UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

Under the Securities Exchange Act of 1934

Flotek

Industries, Inc.

(Name of Issuer)

Common Stock, $0.0001 par value

(Title of Class of Securities)

343389102

(CUSIP NUMBER)

Praesidium Investment Management Company, LLC

1411 Broadway - 29th Floor

New York, NY 10018

Tel.

No.: (212) 821-1495

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

September 2, 2015

(Date of event which requires filing of this statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D/A, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g) check the following box ¨

The information required in the remainder of this cover page shall not be deemed to be “filed” for

the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Act”), or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page. |

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSONS Praesidium Investment Management Company, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP* (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS*

OO (Funds from Investment Advisory Clients) |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Delaware |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

2,659,947 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

2,804,874 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,804,874 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES*

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 5.2% |

| 14 |

|

TYPE OF REPORTING PERSON*

IA |

| * |

SEE INSTRUCTIONS BEFORE FILLING OUT |

Page 2 of 8

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSONS Kevin Oram |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP* (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS*

OO (Funds from Investment Advisory Clients) |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States of America |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

2,659,947 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

2,804,874 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,804,874 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES*

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 5.2% |

| 14 |

|

TYPE OF REPORTING PERSON*

IN, HC |

| * |

SEE INSTRUCTIONS BEFORE FILLING OUT |

Page 3 of 8

|

|

|

|

|

|

|

| 1 |

|

NAME OF

REPORTING PERSONS Peter Uddo |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP* (a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS*

OO (Funds from Investment Advisory Clients) |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States of America |

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

2,659,947 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

2,804,874 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,804,874 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN

ROW (11) EXCLUDES CERTAIN SHARES*

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11) 5.2% |

| 14 |

|

TYPE OF REPORTING PERSON*

IN, HC |

| * |

SEE INSTRUCTIONS BEFORE FILLING OUT |

Page 4 of 8

SCHEDULE 13D

This Schedule 13D relating to shares of common stock, $0.0001 par value (“Common Stock”), of Flotek Industries, Inc., a Delaware

corporation (the “Issuer”) is being filed on behalf of the Reporting Persons (as defined herein).

The information set forth in

response to each separate Item below shall be deemed to be a response to all Items where such information is relevant.

| Item 1. |

Security and Issuer |

Securities acquired: Common Stock

Issuer: Flotek Industries, Inc.

10603 W. Sam Houston Parkway N., Suite 300

Houston, Texas 770064

| Item 2. |

Identity and Background |

(a) This statement is filed by: (i) Praesidium

Investment Management Company, LLC, a Delaware limited liability company (“Praesidium”), (ii) Kevin Oram and (iii) Peter Uddo (together with Praesidium and Mr. Oram, the “Reporting Persons”).

Praesidium, in its capacity as investment manager to certain managed accounts and investment fund vehicles on behalf of investment advisory

clients (collectively, the “Accounts”), has sole power to vote 2,659,947 shares of Common Stock held in the Accounts and to dispose of 2,804,874 shares of Common Stock held in the Accounts. As the managing members of Praesidium, each of

Kevin Oram and Peter Uddo may be deemed to control Praesidium.

(b) The business address of the Reporting Persons is 1411

Broadway—29th Floor, New York, NY 10018.

(c) The principal business of Praesidium is the management of the assets and activities of

the Accounts. Mr. Oram and Mr. Uddo serve as managing members of Praesidium.

(d) None of the Reporting Persons have, during the

last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) None of the Reporting

Persons have, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, Federal or State securities laws or finding any violation with respect to such laws.

Page 5 of 8

(f) Praesidium is a Delaware limited liability company. Each of Mr. Oram and Mr. Uddo

are United States citizens.

| Item 3. |

Source and Amount of Funds |

The net investment costs (including commissions, if

any) of the shares of Common Stock directly owned by the Accounts is approximately $14.01 per share. The source of these funds for the Accounts was their working capital.

Purchases of some securities for certain Accounts were effected through margin accounts maintained with brokers, which may extend margin

credit as and when required to open or carry positions in the margin accounts, subject to applicable federal margin regulations, stock exchange rules and the brokers’ credit policies. In such instances, the positions held in the margin accounts

may be pledged as collateral security for the repayment of debit balances in the accounts.

| Item 4. |

Purpose of Transaction |

The Reporting Persons acquired the shares of Common Stock

reported herein in the ordinary course of business for investment purposes. The Reporting Persons may, depending on market price and other factors, purchase additional shares of Common Stock in public transactions. The Reporting Persons may also,

depending on market conditions and other factors, dispose of, or cause to be disposed, any or all Common Stock held by them at any time.

On September 9, 2015, the Reporting Persons sent a letter (the “Letter”) to the members of the Issuer’s Board of Directors

(the “Board”) expressing support for the Issuer’s management team and offering to work collaboratively with the Issuer’s management and Board to explore various initiatives to unlock and maximize shareholder value. The Reporting

Persons believe, based on their research, that the Issuer’s common stock is undervalued and the full value of the Issuer’s FracMax software asset is currently not reflected in the Issuer’s stock price.

In the Letter, the Reporting Persons state that they would like to suggest to the Issuer’s management and Board initiatives regarding

FracMax that they believe the Board will find helpful and should consider in order to unlock and maximize value for all shareowners. The various initiatives may include organizing a separate software business within the Issuer, licensing the

technology to an established software company that currently sells to the energy industry, setting up a potential joint venture, and/or selling the technology to an analytics company.

The foregoing description of the Letter is not complete and is qualified in its entirety by reference to the full text of the Letter, which is

filed as Exhibit 2 and is incorporated herein by reference.

Page 6 of 8

The Reporting Persons have had informal conversations with members of the Issuer’s

management team and a member of the Board regarding multiple topics, including general business operations and strategic alternatives. Going forward, the Reporting Persons may engage in communications with one or more officers, members of Board,

representatives, shareholders of the Issuer and other relevant parties regarding the Issuer’s business and certain initiatives, which could include topics such as strategic alternatives and one or more of the items in subsections

(a) through (j) of Item 4 of Schedule 13D. The Reporting Persons may, at any time and from time to time, review or reconsider their position and/or change their purpose and/or formulate plans or proposals with respect thereto.

| Item 5. |

Interest in Securities of the Issuer |

(a) - (b) The Reporting Persons

beneficially own 2,804,874 shares of Common Stock, which represents 5.2% of the Issuer’s outstanding shares of Common Stock. The percentage of beneficial ownership of the Reporting Persons, as reported in this Schedule 13D, was calculated by

dividing (i) the total number of shares of Common Stock beneficially owned by the Reporting Persons as of September 10, 2015 as set forth in this Schedule 13D, by (ii) the 53,608,401 shares of Common Stock outstanding as of

July 15, 2015, according to the Issuer’s Current Report on Form 10-Q filed with the SEC on July 22, 2015.

Praesidium, in

its capacity as investment manager to the Accounts, has sole power to vote 2,659,947 shares of Common Stock and the power to dispose of 2,804,874 shares of Common Stock held in the Accounts. As the managing members of Praesidium, each of Kevin Oram

and Peter Uddo has sole power to vote 2,659,947 shares of Common Stock and the power to dispose of 2,804,874 shares of Common Stock held in the Accounts.

(c) Transactions in the Issuer’s securities by the Reporting Persons during the last sixty days are listed in Annex A attached hereto.

(d) Not Applicable.

(e) Not

Applicable.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

Except for the arrangements described herein, to the best knowledge of the Reporting Persons, there are no contracts, arrangements,

understandings and relationships (legal or otherwise) among the persons named in Item 2 and between such persons and any other person with respect to any securities of the Issuer, including but not limited to, transfer or voting of any of the

securities, finder’s fees, joint ventures, loan or option agreements, puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies.

| Item 7. |

Material to be Filed as Exhibits |

|

|

|

|

|

| Exhibit 1. |

|

Joint filing agreement by and among the Reporting Persons. |

|

|

| Exhibit 2. |

|

Letter to the Members of the Board |

Page 7 of 8

Signature

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certifies that the information set forth in this

statement is true, complete and correct.

Dated: September 10, 2015

|

|

|

| PRAESIDIUM INVESTMENT MANAGEMENT COMPANY, LLC |

|

|

| By: |

|

/s/ Kevin Oram |

| Name: |

|

Kevin Oram |

| Title: |

|

Managing Member |

|

| KEVIN ORAM |

|

|

| By: |

|

/s/ Kevin Oram |

|

| PETER UDDO |

|

|

| By: |

|

/s/ Peter Uddo |

Page 8 of 8

EXHIBIT 1

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k) under the Securities Exchange Act of 1934, as amended, the undersigned agree to the joint filing on behalf of

each of them of a Statement on Schedule 13D (including any and all amendments thereto) with respect to the Common Stock of Flotek Industries, Inc., and further agree that this Joint Filing Agreement shall be included as an Exhibit to such joint

filings.

The undersigned further agree that each party hereto is responsible for the timely filing of such Statement on Schedule 13D and

any amendments thereto, and for the accuracy and completeness of the information concerning such party contained therein; provided, however, that no party is responsible for the accuracy or completeness of the information concerning any other party,

unless such party knows or has reason to believe that such information is inaccurate.

This Joint Filing Agreement may be signed in

counterparts with the same effect as if the signature on each counterpart were upon the same instrument.

IN WITNESS WHEREOF, the

undersigned have executed this Agreement as of September 10, 2015.

|

|

|

| PRAESIDIUM INVESTMENT MANAGEMENT COMPANY, LLC

|

| By: |

|

/s/ Kevin Oram |

| Name: |

|

Kevin Oram |

| Title: |

|

Managing Member |

| KEVIN ORAM |

|

|

| By: |

|

/s/ Kevin Oram |

| PETER UDDO |

|

|

| By: |

|

/s/ Peter Uddo |

Annex A

Except as set forth below, there have been no transactions in the Common Stock by the Reporting Persons or, to the knowledge of the Reporting Persons, by any

of the other persons named in Item 2 during the past sixty days.

During the past sixty days, the Reporting Persons effected the following purchases

and sales of shares of Common Stock through the Accounts in open market transactions:

|

|

|

|

|

|

|

|

|

|

|

| Trade Date |

|

Settle Date |

|

Amount Purchased/(Sold) |

|

|

Price |

|

| 7/7/2015 |

|

7/10/2015 |

|

|

28,386 |

|

|

|

11.59 |

|

| 7/8/2015 |

|

7/13/2015 |

|

|

72,865 |

|

|

|

11.72 |

|

| 7/16/2015 |

|

7/21/2015 |

|

|

69,000 |

|

|

|

13.29 |

|

| 7/16/2015 |

|

7/21/2015 |

|

|

100,000 |

|

|

|

13.35 |

|

| 7/17/2015 |

|

7/22/2015 |

|

|

75,000 |

|

|

|

12.93 |

|

| 7/20/2015 |

|

7/23/2015 |

|

|

80,000 |

|

|

|

12.61 |

|

| 7/22/2015 |

|

7/27/2015 |

|

|

10,000 |

|

|

|

12.93 |

|

| 7/22/2015 |

|

7/27/2015 |

|

|

93,000 |

|

|

|

12.94 |

|

| 7/29/2015 |

|

8/3/2015 |

|

|

200,000 |

|

|

|

16.57 |

|

| 8/3/2015 |

|

8/6/2015 |

|

|

2,750 |

|

|

|

16.76 |

|

| 8/4/2015 |

|

8/7/2015 |

|

|

161,300 |

|

|

|

17.03 |

|

| 8/5/2015 |

|

8/10/2015 |

|

|

55,691 |

|

|

|

17.20 |

|

| 8/11/2015 |

|

8/14/2015 |

|

|

10,000 |

|

|

|

17.63 |

|

| 8/17/2015 |

|

8/20/2015 |

|

|

11,387 |

|

|

|

18.00 |

|

| 8/19/2015 |

|

8/24/2015 |

|

|

50,000 |

|

|

|

17.14 |

|

| 8/20/2015 |

|

8/25/2015 |

|

|

15,000 |

|

|

|

16.90 |

|

| 8/21/2015 |

|

8/26/2015 |

|

|

10,000 |

|

|

|

16.62 |

|

| 8/24/2015 |

|

8/27/2015 |

|

|

17,075 |

|

|

|

16.28 |

|

| 8/28/2015 |

|

9/2/2015 |

|

|

(4,403 |

) |

|

|

18.76 |

|

| 9/1/2015 |

|

9/4/2015 |

|

|

32,822 |

|

|

|

18.97 |

|

| 9/2/2015 |

|

9/8/2015 |

|

|

125,000 |

|

|

|

18.97 |

|

| 9/4/2015 |

|

9/10/2015 |

|

|

500 |

|

|

|

20.44 |

|

| 9/8/2015 |

|

9/11/2015 |

|

|

78,500 |

|

|

|

19.91 |

|

EXHIBIT 2

LETTER TO THE MEMBERS OF THE BOARD

[See Attached]

September 9, 2015

Board of Directors

Flotek Industries, Inc.

10603 W. Sam Houston Parkway N., Suite 300

Houston, Texas 77064

Dear Members of the Board of Directors:

Praesidium

Investment Management Company, LLC (“Praesidium” or “we”) on behalf of its clients, currently beneficially owns approximately 5.2% of the outstanding shares of common stock of Flotek Industries, Inc. (“Flotek” or the

“Company”). Praesidium is a registered investment adviser and serves as the investment management company for several investment funds and managed accounts whose investor base consists primarily of university endowments, foundations and

wealthy families.

Praesidium’s investment team focuses on uncovering and investing in what we believe are high-quality, undervalued companies. We

concentrate our investments in approximately 15 companies at a time, with a long-term, multi-year average holding period. We often collaborate with the management teams and boards of our portfolio companies and serve as a resource to help them

unlock value. One key differentiating feature of Praesidium is our expertise within the enterprise software sector, in which we typically invest 30-40% of our clients’ assets.

We are highly supportive of Flotek’s management team, and believe, based on our research, that the Company has a significant growth opportunity as a

result of Flotek’s proprietary Complex Nanofluid (CnF) suite of custom chemistry formulations. Given our expectations for CnF’s future market adoption potential as well as the potentially high return on investment that CnF provides

oilfield customers, we believe that as the sole provider of this disruptive oilfield technology, Flotek is a rare and valuable company.

Our research

around CnF was the driver for our investment in Flotek. However, we believe that the Company possesses a potentially valuable yet under-appreciated asset in its FracMax software. We are writing to the Board of Flotek to share our views on the value

we see in Flotek today and to advise the Board that we intend to put forth, in future discussions, various initiatives regarding its FracMax software asset that we believe the Board will find helpful and should consider in order to unlock and

maximize value for shareowners.

Unlocking Value in Flotek’s FracMax Software

In our opinion, much of the recent acceleration in growth of CnF can be attributed to FracMax, the Company’s proprietary production optimization

analytical software that was internally developed to efficiently illustrate the efficacy of CnF in enhancing production rates relative to those wells that do not use CnF. We believe FracMax is a powerful software tool that allows the user to access

information at a very granular level to evaluate the side-by-side performance of wells from any basin in North America, in an easy to use, graphical interface. We think that the FracMax software application, beyond effectively demonstrating the

efficacy of CnF to customers, potentially has a much broader use and value as a big data analytical tool to help analyze and optimize the full range of drilling and completion techniques.

Given our history investing in the software sector, coupled with our knowledge of Flotek, we believe that

Praesidium is uniquely positioned to help the Board unlock the potential value we think the Company has built in FracMax. In fact, through a prior software investment, Praesidium has direct experience and many contacts in the area of business

intelligence data visualization software, which we believe we can leverage to help maximize the value of FracMax.

As mentioned, we are very supportive of

Flotek’s management and look forward to collaboratively working with the management team and Board to explore ways to maximize the value we see in the Company, as well as to offer our ideas for strategic alternatives for the FracMax software.

Such alternatives may include organizing a separate software business within Flotek, licensing the technology to an established software company that currently sells to the energy industry, setting up a potential joint venture, and/or selling the

technology to an analytics company. We believe our experience and vast network of contacts in the software industry will be a valuable resource to the Company and its shareholders in this regard.

Regards,

Praesidium Investment Management Company, LLC

|

|

|

|

|

|

|

|

| Kevin Oram |

|

Peter Uddo |

| Managing Director |

|

Managing Director |

Forward-Looking Statements

This letter contains “forward-looking statements” – that is, statements related to future, not past, events. In this context, forward-looking

statements address our expectations of future business and financial condition based on our analysis and assumptions, and often contain words such as “expect,” “anticipate,” “intend,” “plan,”

“believe,” “think,” “seek,” “see,” “will,” “would,” or “target.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain. Actual

future business and financial performance could differ materially from such forward-looking statements. We do not intend, nor assume any obligation, to update or revise these forward-looking statements in light of developments which differ from

those anticipated.

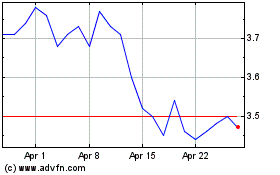

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

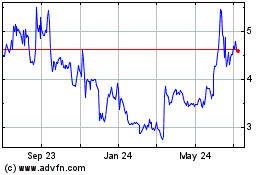

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Apr 2023 to Apr 2024