UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

October 1, 2015

Date of Report (date of earliest event reported)

|

|

MICRON TECHNOLOGY, INC. |

(Exact name of registrant as specified in its charter) |

|

| | | | |

Delaware | | 1-10658 | | 75-1618004 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

|

|

8000 South Federal Way |

Boise, Idaho 83716-9632 |

(Address of principal executive offices) |

|

|

(208) 368-4000 |

(Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c))

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

On October 1, 2015, the Company announced its financial results for the fourth quarter and fiscal year ended September 3, 2015. The full text of the press release issued in connection with the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K.

|

| |

Item 9.01. | Financial Statements and Exhibits. |

| |

| (d) Exhibits. |

|

| | |

Exhibit No. | | Description |

99.1 | | Press Release issued on October 1, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | MICRON TECHNOLOGY, INC. |

| | | |

| | | |

Date: | October 1, 2015 | By: | /s/ Ernest E. Maddock |

| | Name: | Ernest E. Maddock |

| | Title: | Chief Financial Officer and Vice President, Finance |

INDEX TO EXHIBITS FILED WITH

THE CURRENT REPORT ON FORM 8-K

|

| | |

Exhibit | | Description |

99.1 | | Press Release issued on October 1, 2015 |

Exhibit 99.1

FOR IMMEDIATE RELEASE

|

| | |

Contacts: | Kipp A. Bedard | Daniel Francisco |

| Investor Relations | Media Relations |

| kbedard@micron.com | dfrancisco@micron.com |

| (208) 368-4465 | (208) 368-5584 |

MICRON TECHNOLOGY, INC., REPORTS RESULTS FOR THE

FOURTH QUARTER AND 2015 FISCAL YEAR

BOISE, Idaho, October 1, 2015 – Micron Technology, Inc., (NASDAQ: MU) today announced results of operations for its fourth quarter and 2015 fiscal year, which ended September 3, 2015. Revenues for the fourth quarter of fiscal 2015 were $3.60 billion and were 7 percent lower compared to the third quarter of fiscal 2015 and 15 percent lower compared to the fourth quarter of fiscal 2014. Revenues for fiscal year 2015 were $16.19 billion and net income attributable to Micron shareholders was $2.90 billion, or $2.47 per diluted share. Cash flows from operations were $5.21 billion for fiscal year 2015.

"We are pleased to report Fiscal Year 2015 results that include revenue of $16.2 billion, $2.72 in non-GAAP earnings per share, and $2.3 billion in dilution management activities, including convert retirements and share repurchases," stated D. Mark Durcan, Chief Executive Officer. "While fourth quarter results were impacted by continued weakness in the PC sector, we believe that memory industry fundamentals remain favorable over the long term."

GAAP Income and Per Share Data – On a GAAP(1) basis, net income attributable to Micron shareholders for the fourth quarter of fiscal 2015 was $471 million, or $0.42 per diluted share, compared to net income of $491 million, or $0.42 per diluted share, for the third quarter of fiscal 2015 and net income of $1.15 billion, or $0.96 per diluted share, for the fourth quarter of fiscal 2014.

Non-GAAP Income and Per Share Data – On a non-GAAP(2) basis, net income attributable to Micron shareholders for the fourth quarter of fiscal 2015 was $399 million, or $0.37 per diluted share, compared to net income of $620 million, or $0.54 per diluted share, for the third quarter of fiscal 2015. For a reconciliation of GAAP to non-GAAP results, see the accompanying financial tables and footnotes.

Revenues for the fourth quarter of fiscal 2015 were 7 percent lower compared to the third quarter of fiscal 2015 primarily due to a 7 percent decline in DRAM average selling prices and relatively flat DRAM sales volume. Non-Volatile trade revenues for the fourth quarter of fiscal 2015 also declined 7 percent compared to the third quarter primarily as a result of lower sales volume. The company's overall consolidated gross margin of 27 percent for the fourth quarter of fiscal 2015 was 4 percent lower compared to the third quarter of fiscal 2015 primarily due to lower average selling prices for DRAM.

Cash flows from operations were $1.03 billion for the fourth quarter of fiscal 2015, while investments in capital expenditures were $1.85 billion. For fiscal year 2015, cash flows from operations were $5.21 billion and investments in capital expenditures were $4.12 billion. The company ended the fourth quarter of fiscal 2015 with cash and marketable investments of $5.63 billion.

The company will host a conference call Thursday, Oct. 1, 2015 at 2:30 p.m. MT to discuss its financial results. The call, audio and slides will be available online at http://investors.micron.com/events.cfm. A webcast replay will be available on the company's website until Oct. 1, 2016. A taped audio replay of the conference call will also be available at 1-404-537-3406 or 1-855-859-2056 (conference number: 43149721) beginning at 5:30 p.m. MT, Thursday, Oct. 1, 2015 and continuing until 5:30 p.m. MT, Thursday, Oct. 8, 2015. For Investor Relations and other company updates, follow @MicronTech on Twitter at https://twitter.com/MicronTech.

Micron Technology, Inc., is a global leader in advanced semiconductor systems. Micron's broad portfolio of high-performance memory technologies-including DRAM, NAND and NOR Flash-is the basis for solid state drives, modules, multichip packages and other system solutions. Backed by more than 35 years of technology leadership, Micron's memory solutions enable the world's most innovative computing, consumer, enterprise storage, networking, mobile, embedded and automotive applications. Micron's common stock is traded on the NASDAQ under the MU symbol. To learn more about Micron Technology, Inc., visit www.micron.com.

(1) GAAP represents U.S. Generally Accepted Accounting Principles.

(2) Non-GAAP represents GAAP excluding the impact of certain activities which the company's management excludes in analyzing the company's operating results and understanding trends in the company's earnings. Non-GAAP also includes the impact on shares used in per share calculations of the company's outstanding capped call transactions. For a reconciliation of GAAP to non-GAAP results, see the accompanying financial tables and footnotes.

MICRON TECHNOLOGY, INC.

CONSOLIDATED FINANCIAL SUMMARY

(in millions except per share amounts)

|

| | | | | | | | | | | | | | | | | | | | |

| | 4th Qtr. | | 3rd Qtr. | | 4th Qtr. | | Year Ended |

| | September 3,

2015 | | June 4,

2015 | | August 28,

2014 | | September 3,

2015 | | August 28,

2014 |

Net sales | | $ | 3,600 |

| | $ | 3,853 |

| | $ | 4,227 |

| | $ | 16,192 |

| | $ | 16,358 |

|

Cost of goods sold | | 2,630 |

| | 2,651 |

| | 2,842 |

| | 10,977 |

| | 10,921 |

|

Gross margin | | 970 |

| | 1,202 |

| | 1,385 |

| | 5,215 |

| | 5,437 |

|

Selling, general and administrative | | 170 |

| | 169 |

| | 180 |

| | 719 |

| | 707 |

|

Research and development | | 379 |

| | 406 |

| | 358 |

| | 1,540 |

| | 1,371 |

|

Other operating (income) expense, net (1) | | (6 | ) | | (4 | ) | | 19 |

| | (42 | ) | | 272 |

|

Operating income | | 427 |

| | 631 |

| | 828 |

| | 2,998 |

| | 3,087 |

|

Gain on MMJ Acquisition (2) | | — |

| | — |

| | — |

| | — |

| | (33 | ) |

Interest income (expense), net | | (90 | ) | | (88 | ) | | (81 | ) | | (336 | ) | | (329 | ) |

Other non-operating income (expense), net (3) | | 18 |

| | (16 | ) | | 198 |

| | (53 | ) | | 8 |

|

Income tax (provision) benefit (4) | | 69 |

| | (104 | ) | | 87 |

| | (157 | ) | | (128 | ) |

Equity in net income of equity method investees | | 47 |

| | 68 |

| | 119 |

| | 447 |

| | 474 |

|

Net (income) attributable to noncontrolling interests | | — |

| | — |

| | (1 | ) | | — |

| | (34 | ) |

Net income attributable to Micron | | $ | 471 |

| | $ | 491 |

| | $ | 1,150 |

| | $ | 2,899 |

| | $ | 3,045 |

|

| | | | | | | | | | |

Earnings per share: | | | | | | | | | | |

Basic | | $ | 0.44 |

| | $ | 0.46 |

| | $ | 1.08 |

| | $ | 2.71 |

| | $ | 2.87 |

|

Diluted | | 0.42 |

| | 0.42 |

| | 0.96 |

| | 2.47 |

| | 2.54 |

|

| | | | | | | | | | |

Number of shares used in per share calculations: | | | | | | | | | | |

Basic | | 1,060 |

| | 1,073 |

| | 1,068 |

| | 1,070 |

| | 1,060 |

|

Diluted | | 1,124 |

| | 1,170 |

| | 1,203 |

| | 1,170 |

| | 1,198 |

|

CONSOLIDATED FINANCIAL SUMMARY, Continued

|

| | | | | | | | | | | | |

As of | | September 3,

2015 | | June 4,

2015 | | August 28,

2014 |

Cash and short-term investments | | $ | 3,521 |

| | $ | 4,860 |

| | $ | 4,534 |

|

Receivables | | 2,507 |

| | 2,530 |

| | 2,906 |

|

Inventories | | 2,340 |

| | 2,381 |

| | 2,455 |

|

Total current assets | | 8,596 |

| | 10,008 |

| | 10,245 |

|

Long-term marketable investments | | 2,113 |

| | 2,470 |

| | 819 |

|

Property, plant and equipment, net | | 10,554 |

| | 9,857 |

| | 8,682 |

|

Total assets | | 24,143 |

| | 25,052 |

| | 22,416 |

|

| | | | | | |

Accounts payable and accrued expenses | | 2,611 |

| | 3,204 |

| | 2,864 |

|

Current debt (3)(5) | | 1,089 |

| | 1,134 |

| | 1,618 |

|

Total current liabilities | | 3,905 |

| | 4,551 |

| | 4,791 |

|

Long-term debt (3)(5) | | 6,252 |

| | 6,334 |

| | 4,893 |

|

| | | | | | |

Total Micron shareholders' equity | | 12,302 |

| | 12,449 |

| | 10,760 |

|

Noncontrolling interests in subsidiaries | | 937 |

| | 897 |

| | 802 |

|

Total equity | | 13,239 |

| | 13,346 |

| | 11,562 |

|

|

| | | | | | | | |

| | Year Ended |

| | September 3,

2015 | | August 28,

2014 |

Net cash provided by operating activities | | $ | 5,208 |

| | $ | 5,699 |

|

Net cash provided by (used for) investing activities | | (6,232 | ) | | (2,902 | ) |

Net cash provided by (used for) financing activities | | (718 | ) | | (1,499 | ) |

| | | | |

Depreciation and amortization | | 2,805 |

| | 2,270 |

|

Expenditures for property, plant and equipment | | (4,021 | ) | | (3,107 | ) |

Payments on equipment purchase contracts | | (95 | ) | | (30 | ) |

Repayments of debt | | (2,329 | ) | | (3,843 | ) |

Proceeds from issuance of debt and sale-leaseback transactions | | 2,503 |

| | 2,226 |

|

Cash paid to acquire treasury stock | | (884 | ) | | (76 | ) |

| | | | |

Noncash equipment acquisitions on contracts payable and capital leases | | 345 |

| | 243 |

|

| |

(1) | Other operating expense for fiscal 2014 included a charge in the first quarter of $233 million to accrue a liability in connection with the company's settlement of all pending litigation between it and Rambus, Inc., including all antitrust and patent matters. The amount accrued represented the discounted value of amounts due under the arrangement. Other expense in the fourth quarter of fiscal 2014 and fiscal year 2014 included charges of $22 million and $40 million, respectively, primarily associated with the company's efforts to wind down and dispose of its 200mm operations, primarily in Agrate, Italy and Kiryat Gat, Israel, and charges associated with other workforce optimization activities. |

| |

(2) | In the second quarter of 2014, the provisional amounts recorded in connection with the acquisition of Elpida Memory, Inc., now known as Micron Memory Japan, Inc. ("MMJ"), were adjusted, primarily for pre-petition liabilities, and the company recorded a non-operating expense of $33 million for these measurement period adjustments. |

| |

(3) | Other non-operating income (expense) consisted of the following: |

|

| | | | | | | | | | | | | | | | | | | | |

| | 4th Qtr. | | 3rd Qtr. | | 4th Qtr. | | Year Ended |

| | September 3,

2015 | | June 4,

2015 | | August 28,

2014 | | September 3,

2015 | | August 28,

2014 |

Loss on restructure of debt | | $ | (1 | ) | | $ | (18 | ) | | $ | (13 | ) | | $ | (49 | ) | | $ | (184 | ) |

Gain (loss) from changes in currency exchange rates | | (1 | ) | | 1 |

| | (3 | ) | | (27 | ) | | (28 | ) |

Gain from disposition of interest in Aptina | | — |

| | — |

| | 119 |

| | 1 |

| | 119 |

|

Gain from issuance of Inotera shares | | — |

| | — |

| | 93 |

| | — |

| | 93 |

|

Other | | 20 |

| | 1 |

| | 2 |

| | 22 |

| | 8 |

|

| | $ | 18 |

| | $ | (16 | ) | | $ | 198 |

| | $ | (53 | ) | | $ | 8 |

|

In fiscal 2015, the company initiated a series of actions to restructure its debt, including:

| |

• | Debt Conversions and Settlement: Holders of substantially all of the company's remaining 2031B Notes (with an aggregate principal amount of $114 million) exercised their option in the fourth quarter of fiscal 2014 to convert their remaining notes and, in each case, the company elected to settle the conversion amount entirely in cash, resulting in aggregate payments of $389 million in the first quarter of fiscal 2015. |

| |

• | Cash Repurchases: Repurchased $368 million in aggregate principal amount of 2032 Notes and 2033 Notes for an aggregate of $1,019 million in cash. |

| |

• | Early Repayment of Debt: Repaid a $121 million note prior to its scheduled maturity. |

These actions resulted in aggregate losses of $1 million, $18 million and $30 million in the fourth, third and first quarters of fiscal 2015, respectively. In fiscal 2014, the company recognized losses of $184 million from transactions to restructure its debt, including conversions and settlements, repurchases, exchange transactions and the early repayment of notes and capital leases.

The company previously held an equity interest in Aptina Imaging Corporation ("Aptina"), which was accounted for under the equity method. On August 15, 2014, ON Semiconductor Corporation completed its acquisition of Aptina. In connection therewith, the company recognized a gain of $119 million in the fourth quarter of fiscal 2014 based on its diluted ownership interest in Aptina of approximately 27%.

Other non-operating income in the fourth quarter of fiscal 2014 included a gain of $93 million recognized in connection with the issuances of common shares by Inotera Memory, Inc., an equity method investment of the company, in May 2014. As a result of the issuances, the company's interest in Inotera decreased to 33%.

| |

(4) | Income taxes for the fourth quarter of fiscal 2015 and fiscal year 2015 included a benefit of $58 million and expense of $80 million, respectively, related to changes in amounts of net deferred tax assets associated with the company's MMJ and MMT operations. The company's unrecognized tax benefits increased by approximately $120 million in fiscal 2015, primarily related to transfer pricing and other matters. Income taxes for the fourth quarter of fiscal 2014 and fiscal year 2014 included a benefit of $118 million and expense of $59 million, respectively, related to changes in amounts of net deferred tax assets associated with the company's MMJ and MMT operations. Remaining taxes for fiscal 2015 and 2014 primarily reflect taxes on the company's other non-U.S. operations. The company has a full valuation allowance for its net |

deferred tax asset associated with its U.S. operations. The provision (benefit) for taxes on U.S. operations for fiscal 2015 and 2014 was substantially offset by changes in the valuation allowance.

| |

(5) | Effective in the fourth quarter of 2015, the company adopted ASU 2015-03 – Simplifying the Presentation of Debt Issuance Costs. ASU 2015-03 requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts, as opposed to an asset. The new accounting standard required retrospective application and the financial information contained herein has been adjusted to reflect the impact of adopting this new accounting standard. |

On April 30, 2015, the company issued $550 million in aggregate principal amount of 5.25% Senior Notes due January 2024 (the "2024 Notes") and $450 million in aggregate principal amount of 5.625% Senior Notes due January 2026 (the "2026 Notes"). Issuance costs for the 2024 Notes and 2026 Notes totaled $9 million.

On February 3, 2015, the company issued $1.00 billion in aggregate principal amount of 5.25% Senior Notes due August 2023 (the "2023 Notes"). Issuance costs for the 2023 Notes totaled $12 million.

In 2015, we recorded capital lease obligations aggregating $324 million, including $291 million related to equipment sale-leaseback transactions, at a weighted-average effective interest rate of 3.2%, payable in periodic installments through May 2019.

As of September 3, 2015, the company had revolving credit facilities available that provide for up to $842 million of additional financing based on eligible receivables and inventories and a term loan agreement available to obtain financing collateralized by certain property, plant, and equipment in the amount of 6.90 billion New Taiwan dollars or an equivalent amount in U.S. dollars (approximately $213 million as of September 3, 2015), of which the company drew $40 million on June 18, 2015.

MICRON TECHNOLOGY, INC.

RECONCILIATION OF GAAP TO NON-GAAP RESULTS

(in millions except per share amounts)

|

| | | | | | | | | | |

| | | | 4th Qtr. | | 3rd Qtr. |

| | | | September 3,

2015 | | June 4,

2015 |

GAAP net income attributable to Micron | | | | $ | 471 |

| | $ | 491 |

|

Non-GAAP adjustments: | | | | | | |

Restructure and asset impairments | | | | — |

| | 1 |

|

Amortization of debt discount and other costs | | | | 33 |

| | 34 |

|

Loss on restructure of debt | | | | 1 |

| | 18 |

|

(Gain) loss from changes in currency exchange rates | | | | 1 |

| | (1 | ) |

(Gain) from remeasurement of equity interest | | | | (21 | ) | | — |

|

Estimated tax effects of above items | | | | (13 | ) | | — |

|

Non-cash taxes from MMJ and MMT | | | | (58 | ) | | 67 |

|

Non-cash taxes from business acquisition activities | | | | (21 | ) | | — |

|

Non-cash taxes from Inotera | | | | 6 |

| | 10 |

|

Total non-GAAP adjustments | | | | (72 | ) | | 129 |

|

Non-GAAP net income attributable to Micron | | | | $ | 399 |

| | $ | 620 |

|

| | | | | | |

Number of shares used in diluted per share calculations: | | | | | | |

GAAP | | | | 1,124 |

| | 1,170 |

|

Effect of capped calls | | | | (44 | ) | | (31 | ) |

Non-GAAP | | | | 1,080 |

| | 1,139 |

|

| | | | | | |

Diluted earnings per share: | | | | | | |

GAAP | | | | $ | 0.42 |

| | $ | 0.42 |

|

Effects of above | | | | (0.05 | ) | | 0.12 |

|

Non-GAAP | | | | $ | 0.37 |

| | $ | 0.54 |

|

The table above sets forth non-GAAP net income attributable to Micron, diluted shares and diluted earnings per share. The adjustments above may or may not be infrequent or nonrecurring in nature but are a result of periodic or non-core operating activities of the company. The company believes this non-GAAP information is helpful to understanding trends and in analyzing the company's operating results and earnings. The company is providing this information to investors to assist in performing analyses of the company's operating results. When evaluating performance and making decisions on how to allocate company resources, management uses this non-GAAP information and believes investors should have access to similar data when making their investment decisions. The presentation of these adjusted amounts vary from numbers presented in accordance with U.S. GAAP and therefore may not be comparable to amounts reported by other companies.

The company's management excludes the following items in analyzing the company's operating results and understanding trends in the company's earnings:

| |

• | Restructure and asset impairments; |

| |

• | Amortization of debt discount and other costs, including the accretion of non-cash interest expense associated with the company's convertible debt and the MMJ installment debt; |

| |

• | Loss on restructure of debt; |

| |

• | (Gain) loss from changes in currency exchange rates; |

| |

• | (Gain) from remeasurement of equity interest; |

| |

• | The estimated tax effects of above items; |

| |

• | Non-cash taxes resulting from utilization of, and other changes in, deferred tax assets of MMJ and MMT; |

| |

• | Non-cash taxes resulting from business acquisition activities; and |

| |

• | Non-cash taxes resulting from utilization of, and other changes in, deferred tax assets of Inotera, an equity method investment of the company. |

Non-GAAP diluted shares include the impact of the company's outstanding capped call transactions, which are anti-dilutive in GAAP earnings per share but are expected to mitigate the dilutive effect of the company's convertible notes. The anti-dilutive effect of the capped calls is based on the average share price for the period the capped calls are outstanding during the quarter.

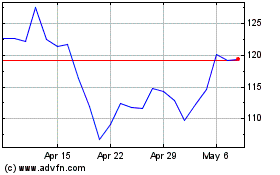

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Micron Technology (NASDAQ:MU)

Historical Stock Chart

From Apr 2023 to Apr 2024