Filed Pursuant to Rule 424(b)(3)

Registration No. 333-206053

VAPOR

CORP.

PROSPECTUS

5,615,933

Shares of Common Stock

This

prospectus relates to the sale of up to 5,615,933 shares of our common stock, including (i) 3,516,824 shares of our common stock

presently issued and outstanding, (ii) 822,960 shares of common stock issuable upon exercise of warrants, (iii) 1,215,911 shares

of common stock issuable upon conversion of convertible notes and (iv) 60,238 shares of common stock issuable upon the delivery

of restricted stock units, each of which may be offered by the selling shareholders identified in this prospectus. We will not

receive any proceeds from the sales of shares of our common stock by the selling shareholders named on page 9. We will, however,

receive proceeds in connection with the exercise of the warrants referred to above.

Our

common stock trades on the Nasdaq Stock Market under the symbol “VPCO”. As of August 31, 2015, the closing price of

our common stock was $0.74 per share.

The

common stock offered in this prospectus involves a high degree of risk. See “Risk Factors” beginning on page 7 of

this prospectus to read about factors you should consider before buying shares of our common stock.

No

underwriter or other person has been engaged to facilitate the sale of shares of our common stock in this offering. The selling

shareholders may be deemed underwriters of the shares of our common stock that they are offering within the meaning of the Securities

Act of 1933. We will bear all costs, expenses and fees in connection with the registration of these shares.

The

selling shareholders are offering these shares of common stock. The selling shareholders may sell all or a portion of these shares

from time to time in market transactions through any market on which our common stock is then traded, in negotiated transactions

or otherwise, and at prices and on terms that will be determined by the then prevailing market price or at negotiated prices directly

or through a broker or brokers, who may act as agent or as principal or by a combination of such methods of sale. The selling

shareholders will receive all proceeds from the sale of the common stock. We will receive proceeds from the exercise of the warrants

if the warrants are exercised, which proceeds will be used for working capital and general corporate purposes. For additional

information on the methods of sale, you should refer to the section entitled “Plan of Distribution.”

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is August 31, 2015.

TABLE

OF CONTENTS

You

should rely only on information contained in this prospectus. We have not authorized anyone to provide you with information that

is different from that contained in this prospectus. The selling shareholders are not offering to sell or seeking offers to buy

shares of common stock in jurisdictions where offers and sales are not permitted. The information contained in this prospectus

is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our

common stock. We are responsible for updating this prospectus to ensure that all material information is included and will update

this prospectus to the extent required by law.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully including

the section entitled “Risk Factors” before making an investment decision. Vapor Corp. is referred to throughout this

prospectus as “Vapor,” “the Company,” “we,” “our” or “us.”

Our

Company

We

operate 12 Florida-based vape stores and are focusing on expanding the number of Company operated stores as well as launching

a franchise program. In addition, we design, market, and distribute vaporizers, e-liquids, electronic cigarettes and accessories

under the emagine vaporTM, Krave®, Fifty-One® (also known as Smoke 51), Vapor X®, Hookah Stix® and Alternacig®

brands. We also design and develop private label brands for our distribution customers. Third party manufacturers manufacture

our products to meet our design specifications. We market our products as alternatives to traditional tobacco cigarettes and cigars.

In 2014, as a response to market product demand changes, Vapor began to shift its primary focus from electronic cigarettes to

vaporizers. “Vaporizers” and “electronic cigarettes,” or “e-cigarettes,” are battery-powered

products that enable users to inhale nicotine vapor without smoke, tar, ash, or carbon monoxide.

We

offer our vaporizers and e-cigarettes and related products through our vape stores, online, to retail channels through our direct

sales force, and through third party wholesalers, retailers and value-added resellers. Retailers of our products include small-box

discount retailers, big-box retailers, gas stations, drug stores, convenience stores, and tobacco shops and kiosk locations in

shopping malls throughout the United States. Vapor leverages its ability to design, market and develop multiple vaporizer and

e-cigarette brands and to bring those brands to market through its multiple distribution channels including the vape stores, online

and through retail operations operated by third parties. The Company’s business strategy is currently focused on a multi-pronged

approach to diversify our revenue streams to include the Vape Store brick-and-mortar retail locations which were successfully

deployed by Vaporin, Inc., a corporation with which we merged in March 2015.

Our

Corporate Information

The

Company was originally incorporated under the name Consolidated Mining International, Inc. in 1985. On November 5, 2009, the Company

acquired Smoke Anywhere USA, Inc., a distributor of electronic cigarettes, in a reverse triangular merger. On January 7, 2010,

the Company changed its name to Vapor Corp. The Company reincorporated in the State of Delaware from the State of Nevada effective

on December 31, 2013. On March 3, 2015, the Company merged with Vaporin, Inc., a Delaware corporation, and was the surviving and

controlling entity.

Our

executive offices are located at 3001 Griffin Road, Dania Beach, Florida 33312, and our telephone number is (888) 766-5351. Our

website is located at www.vapor-corp.com. The information contained on, or that can be accessed through, our website is not incorporated

by reference in this prospectus and should not be considered a part of this prospectus.

THE

OFFERING

| Common

stock outstanding prior to the offering: |

|

8,563,090

|

| |

|

|

| Common

stock offered by the selling shareholders: |

|

5,615,933

shares (1) |

| |

|

|

| Common

stock outstanding immediately following the offering: |

|

12,460,875

shares (2) |

| |

|

|

| Use

of proceeds: |

|

We

will not receive any proceeds from the sale of the shares of common stock by the selling shareholders but will receive proceeds

from the exercise of the warrants if the warrants are exercised, which proceeds will be used for working capital and general

corporate purposes. |

| |

|

|

| Risk

Factors: |

|

See

“Risk Factors” beginning on page 8 of this prospectus for a discussion of factors you should carefully consider

before deciding to invest in shares of our common stock. |

| |

|

|

| Stock

Symbol: |

|

Nasdaq: VPCO |

(1)

Except for 822,960 shares underlying warrants, 1,215,911 shares underlying convertible notes, 60,238 shares issuable upon delivery

of restricted stock units, and 1,798,676 shares, the issuance of which is dependent upon shareholder approval, all of the

shares offered under this prospectus have been issued and are outstanding. The issuance of 1,215,911 shares underlying convertible

notes assumes shareholder approval of a reduction in the conversion price of such notes from $5.50 to $1.10. Without such shareholder

approval, only 243,182 shares will be issuable upon conversion of the convertible notes.

(2)

The number of shares of common stock to be outstanding after this offering excludes:

| |

● |

229,634

shares of common stock issuable upon the exercise of outstanding stock options; |

| |

|

|

| |

● |

614,708 shares of common stock issuable upon the

exercise of outstanding warrants, not including the shares underlying warrants registered herein; |

| |

|

|

| |

● |

37,616,570

shares of common stock issuable upon the full conversion of our Series A Convertible Preferred Stock and up to 75,233,140

shares of common stock issuable upon the full exercise of our Series A Warrants, assuming the warrants are exercised for cash;

and |

| |

|

|

| |

● |

1,880,829

shares of common stock issuable upon the full conversion of our Series A Convertible Preferred Stock and up to 3,761,657 shares

of common stock upon the full exercise of the Series A Warrants, assuming the warrants are exercised for cash, included in

the unit purchase option issued to the representative of the underwriters in connection with our registered offering that

closed July 29, 2015. |

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

prospectus including the incorporated documents contains forward-looking statements. All statements other than statements of historical

facts, including statements regarding our future financial position, liquidity, business strategy and plans and objectives of

management for future operations, are forward-looking statements. The words “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “could,”

“target,” “potential,” “is likely,” “will,” “expect” and similar expressions,

as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely

on our current expectations and projections about future events and financial trends that we believe may affect our financial

condition, results of operations, business strategy and financial needs.

The

results anticipated by any or all of these forward-looking statements might not occur. Important factors, uncertainties and risks

that may cause actual results to differ materially from these forward-looking statements are contained in the risk factors that

follow and the incorporated documents. We undertake no obligation to publicly update or revise any forward-looking statements,

whether as the result of new information, future events or otherwise. For more information regarding some of the ongoing risks

and uncertainties of our business, see the risk factors that follow and that are disclosed in our incorporated documents.

RISK

FACTORS

Investing in our securities

involves substantial risks. Before purchasing the common stock offered by this prospectus you should consider carefully the risk

factors incorporated by reference in this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2014

filed with the Securities and Exchange Commission (the “SEC”) on March 31, 2015, in addition to, and as updated by,

the risks, uncertainties and additional information (i) set forth in our SEC reports on Forms 10-K, 10-Q and 8-K and in the other

documents incorporated by reference in this prospectus that we file with the SEC after the date of this prospectus and which are

deemed incorporated by reference in this prospectus, and (ii) the information contained in any applicable prospectus supplement.

For a description of these reports and documents, and information about where you can find them, see “Incorporation of Certain

Documents By Reference.” The risks and uncertainties we discuss in this prospectus and in the documents incorporated by

reference in this prospectus are those that we currently believe may materially affect our company. Additional risks not presently

known, or currently deemed immaterial, also could materially and adversely affect our financial condition, results of operations,

business and prospects.

In

addition to the above, we are also subject to the following risks:

If

we cannot manage our vape stores as we grow, we may incur substantial operating losses and adversely affect our financial condition.

Our

business model is focusing on expanding the number of vape stores beyond those we presently operate. As we expand the number of

vape stores and their location, it will be more difficult to manage them and our promotional costs will increase. None of our

senior managers has experience in operating a significant number of retail stores in different locations. If we expand our vape

stores beyond our capabilities, we may be materially and adversely affected.

We

have been named as defendants in litigation brought under California Proposition 65 which, if resolved adversely to us, could

have a material adverse impact on our financial condition.

On

June 22, 2015, the Center for Environment Health, as plaintiff, filed suit against a number of defendants including us, our wholly-owned

subsidiary, the Vape Store, Inc., Vaporin, Inc. and another wholly-owned subsidiary, Vaporin Florida, Inc. The lawsuit was filed

in the Superior Court of the State of California, County of Alameda. The suit seeks relief under California Proposition 65 which

makes it unlawful for businesses to knowingly and intentionally expose individuals in California to chemicals known to cause birth

defects or other harm without providing clear and reasonable warnings. All of the defendants are alleged to have sold products

containing significant quantities of nicotine in violation of Proposition 65. The plaintiff is seeking a civil penalty against

these defendants in the amount of $2,500 per day for each violation of Proposition 65, together with attorneys’ fees and

costs.

The

Company and its subsidiaries are in the process of hiring counsel and intend to defend the allegations. We believe that all of

the e-liquid products derived from nicotine sold by Vapor Corp. have always contained an appropriate warning. We are gathering

information on sales by Vaporin, Inc. and its former subsidiaries. We cannot assure you that we will prevail in this litigation.

If the case is resolved adversely to us and we are the subject of substantial civil penalties, it could have a material adverse

impact on our financial condition. Even if the litigation is dismissed or ultimately resolved in our favor, the cost of litigating

could be substantial and adversely affect our financial condition.

If

our stock price materially declines, the Series A Warrant holders will have the right to a large number of shares of common stock

upon exchange of their Series A Warrants, which may result in significant dilution.

The

Series A Warrants contained in the Units sold in the Company’s registered public offering that closed in July 2015 have

a feature which is designed to compensate the Series A Warrant holders regardless of whether the price of our common stock rises

or falls. Similar to a typical warrant, the holder benefits when the price of the underlying common stock rises; however, even

if our common stock falls below the exercise price, the Series A Warrant holders are provided with value. If our common stock

price materially falls following the separation of the Units, unless we elect to pay the Series A Holder a cash payment, we may

be obligated to issue a large number of shares to holders upon exchange of their Series A Warrants even though the exercise price

is more than current fair market value of our common stock. This in turn may materially dilute existing shareholders. The

potential for such dilutive exercise of the Series A Warrants may depress the price of common stock regardless of our business

performance, and could encourage short selling by market participants, especially if the trading price of our common stock begins

to decrease.

If

Nasdaq were to delist our common stock from its exchange, your ability to make transactions in our common stock would be limited

and may subject us to additional trading restrictions.

Should

we fail to satisfy the continued listing requirements of Nasdaq, such as the minimum closing bid price requirement, our common

stock may be delisted from Nasdaq. If Nasdaq delists our common stock, it is probable it will delist the Units sold in the Company’s

July 2015 registered public offering, which will cause the Units to separate into shares of Series A Preferred Stock and Series

A Warrants. Such a delisting would likely have a negative effect on the price of our common stock and would impair your ability

to sell or purchase our common stock when you wish to do so. In the event of a delisting, we would take actions to restore our

compliance with Nasdaq’s listing requirements, but we can provide no assurance that any such action taken by us would allow

our common stock to become listed again, stabilize the market price or improve the liquidity of our common stock, prevent our

common stock from dropping below the Nasdaq minimum bid price requirement or prevent future non-compliance with Nasdaq’s

listing requirements.

If

the Nasdaq Capital Market does not maintain the listing of our securities for trading on its exchange, we could face significant

material adverse consequences, including:

| |

● |

a limited availability of market quotations for our securities;

|

| |

|

|

| |

● |

reduced liquidity with respect to our securities; |

| |

|

|

| |

● |

our shares of common stock will be a “penny stock”,

which will require brokers trading in our shares of common stock to adhere to more stringent rules, possibly resulting in

a reduced level of trading activity in the secondary trading market for our shares of common stock; |

| |

|

|

| |

● |

a limited amount of news and analyst coverage for our company;

and |

| |

|

|

| |

● |

decreased ability to issue additional securities or obtain additional

financing in the future. |

Therefore, it may be difficult

for investor to sell any shares if they desire or need to sell them.

USE

OF PROCEEDS

In connection with registration

rights agreements with the selling shareholders, we are registering 5,615,933 shares of our common stock, including (i) 3,516,824

shares of our common stock presently issued and outstanding, (ii) 822,960 shares of common stock issuable upon exercise of warrants,

(iii) 1,215,911 shares of common stock issuable upon conversion of convertible notes and (iv) 60,238 shares of common stock issuable

upon the delivery of restricted stock units, each of which may be offered by the selling shareholders identified in this prospectus.

We will not receive any proceeds from the sale of the shares of our common stock offered for resale by them under this prospectus.

We will, however, receive proceeds from the exercise of warrants which will be used for working capital and general corporate

purposes.

SELLING

SHAREHOLDERS

The following table provides

information about each selling shareholder listing how many shares of our common stock they own on the date of this prospectus,

how many shares are offered for sale by this prospectus, and the number and percentage of outstanding shares each selling

shareholder will own after the offering assuming all shares covered by this prospectus are sold. Each of Alpha Capital Anstalt,

Mr. Barry Honig and Mr. Michael Brauser have been beneficial owners of over 5% of our outstanding common stock at one time during

the past three years. In addition, Mr. Greg Brauser (who is Michael Brauser’s son) is presently serving as an executive

officer and director of the Company, Messrs. Brandon Bal and Jamie Polina are present employees of the Company and Mr. Scott Frohman

is a former employee. Other than these individuals, none of the selling shareholders have had any position, office, or material

relationship with us or our affiliates within the past three years. The information concerning beneficial ownership has been taken

from our stock transfer records and information provided by the selling shareholders. Information concerning the selling shareholders

may change from time to time, and any changed information will be set forth if and when required in prospectus supplements or

other appropriate forms permitted to be used by the SEC.

We

do not know when or in what amounts a selling shareholder may offer shares for sale. The selling shareholders may not sell any

or all of the shares offered by this prospectus. Because the selling shareholders may offer all or some of the shares, and because

there are currently no agreements, arrangements or understandings with respect to the sale of any of the shares, we cannot estimate

the number of the shares that will be held by the selling shareholders after completion of the offering. However, for purposes

of this table, we have assumed that, after completion of the offering, all of the shares covered by this prospectus will be sold

by the selling shareholder.

Unless

otherwise indicated, the selling shareholders have sole voting and investment power with respect to their shares of common stock.

The information contained in the table below is based upon information contained in transfer agent records and/or information

provided to us by the selling shareholders, and we have not independently verified this information. The selling shareholders

may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time or from time to

time since the date on which it provided the information regarding the shares beneficially owned, all or a portion of the shares

beneficially owned in transactions exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities

Act”).

The

number of shares outstanding, and the percentages of beneficial ownership, post-offering are calculated on the basis of (i)

8,563,090 share shares outstanding as of August 20, 2015, and (ii) 12,460,875 shares of our common stock to be issued and outstanding

as of the conclusion of the offering, which assumes exercise of all warrants, conversion of all convertible notes, and delivery

of all restricted stock units for which, in each case, underlying shares are registered herein. In addition, shares outstanding

post-offering assumes shareholder approval of a reduction in the exercise price of the convertible notes offered herein and that

all shares, the issuance of which is contingent on shareholder approval, will have been issued. For the purposes of the following

table, the number of shares of common stock beneficially owned has been determined in accordance with Rule 13d-3 under the Securities

Exchange Act of 1934 (the “Exchange Act”), and such information is not necessarily indicative of beneficial ownership

for any other purpose. Under Rule 13d-3, beneficial ownership includes any shares as to which a selling shareholder has sole or

shared voting power or investment power and also any shares which that selling shareholder has the right to acquire within 60

days of the date of this prospectus through the exercise of any stock option, warrant or other rights.

| Name | |

Number

of

securities

beneficially

owned before

offering | | |

Number

of

securities

to be

offered | | |

Number

of

securities

owned after

offering | | |

Percentage

of

securities

beneficially

owned after

offering | |

| | |

| | |

| | |

| | |

| |

| Alpha Capital Anstalt (1) | |

| 668,330 | | |

| 1,656,045 | | |

| 322,865 | | |

| 2.5 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Michael Brauser (2) | |

| 244,581

| | |

| 405,632 | | |

| 195,560 | | |

| 1.6 | % |

| | |

| | | |

| | | |

| | | |

| | |

| John W. Fitzgerald (3) | |

| 39,281 | | |

| 40,563 | | |

| 17,649 | | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Darren Goodrich, Inc. 401K PST (4) | |

| 32,718 | | |

| 45,025 | | |

| 8,705 | | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Frost Gamma Investments Trust (5) | |

| 368,404 | | |

| 202,816 | | |

| 260,237 | | |

| 2.1 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Heller Family Foundation Inc. (6) | |

| 166,402 | | |

| 202,816 | | |

| 58,235 | | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Barry Honig (7) | |

| 427,298 | | |

| 994,273 | | |

| 421,961 | | |

| 3.4 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Horberg Enterprises Limited Partnership (8) | |

| 153,851 | | |

| 121,689 | | |

| 88,952 | | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Marlin Capital Investments, LLC (9) | |

| 26,233 | | |

| 36,101 | | |

| 6,980 | | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Melechdavid Inc. (10) | |

| 117,840 | | |

| 121,689 | | |

| 52,941 | | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Richard Molinsky (11) | |

| 30,954 | | |

| 20,281 | | |

| 20,139 | | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Palladium Capital Advisors, LLC (12) | |

| 206,336 | | |

| 283,942 | | |

| 54,903 | | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Sandor Capital Master Fund (13) | |

| 281,565 | | |

| 202,815 | | |

| 173,398 | | |

| 1.4 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Stuart Smith (14) | |

| 117,840 | | |

| 121,689 | | |

| 52,941 | | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Daniel Waldman (15) | |

| 20,394 | | |

| 21,060 | | |

| 9,164 | | |

| * | |

| | |

| | | |

| | | |

| | | |

| | |

| Brio Capital Master Fund (16) | |

| 286,520 | | |

| 362,239 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Point Capital, Inc. (17) | |

| 143,260 | | |

| 181,120 | | |

| 0 | | |

| 0 | % |

| Southern Biotech, Inc. (18) | |

| 179,075 | | |

| 226,399 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Scott Frohman (19) | |

| 83,087 | | |

| 83,087 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Birchtree Capital, LLC (20) | |

| 83,087 | | |

| 83,087 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| GRQ Consultants, Inc. (21) | |

| 83,087 | | |

| 83,087 | | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Gregory Brauser (22) | |

| 189,752 | | |

| 83,087 | | |

| 134,360 | | |

| 1.1 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Brandon Bal (23) | |

| 22,157 | | |

| 33,235 | | |

| 0 | | |

| 0.0 | % |

| | |

| | | |

| | | |

| | | |

| | |

| Jamie Polina (24) | |

| 2,768 | | |

| 4,154 | | |

| 0 | | |

| 0.0 | % |

| |

(1) |

Alpha

Capital: Securities to be offered includes 486,364 shares of common stock underlying convertible notes (including interest

accruable through maturity), and 233,330 shares of common stock issuable upon exercise of warrants. Pre-offering beneficial

ownership does not include certain shares (i) issuable only upon shareholder approval and (2) that cannot be acquired within

60 days due to a 4.99% blocker, but such shares are included in the number of securities to be offered. Address is Lettstrasse

32, P.O. Box 1212, FL-9490, Vaduz Furstentum Liechtenstein c/o LH Financial Services Corp., 510 Madison Avenue, Ste 1400,

New York, NY 10022. |

| |

|

|

| |

(2) |

M.

Brauser: Securities to be offered includes 73,690 shares of common stock issuable upon exercise of warrants. Mr. Brauser,

through entities of which he is trustee, also claims beneficial ownership of the securities held by Birchtree Capital, LLC

and 50% of the securities held by Marlin Capital Investments, LLC. Pre-offering beneficial ownership does not include certain

shares (i) issuable only upon shareholder approval and (2) that cannot be acquired within 60 days due to a 4.99% blocker,

but such shares are included in the number of securities to be offered. Address is 4400 Biscayne Blvd., Suite 850, Miami,

FL 33137. |

| |

|

|

| |

(3) |

Fitzgerald:

Securities to be offered includes 7,370 shares of common stock issuable upon exercise of warrants. Pre-offering beneficial

ownership does not include certain shares issuable only upon shareholder approval, but such shares are included in the number

of securities to be offered. Address is 10100 88th Avenue, Pleasant Prairie, WI 53158. |

| |

|

|

| |

(4) |

Goodrich:

Securities to be offered includes 8,180 shares of common stock issuable upon exercise of warrants. Pre-offering beneficial

ownership does not include certain shares issuable only upon shareholder approval, but such shares are included in the number

of securities to be offered. Address is 225 John Street, Manhattan Beach, CA 90266. |

| |

|

|

| |

(5) |

Frost

Gamma: Securities to be offered includes 36,845 shares of common stock issuable upon exercise of warrants. Pre-offering

beneficial ownership does not include certain shares issuable only upon shareholder approval, but such shares are included

in the number of securities to be offered. All securities shown are held by Frost Gamma Investments Trust, of which Phillip

Frost M.D., is the trustee. Frost Gamma L.P. is the sole and exclusive beneficiary of Frost Gamma Investments Trust. Dr. Frost

is one of two limited partners of Frost Gamma L.P. The general partner of Frost Gamma L.P. is Frost Gamma, Inc., and the sole

shareholder of Frost Gamma, Inc. is Frost-Nevada Corporation. Dr. Frost is also the sole shareholder of Frost-Nevada Corporation.

Dr. Frost disclaims beneficial ownership of these securities, except to the extent of any pecuniary interest therein and this

disclosure shall not be deemed an admission that Dr. Frost is the beneficial owner of these securities for purposes of Section

16 or for any other purpose. Address is 4400 Biscayne Blvd., Miami, FL 33137. |

| |

(6) |

Heller

Family: Securities to be offered includes 36,845 shares of common stock issuable upon exercise of warrants. Pre-offering

beneficial ownership does not include certain shares issuable only upon shareholder approval, but such shares are included

in the number of securities to be offered. Mr. Ronald Heller, the trustee of Heller Family Foundation, Inc., has voting and

dispositive power over the securities reported. Address is 700 East Palisades Avenue, Englewood Cliffs, NJ 07632. |

| |

|

|

| |

(7) |

Honig:

Securities to be offered includes 316,137 shares of common stock underlying convertible notes (including interest accruable

through maturity), and 153,508 shares of common stock issuable upon exercise of warrants. Mr. Honig, through entities of which

he is trustee, also claims beneficial ownership of the securities held by Southern Biotech, Inc. and GRQ Consultants, Inc.

and 50% of the securities held by Marlin Capital Investments, LLC. Pre-offering beneficial ownership does not include certain

shares (i) issuable only upon shareholder approval and (2) that cannot be acquired within 60 days due to a 4.99% blocker,

but such shares are included in the number of securities to be offered. Address is 555 S. Federal Hwy #450, Boca Raton, FL

33433. |

| |

|

|

| |

(8) |

Horberg

Enterprises: Securities to be offered includes 22,107 shares of common stock issuable upon exercise of warrants. Pre-offering

beneficial ownership does not include certain shares issuable only upon shareholder approval but such shares are included

in the number of securities to be offered. Address is 289 Prospect Avenue, Highland Park, IL 60035. |

| |

|

|

| |

(9) |

Marlin

Capital: Securities to be offered includes 6,558 shares of common stock issuable upon exercise of warrants. Pre-offering

beneficial ownership does not include certain shares issuable only upon shareholder approval, but such shares are included

in the number of securities to be offered. Michael Brauser and Barry Honig, through entities of which they are trustees, each

claim beneficial ownership over 50% of the securities held by Marlin Capital. Address is 555 S. Federal Hwy #450, Boca Raton,

FL 33433. |

| |

|

|

| |

(10) |

Melechdavid:

Securities to be offered includes 22,107 shares of common stock issuable upon exercise of warrants. Pre-offering beneficial

ownership does not include certain shares issuable only upon shareholder approval, but such shares are included in the number

of securities to be offered. Mr. Mark Groussman has voting and dispositive power over the securities reported. Address is

5154 La Gorce Drive, Miami Beach, FL 33140. |

| |

|

|

| |

(11) |

Molinsky:

Securities to be offered includes 3,684 shares of common stock issuable upon exercise of warrants. Pre-offering beneficial

ownership does not include certain shares issuable only upon shareholder approval, but such shares are included in the number

of securities to be offered. Address is 51 Lord’s Hwy East, Weston, CT 06883. |

| |

|

|

| |

(12) |

Palladium

Capital: Securities to be offered includes 51,583 shares of common stock issuable upon exercise of warrants. Pre-offering

beneficial ownership does not include certain shares issuable only upon shareholder approval, but such shares are included

in the number of securities to be offered. Address is 230 Park Avenue, #539, New York, NY 10169. |

| |

|

|

| |

(13) |

Sandor

Capital: Securities to be offered includes 36,845 shares of common stock issuable upon exercise of warrants. Pre-offering

beneficial ownership does not include certain shares issuable only upon shareholder approval, but such shares are included

in the number of securities to be offered. Mr. John S. Lemak has voting and dispositive power over the securities reported.

Address is 2828 Routh Street, Suite 500, Dallas, TX 75201. |

| |

|

|

| |

(14) |

Smith:

Securities to be offered includes 22,107 shares of common stock issuable upon exercise of warrants. Pre-offering beneficial

ownership does not include certain shares issuable only upon shareholder approval, but such shares are included in the number

of securities to be offered. Address is 100 South Pointe Drive #3304, Miami Beach, FL 33139. |

| |

(15) |

Waldman:

Securities to be offered includes 3,827 shares of common stock issuable upon exercise of warrants. Pre-offering beneficial

ownership does not include certain shares issuable only upon shareholder approval, but such shares are included in the number

of securities to be offered. Address is 100 Riverside Drive, Apt.9D, New York, NY 10024. |

| |

|

|

| |

(16) |

Brio

Capital: Securities to be offered includes 194,546 shares of common stock underlying convertible notes (including interest

accruable through maturity), and 49,117 shares of common stock issuable upon exercise of warrants. Pre-offering beneficial

ownership does not include certain shares issuable only upon shareholder approval, but such shares are included in the number

of securities to be offered. Address is c/o Brio Capital Management LLC, 100 Merrick Road, Suite 401 W, Rockville Centre,

NY 11570-4800. |

| |

|

|

| |

(17) |

Point

Capital: Securities to be offered includes 97,273 shares of common stock underlying convertible notes (including interest

accruable through maturity), and 24,559 shares of common stock issuable upon exercise of warrants. Pre-offering beneficial

ownership does not include certain shares issuable only upon shareholder approval, but such shares are included in the number

of securities to be offered. Address is 285 Grand Avenue, Building 52nd Floor, Englewood, NJ 07631. |

| |

|

|

| |

(18) |

Southern

Biotech: Securities to be offered includes 121,591 shares of common stock underlying convertible notes (including interest

accruable through maturity), and 30,698 shares of common stock issuable upon exercise of warrants. Mr. Barry Honig, through

entities of which he is trustee, claims beneficial ownership of these securities. Pre-offering beneficial ownership does not

include certain shares issuable only upon shareholder approval, but such shares are included in the number of securities to

be offered. Address is 555 S. Federal Hwy #450, Boca Raton, FL 33433. |

| |

|

|

| |

(19) |

Frohman:

Address is 1900 Purdy Avenue, Apt. 1901, Miami Beach, FL 33139. |

| |

|

|

| |

(20) |

Birchtree

Capital: Mr. Michael Brauser claims beneficial ownership over these securities. Address is 4400 Biscayne Blvd., Suite

850, Miami, FL 33137. |

| |

|

|

| |

(21) |

GRQ

Consultants: Mr. Barry Honig claims beneficial ownership over these securities. Address is 555 S. Federal Hwy #450, Boca

Raton, FL 33433. |

| |

|

|

| |

(22) |

G.

Brauser: Securities to be offered includes 41,543 shares of common stock underlying undelivered restricted stock units.

Pre-offering beneficial ownership does not include shares underlying undelivered restricted stock units (other than shares

deliverable within 60 days), but such shares are included in the number of securities to be offered. Address is c/o Vapor

Corp., 3001 Griffin Road, Dania Beach, Florida 33312. |

| |

|

|

| |

(23) |

Bal:

Securities to be offered includes 16,618 shares of common stock underlying undelivered restricted stock units. Pre-offering

beneficial ownership does not include shares underlying undelivered restricted stock units (other than shares deliverable

within 60 days), but such shares are included in the number of securities to be offered. Address is c/o Vapor Corp., 3001

Griffin Road, Dania Beach, Florida 33312. |

| |

|

|

| |

(24) |

Polina:

Securities to be offered includes 2,077 shares of common stock underlying undelivered restricted stock units. Pre-offering

beneficial ownership does not include shares underlying undelivered restricted stock units (other than shares deliverable

within 60 days), but such shares are included in the number of securities to be offered. Address is c/o Vapor Corp., 3001

Griffin Road, Dania Beach, Florida 33312. |

DESCRIPTION

OF SECURITIES

We

are authorized to issue 150,000,000 of common stock, par value $0.001 per share, and 1,000,000 shares of preferred stock, par

value $0.001 per share.

Common

Stock

We

are authorized to issue 150,000,000 shares of common stock, par value $0.001 per share. The holders of common stock are entitled

to one vote per share on all matters submitted to a vote of shareholders, including the election of directors. There is no cumulative

voting in the election of directors. The holders of common stock are entitled to any dividends that may be declared by the Board

out of funds legally available for payment of dividends subject to the prior rights of holders of preferred stock and any contractual

restrictions we have against the payment of dividends on common stock. In the event of our liquidation or dissolution, holders

of common stock are entitled to share ratably in all assets remaining after payment of liabilities and the liquidation preferences

of any outstanding shares of preferred stock. Holders of common stock have no preemptive rights and have no right to convert their

common stock into any other securities and there are no redemption provisions applicable to our common stock.

Preferred

Stock

We

are authorized to issue 1,000,000 shares of “blank check” preferred stock with designations, rights and preferences

as may be determined from time to time by our Board of Directors.

Series

A Convertible Preferred Stock

In

connection with our registered offering which closed July 29, 2015, we issued 3,761,657 Units, each Unit consisting of one-fourth

of a share of Series A Convertible Preferred Stock and Series A Warrants. Each one-fourth share of Series A Convertible Preferred

Stock will separate from the warrants and be convertible into 10 shares of common stock upon the separation of the Units. The

Units will automatically separate into the Series A Convertible Preferred Stock and Series A Warrants on January 23, 2016, provided

that the Units will separate earlier if at any time after August 24, 2015, the closing price of Vapor’s common stock is

greater than $2.48 per share for 10 consecutive trading days, the Units are delisted, or the Series A Warrants are exercised for

cash (solely with respect to the Units that included the exercised Series A Warrants). The Series A Convertible Preferred Stock

will not be convertible by the holder of such preferred stock to the extent (and only to the extent) that the holder or any of

its Affiliates would beneficially own in excess of 4.99% of the common stock of the Company as defined in the Securities Exchange

Act of 1934 and the rules promulgated thereunder. Each share of Series A Convertible Preferred Stock shall be automatically converted

into shares of common stock in the event of a change of control and certain other major transactions.

With

certain limited exceptions, the Series A Convertible Preferred Stock has no voting rights. With respect to payment of dividends

and distribution of assets upon liquidation or dissolution or winding up of the Company, the Series A Convertible Preferred Stock

shall rank equal to the common stock of the Company. No sinking fund has been established for the retirement or redemption of

the Convertible Preferred Stock. As such, the Series A Convertible Preferred Stock is not subject to any restriction on the repurchase

or redemption of shares by the Company due to an arrearage in the payment of dividends or sinking fund installments. The Series

A Convertible Preferred Stock also has no liquidation rights or preemption rights, and there are no special classifications of

our Board related to the Series A Convertible Preferred Stock.

For

a description of how issuances of additional shares of our preferred stock could affect the rights of our shareholders, see “Certain

Provisions of Delaware Law and of Our Charter and Bylaws - Issuance of “blank check” Preferred Stock,” below.

Dividends

We

have not paid dividends on our common stock since inception and do not plan to pay dividends on our common stock in the foreseeable

future.

Transfer

Agent

We

have appointed Equity Stock Transfer, as our transfer and warrant agent. Their contact information is: 237 West 37th Street, Suite

601, New York, New York 10018, phone number (917) 746-4595, facsimile (347) 584-3644.

CERTAIN

PROVISIONS OF DELAWARE LAW AND OF OUR CHARTER AND BYLAWS

Anti-takeover

Provisions

In

general, Section 203 of the Delaware General Corporations Law (the “DGCL”) prohibits a Delaware corporation with a

class of voting stock listed on a national securities exchange or held of record by 2000 or more shareholders from engaging in

a “business combination” with an “interested shareholder” for a three-year period following the time that

this shareholder becomes an interested shareholder, unless the business combination is approved in a prescribed manner. A “business

combination” includes, among other things, a merger, asset or stock sale or other transaction resulting in a financial benefit

to the interested shareholder. An “interested shareholder” is a person who, together with affiliates and associates,

owns, or did own within three years prior to the determination of interested shareholder status, 15% or more of the corporation’s

voting stock. Under Section 203, a business combination between a corporation and an interested shareholder is prohibited unless

it satisfies one of the following conditions:

| |

● |

before

the shareholder became interested, the board of directors approved either the business combination or the transaction which

resulted in the shareholder becoming an interested shareholder; |

| |

|

|

| |

● |

upon

consummation of the transaction which resulted in the shareholder becoming an interested shareholder, the interested shareholder

owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for

purposes of determining the voting stock outstanding, shares owned by persons who are directors and also officers, and employee

stock plans, in some instances; or |

| |

|

|

| |

● |

at

or after the time the shareholder became interested, the business combination was approved by the board of directors of the

corporation and authorized at an annual or special meeting of the shareholders by the affirmative vote of at least two-thirds

of the outstanding voting stock which is not owned by the interested shareholder. |

The

DGCL permits a corporation to opt out of, or choose not to be governed by, its anti-takeover statute by expressly stating so in

its original certificate of incorporation (or subsequent amendment to its certificate of incorporation or bylaws approved by its

shareholders). The Vapor Certificate of Incorporation contains a provision expressly opting out of the application of Section

203 of the DGCL; therefore the anti-takeover statute does not apply to Vapor.

Issuance

of “blank check” Preferred Stock

Our

Certificate of Incorporation authorizes the issuance of up to 1,000,000 shares of “blank check” preferred stock with

designations, rights and preferences as may be determined from time to time by our Board of Directors. Our Board is empowered,

without shareholder approval, to issue a series of preferred stock with dividend, liquidation, conversion, voting or other rights

which could dilute the interest of, or impair the voting power of, our common shareholders. The issuance of a series of preferred

stock could be used as a method of discouraging, delaying or preventing a change in control. For example, it would be possible

for our Board of Directors to issue preferred stock with voting or other rights or preferences that could impede the success of

any attempt to effect a change in control of our company.

Our

Bylaws also allow our Board of Directors to fix the number of directors. Our shareholders do not have cumulative voting in the

election of directors.

Any

aspect of the foregoing, alone or together, could delay or prevent unsolicited takeovers and changes in control or changes in

our management.

Shareholder

Action by Written Consent

Our

Bylaws provide for action by our shareholders without a meeting with the written consent of shareholders holding the number of

shares necessary to approve such action if it were taken at a meeting of shareholders.

Special

Shareholder Meetings

Under

our Bylaws, the Chairperson of our Board, our Chief Executive Officer and a majority of the number of total authorized directors

(without regard to vacancies) may call a special meeting of shareholders. In addition, a special meeting may be called by the

shareholders of the Company holding at least one-fourth of all shares entitled to vote at a meeting of shareholders. Our Bylaws

establish that no business may be transacted at a special meeting otherwise than as specified in the notice of meeting provided

in advance to shareholders, which must be delivered to shareholders between 10 and 60 days prior to the special meeting.

PLAN

OF DISTRIBUTION

Each

Selling Shareholder (the “Selling Shareholders”) of the securities and any of their pledgees, assignees and successors-in-interest

may, from time to time, sell any or all of their securities covered hereby on the principal Trading Market or any other stock

exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed

or negotiated prices. A Selling Shareholder may use any one or more of the following methods when selling securities:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the

block as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

● |

in

transactions through broker-dealers that agree with the Selling Shareholders to sell a specified number of such securities

at a stipulated price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

Selling Shareholders may also sell securities under Rule 144 under the Securities Act of 1933, as amended (the “Securities

Act”), if available, rather than under this prospectus.

Broker-dealers

engaged by the Selling Shareholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive

commissions or discounts from the Selling Shareholders (or, if any broker-dealer acts as agent for the purchaser of securities,

from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an

agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a

principal transaction a markup or markdown in compliance with FINRA IM-2440.

In

connection with the sale of the securities or interests therein, the Selling Shareholders may enter into hedging transactions

with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of

hedging the positions they assume. The Selling Shareholders may also sell securities short and deliver these securities to close

out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling

Shareholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one

or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered

by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus

(as supplemented or amended to reflect such transaction).

The

Selling Shareholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each Selling Shareholder has informed the Company that it does not have any written or oral agreement

or understanding, directly or indirectly, with any person to distribute the securities.

The

Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The

Company has agreed to indemnify the Selling Shareholders against certain losses, claims, damages and liabilities, including liabilities

under the Securities Act.

We

agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the Selling

Shareholders without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without

the requirement for the Company to be in compliance with the current public information under Rule 144 under the Securities Act

or any other rule of similar effect or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under

the Securities Act or any other rule of similar effect. The resale securities will be sold only through registered or licensed

brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered

hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the

registration or qualification requirement is available and is complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not

simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined

in Regulation M, prior to the commencement of the distribution. In addition, the Selling Shareholders will be subject to applicable

provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of

purchases and sales of the common stock by the Selling Shareholders or any other person. We will make copies of this prospectus

available to the Selling Shareholders and have informed them of the need to deliver a copy of this prospectus to each purchaser

at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL

MATTERS

The

validity of the securities offered hereby will be passed upon for us by Nason, Yeager, Gerson, White & Lioce, P.A., West Palm

Beach, Florida.

EXPERTS

The

consolidated financial statements of Vapor Corp. incorporated by reference in this prospectus and registration statement as of

and for the years ended December 31, 2014 and 2013 have been audited by Marcum LLP, an independent registered public accounting

firm, as set forth in their report, which contains an explanatory paragraph as to the Company’s ability to continue as a

going concern, and are included in reliance upon such report given on the authority of such firm as experts in accounting and

auditing.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

documents listed below are incorporated by reference into this registration statement:

| |

● |

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2014, filed with the SEC on March 31, 2015; |

| |

|

|

| |

● |

The

information specifically incorporated by reference into our Annual Report on Form 10-K for the year ended December 31, 2014

from our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 30, 2015; |

| |

|

|

| |

● |

Our

Quarterly Report on Form 10-Q for the period ended March 31, 2015, filed with the SEC on May 15, 2015 and our Quarterly Report

on Form 10-Q for the period ended June 30, 2015, filed with the Commission on August 14, 2015; |

| |

|

|

| |

● |

Our

Current Reports on Form 8-K as filed with the SEC on January 26, 2015, January 28, 2015, February 3, 2015, February 26, 2015,

March 5, 2015 (as amended by the Form 8-K/A filed May 20, 2015), March 24, 2015, April 2, 2015, April 23, 2015, May 26, 2015,

June 9, 2015, June 25, 2015, July 7, 2015, July 28, 2015, July 31, 2015, August 4, 2015, August 6, 2015, and August 7, 2015

(other than information furnished pursuant to Items 2.02 and 7.01 of Form 8-K and any related exhibits); |

| |

|

|

| |

● |

The

description of our Common Stock contained in our Registration Statement on Form S-4 filed with the SEC on January 14, 2015,

including any amendment or report filed for the purpose of updating such description; and |

| |

|

|

| |

● |

All

documents subsequently filed pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of

the offering, (other than information furnished pursuant to Items 2.02 and 7.01 of Form 8-K and any related exhibits), shall

be deemed to be incorporated by reference into the prospectus. |

Any

statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus is modified or superseded

for purposes of the prospectus to the extent that a statement contained in this prospectus or in any other subsequently filed

document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement.

Upon

oral or written request, we will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a

copy of any or all of the information that has been incorporated by reference in this prospectus but not delivered with the prospectus.

You may request such information by writing to the Company at 3001 Griffin Road, Dania Beach, Florida 33312, Attention: Corporate

Secretary, or by contacting us at (561) 366-1249.

We

are an Exchange Act reporting company and are required to file periodic reports on Form 10-K and 10-Q and current reports on Form

8-K. You may read and copy all or any portion of the registration statement or any other information, which we file at the SEC’s

public reference room at 100 F Street, N.E., Washington, DC 20549, Please call the SEC at 1-800-SEC-0330 for further information

on the operation of the public reference room. Also, the SEC maintains an internet site that contains reports, proxy and information

statements, and other information that we file electronically with the SEC, including the registration statement. The website

address is www.sec.gov.

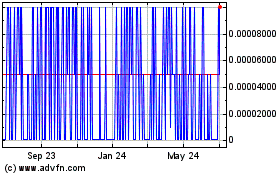

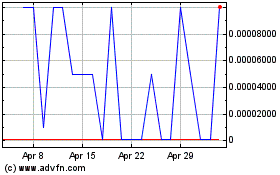

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024