Persons intend to review their investment in the Company on an ongoing basis. Depending on various factors (including, without

limitation, the Company’s financial position and strategic direction, actions taken by the Board, price levels of the relevant securities, other investment opportunities available to the Reporting Persons, market conditions and general economic

and industry conditions), the Reporting Persons may take such actions with respect to their investment in the Company as they deem appropriate, including, without limitation, purchasing additional shares of Common Stock or other financial

instruments of or related to the Company, or selling some or all of their beneficial holdings, engaging in hedging or similar transactions with respect to the securities of or relating to the Company and/or otherwise changing their intention with

respect to any and all matters referred to in Item 4 of Schedule 13D.

Page 6 of 13 Pages

Item 5. Interest in Securities of the Issuer.

| |

(a) |

As of the date hereof, Lux Gamma Three is deemed to beneficially own an aggregate of 6,011,106 Shares, representing approximately 20.8% of the Company’s outstanding Common Stock, based upon

22,949,819 shares of Common Stock outstanding as reflected in the Company’s Quarterly Report on Form 10-Q filed on August 11, 2015 for the quarter ended June 30, 2015. WPP plc

indirectly owns 100% of Lux Gamma Three and therefore may be deemed to have beneficial ownership of the Shares. Lux Gamma Three disclaims beneficial ownership of the Shares. |

| |

(b) |

Each of Lux Gamma Three and WPP plc may be deemed to have shared power to vote and dispose or direct the vote and direct the disposition of the Shares. |

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to

Securities of the Issuer.

On September 24, 2015, the Company amended and restated an existing Co-Marketing Agreement with Grey Healthcare Group,

LLC (“GHG”) an affiliate of the Investor (the “Amended and Restated Co-Marketing Agreement”). The Amended and Restated Co-Marketing Agreement was amended to give the GHG the option to receive all or part of the

compensation due under the agreement in shares of the Company’s Common Stock. Shares issuable under the Amended and Restated Co-Marketing Agreement will be issued to the Investor or any other affiliate of GHG designated in writing by GHG at the

following rates:

| |

• |

|

Until June 30, 2016, the Company will issue the number of shares of Common Stock equal to GHG’s share of net revenues received for sales of new services to GHG or Company clients (“GHG Net

Revenues”) divided by $0.7875. |

| |

• |

|

After June 30, 2016, the Company will issue the number of shares of Common Stock equal to the GHG Net Revenues divided by a price equal to 80% multiplied by the average trading price of one share of Common Stock

during the 30 trading day period immediately prior to the date of the most recent statement of GHG Net Revenues set forth by the Company. |

See Item 3 with respect to the Stock Purchase Agreement and Item 4 with respect to the Investor Rights Agreement.

Page 7 of 13 Pages

Item 7. Material to be Filed as Exhibits.

| |

1. |

Joint Filing Agreement among the Reporting Persons, dated as of September 24, 2015. |

| |

2. |

Stock Purchase Agreement, dated as of September 24, 2015, incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed on

September 30, 2015 (the “Form 8-K”). |

| |

3. |

Investor Rights Agreement, dated as of September 24, 2015, incorporated by reference to Exhibit 10.2 to the Form 8-K. |

Page 8 of 13 Pages

After reasonable inquiry and to the best of my knowledge and belief, I certify that the

information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

| Dated: October 2, 2015 |

|

|

|

|

|

|

|

|

WPP LUXEMBOURG GAMMA THREE S.À R.L. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Anne Ehrismann |

|

|

|

|

Name: Anne Ehrismann |

|

|

|

|

Title: Manager |

|

|

|

|

|

|

|

|

By: |

|

/s/ Thierry Lenders |

|

|

|

|

Name: Thierry Lenders |

|

|

|

|

Title: Manager |

|

|

|

|

|

|

|

|

By: |

|

/s/ Paul W.G. Richardson |

|

|

|

|

Name: Paul W.G. Richardson |

|

|

|

|

Title: Chief Financial Officer |

Page 9 of 13 Pages

Annex A

Executive Officers and Directors

|

|

|

|

|

|

|

| WPP Luxembourg Gamma Three S.à r.l. |

|

|

|

|

|

|

| Name and Citizenship |

|

Position |

|

Principal Occupation or

Employment |

|

Business Address |

|

|

|

|

| De Bodt, Michel Belgium |

|

Manager |

|

Finance Director |

|

Rue Jules Cockx 8-10, Brussels, 1160, Belgium |

|

|

|

|

| Ehrismann, Anne France |

|

Manager |

|

Manager |

|

124 Boulevard de la Petrusse, Luxembourg, L-2330 |

|

|

|

|

| Feider, Marc Luxembourg |

|

Manager |

|

Lawyer |

|

33 Avenue J.F. Kennedy, L-1855 Luxembourg |

|

|

|

|

| Gerrard, Peter Luxembourg |

|

Manager |

|

Managing Director |

|

124 Boulevard de la Petrusse, Luxembourg, L-2330 |

|

|

|

|

| Lenders, Thierry Luxembourg |

|

Manager |

|

European Treasury Manager |

|

Rue Jules Cockx 8-10, Brussels, 1160, Belgium |

|

|

|

|

| van Popering, Emile

Netherlands |

|

Manager |

|

Finance Director |

|

Cantersteen 47, Brussels, 1000, Belgium |

|

|

|

|

| Stenke, Lennart Sweden |

|

Manager |

|

Company Director |

|

124 Boulevard de la Petrusse, Luxembourg, L-2330 |

|

|

|

|

| Mulder, Astrid Netherlands |

|

Manager |

|

Chief Financial Officer |

|

Laan op Zuid 167, Rotterdam, 3072 DB, Netherlands |

|

|

|

|

| WPP plc |

|

|

|

|

|

|

|

|

|

|

| Name and Citizenship |

|

Position |

|

Principal Occupation or

Employment |

|

Business Address |

|

|

|

|

| Sorrell, Sir Martin Great Britain |

|

Director |

|

Group Chief Executive (WPP plc) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

Page 10 of 13 Pages

|

|

|

|

|

|

|

|

|

|

|

| Richardson, Paul Great Britain, US |

|

Director |

|

Group Finance Director (WPP plc) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

|

|

|

|

| Quarta, Roberto Italy, US |

|

Director and Chairman |

|

Partner (Clayton, Dubilier & Rice) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

|

|

|

|

|

|

|

|

Non-Executive Chairman

(Smith & Nephew plc) |

|

|

|

|

|

|

|

|

|

|

Non-Executive Chairman (WPP plc) |

|

|

|

|

|

|

| Agnelli, Roger Brazil |

|

Director |

|

Founding Partner & CEO (AGN

Holding) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

|

|

|

|

|

|

|

|

Non-Executive Chairman (B&A

Mineracão S.A.) |

|

|

|

|

|

|

|

|

|

|

Non-Executive Director (ABB Ltd) |

|

|

|

|

|

|

| Aigrain, Jacques Switzerland |

|

Director |

|

Partner (Warburg Pincus International LLC) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

|

|

|

|

|

|

|

|

Non-Executive Director (London Stock Exchange Group plc) |

|

|

|

|

|

|

| Begley, Charlene US |

|

Director |

|

Non-Executive Director (NASDAQ OMX) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

|

|

|

|

|

|

|

|

Non-Executive Director (Red Hat) |

|

|

|

|

|

|

| Hood, John New Zealand |

|

Director |

|

President & CEO (Robertson Foundation) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

|

|

|

|

|

|

|

|

Chairman (Urenco Limited, Matakina Limited and Study Group Limited) |

|

|

|

|

|

|

|

|

|

|

Chair (Rhodes Trust and Teach For All) |

|

|

Page 11 of 13 Pages

|

|

|

|

|

|

|

|

|

|

|

| Li, Ruigang China |

|

Director |

|

Founding Chairman (CMC Capital Partners) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

|

|

|

|

|

|

|

|

Chairman (Shanghai Media Group) |

|

|

|

|

|

|

| Riccardi, Daniela Italy |

|

Director |

|

Chief Executive Officer (Baccarat) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

|

|

|

|

|

|

|

|

Non-Executive Director (Kering) |

|

|

|

|

|

|

| Seligman, Nicole US |

|

Director |

|

President (Sony Entertainment Inc. and Sony Corporation of America) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

|

|

|

|

|

|

|

|

Senior Legal Counsel (Sony Group) |

|

|

|

|

|

|

| Shong, Hugo US |

|

Director |

|

Executive Vice President, (International Data

Group) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

|

|

|

|

|

|

|

|

Member (Board of China Jiuhao Health Industry Corp) |

|

|

|

|

|

|

|

|

|

|

Member (Board of Mei Ah Entertainment Group) |

|

|

|

|

|

|

|

|

|

|

Member (Board of Trustees of Boston University) |

|

|

Page 12 of 13 Pages

|

|

|

|

|

|

|

|

|

|

|

| Shriver, Timothy A. US |

|

Director |

|

Chairman (Special Olympics) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

|

|

|

|

|

|

|

|

Co-Founder and Chair (Collaborative for Academic, Social and Emotional Learning (CASEL)) |

|

|

|

|

|

|

|

|

|

|

Member (Council on Foreign Relations) |

|

|

|

|

|

|

| Susman, Sally US |

|

Director |

|

Executive Vice President, Corporate Affairs (Pfizer) |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

|

|

|

|

|

|

|

|

Member (Board of International Rescue Committee) |

|

|

|

|

|

|

|

|

|

|

Trustee (Library of Congress) |

|

|

|

|

|

|

| Trujillo, Solomon US |

|

Director |

|

Member of various corporate boards in the US, EU and China |

|

27 Farm Street, London, W1J 5RJ, United Kingdom |

Page 13 of 13 Pages

Exhibit 1

Joint Filing Agreement

AGREEMENT dated

as of September 24, 2015, by and among WPP Luxembourg Gamma Three S.à r.l. and WPP plc (collectively, the “Parties”).

Each

of the Parties hereto represents to the other Parties that it is eligible to use Schedule 13D to report its beneficial interest in the common stock of OptimizeRx Corporation (“Schedule 13D”) and it will file the

Schedule 13D on behalf of itself.

Each of the Parties agrees to be responsible for the timely filing of the Schedule 13D and any and all

amendments thereto and for the completeness and accuracy of the information concerning itself contained in the Schedule 13D, and the other Parties to the extent it knows or has reason to believe that any information about the other Parties is

inaccurate.

|

|

|

|

|

|

|

|

|

WPP LUXEMBOURG GAMMA THREE S.À R.L. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Anne Ehrismann |

|

|

|

|

Name: Anne Ehrismann |

|

|

|

|

Title: Manager |

|

|

|

|

|

|

|

|

By: |

|

/s/ Thierry Lenders |

|

|

|

|

Name: Thierry Lenders |

|

|

|

|

Title: Manager |

|

|

|

|

WPP PLC |

|

|

|

|

|

|

|

|

By: |

|

/s/ Paul W.G. Richardson |

|

|

|

|

Name: Paul W.G. Richardson |

|

|

|

|

Title: Chief Financial Officer |

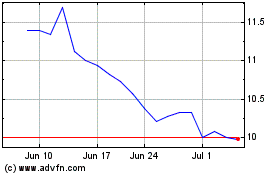

OptimizeRx (NASDAQ:OPRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

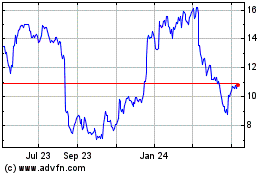

OptimizeRx (NASDAQ:OPRX)

Historical Stock Chart

From Apr 2023 to Apr 2024