UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

(Amendment No. 1)

Check the appropriate box:

x Preliminary Information Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-5(d)(2))

¨ Definitive Information Statement

Wisdom Homes of America, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

x No fee required

¨ Fee computed on table below per Exchange Act Rules 14c-5(g) and O-11.

| 1) | Title of each class of securities to which transaction applies: |

| |

| 2) | Aggregate number of securities to which transaction applies: |

| |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule O-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| 4) | Proposed maximum aggregate value of transaction: |

| |

| 5) | Total fee paid: |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| 1) | Amount Previously Paid: |

| |

| 2) | Form, Schedule or Registration Statement No.: |

| |

| 3) | Filing Party: |

| |

| 4) | Date Filed: |

WISDOM HOMES OF AMERICA, INC.

500 North Northeast Loop 323

Tyler, TX 75708

September __, 2015

NOTICE OF ACTION BY WRITTEN CONSENT

IN LIEU OF MEETING OF STOCKHOLDERS

TO OUR SHAREHOLDERS:

This Information Statement is furnished by the Board of Directors of Wisdom Homes of America, Inc., a Nevada corporation (the "Company"), to holders of record of the Company's common stock, $0.001 par value per share, at the close of business on August 25, 2015. The purpose of this Information Statement is to inform the Company's stockholders of certain actions taken by the written consent of the holders of a majority of the Company's common stock, dated as of August 25, 2015. This Information Statement shall be considered the notice required under Section 78.370 of the Nevada Revised Statutes. This Information Statement provides notice that the Board of Directors has recommended and approved, and holders of a majority of the voting power of our outstanding common stock have approved, the following items:

1. To approve an amendment to the Company's Articles of Incorporation to increase the authorized common stock from 300,000,000 shares, par value $0.001, to 900,000,000 shares, par value $0.001 (the "Increase in Authorized Amendment"); and

2. To approve an amendment to the Company's Articles of Incorporation to effectuate a reverse split of the Company's issued and outstanding shares of common stock, at a time to be chosen by the Board of Directors in their sole discretion but not later than the close of business on December 31, 2016, on a ratio to be determined by the Company's Board of Directors but not to exceed 1-for-50 (the "Reverse Split Amendment").

The Increase in Authorized Amendment will become effective on or about September __, 2015. The Reverse Split Amendment will become effective at a date to be determined by the Board of Directors in their sole discretion but not later than the close of business on December 31, 2016. Both items are more fully described in the Information Statement accompanying this Notice.

Under the rules of the Securities and Exchange Commission, the above actions cannot become effective until at least 20 days after the accompanying Information Statement has been distributed to the stockholders of the Company.

This is not a notice of a special meeting of stockholders and no stockholder meeting will be held to consider any matter that will be described herein.

| | By Order of the Board of Directors | |

| | | | |

| September __, 2015 | By | | |

| Tyler, Texas | | James Pakulis, President | |

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

INFORMATION STATEMENT

INFORMATION STATEMENT PURSUANT TO SECTION 14C OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT HAVE BEEN APPROVED BY HOLDERS OF A MAJORITY OF OUR COMMON STOCK. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THERE ARE NO DISSENTERS' RIGHTS WITH RESPECT TO THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT.

INTRODUCTION

This Information Statement is being mailed or otherwise furnished to the holders of common stock, $0.001 par value per share (the "Common Stock") of Wisdom Homes of America, Inc., a Nevada corporation (the "Company") by the Board of Directors to notify them about certain actions that the holders of a majority of the Company's outstanding Common Stock (the "Majority Stockholders") have taken by written consent, in lieu of a special meeting of the stockholders. The action was taken on August 25, 2015.

Copies of this Information Statement are first being sent on or before September __, 2015 to the holders of record on August 25, 2015 of the outstanding shares of the Company's Common Stock.

General Information

Stockholders of the Company owning a majority of the Company's outstanding Common Stock have approved the following actions (the "Actions") by written consent dated August 25, 2015, in lieu of a special meeting of the stockholders:

| 1. | To approve an amendment to the Company's Articles of Incorporation to increase the authorized Common Stock from 300,000,000 shares, par value $0.001, to 900,000,000 shares, par value $0.001 (the "Increase in Authorized Amendment"); and |

| | |

| 2. | To approve an amendment to the Company's Articles of Incorporation to effectuate a reverse split of the Company's issued and outstanding shares of Common Stock, at a time to be chosen by the Board of Directors in their sole discretion but not later than the close of business on December 31, 2016, on a ratio to be determined by the Company's Board of Directors but not to exceed 1-for-50 (the "Reverse Split Amendment"). |

The Company has asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of the Common Stock held of record by such persons and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

Dissenters' Right of Appraisal

No dissenters' or appraisal rights under the Nevada Revised Statutes ("NRS") are afforded to the Company's stockholders as a result of the approval of the Actions.

Vote Required

The vote which was required to approve each of the above Actions was the affirmative vote of the holders of a majority of the Company's voting stock. Each holder of Common Stock is entitled to one (1) vote for each share of Common Stock held.

The record date for purposes of determining the number of outstanding shares of voting stock of the Company, and for determining stockholders entitled to vote, was the close of business on August 25, 2015 (the "Record Date"). As of the Record Date, the Common Stock was the Company's only issued and outstanding class of voting stock. As of the Record Date, the Company had outstanding 80,555,383 shares of Common Stock. Holders of the Common Stock have no preemptive rights. All outstanding shares are fully paid and nonassessable.

Transfer Agent

The transfer agent for our Common Stock is Empire Stock Transfer, Inc., 1859 Whitney Mesa Drive, Henderson, Nevada 89014, telephone (702) 818-5898.

Vote Obtained Section 78.320 Nevada Revised Statutes

NRS 78.320 provides that the written consent of the holders of the outstanding shares of voting stock, having not less than the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted, may be substituted for such a meeting.

In order to eliminate the costs and management time involved in soliciting and obtaining proxies to approve the Actions and in order to effectuate the Actions as early as possible in order to accomplish the purposes of the Company as hereafter described, the Board of Directors of the Company voted to utilize, and did in fact obtain, the written consent of the holders of a majority of the voting power of the Company. The consenting shareholders own in the aggregate approximately 50.4% of the outstanding voting stock.

Pursuant to NRS 78.370, the Company is required to provide prompt notice of the taking of the corporate action without a meeting to the stockholders of record who have not consented in writing to such action. This Information Statement is intended to provide such notice.

ACTION ONE AMENDMENT TO THE COMPANY'S ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED COMMON STOCK

General

On August 20, 2015, the Board of Directors of the Company approved, declared it advisable and in the Company's best interest and directed that there be submitted to the holders of a majority of the Company's voting stock for approval, the prospective amendment to the Third Article of the Company's Articles of Incorporation to increase the authorized Common Stock from 300,000,000 shares, par value $0.001, to 900,000,000 shares, par value $0.001 (the "Increase in Authorized Amendment"), a copy of which is attached hereto as Exhibit A. On August 25, 2015, the Majority Stockholders approved the Increase in Authorized Amendment by written consent, in lieu of a special meeting of the stockholders.

Reasons for the Increase in Authorized Amendment

Currently, the Company is authorized to issue 300,000,000 shares of Common Stock. Of the 300,000,000 shares of Common Stock authorized, as of the Record Date, there were 80,555,383 shares of Common Stock issued and outstanding, and over 800,000,000 shares of Common Stock reserved for issuance upon the exercise of outstanding convertible debt, warrants, and options. Consequently, in the event of the conversion of one or more convertible notes, the Company would not have sufficient authorized but unissued shares of Common Stock to honor the conversions.

As a general matter, the Board of Directors does not believe the currently available number of unissued shares of Common Stock is an adequate number of shares to assure that there will be sufficient shares available for issuance in connection with possible future acquisitions, equity and equity-based financings, possible future awards under employee benefit plans, stock dividends, stock splits, and other corporate purposes. Therefore, the Board of Directors and Majority Stockholders approved the increase in authorized shares of Common Stock as a means of providing the Company with the flexibility to act with respect to the issuance of Common Stock or securities exercisable for, or convertible into, Common Stock in circumstances which they believe will advance the interests of the Company and its stockholders without the delay of seeking an amendment to the Certificate of Incorporation at that time.

The Board of Directors is considering, and will continue to consider, various financing options, including the issuance of Common Stock or securities convertible into Common Stock from time to time to raise additional capital necessary to support future growth of the Company. As a result of the Increase in Authorized Amendment, the Board of Directors will have more flexibility to pursue opportunities to engage in possible future capital market transactions involving Common Stock or securities convertible into Common Stock, including, without limitation, public offerings or private placements of such Common Stock or securities convertible into Common Stock. There are no specific financing transactions under consideration at this time.

In addition, the Company's growth strategy may include the pursuit of selective acquisitions to execute its business plan. The Company could also use the additional Common Stock for potential strategic transactions, including, among other things, acquisitions, spin-offs, strategic partnerships, joint ventures, restructurings, divestitures, business combinations and investments. There are no specific acquisitions under consideration at this time.

ACTION TWO

AMENDMENT TO THE COMPANY'S ARTICLES OF INCORPORATION

TO INCREASE THE AUTHORIZED COMMON STOCK

General

On August 20, 2015, the Board of Directors of the Company approved, declared it advisable and in the Company's best interest and directed that there be submitted to the holders of a majority of the Company's voting stock for approval, the prospective amendment to the Third Article of the Company's Articles of Incorporation to effectuate a reverse split of the Company's issued and outstanding shares of Common Stock, at a time to be chosen by the Board of Directors in their sole discretion but not later than the close of business on December 31, 2016, on a ratio to be determined by the Company's Board of Directors but not to exceed 1-for-50 (the "Reverse Split Amendment"). Fractional shares will be rounded up to the next whole share. On August 25, 2015, the Majority Stockholders approved the Reverse Split Amendment by written consent, in lieu of a special meeting of the stockholders.

Reasons for the Reverse Split Amendment

The Board of Directors of the Company and the Majority Stockholders believe that it is advisable and in the Company's best interest to effectuate a reverse stock split of the issued and outstanding shares of Common Stock at a ratio of up to 1-for-50 shares (the "Reverse Split") in order to provide the Company flexibility to use its Common Stock for potential future transactions, as well as to provide adequate authorized but unissued Common Stock upon the conversion for all of the currently outstanding promissory notes, as well as the exercise of all the currently outstanding options, warrants, and other convertible instruments. Currently, over 800,000,000 shares of Common Stock are reserved for issuance upon the exercise of outstanding convertible debt, warrants, and options. Additionally, authorized but unissued shares will be available for issuance from time to time by the Company in the discretion of the Board of Directors, normally without further stockholder action (except as may be required for a particular transaction by applicable law, requirements of regulatory agencies or by stock exchange rules), for any proper corporate purpose including, among other things, future acquisitions of property or securities of other corporations, stock dividends, stock splits, stock options, convertible debt and equity financing. This step is necessary, in the judgment of the Board of Directors, in order to meet existing contractual obligations to the holders of convertible instruments, attract potential new equity capital, explore potential acquisitions and carry out the Company's business objectives.

In approving the Reverse Split, the Board of Directors and the Majority Stockholders also considered certain factors concerning the Common Stock, including:

| | · | because of their increased volatility: |

| | | |

| | | · | some investors are reluctant to purchase lower priced securities; |

| | | | |

| | | · | brokerage firms are generally reluctant to recommend lower priced securities to their clients; and |

| | | | |

| | | · | most investment funds are reluctant to invest in lower priced securities; moreover, many funds are not permitted by their investment guidelines to invest in lower priced securities. |

| | | |

| | · | investors may also be dissuaded from purchasing lower priced securities because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks; and |

| | | |

| | · | lower priced securities attract less research analyst coverage than higher priced securities. |

The Company believes that the Reverse Split may improve the level and stability of the Common Stock trading price, and that a higher share price could help generate additional interest in the Company.

Potential Risks of the Reverse Split

The effect of the Reverse Split on the market price for the Company's Common Stock cannot be predicted, and the performance history of similar stock splits for companies in like circumstances is varied. There can be no assurance that the Company's Common Stock will continue to trade at least in proportion to the reduction in the number of outstanding shares resulting from the Reverse Split or that the market price of the post-split Common Stock can be maintained. The market price of the Company's Common Stock will also be based on its financial performance, market conditions, the market perception of its future prospects and the Company's industry as a whole, as well as other factors, many of which are unrelated to the number of shares outstanding.

Effects of the Reverse Split

General. A reverse stock split is a reduction in the number of outstanding shares of a class of a corporation's capital stock, which may be accomplished by the Company, in this case, by reclassifying and converting all outstanding shares of the Company's Common Stock into a proportionately fewer number of shares of Common Stock. For example, upon implementation of a Reverse Split at a ratio of 1-for-50 shares, a stockholder holding 1,000 shares of the Company's Common Stock before the Reverse Split would hold 20 shares of the Company's Common Stock after the Reverse Split. Each stockholder's proportionate ownership of the issued and outstanding shares of the Company's Common Stock would remain the same, except for minor changes that may result from rounding fractional shares up to the next whole share. Outstanding shares of new Common Stock resulting from the Reverse Split will remain fully paid and non-assessable.

Fractional Shares. The Company will not issue fractional shares in connection with the Reverse Split. Instead, any fractional share that results from the Reverse Split will be rounded up to the next whole share. The Company is doing this to avoid the expense and inconvenience of issuing and transferring fractional shares of the Company's Common Stock as a result of the stock split. The shares issued upon such rounding do not represent separately bargained for consideration.

Accounting Matters. The Reverse Split will not affect the par value of the Company's Common Stock. As a result, on the effective date of the Reverse Split, if the Reverse Split ratio were 1-for-50, the stated capital on the Company's balance sheet attributable to Common Stock would be reduced from its present amount by a fraction that equals one divided by fifty, and the additional paid-in capital account would be credited with the amount by which the stated capital was reduced. The per share net income or loss and net book value per share would be increased because there would be fewer shares.

Effect on Authorized and Outstanding Shares. As an example, based on the shareholders as of August 25, 2015, and assuming a 1-for-50 Reverse Split, there will be approximately 1,611,108 shares of Common Stock issued and outstanding and held by approximately 84 shareholders of record following the Reverse Split. As a result of the Reverse Split, the number of shares of Common Stock issued and outstanding would be reduced to the approximate number of shares of Common Stock issued and outstanding immediately prior to the effectiveness of the Reverse Split divided by 50.

The number of shares of Common Stock underlying any stock options would be divided by 50 for each award (with any fractional amount disregarded) and the exercise price per share would be increased by multiplying by 50.

There will be no change to the number of authorized shares of our Common Stock or preferred stock as a result of the Reverse Split.

With the exception of the number of shares issued and outstanding, the rights and preferences of the shares of Common Stock prior and subsequent to the Reverse Split will remain the same. It is not anticipated that the Company's financial condition, the percentage ownership of management, the number of stockholders, or any aspect of the Company's business would materially change, solely as a result of the Reverse Split. The Reverse Split will be effectuated simultaneously for all of the Company's Common Stock. The Reverse Split will affect all of our stockholders uniformly and will not affect any stockholder's percentage ownership interests in the Company or proportionate voting power, except for minor changes that may result from rounding fractional shares up to the next whole share.

Increase of Shares of Common Stock Available for Future Issuance. As a result of the Reverse Split, there will be a reduction in the number of shares of Common Stock issued and outstanding and an associated increase in the number of authorized shares that would be unissued and available for future issuance after the Reverse Split. The increase in available shares could be used for any proper corporate purpose approved by the Board of Directors, including, among other purposes, future financing transactions and acquisitions.

Effectiveness of the Reverse Split. The Reverse Split will become effective at a time chosen by our Board of Directors, but not later than December 31, 2016, upon the filing of a Certificate of Amendment to the Company's Articles of Incorporation with the Secretary of State of the State of Nevada. Our management does not currently have an anticipated effective date for the Reverse Split, or even that a Reverse Split will be effected.

Tax Consequences of the Reverse Split. The following discussion summarizing material federal income tax consequences of the Reverse Split is based on the Internal Revenue Code of 1986, as amended (the "Code"), the applicable Treasury Regulations promulgated thereunder, judicial authority and current administrative rulings and practices in effect on the date this Information Statement was first mailed to stockholders. This discussion does not discuss consequences that may apply to special classes of taxpayers (e.g., non-resident aliens, broker-dealers, or insurance companies). Stockholders should consult their own tax advisors to determine the particular consequences to them.

The receipt of the Common Stock following the effective date of the Reverse Split, solely in exchange for the Common Stock held prior to the Reverse Split, will not generally result in recognition of gain or loss to the stockholders. The aggregate tax basis of the post-split shares received in the Reverse Split (including any fraction of a new share deemed to have been received) will be the same as the stockholder's aggregate tax basis in the pre-split shares exchanged therefore, and the holding period of the post-split shares received in the Reverse Split will include the holding period of the pre-split shares surrendered therein.

No gain or loss will be recognized by the Company as a result of the Reverse Split. The Company's views regarding the tax consequences of the Reverse Split are not binding upon the Internal Revenue Service or the courts, and there can be no assurance that the Internal Revenue Service or the courts would accept the positions expressed above.

THIS SUMMARY IS NOT INTENDED AS TAX ADVICE TO ANY PARTICULAR PERSON. IN PARTICULAR, AND WITHOUT LIMITING THE FOREGOING, THIS SUMMARY ASSUMES THAT THE SHARES OF COMMON STOCK ARE HELD AS "CAPITAL ASSETS" AS DEFINED IN THE CODE, AND DOES NOT CONSIDER THE FEDERAL INCOME TAX CONSEQUENCES TO THE COMPANY'S STOCKHOLDERS IN LIGHT OF THEIR INDIVIDUAL INVESTMENT CIRCUMSTANCES OR TO HOLDERS WHO MAY BE SUBJECT TO SPECIAL TREATMENT UNDER THE FEDERAL INCOME TAX LAWS (SUCH AS DEALERS IN SECURITIES, INSURANCE COMPANIES, FOREIGN INDIVIDUALS AND ENTITIES, FINANCIAL INSTITUTIONS AND TAX EXEMPT ENTITIES). IN ADDITION, THIS SUMMARY DOES NOT ADDRESS ANY CONSEQUENCES OF THE REVERSE SPLIT UNDER ANY STATE, LOCAL OR FOREIGN TAX LAWS. THE STATE AND LOCAL TAX CONSEQUENCES OF THE REVERSE SPLIT MAY VARY AS TO EACH STOCKHOLDER DEPENDING ON THE STATE IN WHICH SUCH STOCKHOLDER RESIDES.

AS A RESULT, IT IS THE RESPONSIBILITY OF EACH STOCKHOLDER TO OBTAIN AND RELY ON ADVICE FROM HIS, HER OR ITS TAX ADVISOR AS TO, BUT NOT LIMITED TO, THE FOLLOWING: (A) THE EFFECT ON HIS, HER OR ITS TAX SITUATION OF THE REVERSE SPLIT, INCLUDING, BUT NOT LIMITED TO, THE APPLICATION AND EFFECT OF STATE, LOCAL AND FOREIGN INCOME AND OTHER TAX LAWS; (B) THE EFFECT OF POSSIBLE FUTURE LEGISLATION OR REGULATIONS; AND (C) THE REPORTING OF INFORMATION REQUIRED IN CONNECTION WITH THE REVERSE SPLIT ON HIS, HER OR ITS OWN TAX RETURNS. IT WILL BE THE RESPONSIBILITY OF EACH STOCKHOLDER TO PREPARE AND FILE ALL APPROPRIATE FEDERAL, STATE, LOCAL, AND, IF APPLICABLE, FOREIGN TAX RETURNS.

Share Certificates

Following the Reverse Split, the share certificates you now hold will continue to be valid and will evidence your ownership in post-split shares of Common Stock. Going forward, following the effective date of the Reverse Split, new shares of Common Stock issued will reflect the Reverse Split, but this in no way will affect the validity of your current share certificates. However, after the effective date of the Reverse Split, those stockholders who wish to obtain new certificates should contact the exchange agent at:

Empire Stock Transfer, Inc.

1859 Whitney Mesa Dr.

Henderson, NV 89014

(702) 818-5898

www.empirestock.com

Many stockholders hold some or all of their shares electronically in book-entry form either through a representative broker-dealer or through the direct registration system for securities. If you hold registered shares in a book-entry form, you do not need to take any action to receive your post-split shares or your cash payment in lieu of any fractional share interest, if applicable. If you are entitled to post-split shares, a transaction statement will automatically be sent to your address of record by either your broker (if you hold your shares through a broker) or the exchange agent indicating the number of shares you hold.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth, as of August 25, 2015, certain information with respect to our equity securities owned of record or beneficially by (i) each Officer and Director; (ii) each person who owns beneficially more than 5% of each class of our outstanding equity securities; and (iii) all Directors and Executive Officers as a group.

| Title of Class | | Name and Address of Beneficial Owner (1) | | Amount and Nature of Beneficial Ownership | | | Percent of Class (2) | |

| | | | | | | | | |

| Common Stock | | James Pakulis (3)(4) | | | 26,817,290 | | | | 33.3 | % |

| | | | | | | | | | | |

| Common Stock | | Munjit Johal (3) | | | 20,000 | | | | 1 | % |

| | | | | | | | | | | |

| Common Stock | | All Directors and Officers As a Group (2 persons) | | | 26,837,290 | | | | 33.3 | % |

___________________

(1) Unless indicated otherwise, the address of the shareholder is c/o Wisdom Homes of America, Inc., 500 North Northeast Loop 323, Tyler, TX 75708.

(2) Unless otherwise indicated, based on 80,555,383 shares of Common Stock issued and outstanding. Shares of Common Stock subject to options or warrants currently exercisable, or exercisable within 60 days, are deemed outstanding for purposes of computing the percentage of the person holding such options or warrants, but are not deemed outstanding for the purposes of computing the percentage of any other person.

(3) Indicates one of our officers or directors.

(4) 26,817,290 of the shares held by Mr. Pakulis are held of record by R.H. Daignault Law Corporation, In Trust, pursuant to an escrow agreement between them and the parties who assigned certain debts to Pakulis prior to its conversion into the shares. Mr. Pakulis maintains investment control, including the power of disposition and voting, over the shares.

The issuer is not aware of any person who owns of record, or is known to own beneficially, five percent or more of the outstanding securities of any class of the issuer, other than as set forth above. There are no classes of stock other than as set forth above.

There are no current arrangements which will result in a change in control.

| | By Order of the Board of Directors | |

| | | | |

| September __, 2015 | By | | |

| Tyler, Texas | | James Pakulis, President | |

Exhibit A

Increase in Authorized Amendment

CERTIFICATE OF AMENDMENT

OF

ARTICLES OF INCORPORATION

OF

WISDOM HOMES OF AMERICA, INC.

(Pursuant to NRS 78.385 and 78.390 – after issuance of stock)

The undersigned, being the President and Secretary, respectively, of Wisdom Homes of America, Inc., a Nevada Corporation, hereby certify that pursuant to Unanimous Written Consent of the Board of Directors of said Corporation on August 19, 2015, and pursuant to Majority Written Consent of the Shareholders of said Corporation on August 25, 2015, it was voted that this Certificate of Amendment of Articles of Incorporation be filed.

The undersigned certify that Article III of the Articles of Incorporation is amended and restated to read as follows:

"III.

This Corporation is authorized to issue two classes of shares of stock to be designated as "Common Stock" and "Preferred Stock." The total number of shares of Common Stock which this Corporation is authorized to issue is Nine Hundred Millioni (900,000,000) shares, par value $0.001. The total number of shares of Preferred Stock which this Corporation is authorized to issue is Twenty Million (20,000,000) shares, par value $0.001.

The shares of Preferred Stock may be issued from time to time in one or more series. The Board of Directors of the Corporation (the "Board of Directors") is expressly authorized to provide for the issue of all or any of the shares of the Preferred Stock in one or more series, and to fix the number of shares and to determine or alter for each such series, such voting powers, full or limited, or no voting powers, and such designations, preferences, and relative, participating, optional, or other rights and such qualifications, limitations, or restrictions thereof, as shall be stated and expressed in the resolution or resolutions adopted by the Board of Directors providing for the issue of such shares (a "Preferred Stock Designation") and as may be permitted by the Nevada Revised Statutes. The Board of Directors is also expressly authorized to increase or decrease (but not below the number of shares of such series then outstanding) the number of shares of any series subsequent to the issue of shares of that series. In case the number of shares of any such series shall be so decreased, the shares constituting such decrease shall resume the status that they had prior to the adoption of the resolution originally fixing the number of shares of such series.

A. No holder of any of the shares of any class of the Corporation shall be entitled as of right to subscribe for, purchase, or otherwise acquire any shares of any class of the Corporation which the Corporation proposes to issue or any rights or options which the Corporation proposes to grant for the purchase of shares of any class of the Corporation or for the purchase of any shares, bonds, securities, or obligations of the Corporation which are convertible into or exchangeable for, or which carry any rights, to subscribe for, purchase, or otherwise acquire shares of any class of the Corporation; and any and all of such shares, bonds, securities, or obligations of the Corporation, whether now or hereafter authorized or created, may be issued, or may be reissued or transferred if the same have been reacquired and have treasury status, and any and all of such rights and options may be granted by the Board of Directors to such persons, firms, corporations, and associations, and for such lawful consideration, and on such terms, as the Board of Directors in its discretion may determine, without first offering the same, or any thereof, to any said holder.

B. The Corporation elects not to be governed by the terms and provisions of Sections 78.378 through 78.3793, inclusive, and Sections 78.411 through 78.444, inclusive, of the Nevada Revised Statutes, as the same may be amended, superseded, or replaced by any successor section, statute, or provision.

C. In addition, the Corporation elects not to be governed by the terms and provisions of Sections 78.2055 and NRS 78.207 of the Nevada Revised Statutes requiring shareholder approval of forward and reverse splits in cases where there is no corresponding increase or decrease in and to the number of Authorized shares of the class or series subject to the forward or reverse split and, therefore, shareholder approval will not be required for the Board of Directors of this Corporation to authorize forward and reverse splits of this Corporation's securities without corresponding increases or decreases in and to the number of authorized shares of the class or series subject to the forward or reverse split.

D. No amendment to these Articles of Incorporation, directly or indirectly, by merger or consolidation or otherwise, having the effect of amending or repealing any of the provisions of this paragraph shall apply to or have any effect on any transaction involving acquisition of control by any person, or any transaction with an interested stockholder, or any Board action with respect to Sections 78.2055 and 78.207 NRS, occurring prior to such amendment or repeal."

The undersigned hereby certify that they have on September ___, 2015 executed this Certificate amending the Articles of Incorporation heretofore filed with the Secretary of State of Nevada.

| ___________________________________ | | ___________________________________ |

| James Pakulis, President | | Munjit Johal, Secretary |

13

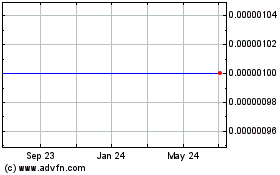

Wisdom Homes of America (CE) (USOTC:WOFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

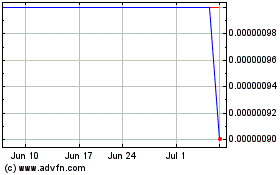

Wisdom Homes of America (CE) (USOTC:WOFA)

Historical Stock Chart

From Apr 2023 to Apr 2024