Drilling Contractor Weatherford Cancels Fund-Raising Effort

September 22 2015 - 6:50PM

Dow Jones News

One of the biggest drilling contractors in the world abandoned

its efforts to raise about $1 billion in cash after investors

hammered its stock, in sign that Wall Street's love affair with

energy finance is cooling along with hopes that oil prices will

rise anytime soon.

Weatherford International Ltd. said Monday morning that it

planned to sell a combination of shares and convertible bonds for

unspecified potential acquisitions. The company's shares quickly

fell about 17%, to $8.41, prompting the company to cancel the

offerings just 14 hours after unveiling the plan.

"While investor interest was strong for this offering, we are

unwilling to sell securities at prices that do not reflect the

value we have created at Weatherford," the company said.

A Weatherford spokeswoman declined to comment beyond the

company's press release.

The about-face helped Weatherford's stock regain some of

Monday's losses; in 4 p.m. trading Tuesday on the New York Stock

Exchange, the shares were up more than 10% at $9.31.

The episode soured some investors and analysts, who said that

Weatherford executives had promised to focus on reducing debt at

the beleaguered company, which has struggled in recent years with

undigested acquisitions and accounting problems. Houston-based

energy investment bank Tudor, Pickering, Holt & Co. said in a

note to clients that there is "no point to sugarcoating [the] blow

to management credibility."

The stock market's reaction contrasts with investor sentiment

earlier this year, when energy producers were able to sell record

amounts of new stock and bonds to shore up their balance sheets,

replace bank financing and fund acquisitions.

North American energy producers have sold about $17 billion of

new stock this year, according to a Wall Street Journal analysis of

Dealogic data. The bulk of those offerings came during the first

part of the year, when many investors expected oil prices to bounce

back toward the triple-digit levels of a year ago. Instead, after a

brief uptick, U.S. oil prices have ducked back below $50 a

barrel.

That's left many investors nursing big losses. Whiting Petroleum

Corp., a North Dakota oil producer, put itself on the block early

in the year before deciding instead to raise cash selling stock and

bonds. Whiting sold $1.05 billion of new shares in late March at

$30 apiece; now they are trading for less than $18, a decline of

more than 40%.

A few energy companies have succeeded in selling stock recently;

Memorial Resources Development Corp., an oil producer, said Tuesday

that it sold about $243 million of new shares this week to fund an

acquisition of Louisiana drilling land, boosting the size of the

offering at the last minute amid strong demand.

Oilfield-service companies like Weatherford, however, have

raised less than $500 million this year, according to Dealogic.

Such companies often suffer the most during energy-price downturns

because the oil and gas producers they work for cut back on

drilling and squeeze contractors on pricing.

Weatherford been losing ground to its larger rivals. The

company, which is based in Baar, Switzerland, and has its

operational headquarters in Houston, has long been a distant fourth

to oilfield-services giants Schlumberger Ltd., Halliburton Co. and

Baker Hughes Inc.

Halliburton said in November that it planned to buy Baker Hughes

for about $35 billion, and Schlumberger last month said it would

buy Cameron International Corp., a maker of drilling equipment, for

$12.7 billion.

Having more cash on hand would have made Weatherford a stronger

player if it bid for businesses Halliburton and Baker Hughes plan

to shed in order to pass antitrust scrutiny. Some of those

businesses make strategic sense for Weatherford, but investors

prefer that the company focus on cleaning up its own house, said

William Herbert, co-head of research at Houston-based energy

investment bank Simmons & Co. International.

"They don't necessarily want Weatherford to be adventurous with

regards to taking advantage of this downturn," Mr. Herbert said.

"They don't want this management team to take big bets with the

balance sheet."

Under Chairman and Chief Executive Bernard Duroc-Danner,

Weatherford grew into the world's fourth largest oilfield-services

company by making more than 100 acquisitions over 20 years. But it

began to show signs it was overextended, announcing in 2011 that an

internal review uncovered tax-accounting errors that prompted

multiple restatements of earnings in recent years.

The company agreed in 2013 to pay nearly $253 million to resolve

yearslong U.S. government investigations into foreign bribery and

trade-sanction violations—problems that the Securities and Exchange

Commission attributed to "the nonexistence of internal

controls."

More recently Weatherford said it would slim down by selling off

business units outside its core and laying off staff. Last year it

brought in $1.7 billion by selling "noncore" businesses. In July,

Mr. Duroc-Danner told investors, "I think our time is better used

focusing on what we have than on sort of daydreaming about what we

could be adding or not."

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 22, 2015 18:35 ET (22:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

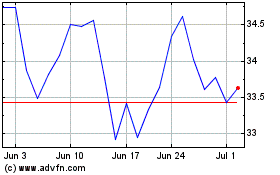

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

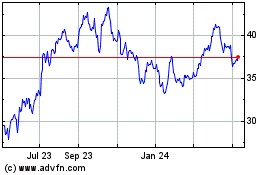

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024