By Christina Rexrode And Peter Rudegeair

Thomas Montag rose to second in command at Bank of America Corp.

in large part by making his investment-banking units consistently

among the firm's most profitable.

Now, as Mr. Montag's group struggles through its toughest patch

in years, it gets a new mandate: Do more with less.

Bank of America on Tuesday announced plans to lay off about 200

employees--all in Mr. Montag's trading and investment-banking

units--as Chief Executive Brian Moynihan makes good on his pledge

from earlier this month that he would further reduce costs if

results didn't improve.

The moves highlight the pressure on Mr. Montag, a former

Stanford University baseball player and Goldman Sachs Group Inc.

trader who faces the difficult task of maintaining morale and

competitiveness at the investment bank while enforcing the

conservative and increasingly cost-conscious mandates of his

boss.

Bank of America's investment-banking and trading units in recent

years routinely generated as much as 40% of revenue with less than

10% of the bank's staff.

But it is the only large U.S. bank to post a decline in revenue

from trading and investment banking for the first half of this

year. The bank has lost ground in areas it has identified for

expansion, such as mergers and acquisitions. Recently, more

managing directors in the investment bank have departed than at

rivals J.P. Morgan Chase & Co. and Citigroup Inc. combined,

according to a confidential report from recruiting firm Sheffield

Haworth that was reviewed by The Wall Street Journal. The report

examined departures from the start of 2014 through the first half

of this year.

The tension within the investment bank is in many ways a legacy

of the awkward 2009 marriage between Bank of America--long a large

consumer-focused bank--and Merrill Lynch, the historic Wall Street

firm that overloaded on risky securities in the years before the

financial crisis.

Many Merrill bankers, used to operating in regional fiefdoms,

have long been annoyed at Bank of America's stricter oversight of

their business decisions like hiring and compensation, said people

familiar with the matter. A few years ago, Mr. Montag supported an

idea to call his units "Merrill Lynch" rather than their current

title, "Bank of America Merrill Lynch," people close to the

situation said. Some bankers thought the Merrill Lynch brand would

be more appealing to some clients.

Mr. Moynihan, who disagreed, won out.

Bank of America's more regimented culture has manifested itself

in various ways. Senior bankers have chafed at a requirement that

they fill out time sheets documenting how they spend each hour,

current and former employees said. The bank has also cut back on

leveraged loans due to tougher regulatory scrutiny, even while some

rivals pressed ahead.

The bank said its caution is appropriate. In a memo earlier this

year, Mr. Moynihan said Mr. Montag's global banking and global

markets groups had "struck the risk-reward balance that is the new

standard for our industry."

Mr. Moynihan has said he wants Mr. Montag's trading business to

take less risk than it might have in the past and to produce less

volatile earnings. He has said Mr. Montag's banking business, which

helps corporate clients with transactions, can grow along with

customers.

In an interview Tuesday, Mr. Montag said new regulations mean

the bank is no longer going to engage in some of the products and

activities that it may have even just a few years ago. "The rules

have changed," Mr. Montag said.

Mr. Moynihan won a proxy battle this month enabling him to keep

the title of chairman as well as CEO. But the firm has lagged

behind peers on measures like stock performance and profits, and

some analysts believe Mr. Moynihan's expense-cutting strategy is

starting to run out of steam.

Mr. Montag, 58 years old, joined Bank of America when it bought

Merrill, though he had been at Merrill only briefly at the time.

People at the firm said he presents a personality contrast to Mr.

Moynihan, a detail-oriented workhorse who isn't known to be

gregarious. Mr. Montag spent much of his Goldman career in Japan,

has been known to sing karaoke at work functions and frequently

walks the trading floor to chat up employees, people who have

worked with him said.

The two executives aren't personally close, people familiar with

the matter said.

In July, when Mr. Moynihan shook up his management team, Mr.

Montag was the first executive named in the memo, leading many

investors and analysts to assume that he is the leading candidate

if Mr. Moynihan were to step down in the near term. Mr. Moynihan

praised Mr. Montag's "energetic record of accomplishment," as well

as his "expertise and steady hand."

Bank of America has depended heavily on the investment bank

since buying Merrill Lynch on the cusp of the financial crisis, as

low interest rates have challenged the consumer bank. Mr. Montag's

units also often carried the bank through its long years of high

legal costs, many of which stemmed from the consumer unit.

But Mr. Montag's group is now slipping in some key areas.

This year, the bank dropped to No. 12 in health-care deals from

No. 2 last year, according to Dealogic. Overall, the bank's track

record this year puts it at risk of losing its place among the top

three investment banks as measured by fees for the first time since

the Merrill Lynch acquisition.

One area where Mr. Montag appears to be gaining traction is in

his push to get his investment bank to work with the consumer bank

and wealth- management unit. The strategy, known as cross-selling,

is meant to encourage investment bankers to entice corporate

clients to do other business with the bank, such as 401(k)s for its

employees or a mortgage for its CEO.

At one company function, Mr. Montag wore a hat and T-shirt

emblazoned with the words "Cross Sell." The bank said earlier this

year that referral volume had increased to 4.2 million in 2014 from

300,000 in 2010, with a success rate of 20%.

Part of Bank of America's problem is the business mix. Bank of

America's trading unit tends to focus on credit products and

mortgage-backed securities, which have fared poorly this year

across the industry. Asked earlier this year if the bank needed to

change its trading makeup, Mr. Moynihan replied that the current

setup created lower risk and would perform better when credit

products pick up.

"It's not an existential question at all," Mr. Moynihan said at

the time.The bank said it has hired other employees this year in

banking and trading, including more than 650 recent graduates as

analysts and associates.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 29, 2015 19:22 ET (23:22 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

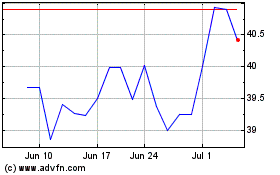

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

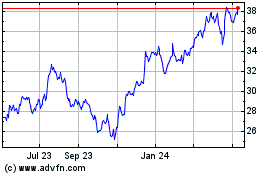

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024