UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 24, 2015

______________________________

|

| | | | |

| | | | |

LIFEVANTAGE CORPORATION (Exact name of registrant as specified in its charter) |

______________________________

|

| | | | |

|

| | | | |

Colorado | | 001-35647 | | 90-0224471 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

9785 S. Monroe Street, Suite 300, Sandy, UT 84070 |

(Address of Principal Executive Offices and Zip Code) |

| | | | |

Registrant’s telephone number, including area code: (801) 432-9000 |

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

|

| |

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

| |

|

| |

|

| |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(c)

On August 24, 2015, LifeVantage Corporation (the “Company”) announced the appointment of Mark Jaggi as its Chief Financial Officer, effective immediately. The press release announcing Mr. Jaggi’s appointment is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

In connection with his employment, the Company and Mr. Jaggi have entered into an offer letter and a Key Executive Benefit Package. Pursuant to the offer letter, the Company agreed to pay Mr. Jaggi an annual base salary of $325,000. Mr. Jaggi is also eligible to participate in the Company’s annual incentive plan at the officer level with a target bonus of 50% of his base salary. Any such incentive bonus will be paid to him during the first three months of the fiscal year that follows the applicable performance fiscal year. The incentive bonus, if any, will be deemed to have been earned on the date of payment of such bonus and Mr. Jaggi must be employed through the date of payment in order to receive the incentive bonus. The offer letter also provides that Mr. Jaggi will be granted restricted stock under the Company’s 2010 Long Term Incentive Plan in the amount of 120,000 shares of the Company’s common stock effective as of his employment start date of August 24, 2015. The Company and Mr. Jaggi will enter into a restricted stock grant agreement prescribed by the Company that will provide the terms and conditions of the restricted stock grant. The restricted stock award will vest as to 40,000 shares upon each of the first three year anniversaries of the date of grant, provided that Mr. Jaggi is still employed with the Company on each vesting date. The restricted stock grant will be subject to the terms of the Company’s 2010 Long-Term Incentive Plan.

Mr. Jaggi’s employment with the Company is at-will and either he or the Company can terminate his employment at any time and for any reason or for no reason, in each case subject to the terms and provisions of his offer letter and Key Executive Benefit Package. Upon termination of employment for any reason, Mr. Jaggi will receive payment or benefits from the Company covering the following: (i) all unpaid salary and unpaid vacation accrued through the date of termination of employment, (ii) any payments/benefits to which he is entitled under the express terms of any applicable Company employee benefit plan, (iii) any unreimbursed business expenses, and (iv) his then outstanding equity compensation awards as governed by their applicable terms. The payments and benefits described in the immediately preceding clauses “(i)” through “(iv)” are referred to collectively as the “Accrued Pay.”

If Mr. Jaggi voluntarily terminates his employment, if the Company terminates Mr. Jaggi’s employment for “cause” (as defined in the Key Executive Benefit Package) or if his employment terminates due to his disability (as defined in the Key Executive Benefit Package), death or presumed death, then he or his estate will be entitled to receive only the Accrued Pay.

If the Company terminates Mr. Jaggi’s employment without cause, he will be asked to execute and deliver to the Company a separation agreement that will provide, among other things, a release of all claims against the Company and a covenant not to sue the Company. So long as Mr. Jaggi executes and does not revoke the separation agreement, and he remains in full compliance with its terms, he will be entitled to (i) the Accrued Pay, and (ii) payments equal in the aggregate to six months of his then annualized base salary. The payments referred to in the immediately preceding clause “(ii)” will be paid in substantially equal monthly installments over the six month period following the date of termination of employment, except that the first payment (in an amount equal to two months of base salary) will be made on the 60th day following the date of termination of employment.

The description of the terms and provisions of the offer letter and Key Executive Benefit Package contained in this Item 5.02 is qualified in its entirety by reference to the actual offer letter and Key Executive Benefit Package, copies of which are attached hereto as Exhibit 10.1 and Exhibit 10.2, respectively, and incorporated herein by reference.

Prior to joining the Company, Mr. Jaggi, age 40, was the Executive Vice President, Treasurer and Chief Financial Officer of Twinlab Consolidated Holdings Inc., a publicly traded nutritional supplements and natural products company. Prior to joining Twinlab Consolidated Holdings in March 2012, Mr. Jaggi was with Summit Industries, a manufacturer and marketer of pharmaceutical and non-regulated liquid and cream solutions, as its President and Chief Executive Officer from 2009 until March 2012 and as its Chief Financial Officer from 2007 to 2009. Prior to Summit Industries, Mr. Jaggi served as Director of Finance at O’Sullivan Industries from 2005 to 2007 and held positions of increasing responsibility at Ford Motor Company from 1998 to 2005. Mr. Jaggi holds a Bachelors degree in Finance from the University of Utah and an MBA from Duke University.

There is no arrangement or understanding between Mr. Jaggi and any other person pursuant to which he was selected as an officer of the Company. Mr. Jaggi has no family relationship (within the meaning of Item 401(d) of Regulation S-K) with any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer. There has been no transaction since the beginning of the Company’s last fiscal year, and there is no currently proposed transaction, in excess of $120,000 in which the Company is or was a participant and in which Mr. Jaggi or any of his immediate family members (within the meaning of Item 404 of Regulation S-K) had or will have a direct or indirect material interest.

Prior to his employment start date as Chief Financial Officer of the Company, beginning July 21, 2015, Mr. Jaggi served as a consultant to the Company. The consulting relationship was pursuant to a Consulting Agreement between Mr. Jaggi and the Company, which provided that Mr. Jaggi was paid $150 per hour for his services.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

| | |

Exhibit No. | | Description |

10.1 | | Offer Letter by and between Mark Jaggi and LifeVantage Corporation dated July 17, 2015* |

10.2 | | Key Employee Benefits Package by and between Mark Jaggi and LifeVantage Corporation dated August 24, 2015* |

99.1 | | Press Release issued August 24, 2015 announcing appointment of new Chief Financial Officer |

* | | Management contract or compensatory plan or arrangement |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| |

|

| |

Date: August 24, 2015 | LIFEVANTAGE CORPORATION By: /s/ Beatryx Washington Name: Beatryx Washington Title: Vice President, Legal Affairs |

Mark R. Jaggi

Dear Mark,

LifeVantage Corporation (the “Company”), is pleased to offer you a position as Chief Financial Officer reporting directly to our President and Chief Executive Officer. We trust that your knowledge, skills and experience will be among our most valuable assets.

| |

• | Salary: Annual gross starting salary of $325,000 paid in installments by direct deposit. |

| |

• | Performance Bonuses: Subject to approval by the Board of Directors each fiscal year, participation in the Employee Bonus Plan at the Executive level with a target bonus of 50% of your annual base pay. |

| |

• | Equity: Upon approval of the Board of Directors, and equity grant in the amount of 120,000 restricted stock units vesting over three years. After the initial new hire grant, participation annually in the executive equity plan. |

| |

• | Benefits: Executive benefits as described in the attached Key Executive Benefits Agreement. |

To accept this job offer: Sign and date this job offer letter where indicated below.

If you accept this job offer, your hire date will be no later than August 17, 2015 as we would very much like you to be part of our year end close process and audit.

Please be aware that this offer of employment is contingent upon a drug screening and background check. LifeVantage is strongly committed to maintaining a drug-free workplace, and providing a safe and productive work environment for you. To maintain this environment, LifeVantage requires all new employees to pass a drug-screening test as a condition of employment, the results of which remain confidential. Upon your acceptance, please contact me to set up a convenient time for your screening.

|

| |

Sincerely,

/s/Michelle Oborn

Michelle Oborn Vice President Human Resources | Agreed to and accepted this 17th day of July, 2015.

/s/ Mark Jaggi

Mark Jaggi |

KEY EXECUTIVE BENEFIT PACKAGE

LifeVantage has established this Key Executive Benefit Package to attract, motivate and retain certain key executives of the company. An employee is considered a Key Executive upon the recommendation of the CEO and approval by the Company’s Compensation Committee. The components of the Key Executive Benefit Package are included below.

1.Position and Responsibilities. As of the Effective Date, you will commence serving as a key management executive of the Company. You shall have the duties, responsibilities and authority that are customarily associated with such position and such other senior management duties as may reasonably be assigned. You will devote your full time, efforts, abilities, and energies to promote the general welfare and interests of the Company and any related enterprises of the Company. Unless otherwise approved in writing by the Company’s Chief Executive Office and the Chairman of the Company’s Board of Directors, your primary workplace will be located at the Company’s headquarters located in Sandy, Utah. Nothing herein shall preclude you from (i) serving, with the prior consent of the President and CEO, as a member of the board of directors or advisory boards (or their equivalents in the case of a non-corporate entity) of non-competing businesses and charitable organizations, (ii) engaging in charitable activities and community affairs, and (iii) managing your personal investments and affairs; provided, however, that the activities set out in clauses (i), (ii) and (iii) shall be limited by you so as not to materially interfere, individually or in the aggregate, with the performance of your duties and responsibilities hereunder.

2. Annual Incentive Plan. As a key executive and during your continued employment as a key executive, you will be eligible to participate in the Employee Annual Incentive Plan at the level indicated in Exhibit A pursuant to the details of Board of Directors’ approved Annual Incentive Plan. Any Annual Incentive Award shall be paid to you during the first three months of the fiscal year that follows the applicable performance fiscal year. The Annual Incentive Award will be deemed to have been earned on the date of payment of such bonus and you must remain an employee of the Company through the date of payment in order to receive the Award.

3. Long Term Incentive Compensation Plan. As a key executive and during your continued employment as a key executive, you will be eligible to participate in the Board of Directors’ approved Employee Equity Plan pursuant to the plan details. Such equity grants, if any, will be made in the sole discretion of the Board of Directors and will be subject to the terms and conditions specified by the Board of Directors, the Company’s stock plan, the award agreement that you must execute as a condition of any grant and the Company’s insider trading policy. If required by applicable law with respect to transactions involving Company equity securities, you agree that you shall use your best efforts to comply with any duty that you may have to (i) timely report any such transactions and (ii) to refrain from engaging in certain transactions from time to time. The Company has no duty to register under (or otherwise obtain an exemption from) the Securities Act of 1933 (or applicable state securities laws) with respect to any Company equity securities that may be issued to you.

4. Employee Benefit Programs. During your employment with the Company, and except as may be provided under an employee stock purchase plan, you will be entitled to

participate, in all Company employee benefit plans and programs at the time or thereafter made available to Key Executives including, without limitation, any savings or profit sharing plans, deferred compensation plans, stock option incentive plans, group life insurance, accidental death and dismemberment insurance, hospitalization, surgical, major medical and dental coverage, vacation, sick leave (including salary continuation arrangements), long-term disability, holidays and other employee benefit programs sponsored by the Company. The Company may amend, modify or terminate these benefits at any time and for any reason. Any change in any employee benefit program or programs applicable to all covered key executive employees or all covered employees shall not constitute a material breach of the terms of the Agreement.

LifeVantage will pay all or a portion of the costs associated with the following company employee benefit plans:

5. Termination of Employment. Unless the Company requests otherwise in writing, upon termination of your employment for any reason, you understand and agree that you shall be deemed to have also immediately resigned from all positions as a key executive with the Company (and its affiliates) as of your last day of employment (the “Termination Date”). Upon termination of your employment for any reason, you shall receive payment or benefits from the Company covering the following: (i) all unpaid salary and unpaid vacation accrued pursuant to the paid time off policy through the Termination Date, (ii) any payments/benefits to which you are entitled under the express terms of any applicable Company employee benefit plan, (iii) any unreimbursed valid business expenses for which you have submitted properly documented reimbursement requests, and (iv) your then outstanding equity compensation awards as governed by their applicable terms (collectively, (i) through (iv) are the “Accrued Pay”). You may also be eligible for other post-employment payments and benefits as provided in this Agreement. Termination shall not be made until on or after the date of a “separation from service” within the meaning of Code Section 409A.

(a) At-Will Employment. Your employment with the Company is at-will and either you or the Company may terminate your employment at any time and for any reason (or no reason), with or without Cause (as defined below), in each case subject to the terms and provisions of this Agreement.

(b) For Cause. For purposes of this Agreement, your employment may be terminated by the Company for “Cause” as a result of the occurrence of one or more of the following: a charge, through indictment or criminal complaint, entry of pretrial diversion or sentencing agreement, or your conviction of, or a plea of guilty or nolo contendere to, a felony or other crime involving moral turpitude, dishonesty or fraud, or any other criminal arrest (for example D.U.I.) which the Company, in its discretion considers inappropriate or harmful to its interests;

(i) your refusal, or inability to satisfactorily, in the judgment or your supervisor, perform in any material respect your duties and responsibilities for the Company or your failure to comply in any material respect with the terms of this Agreement and the Confidentiality Agreement and the policies and procedures of the Company;

(ii) fraud or deceptive or illegal conduct in your performance of duties for the Company;

(iii) your material breach of any material term of this Agreement; or

(iv) any conduct by you which is materially injurious to the Company or materially injurious to the business reputation of the Company or a Company affiliate.

In the event your employment is terminated by the Company for Cause you will be entitled only to your Accrued Pay and you will be entitled to no other compensation from the Company.

(c) Without Cause. The Company may terminate your employment Without Cause at any time and for any reason with notice. If your employment is terminated Without Cause then, in addition to your Accrued Pay, you will be eligible to receive payments equal, in the aggregate amount, to six months of your base salary as of the Termination Date. Such payments shall be paid to you in cash, in substantially equal monthly installments payable over the six (6) month period following your Termination Date; provided, however, the first payment (in an amount equal to two (2) months of Base Salary) shall be made on the sixtieth (60th) day following the Termination Date. As a condition to receiving (and continuing to receive) the payments provided in this Section you must: (i) within not later than forty-five (45) days after your Termination Date, execute (and not revoke) and deliver to the Company a Separation Agreement in a form prescribed by the Company and such Separation Agreement shall include without limitation a release of all claims against the Company and its affiliates along with a covenant not to sue and (ii) remain in full compliance with such Separation Agreement and this Key Executive Benefit Package.

(d) Voluntary Termination. In the event you voluntarily terminate your employment with the Company, you will be entitled to receive only your Accrued Pay. You will be entitled to no other compensation from the Company.

(e) Death or Disability. In the event your employment with the Company is terminated due to your Disability, death or presumed death, then you or your estate will be entitled to receive your Accrued Pay. For purposes of this plan, “Disability” is defined to occur when you are unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than twelve (12) months.

6. Proprietary Information and Inventions Agreement; Confidentiality. You will be required, as a condition of your employment with the Company, to timely execute the Company’s form of proprietary information and inventions agreement as may be amended from time to time by the Company (“Confidentiality Agreement”).

7. Governing Law; Arbitration. To the extent not preempted by federal law, this Agreement will be deemed a contract made under, and for all purposes shall be construed in accordance with, the laws of Utah. Any controversy or claim relating to this Agreement or any breach thereof, and any claims you may have arising from or relating to your employment with the Company, will be settled solely and finally by arbitration in Salt Lake City, Utah before a single arbitrator and judgment upon such award rendered by the arbitrator may be entered in any court having jurisdiction thereof, provided that this Section shall not be construed to eliminate or reduce any right the Company or you may otherwise have to obtain a temporary restraining order or a preliminary or permanent injunction to enforce any of the covenants contained in this Agreement before the matter can be heard in arbitration.

8. Taxes. The Company shall have the right to withhold and deduct from any payment hereunder any federal, state or local taxes of any kind required by law to be withheld with respect to any such payment. The Company shall not be liable to you or other persons as to any unexpected or adverse tax consequence realized by you and you shall be solely responsible for the timely payment of all taxes arising from this Agreement that are imposed on you. This Agreement is intended to comply with the applicable requirements of Code Section 409A and shall be limited, construed and interpreted in a manner so as to comply therewith. Each payment made pursuant to any provision of this Agreement shall be considered a separate payment and not one of a series of payments for purposes of Code Section 409A. While it is intended that all payments and benefits provided under this Agreement to you will be exempt from or comply with Code Section 409A, the Company makes no representation or covenant to ensure that the payments under this Agreement are exempt from or compliant with Code Section 409A. The Company will have no liability to you or any other party if a payment or benefit under this Agreement is challenged by any taxing authority or is ultimately determined not to be exempt or compliant. In addition, if upon your Termination Date, you are then a “specified employee” (as defined in Code Section 409A), then solely to the extent necessary to comply with Code Section 409A and avoid the imposition of taxes under Code Section 409A, the Company shall defer payment of “nonqualified deferred compensation” subject to Code Section 409A payable as a result of and within six (6) months following your Termination Date until the earlier of (i) the first business day of the seventh (7th) month following your Termination Date or (ii) ten (10) days after the Company receives written confirmation of your death. Any such delayed payments shall be made without interest. Additionally, the reimbursement of expenses or in-kind benefits provided pursuant to this Agreement shall be subject to the following conditions: (1) the expenses eligible for reimbursement or in-kind benefits in one taxable year shall not affect the expenses eligible for reimbursement or in-kind benefits in any other taxable year; (2) the reimbursement of eligible expenses or in-kind benefits shall be made promptly, subject to the Company’s applicable policies, but in no event later than the end of the year after the year in which such expense was incurred; and (3) the right to reimbursement or in-kind benefits shall not be subject to liquidation or exchange for another benefit.

9. Entire Agreement. Except as otherwise specifically provided in this Agreement, this Agreement (and the agreements referenced herein) contains all the legally binding understandings and agreements between you and the Company pertaining to the subject matter of this Agreement and supersedes all such agreements, whether oral or in writing, previously discussed or entered into between the parties including without limitation any term sheets regarding your potential employment with the Company. As a material condition of this

Agreement, you represent that by entering into this Agreement or by becoming a Company employee you are not violating the terms of any other contract or agreement or other legal obligations that would prohibit you from performing your duties for the Company. You further agree and represent that in providing your services to the Company you will not utilize or disclose any other entity's trade secrets or confidential information or proprietary information. You represent that you are not resigning employment or relocating any residence in reliance on any promise or representation by the Company regarding the kind, character, or existence of such work, or the length of time such work will last, or the compensation therefor.

10. Non-Competition and Non-Solicitation.

(a) Non-solicitation of employees and consultants. During your employment and for a period of two years after your employment terminates, you will not directly or indirectly solicit or induce, or attempt to solicit or induce, any employee or consultant, to include independent contractors, of the Company to quit their employment or cease rendering services to the Company, unless you are specifically authorized to do so by the Company in writing.

(b) Non-solicitation of Independent Distributors or Customers. To the extent permitted under applicable law, and in order to protect the Confidential Information and preserve the Company’s relationships with its prospects and customers, you agree that for a period of two (2) years after your employment with the Company ends for any reason, you will not directly or indirectly solicit any Independent Distributor, Preferred Customer or Direct Retail Customer for another competing Network Marketing Venture consisting of nutritional supplements or any other product (any product in the same generic product category as a Company product is deemed to be competing (e.g., any nutritional supplement is in the same generic category as Company’s nutritional supplements, and is therefore a competing product, regardless of differences in cost, quality, ingredients or nutrient content) or service of the Company at the time of your termination with any prospect or customer of the Company. By signing the Agreement, you acknowledge and agree that the Company is trying to protect legitimate business interests by this prohibition and such prohibition is reasonable in its scope and duration.

(c) Non-Competition. You shall not, for a period of one (1) year after your employment with the Company ends for any reason, engage in, advise or consult with, or accept employment with any company, business or any entity, or contribute your knowledge to any work or activity that involves a product, process, provision of services or distribution channel (network marketing) as offered by the company, the development and/or sales of nutritional supplements, or any other product or service of the Company which is competitive with and the same as or similar to a product, process, or provision of services or distribution channel (network marketing) on which you worked or with respect to which you had access to confidential information while with the Company. Following expiration of said one-year period, you shall continue to be obligated under the confidential provisions of this Agreement and of your proprietary information and inventions agreement not to disclose and/or use confidential information so long as it shall remain proprietary or protectable as confidential or trade secret information. You acknowledge that this restraint is reasonable as to time and geographic limits

and is necessary to protect the Company’s Confidential Information, and that it will not unduly restrict your ability to secure suitable employment after leaving the Company.

(d) Modification By Court. If any court or arbitrator determines that any post-employment restrictive covenant is unreasonable in any respect, you agree that the Court may modify any unreasonable terms and enforce the agreement as modified.

(e) Extension of Non-Compete. For any period of time in which you are found to be in violation of any of the above non-compete or non-solicitation agreements, that period of time shall be added on to the length of the restriction or period of protection for the Company.

(f) Notice to Subsequent Employers. You agree that the Company may provide notice of your obligations under any provision of this Agreement to any company or future employer of yours should the Company consider it necessary for the enforcement of those obligations.

11. Covenants. As a condition of this Agreement and to your receipt of any post-employment benefits, you agree that you will fully and timely comply with all of the covenants set forth in this subsection (which shall survive your termination of employment and termination or expiration of this Agreement):

(a) You will fully comply with all obligations under the Confidentiality Agreement and further agree that the provisions of the Confidentiality Agreement shall survive any termination or expiration of this Agreement or termination of your employment or any subsequent service relationship with the Company;

(i) Within five (5) days of the Termination Date, you shall return to the Company all Company confidential information including, but not limited to, intellectual property, etc., and you shall not retain any copies, facsimiles or summaries of any Company proprietary information;

(ii) You will not at any time make (or direct anyone to make) any disparaging statements (oral or written) about the Company, or any of its affiliated entities, officers, directors, employees, stockholders, representatives or agents, or any of the Company’s products or services or work-in-progress, that are harmful to their businesses, business reputations or personal reputations.;

(iii) You agree that during the period of your employment with the Company and thereafter, you will not utilize any trade secrets of the Company in order to solicit, either on behalf of yourself or any other person or entity, the business of any client or customer of the Company, whether past, present or prospective. The Company considers the following, without limitation, to be its trade secrets: Financial information, administrative and business records, analysis, studies, governmental licenses, employee records (including but not limited to counts and goals), prices, discounts, financials, electronic and written files of Company policies, procedures, training, and forms, written or electronic work product that was authored, developed, edited, reviewed or received from or on behalf of the Company during period of employment, Company developed technology, software, or computer programs, process manuals, products,

business and marketing plans and or projections, Company sales and marketing data, Company technical information, Company strategic plans, Company financials, vendor affiliations, proprietary information, technical data, trade secrets, know-how, copyrights, patents, trademarks, intellectual property, and all documentation related to or including any of the foregoing; and

(iv) You agree that, upon the Company’s request and without any payment therefore, you shall reasonably cooperate with the Company (and be available as necessary) after the Termination Date in connection with any matters involving events that occurred during your period of employment with the Company.

(b) You also agree that you will fully and timely comply with all of the covenants set forth in this subsection (which shall survive your termination of employment and termination or expiration of this Agreement):

(i) You will fully pay off any outstanding amounts owed to the Company no later than their applicable due date or within thirty days of your Termination Date (if no other due date has been previously established);

(ii) Within five (5) days of the Termination Date, you shall return to the Company all Company property including, but not limited to, computers, cell phones, pagers, keys, business cards, etc.;

(iii) Within thirty (30) days of the Termination Date, you will submit any outstanding expense reports to the Company for expenses incurred prior to the Termination Date; and

(iv) As of the Termination Date, you will no longer represent that you are an officer, director or employee of the Company and you will immediately discontinue using your Company mailing address, telephone, facsimile machines, voice mail and e-mail;

(c) You agree that you will strictly adhere to and obey all Company rules, policies, procedures, regulations and guidelines, including but not limited to those contained in the Company’s employee handbook, as well any others that the Company may establish including without limitation any policy the Company adopts on the recoupment of compensation (“Clawback Policy”).

12. Offset. Any severance or other payments or benefits made to you under this Agreement may be reduced, in the Company’s discretion, by any amounts you owe to the Company provided that any such offsets do not violate Code Section 409A.

13. Notice. Any notice that the Company is required to or may desire to give you shall be given by personal delivery, recognized overnight courier service, email, telecopy or registered or certified mail, return receipt requested, addressed to you at your address of record with the Company, or at such other place as you may from time to time designate in writing. Any notice that you are required or may desire to give to the Company hereunder shall be given by personal delivery, recognized overnight courier service, email, telecopy or by registered or certified mail, return receipt requested, addressed to the Company’s General Counsel at its principal office, or at such other office as the Company may from time to time designate in

writing. The date of actual delivery of any notice under this Section shall be deemed to be the date of delivery thereof.

14. Waiver; Severability. No provision of this Agreement may be amended or waived unless such amendment or waiver is agreed to by you and the Company in writing and such amendment or waiver expressly references this Section. No waiver by you or the Company of the breach of any condition or provision of this Agreement will be deemed a waiver of a similar or dissimilar provision or condition at the same or any prior or subsequent time. Except as expressly provided herein to the contrary, failure or delay on the part of either party hereto to enforce any right, power, or privilege hereunder will not be deemed to constitute a waiver thereof. In the event any portion of this Agreement is determined to be invalid or unenforceable for any reason, the remaining portions shall be unaffected thereby and will remain in full force and effect to the fullest extent permitted by law.

15. Voluntary Agreement. You acknowledge that you have been advised to review this Agreement with your own legal counsel and other advisors of your choosing and that prior to entering into this Agreement, you have had the opportunity to review this Agreement with your attorney and other advisors and have not asked (or relied upon) the Company or its counsel to represent you or your counsel in this matter. You further represent that you have carefully read and understand the scope and effect of the provisions of this Agreement and that you are fully aware of the legal and binding effect of this Agreement. This Agreement is executed voluntarily by you and without any duress or undue influence on the part or behalf of the Company.

16. Key-Man Insurance. The Company shall have the right to insure your life for the sole benefit of the Company, in such amounts, and with such terms, as it may determine. All premiums payable thereon shall be the obligation of the Company. You shall have no interest in any such policy, but you agree to cooperate with the Company in taking out such insurance by submitting to physical examinations, supplying all information required by the insurance company, and executing all necessary documents, provided that no financial obligation is imposed on you by any such documents.

ACKNOWLEDGED AND AGREED:

|

| | |

This 24th day of August, 2015. | | This 24th day of August, 2015. |

LIFEVANTAGE CORPORATION KEY EXECUTIVE

|

| | | |

/s/ Darren Jensen | | /s/ Mark Jaggi |

BY: Darren Jensen | | | Name: Mark Jaggi |

TITLE: President and CEO | | | |

EXHIBIT A

TARGET ANNUAL INCENTIVE

|

| | | | |

Name | | Title | | Target Annual Incentive |

Mark Jaggi | | Chief Financial Officer | | 50% |

LifeVantage Appoints Mark Jaggi New Chief Financial Officer

Salt Lake City, UT, August 24, 2015, LifeVantage Corporation (Nasdaq: LFVN), announced today that Mark Jaggi has been appointed Chief Financial Officer for the company effective August 24, 2015.

Mr. Jaggi is a highly experienced finance and operations executive, having spent the past 20 years in lead financial, operational, and strategic planning roles. Most recently, Mr. Jaggi served as Chief Financial Officer at TwinLab Consolidated Holdings, where he led and supported their debt and equity financing, as well as the financial and operational decision-making in all areas of the business.

Prior to TwinLab Consolidated Holdings, Mr. Jaggi served as Chief Executive Officer and Chief Financial Officer at Summit Industries, a manufacturer and marketer of pharmaceutical and non-regulated liquid and cream solutions. Prior to Summit Industries, Mr. Jaggi was Chief Financial Officer at O’Sullivan Industries, where he led the international financial processes including analysis, accounting operations, reporting, forecasting and auditing within the consumer products industry. Mr. Jaggi began his career in finance at Ford Motor Company serving in product development vehicle line finance, acquisitions, and sales and marketing.

“The opportunity to join LifeVantage, with its high-quality products and Distributors, was a compelling opportunity for me,” said Jaggi. “I look forward to helping the company leverage its underlying strengths including the science-based product offering, the distributor field, its healthy balance sheet, and solid base of operations. I am excited to be joining this executive management team that is united in the goal of significantly improving the financial performance at LifeVantage.”

“Mark Jaggi brings the perfect mix of business acumen and financial expertise to the company,” said LifeVantage President and Chief Executive Officer Darren Jensen. “His years of experience in the nutritional supplement industry as a finance and operations executive, and within growing, publicly traded companies gives Mark a clear understanding of

what needs to be accomplished to successfully and responsibly position LifeVantage for long-term sustainable growth.”

About LifeVantage Corporation

LifeVantage Corporation (Nasdaq: LFVN), is a science based network marketing company dedicated to visionary science that looks to transform health, wellness and anti-aging internally and externally at the cellular level. The company is the maker of Protandim®, the Nrf2 Synergizer® patented dietary supplement, the TrueScience™ Anti-Aging Skin Care Regimen, Canine Health, and the AXIO™ energy product line. LifeVantage was founded in 2003 and is headquartered in Salt Lake City, Utah.

Forward Looking Statements

This document contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as "believe," "hopes," "intends," "estimates," "expects," "projects," "plans," "anticipates," "look forward to," "goal" and variations thereof, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. Examples of forward-looking statements include, but are not limited to, statements we make regarding our leadership transition, future growth and financial performance. Such forward-looking statements are not guarantees of performance and the Company's actual results could differ materially from those contained in such statements. These forward-looking statements are based on the Company's current expectations and beliefs concerning future events affecting the Company and involve known and unknown risks and uncertainties that may cause the Company's actual results or outcomes to be materially different from those anticipated and discussed herein. These risks and uncertainties include, among others, those discussed in greater detail in the Company's Annual Report on Form 10-K and the Company's Quarterly Report on Form 10-Q under the caption "Risk Factors," and in other documents filed by the Company from time to time with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this document. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this document, except as required by law.

Investor Relations Contacts:

Cindy England (801) 432-9036

Director of Investor Relations

-Or-

John Mills (646) 277-1254

Partner, ICR INC

Company Relations Contact:

John Genna (801) 432-9172

Vice President of Communications &

Corporate Partnerships

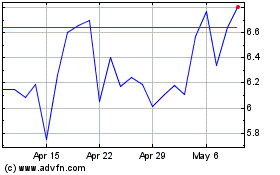

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

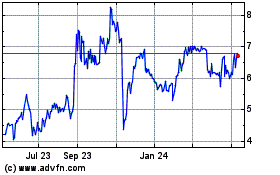

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Apr 2023 to Apr 2024