|

|

Prospectus Supplement No. 43

(to Prospectus dated May 30, 2013)

|

Filed pursuant to Rule 424(b)(4)

Registration No. 333-187508

|

125,000 Shares of Series A Convertible Preferred Stock

12,500,000 Shares of Common Stock Underlying the Preferred Stock

Warrants to Purchase up to 6,250,000 Shares of Common Stock and

6,250,000 Shares of Common Stock Underlying the Warrants

ARCA biopharma, Inc.

This prospectus supplement supplements the prospectus dated May 30, 2013 (the “Prospectus”), as supplemented by that certain Prospectus Supplement No. 1 dated July 17, 2013 (“Supplement No. 1”), by that certain Prospectus Supplement No. 2 dated July 19, 2013 (“Supplement No. 2”), by that certain Prospectus Supplement No. 3 dated July 24, 2013 (“Supplement No. 3”), by that certain Prospectus Supplement No. 4 dated July 30, 2013 (“Supplement No. 4”), by that certain Prospectus Supplement No. 5 dated August 6, 2013 (“Supplement No. 5”), by that certain Prospectus Supplement No. 6 dated September 4, 2013 (“Supplement No. 6”), by that certain Prospectus Supplement No. 7 dated September 23, 2013 (“Supplement No. 7”), by that certain Prospectus Supplement No. 8 dated October 29, 2013 (“Supplement No. 8”), by that certain Prospectus Supplement No. 9 dated November 6, 2013 (“Supplement No. 9”), by that certain Prospectus Supplement No. 10 dated November 13, 2013 (“Supplement No. 10”), by that certain Prospectus Supplement No. 11 dated November 21, 2013 (“Supplement No. 11”), by that certain Prospectus Supplement No. 12 dated December 5, 2013 (“Supplement No. 12”), by that certain Prospectus Supplement No. 13 dated January 8, 2014 (“Supplement No. 13”), by that certain Prospectus Supplement No. 14 dated February 10, 2014 (“Supplement No. 14”), by that certain Prospectus Supplement No. 15 dated February 12, 2014 (“Supplement No. 15”), by that certain Prospectus Supplement No. 16 dated February 18, 2014 (“Supplement No. 16”), by that certain Prospectus Supplement No. 17 dated March 3, 2014 (“Supplement No. 17”), by that certain Prospectus Supplement No. 18 dated March 20, 2014 (“Supplement No. 18”), by that certain Prospectus Supplement No. 19 dated May 13, 2014 (“Supplement No. 19”), by that certain Prospectus Supplement No. 20 dated June 9, 2014 (“Supplement No. 20”), by that certain Prospectus Supplement No. 21 dated August 13, 2014 (“Supplement No. 21”), by that certain Prospectus Supplement No. 22 dated August 18, 2014 (“Supplement No. 22”), by that certain Prospectus Supplement No. 23 dated November 12, 2014 (“Supplement No. 23”), by that certain Prospectus Supplement No. 24 dated December 1, 2014 (“Supplement No. 24”), by that certain Prospectus Supplement No. 25 dated December 10, 2014 (“Supplement No. 25”), by that certain Prospectus Supplement No. 26 dated December 11, 2014 (“Supplement No. 26”), by that certain Prospectus Supplement No. 27 dated December 30, 2014 (“Supplement No. 27”), by that certain Prospectus Supplement No. 28 dated February 4, 2015 (“Supplement No. 28”), by that certain Prospectus Supplement No. 29 dated February 17, 2015 (“Supplement No. 29”), by that certain Prospectus Supplement No. 30 dated February 23, 2015 (“Supplement No. 30”), by that certain Prospectus Supplement No. 31 dated March 16, 2015 (“Supplement No. 31”), by that certain Prospectus Supplement No. 32 dated March 19, 2015 (“Supplement No. 32”), by that certain Prospectus Supplement No. 33 dated April 13, 2015 (“Supplement No. 33”), by that certain Prospectus Supplement No. 34 dated April 14, 2015 (“Supplement No. 34”), by that certain Prospectus Supplement No. 35 dated May 12, 2015 (“Supplement No. 35”), by that certain Prospectus Supplement No. 36 dated June 5, 2015 (“Supplement No. 36”), by that certain Prospectus Supplement No. 37 dated June 11, 2015 (“Supplement No. 37”), and by that certain Prospectus Supplement No. 38 dated June 11, 2015 (“Supplement No. 38), by that certain Prospectus Supplement No. 39 dated June 23, 2015 (“Supplement No. 39”), by that certain Prospectus Supplement No. 40 dated July 16, 2015 (“Supplement No. 40”), and by that certain Prospectus Supplement No. 41 dated August 11, 2015 (“Supplement No. 41”), and by that certain Prospectus Supplement No. 42 dated September 3, 2015 (“Supplement No. 42, and together with Supplement No. 1, Supplement No. 2, Supplement No. 3, Supplement No. 4, Supplement No. 5, Supplement No. 6, Supplement No. 7, Supplement No. 8, Supplement No. 9, Supplement No. 10, Supplement No. 11, Supplement No. 12, Supplement No. 13, Supplement No. 14, Supplement No. 15, Supplement No. 16, Supplement No. 17, Supplement No. 18, Supplement No. 19, Supplement No. 20, Supplement No. 21, Supplement No. 22, Supplement No. 23, Supplement No. 24, Supplement No. 25, Supplement No. 26, Supplement No. 27, Supplement No. 28, Supplement No. 29, Supplement No. 30, Supplement No. 31, Supplement No. 32, Supplement No. 33, Supplement No. 34, Supplement No. 35, Supplement No. 36, Supplement No. 37, Supplement No. 38, Supplement No. 39, Supplement No. 40, and Supplement No. 41, the “Supplements”), which form a part of our Registration Statement on Form S-1 (Registration No. 333-187508). This prospectus supplement is being filed to update and supplement the information in the Prospectus and the Supplements with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission (the “Commission”) on September 9, 2015 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus, the Supplements and this prospectus supplement relate to the offer and sale of up to 125,000 shares of Series A Convertible Preferred Stock (“Preferred Stock”) which are convertible into 12,500,000 shares of Common Stock, warrants to purchase up to 6,250,000 shares of our Common Stock and 6,250,000 shares of Common Stock underlying the warrants.

This prospectus supplement should be read in conjunction with the Prospectus and the Supplements. This prospectus supplement updates and supplements the information in the Prospectus and the Supplements. If there is any inconsistency between the information in the Prospectus, the Supplements and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our common stock is traded on the Nasdaq Global Market under the trading symbol “ABIO.” On September 9, 2015, the last reported sale price of our common stock was $6.64 per share.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 5 of the Prospectus and beginning on page 21 of our quarterly report on Form 10-Q for the period ended June 30, 2015 before you decide whether to invest in shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is September 9, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 9, 2015 (September 9, 2015)

ARCA biopharma, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware |

000-22873 |

36-3855489 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

11080 CirclePoint Road, Suite 140, Westminster, CO 80020

(Address of Principal Executive Offices) (Zip Code)

(720) 940-2200

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

£ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

£ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

£ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

£ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 8 — Other Events

On September 9, 2015, ARCA biopharma, Inc. (“ARCA”) announced that the paper “Bucindolol Prevents Atrial Flutter via the Beta-1 389 Arg/Gly Adrenergic Receptor Polymorphism” will be presented at the 19th Annual Scientific Meeting of the Heart Failure Society of America (HFSA) to be held in Washington, D.C. September 26-29, 2015. The press release is furnished as Exhibit 99.1 hereto, the contents of which are incorporated herein by reference.

Section 9 — Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

Exhibit Number |

|

Description |

|

|

|

|

99.1 |

|

Press Release titled “GencaroTM Potential Efficacy Preventing Atrial Flutter in Heart Failure Paper to be Presented at 2015 HFSA Annual Scientific Meeting” dated September 9, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Dated: September 9, 2015 |

|

|

|

|

|

|

ARCA biopharma, Inc. |

|

|

(Registrant) |

|

|

|

|

|

|

By: |

/s/ Christopher D. Ozeroff |

|

|

|

Name: |

Christopher D. Ozeroff |

|

|

|

Title: |

Senior Vice President and General Counsel |

INDEX TO EXHIBITS

|

|

|

|

|

Exhibit Number |

|

Description |

|

|

|

|

99.1 |

|

Press Release titled “GencaroTM Potential Efficacy Preventing Atrial Flutter in Heart Failure Paper to be Presented at 2015 HFSA Annual Scientific Meeting” dated September 9, 2015.

|

|

|

|

|

Exhibit 99.1

gencaroTM potential efficacy preventing atrial flutter in Heart failure paper to be presented at 2015 HFSA aNNUAL SCIENTIFIC meeting

--------------------------------------------------------------------------------------------------

The Paper, Which Describes Pharmacogenetic Enhancement of Effectiveness for Prevention of Atrial Flutter, Was Also Published in the Journal of Cardiac Failure

Westminster, CO, September 9, 2015 – ARCA biopharma, Inc. (Nasdaq: ABIO), a biopharmaceutical company developing genetically-targeted therapies for cardiovascular diseases, today announced that the paper “Bucindolol Prevents Atrial Flutter via the Beta-1 389 Arg/Gly Adrenergic Receptor Polymorphism” will be presented at the 19th Annual Scientific Meeting of the Heart Failure Society of America (HFSA) to be held in Washington, D.C. September 26-29, 2015. The paper was recently published in the Journal of Cardiac Failure [http://www.onlinejcf.com/article/S1071-9164(15)00366-8/fulltext], the official journal of the Heart Failure Society of America and the Japanese Heart Failure Society. The lead author on the paper is cardiologist-electrophysiologist Ryan G. Aleong of the University of Colorado, Anschutz Medical Campus, and a co-author on the paper is Dr. Michael R. Bristow, the Company’s Chief Executive Officer.

Based on prior data from the Beta-Blocker Evaluation of Survival Trial (BEST) which suggested that Gencaro (bucindolol hydrochloride) decreased incident atrial fibrillation (AF) in patients with heart failure with reduced left ventricular ejection fraction (HFREF), the authors sought to investigate whether bucindolol prevented atrial flutter (AFL) to the same degree as AF in BEST. The author’s retrospective analysis was performed on data from BEST, which enrolled 2,708 NYHA class III or IV patients and included a 1,040 patient DNA substudy that genotyped patients for the β1 -AR 389 Arg/Gly polymorphism.

The author’s results indicated that in BEST there were 17 patients with AFL and 303 patients with AF on their pre-randomization baseline electrocardiogram (ECG). In patients with baseline AFL, bucindolol was associated with a higher rate of reversion to sinus rhythm compared to placebo (bucindolol 8/9 (89%) vs. placebo 2/8 (25%); p = 0.0075). In patients who entered the trial not in AF or AFL, there were a total of 45 incident episodes of AFL during the trial, with fewer new onset AFL cases in the bucindolol group [bucindolol 17/1193 (1.4%) vs. Placebo 28/1182 (2.4%); HR = 0.55 (95% CI 0.30, 1.01)]. This prevention of AFL was similar to previous reports of AF prevention by bucindolol and, therefore, AF and AFL were grouped into one endpoint (AFL/AF). There was significantly less new onset AFL/AF with bucindolol compared to placebo [bucindolol 88/1193 (7.4%) vs. placebo 137/1182 (11.6%); HR 0.58 (95% CI 0.45, 0.76)]. In the BEST DNA substudy, prevention of AFL/AF was observed exclusively in the β1 Arg/Arg subgroup [HR 0.29(0.14,0.60)] compared to the β1 Gly carrier group [HR 0.91 (0.53, 1.56)] with a significant interaction between the genotype and treatment (p = 0.019).

The authors concluded: “Bucindolol appears to prevent atrial flutter to a similar degree and by a similar mechanism as atrial fibrillation and, therefore, grouping atrial flutter with atrial fibrillation appears to be a legitimate endpoint in HFREF AF prevention trials.”

Atrial Flutter (AFL)

Atrial flutter is the second most common abnormal heart rhythm, or tachyarrhythmia, after atrial fibrillation. The condition is a type of supraventricular (above the ventricles) tachycardia (rapid heartbeat). In AFL, the upper chambers, or atria, of the heart beat too fast, which results in atrial muscle contractions that are faster than and out of sync with the lower chambers, or ventricles. AFL itself is not life threatening. If left untreated, the side effects of AFL can be potentially life threatening. Without treatment, AFL can also cause another type of arrhythmia called atrial fibrillation, the most common type of abnormal heart rhythm. Approximately 200,000 new cases of atrial flutter are estimated to be diagnosed in the United States each year.

About ARCA biopharma

ARCA biopharma is dedicated to developing genetically-targeted therapies for cardiovascular diseases. The Company's lead product candidate, GencaroTM (bucindolol hydrochloride), is an investigational, pharmacologically unique beta-blocker and mild vasodilator being developed for atrial fibrillation. ARCA has identified common genetic variations that it believes predict individual patient response to Gencaro, giving it the potential to be the first genetically-targeted atrial fibrillation prevention treatment. ARCA has a collaboration with Medtronic, Inc. for support of the GENETIC-AF trial. For more information please visit www.arcabiopharma.com.

Safe Harbor Statement

This press release contains "forward-looking statements" for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements regarding, potential timing for patient enrollment in the GENETIC-AF trial, potential timeline for GENETIC-AF trial activities, the sufficiency of the Company’s capital to support its operations, the potential for genetic variations to predict individual patient response to Gencaro, Gencaro’s potential to treat atrial fibrillation, Gencaro’s potential efficacy in treating atrial flutter, future treatment options for patients with atrial fibrillation or atrial flutter, and the potential for Gencaro to be the first genetically-targeted atrial fibrillation prevention treatment. Such statements are based on management's current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors, including, without limitation, the risks and uncertainties associated with: the Company's financial resources and whether they will be sufficient to meet the Company's business objectives and operational requirements; results of earlier clinical trials may not be confirmed in future trials, the protection and market exclusivity provided by the Company’s intellectual property; risks related to the drug discovery and the regulatory approval process; and, the impact of competitive products and technological changes. These and other factors are identified and described in more detail in ARCA’s filings with the SEC, including without limitation the Company’s annual report on Form 10-K for the year ended December 31, 2014, and subsequent filings. The Company disclaims any intent or obligation to update these forward-looking statements.

Investor & Media Contact:

Derek Cole

720.940.2163

derek.cole@arcabiopharma.com

###

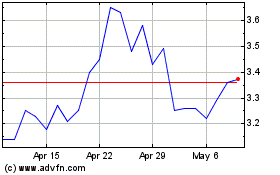

ARCA Biopharma (NASDAQ:ABIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

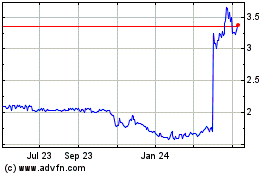

ARCA Biopharma (NASDAQ:ABIO)

Historical Stock Chart

From Apr 2023 to Apr 2024