UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 13, 2015

CORTEX

PHARMACEUTICALS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

1-16467 |

|

33-0303583 |

| (State

or other jurisdiction |

|

(Commission |

|

(I.R.S

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

126

Valley Road, Suite C

Glen

Rock, New Jersey |

|

07452 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (201) 444-4947

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| [ ] |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| [ ] |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item

1.01 Entry into a Material Definitive Agreement.

On

November 5, 2014, Cortex Pharmaceuticals, Inc. (the “Company”) entered into a Convertible Note and Warrant Purchase

Agreement (the “Purchase Agreement”) with various accredited investors (each, a “Purchaser”), pursuant

to which the Company sold its (i) 10% Convertible Notes due September 15, 2015 (“Notes”) and (ii) Warrants to Purchase

Common Stock (“Warrants”). This financing was the initial closing on a private placement of up to $1,000,000 (the

“Private Placement”), and subsequent closings occurred on December 9, 2014, December 31, 2014 and February 2, 2015.

The Company terminated the Private Placement on February 18, 2015, having generated aggregate gross proceeds of $579,500 in the

four closings.

As

set forth in the Notes, the outstanding principal balance of each Note and all accrued and unpaid interest was due and payable

in full on September 15, 2015, subject to the Company’s ability to extend that maturity date. On August 13, 2015, the Company

determined to extend the maturity date of the Notes to September 15, 2016 and sent notice to note holders of its election, pursuant

to the terms of the Notes. As a consequence of this election, under the terms of the Notes the Company will be required to issue

to note holders approximately 8,900,000 additional warrants (the “New Warrants”) that will be exercisable through

September 15, 2016. As set forth in Section 2 of the Notes, the New Warrants will be exercisable for that number of shares of

common stock of the Company calculated as the principal amount of the Note (an aggregate amount of $579,500), plus any accrued

and unpaid interest (estimated to be approximately $43,750 in the aggregate through September 15, 2015), multiplied by 50%, and

then divided by $0.035. The New Warrants will otherwise have terms substantially similar to the Warrants. The form of both the

Warrants and the Notes was attached as an Exhibit to the form of Purchase Agreement, filed November 12, 2014 as Exhibit 10.1 to

the Company’s Current Report in Form 8-K in connection with the initial sale of the Notes and Warrants, and is incorporated

herein by reference.

The

Warrants to purchase approximately 16,600,000 shares of common stock initially distributed with the Notes were exercisable until

5:00 p.m. on September 15, 2015 at the same price per share of Common Stock at which the Notes are convertible and into the number

of shares of Common Stock calculated as each Purchaser’s investment amount divided by $0.035. In connection with the extension

of the maturity date of the Notes, the Board of Directors of the Company (the “Board”) determined to extend the termination

date of the original Warrants to September 15, 2016, so that they are coterminous with the new maturity date of the Notes.

Item

2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

The

information provided in response to Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.04.

By electing to extend the maturity date of the Notes, the Company will increase its aggregate obligations under the Notes through

the increase in the total accrued interest to be paid on the Notes at the extended maturity date by the amount to be accrued during

the extension period.

Item

3.02 Unregistered Sales of Equity Securities.

The

information provided in response to Item 1.01 of this report is incorporated by reference into this Item 3.02. The Purchasers

of the Notes and Warrants made representations to the Company that they met the accredited investor definition of Rule 501 of

the Securities Act, and the Company relied on such representations. The offer and sale of the Notes and Warrants, and subsequent

issuance of the New Warrants, were made in reliance on the exemption from registration afforded by Section 4(a)(2) of the Securities

Act as provided in Rule 506(b) of Regulation D promulgated thereunder. The offering of the Notes and Warrants, and the issuance

of the New Warrants, were not conducted in connection with a public offering, and no public solicitation or advertisement was

made or relied upon by any investor in connection with the offering. This Current Report on Form 8-K shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall such securities be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

Appointment

of New President and CEO

On

August 18, 2015, the Company entered into a contract hiring James S. J. Manuso, as its new President and Chief Executive Officer.

Dr. Manuso, age 66, is being hired for an initial three year term. There is no family relationship between Dr. Manuso and any

other officer or director of the Company. Since the end of the Company’s last fiscal year, there have been no transactions

in excess of $120,000 in which the Company was a participant and Dr. Manuso had a direct or indirect financial interest.

Dr.

Manuso will receive an initial annual base salary of $375,000, subject to certain conditions, which will increase to $425,000

annually upon the first anniversary of his contract, again subject to certain conditions being met. Dr. Manuso will also be eligible

to receive bonuses ranging from $100,000 to $300,000, once certain conditions have been met or at the discretion of the Board.

In connection with his hiring and as further discussed below, Dr. Manuso will also receive stock options to acquire 85,000,000

shares of common stock of the Company, in part under its 2014 Equity, Equity-Linked and Equity Derivative Incentive Plan (the

“2014 Plan”) and in part under its 2015 Stock and Stock Option Plan (the “2015 Plan” and together with

the 2014 Plan, the “Plans”). Dr. Manuso will be eligible to receive additional awards under the Plans in the Board’s

discretion. Dr. Manuso also has agreed to subscribe to purchase newly issued securities of the Company in an amount of $250,000,

on terms to be agreed between the parties. Dr. Manuso will also receive, beginning on the first anniversary of the Effective Date

(as defined in the agreement), additional compensation to cover automobile lease expenses (up to a maximum of $16,000 annually)

if certain conditions are met, and, until such time as the Company establishes a group health plan for its employees, $1,200 per

month to cover the cost of health coverage and up to $1,000 per month for a term life insurance policy and disability insurance

policy. He will also be reimbursed for business expenses, as set forth in greater detail in his employment agreement. This description

of Dr. Manuso’s employment agreement with the Company does not purport to be complete and is qualified in its entirety by

reference to his employment agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.2 and is incorporated

herein by reference.

Dr. Manuso is the former Chairman of the Board

of Directors and Chief Executive Officer of Astex Pharmaceuticals, Inc. (“Astex”) (NASDAQ: ASTX), having served in

such positions from July 2011 through October 2013. Dr. Manuso had previously served as the President and Chief Executive Officer,

as well as Chairman of the Board of Directors, of Astex (formerly SuperGen, Inc.: NASDAQ: SUPG) from January 2004 to July 2011,

and as a director of Astex since February 2001.

Dr.

Manuso currently serves on the board of directors of privately-held KineMed, Inc. Previously, Dr. Manuso served on the boards

of directors of The Biotechnology Industry Organization (BIO) and its Health Section Governing Board, Novelos Therapeutics, Inc.

(NVLT.OB; now Cellectar Biosciences, Inc.), Symbiontics, Inc., Quark Pharmaceuticals, Inc., EuroGen, Ltd. (London, UK), where

he was chairman, and other industry companies.

Appointment

of New Director and Vice Chairman

Dr.

Manuso is also being appointed as a director of the Company, as of August 18, 2015, filling an existing vacancy on the Board.

In addition to being a member of the Board, he has agreed to serve as Vice Chairman, a non-executive position. Dr. Manuso will

not receive any additional compensation in his capacity as either a director or Vice Chairman. It has not yet been determined

on which committees of the Board Dr. Manuso will serve.

Resignation

of Existing President and Chief Executive Officer and Appointment to New Position

On

August 18, 2015, the Company, concurrently with the hiring of James S. J. Manuso as the new President and Chief Executive Officer

of the Company as described above, accepted the resignation of Dr. Arnold S. Lippa, as President and Chief Executive Officer.

Dr. Lippa will remain the Company’s Executive Chairman and a member of the Board. Also on August 18, 2015, Dr. Lippa was

named Chief Scientific Officer of the Company, and the Company entered into a contract with him in that capacity. Dr. Lippa’s

contract as Chief Scientific Officer has an initial three year term and provides for an annual base salary of $300,000, subject

to certain conditions. This description of Dr. Lippa’s employment agreement with the Company does not purport to be complete

and is qualified in its entirety by reference to his employment agreement, a copy of which is attached to this Current Report

on Form 8-K as Exhibit 10.3 and is incorporated herein by reference.

Entry

into Employment Agreements with Other Officers

On

August 18, 2015, the Company entered into a formal employment agreement with Robert N. Weingarten, its Vice President and Chief

Financial Officer. Mr. Weingarten has held these positions with the Company since April 2013. Mr. Weingarten’s employment

agreement has an initial term of one year and provides for an annual base salary of $195,000, subject to certain conditions. This

description of Mr. Weingarten’s employment agreement with the Company does not purport to be complete and is qualified in

its entirety by reference to his employment agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit

10.4 and is incorporated herein by reference.

On

August 18, 2015, the Company also entered into a formal employment agreement with Jeff E. Margolis, its Vice President, Treasurer

and Secretary. Mr. Margolis has held these positions with the Company since March 2013. Mr. Margolis’s employment agreement

has an initial term of one year and provides for an annual base salary of $195,000, subject to certain conditions. This description

of Mr. Margolis’s employment agreement with the Company does not purport to be complete and is qualified in its entirety

by reference to his employment agreement, a copy of which is attached to this Current Report on Form 8-K as Exhibit 10.5 and is

incorporated herein by reference.

Modification

of the 2015 Plan

On

August 18, 2015, the Board, acting by written consent, amended the 2015 Plan, increasing the number of shares that may be issued

under the 2015 Plan from 150,000,000 to 250,000,000. The 2015 Plan is not being amended in any way, other than the increase in

the number of shares available thereunder. This description of the 2015 Plan does not purport to be complete and is qualified

in its entirety by reference to the 2015 Plan itself, a copy of which was originally filed as Exhibit 10.1 to the Company’s

Current Report on Form 8-K, filed July 8, 2015, and is incorporated by reference to this Current Report on Form 8-K as Exhibit

10.6 and is incorporated herein by reference.

Grant

of Options to Officers, Independent Driectors and Service Providers

On

August 18, 2015, the Board approved the grant of non-qualified stock options to certain officers of the Company, including its

named executive officers (including to Dr. Manuso, the Company’s new Chief Executive Officer and President upon commencement

of his employment, as described above), its independent directors and certain service providers to the Company. These grants were

issued with respect to approximately 136,000,000 shares in the aggregate. Grants approved with respect to named executive officers,

including Dr. Manuso, and the independent directors, are set forth below:

| Grantee | |

Options granted | |

| Arnold S. Lippa | |

| 10,000,000 | |

| Robert N. Weingarten | |

| 10,000,000 | |

| Jeff Eliot Margolis | |

| 10,000,000 | |

| Kathryn MacFarlane | |

| 3,000,000 | |

| James E. Sapirstein | |

| 3,000,000 | |

| Richard D. Purcell | |

| 3,000,000 | |

The

options listed above will vest as to each recipient, 25% on December 31, 2015, 25% on March 31, 2016, 25% on June 30, 2016 and

25% on September 30, 2016. Other terms of the options are consistent with the form of award for the 2015 Plan, filed as Exhibit

as Exhibit 10.2 to the Company’s Current Report on Form 8-K, filed July 8, 2015.

Pursuant

to his employment agreement, upon commencement of his employment with the company, Dr. Manuso will be awarded incentive stock

options with respect to approximately 5,000,000 shares of common stock of the Company, under the 2014 Plan. If the number of shares

available under the 2014 Plan or the restrictions regarding incentive stock options limit the number shares with respect to which

such options can be awarded, Dr. Manuso will receive the maximum number of incentive stock options that may be awarded to him

under the 2014 Plan. In addition, Dr. Manuso will be awarded non-qualified stock options with respect to 80,000,000 shares of

common stock of the Company. Both options will have a term of ten years (subject to adjustment for the incentive stock option)

and will vest as to 50% on the Effective Date (as defined in the employment agreement), 25% on the date that is six months following

the Effective Date, and 25% on the first anniversary of the Effective Date, subject to Dr. Manuso’s continuous service to

the Company through each vesting date. Further details regarding Dr. Manuso’s option awards are set forth in his employment

agreement, which is attached to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits

(d) Exhibits.

A

list of exhibits required to be filed as part of this report is set forth in the Exhibit Index, which is presented elsewhere in

this document, and is incorporated herein by reference.

Cautionary

Statement

Statements

in this report that are “forward-looking statements” within the meaning of the federal securities laws, including

the Company’s expectations and beliefs about its recording of revenue and the effects of any misreporting on its financial

statements, are based on currently available information. Terminology such as “believe,” “expect,” “intend,”

“estimate,” “project,” “anticipate,” “will” or similar statements or variations

of such terms are intended to identify forward-looking statements, although not all forward-looking statements contain such terms.

These forward-looking are subject to a number of risks, uncertainties and other factors that could cause the Company’s actual

results, performance, prospects or opportunities in 2015 and beyond to differ materially from those expressed in, or implied by,

these forward-looking statements. These risks include the Company’s inability to promptly restate the affected financial

statements and the risks referenced in the Company’s current Annual Report on Form 10-K or as may be described from time

to time in the Company’s subsequent SEC filings; and such factors are incorporated by reference herein.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| Date:

August 19, 2015 |

CORTEX

PHARMACEUTICALS, INC. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/

Robert N. Weingarten |

| |

|

Robert N. Weingarten |

| |

|

Vice President

and Chief Financial Officer |

EXHIBIT

INDEX

Exhibit

Number |

|

Exhibit

Description |

| |

|

|

| 10.1 |

|

Form

of Purchase Agreement (including the Form of Note and the Form of Warrant), incorporated by reference to Exhibit 10.1 to the

Company’s Current Report on Form 8-K filed November 12, 2014. |

| |

|

|

| 10.2* |

|

Employment

Agreement between Cortex Pharmaceuticals, Inc. and James S. J. Manuso. |

| |

|

|

| 10.3* |

|

Employment

Agreement between Cortex Pharmaceuticals, Inc. and Arnold S. Lippa. |

| |

|

|

| 10.4* |

|

Employment

Agreement between Cortex Pharmaceuticals, Inc. and Robert N. Weingarten. |

| |

|

|

| 10.5* |

|

Employment

Agreement between Cortex Pharmaceuticals, Inc. and Jeff E. Margolis. |

| |

|

|

| 10.6 |

|

Cortex

Pharmaceuticals, Inc. 2015 Stock and Stock Option Plan, incorporated by reference to Exhibit 10.1 to the Company’s Current

Report on Form 8-K filed July 8, 2015. |

* filed

herewith

Exhibit

10.2

EMPLOYMENT

AGREEMENT

This

Employment Agreement (the “Agreement”) is made and entered into as of August 18, 2015 (the “Effective Date”),

by and between Cortex Pharmaceuticals, Inc., a Delaware corporation (the “Company”), and James S. J. Manuso (“Executive”).

WHEREAS,

the Company desires to employ the Executive on the terms and conditions set forth herein; and

WHEREAS,

the Executive desires to be employed by the Company on such terms and conditions.

NOW,

THEREFORE, in consideration of the mutual covenants, promises and obligations set forth herein, the parties agree as follows:

1.

Term. The Executive’s employment hereunder shall be

effective as of the Effective Date and shall continue until September 30, 2018 , unless terminated earlier pursuant to Section

7.4 of this Agreement; provided that, on September 30, 2018 (such date and the one year anniversary of each such date thereafter,

a “Renewal Date”), the Agreement shall be deemed to be automatically extended, upon the same terms and conditions,

for successive periods of one year, unless either party provides written notice of its intention not to extend the term of the

Agreement at least ninety (90) days prior to the applicable Renewal Date. The period during which the Executive is employed by

the Company hereunder is hereinafter referred to as the “Employment Term.”

2.

Positions and Duties.

2.1

During the Employment Term, Executive shall serve the Company as its President and Chief Executive Officer or in such other additional

executive capacity as the Board of Directors of the Company (the “Board”) may from time to time request. During the

Employment Term, Executive shall have all duties and responsibilities that are reasonably consistent with these titles and positions

and shall devote all of his normal business time and attention to, and use his best efforts to advance, the business of the Company.

Executive will also serve as Vice Chairman of the Board, a non-executive position, so long as he remains an officer of the Company,

and agrees (i) to serve on the Board and in the Vice Chairman capacity, and any other capacity on the Board in which he may serve,

without additional compensation, and (ii) to immediately resign as Vice Chairman and as a member of the Board if he ceases to

be an officer of the Company. Executive agrees not to actively engage in any other employment, occupation or consulting activity

for any direct or indirect remuneration without such prior approval of the Board, except that without the prior approval of the

Board, Executive may serve on the board of directors of other companies if in so doing Executive does not breach the terms of

this Agreement, his fiduciary duties to the Company, or his confidentiality obligations to the Company, or otherwise interfere

with the performance of the Executive’s duties and responsibilities to the Company as provided hereunder, including, but

not limited to, the obligations set forth in this Section 2.

2.2

Executive represents and warrants to the Company that Executive is free to accept employment with the Company, and that Executive

has no prior or other commitments or obligations of any kind to anyone else or any entity that would restrict, hinder or interfere

with Executive’s acceptance of his obligations hereunder or the exercise of Executive’s best efforts to the performance

of his duties hereunder.

2.3

Executive agrees to subscribe on the Effective Date, to purchase newly issued securities of the Company in an amount of $250,000,

on terms to be agreed between the parties. In addition, Executive agrees to use his best efforts to encourage, as may be appropriate

in their personal circumstances and subject to compliance with applicable securities laws and regulations, his acquaintances,

contacts and their affiliated entities (“Prospective Investors”), to the extent such Prospective Investors are accredited

investors, to subscribe for and purchase securities of the Company in any future offering or financing of the Company. Executive

also agrees to use his best efforts to encourage, as may be appropriate, select intermediaries to obtain investors for any future

offering or financing, subject to compliance with applicable securities laws and regulations.

3.

Confidential Information.

3.1

Company Information. Executive agrees at all times during Employment Term and thereafter, to hold in the strictest confidence,

and not to use, except for the benefit of the Company, or to disclose to any person, firm or corporation without written authorization

of the Board, any Confidential Information (as defined below) of the Company, except as otherwise provided under a non-disclosure

agreement duly authorized and executed by the Company. Executive understands that “Confidential Information” means

any non-public information that relates to the actual or anticipated business or research and development of the Company, technical

data, trade secrets or know-how, including, but not limited to, research, product plans or other information regarding Company’s

products or services and markets, customer lists and customers, software developments, inventions, processes, formulas, technology,

designs, drawings, engineering, hardware configuration information, marketing, finances or other business information or any other

non-public financial, commercial, business or technical information related to the Company. Executive further understands that

Confidential Information does not include any of the foregoing items that have been previously disclosed to the public by the

Company or have become public knowledge through no direct or indirect fault of Executive or any person acting on Executive’s

behalf.

Executive

agrees that on termination of his employment with the Company for any reason, Executive will immediately return to the Company

all Confidential Information and all memoranda, books, papers, plans, information, letters and other data, and all copies and

derivatives thereof or therefrom, in any way relating to the business of the Company. Executive further agrees that he will not

retain or use for his account at any time any tradenames, trademark or other proprietary business designation used or owned in

connection with the business of the Company.

3.2

Former Employer Information. Executive agrees that he will not, during the Employment Term, improperly use or disclose

any proprietary information or trade secrets of any former employer or other person or entity and that he will not bring onto

the premises of the Company any unpublished document or proprietary information belonging to any such employer, person or entity

unless consented to in writing by such employer, person or entity.

3.3

Third Party Information. Executive recognizes that the Company has received, and in the future will receive, from third

parties their confidential or proprietary information subject to a duty on the Company’s part to maintain the confidentiality

of such information and to use it only for certain limited purposes. Executive agrees to hold all such confidential or proprietary

information in the strictest confidence and not to disclose it to any person, firm or corporation or to use it except as necessary

in carrying out Executive’s work for the Company consistent with the Company’s agreement with such third party.

4.

Inventions.

4.1

Inventions Retained and Licensed. Except as listed on Exhibit A, Executive does not have any inventions, original works

of authorship, developments, improvements, and trade secrets which were made by him prior to his employment with the Company (collectively

referred to as “Prior Inventions”), which belong to him, which may relate to the Company’s proposed business,

products or research and development, and which were not previously assigned to the Company. If, in the course of Executive’s

employment with the Company, Executive incorporates into a Company product, process or service a Prior Invention owned by Executive

or in which Executive has an interest, Executive hereby grants to the Company a nonexclusive, royalty-free, fully paid-up, irrevocable,

perpetual, worldwide license to make, have made, modify, use and sell such Prior Invention as part of or in connection with such

product, process or service, and to practice any method related thereto. Executive agrees to cooperate with and assist the Company,

as the Company may request, in connection with the provisions of this paragraph.

4.2

Assignment of Inventions. Executive agrees that Executive will promptly make full written disclosure to the Company, will

hold in trust for the sole right and benefit of the Company, and hereby assigns to the Company, or its designee, all Executive’s

right, title, and interest in and to any and all inventions, original works of authorship, developments, concepts, improvements,

designs, discoveries, ideas, trademarks or trade secrets, whether or not patentable or registrable under copyright or similar

laws, which Executive may solely or jointly conceive or develop or reduce to practice, or cause to be conceived or developed or

reduced to practice, during the period of time Executive is in the employ of the Company (collectively referred to as “Inventions”).

Executive further acknowledges that all original works of authorship which are made by him (solely or jointly with others) within

the scope of and during the Employment Term, and which are protectable by copyright, are “works made for hire,” as

that term is defined in the United States Copyright Act. Executive understands and agrees that the decision whether or not to

commercialize or market any Invention developed by Executive solely or jointly with others is within the Company’s sole

discretion and for the Company’s sole benefit and that no royalty will be due to Executive as a result of the Company’s

efforts to commercialize or market any such Invention.

4.3

Inventions Assigned to the United States. Executive agrees to assign to the United States government all his right, title,

and interest in and to any and all Inventions whenever such full title is required to be in the United States by a contract between

the Company and the United States or any of its agencies.

4.4

Maintenance of Records. Executive agrees to keep and maintain adequate and current written records of all Inventions made

by Executive (solely or jointly with others) during the Employment Term. The records will be in the form of notes, sketches, drawings,

and any other format that may be specified by the Company. The records will be available to and remain the sole property of the

Company at all times.

4.5

Patent and Copyright Registrations. Executive agrees to assist the Company, or its designee, at the Company’s expense,

in every proper way to secure the intellectual property rights of the Company in any and all countries, including, but not limited

to, the disclosure to the Company of all pertinent information and data with respect to such intellectual property rights, the

execution of all applications, specifications, oaths, assignments and all other instruments which the Company shall deem necessary

in order to apply for and obtain such rights and in order to assign and convey to the Company, its successors, assigns, and nominees

the sole and exclusive rights, title and interest in and to such Inventions, and any copyrights, patents, mask work rights or

other intellectual property rights of the Company. Executive further agrees that his obligation to execute or cause to be executed,

when it is in his power to do so, any such instrument or papers, shall continue after the termination of this Agreement. If the

Company is unable because of Executive’s mental or physical incapacity or for any other reason to secure Executive’s

signature to apply for or to pursue any application for any United States or foreign patents or copyright registrations covering

Inventions or original works of authorship assigned to the Company as above, then Executive hereby irrevocably designates and

appoints the Company and its duly authorized officers and agents as his agent and attorney in fact, to act for and in Executive’s

behalf and stead to execute and file any such applications and to do all other lawfully permitted acts to further the prosecution

and issuance of letters patent or copyright registrations thereon with the same legal force and effect as if executed by Executive.

5.

Office and Travel. The principal place of Executive’s

employment shall be located in New York, New York. Executive will be required to travel on Company business during the Employment

Term.

6.

Compensation and Fringe Benefits.

6.1

Base Salary. For all services rendered by Executive during the first year of this Agreement, the Company shall incur a

payroll obligation to be accrued, if not otherwise paid, to Executive at an annual total base salary (as in effect from time to

time, the “Base Salary”) of $375,000. The payment obligation associated with this first year Base Salary: (i) shall

accrue, but no payments to be made until at least $2,000,000 of net proceeds from any offering or financing of debt or equity,

or a combination thereof, after the Effective Date has been received by the Company, at which time, payment shall be a gross amount

of $3,846 made on a bi-weekly basis (this equates to a rate of $100,000 per year), and subjected to required and appropriate payroll

withholding taxes, and any unpaid portion of the Base Salary shall continue to be accrued, and (ii) upon the Company having raised

$10,000,000 or more of net proceeds on a cumulative basis, from any offering or financing of debt or equity, or a combination

thereof, that closes during the first year of this Agreement, (A) the gross bi-weekly payroll rate shall be adjusted to that amount

that would result in gross payroll equal to the $375,000 Base Salary amount, and (B) all accrued but unpaid salary shall be paid

in a lump sum, with all such bi-weekly payroll payments and other payments being subjected to required and appropriate withholding

taxes. If $10,000,000 has been raised in the first year after the Effective Date as set forth in clause (ii) in the preceding

sentence, on the first anniversary of the Effective Date, the Executive’s Base Salary shall be increased to $450,000; otherwise,

salary and accruals shall continue as set forth above until such time as the Board determines that sufficient capital has been

raised by the Company or is otherwise available to fund the Company’s operations on an ongoing basis and to support such

alternative increase in salary as the Board may determine. Beginning January 1, 2017, so long as $10,000,000 of net proceeds has

been raised as set forth above or if the Board determines that a lesser but sufficient amount of funds have been raised or is

otherwise available to fund the Company’s operations on an ongoing basis, Executive’s Base Salary shall be adjusted

annually beginning on October 1, 2016 and each successive year during the Employment Term to compensate for changes in the cost

of living. The amount of each annual cost of living increase shall be the lesser of twice the rate determined for the prior calendar

year by the “Consumer Price Index for Urban Wage Earners and Clerical Workers (All Items) published by the bureau of Labor

Statistics, U.S. Department of Labor (1967 equals 100)” or 6.5%.

6.2

Performance Bonus.

(a)

With respect to the first year of Employment Term, the Company shall pay Executive a single cash bonus (not cumulative), as follows:

| Cash

Bonus | |

Conditions

Precedent to Payment of Bonus – Amount of Net Proceeds from any Financing During First Year of Employment Term |

| $100,000 (“threshold level”) | |

$10,000,000 – $11,999,999 |

| $300,000 (“maximum level”) | |

$12,000,000 or more |

The

Company may, in its sole and absolute discretion, (i) pay a bonus for performance below the threshold level, (ii) pay an increased

bonus for performance between the threshold level and maximum level, and (iii) pay an increased bonus for performance above the

maximum level. Such bonuses, if any, will be paid in a lump sum on the 30th calendar day following the first anniversary of the

Effective Date (or, if such date is not a Business Day, the first Business Day thereafter). In order to be eligible to receive

such bonuses, the Executive must be employed by the Company on the date that such bonuses are earned and paid.

(b)

For each year during the Employment Term, the Executive shall be eligible to earn a performance-based annual bonus award of up

to 50% of Base Salary, based upon the achievement of annual performance goals established by the Board in consultation with the

Executive prior to the start of such year. This metric notwithstanding, the Board may determine, at its sole discretion, to pay

to Executive any amount of an extraordinary bonus, in recognition of extraordinary achievements that benefit the Company.

6.3

Stock Options.

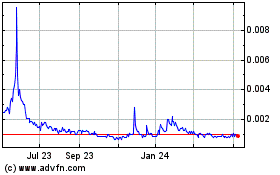

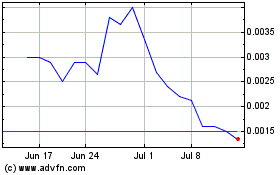

(a)

Initial ISO Grant. On the Effective Date, the Company shall grant Executive a stock option, which will be exercisable into

the maximum number of shares possible under the $100,000 rule of Section 422(d) of the Internal Revenue Code of 1986, as amended

(the “Code”), intended to be an “incentive stock option” (as defined in Section 422 of the Code), under

the Company’s 2014 Equity, Equity-Linked and Equity Derivative Incentive Plan (the “2014 Plan”) to purchase

approximately 5,000,000 shares of the Company’s common stock, the exact amount to be determined as the maximum number of

whole shares up to a value that is equal to or less than $100,000, which shall have a per share exercise price equal to 100% (110%

in the event Executive is a more-than-10%-shareholder) of the simple average of the most recent four (4) full trading weeks, weekly

Volume Weighted Average Prices (“VWAPs”) of the Company’s common stock price immediately preceding date of grant

as reported by OTC IQ and a term of ten (10) years (five (5) years in the event Executive is a more-than-10%-shareholder) from

its date of grant, subject to earlier termination in connection with Executive’s termination of service to the Company as

provided in the 2014 Plan and the stock option agreements to be executed by and between Executive and the Company (the “Option

Agreements”). Subject to the accelerated vesting provisions set forth herein, such option will vest as to 50% on the Effective

Date, 25% on the date that is six (6) months following the Effective Date, and 25% on the first anniversary of the Effective Date,

so that the option will be fully vested and exercisable one year from its grant date, subject to Executive’s continuous

service to the Company through each vesting date.

(b)

Initial NQSO Grant. On the Effective Date, the Company shall grant Executive a stock option, which will not be an “incentive

stock option” (as defined in Section 422 of the Code), under the Company’s 2015 Stock and Stock Option Plan (the “2015

Plan” and together with the 2014 Plan, the “Plans”) to purchase 80,000,000 shares of the Company’s common

stock, which shall have a per share exercise price equal to the simple average of the most recent four (4) full trading weeks,

weekly VWAPs of the Company’s common stock price immediately preceding the date of grant as reported by OTC IQ. Subject

to the accelerated vesting provisions set forth herein, such option will vest as to 50% on the Effective Date, 25% on the date

that is six (6) months following the Effective Date, and 25% on the first anniversary of the Effective Date, so that the option

will be fully vested and exercisable one year from its grant date, subject to Executive’s continuous service to the Company

through each vesting date. Such option shall have a term of ten (10) years from its date of grant, subject to earlier termination

in connection with Executive’s termination of service to the Company as provided in the 2015 Plan and the Option Agreements.

If there are insufficient shares in the 2015 Plan to make the grant set forth in this Section 6.3(b) at the Effective Date, the

Company will amend the 2015 Plan to increase the number of shares available, and make the grant set forth above, as soon as practical

after the Effective Date.

(c)

Upon Executive’s appointment, the Executive shall be eligible to participate in the Plans or any successor plans, subject

to the terms of the Plans or successor plans, as determined by the Board, in its discretion.

(d)

The options granted to Executive pursuant to this Section 6.3 (the “Options”) will be subject to the terms, definitions

and provisions of the Plans and the Option Agreements, all of which documents are incorporated herein by reference. Notwithstanding

the above, (i) in the event of a Change in Control (as defined in Section 7.4 below) of the Company prior to the vesting of the

Options (if outstanding) and that occurs while Executive remains employed hereunder, 100% of the then unvested shares subject

to the Options (if outstanding) shall immediately vest and become exercisable, and (ii) the Options may be exercised by cashless

or net exercise, subject to any limitations set forth in the Plans, applicable Option Agreements and applicable law.

6.4

Other Benefits. Executive shall be entitled to participate in such employee benefit plans which may be instituted by the

Company for the benefit of its executive employees generally, upon such terms as may be therein provided of general application

to all executive employees of the Company and such other benefits as are mutually deemed appropriate by the Board and Executive

to the position held by Executive and to the discharge of Executive’s duties, as the same may be amended from time to time.

Executive shall be entitled to not less than twenty (20) business days’ vacation per year, with remuneration, which shall

be coordinated with the vacation periods of other officers of the Company in a manner that will minimize disruption of the Company’s

management efforts.

7.

Expenses.

7.1

Automobile Expense. During the Employment Term and after the first anniversary of the Effective Date, if $10,000,000 has

been raised in the first year after the Effective Date as set forth in Section 6.1 a maximum of $16,000, tax-equalized, annually,

shall be reimbursed to Executive for automobile expenses that includes the cost of a lease in Executive’s name.

7.2

Insurance Allowance. During the Employment Term and until such time as the Company establishes a group health plan for

its employees, the Company shall pay the Executive $1,200 per month, on a tax-equalized basis, as additional compensation for

the purpose of Executive purchasing health coverage for himself. In addition, during the Employment Term and until such time as

the Company establishes a group term life and disability insurance plan for its employees, the Company shall pay the Executive

monthly, tax-equalized, an amount not to exceed $1,000 for a $1,000,000 term life insurance policy plus a disability insurance

policy for Executive.

7.3

Business Expenses. The Company will pay or reimburse Executive for reasonable business travel, entertainment, computer,

mobile phone, telecommunications and other expenses incurred by Executive in the furtherance of or in connection with the performance

of Executive’s duties hereunder in accordance with the Company’s established policies. Executive shall furnish the

Company with written evidence of the incurrence of such expenses within a reasonable period of time from the date that they were

incurred. Executive shall be reimbursed for mileage based on the IRS’s applicable standard mileage reimbursement rate for

any business travel requiring the use of Executive’s car.

7.4

Termination of Employment.

(a)

For Cause or Without Good Reason. Executive’s employment hereunder may be terminated by the Company for Cause (as

defined below) or by Executive without Good Reason (as defined below). On any such termination, Executive will be entitled to

receive only the following payments and benefits (collectively, the “Accrued Benefits”): (i) any Base Salary earned

but not paid through the date of such termination, paid on the next regularly scheduled payroll date following such termination

and (ii) all other benefits, if any, due Executive, as determined in accordance with the plans, policies and practices of the

Company, including any expense reimbursement obligations described in Section 7.3 that were incurred as of the date of such termination.

(b)

Death or Disability. Executive’s employment hereunder will automatically terminate on his death. If Executive suffers

a Disability (as defined below), the Company will have the right to terminate this Agreement effective on the giving of notice

thereof to Executive. On termination of Executive’s employment hereunder on account of death or Disability, Executive (or

his estate, if applicable) will be entitled to receive the Accrued Benefits. “Disability” means a physical or mental

condition that, after reasonable accommodation, has prevented Executive from performing satisfactorily his duties hereunder for

a period of at least (i) one hundred twenty (120) consecutive days or (ii) one hundred eighty (180) non-consecutive days in any

365 day period. Any question as to the existence of Executive’s Disability as to which Executive and the Company cannot

agree shall be determined in writing by a qualified independent physician mutually acceptable to the Executive and the Company.

If Executive and the Company cannot agree as to a qualified independent physician, each shall appoint such a physician and those

two physicians shall select a third who shall make such determination in writing.

(c)

Without Cause or For Good Reason. Executive’s employment hereunder may be terminated by the Executive for Good Reason

or by the Company without Cause. If Executive’s employment with the Company is terminated by the Company as a result of

an involuntary termination without Cause (which shall not include a termination due to death, Disability, or non-renewal of the

Employment Term) or a voluntary termination for Good Reason, Executive shall be entitled to receive the following severance benefits:

(i) a lump sum payment equivalent to twelve (12) months of Executive’s then current Base Salary, which shall be paid no

later than fifty-three (53) days following the date of Executive’s termination of employment; and (ii) full acceleration

of the vesting of any then unvested stock options or other equity compensation awards held by the Executive (with any unvested

performance-based awards accelerated at 100% of target performance levels). If Executive’s employment hereunder is terminated

by the Company without Cause or for Good Reason (as defined in this Section 7.4(c)) Executive shall not be forced to exercise

any of his NQSOs, or any of his ISOs, subject to any statutory limitations.

For

the purposes of this Agreement, “Good Reason” means without Executive’s express written consent (i) a material

diminution of Executive’s duties, position or responsibilities relative to Executive’s duties, position or responsibilities

in effect immediately prior to such reduction; (ii) a material diminution by the Company of Executive’s Base Salary as in

effect immediately prior to such reduction, other than a general reduction in base salary that affects all of the Company’s

executive officers; (iii) any material breach by the Company; or (iv) the relocation of Executive to a facility or a location

more than fifty (50) miles from the current location of the Executive’s principal office, which the Company and Executive

agree would constitute a material change in the geographic location at which Executive must perform services to the Company. Executive

cannot terminate his employment for Good Reason or a material breach of this Agreement unless he has provided written notice to

the Company of the existence of the circumstances providing grounds for termination for Good Reason within sixty (60) days of

the initial existence of such grounds and the Company has had at least thirty (30) days from the date on which such notice is

provided to cure such circumstances. If the Executive does not terminate his employment for Good Reason within sixty (60) days

after the end of such cure period, then the Executive will be deemed to have waived his right to terminate for Good Reason with

respect to such grounds.

For

the purposes of this Agreement, “Change in Control” means the occurrence of any of the following events: (i) any “person”

(as such term is used in Sections 13(d) and 14(d) of the Exchange Act) becomes the “beneficial owner” (as defined

in Rule 13d-3 of the Exchange Act), directly or indirectly, of securities of the Company representing more than fifty percent

(50%) of the total voting power represented by the Company’s then outstanding voting securities; (ii) the consummation of

the sale or disposition by the Company of all or substantially all of the Company’s assets; or (iii) the consummation of

a merger or consolidation of the Company with any other corporation, other than a merger consolidation which would result in the

voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding

or by being converted into voting securities of the surviving entity or its parent) more than fifty percent (50%) of the total

voting power represented by the voting securities of the Company or such surviving entity or its parent outstanding immediately

after such merger or consolidation; provided, however, that notwithstanding the foregoing, the following shall not constitute

a Change in Control: (A) any acquisition directly from the Company, (B) any acquisition by the Company, (C) any acquisition by

any employee benefit plan (or related trust) sponsored or maintained by the Company or one of its affiliates, (D) any joint venture,

(E) any royalty agreement, or (F) any license agreement.

For

the purposes of this Agreement, “Cause” means (i) any act of personal dishonesty taken by the Executive in connection

with his employment hereunder, (ii) the Executive’s conviction or plea of nolo contendere to a felony, (iii) any

act by the Executive that constitutes material misconduct and is injurious to the Company, (iv) continued violations by the Executive

of the Executive’s obligations to the Company, (v) material breach of this Agreement, (vi) commission of any act of serious

moral turpitude, or (vii) material failure to comply with the lawful direction of the Board. Except for a failure, breach or refusal

which, by its nature, cannot reasonably be expected to be cured, Executive shall have ten (10) business days from the delivery

of written notice by the Company within which to cure any acts constituting Cause; provided however, that, if the Company reasonably

expects irreparable injury from a delay of ten (10) business days, the Company may give Executive notice of such shorter period

within which to cure as is reasonable under the circumstances, which may include the termination of the Executive’s employment

without notice and with immediate effect. Notwithstanding anything to the contrary in this Agreement, if at any time the Board

determines that Executive might have engaged in an act or omission that could constitute grounds for the Company to terminate

Executive’s employment hereunder for Cause, the Board may suspend Executive from his offices and duties with the Company

and its subsidiaries for a period of time reasonably necessary to permit the Board to complete an appropriate investigation. During

such suspension period, Executive will remain an employee of the Company and will continue to be eligible to receive all compensation

and benefits due to Executive hereunder, but Executive will not be authorized to act, or to hold himself out, as an officer or

agent of the Company or any of its subsidiaries and promptly return to the Company all property of the Company and its subsidiaries.

Executive

agrees that as a condition precedent to receipt of any severance benefits described in Section 7.4(c), Executive (or Executive’s

estate, in the event of Executives death) shall be required to promptly execute and not revoke a general full release of all claims

against the Company (or any person affiliated with the Company) in substantially the form attached as Exhibit B. Receipt of the

severance payments and benefits specified in Section 7.4(c) shall be contingent on the receipt of such executed release and the

lapse of any statutory period for revocation, and such release becoming effective in accordance with its terms within fifty-two

(52) days following the termination date. Any severance benefits to which Executive is entitled to under Section 7.4(c) shall

be sent by the Company to the Executive on the fifty-third (53rd) day following Executive’s employment termination date

or such later date as is required to avoid the imposition of additional taxes under Section 409A of the Code. If the fifty-third

(53rd) day falls on a non-business day and/or holiday, the severance benefits shall be sent to the Executive on the next business

day.

Company

will provide appropriate and ample directors and officers liability insurance coverage for Executive throughout the course of

his employment.

(d)

Forfeiture of Severance. Notwithstanding anything in this Agreement to the contrary, if (i) Executive breaches any of the

restrictions set forth in Section 3, 4, or 8 or any similar restrictions set forth in any other written agreement between Executive

and the Company or any of its subsidiaries or (ii) at any time following termination of Executive’s employment with the

Company, the Company determines that Executive engaged in an act or omission that, if discovered during Executive’s employment,

would have entitled the Company to terminate Executive’s employment hereunder for Cause, Executive will forfeit his entitlement

to the severance to the extent not yet paid and any unvested options and any vested but unexercised options. For the avoidance

of doubt, following any such forfeiture, Executive will remain subject to the restrictions set forth in Section 3, 4, and 8 and

any similar restrictions set forth in any other written agreement between Executive and the Company or any of its subsidiaries

in accordance with their terms.

(e)

Resignation from All Positions. On termination of Executive’s employment hereunder for any reason, Executive will

immediately resign from any and all other positions or committees that Executive holds or is a member of with the Company or any

of its subsidiaries, including as an officer or director.

7.5

Code Section 280G Best Results.

(a)

If any payment or benefit Executive would receive pursuant to this Agreement or otherwise, including accelerated vesting of any

equity compensation (“Payment”) would (i) constitute a “parachute payment” within the meaning of Section

280G of the Code, and (ii) but for this sentence, be subject to the excise tax imposed by Section 4999 of the Code (the “Excise

Tax”), then such Payment shall be reduced to the Reduced Amount. The “Reduced Amount” shall be either (x) the

largest portion of the Payment that would result in no portion of the Payment being subject to the Excise Tax or (y) the largest

portion, up to and including the total, of the Payment, whichever amount, after taking into account all applicable federal, state

and local employment taxes, income taxes, and the Excise Tax (all computed at the highest applicable marginal rate), results in

Executive’s receipt, on an after-tax basis, of the greater amount of the Payment notwithstanding that all or some portion

of the Payment may be subject to the Excise Tax. If a reduction in payments or benefits constituting “parachute payments”

is necessary so that the Payment equals the Reduced Amount, reduction shall occur in the following order: (A) cash payments shall

be reduced first and in reverse chronological order such that the cash payment owed on the latest date following the occurrence

of the event triggering such excise tax will be the first cash payment to be reduced; (B) accelerated vesting of stock awards

shall be cancelled/reduced next and in the reverse order of the date of grant for such stock awards (i.e., the vesting of the

most recently granted stock awards will be reduced first), with full-value awards reversed before any stock option or stock appreciation

rights are reduced; and (C) employee benefits shall be reduced last and in reverse chronological order such that the benefit owed

on the latest date following the occurrence of the event triggering such excise tax will be the first benefit to be reduced.

(b)

The Company shall appoint a nationally recognized accounting firm to make the determinations required hereunder and perform the

foregoing calculations. The Company shall bear all expenses with respect to the determinations by such accounting firm required

to be made hereunder. The accounting firm engaged to make the determinations hereunder shall provide its calculations, together

with detailed supporting documentation, to the Company and Executive within fifteen (15) calendar days after the date on which

right to a Payment is triggered (if requested at that time by the Company or Executive) or such other time as requested by the

Company or Executive. Any good faith determinations of the accounting firm made hereunder shall be final, binding and conclusive

upon the Company and Executive.

7.6

Section 409A.

(a)

Notwithstanding anything to the contrary in the Agreement, if Executive is a “specified employee” within the meaning

of Section 409A of the Code at the time of Executive’s termination of employment (other than due to death), and the severance

payable to Executive, if any, pursuant to the Agreement, when considered together with any other severance payments or separation

benefits that are considered deferred compensation under Section 409A of the Code (together, the “Deferred Compensation

Separation Benefits”) that are payable within the first six (6) months following Executive’s termination of employment,

then such severance will become payable on the first payroll date that occurs on or after the date six (6) months and one (1)

day following the date of Executive’s termination of employment. All subsequent Deferred Compensation Separation Benefits,

if any, will be payable in accordance with the payment schedule applicable to each payment or benefit. Notwithstanding anything

herein to the contrary, if Executive dies following Executive’s termination of employment but prior to the six (6) month

anniversary of Executive’s termination of employment, then any payments delayed in accordance with this paragraph will be

payable in a lump sum as soon as administratively practicable after the date of Executive’s death and all other Deferred

Compensation Separation Benefits will be payable in accordance with the payment schedule applicable to each payment or benefit.

Each payment and benefit payable under this Agreement is intended to constitute separate payments for purposes of Section 1.409A-2(b)(2)

of the Treasury Regulations.

(b)

Any amount paid under the Agreement that satisfies the requirements of the “short-term deferral” rule set forth in

Section 1.409A-1(b)(4) of the Treasury Regulations will not constitute Deferred Compensation Separation Benefits for purposes

of this Agreement. Any amount paid under the Agreement that qualifies as a payment made as a result of an involuntary separation

from service pursuant to Section 1.409A-1(b)(9)(iii) of the Treasury Regulations that does not exceed the Section 409A Limit will

not constitute Deferred Compensation Separation Benefits for purposes of this Agreement. For this purpose, “Section 409A

Limit” means the lesser of two (2) times: (A) Executive’s annualized compensation based upon the annual rate of pay

paid to Executive during the Company’s taxable year preceding the Company’s taxable year of Executive’s termination

of employment as determined under Treasury Regulation 1.409A-1(b)(9)(iii)(A)(1) and any Internal Revenue Service guidance issued

with respect thereto; or (B) the maximum amount that may be taken into account under a qualified plan pursuant to Section 401(a)(17)

of the Code for the year in which Executive’s employment is terminated.

(c)

The foregoing provisions are intended to comply with the requirements of Section 409A of the Code so that none of the severance

payments and benefits to be provided hereunder will be subject to the additional tax imposed under Section 409A of the Code, and

any ambiguities herein will be interpreted to so comply. Executive and the Company agree to work together in good faith to consider

amendments to the Agreement and to take such reasonable actions which are necessary, appropriate or desirable to avoid imposition

of any additional tax or income recognition prior to actual payment to Executive under Section 409A of the Code.

8.

Restrictive Covenants.

8.1

Non-competition. Because of the Company’s legitimate business interest as described herein and the good and valuable

consideration offered to Executive, during the Employment Term and for twelve (12) months, to run consecutively, beginning on

the last day of Executive’s employment with the Company, Executive agrees and covenants not to engage in any Competitive

Activity within the therapeutic areas of Ampakines and cannabinoids as applied to breathing disorders and potential therapeutic

areas of Ampakines and breathing disorders or respiratory distress in general, including but not limited to the use of cannabinoids

or Ampakines. Notwithstanding any such restrictions, Executive agrees not to use the Company’s Confidential Information

to compete against the Company at any time post termination of employment.

For

purposes of this non-compete clause, “Competitive Activity” means to, directly or indirectly, in whole or in part,

engage in, provide services to or otherwise participate in, whether as an employee, employer, owner, operator, manager, advisor,

consultant, agent, partner, director, stockholder, officer, volunteer, intern or any other similar capacity, any entity engaged

in a business that is competitive with the business of the Company, including Galleon Pharmaceuticals, Inc. and any other companies

in the therapeutic areas of Ampakines and cannabinoids as applied to breathing disorders and potential therapeutic areas of Ampakines

and breathing disorders or respiratory distress in general, including but not limited to the use of cannabinoids or Ampakines.

Without limiting the foregoing, Competitive Activity also includes activity that may require or inevitably require disclosure

of trade secrets, proprietary information or Confidential Information.

Nothing

herein shall prohibit Executive from purchasing or owning less than ten percent (10%) of the publicly traded securities of any

corporation other than the Company, provided that such ownership represents a passive investment and that Executive is not a controlling

person of, or a member of a group that controls, such corporation.

8.2

Non-solicitation of Employees. Executive understands and acknowledges that the Company has expended and continues to expend

significant time and expense in recruiting and training its employees and that the loss of employees would cause significant and

irreparable harm to the Company. Executive agrees and covenants not to directly or indirectly solicit, hire, recruit, attempt

to hire or recruit, or induce the termination of employment of any employee of the Company during the eighteen (18) month period,

to run consecutively, beginning on the last day of the Executive’s employment with the Company.

8.3

Non-solicitation of Customers. Executive understands and acknowledges that the Company has expended and continues to expend

significant time and expense in developing relationships with customers focused on the therapeutic areas of Ampakines and cannabinoids

as applied to breathing disorders and potential therapeutic areas of Ampakines and breathing disorders or respiratory distress

in general, including but not limited to the use of cannabinoids or Ampakines, customer information and goodwill, and that because

of Executive’s experience with and relationship to the Company, he has had access to and learned about much or all of the

Company’s customer information. Customer information includes, but is not limited to, names, phone numbers, addresses, e-mail

addresses, order history, order preferences, chain of command, pricing information and other information identifying facts and

circumstances specific to the customer.

Executive

understands and acknowledges that loss of this customer relationship and/or goodwill will cause significant and irreparable harm

to the Company.

Executive

agrees and covenants, during the twelve (12) month period, to run consecutively, beginning on the last day of the Executive’s

employment with the Company, not to directly or indirectly solicit, contact (including but not limited to e-mail, regular mail,

express mail, telephone, fax, and instant message), attempt to contact or meet with the Company’s current, former or prospective

customers for purposes of offering or accepting goods or services similar to or competitive with those offered by the Company.

8.4

Non-disparagement. Executive agrees and covenants that he will not at any time (whether during or after the termination

of his employment) make, publish or communicate to any person or entity or in any public forum any defamatory or disparaging remarks,

comments or statements concerning the Company or its businesses, or any of its employees, officers, and existing and prospective

customers, suppliers, investors and other associated third parties.

8.5

Acknowledgement. Executive acknowledges and agrees that the services to be rendered by him to the Company are of a special

and unique character; that Executive will obtain knowledge and skill relevant to the Company’s industry, methods of doing

business and marketing strategies by virtue of Executive’s employment; and that the restrictive covenants and other terms

and conditions of this Agreement are reasonable and reasonably necessary to protect the legitimate business interest of the Company.

Executive

further acknowledges that the amount of his compensation reflects, in part, his obligations and the Company’s rights under

Section 3, Section 4 and Section 8 of this Agreement; that he has no expectation of any additional compensation, royalties or

other payment of any kind not otherwise referenced herein in connection herewith; that he will not be subject to undue hardship

by reason of his full compliance with the terms and conditions of Section 3, Section 4 and Section 8 of this Agreement or the

Company’s enforcement thereof.

8.6

Remedies. In the event of a breach or threatened breach by Executive of Section 3, Section 4 or Section 8 of this Agreement,

Executive hereby consents and agrees that the Company shall be entitled to seek, in addition to other available remedies, a temporary

or permanent injunction or other equitable relief against such breach or threatened breach from any court of competent jurisdiction,

without the necessity of showing any actual damages or that money damages would not afford an adequate remedy, and without the

necessity of posting any bond or other security. The aforementioned equitable relief shall be in addition to, not in lieu of,

legal remedies, monetary damages or other available forms of relief.

9.

Arbitration.

9.1

Arbitration. In consideration of Executive’s employment with the Company, the Company’s promise to arbitrate

all employment-related disputes, and Executive’s receipt of the compensation and other benefits paid to Executive by the

Company, at present and in the future, Executive agrees that any and all controversies claims or disputes with anyone (including

the Company and any employee, officer, director, shareholder or benefit pan of the Company in their capacity as such or otherwise)

arising out of, relating to, or resulting from Executive’s employment with the Company, or the termination of Executive’s

employment with the Company, including any breach of this Agreement, other than injunctive relief or other equitable relief under

Section 8.6 above, shall be subject to binding arbitration rules set forth in New York law (the “Rules”) and pursuant

to New York law. The Federal Arbitration Act shall continue to apply with full force and effect notwithstanding the application

of procedural rules set forth in the Rules. Disputes which Executive agrees to arbitrate, and thereby agrees to waive any right

to a trial by jury, include any statutory claims under local, state or federal law, including, but not limited to, claims under

title VII of the Civil Rights Act of 1964, the Americans with Disabilities Act of 1990, the Age Discrimination in Employment Act

of 1967, the Older Workers Benefit Protection Act, the Sarbanes-Oxley Act, the Worker Adjustment and Retraining Notification Act,

New York law, the Family and Medical Leave Act, claims of harassment, discrimination or wrongful termination and any statutory

or common law claims. Executive further understands that this Agreement to arbitrate also applies to any disputes that the Company

may have with Executive.

9.2

Procedure. Executive agrees that any arbitration will be administered by the American Arbitration Association (“AAA”)

and that the neutral arbitrator will be selected in a manner consistent with its National rules for the Resolution of Employment

Disputes. Executive agrees that the arbitrator shall have the power to decide any motions brought by any party to the arbitration,

including motions for summary judgment and/or adjudication and motions to dismiss and demurrers, prior to any arbitration hearing.

Executive also agrees that the arbitrator shall have the power to award any remedies, including attorneys’ fees and costs,

available under applicable law. Executive understands the Company will pay for any administrative or hearing fees charged by the

arbitrator or AAA, except that Executive shall pay any filing fees associated with any arbitration he initiates. Executive agrees

that the arbitrator shall administer and conduct any arbitration in accordance with New York law, including the New York Code

- Civil Practice Law and Rules, and that the arbitrator shall apply substantive and procedural New York law to any dispute or

claim, without reference to rules of conflict of law. To the extent that the AAA’s National Rules for the Resolution of

Employment Disputes conflict with New York law, New York law shall take precedence. Executive agrees that the decision of the

arbitrator on the merits shall be in writing. Executive agrees that the decree or award rendered by the arbitrator may be entered

as a final and binding judgment in any court having jurisdiction thereof. Executive agrees that any arbitration under this Agreement

shall be conducted in New York, New York.

9.3

Remedy. Except as provided by the Rules and this Agreement, arbitration shall be the sole, exclusive and final remedy for

any dispute between Executive and the Company, other than injunctive relief or other equitable relief under Section 8.6 above.

Accordingly, except as provided for and by the Rules and this Agreement, neither Executive nor the Company will be permitted to

pursue court action regarding claims that are subject to arbitration. Notwithstanding, the arbitrator will not have the authority

to disregard or refuse to enforce any lawful Company policy, and the arbitrator shall not order or require the Company to adopt

a policy not otherwise required by law which the Company has not adopted.

9.4

Administrative Relief. Executive understands that this Agreement does not prohibit Executive from pursuing an administrative

claim with a local, state or federal administrative body such as the Department of Fair Employment and Housing, the Equal Employment

Opportunity Commission, or the Workers’ Compensation Board. This Agreement, however, does preclude Executive from pursing

court action regarding any such claim.

9.5

Voluntary Nature of This Agreement. Executive acknowledges and agrees that Executive is executing this Agreement voluntarily

and without any duress or undue influence by the Company or anyone else. Executive further acknowledges and agrees that Executive

has carefully read this Agreement and has asked any questions needed for Executive to understand the terms, consequences and binding

effect of this Agreement and fully understand it, including that Executive is waiving his right to a jury trial. Finally, Executive

agrees that he has been provided an opportunity to seek the advice of an attorney of his choice before signing this Agreement.

10.

Assignment. This Agreement shall be binding upon and inure

to the benefit of (a) the heirs, executors and legal representatives of Executive upon Executive’s death and (b) any successor

of the Company. Any such successor of the Company shall be deemed substituted for the Company under the terms of this Agreement

for all purposes. As used herein, “successor” shall include any person, firm, corporation or other business entity

which at any time, whether by purchase, merger or otherwise, directly or indirectly acquires all or substantially all of the assets

or business of the Company. None of the rights of Executive to receive any form of compensation payable pursuant to this Agreement

shall be assignable or transferable except through a testamentary disposition or by the laws of descent and distribution upon

the death of Executive. Any attempted assignment, transfer, conveyance or other disposition (other than as aforesaid) of any interest

in the rights of Executive to receive any form of compensation hereunder shall be null and void.

11.

Notices. All notices, requests, demands and other communications

called for hereunder shall be in writing and shall be deemed given if delivered personally or three (3) days after being mailed

by registered or certified mail, return receipt requested, or overnight courier service, prepaid and addressed to the parties

or their successors in interest at the following addresses, or at such other addresses as the parties may designate by written

notice in the manner aforesaid:

If

to the Company:

Cortex

Pharmaceuticals, Inc.

126

Valley Road, Suite C

Glen

Rock, New Jersey 07452

If

to the Executive:

James

S.J. Manuso

2

Fifth Avenue

New

York, NY 10011

12.

Severability. In the event that any provision hereof becomes

or is declared by a court of competent jurisdiction to be illegal, unenforceable or void, this Agreement shall continue in full

force and effect without said provision.

13.

Entire Agreement. This Agreement, together with the Plans

and the related equity award agreements, represents the entire agreement and understanding between the Company and Executive concerning

Executive’s employment relationship with the Company, and supersedes and replaces any and all prior agreements and understandings,

whether oral or written, concerning Executive’s employment relationship with the Company.

14.

Waiver of Breach. The waiver of a breach of any term or provision

of this Agreement, which must be in writing, will not operate as or be construed to be a waiver of any other previous or subsequent

breach of this Agreement.

15.

Headings. All captions and section headings used in this

Agreement are for convenient reference only and do not form a part of this Agreement.

16.

No Oral Modification, Cancellation or Discharge. This Agreement

may only be amended, canceled or discharged in writing signed by Executive and the Company.

17.

Tax Withholding. All payments made pursuant to this Agreement

will be subject to withholding of applicable taxes.

18.

Governing Law. This Agreement shall be governed by the internal

substantive laws, but not the choice of law rules, of the State of New York.

19.

Acknowledgement. Executive acknowledges that he has had the