UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 or 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2015.

Commission File Number 001-36204

| ENERGY

FUELS INC. |

| (Translation of registrant’s name into English) |

|

225 Union Blvd., Suite 600

Lakewood, CO 80228 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

| |

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders. |

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

| |

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

/s/ David C. Frydenlund |

| Date: September 30, 2015 |

David C. Frydenlund

Senior Vice President, General Counsel & Corporate Secretary |

INDEX TO EXHIBITS

| 99.1 |

News release dated September

30, 2015 - Ames Brown Joins Energy Fuel’s Board of Directors |

Exhibit 99.1

Ames Brown Joins Energy Fuels’ Board

of Directors

Lakewood, Colorado – September

30, 2015

Energy Fuels Inc. (NYSE MKT:UUUU;

TSX:EFR) (“Energy Fuels” or the “Company”), one of the leading producers of uranium in the United States,

is pleased to announce that the Company has increased the size of its Board of Directors from eight to nine through the addition

of Mr. Ames Brown to its Board of Directors. Mr. Brown has been the Chief Investment Officer (“CIO”) at Capital Counsel

Management LLC since 2014 and previously worked in financial management with Wells Fargo. As CIO of Capital Counsel Management,

Mr. Brown holds ultimate responsibility for a large portfolio of global investments in oil, gas, mining, and financial services.

In his role with Wells Fargo, Mr. Brown managed similarly constituted portfolios of global investments. Mr. Brown holds a Master

of Business Administration and a Master of Science in Strategic Communications from Columbia University, a Bachelor of Arts in

History from Yale University, and completed two years of doctoral studies in financial accounting at Harvard University and the

Massachusetts Institute of Technology.

Stephen P. Antony, President and CEO

of Energy Fuels stated: “On behalf of the entire Board and management team of Energy Fuels, we welcome Mr. Brown to our Board

of Directors. I expect his experience in finance, natural resources, econometrics, and investment management to add value as the

Company continues to grow during these exciting times in the uranium industry. Energy Fuels is emerging as a dominant uranium producer

in the U.S., with both conventional and in situ production. As the U.S. seeks to expand the use of clean energy, including nuclear

power which currently produces about two-thirds of the emission-free electricity generated in the U.S., uranium demand is expected

to rise. We believe that Mr. Brown’s unique skill-set will help prepare Energy Fuels to capitalize on these positive long-term

market fundamentals, and that through his funds’ significant ownership of Energy Fuels’ common shares, Mr. Brown is

well-aligned with other Energy Fuels shareholders.”

About Energy Fuels:

Energy Fuels is a leading integrated US-based uranium mining company, supplying U3O8 to major nuclear utilities.

Energy Fuels operates two of America’s key uranium production centers, the White Mesa Mill in Utah and the Nichols Ranch

Processing Facility in Wyoming. The White Mesa Mill is the only conventional uranium mill operating in the U.S. today and has a

licensed capacity of over 8 million pounds of U3O8 per year. The Nichols Ranch Processing Facility, acquired

in the Company’s acquisition of Uranerz Energy Corporation, is an in situ recovery (“ISR”) production center

with a licensed capacity of 2 million pounds of U3O8 per year. Energy Fuels also has the largest NI

43-101 compliant uranium resource portfolio in the U.S. among producers, and uranium mining projects located in a number of Western

U.S. states, including two producing mines, mines on standby, and mineral properties in various stages of permitting and development.

The Company’s common shares are listed on the NYSE MKT under the trading symbol “UUUU”, and on the Toronto Stock

Exchange under the trading symbol “EFR”.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain

“Forward Looking Information” and “Forward Looking Statements” within the meaning of applicable Canadian

and United States securities legislation, which may include, but is not limited to, statements with respect to the future financial

or operating performance of the Company and its projects, including: Mr. Brown’s expected future contributions to the Company,

Energy Fuels’ emergence as a dominant uranium producer in the U.S., future expected demand for uranium, and the positive

long-term uranium market fundamentals. Generally, these forward-looking statements can be identified by the use of forward-looking

terminology such as “plans”, “expects” “does not expect”, “is expected”, “is

likely”, “budget” “scheduled”, “estimates”, “forecasts”, “intends”,

“anticipates”, “does not anticipate”, or “believes”, or variations of such words and phrases,

or state that certain actions, events or results “may”, “could”, “would”, “might”

or “will be taken”, “occur”, “be achieved” or “have the potential to”. All

statements, other than statements of historical fact, herein are considered to be forward-looking statements. Forward-looking

statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or

achievements of the Company to be materially different from any future results, performance or achievements express or implied

by the forward-looking statements. Factors that could cause actual results to differ materially from those anticipated in

these forward-looking statements include risks associated with: Mr. Brown’s expected future contributions to the Company,

Energy Fuels’ emergence as a dominant uranium producer in the U.S., future expected demand for uranium, and the positive

long-term uranium market fundamentals, and the other factors described under the caption “Risk Factors” in the Company’s

Annual Information Form dated March 18, 2015, which is available for review on SEDAR at www.sedar.com, in its Form 40-F,

which is available for review on EDGAR at www.sec.gov/edgar.shtml and in its prospectus supplement dated September 29, 2015

which is available for review on SEDAR and EDGAR. Forward-looking statements contained herein are made as of the date of

this news release, and the Company disclaims, other than as required by law, any obligation to update any forward-looking statements

whether as a result of new information, results, future events, circumstances, or if management’s estimates or opinions should

change, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned

not to place undue reliance on forward-looking statements.

The Company assumes no obligation

to update the information in this communication, except as otherwise required by law.

Investor Inquiries:

Energy Fuels Inc.

Curtis Moore

VP – Marketing and Corporate Development

(303) 974-2140 or Toll free: (888) 864-2125

investorinfo@energyfuels.com

www.energyfuels.com

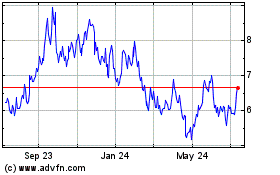

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energy Fuels (AMEX:UUUU)

Historical Stock Chart

From Apr 2023 to Apr 2024