Nexstar Broadcasting Makes Bid for Media General

September 28 2015 - 7:20AM

Dow Jones News

Nexstar Broadcasting Group Inc. offered to buy local-television

station owner Media General Inc. in a bold attempt to break up

Media General's recent agreement to buy Meredith Corp.

Nexstar Chairman and Chief Executive Perry Sook sent a letter

Monday morning to Media General's board offering $14.50 a share for

the company. The offer includes $10.50 in cash and 0.0898 Nexstar

shares for each Media General share, according to the letter, a

copy of which was reviewed by The Wall Street Journal.

The proposal, which values the Richmond, Va., company at about

$1.85 billion, represents a premium of 30% over Media General's

closing price on Friday of $11.15 a share. Including Media

General's debt, it is worth some $4.1 billion.

Media General earlier this month said it agreed to buy Meredith

for about $2.4 billion in cash and stock. Including debt, the deal,

which must be approved by both companies' shareholders, was valued

at $3.1 billion.

Media General shareholders didn't react well, driving down the

company's stock that day even though it has since regained

ground—in part on speculation Nexstar would make a bid.

Nexstar, based in Irving, Texas, has a portfolio of more than

100 TV stations in 58 markets, covering about 18% of U.S.

television households. Media General operates or services 71

stations. Combining Nexstar and Media General would create a

pure-play broadcast company owning or providing services to 162

stations in 99 markets, reaching 39% of U.S. television homes,

according to Nexstar's letter.

Nexstar in August privately offered $17 a share for Media

General, but the bid was rebuffed, according to people familiar

with the matter. The broad market sell off since then helps explain

the lower offer, they said.

"The combined company's significantly expanded audience reach

and portfolio diversification would be highly attractive to

programmers and advertisers alike, and its enhanced operating and

financial scale would position it for near- and long-term success

in an environment of ongoing industry consolidation," Mr. Sook

wrote in Monday's letter.

There has been a wave of consolidation in the U.S. broadcast

industry, as local TV stations seek to maintain or increase

negotiating leverage with big cable and satellite providers, many

of whom themselves are striking combinations.

In a conference call with analysts when the Media General deal

was announced, Meredith Chief Executive Stephen Lacy said: "This

deal creates a powerful, multiplatform and highly diversified media

company and it builds a platform for continued industry

consolidation." Mr. Lacy would be CEO of the combined company.

Meredith is known for magazines such as Better Homes Gardens and

Family Circle. But its 17 local TV stations are the centerpiece of

the Media General deal. Meredith Media General, as it would be

known, would encompass 88 stations reaching 30% of U.S. households,

or 34 million homes.

After selling most of its newspaper holdings to a subsidiary of

Warren Buffett's Berkshire Hathaway a few years ago, Media General

has bulked up through deals including its purchase of LIN Media LLC

last year and New Young Broadcasting in 2013. Nexstar had been

interested in buying LIN prior to its purchase by Media General,

the people said.

Nexstar indicated in its letter that it believes it is a mistake

for Media General to increase once again its exposure to the

publishing business, which has been bedeviled by declining

circulation and advertising revenue.

Executives for both Meredith and Media General have said that

they view Meredith's magazine titles as a key driver of content

creation for their digital properties.

The developing tussle comes as many media companies are

splitting their broadcast businesses from their print operations.

In June, Gannett Co. completed the spinoff of its broadcasting and

digital-media business, now called Tegna Inc. That followed similar

moves by Tribune Media Co. and News Corp, publisher of the

Journal.

Nexstar is betting that any dissatisfaction among Media General

shareholders with the Meredith deal will encourage them to pressure

the company's management to negotiate a deal with Nexstar, which

had a market value roughly similar to Media General's, at about

$1.4 billion.

Mr. Sook, who is also Nexstar's founder, was a pioneer of the

"retransmission consent" revenue stream for local TV stations, the

payments cable and satellite operators make to carry their signals.

Those fees have become a major driver of growth for stations in the

past several years, as well as the major broadcast networks that

get a cut of the cash for providing valuable programming like

sports and prime-time shows.

Write to Dana Cimilluca at dana.cimilluca@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 28, 2015 07:05 ET (11:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

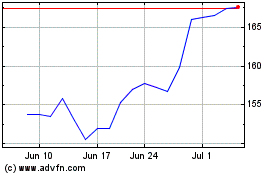

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Mar 2024 to Apr 2024

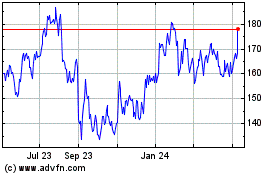

Nexstar Media (NASDAQ:NXST)

Historical Stock Chart

From Apr 2023 to Apr 2024