Gates Foundation Sues Petrobras, Auditor for Fraud

September 25 2015 - 4:30PM

Dow Jones News

RIO DE JANEIRO—The Bill and Melinda Gates Foundation is suing

Brazil's Petró leo Brasileiro S.A and its auditor in a New York

court, claiming a vast corruption scheme centered on the state-run

oil company caused the charitable organization to lose tens of

millions of dollars.

The foundation, started by the billionaire co-founder of

Microsoft Corp. and his wife, joins a long list of plaintiffs

seeking to recoup money as a result of the scandal that has

hammered Petrobras shares. And it is just the latest bad news for

the troubled oil company, which is scrambling to restore its

reputation, rebuild investor confidence and pay down ballooning

debt amid a global slump in oil prices.

Petrobras has long maintained that it was a victim of a

yearslong bid-rigging and bribery ring that Brazilian prosecutors

say was cooked up by suppliers and a few crooked insiders who

fleeced the oil company for at least $2 billion.

But the Gates lawsuit, filed against Petrobras and the Brazilian

unit of PricewaterhouseCoopers LLP or PwC, alleges that corruption

at the oil company was so widespread as to be "institutional" and

that the wrongdoing was "willfully ignored" by its auditor.

"The depth and breadth of the fraud within Petrobras is

astounding. By Petrobras's own admission, the kickback scheme

infected over $80 billion of its contracts, representing

approximately one-third of its total assets," the lawsuit said.

"Equally breathtaking is that the fraud went on for years under

PwC's watch, who repeatedly endorsed the integrity of Petrobras'

internal controls and financial reports. This is not a case of

rogue actors. This is a case of institutional corruption, criminal

conspiracy, and a massive fraud on the investing public."

The Gates Foundation filed the lawsuit late Thursday in the

Southern District Court of New York. A co-plaintiff in the lawsuit

is WGI Emerging Markets Fund, LLC, which managed investments for

the Gates Foundation.

The plaintiffs didn't disclose how much they invested in

Petrobras shares.

A spokesperson for Petrobras didn't respond to a request for

comment. A spokesman for the Gates Foundation referred a request

for comment to the Foundation's Trust, which didn't respond to the

request. The other plaintiff, Boston-based Westwood Global

Investments, didn't respond to requests for comment. PwC declined

to comment.

More than a dozen lawsuits have been filed by U.S. investors who

bought American depositary receipts sold by Petrobras in New York,

including the attorney general of Ohio, public pension funds in

Idaho and Hawaii, and the city of Providence, R.I.

In June, Petrobras wrote off some $17 billion to reflect losses

because of corruption and inflated contracts. It is now scrambling

to sell some $58 billion in assets through 2018 to raise cash and

deal with a ballooning debt pile.

So far this year, Petrobras' credit ratings were downgraded to

junk status by both Moody's Investors Service and Standard &

Poor's Ratings Services.

Petrobras shares were down 1% Friday afternoon in New York.

The stock has fallen more than 44% this year, wiping out

billions of dollars in shareholder value. In 2010, the company

ranked among the top five biggest companies in the world, with

market capitalization in excess of $220 billion. Now, the company's

market cap is around $23 billion.

Prosecutors say that for at least a decade, some of Brazil's

biggest construction firms formed a cartel to skim billions of

dollars from Petrobras through inflated contracts, kicking back

bribes to company insiders and politicians who helped them keep the

scam going.

The investigation has resulted in more than 100 arrests and more

than 30 convictions. Some of the accused have cooperated with

authorities and turned state's evidence in exchange for lighter

sentences. Others have drawn long prison terms, while still others

maintain their innocence.

The Gates Foundation is a charity that distributes money to

grantees working on everything from the eradication of polio to

helping small coffee farmers.

The Foundation's Trust manages the group's $41 billion

endowment.

Write to Will Connors at william.connors@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 25, 2015 16:15 ET (20:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

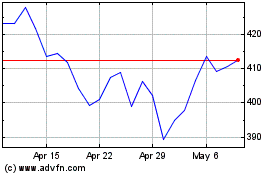

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024