UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 29, 2015

Western Digital Corporation

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

001-08703 |

|

33-0956711 |

| (State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 3355 Michelson Drive, Suite 100

Irvine, California |

|

92612 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(949) 672-7000

(Registrant’s Telephone Number, Including Area Code)

Not applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 240.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

The information provided under Item 3.02 below is incorporated by reference to this Item 1.01 in its entirety.

Item 3.02 Unregistered Sales of Equity Securities.

On September 29, 2015, Western Digital Corporation (the “Company”) entered into a stock purchase agreement (the “Stock Purchase

Agreement”) with Unis Union Information System Ltd., a Hong Kong corporation (the “Investor”), and Unisplendour Corporation Limited, a Chinese corporation (the “Guarantor”), pursuant to which the Company agreed to issue and

sell to the Investor 40,814,802 shares of the Company’s common stock (the “Shares”) for $92.50 per share, for an aggregate purchase price of approximately $3.775 billion, and the Guarantor agreed to guarantee the payment and

performance of Investor’s obligations therein (collectively, the “Transaction”). The Investor’s ownership in the Company’s common stock will be approximately 15% of the Company’s total issued and outstanding shares of

common stock as of September 25, 2015, as adjusted for the issuance of the Shares.

The closing of the Transaction is subject to certain closing

conditions. These closing conditions include clearance by the U.S. Committee on Foreign Investment in the United States and the receipt of requisite regulatory approvals, including clearance by U.S. antitrust authorities and certain Chinese

regulatory approvals, including clearance by the Ministry of Commerce of the People’s Republic of China, the Ministry of Education of the People’s Republic of China, the National Development and Reform Commission of the People’s

Republic of China and the State Administration of Foreign Exchange of the People’s Republic of China. In addition, the Investor’s obligation to purchase the shares of common stock of the Company and the Guarantor’s guarantee are

subject to approval of the Transaction by shareholders of the Guarantor. The Transaction is expected to close in the fourth quarter of calendar 2015 or the first quarter of calendar 2016.

At the closing of the Transaction, the Company, the Investor and the Guarantor would enter into an investor rights agreement (the “Investor Rights

Agreement”). Under the Investor Rights Agreement, as long as the Investor and the Guarantor hold more than 10% of the issued and outstanding shares of common stock of the Company, the Investor will have the right to nominate one representative

for election to the Board of Directors of the Company. In addition, until the later of such time as the Investor and the Guarantor hold less than 5% of the total voting power of the Company and six months following the date on which the Investor is

no longer entitled to nominate a representative for election to the Board of Directors of the Company, each of the Investor and the Guarantor has agreed to vote its shares in accordance with the recommendation of the Company on various matters

submitted to a vote of the stockholders of the Company, including, among other things, matters relating to the election of directors, business combination transactions, the issuance of indebtedness and compensation matters. Otherwise, the Investor

and the Guarantor may vote such shares in their discretion. Further, under the Investor Rights Agreement, the Investor and the Guarantor will be subject to a customary standstill restriction which, among other things, generally prohibits the

Investor and the Guarantor from purchasing additional securities of the Company beyond the 15% ownership level acquired under the Stock Purchase Agreement. The standstill terminates at the latest to occur of the fifth anniversary of closing, such

time as the Investor and the Guarantor hold less than 5% of the Company’s voting securities and three months following the date on which the Investor is no longer entitled to nominate a representative for election to the Board of Directors of

the Company. In addition, the Investor and the Guarantor have agreed to a lock-up restriction such that the Investor and the Guarantor will not sell the Shares for a period of five years following the closing, subject to certain exceptions,

including the elimination of the lock-up restriction for 2.5% of the Shares on the six-month anniversary following the closing, and an additional 5%, 15%, 20% and 27.5% of the Shares on each of the first, second, third and fourth year anniversaries,

respectively, following the closing. The Investor will have certain registration rights under the Investor Rights Agreement with respect to the Shares.

Item 7.01 Regulation FD Disclosure.

On

September 30, 2015, the Company issued a press release announcing its entry into the Stock Purchase Agreement, which is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The press release is

furnished and not filed, pursuant to Instruction B.2 of Form 8-K.

On September 30, 2015, the Company released the WDC Equity Investment by

Unisplendour Corporation (Unis) FAQ attached as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by reference. The WDC Equity Investment by Unisplendour Corporation (Unis) FAQ is furnished and not filed, pursuant to

Instruction B.2 of Form 8-K.

Item 9.01 Financial Statements and Exhibits

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release issued by Western Digital Corporation, dated September 30, 2015. |

|

|

| 99.2 |

|

WDC Equity Investment by Unisplendour Corporation (Unis) FAQ released by Western Digital Corporation. |

Safe Harbor for Forward-Looking Statements

This Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements

include the expected timing of the completion of the Transaction and the expected benefits and other impacts. These forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties that could

cause actual results to differ materially from those expressed or implied in the forward-looking statements, including: the possibility that the Transaction may not close within the anticipated timeframe or at all; the expected benefits and other

impacts resulting from the Transaction may not materialize as expected; volatility in global economic conditions; business conditions and growth in the storage ecosystem; pricing trends and fluctuations in average selling prices; the availability

and cost of commodity materials and specialized product components; unexpected advances in competing technologies; the development and introduction of products based on new technologies and expansion into new data storage markets; actions by

competitors; and other risks and uncertainties in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K filed on August 21, 2015. You should not place undue reliance on

these forward-looking statements, which speak only as of the date hereof, and none of the Company, the Investor or the Guarantor undertake any obligation to update these forward-looking statements to reflect subsequent events or circumstances.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Western Digital Corporation |

|

|

|

|

(Registrant) |

|

|

|

|

|

By: |

|

/s/ Michael C. Ray |

| Date: September 30, 2015 |

|

|

|

Michael C. Ray |

|

|

|

|

Senior Vice President, General Counsel

and Secretary |

Exhibit 99.1

FOR IMMEDIATE RELEASE:

WESTERN DIGITAL ANNOUNCES EQUITY INVESTMENT BY

UNISPLENDOUR CORPORATION LIMITED

Unisplendour to Purchase $3.775 Billion of Newly Issued Western Digital Common Stock

Investment Represents a 15% Equity Stake in Western Digital

IRVINE, Calif. and BEIJING, China — Sept. 30, 2015 — Western Digital® Corporation (NASDAQ: WDC) and

Unisplendour Corporation Limited (Unis) today jointly announced that they have entered into an agreement under which a subsidiary of Unis will make a $3.775 billion equity investment in Western Digital. Under the terms of the investment, Unis has

agreed to purchase newly issued Western Digital common stock at a price of $92.50 per share.

Immediately following the closing of the investment,

Unis will hold approximately 15% of Western Digital’s issued and outstanding shares of common stock based on the number of issued and outstanding shares as of Sept. 25, 2015. Unis will have the right to nominate one representative to the

Western Digital board of directors and will be subject to a five-year position standstill and voting restrictions. The board representative right terminates if Unis’ ownership falls below 10%. In addition, Unis has agreed to a five-year lock-up

on its shares, with a limited number of shares becoming available for transfer each year.

Proceeds from the investment will go toward strengthening

Western Digital’s balance sheet, providing financial flexibility and pursuing long-term strategic growth initiatives.

“The equity

investment by Unis will help facilitate our growth as we look to capitalize on the many opportunities and changes within the global storage industry,” said Steve Milligan, president and chief executive officer, Western Digital. “This

investment reflects Unis’ strong support for Western Digital’s value-creation efforts.”

Western Digital Announces Equity Investment by Unisplendour Corporation Limited

Page | 2

“We are excited to establish a relationship with Western Digital, a leading company in the

storage industry with a capable and talented management team and workforce. We believe this long-term investment will serve as a constructive collaboration model for Chinese and U.S. companies to work together for success,” said Weiguo Zhao,

Chairman of Tsinghua Unigroup and Unisplendour Corporation.

The closing of this investment transaction is subject to certain regulatory approvals

and other customary closing conditions.

Wells Fargo Securities, LLC has acted as the financial advisor to Western Digital.

Supplemental Information

A question and answer document

related to the Unis investment is available on the Western Digital website at investor.wdc.com. The companies are not holding a conference call related to the transaction; Western Digital will provide additional commentary on its next

quarterly results conference call.

The common stock was offered and sold in a private placement pursuant to Section 4(a)(2) of the Securities

Act of 1933, as amended. The shares have not been registered under the Securities Act or state securities laws and may not be offered or sold in the United States absent registration with the Securities and Exchange Commission or an applicable

exemption from such registration requirements.

About Western Digital

Founded in 1970, Western Digital Corp. (NASDAQ: WDC), Irvine, Calif., is an industry-leading developer and manufacturer of storage solutions that enable

people to create, manage, experience and preserve digital content. Its HGST and WD® subsidiaries are long-time innovators in the storage industry. Western Digital Corporation is responding to

changing market needs by providing a full portfolio of compelling, high-quality storage products with effective technology deployment, high efficiency, flexibility and speed. Our products are marketed under the HGST, WD and G-Technology™ brands to OEMs, distributors, resellers, cloud infrastructure providers and consumers. Financial and investor information is available on the company’s Investor Relations website at

investor.wdc.com.

Western Digital Announces Equity Investment by Unisplendour Corporation Limited

Page | 3

About Unisplendour

As a leading information technology company in China, Unisplendour Corporation Limited (Unis, 000938.SZ) is dedicated to research, development,

production, sales and service of IT products and solutions. Centered by its “cloud-network-endpoint” strategy, Unis’ business has covered a broad range from servers, storage, networking equipment to IT service, application development

and system integration, and is expanding to cloud computing, mobile Internet and big data processing.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking

statements include those concerning Unis’ investment in Western Digital (the “transaction”), what Western Digital intends to do with the proceeds from the transaction, the expected benefits and other impacts resulting from the

transaction, and Western Digital’s value-creation efforts. These forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties that could cause actual results to differ materially from

those expressed or implied in the forward-looking statements, including: the possibility that transaction may not close within the anticipated timeframe or at all; the expected benefits and other impacts resulting from the transaction may not

materialize as expected; volatility in global economic conditions; business conditions and growth in the storage ecosystem; pricing trends and fluctuations in average selling prices; the availability and cost of commodity materials and specialized

product components; unexpected advances in competing technologies; the development and introduction of products based on new technologies and expansion into new data storage markets; actions by competitors; and other risks and uncertainties in

Western Digital’s filings with the Securities and Exchange Commission, including Western Digital’s Annual Report on Form 10-K filed on Aug. 21, 2015. You should not place undue reliance on these forward-looking statements, which speak only

as of the date hereof, and neither Western Digital nor Unis undertake any obligation to update these forward-looking statements to reflect subsequent events or circumstances.

###

Western Digital Announces Equity Investment by Unisplendour Corporation Limited

Page | 4

Western Digital, WD and the WD logo are registered trademarks in the U.S. and other countries. HGST trademarks are

intended and authorized for use only in countries and jurisdictions in which HGST has obtained the rights to use, market and advertise the brand. Other marks may be mentioned herein that belong to other companies.

|

|

|

| Western Digital Media Contact: |

|

Western Digital Investor Contact: |

| Jim Pascoe |

|

Bob Blair |

| Western Digital Corp. |

|

Western Digital Corp. |

| 408.717.5950 |

|

949.672.7834 |

| jim.pascoe@wdc.com |

|

robert.blair@wdc.com |

|

|

| Brunswick Group Media Contact: |

|

|

| Monika Driscoll |

|

|

| Brunswick Group |

|

|

| 212.333.3810 |

|

|

| mdriscoll@brunswickgroup.com |

|

|

Exhibit 99.2

WDC Equity Investment by Unisplendour Corporation (Unis)

FAQ

| 1. |

What is being announced today? |

| |

• |

|

Western Digital is announcing a $3.775 billion equity investment by a subsidiary of China-based technology company Unisplendour Corporation Limited (Unis). |

| |

• |

|

Under the terms of the agreement, Unis has agreed to purchase newly issued Western Digital common stock at a price of $92.50 per share. |

| |

• |

|

The investment represents an approximately 15% non-controlling equity stake in Western Digital based on the number of issued and outstanding shares as of September 25, 2015, including 40,814,802 newly issued

shares. |

| |

• |

|

Unis will have the right to nominate one representative to the Western Digital board of directors and will be subject to a five-year position standstill and voting restrictions. The board representative right terminates

if Unis’s ownership falls below 10%. |

| |

• |

|

Unis is a respected, publicly-traded Chinese company. It has been trading on the Shenzhen exchange since 1999, with its largest single shareholders being Tsinghua University and its subsidiaries. |

| |

• |

|

Unis has a positive track-record of working with other global technology companies, including Intel and HP. |

| |

• |

|

Intel made a $1.5 billion investment in Unis in September 2014. |

| |

• |

|

As announced in May 2015, Unis is also seeking a $2.3 billion acquisition of 51% of HP’s H3C business which operates primarily in China. |

| 3. |

What is Western Digital going to do with the proceeds from the investment? |

| |

• |

|

Capital from the investment will be used to strengthen Western Digital’s balance sheet, provide financial flexibility and pursue long-term strategic growth initiatives, in the United States and abroad.

|

| 4. |

Will this infusion of cash change your capital allocation policy? |

| |

• |

|

There is no change to the company’s capital allocation policy in connection with this investment. |

| 5. |

What are Unis’s voting restrictions? |

| |

• |

|

As a shareholder of Western Digital, Unis will be obligated to vote its shares in accordance with Western Digital’s board recommendation on multiple significant matters. |

| |

• |

|

Unis’s board member will be restricted from participating in discussions that involve government contracts, sales or products and services, and other such sensitive matters. |

| 6. |

When is the transaction expected to close? |

| |

• |

|

The regulatory approval process after execution could take between 45-90 days, or potentially longer. Therefore, we expect the transaction to close late this calendar year or 1st quarter 2016. |

| 7. |

Is there a shareholder vote required by Western Digital shareholders? |

| |

• |

|

No, a shareholder vote is not required by Western Digital shareholders. |

| 8. |

How does this investment impact existing shareholders? |

| |

• |

|

The investment by Unis is a significant opportunity to create long-term value for our shareholders. |

| |

• |

|

We believe our shareholders will greatly benefit from our strengthened balance sheet, financial flexibility and long-term strategic growth initiatives as a result of this investment. |

| 9. |

Are there anticipated hurdles related to this transaction? |

| |

• |

|

The investment is subject to certain customary closing conditions, including regulatory approvals and filings and approval of the investment by Unis’s shareholders. |

| |

• |

|

The 15% ownership stake is non-controlling, so we do not believe it is subject to CFIUS review. However, we will be filing with CFIUS out of an abundance of caution. |

| 10. |

Are Western Digital’s IP and trade secrets protected? |

| |

• |

|

Yes. Unis will not have any day-to-day or operational control over Western Digital, nor will it control, own or manage Western Digital IP or technology. |

| |

• |

|

While Unis would have the right to nominate one board member, that board member would be restricted from participating in discussions that involve government contracts, sales, or products and services and other such

sensitive matters. |

| 11. |

What are the tax implications of Unis’s investment in Western Digital? |

| |

• |

|

There will be no tax impact to Western Digital. |

Forward Looking Statements

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include

those concerning Unis’s investment in Western Digital (the “transaction”), what Western Digital intends to do with the proceeds from the transaction, the expected benefits and other impacts resulting from the transaction, Western

Digital’s cash allocation policy, when the transaction is expected to close, and the anticipated tax implications of the transaction. These forward-looking statements are based on management’s current expectations and are subject to risks

and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward-looking statements, including: the possibility that transaction may not close within the anticipated timeframe or at all; the

expected benefits and other impacts resulting from the transaction may not materialize as expected; volatility in global economic conditions; business conditions and growth in the storage ecosystem; pricing trends and fluctuations in average selling

prices; the availability and cost of commodity materials and specialized product components; unexpected advances in competing technologies; the development and introduction of products based on new technologies and expansion into new data storage

markets; actions by competitors; and other risks and uncertainties listed in Western Digital’s filings with the Securities and Exchange Commission, including Western Digital’s Annual Report on Form 10-K filed on Aug. 21, 2015. You should

not place undue reliance on these forward-looking statements, which speak only as of the date hereof, and neither Western Digital nor Unis undertake any obligation to update these forward-looking statements to reflect subsequent events or

circumstances.

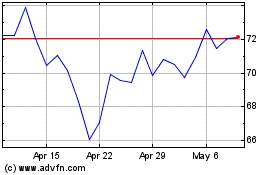

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

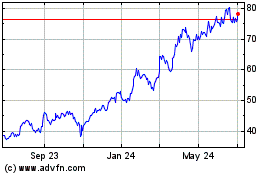

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024