UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2015

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________.

Commission file number: 000-54267

FREEZE TAG, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | | 20-4532392 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 18062 Irvine Blvd, Suite 103 Tustin, California | | 92780 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (714) 210-3850

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Applicable only to issuers involved in bankruptcy proceedings during the preceding five years:

Indicate by check mark whether the registrant filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

Applicable only to corporate issuers:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of August 14, 2015, there were 255,166,405 shares of common stock, $0.001 par value, issued and outstanding.

FREEZE TAG, INC.

TABLE OF CONTENTS

QUARTER ENDED JUNE 30, 2015

| PART I – FINANCIAL INFORMATION | | | |

| | | | | |

| Item 1. | Financial Statements | | | 4 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | 19 | |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | | | 23 | |

| Item 4. | Controls and Procedures | | | 23 | |

| | | | | | |

| PART II – OTHER INFORMATION | | | | |

| | | | | | |

| Item 1. | Legal Proceedings | | | 24 | |

| Item 1A. | Risk Factors | | | 24 | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | | | 24 | |

| Item 3. | Defaults Upon Senior Securities | | | 24 | |

| Item 4. | Mine Safety Disclosures | | | 24 | |

| Item 5. | Other Information | | | 24 | |

| Item 6. | Exhibits | | | 25 | |

PART I – FINANCIAL INFORMATION

The accompanying condensed financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information and in accordance with the instructions for Form 10-Q. Accordingly, they do not include all of the information and notes required by generally accepted accounting principles for complete financial statements.

In the opinion of management, the condensed financial statements contain all material adjustments, consisting only of normal recurring adjustments necessary to present fairly the financial condition, results of operations, and cash flows of the Company for the interim periods presented.

The results for the period ended June 30, 2015 are not necessarily indicative of the results of operations for the full year. These condensed financial statements and related notes should be read in conjunction with the financial statements and notes thereto included in the Company’s Form 10-K filed with the Securities and Exchange Commission for the year ended December 31, 2014.

FREEZE TAG, INC.

(A DELAWARE CORPORATION)

CONDENSED BALANCE SHEETS

| | | June 30, 2015 | | | December 31, 2014 | |

| | | (Unaudited) | | | | |

| ASSETS | | | | | | |

| | | | | | | |

| Current assets: | | | | | | |

| Cash | | $ | 64,287 | | | $ | 14,688 | |

| Accounts receivable, net of allowance of $5,600 | | | 7,650 | | | | 16,197 | |

| Prepaid expenses and other current assets | | | 4,848 | | | | 8,245 | |

| Total current assets | | | 76,785 | | | | 39,130 | |

| | | | | | | | | |

| | | $ | 76,785 | | | $ | 39,130 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | | | | | | | | |

| | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 115,563 | | | $ | 116,150 | |

| Accrued expenses | | | 501,043 | | | | 495,315 | |

| Accrued interest payable – related party | | | 142,066 | | | | 68,106 | |

| Accrued interest payable | | | 84,309 | | | | 41,385 | |

| Unearned royalties | | | 198,679 | | | | 202,499 | |

| Convertible notes payable – related party | | | 1,456,254 | | | | 1,456,254 | |

| Convertible notes payable, net of discount of $257,085 and $343,902, respectively | | | 991,658 | | | | 412,841 | |

| Derivative liabilities | | | 755,239 | | | | 438,374 | |

| Total current liabilities | | | 4,244,811 | | | | 3,230,924 | |

| | | | | | | | | |

| Commitments and contingencies | | | | | | | | |

| | | | | | | | | |

| Stockholders’ deficit: | | | | | | | | |

| Preferred stock, $0.001 par value, 10,000,000 shares authorized, no shares issued and outstanding | | | - | | | | - | |

| Common stock; $0.001 par value, 500,000,000 shares authorized, 244,720,743 and 184,518,250 shares issued and outstanding, respectively | | | 244,719 | | | | 184,517 | |

| Additional paid-in capital | | | 3,860,038 | | | | 3,720,722 | |

| Common stock payable | | | 16,800 | | | | 16,800 | |

| Accumulated deficit | | | (8,289,583 | ) | | | (7,113,833 | ) |

| Total stockholders’ deficit | | | (4,168,026 | ) | | | (3,191,794 | ) |

| | | | | | | | | |

| | | $ | 76,785 | | | $ | 39,130 | |

The accompanying notes are an integral part of the condensed financial statements

FREEZE TAG, INC.

(A DELAWARE CORPORATION)

CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

| | | | | | | | | | | | | |

| Revenues | | $ | 7,623 | | | $ | 13,102 | | | $ | 15,526 | | | $ | 27,944 | |

| | | | | | | | | | | | | | | | | |

| Operating costs and expenses: | | | | | | | | | | | | | | | | |

| Cost of sales | | | 114,045 | | | | 27,120 | | | | 241,369 | | | | 50,660 | |

| Selling, general and administrative expenses | | | 133,861 | | | | 153,080 | | | | 284,540 | | | | 293,704 | |

| Depreciation and amortization expense | | | - | | | | 6,100 | | | | - | | | | 12,200 | |

| | | | | | | | | | | | | | | | | |

| Total operating costs and expenses | | | 247,906 | | | | 186,300 | | | | 525,909 | | | | 356,564 | |

| | | | | | | | | | | | | | | | | |

| Loss from operations | | | (240,283 | ) | | | (173,198 | ) | | | (510,383 | ) | | | (328,620 | ) |

| | | | | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | | | | |

| Interest expense, net | | | (226,697 | ) | | | (197,415 | ) | | | (444,445 | ) | | | (361,113 | ) |

| Loss on change in derivative liabilities | | | (211,769 | ) | | | (18,702 | ) | | | (220,522 | ) | | | (155,592 | ) |

| | | | | | | | | | | | | | | | | |

| Total other income (expense) | | | (438,466 | ) | | | (216,117 | ) | | | (664,967 | ) | | | (516,705 | ) |

| | | | | | | | | | | | | | | | | |

| Loss before income taxes | | | (678,749 | ) | | | (389,315 | ) | | | (1,175,350 | ) | | | (845,325 | ) |

| Provision for income taxes | | | - | | | | - | | | | 400 | | | | 1,267 | |

| | | | | | | | | | | | | | | | | |

| Net loss | | $ | (678,749 | ) | | $ | (389,315 | ) | | $ | (1,175,750 | ) | | $ | (846,592 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted average number of common shares outstanding – basic and diluted | | | 229,781,350 | | | | 99,938,817 | | | | 210,761,012 | | | | 99,938,817 | |

| | | | | | | | | | | | | | | | | |

| Loss per common share – basic and diluted | | $ | (0.00 | ) | | $ | (0.00 | ) | | $ | (0.01 | ) | | $ | (0.01 | ) |

The accompanying notes are an integral part of the condensed financial statements

FREEZE TAG, INC.

(A DELAWARE CORPORATION)

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | Six Months Ended June 30, | |

| | | 2015 | | | 2014 | |

| Cash flows from operating activities: | | | | | | |

| Net loss | | $ | (1,175,750 | ) | | $ | (846,592 | ) |

| Adjustments to reconcile net loss to net cash used by operating activities: | | | | | | | | |

| Depreciation and amortization expense | | | - | | | | 12,200 | |

| Amortization of debt discount to interest expense | | | 319,368 | | | | 276,499 | |

| Loss on change in derivative liabilities | | | 220,522 | | | | 155,592 | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable, net | | | 8,547 | | | | 943 | |

| Prepaid expenses and other current assets | | | 3,397 | | | | 1,267 | |

| Accounts payable | | | (587 | ) | | | (3,529 | ) |

| Accrued expenses | | | 5,728 | | | | 5,437 | |

| Accrued interest payable – related party | | | 73,960 | | | | 72,110 | |

| Accrued interest payable | | | 50,234 | | | | 12,498 | |

| Unearned royalties | | | (3,820 | ) | | | (4,682 | ) |

| | | | | | | | | |

| Net cash used by operating activities | | | (498,401 | ) | | | (318,257 | ) |

| | | | | | | | | |

| Cash flows from investing activities | | | - | | | | - | |

| | | | | | | | | |

| Net cash provided by investing activities | | | - | | | | - | |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Borrowings of debt | | | 548,000 | | | | 300,000 | |

| | | | | | | | | |

| Net cash provided by financing activities | | | 548,000 | | | | 300,000 | |

| | | | | | | | | |

| Net increase (decrease) in cash | | | 49,599 | | | | (18,257 | ) |

| Cash at the beginning of the period | | | 14,688 | | | | 39,847 | |

| | | | | | | | | |

| Cash at the end of the period | | $ | 64,287 | | | $ | 21,590 | |

| Non-cash transactions: | | | | | | |

| Conversion of debt to common shares | | $ | 56,000 | | | $ | - | |

| Conversion of accrued interest to common shares | | | 7,310 | | | | - | |

| Conversion of derivative liabilities to common shares | | | 136,208 | | | | - | |

| Debt discount due to derivative | | | 232,551 | | | | 289,049 | |

| Issuance of preferred shares for preferred stock payable | | | - | | | | 30,700 | |

The accompanying notes are an integral part of the condensed financial statements

FREEZE TAG, INC.

(A DELAWARE CORPORATION)

Notes to Condensed Financial Statements

Six Months Ended June 30, 2015

(Unaudited)

NOTE 1 – THE COMPANY

Freeze Tag, Inc. (the “Company”) is a leading creator of mobile social games that are fun and engaging for all ages. Based on a free-to-play business model that has propelled games like Candy Crush Saga to worldwide success, the Company employs state-of-the-art data analytics and proprietary technology to dynamically optimize the gaming experience for revenue generation. Players can download and enjoy the Company’s games for free, or they can purchase virtual items and additional features within the game to increase the fun factor. The Company’s games encourage players to compete and engage with their friends on major social networks such as Facebook and Twitter.

NOTE 2 – GOING CONCERN

As shown in the accompanying financial statements for the six-month periods ended June 30, 2015 and 2014, the Company incurred net losses of $1,175,750 and $846,592, respectively. As of June 30, 2015, the Company’s accumulated deficit was $8,289,583. During the period ended June 30, 2015 and the year ended December 3l, 2014, the Company experienced negative cash flows from operations largely due to its continued investment spending for product development of game titles for smartphones and tablets that are expected to benefit future periods. Those facts, along with our lack of access to a significant bank credit facility, create an uncertainty about the Company’s ability to continue as a going concern. Accordingly, the Company is currently evaluating its alternatives to secure financing sufficient to support the operating requirements of its current business plan, as well as continuing to execute its business strategy of distributing game titles to digital distribution outlets, including mobile gaming app stores, online PC and Mac gaming portals, and opportunities for new devices such as tablet (mobile internet device) applications, mobile gaming platforms and international licensing opportunities.

The Company’s ability to continue as a going concern is dependent upon its success in securing sufficient financing and in successfully executing its plans to return to positive cash flows during fiscal 2015. The Company’s financial statements do not include any adjustments that might be necessary if it were unable to continue as a going concern.

NOTE 3 – ACCRUED EXPENSES

Accrued liabilities consisted of the following at:

| | | June 30, 2015 | | | December 31, 2014 | |

| | | | | | | |

| Accrued vacation | | $ | 69,298 | | | $ | 68,344 | |

| Accrued royalties | | | 408,034 | | | | 406,790 | |

| Technology payable | | | 18,000 | | | | 18,000 | |

| Other | | | 5,711 | | | | 2,181 | |

| | | | | | | | | |

| | | $ | 501,043 | | | $ | 495,315 | |

Accrued royalties consist of amounts owed to other parties with whom the Company has revenue-sharing agreements or from whom it licenses certain trademarks or copyrights.

Unearned royalties consist of royalties received from licensees, which have not yet been earned. Unearned royalties were $198,679 and $202,499 at June 30, 2015 and December 31, 2014, respectively.

As of June 30, 2015 and December 31, 2014, the Company had technology payable of $18,000 resulting from a technology transfer agreement with an unrelated party entered into in June 2011, payable in 24 installments of $1,500 without interest.

NOTE 4 – DEBT

Convertible Notes Payable – Related Party

Convertible notes payable, related party consisted of the following at:

| | | June 30, 2015 | | | December 31, 2014 | |

| Convertible note payable to the Holland Family Trust, maturing on September 30, 2015, with interest at 10% | | $ | 222,572 | | | $ | 222,572 | |

| Convertible note payable to Craig Holland, maturing on September 30, 2015, with interest at 10% | | | 813,602 | | | | 813,602 | |

| Convertible note payable to Craig Holland, maturing on December 31, 2014, with interest at 10% | | | 186,450 | | | | 186,450 | |

| Convertible note payable to Mick Donahoo, maturing on December 31, 2014, with interest at 10% | | | 186,450 | | | | 186,450 | |

| Convertible note payable to Craig Holland, maturing on December 31, 2014, with interest at 10% | | | 11,532 | | | | 11,532 | |

| Convertible note payable to Mick Donahoo, maturing on December 31, 2014, with interest at 10% | | | 35,648 | | | | 35,648 | |

| | | | | | | | | |

| Total | | $ | 1,456,254 | | | $ | 1,456,254 | |

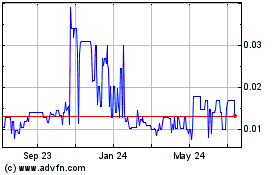

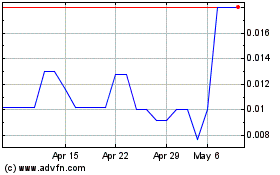

The “Holland Family Trust Convertible Note” is convertible into Company common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 50% multiplied by the Market Price (representing a discount rate of 50%). “Market Price” means the average of the three lowest trading prices for the Company’s common stock during the twenty-five (25) trading-day period ending on the latest complete trading day prior to the date of conversion. “Fixed Conversion Price” shall mean $0.00005.

The Company evaluated the Holland Family Trust Convertible Note and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, does not constitute a derivative liability as the Company has obtained authorization from a majority of shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be available or issuable for settlement to occur. The note payable is convertible into common stock at the discretion of the Holland Family Trust. Furthermore, at any time, the Company may pay the balance of the unconverted note payable in cash.

As of September 30, 2014, $72,107 of accrued interest was added to the note principal and $813,602 of the note was transferred to Craig Holland. A new convertible note for $222,572 was issued to the Holland Family Trust with the same terms as the previous note, with the exception of the maturity date, which has been extended to September 30, 2015. As of June 30, 2015 and December 31, 2014, accrued interest related to the Holland Family Trust Convertible Note was $16,647 and $5,610, respectively.

On September 30, 2014, $813,602 principal balance (including interest) of the Holland Family Trust Convertible Note was transferred to Craig Holland (the “Holland Transferred Convertible Note”). The Holland Transferred Convertible Note retains the same terms as the original Holland Family Trust Convertible Note with the exception of the maturity date, which has been extended to September 30, 2015. As of June 30, 2015 and December 31, 2014, accrued interest related to the Holland Transferred Convertible Note was $60,853 and $20,507, respectively.

On December 31, 2013, the Company converted $186,450 of accrued salaries due to Craig Holland into a convertible note (the “Holland Accrued Salary Note”) and converted $186,450 of accrued salaries due to Mick Donahoo into a convertible note (the “Donahoo Accrued Salary Note”). The Holland Accrued Salary Note and the Donahoo Accrued Salary Note are convertible into Company common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 50% multiplied by the Market Price (representing a discount rate of 50%). “Market Price” means the average of the three lowest trading prices for the Company’s common stock during the twenty-five (25) trading-day period ending on the latest complete trading day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.00005.

The Company evaluated the Holland Accrued Salary Note and the Donahoo Accrued Salary Note and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, the conversion feature does not constitute a derivative liability as the Company has obtained authorization from a majority of shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be available or issuable for settlement to occur. As of June 30, 2015 and December 31, 2014, there was $27,891 and $18,645, respectively, of accrued interest related to each of the notes.

On December 31, 2013, the Company converted a note payable to Mick Donahoo of $55,250 and accrued interest of $15,399 into a new convertible related party note in the amount of $70,649 (the “Mick Donahoo Convertible Note”).

On December 31, 2013, the Company converted a note payable to Craig Holland of $35,100 and accrued interest of $11,432 into a new convertible related party note in the amount of $46,532 (the “Craig Holland Convertible Note”).

The Mick Donahoo Convertible Note and the Craig Holland Convertible Note are convertible into Company common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 50% multiplied by the Market Price (representing a discount rate of 50%). “Market Price” means the average of the three lowest trading prices for the Company’s common stock during the twenty-five (25) trading-day period ending on the latest complete trading day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.00005.

The Company evaluated the Mick Donahoo Convertible Note and the Craig Holland Convertible Note and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, does not constitute a derivative liability as the Company has obtained authorization from a majority of shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be available or issuable for settlement to occur. The agreements modified the debt to make it convertible into common stock of the Company. As of June 30, 2015 and December 31, 2014, there was a total of $8,784 and $4,699, respectively, of accrued interest payable related to these notes.

On October 23, 2014, Craig Holland converted $35,000 principal and $2,836 accrued interest into 39,829,849 shares of the Company’s common stock.

On October 23, 2014, Mick Donahoo converted $35,000 principal and $2,836 accrued interest into 39,829,849 shares of the Company’s common stock.

Total accrued interest payable for the above related party convertible notes was $142,066 and $68,106 as of June 30, 2015 and December 31, 2014, respectively.

Convertible Notes Payable – Non-Related Party

Convertible notes payable – non-related party consisted of the following at:

| | | June 30, 2015 | | | December 31, 2014 | |

| Convertible note payable to Robert Cowdell, maturing on December 31, 2014, with interest at 10% | | $ | 61,443 | | | $ | 61,443 | |

| Convertible note payable to an accredited investor, with interest at 10% | | | - | | | | 45,300 | |

| Convertible note payable to an accredited investor, maturing on September 30, 2015, with interest at 10% | | | 39,300 | | | | 50,000 | |

| Convertible note payable to an accredited investor, maturing on September 30, 2015, with interest at 10% | | | 50,000 | | | | 50,000 | |

| Convertible note payable to an accredited investor, maturing on September 30, 2015, with interest at 10% | | | 50,000 | | | | 50,000 | |

| Convertible note payable to an accredited investor, maturing on September 30, 2015, with interest at 10% | | | 50,000 | | | | 50,000 | |

| Convertible note payable to an accredited investor, maturing on September 30, 2015, with interest at 10% | | | 50,000 | | | | 50,000 | |

| Convertible note payable to an accredited investor, maturing on June 25, 2016, with interest at 10% | | | 50,000 | | | | 50,000 | |

| Convertible note payable to an accredited investor, maturing on June 25, 2016, with interest at 10% | | | 50,000 | | | | 50,000 | |

| Convertible note payable to an accredited investor, maturing on June 25, 2016, with interest at 10% | | | 50,000 | | | | 50,000 | |

| Convertible note payable to an accredited investor, maturing on June 25, 2016, with interest at 10% | | | 50,000 | | | | 50,000 | |

| Convertible note payable to an accredited investor, maturing on June 25, 2016, with interest at 10% | | | 50,000 | | | | 50,000 | |

| Convertible note payable to an accredited investor, maturing on June 25, 2016, with interest at 10% | | | 100,000 | | | | 100,000 | |

| Convertible note payable to an accredited investor, maturing on June 25, 2016, with interest at 10% | | | 50,000 | | | | 50,000 | |

| Convertible note payable to an accredited investor, maturing on June 25, 2016, with interest at 10% | | | 70,000 | | | | - | |

| Convertible note payable to an accredited investor, maturing on June 25, 2016, with interest at 10% | | | 30,000 | | | | - | |

| Convertible note payable to an accredited investor, maturing on November 11, 2015, with interest at 10% | | | 30,000 | | | | - | |

| Convertible note payable to an accredited investor, maturing on November 25, 2015, with interest at 10% | | | 40,000 | | | | - | |

| Convertible note payable to an accredited investor, maturing on December 10, 2015, with interest at 10% | | | 110,000 | | | | - | |

| Convertible note payable to an accredited investor, maturing on January 17, 2016, with interest at 10% | | | 88,000 | | | | - | |

| Convertible note payable to an accredited investor, maturing on February 22, 2016, with interest at 10% | | | 90,000 | | | | - | |

| Convertible note payable to an accredited investor, maturing on March 23, 2016, with interest at 10% | | | 90,000 | | | | - | |

| Total | | | 1,248,743 | | | | 756,743 | |

| Less discount | | | (257,085 | ) | | | (343,902 | ) |

| | | | | | | | | |

| | | $ | 991,658 | | | $ | 412,841 | |

On December 31, 2013, the Company converted $55,429 of convertible debt and $6,014 in accrued interest due to Robert Cowdell (the “Convertible Cowdell Note”) into a convertible note. The Convertible Cowdell Note is convertible into Company common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 50% multiplied by the Market Price (representing a discount rate of 50%). “Market Price” means the average of the three lowest trading prices for the Company’s common stock during the twenty-five (25) trading-day period ending on the latest complete trading day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.00005. The Convertible Cowdell Note had accrued interest of $9,191 and $6,144 as of June 30, 2015 and December 31, 2014, respectively.

The Company evaluated the Convertible Cowdell Note and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, does not constitute a derivative liability as the Company has obtained authorization from a majority of shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be available or issuable for settlement to occur. The agreement modified the debt to make it convertible into common stock of the Company.

The convertible notes to an accredited investor (the “Accredited Investor”) with outstanding balances at June 30, 2015 were issued in $50,000 tranches in January, February, March, April, May, June, July, August, September, October and December 2014, and tranches of $100,000 in November 2014, $70,000 in January 2015, two $30,000 tranches in February 2015, $40,000 in February 2015, $110,000 in March 2015, $88,000 in April 2015 and $90,000 in May and June 2015. Each note is convertible into Company common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 50% multiplied by the Market Price (representing a discount rate of 50%). “Market Price” means the average of the three lowest trading prices for the Company’s common stock during the twenty-five (25) trading-day period ending on the latest complete trading day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.00005. The notes also include conversion price reset features that are triggered when new equity issuances are made by the Company; as a result, this feature caused the Company to consider this feature a derivative liability. The maturity date of the notes is generally one year from the date of funding with the exception of the last six notes issued during the six months ended June 30, 2015, which have a maturity date of nine months from the date of funding. The due date of the note that includes tranches funded through May 2014 with outstanding principal balances totaling $239,300 as of June 30, 2015 was extended to September 30, 2015. The due date of the note that includes tranches funded from June 2014 through February 2015 with outstanding principal balances totaling $500,000 as of June 30, 2015 was extended to June 25, 2016.

The January 2014 derivative was valued as of January 6, 2014 at $44,493, of which all was recorded as a debt discount. During the six months ended June 30, 2015, $731 was amortized from the debt discount. The debt discount was fully amortized at June 30, 2015. The January 2014 note had accrued interest of $5,680 and $4,863 as of June 30, 2015 and December 31, 2014, respectively.

The February 2014 derivative was valued as of February 18, 2014 at $44,556, of which all was recorded as a debt discount. During the six months ended June 30, 2015, $5,981 was amortized from the debt discount. The debt discount was fully amortized at June 30, 2015. The February 2014 note had accrued interest of $6,808 and $5,981 as of June 30, 2015 and December 31, 2014, respectively.

The March 2014 derivative was valued as of March 26, 2014 at $77,884, of which $50,000 was recorded as a debt discount with the remaining amount that exceeded the face value of the note expensed. During the six months ended June 30, 2015, $11,644 was amortized from the debt discount. The debt discount was fully amortized at June 30, 2015. The March 2014 note had accrued interest of $6,315 and $3,836 as of June 30, 2015 and December 31, 2014, respectively.

The April 2014 derivative was valued as of April 25, 2014 at $90,605, of which $50,000 was recorded as a debt discount with the remaining amount that exceeded the face value of the note expensed. During the six months ended June 30, 2015, $15,753 was amortized from the debt discount. The debt discount was fully amortized at June 30, 2015. The April 2014 note had accrued interest of $5,904 and $3,425 as of June 30, 2015 and December 31, 2014, respectively.

The May 2014 derivative was valued as of May 21, 2014 at $95,029, of which $50,000 was recorded as a debt discount with the remaining amount that exceeded the face value of the note expensed. During the six months ended June 30, 2015, $19,315 was amortized from the debt discount. The debt discount was fully amortized at June 30, 2015. The May 2014 note had accrued interest of $5,548 and $3,068 as of June 30, 2015 and December 31, 2014, respectively.

The June 2014 derivative was valued as of June 25, 2014 at $83,184, of which $50,000 was recorded as a debt discount with the remaining amount that exceeded the face value of the note expensed. During the six months ended June 30, 2015, $24,110 was amortized from the debt discount. The debt discount was fully amortized at June 30, 2015. The June 2014 note had accrued interest of $5,055 and $2,575 as of June 30, 2015 and December 31, 2014, respectively.

The July 2014 derivative was valued as of July 15, 2014 at $73,999, of which $50,000 was recorded as a debt discount with the remaining amount that exceeded the face value of the note expensed. During the six months ended June 30, 2015, $24,794 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $2,055. The July 2014 note had accrued interest of $4,781 and $2,301 as of June 30, 2015 and December 31, 2014, respectively.

The August 2014 derivative was valued as of August 19, 2014 at $64,104, of which $50,000 was recorded as a debt discount with the remaining amount that exceeded the face value of the note expensed. During the six months ended June 30, 2015, $24,795 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $6,849. The August 2014 note had accrued interest of $4,301 and $1,822 as of June 30, 2015 and December 31, 2014, respectively.

The September 2014 derivative was valued as of September 17, 2014 at $62,915, of which $50,000 was recorded as a debt discount with the remaining amount that exceeded the face value of the note expensed. During the six months ended June 30, 2015, $24,794 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $10,822. The September 2014 note had accrued interest of $3,918 and $1,438 as of June 30, 2015 and December 31, 2014, respectively.

The October 2014 derivative was valued as of October 13, 2014 at $63,347, of which $50,000 was recorded as a debt discount with the remaining amount that exceeded the face value of the note expensed. During the six months ended June 30, 2015, $24,794 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $14,384. The October 2014 note had accrued interest of $3,548 and $1,068 as of June 30, 2015 and December 31, 2014, respectively.

The November 2014 derivative was valued as of November 7, 2014 at $99,757, of which all was recorded as a debt discount. During the six months ended June 30, 2015, $49,468 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $35,530. The November 2014 note had accrued interest of $6,603 and $1,671 as of June 30, 2015 and December 31, 2014, respectively.

The December 2014 derivative was valued as of December 17, 2014 at $58,456, of which $50,000 was recorded as a debt discount with the remaining amount that exceeded the face value of the note expensed. During the six months ended June 30, 2015, $24,794 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $23,288. The December 2014 note had accrued interest of $2,658 and $178 as of June 30, 2015 and December 31, 2014, respectively.

The January 2015 derivative was valued as of January 14, 2015 at $29,360, of which all was recorded as a debt discount. During the six months ended June 30, 2015, $13,433 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $15,927. The January 2015 note had accrued interest of $3,222 as of June 30, 2015.

The first February 2015 derivative was valued as of February 10, 2015 at $23,984, of which all was recorded as a debt discount. During the six months ended June 30, 2015, $9,199 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $14,785. The first February 2015 note had accrued interest of $1,159 as of June 30, 2015.

The second February 2015 derivative was valued as of February 11, 2015 at $18,003, of which all was recorded as a debt discount. During the six months ended June 30, 2015, $9,166 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $8,837. The second February 2015 note had accrued interest of $1,151 as of June 30, 2015.

The third February 2015 derivative was valued as of February 25, 2015 at $19,494, of which all was recorded as a debt discount. During the six months ended June 30, 2015, $8,926 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $10,568. The third February 2015 note had accrued interest of $2,071 as of June 30, 2015.

The March 2015 derivative was valued as of March 10, 2015 at $31,885, of which all was recorded as a debt discount. During the six months ended June 30, 2015, $12,986 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $18,899. The March 2015 note had accrued interest of $3,405 as of June 30, 2015.

The April 2015 derivative was valued as of April 17, 2015 at $31,397, of which all was recorded as a debt discount. During the six months ended June 30, 2015, $8,449 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $22,948. The April 2015 note had accrued interest of $1,808 as of June 30, 2015.

The May 2015 derivative was valued as of May 22, 2015 at $36,550, of which all was recorded as a debt discount. During the six months ended June 30, 2015, $5,165 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $31,385. The May 2015 note had accrued interest of $986 as of June 30, 2015.

The June 2015 derivative was valued as of June 23, 2015 at $41,878, of which all was recorded as a debt discount. During the six months ended June 30, 2015, $1,070 was amortized from the debt discount. The debt discount had a balance at June 30, 2015 of $40,808. The June 2015 note had accrued interest of $197 as of June 30, 2015.

Total accrued interest payable for the above non-related party convertible notes was $84,309 and $41,385 as of June 30, 2015 and December 31, 2014, respectively.

The Company recorded total interest expense, including debt discount and beneficial conversion feature amortization, for all debt of $226,697 and $197,415 for the three months ended June 30, 2015 and 2014, respectively, and $444,445 and $361,113 for the six months ended June 30, 2015 and 2014, respectively.

NOTE 5 – FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company adopted FASB ASC 820 on October 1, 2008. Under this FASB, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). The standard outlines a valuation framework and creates a fair value hierarchy in order to increase the consistency and comparability of fair value measurements and the related disclosures. Under GAAP, certain assets and liabilities must be measured at fair value, and FASB ASC 820-10-50 details the disclosures that are required for items measured at fair value.

The Company has various financial instruments that must be measured under the new fair value standard including: cash and debt. The Company currently does not have non-financial assets or non-financial liabilities that are required to be measured at fair value on a recurring basis. The Company’s financial assets and liabilities are measured using inputs from the three levels of the fair value hierarchy. The three levels are as follows:

Level 1 - Inputs are unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date. The fair value of the Company’s cash is based on quoted prices and therefore classified as Level 1.

Level 2 - Inputs include quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates, yield curves, etc.), and inputs that are derived principally from or corroborated by observable market data by correlation or other means (market corroborated inputs).

Level 3 - Unobservable inputs that reflect our assumptions about the assumptions that market participants would use in pricing the asset or liability.

Cash, accounts receivable, capitalized production costs, prepaid royalties, prepaid expenses, accounts payable, accrued compensation, accrued royalties, accrued interest, accrued expenses, unearned royalties, notes payable – related party and technology payables reported on the balance sheet are estimated by management to approximate fair market value due to their short term nature.

The following tables provide a summary of the fair values of assets and liabilities measured on a non-recurring basis as of June 30, 2015 and December 31, 2014:

| June 30, 2015 | | Total | | | Level 1 | | | Level 2 | | | Level 3 | | | Losses (Gains) | |

| | | | | | | | | | | | | | | | |

| Derivative liabilities | | $ | 755,239 | | | $ | - | | | $ | - | | | $ | 755,239 | | | $ | 220,522 | |

| December 31, 2014 | | Total | | | Level 1 | | | Level 2 | | | Level 3 | | | Losses (Gains) | |

| | | | | | | | | | | | | | | | |

| Derivative liabilities | | $ | 438,374 | | | $ | - | | | $ | - | | | $ | 438,374 | | | $ | (241,154 | ) |

NOTE 6 – DERIVATIVE FINANCIAL INSTRUMENTS

As discussed in Note 4, the Company issued convertible notes payable to non-related parties that contain anti-dilutive, or down round, price protection. Pursuant to ASC 815-15 Embedded Derivatives and ASC 815-40 Contracts in Entity’s Own Equity, the Company recorded a derivative liability for the price protection provisions issued within the convertible debt transactions.

The fair values of the Company’s derivative liabilities are estimated at the issuance date and are revalued at each subsequent reporting date using a multinomial lattice model simulation discussed below. At June 30, 2015 and December 31, 2014, the Company recorded current derivative liabilities of $755,239 and $438,374, respectively. The net change in fair value of the derivative liabilities for the three months and six months ended June 30, 2015 was a loss of $211,769 and $220,522, respectively, and a loss of $18,702 and $155,592 for the three months and six months ended June 30, 2014, respectively, which was reported as other expense in the statements of operations.

The following table presents details of the Company’s derivative liabilities for the six months ended June 30, 2015:

| Balance, December 31, 2014 | | $ | 438,374 | |

| Increases in derivative value due to new issuances of notes | | | 232,551 | |

| Derivative adjustment due to debt conversion | | | (136,208 | ) |

| Change in fair value of derivative liabilities | | | 220,522 | |

| | | | | |

| Balance, June 30, 2015 | | $ | 755,239 | |

The Company calculated the fair value of the compound embedded derivatives using a multinomial lattice model simulation. The model is based on a probability weighted discounted cash flow model using projections of the various potential outcomes.

Key inputs and assumptions used in valuing the Company’s derivative liabilities are as follows for issuances of notes:

| · | Stock prices on all measurement dates were based on the fair market value |

| · | Down round protection is based on the subsequent issuance of common stock at prices less than the conversion feature |

| · | The probability of future financing was estimated at 100% |

| · | Computed volatility ranging from 302% to 310% |

See Note 5 for a discussion of fair value measurements.

NOTE 7 – STOCKHOLDERS’ DEFICIT

Stock Issuances

The Company is authorized to issue up to 500,000,000 shares of its $0.001 par value common stock, and up to 10,000,000 shares of its $.001 par value preferred stock.

As of June 30, 2015 and December 31, 2014, the Company had common stock payable of $16,800 resulting from a technology transfer agreement with an unrelated party that obligated the Company to issue a total of 96,000 shares of its common stock, payable in 8 quarterly installments of 12,000 shares.

During the six months ended June 30, 2015, the Company issued a total of 60,202,493 shares of its common stock to an accredited investor in conversion of $56,000 principal and $7,310 accrued interest payable at conversion prices ranging from $0.00088 to $0.00135 per share and settled $136,208 of derivative liabilities. As a result of the debt conversions and derivative settlement, common stock was increased by $60,202 and additional paid-in capital was increased by $139,316.

2006 Stock Option Plan

The 2006 Stock Option Plan was adopted by our Board of Directors in March of 2006. A total of 550,000 shares of Common Stock have been reserved for issuance to employees, consultants and directors upon exercise of incentive and non-statutory options and stock purchase rights which may be granted under the Company’s 2006 Stock Plan (the “2006 Plan”). On October 15, 2009, 235,000 of those options were exercised, leaving 315,000 shares available for issuance to employees. Because of the 5.31-for-one forward stock split of the Company’s common stock on October 15, 2009, there are now 1,512,650 shares available for issuance as a part of this stock plan. As of June 30, 2015, there were 560,000 options outstanding to purchase shares of Common Stock, and no shares of Common Stock had been issued pursuant to stock purchase rights under the 2006 Plan.

Under the 2006 Plan, options may be granted to employees, directors, and consultants. Only employees may receive “incentive stock options,” which are intended to qualify for certain tax treatment, and consultants and directors may receive “non-statutory stock options,” which do not qualify for such treatment. A holder of more than 10% of the outstanding voting shares may only be granted options with an exercise price of at least 110% of the fair market value of the underlying stock on the date of the grant, and if such holder has incentive stock options, the term of the options must not exceed five years.

Options and stock purchase rights granted under the 2006 Plan generally vest ratably over a four year period (typically 1⁄4 or 25% of the shares vest after the 1st year and 1/48 of the remaining shares vest each month thereafter); however, alternative vesting schedules may be approved by the Board of Directors in its sole discretion. Any unvested portion of an option or stock purchase right will accelerate and become fully vested if a holder’s service with the Company is terminated by the Company without cause within twelve months following a Change in Control (as defined in the 2006 Plan).

All options must be exercised within ten years after the date of grant. Upon a holder’s termination of service for any reason prior to a Change in Control, the Company may repurchase any shares issued to such holder upon the exercise of options or stock purchase rights. The Board of Directors may amend the 2006 Plan at any time. The 2006 Plan will terminate in 2016, unless terminated sooner by the Board of Directors.

The Company did not grant any stock options or warrants during the six months ended June 30, 2015, and did not record any stock-based compensation expense during the three months and six months ended June 30, 2015 and 2014.

A summary of the status of the options and warrants issued by the Company as of June 30, 2015, and changes during the six months then ended is presented below:

| | | | | | Weighted Average | |

| | | Shares | | | Exercise Price | |

| | | | | | | |

| Outstanding, December 31, 2014 | | | 560,000 | | | $ | 0.10 | |

| | | | | | | | | |

| Granted | | | - | | | | - | |

| Canceled / Expired | | | - | | | | - | |

| Exercised | | | - | | | | - | |

| | | | | | | | | |

| Outstanding, June 30, 2015 | | | 560,000 | | | $ | 0.10 | |

NOTE 8 – LOSS PER COMMON SHARE

The computation of basic earnings per common share is based on the weighted average number of shares outstanding during the period. The computation of diluted earnings per common share is based on the weighted average number of shares outstanding during the period plus the weighted average common stock equivalents which would arise from the exercise of stock options, warrants and rights outstanding using the treasury stock method and the average market price per share during the period.

For the three months and six months ended June 30, 2015 and 2014, the diluted weighted average number of shares is the same as the basic weighted average number of shares as the conversion of debt, options and warrants would be anti-dilutive.

NOTE 9 – RELATED PARTY TRANSACTIONS

The Company had convertible notes payable to related parties totaling $1,456,254 as of June 30, 2015 and December 31, 2014. See Note 4 for a detailed disclosure of this related party debt, including interest rates, terms of conversion and other repayment terms. Accrued interest payable to related parties was $142,066 and $68,106 as of June 30, 2015 and December 31, 2014, respectively.

NOTE 10 – RECENT ACCOUNTING PRONOUNCEMENTS

There were no new accounting pronouncements issued during the six months ended June 30, 2015 and through the date of the filing of this report that we believe are applicable to or would have a material impact on our consolidated financial statements.

NOTE 11 – SUBSEQUENT EVENTS

Subsequent to June 30, 2015, we issued a total of 10,445,662 shares of our common stock in the conversion of convertible notes payable principal totaling $9,500 and accrued interest payable totaling $1,468.

Effective July 28, 2015, we entered into a Convertible Promissory Note to an Accredited Investor and received proceeds from individual notes of $65,000 in July 2015. Each individual note bears interest at 10% per annum and matures nine months from its effective date. Each note is convertible into Company common stock at a defined Conversion Price.

ITEM 2 Management’s Discussion and Analysis of Financial Condition and Results of Operations

Our Management’s Discussion and Analysis contains not only statements that are historical facts, but also statements that are forward-looking. Forward-looking statements are, by their very nature, uncertain and risky. These risks and uncertainties include international, national and local general economic and market conditions; demographic changes; our ability to sustain, manage, or forecast growth; our ability to successfully make and integrate acquisitions; raw material costs and availability; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; and other risks that might be detailed from time to time in our filings with the Securities and Exchange Commission.

Although the forward-looking statements in this Quarterly Statement reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by them. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review and consider the various disclosures made by us in this report and in our other reports as we attempt to advise interested parties of the risks and factors that may affect our business, financial condition, and results of operations and prospects.

The following discussion and analysis of our financial condition and results of operations is based upon, and should be read in conjunction with, its unaudited condensed financial statements and related notes located elsewhere in this Quarterly Report on Form 10-Q, which have been prepared in accordance with accounting principles generally accepted in the United States.

Summary Overview

Freeze Tag, Inc. is a leading creator of mobile social games that are fun and engaging for all ages. Based on a free-to-play business model that has propelled games like Candy Crush Saga to worldwide success, we employ state-of-the-art data analytics and proprietary technology to dynamically optimize the gaming experience for revenue generation. Players can download and enjoy our games for free, or they can purchase virtual items and additional features within the game to increase the fun factor. Our games encourage players to compete and engage with their friends on major social networks such as Facebook and Twitter.

During our most recent fiscal quarter ended June 30, 2015, we generated revenues of $7,623 from the sales our games compared to $13,102 for the quarter ended June 30, 2014.

Our business strategy is now focused on free-to-play games that require constant updates and new content to keep players engaged. Therefore, we no longer measure our success based upon the quantity of titles we launch, but rather on the metrics we receive as we monitor and try to improve upon our games in the market. On November 6, 2014, we released our most recent update to Party Animals: Dance Battle and began a worldwide (English only) promotion and press campaign of the game. During the 3 months ended June 30, 2015, we geo-soft launched our game Black Forest™: Hidden Object Mystery in select countries to gather player data on retention and engagement metrics.

During the three months and six months ended June 30, 2015, we generated net losses of $678,749 and $1,175,750, respectively, primarily attributable to increases in cost of sales and interest, as described below.

Going Concern Uncertainty

As shown in the accompanying financial statements for the six-month periods ended June 30, 2015 and 2014, we incurred net losses of $1,175,750 and $846,592, respectively. As of June 30, 2015, our accumulated deficit was $8,289,583. During the period ended June 30, 2015 and the year ended December 3l, 2014, we experienced negative cash flows from operations largely due to our continued investment spending for product development of game titles for smartphones and tablets that are expected to benefit future periods. Those facts, along with our lack of access to a significant bank credit facility, create an uncertainty about our ability to continue as a going concern. Accordingly, we are currently evaluating our alternatives to secure financing sufficient to support the operating requirements of our current business plan, as well as continuing to execute our business strategy of distributing game titles to digital distribution outlets, including mobile gaming app stores, online PC and Mac gaming portals, and opportunities for new devices such as tablet (mobile internet device) applications, mobile gaming platforms and international licensing opportunities.

Our ability to continue as a going concern is dependent upon our success in securing sufficient financing and in successfully executing our plans to return to positive cash flows during fiscal 2015. Our financial statements do not include any adjustments that might be necessary if we were unable to continue as a going concern.

Results of Operations

Revenues

Our revenues decreased $5,479 to $7,623 for the three months ended June 30, 2015 from $13,102 for the three months ended June 30, 2014. Our revenues decreased $12,418 to $15,526 for the six months ended June 30, 2015 from $27,944 for the six months ended June 30, 2014. Our revenues decreased due to our focused efforts on building games in the free-to-play game genre. Previously, the majority of our released game titles were “pay-per-download”, where the consumer paid to download the game onto their device, leading to revenue per download. Now our games are free to download and play, but have built-in features that require the consumer to pay if they want to access the feature, which means our revenue is tied to when the consumer pays to access the features, if they do. Our revenue can typically fluctuate based on when we release our games and the popularity of the games we release.

We are continuing with the strategy of releasing games more frequently during 2015. During Q2, we soft launched Black Forest: Hidden Object Mystery in specific geographic territories. In addition, we continued development on Etch A Sketch, with a major update in new content planned for Q3 2015. Lastly, we continued development on Kitty Pawp: Bubble Shooter in preparation for geo-soft launch in Q3 2015.

We continued development on a series of Apple Watch games and applications during the quarter. Our first game for the Apple Watch went live in July of 2015, titled Black Forest: Puzzle Tiles for Watch. It is our intention to produce and launch several titles made specifically for the Apple Watch platform.

Operating Costs and Expenses

Our cost of sales increased $86,925 to $114,045 for the three months ended June 30, 2015 from $27,120 for the three months ended June 30, 2014, due to the new titles that we have in development. Our cost of sales increased $190,709 to $241,369 for the six months ended June 30, 2015 from $50,660 for the six months ended June 30, 2014. Our cost of sales includes royalties, subcontractors and internal costs of programming, analytics, and design.

Our selling, general and administrative expenses decreased $19,219 to $133,861 for the three months ended June 30, 2015 from $153,080 for the three months ended June 30, 2014. Our selling, general and administrative expenses decreased $9,164 to $284,540 for the six months ended June 30, 2015 from $293,704 for the six months ended June 30, 2014. On a year-to-date basis, our selling, general and administrative expenses were relatively constant, decreasing approximately 3% from levels incurred during the first six months of the prior year.

Our depreciation and amortization expense decreased $6,100 to $0 for the three months ended June 30, 2015 from $6,100 for the three months ended June 30, 2014, and decreased $12,200 to $0 for the six months ended June 30, 2015 from $12,200 for the six months ended June 30, 2014. The decrease in depreciation and amortization was due to our property and equipment being fully depreciated and not owning technology subject to amortization.

Other Income (Expense)

Our interest expense increased $29,282 to $226,697 for the three months ended June 30, 2015, from $197,415 for the three months ended June 30, 2014, and increased $83,332 to $444,445 for the six months ended June 30, 2015, from $361,113 for the six months ended June 30, 2014. The increase in interest expense is due to the increase in our debt in the current year and the related debt discounts that are amortized to interest expense.

Our estimate of the fair value of the derivative liability for the conversion feature of our convertible notes payable is based on multiple inputs, including the market price of our stock, interest rates, our stock price volatility, and variable conversion prices based on market prices as defined in the respective loan agreements. These inputs are subject to significant changes from period to period; therefore, the estimated fair value of the derivative liability will fluctuate from period to period and the fluctuation may be material. We reported a loss on change in derivative liability of $211,769 and $18,702 for the three months ended June 30, 2015 and 2014, respectively, and $220,522 and $155,592 for the six months ended June 30, 2015 and 2014, respectively.

Net Loss

As a result of the above, our net loss increased to $678,749 for the three months ended June 30, 2015 from $389,315 for the three months ended June 30, 2014 and to $1,175,750 for the six months ended June 30, 2015 from $846,592 for the six months ended June 30, 2014. The increase in our net loss is due primarily to the increase in our debt in the current year and the related debt discounts that are amortized to interest expense, and to our derivative income (expense) of $220, 522 for the six months ended June 30, 2015.

Liquidity and Capital Resources

Introduction

As of June 30, 2015, we had current assets of $76,785 and current liabilities of $4,244,811, resulting in a working capital deficit and a total stockholders’ deficit of $4,168,026. In addition, we had an accumulated deficit of $8,289,583 as of June 30, 2015.

During the six months ended June 30, 2015, because of our operating losses, we did not generate positive operating cash flows. Our cash balance as of June 30, 2015 was $64,287, and our monthly operating cash flow burn rate, based on the six-month period ended June 30, 2015, is approximately $83,000. As a result, we have significant short-term cash needs. These needs are currently being satisfied primarily from the proceeds from short-term convertible debt. We intend to raise additional capital through the issuance of debt from third parties and other related parties until such time as our cash flows from operations will satisfy our cash flow needs. There can be no assurance that we will be successful in these efforts.

Sources and Uses of Cash

We used cash of $498,401 in operating activities for the six months ended June 30, 2015 as a result of our net loss of $1,175,750 and decreases in accounts payable of $587 and unearned royalties of $3,820, partially offset by non-cash expenses totaling $539,890, decreases in accounts receivable, net of $8,547, and prepaid expenses and other current assets of $3,397, and increases in accrued expenses of $5,728, accrued interest payable – related party of $73,960 and accrued interest payable of $50,234.

By comparison, we used cash of $318,257 in operating activities for the six months ended June 30, 2014 as a result of our net loss of $846,592 and decreases in accounts payable of $3,529 and unearned royalties of $4,682, partially offset by non-cash expenses totaling $444,291, decreases in accounts receivable, net of $943 and prepaid expenses and other current assets of $1,267, and increases in accrued expenses of $5,437, accrued interest payable – related party of $72,110 and accrued interest payable of $12,498.

We had no net cash provided by or used by investing activities for the six months ended June 30, 2015 and 2014.

We had net cash provided by financing activities of $548,000 and $300,000 for the six months ended June 30, 2015 and 2014, respectively, comprised of borrowings of debt – proceeds from the issuance of short-term convertible notes payable to non-related parties.

Debt Instruments, Guarantees, and Related Covenants

We have no disclosures required by this item.

Critical Accounting Policies

The preparation of our condensed consolidated financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, costs, expenses and related disclosures. These estimates and assumptions are often based on historical experience and judgments that we believe to be reasonable under the circumstances at the time made. However, all such estimates and assumptions are inherently uncertain and unpredictable and actual results may differ. For further information on our significant accounting policies, see Note 2 to our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2014. There have been no changes to our significant accounting policies since December 31, 2014.

ITEM 3 Quantitative and Qualitative Disclosures About Market Risk

As a smaller reporting company, we are not required to provide the information required by this Item.

ITEM 4 Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures

We carried out an evaluation, under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, of the effectiveness of our disclosure controls and procedures (as defined) in Exchange Act Rules 13a – 15(c) and 15d – 15(e). Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer, who are our principal executive officer and principal financial officers, respectively, concluded that, as of the end of the three month period ended June 30, 2015, our disclosure controls and procedures were effective (1) to ensure that information required to be disclosed by us in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms and (2) to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to us, including our chief executive and chief financial officers, as appropriate to allow timely decisions regarding required disclosure.

(b) Changes in Internal Control over Financial Reporting

During the three months ended June 30, 2015, we engaged an outside financial consultant to address the material weaknesses in internal controls over financial reporting that we have previously reported related to insufficient segregation of duties and the documentation, evaluation and testing of internal controls. The financial consultant now allows us to further segregate the preparation and review of key account analyses and reconciliations, more timely close our quarterly accounting records and prepare our quarterly financial statements, and improve our documentation of material transactions.

Other than the changes reported in the preceding paragraph, there was no change in our internal control over financial reporting identified in connection with the evaluation required by Rule 13a-15(d) and 15d-15(d) of the Exchange Act that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

ITEM 1 Legal Proceedings

We are not a party to or otherwise involved in any legal proceedings.

In the ordinary course of business, we are from time to time involved in various pending or threatened legal actions. The litigation process is inherently uncertain and it is possible that the resolution of such matters might have a material adverse effect upon our financial condition and/or results of operations. However, in the opinion of our management, other than as set forth herein, matters currently pending or threatened against us are not expected to have a material adverse effect on our financial position or results of operations.

ITEM 1A Risk Factors

As a smaller reporting company, we are not required to provide the information required by this Item.

ITEM 2 Unregistered Sales of Equity Securities and Use of Proceeds

From January 1, 2015 through June 30, 2015, we issued an aggregate of 60,202,493 shares of our common stock to a non-affiliate holder of one of our outstanding convertible promissory notes pursuant to a notice of conversion submitted to us from the holder notifying us of their election to convert $63,310 of principal and interest due under the promissory note into the shares. Due to the length of time since the holder lent us the funds and that the holder has held the note, the shares were issued without a standard Rule 144 restrictive legend. Based on the representations of the investor in the Convertible Promissory Note and the Notice of Conversion, the issuance of the shares was exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933. The investor was accredited and sophisticated, familiar with our operations, and there was no solicitation.

ITEM 3 Defaults Upon Senior Securities

There have been no events that are required to be reported under this Item.

ITEM 4 Mine Safety Disclosures

There is no information required to be disclosed by this Item.

ITEM 5 Other Information

There is no information required to be disclosed by this Item.

ITEM 6 Exhibits

| 3.1 (1) | | Articles of Incorporation of Freeze Tag, Inc. |

| | |

| 3.2 (1) | | Articles of Amendment to Articles of Incorporation |

| | |

| 3.3 (1) | | Bylaws of Freeze Tag, Inc. |

| | |

| 3.4 (10) | | Articles of Amendment to Certificate of Incorporation February 4, 2014 |

| | |

| 4.1 (1) | | Freeze Tag, Inc. 2006 Stock Plan |

| | |

| 10.1 (1) | | 10% Convertible Promissory Note dated July 1, 2010 with The Holland Family Trust |

| | |

| 10.2 (1) | | Support Services Agreement with Cardiff Partners, LLC dated October 12, 2009 |

| | |

| 10.3 (1) | | Amendment No. 1 to Support Services Agreement with Cardiff Partners, LLC dated March 2, 2010 |

| | |

| 10.4 (1) | | Amendment No. 2 to Support Services Agreement with Cardiff Partners, LLC dated March 3, 2010 |

| | |

| 10.5 (1) | | Form of Conversion Agreement for October 2009 Conversions |

| | |

| 10.6 (1) | | Form of Option Conversion Agreement for October 2009 Conversions |

| | |

| 10.7 (1) | | Placement Agent and Advisory Services Agreement with Monarch Bay Associates, LLC dated October 12, 2009 |

| | |

| 10.8 (1) | | Corporate Communications Consulting Agreement Michael Southworth dated September 25, 2009 |

| | |

| 10.9 (1) | | Lock-Up Agreement dated November 10, 2009 |

| | |

| 10.10 (2) | | Loan Agreement with Sunwest Bank dated October 20, 2006, as amended |

| | |

| 10.11 (3) | | Securities Purchase Agreement with Asher Enterprises, Inc. dated July 21, 2011 |

| | |

| 10.12 (3) | | Convertible Promissory Note with Asher Enterprises, Inc. dated July 21, 2011 |

| | |

| 10.13 (4) | | Technology Transfer Agreement dated June 22, 2011 |

| 10.14 (5) | | Securities Purchase Agreement with Asher Enterprises, Inc. dated September 16, 2011 |

| | |

| 10.15 (5) | | Convertible Promissory Note with Asher Enterprises, Inc. dated September 16, 2011 |

| | |

| 10.16 (6) | | Securities Purchase Agreement with Asher Enterprises, Inc. dated December 6, 2011 |

| | |

| 10.16 (6) | | Convertible Promissory Note with Asher Enterprises, Inc. dated December 6, 2011 |

| | |

| 10.17 (7) | | Letter Agreement with Crucible Capital, Inc. dated February 29, 2012 |

| | |

| 10.18 (8) | | Amendment No. 1 to Securities Purchase Agreement with Asher Enterprises, Inc. dated July 21, 2011 |

| | |

| 10.19 (8) | | Amendment No. 1 to Securities Purchase Agreement with Asher Enterprises, Inc. dated September 16, 2011 |

| | |

| 10.20 (8) | | Amendment No. 1 to Securities Purchase Agreement with Asher Enterprises, Inc. dated December 6, 2011 |

| | |

| 10.21 (8) | | Amendment No. 1 to Promissory Note with The Lebrecht Group, APLC dated November 17, 2011 |

| | |

| 10.22 (9) | | Convertible Promissory Note (10%) dated December 20, 2013 – Accredited Investor |

| | |

| 10.23 (9) | | Convertible Promissory Note (10%) dated December 31, 2013 – Craig Holland Debt |

| | |

| 10.24 (9) | | Convertible Promissory Note (10%) dated December 31, 2013 – Craig Holland Salary |

| | |

| 10.25 (9) | | Convertible Promissory Note (10%) dated December 31, 2013 – Mick Donahoo Salary |

| | |

| 10.26 (9) | | Convertible Promissory Note (10%) dated December 31, 2013 – Mick Donahoo Debt |

| | |

| 10.27 (9) | | Convertible Promissory Note (10%) dated December 31, 2013 – Robert Cowdell |

| | |

| 10.28 (11) | | Convertible Promissory Note (10%) dated September 30, 2014 – Holland Family Trust |

| | |

| 10.29 (11) | | Convertible Promissory Note (10%) dated September 30, 2014 – Craig Holland |

| | |

| 10.30 (12) | | Consulting and Co-Development Agreement with Gogii Games Corp. dated November 17, 2014 (Redacted Version) |

| | |

| 10.31 (12) | | Convertible Promissory Note with an accredited investor dated February 11, 2015 |

| | |

| 10.32 (12) | | Master Development Agreement with TIC TOC STUDIOS, LLC dated February 18, 2015 (Redacted Version) |

| | |

| 31.1* | | Rule 13a-14(a)/15d-14(a) Certification of Chief Executive Officer |

| | |

| 31.2* | | Rule 13a-14(a)/15d-14(a) Certification of Chief Financial Officer |

| 32.1* | | Section 1350 Certification of Chief Executive Officer |

| | |

| 32.2* | | Section 1350 Certification of Chief Financial Officer. |

| | |

| 101.INS** | | XBRL Instance Document |

| | |

| 101.SCH** | | XBRL Taxonomy Extension Schema Document |

| | |

| 101.CAL** | | XBRL Taxonomy Extension Calculation Linkbase Document |

| | |

| 101.DEF** | | XBRL Taxonomy Extension Definition Linkbase Document |

| | |

| 101.LAB** | | XBRL Taxonomy Extension Label Linkbase Document |

| | |

| 101.PRE** | | XBRL Taxonomy Extension Presentation Linkbase Document |

| ** | Pursuant to Rule 406T of Regulation S-T, these interactive data files are deemed not filed or part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933 or Section 18 of the Securities Act of 1934 and otherwise are not subject to liability. |

| (1) | Incorporated by reference from our Registration Statement on Form S-1, filed with the Commission on August 16, 2010. |

| |

| (2) | Incorporated by reference from Amendment No. 2 to our Registration Statement on Form S-1/A2, filed with the Commission on October 25, 2010. |

| |

| (3) | Incorporated by reference from Current Report on Form 8-K filed with the Commission on August 3, 2011. |

| |

| (4) | Incorporated by reference from Quarterly Report on Form 10-Q for the period ended June 30, 2011 filed with the Commission on August 15, 2011. |

| |

| (5) | Incorporated by reference from Current Report on Form 8-K filed with the Commission on September 21, 2011. |

| |

| (6) | Incorporated by reference from Current Report on Form 8-K filed with the Commission on December 23, 2011. |

| |

| (7) | Incorporated by reference from Current Report on Form 8-K filed with the Commission on March 8, 2012. |

| |

| (8) | Incorporated by reference from Annual Report on Form 10-K filed with the Commission on March 30, 2012. |

| |

| (9) | Incorporated by reference from Current Report on Form 8-K filed with the Commission on October 4, 2013. |

| |

| (10) | Incorporated by reference from Annual Report on Form 10-K filed with the Commission on March 31, 2014. |

| |

| (11) | Incorporated by reference from our Quarterly Report on Form 10-Q filed with the Commission on November 14, 2014. |

| |

| (12) | Incorporated by reference from our Quarterly Report on Form 10-Q filed with the Commission on May 15, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | Freeze Tag, Inc. | |

| | | | |

| Dated: August 14, 2015 | By: | /s/ Craig Holland | |

| | | Craig Holland | |

| | | President and Chief Executive Officer | |

28

EXHIBIT 31.1

Rule 13a-14(a)/15d-14(a) Certification of Chief Executive Officer

I, Craig Holland, certify that:

| 1. | I have reviewed this Quarterly Report on Form 10-Q of Freeze Tag, Inc.; |

| |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| |

| 4. | The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exhibit Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| | |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| | |

| (c) | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| | |

| (d) | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. | The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| | |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| Dated: August 14, 2015 | By: | /s/ Craig Holland | |

| | Craig Holland | |

| | Chief Executive Officer | |

EXHIBIT 31.2