Current Report Filing (8-k)

September 16 2015 - 4:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): September 15, 2015

IMMUNOCELLULAR THERAPEUTICS, LTD.

(Exact name of Company as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35560 |

|

93-1301885 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

23622 Calabasas Road,

Suite 300

Calabasas,

California 91302

(Address of Principal Executive Offices) (Zip Code)

Company’s telephone number, including area code: (818) 264-2300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following

provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Compensatory Arrangements of Certain Officers

On September 15, 2015, ImmunoCellular Therapeutics, Ltd. (the “Company”) entered into an employment agreement with David

Fractor, the Company’s Vice President of Finance and Principal Accounting Officer (the “Employment Agreement”).

Mr. Fractor will continue to serve in his current role, performing such duties as are required by the Company’s President and Chief

Executive Officer. The position is part-time, requiring approximately 80% of a regular full-time schedule.

Pursuant to the Employment

Agreement, Mr. Fractor will receive an initial annual base salary of $184,233.50. Mr. Fractor is eligible to earn a discretionary annual cash bonus of up to 20% of his annual base salary based upon achievement of certain objectives and

milestones to be determined by the board of directors of the Company on an annual basis. Mr. Fractor is eligible to participate in the Company’s employee benefit programs that may be in effect from time to time. The Company will continue

to reimburse Mr. Fractor for reasonable travel, entertainment and other expenses incurred in connection with the performance of his obligations under the Employment Agreement in accordance the Company’s expense reimbursement policies.

Mr. Fractor’s employment relationship remains at-will. Either Mr. Fractor or the Company may terminate the employment

relationship at any time. The Employment Agreement provides that in the event the Company terminates Mr. Fractor’s employment with the Company without “Cause” or Mr. Fractor resigns for “Good Reason” (as such terms

are defined in the Employment Agreement) the Company will provide Mr. Fractor with the following severance benefits: (a) an amount equal to four (4) months of his annual base salary, less applicable deductions, payable in accordance

with the Company’s normal payroll schedule, except that no payments will be made prior to the 60th day following Mr. Fractor’s separation from the Company, after which the Company will pay Mr. Fractor in a lump sum the severance

that he would have received prior to such date under the standard payroll schedule; (b) provided Mr. Fractor timely elects continued coverage under COBRA, the Company will continue to pay Mr. Fractor’s COBRA premiums to continue

such coverage until the earliest to occur of: (i) six (6) months following Mr. Fractor’s separation from the Company; (ii) the date Mr. Fractor becomes eligible for group health insurance coverage through a new

employer; or (iii) the date Mr. Fractor ceases to be eligible for COBRA continuation coverage for any reason; (c) the Company will accelerate the vesting of all equity interests granted to Mr. Fractor that would have vested in

the six (6) months following Mr. Fractor’s separation from the Company; and (d) if such a termination occurs within twelve (12) months of a “Change in Control” (as such term is defined in the Employment Agreement)

the Company will accelerate the vesting of all equity interests granted to Mr. Fractor such that 25% of all unvested shares will be deemed vested and exercisable.

If Mr. Fractor resigns without Good Reason, or if the Company terminates

Mr. Fractor’s employment for Cause or upon Mr. Fractor’s death or disability, the Employment Agreement provides that Mr. Fractor will no longer vest in any equity interests, all payments of compensation by the Company to

Mr. Fractor will terminate immediately (except as to amounts already earned) and Mr. Fractor will not be entitled to any of the aforementioned severance benefits.

The foregoing summary of the Employment Agreement is qualified in its entirety by reference to the form of such agreement which the Company

anticipates filing as an exhibit to its Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

| Date: September 16, 2015 |

|

IMMUNOCELLULAR THERAPEUTICS, LTD. |

|

|

|

|

|

By: |

|

/s/ Andrew Gengos |

|

|

|

|

Andrew Gengos |

|

|

|

|

President and Chief Executive Officer |

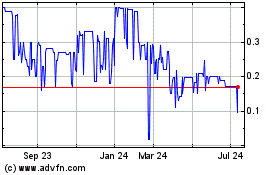

EOM Pharmaceutical (PK) (USOTC:IMUC)

Historical Stock Chart

From Mar 2024 to Apr 2024

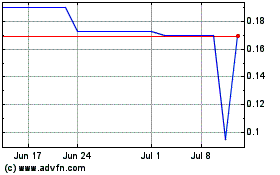

EOM Pharmaceutical (PK) (USOTC:IMUC)

Historical Stock Chart

From Apr 2023 to Apr 2024