UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of Report: September 4, 2015

(Date of earliest event reported)

STEVEN

MADDEN, LTD.

(Exact Name of Registrant as Specified in Charter)

| |

|

|

|

|

| Delaware |

|

000-23702 |

|

13-3588231 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 52-16

Barnett Avenue, Long Island City, New York 11104 |

| (Address

of Principal Executive Offices) (Zip Code) |

Registrant’s

telephone number, including area code: (718) 446-1800

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

|

| o |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item

5.02. |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers. |

On

September 8, 2015, Steven Madden, Ltd. (the “Company”) announced the appointment of Amelia Newton Varela to the newly-created

position of President of the Company. Prior to this appointment, Ms. Varela served as Executive Vice President – Wholesale

of the Company.

In

connection with Ms. Varela’s appointment as President, on September 4, 2015, the Company entered into an amendment (the

“Amendment”) to its existing employment agreement dated January 10, 2014 (the “Varela Employment Agreement”)

with Ms. Varela. The Amendment reflects the change in Ms. Varela’s job title and increases her annual base salary to $600,000

through the end of the term of the Varela Employment Agreement on December 31, 2016. Prior to the Amendment, pursuant to the terms

of the Varela Employment Agreement, Ms. Varela was entitled to an annual performance-based cash bonus for each of the fiscal years

ending December 31, 2015 and 2016 in an amount equal to 2% of the increase, if any, in the Wholesale Division EBIT (earnings before

interest and taxes) for each such year over the Wholesale Division EBIT for the immediately preceding year, less any deductions

required to be withheld by applicable laws and regulations. The Amendment does not affect any change in Ms. Varela’s bonus

for the fiscal year ending December 31, 2015; however, pursuant to the Amendment, Ms. Varela is entitled to a performance-based

cash bonus for the fiscal year ending December 31, 2016 in an amount equal to 2% of the increase, if any, in the Company’s

total EBIT for the fiscal year 2016 over the Company’s total EBIT for fiscal year 2015, less any deductions required to

be withheld by applicable laws and regulations. EBIT attributable to any business acquired by the Company after September 4, 2015

will not be included in the calculation for the purpose of determining Ms. Varela’s annual bonus. Ms. Varela’s annual

bonus, if any, will be paid to her on or about March 15 of the year immediately following the year in which it was earned. All

other terms of the Varela Employment Agreement remain unchanged.

The

foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full

text of the Amendment filed as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

On

September 8, 2015, the Company also announced the appointment of Karla Frieders to the newly-created position of Chief Merchandising

Officer of the Company. Prior to this appointment, Ms. Frieders served as Executive Vice President of Product Development of the

Company.

In

connection with Ms. Frieders’ appointment as Chief Merchandising Officer, on September 4, 2015, the Company entered into

an employment agreement with Ms. Frieders (the “Frieders Employment Agreement”), pursuant to which Ms. Frieders will

serve as Chief Merchandising Officer of the Company for a term commencing on September 4, 2015 and ending on February 29, 2017,

unless sooner terminated in accordance with the terms thereof. Pursuant to the terms of the Frieders Employment Agreement, Ms.

Frieders will receive an annual base salary during the term of $440,000. In addition, the Frieders Employment Agreement entitles

Ms. Frieders to an annual performance-based bonus for each of the fiscal years ending December 31, 2015 and 2016 in an amount

to be determined by the Company in its absolute discretion, which bonus, if any, will be paid to her on or about March 15 of the

year immediately following the year in which it was earned.

The

Company may terminate Ms. Frieders’ employment for Cause (as defined in the Frieders Employment Agreement) in which event

Ms. Frieders would be entitled to receive only her accrued and unpaid compensation through the date of termination. The Frieders

Employment Agreement provides that in the event Ms. Frieders’ employment is terminated by the Company without Cause, Ms.

Frieders would be entitled to receive payment of her annual base salary, payable at regular payroll intervals, from the date of

termination of employment through the remainder of the term.

The

foregoing description of the Frieders Employment Agreement does not purport to be complete and is qualified in its entirety by

reference to the full text of the Frieders Employment Agreement filed as Exhibit 10.2 to this Current Report on Form 8-K, which

is incorporated herein by reference.

| Item 9.01. |

Financial Statements

and Exhibits. |

| Exhibit |

|

Description |

| |

|

|

| 10.1 |

|

First Amendment

to Employment Agreement, dated as of September 4, 2015, between the Company and Amelia Newton Varela. |

| |

|

|

| 10.2 |

|

Employment Agreement,

dated as of September 4, 2015, between the Company and Karla Frieders |

| |

|

|

| 99.1 |

|

Press Release,

dated September 8, 2015, issued by Steven Madden, Ltd. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September

10, 2015

| |

|

|

| |

STEVEN

MADDEN, LTD. |

| |

|

|

| |

By: |

/s/ Edward R.

Rosenfeld |

| |

|

Edward R. Rosenfeld |

| |

|

Chief Executive

Officer |

Exhibit

10.1

FIRST

AMENDMENT TO EMPLOYMENT AGREEMENT

Reference

is made to an employment agreement between Steven Madden, Ltd. (the “Company”) and Amelia Newton Varela (the “Employee”),

dated January 10, 2014, effective January 1, 2014 (the “Agreement”).

Whereas

both the Company and Employee desire to modify the Agreement; then

W

I T N E S S E T H :

| 1. | Section

2 of the Agreement, “Position”, is hereby deleted in its entirety

and replaced by the following: |

“2.

Position. President of the Company.”

| 2. | Section

3 of the Agreement, “Salary”, is hereby deleted in its entirety and

replaced by the following: |

“3.

Salary. $600,000 per annum (paid in accordance with normal Company practice) from the date of execution of this Amendment

through December 31, 2016.”

| 3. | Section

4 of the Agreement, “Annual Wholesale Bonus”, shall be deleted in its entirety

and replaced by the following: |

“4.

Annual Bonus. You shall receive a performance bonus for 2015 equal to 2% of the increase, if any, in Wholesale division

EBIT (earnings before interest and taxes) for that year over Wholesale division EBIT for the immediately prior year, less any

deductions as shall be required to be withheld by any applicable laws and regulations. You shall receive a performance bonus for

2016 equal to 2% of the increase, if any, in total Company EBIT for that year over total Company EBIT for the immediately prior

year, less any deductions as shall be required to be withheld by any applicable laws and regulations. EBIT from any business acquired

after the date of the execution of this Amendment shall not be included in the bonus calculation. Such bonus (net of any deductions

required to be withheld by any applicable laws and regulations) shall be payable on or about March 15 of the following year.”

| 4. | The

remainder of the Agreement shall continue in full force and effect. |

Signed

this 4th day of September, 2015.

| STEVEN

MADDEN, LTD. |

|

AMELIA

NEWTON VARELA |

|

| |

|

|

|

| /s/ Edward R.

Rosenfeld |

|

/s/ Amelia Newton

Varela |

|

| By: Edward R.

Rosenfeld, CEO |

|

|

|

Exhibit

10.2

September

4, 2015

Dear Ms.

Frieders:

This

letter will set forth below the terms and conditions of your employment with Steven Madden, Ltd. (the “Company”):

| 1. | Term

of Agreement. September 4, 2015 through February 29, 2017, unless sooner terminated

in accordance with Paragraph 5 of this Agreement. |

| 2. | Position.

Chief Merchandising Officer. |

| 3. | Salary.

$440,000 per annum (paid in accordance with normal Company practice). |

| 4. | Discretionary

Bonus. You shall be eligible to receive a performance bonus for each of 2015 and

2016 in an amount to be determined by the Company in its absolute discretion. Such bonuses

(net of any deductions required to be withheld by any applicable laws and regulations)

shall be payable on or about March 15th of the following year. |

| (a) | Involuntary

Termination. The Company has the right to terminate your employment, on written notice

to you, at any time without Cause (as defined below). In the event the Company terminates

your employment without Cause, then the Term shall terminate immediately, and you shall

be entitled to receive only Salary payments described in Paragraph 3, at the regular

intervals of payment, from the date of termination through the date this Agreement would

have otherwise terminated but for the involuntary termination. |

| (b) | Voluntary

Termination by you or Termination for Cause. You shall have the right to terminate

your employment at any time for any reason (“Voluntary Termination”) and

the Company shall have the right to terminate your employment at any time for Cause,

on written notice to you, setting forth in reasonable detail the facts and circumstances

resulting in the Cause upon which such termination is based. In the event of a Voluntary

Termination or a termination by the Company for Cause, the Term shall terminate immediately

and you shall be entitled only to any accrued and unpaid Salary described in Paragraph

3 through the date of termination. For the purpose of this Agreement, Cause shall mean: |

| (i) | a

material breach by you of your material duties or obligations to the Company which is

not remedied to the reasonable satisfaction of the Company within ten (10) days after

the receipt by you of written notice of such breach from the Company; |

| (ii) | you

are convicted of, or enter a guilty or “no contest” plea with respect to

a felony or a crime of mural turpitude (whether or not a felony); |

| (iii) | you

have an alcohol or substance abuse problem, which in the reasonable opinion of the Company

materially interferes with your ability to perform your duties; |

| (iv) | any

act or acts of personal dishonesty, fraud, embezzlement, misappropriation or conversion

intended to result in your personal enrichment at the expense of the Company, or any

of its subsidiaries or affiliates, or any other material breach or violation of fiduciary

duty owed to the Company, or any of its subsidiaries or affiliates; |

| (v) | any

grossly negligent act or omission or any willful and deliberate misconduct by you that

results, or is likely to result, in material economic, or other harm, to the Company,

or any of its subsidiaries or affiliates; or |

| (vi) | you

violate or pay fines, suffer sanctions or injunctive relief relating to (whether or not

you are found to have violated ) any federal or state securities laws, rules or regulations

or the rules and regulations of any stock exchange on which the Company is listed or

included. |

| (c) | Disability.

You shall be considered to be “Disabled” if, in the Company’s reasonable

opinion after receiving the written report of an independent physician selected by the

Company, you are incapable, due to mental or physical disability, of performing the essential

functions of your duties for a period of sixty (60) days (whether or not consecutive)

during any period of one hundred twenty (120) days. In the event you shall become Disabled

during the Term, the Company may terminate your employment and the Term and the Company

shall have no further obligation or liabilities to you, except payment of accrued and

unpaid Salary described in Paragraph 3 through the date of termination. |

| (d) | Death.

In the event of your death, your employment and the Term shall terminate immediately

and the Company shall have no further obligation or liabilities to you or your estate

except that your estate shall be entitled to receive payment of accrued and unpaid Salary

described in Paragraph 3 through the date of termination. |

| (e) | Termination

Payment. Provided the Company makes the payments required under this Letter Agreement

that are attributable to the termination of your employment, such payments shall be in

full and complete satisfaction and release of any and all claims you or your beneficiaries,

estate or legal representatives may have against the Company and/or its subsidiaries

or affiliates hereunder. |

| 6. | Non-Solicitation/Non-Competition

Agreement. You recognize that the services to be performed by you hereunder are special

and unique. In consideration of the compensation granted herein, you agree that for as

long as you are receiving your Salary under this Agreement and, if you are terminated

by the Company for Cause or if you quit or resign your position, through February 28,

2017, you shall not, directly or indirectly, anywhere in the United States, whether individually

or as a principal officer, employee, partner, member, director or agent of, or consultant

for, any person or entity: (i) become employed by, an owner of, or otherwise affiliated

with, or furnish services to, any business that competes with the Company, (ii) solicit

any business from any customers of the Company, or (iii) hire, offer to hire, entice

away, or in any manner persuade or attempt to persuade any employee of the Company to

discontinue his/her employment with the Company or any other party that has a business

relationship with the Company to discontinue his/her/its business relationship with the

Company. |

| 7. | Covenant

Not to Disclose. You covenant and agree that you will not, to the detriment of the

Company, at any time during or after the Term, reveal, divulge or make known to any person

(other than (i) to the Company, or (ii) in the regular course of business of the Company)

or use for your own account any confidential or proprietary records, data, processes,

ideas, methods, devices, business concepts, inventions, discoveries, know-how, trade

secrets or any other confidential or proprietary information whatsoever (the “Confidential

Information”) previously possessed or used by the Company or any of its subsidiaries

or affiliates, (whether or not developed, devised or otherwise created in whole or in

part by your efforts) and made known to you by reason of your employment by or affiliation

with the Company. You further covenant and agree that you shall retain all such knowledge

and information which you shall acquire or develop respecting such Confidential Information

in trust for the sole benefit of the Company and its successors and assigns. Additionally,

you agree that all right, title and interest in and to any discoveries, processes, ideas,

methods and/or business concepts that you develop during the Term relating to the business

of the Company are, and shall remain the property of the Company, and you hereby assign

to the Company any right, title and interest you might otherwise claim therein. |

| 8. | Business

Materials, Covenant to Report. All written materials, records and documents made

by you or coming into your possession concerning the business or affairs of the Company

shall be the sole property of the Company and, upon the termination of your employment

with the Company or upon the request of the Company at any time, you shall promptly deliver

the same to the Company and shall retain no copies thereof. You agree to render to the

Company such reports of your activities or activities of others under your direction

during the Term as the Company may request. |

| 9. | Governing

Law; Injunctive Relief. |

| 9.1 | The

validity, interpretation, and performance of this Agreement shall be controlled by and construed under the laws of the State of

New York, excluding choice of law rules thereof. |

| | | |

| 9.2 | You

acknowledge and agree that, in the event you shall violate any of the restrictions of

Paragraphs 6, 7 or 8 hereof, the Company will be without an adequate remedy at law and

will therefore be entitled to enforce such restrictions by temporary or permanent injunctive

or mandatory relief in any court of competent jurisdiction without the necessity of proving

damages or posting a bond or other security, and without prejudice to any other remedies

which it may have at law or in equity. Each of you and the Company acknowledges and agrees

that, in addition to any other state having proper jurisdiction, any such relief may

be sought in, and for such purpose each of you and the Company consents to the jurisdiction

of, the courts of the State of New York. |

| 10. | Assignment.

This Agreement, as it relates to your employment, is a personal contract and your rights

and interests hereunder may not be sold, transferred, assigned, pledged or hypothecated. |

| 11. | Notices.

Any and all notices or other communications or deliveries required or permitted to be

given or made pursuant to any of the provisions of this Agreement shall be deemed to

have been duly given or made for all purposes when hand delivered or sent by certified

or registered mail, return receipt requested and postage prepaid, overnight mail or courier,

or facsimile, addressed, if to the Company, at the Company’s offices, Attn: CEO,

and if to you, at the address of your personal residence as maintained in the Company’s

records, or at such other address as any party shall designate by notice to the other

party given in accordance with this Paragraph 11. |

| 12. | Entire

Agreement. This Agreement represents the entire understanding and agreement between

the parties hereto with respect to the subject matter hereof, supersedes all prior agreements

between such parties with respect to the subject matter hereof, and cannot be amended,

supplemented or modified orally, but only by an agreement in writing signed by the party

against whom enforcement of any such amendment, supplement or modification is sought. |

| 13. | Execution

in Counterparts; Signatures; Severability. This Agreement may be executed in counterparts,

each of which shall be deemed to be an original, but all of which together shall constitute

one and the same instrument. Facsimile or electronic mail signatures hereon shall constitute

original signatures. If any provisions of this Agreement as applied to any part or to

any circumstance shall be adjudged by a court to be invalid or unenforceable, the same

shall in no way affect any other provision of this Agreement, the application of such

provision in any other circumstances or the validity or enforceability of this Agreement. |

| 14. | Representation

by Counsel; Interpretation. Each party acknowledges that it has been represented

by counsel or has had the opportunity to be represented by counsel in connection with

this Agreement and the transactions contemplated by this Agreement. Accordingly, any

rule or law or any legal decision that would require interpretation of any claimed ambiguities

in this Agreement against the party that drafted it has no application and is expressly

waived by such parties. The provisions of this Agreement shall be interpreted in a reasonable

manner to effect the intent of the parties hereto. |

| |

|

|

|

| Signature: |

|

/s/ Edward R.

Rosenfeld |

|

| |

|

Edward R. Rosenfeld,

CEO |

|

| |

|

|

|

| Counter-signature: |

|

/s/ Karla Frieders |

|

| |

|

Karla Frieders |

|

Exhibit

99.1

Steve

Madden Announces Executive Promotions

LONG

ISLAND CITY, N.Y., September 8, 2015 – Steve Madden (Nasdaq: SHOO), a leading designer and marketer of fashion footwear

and accessories for women, men and children, today announced two key executive promotions. Amelia Newton Varela has been named

to the newly created position of President, and Karla Frieders has been appointed to the newly created position of Chief Merchandising

Officer.

Ms.

Newton Varela has more than 17 years of experience with Steve Madden in various roles, most recently as Executive Vice President

of Wholesale. Ms. Frieders has more than 16 years of experience with Steve Madden in various roles, most recently as Executive

Vice President of Product Development.

Edward

Rosenfeld, Chairman and Chief Executive Officer, commented, “Amelia and Karla are both highly talented executives who have

been instrumental to the success and growth of our Company. Under Amelia’s leadership, our wholesale business has grown

exponentially over the last decade, as we have expanded into new brands, new product categories and new distribution channels.

We look forward to her further contributions as she broadens her role in the organization. Karla has proven herself to have a

deep understanding of product and trends, and we are confident she will be highly successful in her role as Chief Merchandising

Officer. We are pleased to recognize the many contributions Amelia and Karla have made to the Company with these promotions and

to further strengthen the executive team at Steve Madden.”

Steve

Madden, Founder and Creative and Design Chief, added, “Amelia and Karla started with the Company when they were just out

of school – Amelia in customer service and Karla in the stores. Over the years, I’ve been proud to watch them develop

into seasoned executives and outstanding leaders that are imbued with the Steve Madden ethos. I know they will be great in their

new roles.”

About

Steve Madden

Steve

Madden designs, sources and markets fashion-forward footwear and accessories for women, men and children. In addition to marketing

products under its own brands including Steve Madden®, Dolce Vita®, Betsey Johnson®, Report®,

Big Buddha®, Brian Atwood®, Cejon®, Blondo® and Mad Love®, Steve Madden

is the licensee of various brands, including Superga® for footwear in North America. Steve Madden also designs and

sources products under private label brand names for various retailers. Steve Madden’s wholesale distribution includes department

stores, specialty stores, luxury retailers, national chains and mass merchants. Steve Madden also operates 161 retail stores (including

Steve Madden’s four Internet stores). Steve Madden licenses certain of its brands to third parties for the marketing and

sale of certain products, including for ready-to-wear, outerwear, intimate apparel, eyewear, hosiery, jewelry, fragrance, luggage

and bedding and bath products. For local store information and the latest Steve Madden booties, pumps, men’s and women’s

boots, dress shoes, sandals and more, visit http://www.stevemadden.com/

Contact

ICR, Inc.

Investor

Relations

Jean Fontana/Megan

Crudele

203-682-8200

www.icrinc.com

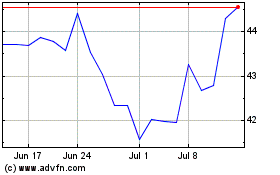

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Mar 2024 to Apr 2024

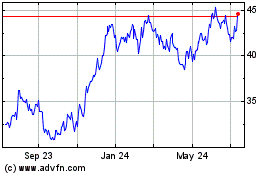

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Apr 2023 to Apr 2024