|

|

UNITED STATES |

|

|

|

SECURITIES AND EXCHANGE COMMISSION |

|

|

|

Washington, D.C. 20549 |

|

|

|

|

|

|

|

SCHEDULE 13D/A |

|

Under the Securities Exchange Act of 1934

(Amendment No. 6 for James A. Dal Pozzo,

Amendment No. 9 for The Jacmar Companies and

Amendment No. 1 for the William Tilley Marital Trust)*

(Name of Issuer)

Common Stock, no par value per share

(Title of Class of Securities)

(CUSIP Number)

James A. Dal Pozzo

The Jacmar Companies

2200 W. Valley Blvd.

Alhambra, California 91803

(626) 576-0737

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. o

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 09180C 10 6 |

|

|

|

|

1 |

Name of Reporting Persons

The Jacmar Companies |

|

|

|

|

2 |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

x |

|

|

|

(b) |

o |

|

|

|

|

3 |

SEC Use Only |

|

|

|

|

4 |

Source of Funds (See Instructions)

WC |

|

|

|

|

5 |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6 |

Citizenship or Place of Organization

California |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

350,000 |

|

|

|

8 |

Shared Voting Power

None |

|

|

|

9 |

Sole Dispositive Power

350,000 |

|

|

|

10 |

Shared Dispositive Power

None |

|

|

|

|

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

350,000 shares |

|

|

|

|

12 |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13 |

Percent of Class Represented by Amount in Row (11)

1.37%(1) |

|

|

|

|

14 |

Type of Reporting Person (See Instructions)

CO |

|

|

|

|

|

|

(1) Based on 25,599,270 shares of BJ’s Restaurants, Inc. Common Stock outstanding as of July 31, 2015, as reported in BJ’s Restaurants’ Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2015.

2

|

CUSIP No. 09180C 10 6 |

|

|

|

|

1 |

Name of Reporting Persons

William Tilley Marital Trust |

|

|

|

|

2 |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

x |

|

|

|

(b) |

o |

|

|

|

|

3 |

SEC Use Only |

|

|

|

|

4 |

Source of Funds (See Instructions)

PF and WC |

|

|

|

|

5 |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6 |

Citizenship or Place of Organization

United States |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

350,000 |

|

|

|

8 |

Shared Voting Power

None |

|

|

|

9 |

Sole Dispositive Power

350,000 |

|

|

|

10 |

Shared Dispositive Power

None |

|

|

|

|

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

350,000 shares |

|

|

|

|

12 |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13 |

Percent of Class Represented by Amount in Row (11)

1.37%(1) |

|

|

|

|

14 |

Type of Reporting Person (See Instructions)

OO |

|

|

|

|

|

|

(1) Based on 25,599,270 shares of BJ’s Restaurants, Inc. Common Stock outstanding as of July 31, 2015, as reported in BJ’s Restaurants’ Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2015.

3

|

CUSIP No. 09180C 10 6 |

|

|

|

|

1 |

Name of Reporting Persons

James A. Dal Pozzo |

|

|

|

|

2 |

Check the Appropriate Box if a Member of a Group (See Instructions) |

|

|

|

(a) |

x |

|

|

|

(b) |

o |

|

|

|

|

3 |

SEC Use Only |

|

|

|

|

4 |

Source of Funds (See Instructions)

PF |

|

|

|

|

5 |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o |

|

|

|

|

6 |

Citizenship or Place of Organization

United States |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

51,021 |

|

|

|

8 |

Shared Voting Power

965,400 (1) |

|

|

|

9 |

Sole Dispositive Power

51,021 |

|

|

|

10 |

Shared Dispositive Power

965,400 (1) |

|

|

|

|

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,016,421 shares |

|

|

|

|

12 |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13 |

Percent of Class Represented by Amount in Row (11)

3.97% (2) |

|

|

|

|

14 |

Type of Reporting Person (See Instructions)

IN |

|

|

|

|

|

|

(1) The reporting person expressly disclaims beneficial ownership with respect to all shares held by The Jacmar Companies except to the extent of the reporting person’s pecuniary interest therein and expressly disclaims beneficial ownership with respect to all shares held by the William Tilley Marital Trust, the 2012 John Tilley Trust, the 2012 Nicole Tilley Trust and the William Tilley Family Foundation.

(2) Based on 25,599,270 shares of BJ’s Restaurants, Inc. Common Stock outstanding as of July 31, 2015, as reported in BJ’s Restaurants’ Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2015.

4

CUSIP No. 09180C 10 6

This statement relating to BJ’s Restaurants, Inc. a California corporation (“BJ Restaurants”), is being filed as (1) Amendment No. 6 to Schedule 13D to amend the Schedule 13D filed by James A. Dal Pozzo with the Securities and Exchange Commission on February 22, 2002, as amended by Amendment No. 1 thereto filed with the Securities and Exchange Commission on January 10, 2003, Amendment No. 2 thereto field with the Securities and Exchange Commission on January 22, 2004, Amendment No. 3 thereto filed with the Securities and Exchange Commission on May 10, 2005, Amendment No. 4 thereto filed with the Securities and Exchange Commission on June 16, 2009 and Amendment No. 5 thereto filed with the Securities and Exchange Commission on February 17, 2015; (2) Amendment No. 9 to Schedule 13D to amend the Schedule 13D filed by The Jacmar Companies with the Securities and Exchange Commission on December 21, 2000, as amended by Amendment No. 1 thereto filed with the Securities and Exchange Commission on January 29, 2001; Amendment No. 2 thereto filed with the Securities and Exchange Commission on May 14, 2001, Amendment No. 3 thereto filed with the Securities and Exchange Commission on February 22, 2002, Amendment No. 4 thereto filed with the Securities and Exchange Commission on January 10, 2003, Amendment No. 5 thereto filed with the Securities and Exchange Commission on January 22, 2004, Amendment No. 6 thereto filed with the Securities and Exchange Commission on May 10, 2005, Amendment No. 7 thereto filed with the Securities and Exchange Commission on June 16, 2009 and Amendment No. 8 thereto filed with the Securities and Exchange Commission on February 17, 2015; and (3) Amendment No. 1 to Schedule 13D to amend the Schedule 13D filed by the William Tilley Marital Trust with the Securities and Exchange Commission on February 17, 2015. The Schedule 13D filed by The Jacmar Companies with the Securities and Exchange Commission on December 21, 2000 was filed to amend the Schedule 13G filed by The Jacmar Companies with the Securities and Exchange Commission on August 10, 2000, as amended by Amendment No. 1 thereto filed with the Securities and Exchange Commission on August 30, 2000 and Amendment No. 2 thereto filed with the Securities and Exchange Commission on December 5, 2000.

Except as specifically provided herein, this statement does not modify any of the information previously reported in the foregoing Amendments to Schedule 13D.

Item 1. Security and Issuer.

This statement relates to shares of BJ’s Restaurant common stock, no par value per share (“BJ’s Restaurants Common Stock”). The principal executive offices of BJ’s Restaurants are located at 7755 Center Avenue, Suite 300, Huntington Beach, CA 92647.

Item 2. Identity and Background.

(a)-(c), (f) The Jacmar Companies is a California corporation. The Jacmar Companies’ address is 2200 W. Valley Blvd., Alhambra, California 91803. The principal business of The Jacmar Companies is operating a specialty wholesale foodservice distributor serving Central and Southern California, operating various restaurants, performing property management services and making investments.

The William Tilley Marital Trust beneficially owns 67.6% of The Jacmar Companies’ outstanding stock. James A. Dal Pozzo and Gregory D. Snyder are co-trustees of the William Tilley Marital Trust. Its business address is 2200 W. Valley Blvd., Alhambra, California 91803.

Mr. Dal Pozzo is a director of BJ’s Restaurants and is the Chairman and CEO of The Jacmar Companies. Mr. Dal Pozzo also beneficially owns 9.3% of The Jacmar Companies’ outstanding stock. His business address is 2200 W. Valley Blvd., Alhambra, California 91803.

The Jacmar Companies, the William Tilley Marital Trust and Mr. Dal Pozzo are referred to herein collectively as the “Filing Parties.” The Filing Parties may be deemed to constitute a “group” for purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have entered into a Joint Filing Agreement, a copy of which is attached hereto as Exhibit 1, to file this statement jointly in accordance with the provisions of Rule 13d-1(k) (1) of the Exchange Act.

Set forth below is a list of the directors and executive officers of The Jacmar Companies, each of whom is a citizen of the United States. Unless otherwise listed, each person’s present principal occupation or employment is as an officer or director of The Jacmar Companies, and unless otherwise noted, the principal business address of each officer and director is that of The Jacmar Companies.

5

CUSIP No. 09180C 10 6

Executive Officers and Directors of The Jacmar Companies:

James A. Dal Pozzo, Chairman and CEO

Robert R. Hill, Director

Individual Investor

Tom Simms, Director

Individual Investor

James P. Birdwell, Director

Principal and Executive V.P. of Reed, Conner & Birdwell, LLC

11111 Santa Monica Blvd.

Los Angeles, California 90025

Donald P. Newell, Director

Individual Investor

Gregory Snyder

Senior Partner

Rose, Snyder & Jacobs

15821 Ventura Blvd., Suite 490

Encino, California 91436

John Tilley

Independent Real Estate Investor

2200 W. Valley Blvd.

Alhambra, California 91803

Robert E. Burwell

Member of Mintz, Levin, Cohn, Ferris, Glovsky & Popeo, P.C.

44 Montgomery St, 36th Floor

San Francisco, CA 94104

(d)-(e) During the last five years, none of the persons named in this Item 2 has been (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of the proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration.

The information set forth in Item 5 is incorporated herein by reference.

Item 4. Purpose of Transaction.

Each of the persons named in Item 2 acquired its shares of BJ’s Restaurants Common Stock for investment purposes. Mr. Dal Pozzo was initially elected to the BJ’s Restaurants board of directors on January 18, 2001 in connection with the purchase of 2,206,500 shares of BJ’s Restaurants Common Stock by BJ Chicago, LLC, an affiliate of The Jacmar Companies, which subsequently distributed its BJ’s Restaurants Common Stock to its members and was dissolved. Mr. Dal Pozzo has been re-elected to the BJ’s Restaurants board each year since his initial appointment, but there is no arrangement or understanding between BJ’s Restaurants and any stockholder requiring the BJ’s Restaurants board to nominate Mr. Dal Pozzo for re-election.

Each of the persons named in Item 2 intends to monitor and evaluate its direct and indirect investments in BJ’s Restaurants on a continuing basis. Based upon their evaluations from time to time, they may acquire additional shares of BJ’s Restaurants Common Stock, dispose of shares of BJ’s Restaurants Common Stock they beneficially own, submit one or more proposals for the consideration of management of BJ’s Restaurants, and/or communicate with other shareholders of BJ’s Restaurants.

6

CUSIP No. 09180C 10 6

Except as set forth above, none of the persons named in Item 2 has any plans or proposals that relate to or would result in any of the matters referred to in paragraphs (a) through (j), inclusive, of Item 4 of Schedule 13D. The persons named in Item 2, however, may at any time and from time to time, review or reconsider their positions with respect to any of such matters.

Item 5. Interest in Securities of the Issuer.

(a)-(b) The Jacmar Companies beneficially owns 350,000 shares of BJ’s Restaurants Common Stock. The shares of BJ’s Restaurants Common Stock beneficially owned by The Jacmar Companies represent approximately 1.37% of the issued and outstanding shares of BJ’s Restaurants Common Stock, based on 25,599,270 shares of BJ’s Restaurants Common Stock outstanding as of July 31, 2015, as reported in BJ’s Restaurants’ Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2015. The shares are held directly by The Jacmar Companies, and The Jacmar Companies has sole voting and dispositive power over such shares.

The William Tilley Marital Trust beneficially owns 350,000 shares of BJ’s Restaurants Common Stock. The shares of BJ’s Restaurants Common Stock beneficially owned by the William Tilley Marital Trust represent approximately 1.37% of the issued and outstanding shares of BJ’s Restaurants Common Stock, based on 25,599,270 shares of BJ’s Restaurants Common Stock outstanding as of July 31, 2015, as reported in BJ’s Restaurants’ Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2015. The shares are held directly by the William Tilley Marital Trust, and the William Tilley Marital Trust has sole voting and dispositive power over such shares.

Mr. Dal Pozzo beneficially owns 1,016,421 shares of BJ’s Restaurants Common Stock. The shares of BJ’s Restaurants Common Stock beneficially owned by Mr. Dal Pozzo represent approximately 3.97% of the issued and outstanding shares of BJ’s Restaurants Common Stock, based on 25,599,270 shares of BJ’s Restaurants Common Stock outstanding as of July 31, 2015, as reported in BJ’s Restaurants’ Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2015. The shares are beneficially owned by Mr. Dal Pozzo as follows, and unless otherwise indicated, Mr. Dal Pozzo has sole voting and dispositive power over such shares:

(1) 19,185 shares are held directly by Mr. Dal Pozzo, including 2,132 shares subject to unvested restricted stock units;

(2) 350,000 shares are held by The Jacmar Companies, of which Mr. Dal Pozzo is Chairman and Chief Executive Officer. Mr. Dal Pozzo also beneficially owns 9.3% of The Jacmar Companies’ outstanding stock. Mr. Dal Pozzo has shared voting and dispositive power over such shares;

(3) 25,400 shares are held by the William Tilley Family Foundation, of which Mr. Dal Pozzo is Secretary and a director. Mr. Dal Pozzo may be deemed to share voting and dispositive power over such shares;

(4) 350,000 shares held by the William Tilley Marital Trust, of which Mr. Dal Pozzo is a co-trustee. Mr. Dal Pozzo has shared voting and dispositive power over such shares;

(5) 120,000 shares held by the 2012 John Tilley Trust, of which Mr. Dal Pozzo is a co-trustee. Mr. Dal Pozzo has shared voting and dispositive power over such shares;

(6) 120,000 shares held by the 2012 Nicole Tilley Trust, of which Mr. Dal Pozzo is a co-trustee. Mr. Dal Pozzo has shared voting and dispositive power over such shares;

(7) 31,836 shares are subject to options that are held by Mr. Dal Pozzo directly and are currently exercisable or will become exercisable within 60 days.

Mr. Dal Pozzo disclaims beneficial ownership with respect to the 350,000 shares of BJ’s Restaurants Common Stock held by The Jacmar Companies except to the extent of his pecuniary interest therein. Mr. Dal Pozzo disclaims beneficial ownership with respect to the 350,000 shares held by the William Tilley Marital Trust, the 120,000 shares held by the John Tilley 2012 Trust, the 120,000 shares held by the Nicole Tilley 2012 Trust, and the 24,500 shares held by the William Tilley Family Foundation.

7

CUSIP No. 09180C 10 6

The officers and directors of the William Tilley Family Foundation, a non-profit charitable foundation formed under Section 501(c)(3) of the Internal Revenue Code of 1986, as amended, are as follows:

|

Name |

|

Position |

|

Nadine B. Tilley |

|

President and Director |

|

James A. Dal Pozzo |

|

Treasurer and Director |

|

Joanne Lee |

|

Secretary |

|

Gregory D. Snyder |

|

Director |

|

John J. Tilley |

|

Director |

|

Nicole R. Tilley |

|

Director |

John Tilley is an independent real estate investor, and his address is 2200 W. Valley Blvd., Alhambra, California 91803. Nadine B. Tilley and Nicole Tilley are independent investors, and their business address is 2200 W. Valley Blvd., Alhambra, California 91803.

Robert R. Hill beneficially owns 2,146 shares of BJ’s Restaurants Common Stock. The shares of BJ’s Restaurants Common Stock beneficially owned by Mr. R. Hill represent less than 0.1% of the issued and outstanding shares of BJ’s Restaurants Common Stock, John Tilley is an independent real estate investor, and his address is 2200 W. Valley Blvd., Alhambra, California 91803. Of the shares beneficially owned by Mr. R. Hill, 2,000 shares are held by Mr. R. Hill directly, over which Mr. R. Hill has sole voting and dispositive power, and 146 shares are held by Timothy Hill, Mr. R. Hill’s son. Mr. R. Hill may be deemed to share voting and dispositive power over, and disclaims beneficial ownership with respect to, the shares of BJ’s Restaurants Common Stock held by Mr. T. Hill. Mr. T. Hill is an employee of a restaurant owned by The Jacmar Companies, and his address is 346 Salta Verde Point, Long Beach, California 90803.

Tom Simms beneficially owns 20,000 shares of BJ’s Restaurants Common Stock. The shares of BJ’s Restaurants Common Stock beneficially owned by Mr. Simms represent approximately 0.1% of the issued and outstanding shares of BJ’s Restaurants Common Stock, John Tilley is an independent real estate investor, and his address is 2200 W. Valley Blvd., Alhambra, California 91803. The shares are beneficially owned by Mr. Simms through a trust of which he is sole trustee, and Mr. Simms has sole voting and dispositive power over such shares.

James P. Birdwell beneficially owns 12,000 shares of BJ’s Restaurants Common Stock. The shares of BJ’s Restaurants Common Stock beneficially owned by Mr. Birdwell represent approximately 0.1% of the issued and outstanding shares of BJ’s Restaurants Common Stock, John Tilley is an independent real estate investor, and his address is 2200 W. Valley Blvd., Alhambra, California 91803. The shares are beneficially owned by Mr. Birdwell directly, and Mr. Birdwell has sole voting and dispositive power over such shares.

Mr. Snyder is a senior partner in the accounting firm of Rose, Snyder & Jacobs and his business address is 15821 Ventura Blvd., Suite 490, Encino, California 91436.

To the knowledge of the Filing Parties, during the last five years, none of Robert R. Hill, Nadine Tilley, John Tilley, Nicole Tilley, Gregory D. Snyder or Joanne Lee has been (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of the proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(c) In August 2015, The Jacmar Companies and five trusts, all of whose beneficiaries are members of the immediate family of William Tilley and for four of which Mr. Dal Pazzo serves as co-trustee (the “Tilley Family Trusts”), contributed shares of BJ’s Restaurants Common Stock to the Rolomar Limited Partnership (the “Limited Partnership”) in exchange for a proportionate number of partnership interests in the Limited Partnership. The Limited Partnership was formed for the purpose of allowing the contributed shares of BJ’s Restaurants Common Stock to be collectively managed by an independent investment adviser who has no affiliation with BJ’s Restaurants. The general partner of the Limited Partnership is Rolomar Management, Inc., a Delaware corporation (the “Management Company”) formed and owned by the Tilley Family Trusts and the John & Nicole Rolomar Management Trust (the “Management Trust”). The Tilley Family Trusts and the Management Trust received their ownership interests in the Management Company in exchange for their contribution to the Management Company of shares of BJ’s Restaurants Common Stock. The Management Company, in turn, contributed those shares to the Limited Partnership in exchange for its partnership interest. The transactions resulting in the Limited Partnership’s ownership of BJ’s Restaurants Common Stock as reported in this Schedule 13D/A are described below.

8

CUSIP No. 09180C 10 6

Formation of the Management Trust

The Management Trust was formed by John J. Tilley and Nicole R. Tilley to facilitate the structuring of the Limited Partnership. The Management Trust’s beneficiaries are John J. Tilley and Nicole R. Tilley, and its trustee is Arthur Zaske, an independent investment adviser to the Tilley family. As of August 31, 2015, John J. Tilley transferred 13,213 shares of BJ’s Restaurants Common Stock to the Management Trust, and Nicole R. Tilley transferred 12,213 shares of BJ’s Restaurants Common Stock to the Management Trust.

Formation of the Management Company

As of August 31, 2015, the Tilley Family Trusts and the Management Trust transferred shares of BJ’s Restaurants Common Stock to the Management Company, in the following amounts, in each case in exchange for a proportionate number of shares in the Management Company:

William Tilley Marital Trust - 7,660 shares;

Nadine B. Tilley Trust - 46 shares;

John J. Tilley Trust - 130 shares;

Nicole Renee Tilley Trust - 48 shares;

William Tilley Descendants Trust - 73 shares; and

Management Trust - 25,426 shares.

Formation of the Limited Partnership

As of August 31, 2015, The Jacmar Companies and the Tilley Family Trusts contributed shares of BJ’s Restaurants Common Stock to the Limited Partnership, in the following amounts, in each case in exchange for a proportionate number of partnership interests:

Jacmar - 1,331,159 shares;

William Tilley Marital Trust - 758,322 shares;

Nadine B. Tilley Trust -4,601 shares;

John J. Tilley Trust - 12,870 shares;

Nicole Renee Tilley Trust - 4,752 shares; and

William Tilley Descendants Trust - 7,266 shares.

Also as of August 31, 2015, the Management Company transferred all 33,383 of its shares of BJ’s Restaurants Common Stock to the Limited Partnership in exchange for a partnership interest proportionate to the number of shares of BJ’s Restaurants Common Stock contributed by all of the partners of the Limited Partnership.

As a result of the foregoing transfers, (i) the Nadine B. Tilley Trust, the John J. Tilley Trust, the Nicole Renee Tilley Trust, the William Tilley Descendants Trust, and the Management Trust no longer beneficially own any shares of BJ’s Restaurants Common Stock, and (ii) The Jacmar Companies, the William Tilley Marital Trust, and Mr. Dal Pozzo beneficially own in the aggregate 1,016,421 shares of BJ’s Restaurants Common Stock, or less than 3.97% of the outstanding shares of BJ’s Restaurants Common Stock, based on 25,599,270 shares of BJ’s Restaurants Common Stock outstanding as of July 31, 2015, as reported in BJ’s Restaurants’ Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2015.

9

CUSIP No. 09180C 10 6

Arthur Zaske is the sole director and president of the Management Company. As general partner of the Limited Partnership, the Management Company has caused the Limited Partnership to enter into an Investment Advisory Agreement (the “Advisory Agreement”) with AZA Capital Management, a Michigan corporation and an independent, federally registered investment adviser (“AZA Capital”), of which Mr. Zaske is the Chief Investment Officer. As a result, Mr. Zaske through AZA Capital holds sole voting and investment power over the shares of BJ’s Restaurants Common Stock held by the Limited Partnership. Neither AZA Capital nor Mr. Zaske is affiliated with any of the entities that transferred BJ’s Restaurants Common Stock to the Management Company or the Limited Partnership as described. AZA Capital may elect to hold, dispose of or purchase shares of BJ’s Restaurants Common Stock held by the Limited Partnership at any time and from time to time in the future as it sees fit but has no current intention to engage in transactions in the BJ’s Restaurants Common Stock. The Advisory Agreement can be amended, assigned or terminated only upon 90 days prior notice by either party.

(d) Not applicable.

(e) As a result of the transfers described in Section 5(c), the reporting persons beneficially own in the aggregate 1,016,421 shares of BJ’s Restaurants Common Stock, or less than 3.97% of the outstanding shares of BJ’s Restaurants Common Stock, based on 25,599,270 shares of BJ’s Restaurants Common Stock outstanding as of July 31, 2015, as reported in BJ’s Restaurants’ Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2015.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Except for the Joint Filing Agreement attached hereto as Exhibit 1, to the knowledge of the Filing Parties, there are no contracts, arrangements, understandings or relationships (legal or otherwise) among any of the persons named in Item 2 or between any of the persons named in Item 2 and any other person with respect to any securities of BJ’s Restaurants, including, but not limited to, transfer or voting of any of the securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding of proxies.

Item 7. Material to be Filed as Exhibits.

(1) Joint Filing Agreement. (Previously filed.)

10

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

|

Dated: September 8, 2015 |

|

|

|

|

|

|

THE JACMAR COMPANIES |

|

|

|

|

|

|

By: |

/s/ JAMES A. DAL POZZO |

|

|

Name: |

James A. Dal Pozzo |

|

|

Its: |

President |

|

|

|

|

|

|

WILLIAM TILLEY MARITAL TRUST |

|

|

|

|

|

|

By: |

/s/ JAMES A. DAL POZZO |

|

|

Name: |

James A. Dal Pozzo |

|

|

|

|

|

|

JAMES A. DAL POZZO |

|

|

|

|

|

|

By: |

/s/ JAMES A DAL POZZO |

|

|

Name: |

James A. Dal Pozzo |

11

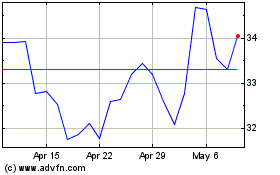

BJs Restaurants (NASDAQ:BJRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

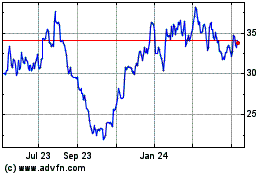

BJs Restaurants (NASDAQ:BJRI)

Historical Stock Chart

From Apr 2023 to Apr 2024