UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

August 12, 2015

Date of Report (Date of earliest event reported)

ATYR PHARMA,

INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-37378 |

|

20-3435077 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 3545 John Hopkins Court, Suite #250

San Diego, California |

|

92121 |

| (Address of principal executive offices) |

|

(Zip Code) |

858-731-8389

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition. |

On August 12, 2015, aTyr Pharma,

Inc. announced financial results for the quarter ended June 30, 2015 in the earnings release attached hereto as Exhibit 99.1.

The information under this Item 2.02 and exhibit 99.1 hereto is being furnished and shall not be deemed “filed” for the

purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference into any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

|

|

| 99.1 |

|

Press release of aTyr Pharma, Inc. dated August 12, 2015. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ATYR PHARMA, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Stan Blackburn |

|

|

|

|

|

|

Stan Blackburn |

|

|

|

|

|

|

Principal Financial and Accounting Officer |

| Date: August 12, 2015 |

|

|

|

|

|

|

3

INDEX TO EXHIBITS

|

|

|

| 99.1 |

|

Press release of aTyr Pharma, Inc. dated August 12, 2015. |

4

Exhibit 99.1

IMMEDIATE RELEASE

|

|

|

|

|

| Contact: |

|

|

|

|

| Marcy Graham |

|

|

Jessica Rowlands |

|

| Vice President, Investor Relations & Corporate Communications |

|

|

Feinstein Kean Healthcare |

|

| mgraham@atyrpharma.com |

|

|

jessica.rowlands@fkhealth.com |

|

| 858-223-1163 |

|

|

202-729-4089 |

|

ATYR PHARMA ANNOUNCES SECOND QUARTER 2015 OPERATING RESULTS

Resolaris™ Franchise Expansion on Track for Planned Initiation of Phase 1b/2 Trials in Early Onset

Facioscapulohumeral Muscular Dystrophy and Limb-Girdle Muscular Dystrophy

SAN DIEGO – August 12, 2015 – aTyr Pharma, Inc. (Nasdaq: LIFE), a biotherapeutics company engaged in the discovery and development of

Physiocrine-based therapeutics to address severe rare diseases, today announced operating results for the second quarter and first half of 2015.

Resolaris™, a first-in-class protein therapeutic in adult patients with facioscapulohumeral muscular dystrophy (FSHD), is currently in an ongoing Phase

1b/2 clinical trial, with initial results expected in late 2015 or early 2016. The Company is on track to initiate a Phase 1b/2 clinical trial in early onset FSHD patients in the third quarter of 2015.

In addition to indications in FSHD, the Company has selected a specific form of limb-girdle muscular dystrophy, referred to as LGMD 2B, as its next expansion

indication and is expected to move forward with a Phase 1b/2 clinical trial of Resolaris™ in LGMD 2B beginning in the fourth quarter of 2015.

Additionally, plans to expand clinical trials of Resolaris™ into specific indications in interstitial lung disease, or ILD, are currently being evaluated

to identify those most appropriate for initial clinical assessment, with a Phase 1b/2 trial expected to begin in the first half of 2016.

Second

Quarter Results

Research and development expenses were $7.5 million for the quarter ended June 30, 2015, as compared to $3.6 million for the same

period in 2014. The increase was primarily due to an additional $2.7 million in clinical development and manufacturing costs associated with Resolaris™ franchise activities, and $0.9 million in expenses resulting from increased headcount,

including $0.4 million in non-cash stock-based compensation.

1

The Company expects its research and development expense to continue to increase with its Resolaris™

franchise expansion activities, including the clinical development of Resolaris™, the first protein therapeutic from the Resokine Pathway; advancements in the development of a second program leveraging the Resokine pathway using an iMod.Fc

protein therapeutic, as well as other therapeutic modalities to harness the power of the pathway in muscle or lung disease; and continued engagement in additional research and development activities relating to the therapeutic applications of

Physiocrines beyond the Resokine pathway.

General and administrative expenses were $3.4 million and $1.7 million for the quarters ended June 30,

2015 and 2014, respectively. The increase of $1.7 million related primarily to employee-related costs resulting from increased headcount, including $0.3 million in stock-based compensation, intellectual property-related projects and costs associated

with being a public company.

The Company expects general and administrative expenses to increase substantially to support the continued development of

its product candidates and the costs associated with operating as a public company, which include supporting regulatory and listing requirements, insurance and investor relations. These increases will also include the cost of additional personnel

and fees to outside consultants, among other expenses.

First Half Results

Research and development expenses for the six months ended June 30, 2015 and 2014 were $14.1 million and $8.0 million, respectively. The

increase was due primarily to an additional $2.9 million in clinical development and manufacturing costs to support various Resolaris™ franchise activities; a $1.7 million increase in compensation expenses resulting from increased headcount,

including $0.4 million in stock-based compensation, and a one-time $1.4 million non-cash expense for the assignment of certain intellectual property rights.

General and administrative expenses were $5.7 million and $3.3 million for the six months ended June 30, 2015 and 2014, respectively. The

change of $2.5 million was due primarily to an increase in headcount, including $0.7 million in stock-based compensation, intellectual property-related projects and costs associated with being a public company.

Net losses for the first six months of 2015 were $20.2 million, as compared to $11.7 million for the same period in 2014.

As of June 30, 2015, the number of shares outstanding was 23.6 million and the Company had cash and cash equivalents of $147.7 million,

including $75.9 million in net proceeds resulting from the IPO and related transactions.

2

About aTyr Pharma

aTyr Pharma is engaged in the discovery and clinical development of innovative medicines for patients suffering from severe rare diseases using its knowledge

of Physiocrine biology, a newly discovered set of physiological modulators. The Company’s lead candidate, Resolaris™, is a first-in-class intravenous protein therapeutic for the treatment of rare myopathies with an immune component.

Resolaris™ is currently in a Phase 1b/2 clinical trial in adult patients with facioscapulohumeral muscular dystrophy (FSHD). Trials are planned in additional indications, including early onset FSHD and limb-girdle muscular dystrophy (LGMD) 2B.

Trials are also planned for indications in interstitial lung disease (ILD). To protect this pipeline, aTyr built an intellectual property estate currently comprising 45 issued or allowed patents and over 240 pending patent applications that are

solely owned or exclusively licensed by aTyr. aTyr’s key programs are currently focused on severe, rare diseases characterized by immune dysregulation for which there are currently limited or no treatment options. The Company was founded by

Professors Paul Schimmel, Ph.D., and Xiang-Lei Yang, Ph.D., two leading aminoacyl tRNA synthetase scientists at The Scripps Research Institute.

For more

information, please visit http://www.atyrpharma.com.

Forward-Looking Statements

Statements we make in this press release may include statements which are not historical facts and are considered forward-looking within the meaning of

Section 27A of the Securities Act and Section 21E of the Securities Exchange Act, which are usually identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,”

“intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions. We intend these forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Securities Exchange Act and are making this statement for purposes of complying with those safe harbor

provisions. These forward-looking statements, including statements regarding the potential of Resolaris, the ability of the Company to undertake certain development activities (such as clinical trial enrollment and the conduct of clinical trials)

and accomplish certain development goals, and the timing of initiation of additional clinical trials reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently

available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that

the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are

beyond our control including, without limitation, risks associated with the discovery, development and regulation of our Physiocrine-based product candidates, as well as those set forth in the prospectus for our recent offering of common stock and

our most recent Quarterly Report on Form 10-Q. Except as required by law, we assume no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

3

ATYR PHARMA INC.

Condensed Consolidated Statements of Operations

(unaudited, in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months |

|

|

Six Months |

|

| |

|

Ended June 30, |

|

|

Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

$ |

7,502 |

|

|

$ |

3,638 |

|

|

$ |

14,095 |

|

|

$ |

8,026 |

|

| General and administrative |

|

|

3,396 |

|

|

|

1,725 |

|

|

|

5,725 |

|

|

|

3,267 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

10,898 |

|

|

|

5,363 |

|

|

|

19,820 |

|

|

|

11,293 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(10,898 |

) |

|

|

(5,363 |

) |

|

|

(19,820 |

) |

|

|

(11,293 |

) |

| Other income (expenses), net |

|

|

(182 |

) |

|

|

(225 |

) |

|

|

(331 |

) |

|

|

(388 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

(11,080 |

) |

|

|

(5,588 |

) |

|

|

(20,151 |

) |

|

|

(11,681 |

) |

| Accretion to redemption value of redeemable convertible preferred stock |

|

|

(15 |

) |

|

|

(139 |

) |

|

|

(15 |

) |

|

|

(277 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to common stockholders |

|

$ |

(11,095 |

) |

|

$ |

(5,727 |

) |

|

$ |

(20,166 |

) |

|

$ |

(11,958 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share attributable to common stockholders, basic and diluted |

|

$ |

(0.74 |

) |

|

$ |

(6.85 |

) |

|

$ |

(2.53 |

) |

|

$ |

(14.69 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding, basic and diluted |

|

|

14,901,473 |

|

|

|

836,533 |

|

|

|

7,955,973 |

|

|

|

814,030 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ATYR PHARMA INC.

Condensed Consolidated Balance Sheets

(in thousands)

|

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

(unaudited) |

|

|

|

|

| Cash, cash equivalents and investment securities |

|

$ |

147,695 |

|

|

$ |

15,853 |

|

| Other assets |

|

|

3,364 |

|

|

|

2,866 |

|

| Property and equipment, net |

|

|

2,022 |

|

|

|

1,925 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

153,081 |

|

|

$ |

20,644 |

|

|

|

|

|

|

|

|

|

|

| Accounts payable, accrued expenses and other liabilities |

|

$ |

7,003 |

|

|

$ |

5,759 |

|

| Current portion of commercial bank debt |

|

|

3,248 |

|

|

|

3,134 |

|

| Convertible promissory note |

|

|

— |

|

|

|

2,000 |

|

| Commercial bank debt, net of current portion |

|

|

3,489 |

|

|

|

5,142 |

|

| Redeemable convertible preferred stock |

|

|

— |

|

|

|

95,619 |

|

| Stockholders’equity (deficit) |

|

|

139,341 |

|

|

|

(91,010 |

) |

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’equity (deficit) |

|

$ |

153,081 |

|

|

$ |

20,644 |

|

|

|

|

|

|

|

|

|

|

# # #

4

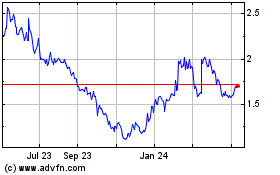

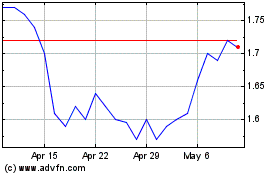

aTyr Pharma (NASDAQ:LIFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

aTyr Pharma (NASDAQ:LIFE)

Historical Stock Chart

From Apr 2023 to Apr 2024