Dollar Tree Swings to a Loss After Deal for Family Dollar -- 2nd Update

September 01 2015 - 5:30PM

Dow Jones News

By Sarah Nassauer And Lisa Beilfuss

Dollar Tree Inc. swung to a loss in its latest quarter as the

discount retailer works to improve a recently acquired rival by

cleaning up stores and stocking shelves with more appealing

merchandise.

Dollar Tree reported a loss of $98 million for the three months

to Aug. 1, from a profit of $121.5 million a year earlier, creating

worries that the benefits of its Family Dollar Inc. acquisition may

take longer to materialize than expected. After completing its $9

billion purchase of Family Dollar in July, the Chesapeake,

Va.-based retailer now operates almost 14,000 stores.

The Family Dollar business "is not broken; we simply need to

roll up our sleeves, focus on what's important," Gary Philbin, the

executive in charge of the Family Dollar stores, said during a

conference call.

Shares of Dollar Tree fell 9.3% Tuesday to $69.20, erasing their

year-to-date gain.

Eight weeks into the merger, the company is focused on cleaning

and fixing up Family Dollar stores, as well as on operational

improvements like better stocking and, in some cases, increasing

employee wages, he said.

The acquisition helped boost sales overall by 48% to $3.01

billion. Family Dollar contributed $811.6 million. Sales in stores

open at least a year under the Dollar Tree banner rose 2.7%,

slightly lower than analysts forecast. Last week, competitor Dollar

General Corp. reported existing-stores sales growth of 2.8%.

Dollar Tree forecasts that the combined company will be able to

achieve $300 million in annual savings by the third year of the

merger, said Dollar Tree Chief Executive Bob Sasser. In the early

stages, synergies will come from sourcing and procurement

advantages, he said.

Dollar Tree and other discount retailers attracted droves of

shoppers during the recession to conveniently located stores

selling inexpensive, smaller-size products.

Lower-than-expected same-store sales raise "a slight note of

concern" that the improving economy will hurt dollar store

retailers because consumers are less primed to buy their products,

said Neil Saunders, CEO of Conlumino, a research and consulting

firm, in a research note. Conlumino research shows that dollar

stores overall are acquiring new customers at a slower pace in

recent months.

During the second quarter, all of the retailer's segments and

regions increased sales, Mr. Sasser said. Sales of candy, food,

party and household supply categories grew fastest, especially in

the Southwest, he said.

As a result of the acquisition and integration, Dollar Tree

said, it would refrain from providing earnings guidance for the

current quarter and pull its per-share profit forecast for the full

year. Previously, the company had said it expected to earn an

adjusted $3.32 to $3.47 this year.

For the business year ending in January, the retailer expects to

report revenue of $15.3 billion to $15.52 billion, based on a low

single-digit increase in same-store sales.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Lisa

Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 01, 2015 17:15 ET (21:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

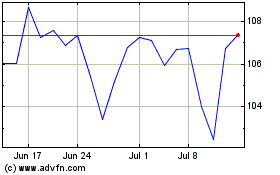

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dollar Tree (NASDAQ:DLTR)

Historical Stock Chart

From Apr 2023 to Apr 2024