UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 9, 2015

ODYSSEY MARINE EXPLORATION, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Nevada |

|

001-31895 |

|

84-1018684 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

5215 West Laurel Street

Tampa, Florida 33607

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (813) 876-1776

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry Into a Material Definitive Agreement. |

On September 9,

2015, Odyssey Marine Exploration, Inc. (the “Company”) amended its three existing loan agreements with Fifth Third Bank (the “Bank”). The Company paid a fee of $25,000 to the Bank related to these amendments.

The Non-Revolving Line of Credit Promissory Note (referred to as “Project Loan Two” in the Company’s most recent SEC Form 10-K

and Forms 10-Q filed thereafter) dated May 7, 2014, as amended on May 7, 2015, in the original principal amount of $10.0 million and with a current principal balance of $7.7 million, was further amended to (a) provide that the

principal amount of $1.4 million due on August 31, 2015, is now due on December 17, 2015, and (b) require the Company to pay into an interest reserve account an amount necessary to bring the amount in such account up to the amount

reasonably estimated by the Bank to prefund the amount of interest to be due and payable by the Company with respect to this loan through the extended maturity date.

The Renewal Commercial Term Promissory Note (referred to as the “Term Loan” in the Company’s most recent SEC Form 10-K and

Forms 10-Q filed thereafter) dated July 11, 2013, in the original principal amount of $5.0 million and a current principal balance of $3.0 million, was amended to (a) provide that the principal payments that were due in January 2016 and

July 2016 are now due on December 17, 2015, and (b) require the Company to pay into an interest reserve account an amount necessary to bring the amount in such account up to the amount reasonably estimated by the Bank to prefund the amount

of interest to be due and payable by the Company with respect to this loan through the amended maturity date.

The Renewal Commercial

Promissory Note (referred to as the “Mortgage Loan” in the Company’s most recent SEC Form 10-K and Forms 10-Q filed thereafter) dated July 11, 2013, with a current principal balance of $1.0 million, was amended to

(a) provide that the final payment of principal is due on December 17, 2015, rather than in July 2016, with payments of principal due and payable monthly until the final payment date, and (b) require the Company to pay into an

interest reserve account an amount necessary to bring the amount in such account up to the amount reasonably estimated by the Bank to prefund the amount of interest to be due and payable by the Company with respect to this loan through the amended

maturity date.

The amendments described above are set forth in an agreement between the Company and the Bank, dated as of

September 9, 2015 (the “Amendment Agreement”). The foregoing descriptions of the amendments do not purport to be complete and are qualified in their entirety to the full text of the Amendment Agreement, which is attached hereto as

Exhibit 10.1 and incorporated herein by reference.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The disclosure set forth below under Item 1.01 (Entry Into a Material Definitive Agreement) is hereby incorporated by reference into this

Item 2.03.

| Item 3.01. |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

As previously reported, on March 9, 2015, the Company received a letter from the Listing Qualifications Staff (the “Staff”) of

The NASDAQ Stock Market notifying the Company that, because the closing bid price of its common stock had been below $1.00 for 30 consecutive business days, it no longer complied with the requirements for continued listing on the NASDAQ Capital

Market set forth in

NASDAQ Listing Rule 5550(a)(2). In accordance with NASDAQ Listing Rule 5810(c)(3)(A), the Company was provided a period of 180 calendar days in which to regain compliance. In order to regain

compliance with the minimum bid price requirement, the closing bid price of the Company’s common stock must have been at least $1.00 per share for a minimum of ten consecutive business days during the 180-day period.

On September 9, 2015, the Company was notified by the Staff that, based on the Company’s continued non-compliance with the $1.00

minimum closing bid price requirement for continued listing, as set forth in NASDAQ Listing Rule 5550(a)(2), the Company’s securities are subject to delisting from NASDAQ unless the Company timely requests a hearing before the NASDAQ Hearings

Panel (the “Panel”). The Company has requested a hearing before the Panel, at which the Company will present its plan to regain compliance with all applicable requirements for continued listing on NASDAQ. This request has been granted and

the hearing is scheduled for the end of October. The Company is also considering available options to regain compliance with the listing requirements, which will be set forth in the plan presented to the Panel. The Company’s common stock will

continue to trade on The NASDAQ Capital Market under the symbol “OMEX” during the hearing process.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

(a) |

Financial Statements of Businesses Acquired. |

Not applicable.

| |

(b) |

Pro Forma Financial Information. |

Not applicable.

| |

(c) |

Shell Company Transactions. |

Not applicable.

| |

10.1 |

Amendment Agreement, dated September 9, 2015, between the Company and Fifth Third Bank. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ODYSSEY MARINE EXPLORATION, INC. |

|

|

|

|

|

| Dated: September 15, 2015 |

|

|

|

|

|

By: |

|

/s/ Philip S. Devine |

|

|

|

|

|

|

|

|

Philip S. Devine |

|

|

|

|

|

|

|

|

Chief Financial Officer |

Exhibit 10.1

AMENDMENT TO LOAN AGREEMENT,

NON-REVOLVING LINE OF CREDIT PROMISSORY NOTE,

AND RELATED LOAN AND SECURITY DOCUMENTS

AMENDMENT TO REVOLVING CREDIT LOAN AND SECURITY

AGREEMENT, RENEWAL COMMERCIAL TERM PROMISSORY

NOTE, AND RELATED LOAN AND SECURITY DOCUMENTS

AMENDMENT TO MORTGAGE AND NOTE MODIFICATION AND

RENEWAL AGREEMENT, AND RENEWAL COMMERCIAL

PROMISSORY NOTE, AND RELATED LOAN AND SECURITY DOCUMENTS

These amendments (collectively, the “Amendments”) are made and entered into effective as of the 9th day of September,

2015, by and between ODYSSEY MARINE EXPLORATION, INC., a Nevada corporation (“Borrower”), and FIFTH THIRD BANK, an Ohio banking corporation, (“Lender”).

RECITALS

A.

Non-Revolving Loan. Borrower requested, and Lender made available to Borrower, a loan (the “Non-Revolving Loan”) in the amount of $10,000,000.00, as evidenced by that certain Non-Revolving Line of Credit Promissory Note made

by Borrower in favor of Lender dated May 7, 2014, in the original principal amount of Ten Million and 00/100 Dollars ($10,000,000.00) (the “Non-Revolving Note”). The Non-Revolving Loan is evidenced by, among other things, that

certain Loan Agreement made by Borrower and Lender, dated May 7, 2014 (the “Non-Revolving Loan Agreement”), as amended. The foregoing documents described in this Recital A and all other documents evidencing, securing, executed

or delivered in connection with the Non-Revolving Loan are referred to hereinafter as the “Non-Revolving Loan Documents.”

B. Revolving Loan. Borrower is also the borrower from Lender in the amount of $5,000,000.00 (the “Revolving Loan”), as

evidenced by that certain Renewal Commercial Term Promissory Note made by Borrower in favor of Lender dated July 11, 2013, in the original principal amount of Five Million and 00/100 Dollars ($5,000,000.00) (the “Revolving

Note”). The Revolving Loan is evidenced by, among other things, that certain Revolving Credit Loan and Security Agreement made by Borrower and Lender, dated February 7, 2008, as amended. The foregoing documents described in this

Recital B and all other documents evidencing, securing, executed or delivered in connection with the Revolving Loan are referred to hereinafter as the “Revolving Loan Documents.”

C. Mortgage Loan. Borrower is also the borrower from Lender in the amount of $1,302,000.00 (the “Mortgage Loan”), as

evidenced by that certain Renewal Commercial Promissory Note dated July 11, 2013, in the original principal amount of One Million Three Hundred Two Thousand and 00/100 Dollars ($1,302,000.00). The Mortgage Loan is evidenced and secured, among

other things, by that certain Mortgage and Note Modification and Renewal Agreement granted by Borrower in favor of Lender dated July 11, 2013 and recorded in O.R.

1

Book 22033, Page 407 of the Official Records of Hillsborough County, Florida (the “Mortgage”). The foregoing documents described in this Recital C and all other documents

evidencing, securing, executed or delivered in connection with the Mortgage Loan are referred to hereinafter as the “Mortgage Loan Documents.”

D. Borrower has requested Lender to modify the payment obligations of the Non-Revolving Note and to extend the Maturity Date of the Odyssey

Notes (as defined below), and Lender is willing to do so on the terms and conditions hereinafter set forth.

AGREEMENT

NOW, THEREFORE, in consideration of the premises and of the mutual covenants and agreements hereinafter set forth, the parties hereto do

hereby agree as follows:

1. Recitals. The Recitals hereinabove contained are true and correct and are made a part hereof.

2. Definitions. The Non-Revolving Loan, the Revolving Loan and the Mortgage Loan are collectively referred to as the

“Odyssey Loans.” The Non-Revolving Note, the Revolving Note and the Mortgage Note are collectively referred to as the “Odyssey Notes.” The Non-Revolving Loan Documents, the Revolving Loan Documents and the Mortgage

Loan Documents are collectively referred to as the “Odyssey Loan Documents.” Capitalized terms used but not defined herein shall have the meaning ascribed thereto in the applicable Odyssey Loan Documents.

3. Odyssey Loan Extensions. So long as no Event of Default (as hereafter defined) occurs hereunder and subject to the

conditions set forth in these Amendments, Lender agrees to extend the Maturity Date of each of the Odyssey Notes through December 17, 2015 (the “Extended Maturity Date”).

4. Payments to Lender. In addition to the terms of payment set forth in the Odyssey Notes and other Odyssey Loan

Documents, Borrower shall make the following payments to Lender:

(a) Borrower shall simultaneously with the execution of these

Amendments pay to Lender (i) a modification fee in the amount of Twenty-Five Thousand Dollars ($25,000.00), and (ii) all costs and expenses incurred in connection with the negotiating and preparation of these Amendments and the

transactions contemplated hereby, including without limitation Lender’s attorneys’ fees and costs.

(b) Borrower shall pay into

the Interest Reserve Accounts for the Odyssey Loans that have an Interest Reserve Account, simultaneously with execution of these Amendments, the amount necessary to bring the balances of such accounts up to the amount reasonably estimated by Lender

to prefund the amount of interest to be due and payable by Borrower for the combined Odyssey Loans through the Extended Maturity Date. The prefunding amount for the Non-Revolving Loan is One Hundred Forty-Six Thousand Four Hundred Fourteen and

03/100ths Dollars ($146,414.03). The prefunding amount for the Revolving Loan is Fifty-Five Thousand Four Hundred Nineteen and 81/100ths Dollars ($55,419.81). The prefunding amount for the

2

Mortgage Loan is Fifty-Seven Thousand Four Hundred Ninety-Five and 29/100ths Dollars ($57,495.29). If Lender reasonably believes that the amount remaining at any time in an Interest Reserve

Account is inadequate to fully fund the interest due for all Odyssey Loans through the Extended Maturity Date, Borrower shall pay the amount of the estimated deficiency into an Interest Reserve Account designated by Lender within ten (10) days

after notice of such deficiency is given by Lender to Borrower.

(c) Lender waives the principal payment due under the Non-Revolving Loan

on or before August 31, 2015, of One Million Four Hundred Thousand and 00/100 Dollars ($1,400,000.00) provided for in Paragraph 4(b) of that certain First Amendment To Loan Agreement, Non-Revolving Line Of Credit Promissory Note, Assignment And

Security Agreement And Pledge Of Deposit Account, Salvage Proceeds Account, And Assignment And Security Agreement And Pledge Of Deposit Account, Interest Reserve Account dated May 7, 2015, by Borrower and Lender. All of other provisions of such

Paragraph remain in full force and effect.

(d) Borrower shall continue to pay all amounts due each month under the Odyssey Notes until

the Extended Maturity Date, at which time all principal and accrued interest with respect to all Odyssey Loans shall be immediately due and payable.

5. Closing Requirements. As a condition precedent to Lender’s execution and delivery of these Amendments:

(a) Lender shall have received the following documents, duly authorized and executed by Borrower, each in form and substance

satisfactory to Lender in Lender’s sole and absolute discretion:

(i) Three originals of these Amendments (or counterparts hereto),

duly authorized and executed by Borrower;

(ii) Borrower’s Certificate;

(iii) Assurance Agreement;

(iv) Allonge to the Non-Revolving Note;

(v) Allonge to the Revolving Note;

(vi) Allonge to the Mortgage Note;

(vii) Amendment to Mortgage;

(viii) Closing Statement; and

(ix) Such other documents or instruments deemed to be necessary or proper by Lender to effectuate the terms of this Agreement.

3

(b) Lender shall have received from Borrower such financial information as contained in the sworn

Borrower’s Affidavit, which has been executed at the same time as this Agreement.

(c) Borrower shall be in compliance with all of

the other terms of the Loan and the Additional Loans.

6. Covenants. Borrower agrees as follows:

(a) Borrower shall continue to comply with all applicable covenants, obligations, terms and conditions of the Odyssey Loan Documents and these

Amendments.

(b) Borrower will give Lender prompt prior written notice of any pending or projected inability of Borrower to pay its

monetary business obligations in full when due, and provide to Lender such detailed information concerning the same as Lender may request.

(c) Borrower acknowledges and agrees that any default under any indebtedness existing from time to time of Borrower to Lender of any kind or

nature, including without limitation the Odyssey Loans, is a default under all indebtedness of Borrower to Lender, whether or not so specified in the provisions of any particular loan. In addition, Borrower acknowledges and agrees that Lender shall

have the benefit of all collateral given by Borrower to or for the benefit of Lender with respect to all indebtedness of Borrower to Lender, with the result that all indebtedness of Borrower to Lender is cross-defaulted and cross-collateralized,

whether or not so specified in the provisions of any particular loan.

7. Confirmation of the Odyssey Loans and the Amounts

Due. Borrower, in consideration of the matters described in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which are acknowledged, hereby covenants and agrees for the benefit of Lender and its

respective successors, transferees, participants and assigns as follows:

(a) As of August 28, 2015, the aggregate outstanding

balances on the Non-Revolving Note, prior to payments under Section 4 above, are:

|

|

|

|

|

| Principal |

|

$ |

7,684,514.25 |

|

| Interest |

|

$ |

26,602.59 |

|

|

|

|

|

|

| TOTAL |

|

$ |

7,711,116.84 |

|

(b) As of August 28, 2015, the aggregate outstanding balances on the Revolving Note, prior to payments

under Section 4 above, are:

|

|

|

|

|

| Principal |

|

$ |

3,000,000.00 |

|

| Interest |

|

$ |

8,652.08 |

|

| TOTAL |

|

$ |

3,008,652.08 |

|

4

(c) As of August 28, 2015, the aggregate outstanding balances on the Mortgage Note, prior to

payments under Section 4 above, are:

|

|

|

|

|

| Principal |

|

$ |

1,033,250.00 |

|

| Interest |

|

$ |

2,262.39 |

|

| TOTAL |

|

$ |

1,035,512.39 |

|

(d) Borrower acknowledges that such amounts exclude all fees and expenses charged or incurred by Lender in

connection with these Amendments.

(e) The Odyssey Loan Documents are valid and enforceable according to their terms.

8. Events of Default. In addition to events of default set forth in the Odyssey Loan Documents, Lender shall be entitled

to exercise all rights and remedies available under each of the Odyssey Loan Documents and applicable law upon the occurrence of the following events (each, an “Event of Default”):

(a) if any of the representations, warranties or covenants made by Borrower either set forth in these Amendments or in any of the Odyssey Loan

Documents or in any other document delivered in connection with these Amendments are determined at any time to have been known to Borrower to be false or misleading in any material respect when made and adversely affect the interests of Lender; or

(b) if Borrower fails to duly and promptly observe, perform and discharge any covenant, term, condition or agreement contained in these

Amendments or in any of the Odyssey Loan Documents (without the application of any applicable notice or cure period set forth therein).

9. Remedies. Upon the occurrence of an Event of Default, in addition to all of the rights and remedies available to

Lender under the Odyssey Loan Documents and applicable law, interest shall be calculated retroactively from September 1, 2015, at the Default Interest Rate, such that all accrued and accruing default interest shall become immediately due and

payable. Borrower acknowledges and confirms that all grace or cure periods provided in any of the Odyssey Loan Documents are hereby deleted and of no force or effect, and, upon the occurrence of any Event of Default as defined in any of the Odyssey

Loan Documents or these Amendments, Lender shall be entitled to immediately exercise all rights and remedies available under the Odyssey Loan Documents, these Amendments and applicable law against Borrower, including the right to declare the unpaid

principal balance and accrued but unpaid interest on the Odyssey Notes, and all other amounts due under the Odyssey Notes and Odyssey Loan Documents, at once due and payable.

10. Representations and Warranties and Agreements. Borrower represents and warrants, covenants and agrees, as applicable,

as follows:

(a) Borrower hereby affirms and warrants that all of the warranties made in the Odyssey Loan Documents, and any other

documents or instruments recited herein or

5

executed with respect thereto directly or indirectly, are true and correct as of the date hereof (except to the extent such representations and warranties expressly related only to an earlier

date, in which case as of such earlier date) and that Borrower is not in default of any of the foregoing nor aware of any default with respect thereto, and that Borrower has no defenses or rights of offset with respect to any indebtedness to the

Bank.

(b) Release of Lender and Waiver of Defenses. To induce Lender to enter into this Agreement, Borrower, for itself and for

its agents, attorneys, predecessors, successors, and assigns, hereby releases Lender and its predecessors, successors, assigns, officers, managers, directors, shareholders, employees, agents, servicers, special servicers, attorneys (including

Carlton Fields Jorden Burt, P.A. and its employees, representatives, parent corporations, subsidiaries, and affiliates (collectively referred to as the “Lender Affiliates”), jointly and severally from any and all claims, counterclaims,

demands, damages, debts, agreements, covenants, suits, contracts, obligations, liabilities, accounts, offsets, rights, actions, negligence, and causes of action for contribution and indemnity of every kind or description, whether arising at law or

in equity, whether presently possessed or, whether known or unknown, whether liability be direct or indirect, liquidated or unliquidated, whether presently accrued or to be accrued, whether absolute or contingent, foreseen or unforeseen, and whether

or not heretofore asserted, for or because of or as a result of any act, omission, communication, transaction, occurrence, representation, promise, damage, breach of contract, fraud, violation of any statute or law, commission of any tort, or any

other matter whatsoever or thing done, omitted or suffered to be done by Lender and/or the Lender Affiliates, which has occurred in whole or in part, or was initiated at any time from the beginning of time up to and immediately preceding the moment

of the execution of this Agreement. Borrower hereby agrees that all defenses and matters of set-off (except for sums received pursuant to this agreement) in connection with the Loans are hereby waived and released. The rights and defenses being

waived and released hereunder include without limitation any claim or defense based on the Bank having charged or collected interest at a rate greater than that allowed to be contracted for by applicable law as changed from time to time, provided,

however, in no event shall such waiver and release be deemed to change or modify the terms of the Loan Documents which provide that sums paid or received in excess of the maximum rate of interest allowed to be contracted for by applicable law, as

changed from time to time, reduce the principal sum due, said provision to be in full force and effect.

(c) this Agreement is a valid,

binding and enforceable obligation of Borrower and does not violate any law, rule, regulation, contract or agreement otherwise enforceable by or against the Borrower;

(d) all financial statements delivered by Borrower to Lender prior to the date of these Amendments presented fairly, in all material respects,

the financial condition and results of operations of the Borrower on a consolidated basis as of the dates and for the periods stated therein;

(e) Borrower has engaged an attorney or attorneys in connection with the preparation and review of this Agreement, has specifically discussed

with its attorneys the meaning and effect of this Agreement, and has carefully read and understood the scope of each provision contained herein, and has not relied upon any representation or statement made by Lender or by any representative of

Lender with regard to the subject matter, basis or effect of this Agreement;

6

(f) Borrower has entered into these Amendments voluntarily and has not been coerced by Lender or

any other party in any manner and have received actual and adequate consideration to enter into these Amendments;

(g) Borrower shall

comply with all applicable terms and conditions of the Loan Documents as amended by these Amendments;

(h) Borrower has the power and

authority to execute, deliver and perform all terms under these Amendments and all related documents to which it is a party and has taken all necessary action to authorize such execution, delivery and performance. Borrower’s execution of these

Amendments and its performance of its obligations hereunder are not subject to any further approval, vote or contingency from any person or committee;

(i) Borrower has disclosed all pending or overtly threatened litigation, administrative ruling or investigation by any federal or state agency

having jurisdiction over Borrower which, if determined adversely to Borrower, would have a material adverse effect on such Borrower’s execution, delivery, or enforceability of these Amendments;

(j) The execution and delivery of these Amendments and the performance by Borrower of its obligations hereunder will not conflict with or be a

breach of any provision of any law, regulation, judgment, order, decree, writ, injunction, contract, agreement or instrument to which Borrower is subject; and Borrower has obtained any consent, approval, authorization or order of any court or

governmental agency or body required for the execution, delivery and performance by Borrower thereof; and

(k) Borrower believes, and has

no cause or reason to not believe, that Borrower can perform each and every covenant contained in these Amendments.

(l) These Amendments

shall be deemed a Florida contract and shall be construed according to the laws of the State of Florida, regardless of whether these Amendments are executed by certain of the parties hereto in other states.

(m) Borrower confirms and ratifies that all Odyssey Loan Documents, as amended by these Amendments, and all other documents given by Borrower

to Lender in connection with the Odyssey Loans are and remain valid, binding and enforceable.

11. Bankruptcy.

Borrower hereby agrees that, in consideration of the recitals and mutual covenants contained herein, and for other good and valuable consideration, including the forbearance of Lender from exercising the rights and remedies otherwise available to it

under the Loan Documents, the receipt and sufficiency of which are hereby acknowledged, in the event Borrower shall (i) file with any bankruptcy court of competent jurisdiction or be the subject of any petition (which Borrower fails to

discharge within sixty (60) days of the filing of such petition) under Title 11 of the U.S. Code, as amended; (ii) be the subject of any order for relief issued under such Title 11 of the U.S. Code, as amended; (iii) file or be the

subject of any petition (which Borrower fails to discharge within sixty (60) days of the filing of such petition)

7

seeking any reorganization, arrangement, composition, readjustment, liquidation, dissolution, or similar relief under any present or future federal or state act or law relating to bankruptcy,

insolvency, or other relief for debtors; (iv) seek or consent to or acquiesce in the appointment of any trustee, receiver, conservator, or liquidator; or (v) be the subject of any order, judgment or decree entered by any court of competent

jurisdiction approving a petition filed against such party for any reorganization, arrangement, composition, readjustment, liquidation, dissolution, or similar relief under any present or future federal or state act or law relating to bankruptcy,

insolvency, or relief for debtors, Lender shall thereupon be entitled to relief from any automatic stay imposed by Section 362 of Title 11 of the U.S. Code, as amended, or otherwise, on or against the exercise of the rights and remedies

otherwise available to Lender as provided in Loan Documents, and as otherwise provided by law. Borrower further represents and warrants that Borrower has not entered into these Amendments or the transactions contemplated herein to provide

preferential treatment to Lender or any other creditor of Borrower in anticipation of seeking relief under the Bankruptcy Code, nor has Borrower entered into these Amendments or the transactions contemplated herein with the actual intent to hinder,

delay or defraud any creditors of Borrower.

12. No Novation. It is the intent of the parties hereto that these

Amendments shall not in any way adversely affect the lien rights or any other rights or obligations of the parties under the Odyssey Loan Documents. To the extent these Amendments or any provision hereof shall be construed by a court of competent

jurisdiction as operating to subordinate the lien priority of the Odyssey Loan Documents to any claim which would otherwise be subordinate thereto (and provided that ruling is not appealed or appealable), such provision or provisions shall be void

and of no force and effect; except that these Amendments shall constitute, as to any provision so construed, a lien upon the collateral subordinate to such third person’s claims, incorporating by reference the terms of the applicable Odyssey

Loan. The Odyssey Loan Documents shall then be enforced pursuant to the terms therein contained, independent of any such provisions.

13. Sale of Loan Documents. Lender, to the extent already provided in the Odyssey Loan Documents, may from time to time,

without prior notice to Borrower, as the context so requires, sell or assign, in whole or in part, or grant participations in, any or all of the Odyssey Notes and/or the obligations evidenced thereby. In all events, the holder of any such sale,

assignment or participation, if the applicable agreement between Lender and such holder so provides, shall be: (a) entitled to all the rights, obligations and benefits of Lender; and (b) deemed to hold and may exercise the rights of setoff

or banker’s lien with respect to any and all obligations of such holder to Borrower in each case as fully as though Borrower were directly indebted to such holder. Lender may in its discretion give notice to Borrower of such sale,

assignment or participation; however, the failure to give such notice shall not affect any of Lender’s or such holder’s rights.

8

14. Miscellaneous.

(a) Lender is under no obligation to grant or to make any further or additional loans to Borrower or to extend, amend or modify the Odyssey

Loan Documents or any other document executed in connection therewith.

(b) These Amendments shall be construed, interpreted, enforced and

governed by and in accordance with the laws of the State of Florida, excluding the principles thereof governing conflicts of law.

(c)

These Amendments shall be binding upon, and shall inure to the benefit of, the respective successors and assigns of the parties hereto.

(d) Time is of the essence of each provision of these Amendments.

(e) Borrower shall pay all documentary stamp taxes, if any, intangible taxes, if any, recording and filing costs and fees, Lender’s

attorney’s fees and all other costs and fees whatsoever incurred with respect to, growing from or arising out of these Amendments and any other document or instrument executed in connection with these Amendments. Borrower hereby agrees to

indemnify, defend and hold Lender harmless therefrom. If any such sums are advanced by Lender, they shall be due and payable on demand and shall bear interest at the Default Rate until paid.

(f) These Amendments and the Odyssey Loan Documents constitute the entire agreement (including all representations and promises made) between

the parties with respect to the subject matter hereof and no modification or waiver shall be effective unless in writing and signed by the party to be charged.

(g) The parties may execute these Amendments and any other agreement executed pursuant to it in counterparts. Each executed counterpart will

be deemed to be an original, and all of them, together, will constitute the same agreement. These Amendments will become effective as of its stated date of execution, when each party has signed a counterpart and all the executed counterparts have

been delivered to Lender.

(h) The Odyssey Loan Documents and all of the documents executed in connection with the foregoing and any and

all prior modifications and extensions to any and all of the foregoing, including without limitation those certain agreement waiving right to jury, are hereby ratified, confirmed and approved in all respects except as specifically amended by these

Amendments.

(i) In the event the conditions to the effectiveness of these Amendments are not satisfied on or prior to 5 p.m. on

September 14, 2015, these Amendments shall be automatically null and void and of no further force or effect.

VENUE AND ORAL

STATEMENT

ANY LITIGATION BASED HEREON, OR ARISING OUT OF, UNDER, OR IN CONNECTION WITH THESE AMENDMENTS OR ANY OTHER ODYSSEY LOAN

9

DOCUMENT, SHALL BE BROUGHT AND MAINTAINED EXCLUSIVELY IN THE COURTS OF THE STATE OF FLORIDA OR IN THE UNITED STATES DISTRICT COURT FOR THE MIDDLE DISTRICT OF FLORIDA. BORROWER HEREBY EXPRESSLY

AND IRREVOCABLY SUBMITS TO THE JURISDICTION OF THE COURTS OF THE STATE OF FLORIDA AND OF THE UNITED STATES DISTRICT COURT FOR THE MIDDLE DISTRICT OF FLORIDA FOR THE PURPOSE OF ANY SUCH LITIGATION AS SET FORTH ABOVE. BORROWER FURTHER IRREVOCABLY

CONSENTS TO THE SERVICE OF PROCESS BY REGISTERED MAIL, POSTAGE PREPAID, OR BY PERSONAL SERVICE WITHIN OR WITHOUT THE STATE OF FLORIDA. BORROWER HEREBY EXPRESSLY AND IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY LAW, ANY OBJECTION WHICH IT

MAY NOW OR HEREAFTER HAVE TO THE LAYING OF VENUE OF ANY SUCH LITIGATION BROUGHT IN ANY SUCH COURT REFERRED TO ABOVE AND ANY CLAIM THAT ANY SUCH LITIGATION HAS BEEN BROUGHT IN AN INCONVENIENT FORUM.

BORROWER AND LENDER AGREE THAT THEY WAIVE ALL RIGHTS TO RELY ON OR ENFORCE ANY ORAL STATEMENTS MADE PRIOR TO OR SUBSEQUENT TO THE SIGNING OF

THIS DOCUMENT.

WAIVER OF JURY TRIAL

BORROWER AND LENDER HEREBY AGREE AS FOLLOWS: (A) EACH OF THEM KNOWINGLY, VOLUNTARILY, INTENTIONALLY, AND IRREVOCABLY WAIVES ANY RIGHT IT

MAY HAVE TO A TRIAL BY JURY IN ANY LAWSUIT, PROCEEDING, COUNTERCLAIM, OR OTHER LITIGATION (AN “ACTION”) BASED UPON, OR ARISING OUT OF, UNDER, OR IN CONNECTION WITH, THESE AMENDMENTS OR ANY RELATED DOCUMENTS, INSTRUMENTS, OR

AGREEMENTS (WHETHER ORAL OR WRITTEN AND WHETHER EXPRESS OR IMPLIED AS A RESULT OF A COURSE OF DEALING, A COURSE OF CONDUCT, A STATEMENT, OR OTHER ACTION OF EITHER PARTY); (B) NONE OF THEM MAY SEEK A TRIAL BY JURY IN ANY SUCH ACTION;

(C) NONE OF THEM WILL SEEK TO CONSOLIDATE ANY SUCH ACTION (IN WHICH A JURY TRIAL HAS BEEN WAIVED) WITH ANY OTHER ACTION IN WHICH A JURY TRIAL CANNOT BE OR HAS NOT BEEN WAIVED; AND (D) NONE OF THEM HAS IN ANY WAY AGREED WITH OR REPRESENTED

TO THE OTHER OF THEM THAT THE PROVISIONS OF THIS SECTION WILL NOT BE FULLY ENFORCED IN ALL INSTANCES.

[Remainder of Page Intentionally

Left Blank]

10

[Signature page to Amendment]

IN WITNESS WHEREOF, the parties hereto have caused these Amendments to be executed as of the day and year first above written.

|

|

|

|

|

|

|

| WITNESSES: |

|

|

|

BORROWER: |

| /s/ Terese Jimenez

Print Name: Terese Jimenez |

|

|

|

ODYSSEY MARINE EXPLORATION, INC.,

a Nevada corporation |

|

|

|

|

| /s/ Brenda D. Cook |

|

|

|

By: |

|

/s/ Philip S. Devine |

| Print Name: Brenda D. Cook |

|

|

|

Name: Philip Devine |

|

|

|

|

Title: Chief Financial Officer |

|

|

|

|

|

| STATE OF FLORIDA |

|

) |

|

|

|

|

) SS: |

|

|

| COUNTY OF HILLSBOROUGH |

|

) |

|

|

The foregoing instrument was acknowledged before me this 9th day of September, 2015, by Philip Devine, as the

Chief Financial Officer of ODYSSEY MARINE EXPLORATION, INC., a Nevada corporation, on behalf of the banking corporation, who q is personally known to me or [X] produced his driver’s license

as identification.

|

|

|

|

|

|

|

|

|

/s/ Melisa Rivera Zambrana |

|

|

|

|

NOTARY PUBLIC, State of Florida |

|

|

|

|

Melisa Rivera Zambrana |

|

|

|

|

Print Name |

|

|

|

|

Commission No. |

|

|

|

|

|

|

|

My Commission Expires: |

11

[Signature page to Amendment]

|

|

|

|

|

|

|

| WITNESSES: |

|

|

|

LENDER: |

| /s/ Marshall S. Fox

Print Name: Marshall S. Fox |

|

|

|

FIFTH THIRD BANK, an Ohio banking

corporation |

|

|

|

|

| /s/ Allen L. Beckes |

|

|

|

By: |

|

/s/ Thomas J. Carroll |

| Print Name: Allen S. Beckes |

|

|

|

Name: Thomas J. Carroll |

|

|

|

|

Title: Vice President |

|

|

|

|

|

| STATE OF FLORIDA |

|

) |

|

|

|

|

) SS: |

|

|

| COUNTY OF ORANGE |

|

) |

|

|

The foregoing instrument was acknowledged before me this 10th day of September, 2015, by Thomas J. Carroll, as

the Vice President of FIFTH THIRD BANK, an Ohio banking corporation, successor by merger with Fifth Third Bank, a Michigan banking corporation, on behalf of the banking corporation, who [X] is personally known to me or q produced his driver’s license as identification.

|

|

|

|

|

|

|

|

|

/s/ Gloria S. Gladeau |

|

|

|

|

NOTARY PUBLIC, State of Florida

|

|

|

|

|

Print Name |

|

|

|

|

Commission No. |

|

|

|

|

My Commission Expires: |

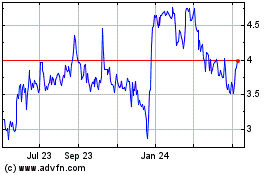

Odyssey Marine Exploration (NASDAQ:OMEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Odyssey Marine Exploration (NASDAQ:OMEX)

Historical Stock Chart

From Apr 2023 to Apr 2024