Revenue growth of 9.1% to USD 52.5 million - above-market

growth in core monitoring services resulting in market share gains

- substantial increase in profitability as efficiency measures bear

fruit - EBITDA margin of 13.8% achieved - net profit of USD 1.9

million vs. net loss of USD 4.7 million in H1 2014 - full-year

guidance reiterated

LifeWatch AG (SIX Swiss Exchange: LIFE), a leading developer and

provider of medical solutions and remote diagnostic monitoring

services in the digital health market, is pleased to report on good

progress during the first half of 2015. In total, revenues during

the first six months amounted to USD 52.5 million, an increase of

9.1% compared to the prior year period. Monitoring services (99.7%

of revenues) grew by 12.1%, clearly outperforming the market

average and thus resulting in market share gains. During the first

half year, our US-based subsidiary LifeWatch Services Inc. signed

40 new or amended contracts, underpinning our brand and sales force

successes. Device sales declined to USD 0.2 million due to delivery

delays into the second half of 2015. The gross profit margin

amounted to 52.8% versus 52.1% a year earlier. We expect the gross

margin to continue to expand mid-term as on-going cost and

efficiency measures, product mix improvements and new project

launches take effect.

Substantial improvement in operating profitability

Our operating profitability improved substantially thanks to the

positive impact of the restructuring and productivity measures that

we implemented over the past year. As such, EBITDA during the first

half year reached USD 7.2 million (H1 2014 LBITDA of USD -1.5

million), equivalent to an EBITDA margin of 13.8%, and EBIT

amounted to USD 3.8 million (EBIT margin of 7.3%), marking the

highest levels since the first half of 2009. Significant progress

was achieved in Sales & Marketing thanks to sales force

optimization and territory realignment, resulting in an 800 bps

reduction to 18% of revenues (H1 2014: 26%). Likewise, the

reorganization of the R&D activities during the second half of

2014 as well as the capitalization of some development costs led to

a 300 bps reduction in R&D to 3.8% of revenues. Without

capitalization, R&D expenses would represent 5.7% of revenues

(H1 2014: 8%). Thanks to these substantial cost savings, together

with slightly lower General & Administration costs, the absence

of restructuring charges and despite a higher tax charge, LifeWatch

was able to achieve a positive net income of USD 1.94 million

during the first half of 2015, compared to a net loss of USD 4.72

million during the prior period. As a result of this good operating

performance, the company generated a cash flow from operations of

USD 4.2 million during the first six months of 2015, against a cash

drain of USD 2.8 million during H1 2014. The equity ratio stood at

54.3% as of June 30, 2015 (53.4% as of December 31, 2014).

On-going development and market activities

As previously announced, development activities are continuing

on both our cardiac and vital signs monitoring patches. The pilot

trials for the vital signs monitoring system are on-going with two

new clinics being added in September, one in the United States and

one in Switzerland. The FDA's enforcement of its new guidances on

medical devices "Design Considerations for Devices Indicated for

Home Use" and "Mobile Medical Applications" has resulted in

unexpected minor delays in obtaining the requisite FDA clearances

for LifeWatch's cutting-edge technologies. Clearance for the vital

signs monitoring system is however still expected later this year,

allowing for a limited market release during the fourth quarter.

The cardiac monitoring patch is currently being tested in a

hospital environment. Here again, the new FDA guidance is somewhat

delaying regulatory clearance, although we still anticipate a full

market launch later this year.

Positive news was received in July regarding an 8% increase in

the reimbursement rate from Medicare for our Telemetry offering

(ACT) as of 2016. This should lead to improved revenues and profits

of around USD 3.5 million in 2016. This change will further enhance

our expected revenue growth for 2016 and beyond.

Furthermore, we are on track to launch our cardiac monitoring

business in the Turkish market in the first half of 2016 and are

currently in the process of establishing the necessary organization

and infrastructure to meet this goal. This is a first step in the

global expansion of our remote cardiac monitoring services.

Although these development activities, as well as other

opportunities currently under review, involve significant costs in

the short-term, we believe they are necessary to enhance our future

growth and thereby remain a leader in this rapidly growing digital

health market.

Outlook

LifeWatch stands by its full-year 2015 guidance. The company is

continuing its efforts to update and grow its core business while

at the same time launching new products and entering new markets.

Dr. Stephan Rietiker commented: "Our market growth and efficiency

programs are progressing well and I am particularly excited about

the prospects for our new products and of our new markets. We

firmly believe that we are setting the stage for continued above

average growth and increased profitability in the years to

come."

Key figures (unaudited, USD millions):

H1 2015

H1 2014

Revenues 52.51 48.12 Gross profit 27.75 25.09 As % of revenues

52.8% 52.1% EBITDA / (LBITDA) 7.23 (1.52) As % of revenues 13.8% NA

EBIT / (LBIT) 3.81 (4.13) As % of revenues 7.3% NA Net income

(loss) 1.94 (4.72) As % of revenues 3.7% NA Earnings (loss) per

share 0.14 (0.36) Total fixed assets, net 16.22 13.02 Total assets

71.94 68.54 Total equity 39.04 34.82 As % of total assets 54.3% 51%

Net cash flow 0.02 (3.92) Employees 612 561

Detailed reporting

The report on the first half 2015 can be found on our website

using the following link:

http://irlifewatch.com/websites/lifewatch_ir/English/4020/interim-reports.

html

The presentation on the first half 2015 is available under this

link:

http://irlifewatch.com/websites/lifewatch_ir/English/5010/financial-presentations.html

Today's conference call

A conference call on LifeWatch's half-year results will be held

today at 14.00 CET.

Dial-in numbers for the conference call:CH: +41 22 580 59 70GER:

+49 69 2222 29 043UK: +44 203 00 92 452US: +1 855 402 77

66Participant Pin Code: 60170589#

The live audio webcast and presentation slides will be available

under following link:

http://lifewatch200815-live.audio-webcast.com/

About LifeWatch AG:

LifeWatch AG, headquartered in Zug and listed on SIX Swiss

Exchange (LIFE), Switzerland, is a leading healthcare technology

and solution company, specializing in advanced digital health

systems and wireless remote diagnostic patient monitoring services.

LifeWatch's services provide physicians with critical information

to determine appropriate treatment and thereby improve patient

outcomes. LifeWatch AG has operative subsidiaries in the United

States, in Switzerland and in Israel, and is the parent company of

LifeWatch Services Inc., and LifeWatch Technologies, Ltd. LifeWatch

Services, Inc. is a leading U.S.-based provider of cardiac

monitoring services and home sleep testing of Obstructive Sleep

Apnea (OSA). LifeWatch Technologies Ltd., based in Israel, is a

leading developer and manufacturer of telemedicine products. For

additional information, please visit www.lifewatch.com.

Sign up for customized e-mail alerts and documentation

requests at http://www.irlifewatch.com/alert-service.aspx

This press release includes forward-looking statements. All

statements other than statements of historical facts contained in

this press release, including statements regarding future results

of operations and financial position, the business strategy, and

plans and objectives for future operations, are forward-looking

statements. The words "believe," "may," "will," "estimate,"

"continue," "anticipate," "intend," "expect" and similar

expressions are intended to identify forward-looking statements.

LifeWatch AG has based these forward-looking statements largely on

current expectations and projections about future events and

financial trends that it believes may affect the financial

condition, results of operations, business strategy, short-term and

long-term business operations and objectives, and financial needs.

These forward-looking statements are subject to a number of risks,

uncertainties and assumptions. In light of these risks,

uncertainties and assumptions, the forward-looking events and

circumstances described may not occur and actual results could

differ materially and adversely from those anticipated or implied

in the forward-looking statements. All forward-looking statements

are based only on data available to LifeWatch AG at the time of the

issue of this press release. LifeWatch AG does not undertake any

obligation to update any forward-looking statements contained in

this press release as a result of new information, future events or

otherwise.

THIS PRESS RELEASE IS NOT BEING ISSUED IN THE UNITED STATES OF

AMERICA AND SHOULD NOT BE DISTRIBUTED TO UNITED STATES PERSONS OR

PUBLICATIONS WITH A GENERAL CIRCULATION IN THE UNITED STATES. THIS

PRESS RELEASE DOES NOT CONSTITUTE AN OFFER OF SECURITIES OF

LIFEWATCH AG OR ANY OF ITS SUBSIDIARIES FOR SALE IN THE UNITED

STATES, OR AN INVITATION TO SUBSCRIBE FOR OR PURCHASE ANY

SECURITIES OF LIFEWATCH AG OR ITS SUBSIDIARIES IN THE UNITED

STATES. IN ADDITION, THE SECURITIES OF LIFEWATCH AG AND ITS

SUBSIDIARIES HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES

SECURITIES LAWS AND MAY NOT BE OFFERED, SOLD OR DELIVERED WITHIN

THE UNITED STATES OR TO U.S. PERSONS ABSENT FROM REGISTRATION UNDER

OR AN APPLICABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF

THE UNITED STATES SECURITIES LAWS. ANY PUBLIC OFFERING OF

SECURITIES TO BE MADE IN THE UNITED STATES WILL BE MADE BY MEANS OF

A PROSPECTUS THAT MAY BE OBTAINED FROM LIFEWATCH AG OR ITS

SUBSIDIARIES, AS APPLICABLE, AND WILL CONTAIN DETAILED INFORMATION

ABOUT THE ISSUER AND ITS MANAGEMENT AS WELL AS FINANCIAL STATEMENTS

OF THE ISSUER.

Language: English Company: LifeWatch AG Baarerstrasse

139 6300 Zug Switzerland Phone: +41 41 728 67 78 Internet:

www.lifewatch.com

ISIN: CH0012815459 Valor: 811189 Listed: Regulated Unofficial

Market in Berlin, Stuttgart; Open Market in Frankfurt ; SIX

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150819006321/en/

LifeWatch AG c/o Dynamics GroupPhilippe Blangey / Doris

RudischhauserPhone: +41 43 268 32 35 / +41 79 410 81

88investor-relations@lifewatch.com

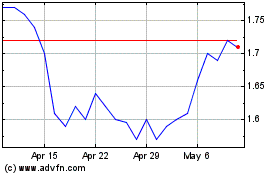

aTyr Pharma (NASDAQ:LIFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

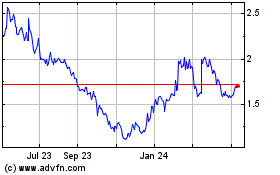

aTyr Pharma (NASDAQ:LIFE)

Historical Stock Chart

From Apr 2023 to Apr 2024