Fannie, Freddie Regulator Leaves Affordable-Housing Targets Little Changed

August 19 2015 - 2:00PM

Dow Jones News

Fannie Mae's and Freddie Mac's regulator won't push the mortgage

companies to direct additional lending resources to low-income

borrowers, a blow to affordable-housing advocates.

On Wednesday, the Federal Housing Finance Agency announced new

target goals for the percentage of the mortgage companies' business

that must go to less well-off borrowers. Under the new goals, which

are effective from this year to 2017, 24% of Fannie's and Freddie's

mortgages to buy homes will be expected to go to families with

incomes no higher than 80% of their areas' median income, up one

percentage point from 2014.

Fannie and Freddie will also have the goal of directing 6% of

their home purchase loans to families with incomes that are no more

than half of their areas' median, down one percentage point from

2014.

Overall, the goals were little changed from 2014 and from what

was proposed a year ago, apart from adjustments reflecting changes

in the overall mortgage market. After an unexpected boomlet in

mortgage refinances, for example, the FHFA dropped sharply the

percentage of refinance loans that Fannie and Freddie must direct

to low-income borrowers from last year's proposal.

The goals are closely watched by affordable-housing advocates,

who see them as a means of guaranteeing that Fannie and Freddie

further mortgage access for low-income borrowers. Some critics, on

the other hand, hold the goals partly responsible for leading to

the risky lending practices that precipitated the financial

crisis.

Last year, when the proposed goals were announced, housing

advocates were disappointed. "The affordable-housing goals proposed

by FHFA fall far short of what will be needed to ensure that all

creditworthy Americans have access to mortgages," said John Taylor,

president of the National Community Reinvestment Coalition, in

response to last year's proposal. "We urge FHFA Director Mel Watt

to adopt meaningful affordable-housing goals that will ensure broad

access to conventional mortgage credit for creditworthy borrowers,

including working-class families."

In a statement on Wednesday, Mr. Watt said, "These goals

establish a solid foundation for affordable and sustainable

homeownership and rental opportunities in this country."

Fannie and Freddie don't make loans. They buy them from lenders,

wrap them into securities and provide guarantees to make investors

whole if the loans default.

Federal law requires a certain percentage of Fannie's and

Freddie's mortgage purchases to be for loans to certain kinds of

borrowers, such as to families who have an income no greater than

80% of their areas' median income. Policy makers meant the law to

ensure that Fannie and Freddie promoted mortgage access for

worse-off borrowers as part of their mission.

Since the financial crisis, some researchers have said the goals

encouraged the sort of risky lending to marginal borrowers that led

to the housing bust. However, other researchers have said that the

goals had little impact on overall mortgage availability.

After Mr. Watt, a former Democratic congressman, in January 2014

took the helm of the FHFA from acting director Ed DeMarco, many

affordable housing advocates were optimistic that he would sharply

increase Fannie's and Freddie's affordable housing benchmarks and

take other initiatives to increase mortgage access for less

creditworthy borrowers.

However, since taking the reins, Mr. Watt has taken a more

measured approach, upsetting some advocates.

For mortgage refinances to low-income borrowers, Fannie and

Freddie's goal increased one percentage point from 2014 to 21%.

Write to Joe Light at joe.light@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 19, 2015 13:45 ET (17:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

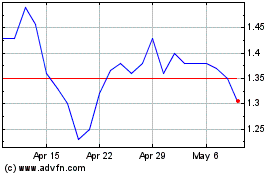

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Apr 2023 to Apr 2024