Nike's Challenge: Staying Ahead of the Pack

September 19 2015 - 5:59AM

Dow Jones News

By Sara Germano

Nike Inc. has long been running in a league of its own but young

rivals are trying to muscle in.

Under Armour Inc. on Wednesday forecast it would double revenues

over the next three years to $7.5 billion. And Skechers USA Inc.

has vaulted into the No. 2 spot among sports-footwear makers in the

U.S.

With $30.6 billion in sales in its last fiscal year, Nike's

position as the world's best seller of sports attire and footwear

is solid--and its challenge is maintaining its giant lead.

When the company reports first-quarter earnings Thursday, its

sales growth faces a tough comparison to last summer's World Cup

mania. Analysts polled by FactSet forecast revenues of $8.2 billion

and earnings per share of $1.19, up slightly from $7.9 billion and

$1.09 a year ago.

A Citigroup research report notes that Nike's North American

region is facing its toughest quarterly comparison since June 2012.

A year ago, the company posted 15% growth in future orders for the

region, an important metric that estimates growth in wholesale

orders for the coming six-month period and is considered an

indicator of demand for Nike products.

Citi says Nike needs to maintain a projected double-digit growth

rate of future orders to avoid a hit on its shares. Nike stock is

up 19% so far this year, making it the second-best performer in the

Dow Jones Industrial Average after UnitedHealth Group Inc.

Nike's recent growth has been helped by something that has less

to do with sweat and more to do with style--the athleisure

phenomenon, which has been called the biggest trend to hit fashion

since the skinny jean. But there, too, it is facing new

competition. Spandex-infused styles were trotting the runways of

New York Fashion Week, highlighting the full breadth of Nike's

ever-growing competition, which now extends beyond sporting goods

bins to high-end luxury.

A recent trouble spot for Nike has been in its legacy product:

running footwear. The proliferation of casual styles at

family-channel stores has boosted Skechers into its second-place

sports-footwear ranking, according to industry tracker NPD Group.

This past spring, Nike executives said midprice running shoes

weren't "performing as well as we would like."

The Skechers surge shows Nike isn't insulated from competition,

though Nike's setback may have been short-lived. On its last

earnings call in June, Nike Brand President Trevor Edwards said the

category was rebounding.

Meanwhile, on the playing field, Under Armour has gotten a lot

of buzz from its sponsorship for golfer Jordan Spieth, basketball

point guard Stephen Curry, and football quarterback Tom Brady all

of whom won major championships this year. German-based Adidas AG,

fighting to combat its declining U.S. market share, recently signed

NBA all-star James Harden and NFL MVP Aaron Rodgers, and announced

it would take over the NHL league outfitting rights in two

years.

Furthermore, central to Nike's task of maintaining its dominance

will be dealing with succession after founder and chairman Phil

Knight retires, something that is expected next year. The company

laid the groundwork for his exit in June, transferring much of his

supervoting class A shares to a separate holding company, and at a

recent shareholders' meeting ratified the election of Mr. Knight's

son Travis to the board of directors.

The company is also expected to announce its first investor day

meeting in two years, for later this year.

The Week Ahead looks at coming corporate events.

Write to Sara Germano at sara.germano@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 19, 2015 05:44 ET (09:44 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

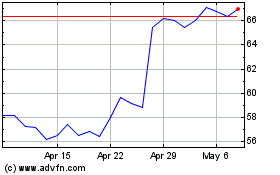

Skechers USA (NYSE:SKX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Skechers USA (NYSE:SKX)

Historical Stock Chart

From Apr 2023 to Apr 2024