UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 4, 2015

MannKind Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-50865 |

|

13-3607736 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 28903 North Avenue Paine

Valencia, California |

|

91355 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (661) 775-5300

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. of Form 8-K):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

As previously reported, on March 3, 2014 MannKind Corporation (the “Company”) entered into an At-The-Market Issuance Sales Agreement with Meyers

Associates, L.P. (now doing business as BP Capital, a division of Meyers Associates, L.P.), and an At-The-Market Issuance Sales Agreement with MLV & Co. LLC. The foregoing agreements are collectively referred to as the “ATM

Agreements.” All offers and sale of common stock of the Company pursuant to the ATM Agreements were previously made under the Company’s Registration Statement on Form S-3 (Registration No. 333-183679) and a prospectus supplement

thereunder, which expired on August 31, 2015.

On September 4, 2015, the Company entered into an amendment to each of the ATM Agreements

(collectively, the “Amendments”) in order to specify that any future offer and sale of common stock of the Company pursuant to the ATM Agreements will be made under the Company’s Registration Statement on Form S-3 (Registration

No. 333-206778), which was filed with the Securities and Exchange Commission (“SEC”) and became automatically effective on September 4, 2015, and a prospectus supplement thereunder. Pursuant to the Amendments, the maximum

offering price of the shares of common stock that may be offered and sold, from and after the date of the Amendments, is $50.0 million under both ATM Agreements in the aggregate. The manner of offering under the ATM Agreements, as amended by the

Amendments, will continue to be any method that is deemed to be an “at-the-market offering” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, including sales made directly on or through The NASDAQ Global

Market or to or through a market maker. MLV and BP Capital may each also sell shares of common stock in negotiated transactions, subject to the Company’s approval.

The foregoing description of the Amendments does not purport to be complete and is qualified in its entirety by reference to the Amendments, copies of which

are attached to this report as Exhibits 99.1 and 99.2, and by reference to the ATM Agreements, copies of which are attached as Exhibits 10.31 and 10.32 to the Company’s Annual Report on Form 10-K filed with the SEC on March 3, 2014. A copy

of the opinion of Cooley LLP, relating to the legality of the shares of common stock issuable under the ATM Agreements, as amended by the Amendments, is filed as Exhibit 5.1 to this report.

The foregoing description of the ATM Agreements shall not constitute an offer to sell or the solicitation of an offer to buy the securities discussed above,

nor shall there be any offer, solicitation or sale of the securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 5.1 |

|

Opinion of Cooley LLP. |

|

|

| 23.1 |

|

Consent of Cooley LLP (included in Exhibit 5.1). |

|

|

| 99.1 |

|

Amendment No. 1 to At-The-Market Issuance Sales Agreement, by and between the Company and Meyers Associates, L.P. (doing business as BP Capital, a division of Meyers Associates, L.P.), dated September 4, 2015. |

|

|

| 99.2 |

|

Amendment No. 1 to At-The-Market Issuance Sales Agreement, by and between the Company and MLV & Co. LLC, dated September 4, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

| Date: September 4, 2015 |

|

MANNKIND CORPORATION |

|

|

|

|

|

By: |

|

/s/ David Thomson |

|

|

|

|

David Thomson, Ph.D., J.D. |

|

|

|

|

Corporate Vice President, General Counsel and Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 5.1 |

|

Opinion of Cooley LLP. |

|

|

| 23.1 |

|

Consent of Cooley LLP (included in Exhibit 5.1). |

|

|

| 99.1 |

|

Amendment No. 1 to At-The-Market Issuance Sales Agreement, by and between the Company and Meyers Associates, L.P. (doing business as BP Capital, a division of Meyers Associates, L.P.), dated September 3, 2015. |

|

|

| 99.2 |

|

Amendment No. 1 to At-The-Market Issuance Sales Agreement, by and between the Company and MLV & Co. LLC, dated September 3, 2015. |

Exhibit 5.1

|

|

Sean M. Clayton

T: +1 858 550 6034 sclayton@cooley.com |

September 4, 2015

MannKind Corporation

28903 North Avenue Paine

Valencia, CA 91355

Ladies and Gentlemen:

You have requested our opinion, as counsel to MannKind Corporation, a Delaware corporation (the “Company”), with respect to certain

matters in connection with the offering by the Company of the lesser of (i) $50,000,000 of shares or (ii) 25,000,000 shares of the Company’s common stock, par value $0.01 (the “Shares”), pursuant to a

Registration Statement on Form S-3 (No. 333-206778) (the “Registration Statement”), filed with the Securities and Exchange Commission (the “Commission”) under the Securities

Act of 1933, as amended (the “Act”), the prospectus included within the Registration Statement (the “Base Prospectus”), and the prospectus supplement dated September 4, 2015, filed with the

Commission pursuant to Rule 424(b) of the Rules and Regulations of the Act (the “Prospectus Supplement”). The Base Prospectus and the Prospectus Supplement are collectively referred to as the

“Prospectus.” The Shares are to be sold by the Company in accordance with (i) an At-The-Market Issuance Sales Agreement, dated March 3,

2014, as amended on September 4, 2015, between the Company and MLV & Co. LLC (the “MLV Agreement”) and (ii) an At-The-Market

Issuance Sales Agreement, dated March 3, 2014, as amended on September 4, 2015, between the Company and Meyers Associates, L.P. (doing business as BP Capital, a division of Meyers Associates, L.P.) (the “BP Capital

Agreement”), as described in the Prospectus.

In connection with this opinion, we have examined and relied upon the Registration Statement

and the Prospectus, the MLV Agreement, the BP Capital Agreement, the Company’s Amended and Restated Certificate of Incorporation, as amended, its Amended and Restated Bylaws, and the originals or copies certified to our satisfaction of such

records, documents, certificates, memoranda and other instruments as in our judgment are necessary or appropriate to enable us to render the opinion expressed below. In rendering this opinion, we have assumed the genuineness and authenticity of all

signatures on original documents; the genuineness and authenticity of all documents submitted to us as originals; the conformity to originals of all documents submitted to us as copies; and the accuracy, completeness and authenticity of certificates

of public officials.

Our opinion herein is expressed solely with respect to the General Corporation Law of the State of Delaware. Our opinion is based on

these laws as in effect on the date hereof. We express no opinion as to whether the laws of any particular jurisdiction other than that identified above are applicable to the subject matter hereof.

4401 EASTGATE MALL, SAN

DIEGO, CA 92121 T: (858) 550-6000 F: (858) 550-6420 WWW.COOLEY.COM

|

| MannKind Corporation September 4, 2015

Page Two |

On the basis of the foregoing, and in reliance thereon, we are of the opinion that the Shares, when sold and issued against

payment therefor in accordance with the MLV Agreement or the BP Capital Agreement, as applicable, the Registration Statement and the Prospectus, will be validly issued, fully paid and nonassessable.

We consent to the reference to our firm under the caption “Legal Matters” in the Prospectus and to the filing of this opinion as an exhibit to the

Company’s Current Report on Form 8-K to be filed with the Commission for incorporation by reference into the Registration Statement.

|

|

|

| Very truly yours, |

|

| Cooley LLP |

|

|

| By: |

|

/s/ Sean M. Clayton |

|

|

Sean M. Clayton |

4401 EASTGATE MALL, SAN

DIEGO, CA 92121 T: (858) 550-6000 F: (858) 550-6420 WWW.COOLEY.COM

Exhibit 99.1

MANNKIND CORPORATION

Common Stock

(par value $0.01 per

share)

Amendment No. 1 to

At-The-Market Issuance Sales Agreement

September 4, 2015

Meyers Associates, L.P.

(doing business as BP Capital, a division of Meyers Associates, L.P.)

3 Columbus Circle, 15th Floor

New York, NY 10019

Ladies and Gentlemen:

This Amendment No. 1 to At-The-Market Issuance Sales Agreement, dated as of the date first set forth above (this “Amendment”) amends that

certain At-the-Market Issuance Sales Agreement, dated as of March 3, 2014 (the “Agreement”), by and between Meyers Associates, L.P. (now doing business as BP Capital, a division of Meyers Associates, L.P.) (“BP”) and

MannKind Corporation, a Delaware corporation (the “Company”). Capitalized terms not otherwise defined in this Amendment shall have the respective meanings ascribed to them in the Agreement.

BACKGROUND

A. On March 3,

2014, the Company and BP entered into the Agreement, which provided for the issuance and sale from time to time of up to $50,000,000 of Common Stock under the Company’s registration statement on Form S-3 (Registration No. 333-183679) (the

“Old Registration Statement”).

B. The Old Registration Statement expired on the third anniversary of the effective date, which

was August 31, 2012.

C. The parties now wish to amend the Agreement in order to allow the continued offer and sale of up to

$50,000,000 of shares of Common Stock under a separate registration statement on Form S-3 (Registration No. 333-206778) (the “New Registration Statement”).

AGREEMENT

In consideration of

the foregoing, the parties hereby agree as follows:

1. Filing of New Registration Statement. The term “Registration

Statement” in the Agreement shall be deemed to mean, prior to August 31, 2015, the Old Registration Statement and from and after the date of this Amendment, the New Registration Statement. Sales under the New Registration Statement may

commence at any time after the filing of a prospectus supplement pursuant to Rule 424(b) under the Securities Act, which shall contain substantially

the same plan of distribution as contained in the prospectus supplement filed with respect to the Old Registration Statement (the “New Prospectus Supplement”). References in the

Agreement, as amended, to the “Prospectus” shall, with respect to sales made under the New Registration Statement, refer to the New Prospectus Supplement and the base prospectus dated on or about the date of this Amendment and related to

the New Registration Statement.

2. Amendment to Aggregate Offering Price. The aggregate offering price of all Placement Shares that

may be issued and sold through BP under the Agreement on or after the date of this Amendment shall be equal to $50,000,000 less the aggregate offering price of any Common Stock sold pursuant to the Concurrent Facility Agreement on or after the date

of this Amendment, and subject to the other limitations set forth in the Agreement.

3. Amendment to Concurrent Facility Agreement.

The term “Concurrent Facility Agreement” in the Agreement shall be deemed to mean, from and after the date of this Amendment, the Concurrent Facility Agreement as amended pursuant to an amendment in substantially similar form to this

Amendment, dated on or about the date hereof.

4. Representations and Warranties. The Company hereby represents and warrants that

the representations and warranties of the Company, as set forth in Section 6 of the Agreement, are true and correct as of the date of this Amendment.

5. Miscellaneous. All other terms of the Agreement shall remain in full force and effect including, without limitation, all

indemnification and contribution terms set forth therein.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

If the foregoing correctly sets forth the understanding between the Company and BP, please so

indicate in the space provided below for that purpose, whereupon this Amendment shall constitute a binding agreement between the Company and BP.

|

|

|

| Very truly yours, |

|

| MANNKIND CORPORATION |

|

|

| By: |

|

/s/ Matthew J. Pfeffer |

| Name: |

|

Matthew J. Pfeffer |

| Title: |

|

Corporate Vice President and CFO |

|

| ACCEPTED as of the date first-above written: |

|

| MEYERS ASSOCIATES, L.P.

(doing business as BP Capital, a

division of Meyers Associates, L.P.) |

|

|

| By: |

|

/s/ Todd Wyche |

| Name: |

|

Todd Wyche |

| Title: |

|

President |

Exhibit 99.2

MANNKIND CORPORATION

Common Stock

(par value $0.01 per

share)

Amendment No. 1 to

At-The-Market Issuance Sales Agreement

September 4, 2015

MLV & Co. LLC

1251 Avenue of the Americas

41st Floor

New York, NY 10020

Ladies and Gentlemen:

This Amendment No. 1 to At-The-Market Issuance Sales Agreement, dated as of the date first set forth above (this “Amendment”) amends that

certain At-the-Market Issuance Sales Agreement, dated as of March 3, 2014 (the “Agreement”), by and between MLV & Co. LLC (“MLV”) and MannKind Corporation, a Delaware corporation (the “Company”).

Capitalized terms not otherwise defined in this Amendment shall have the respective meanings ascribed to them in the Agreement.

BACKGROUND

A. On March 3, 2014, the Company and MLV entered into the Agreement, which provided for the issuance and sale from time to time of

up to $50,000,000 of Common Stock under the Company’s registration statement on Form S-3 (Registration No. 333-183679) (the “Old Registration Statement”).

B. The Old Registration Statement expired on the third anniversary of the effective date, which was August 31, 2012.

C. The parties now wish to amend the Agreement in order to allow the continued offer and sale of up to $50,000,000 of shares of Common Stock

under a separate registration statement on Form S-3 (Registration No. 333-206778) (the “New Registration Statement”).

AGREEMENT

In consideration of

the foregoing, the parties hereby agree as follows:

1. Filing of New Registration Statement. The term “Registration

Statement” in the Agreement shall be deemed to mean, prior to August 31, 2015, the Old Registration Statement and from and after the date of this Amendment, the New Registration Statement. Sales under the New Registration Statement may

commence at any time after the filing of a prospectus supplement pursuant to Rule 424(b) under the Securities Act, which shall contain substantially

the same plan of distribution as contained in the prospectus supplement filed with respect to the Old Registration Statement (the “New Prospectus Supplement”). References in the

Agreement, as amended, to the “Prospectus” shall, with respect to sales made under the New Registration Statement, refer to the New Prospectus Supplement and the base prospectus dated on or about the date of this Amendment and related to

the New Registration Statement.

2. Amendment to Aggregate Offering Price. The aggregate offering price of all Placement Shares that

may be issued and sold through MLV under the Agreement on or after the date of this Amendment shall be equal to $50,000,000 less the aggregate offering price of any Common Stock sold pursuant to the Concurrent Facility Agreement on or after the date

of this Amendment, and subject to the other limitations set forth in the Agreement.

3. Amendment to Concurrent Facility Agreement.

The term “Concurrent Facility Agreement” in the Agreement shall be deemed to mean, from and after the date of this Amendment, the Concurrent Facility Agreement as amended pursuant to an amendment in substantially similar form to this

Amendment, dated on or about the date hereof.

4. Representations and Warranties. The Company hereby represents and warrants that

the representations and warranties of the Company, as set forth in Section 6 of the Agreement, are true and correct as of the date of this Amendment.

5. Miscellaneous. All other terms of the Agreement shall remain in full force and effect including, without limitation, all

indemnification and contribution terms set forth therein.

If the foregoing correctly sets forth the understanding between the Company and

MLV, please so indicate in the space provided below for that purpose, whereupon this Amendment shall constitute a binding agreement between the Company and MLV.

|

|

|

| Very truly yours, |

|

| MANNKIND CORPORATION |

|

|

| By: |

|

/s/ Matthew J. Pfeffer |

| Name: Matthew J. Pfeffer |

| Title: Corporate Vice President and CFO |

|

| ACCEPTED as of the date first-above written: |

|

| MLV & Co. LLC |

|

|

| By: |

|

/s/ Patrice McNicoll |

| Name: |

|

Patrice McNicoll |

| Title: |

|

Chief Executive Officer |

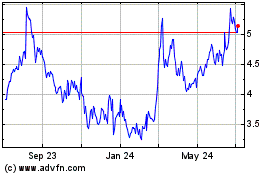

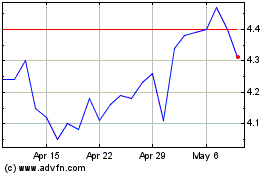

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Mar 2024 to Apr 2024

MannKind (NASDAQ:MNKD)

Historical Stock Chart

From Apr 2023 to Apr 2024