UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________

FORM 8-K

__________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 11, 2015

__________________________________________________

INFINERA CORPORATION

(Exact name of registrant as specified in its charter)

__________________________________________________

|

| | | | |

| | | | |

Delaware | | 001-33486 | | 77-0560433 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

140 Caspian Court

Sunnyvale, CA 94089

(Address of principal executive offices, including zip code)

(408) 572-5200

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

__________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.01 | Completion of Acquisition or Disposition of Assets. |

On April 9, 2015, Infinera Corporation (the “Company”) announced a recommended public offer to the shareholders of Transmode AB (“Transmode”) to tender all their shares in Transmode to the Company (the “Offer”). On June 29, 2015, Infinera announced that the Offer had been enhanced by providing Transmode shareholders with an additional consideration alternative. An offer document regarding the Offer was made public on July 9, 2015 (the “Offer Document”) and on July 29, 2015 Infinera published a supplement to the Offer Document.

The acceptance period of the Offer expired at 5:00 p.m. (CET) on August 7, 2015. On August 11, 2015 (PST), the Company announced the results of the Offer and declared the Offer to be unconditional. A total of 26,536,929 Transmode shares were validly tendered and not withdrawn. The tendered shares represent approximately 95.8% of the total number of outstanding shares and votes in Transmode. Depending on the form of consideration selected, Transmode shareholders will receive either (A) a mixture of cash and shares of the Company’s common stock (the “Original Consideration Alternative”) or (B) SEK 110 per Transmode share in cash consideration. Under the Original Consideration Alternative, approximately 73.80 percent of the shares tendered by each shareholder will be exchanged for approximately 0.6376 shares of the Company’s common stock per Transmode share, and the remaining 26.20 percent of Transmode shares tendered by each shareholder will be exchanged for SEK 107.05 in cash per Transmode share.

Settlement with respect to the Transmode shares duly tendered by August 7, 2015 is expected to occur on or around August 20, 2015. The Company intends to initiate compulsory acquisition proceedings under Swedish law regarding the Transmode shares not tendered in the Offer and to have Transmode’s shares delisted from Nasdaq Stockholm.

The issuance of the Company’s Common Stock in connection with the Offer, as described above, was registered under the Securities Act of 1933, as amended, pursuant to the Company’s registration statement on Form S-4 (File No. 333-204806), filed with the Securities and Exchange Commission and declared effective on July 10, 2015 (the “Registration Statement”).

A copy of the Company’s press release issued in Sweden announcing the foregoing matters is filed herewith as Exhibit 99.1.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

(a) | Financial Statements of Business Acquired. |

The financial statements required by Item 9.01(a) will be filed by amendment no later than 71 calendar days after the date this Current Report on Form 8-K must be filed.

|

| |

(b) | Pro Forma Financial Information. |

The pro forma financial information required by Item 9.01(b) will be filed by amendment no later than 71 calendar days after the date this Current Report on Form 8-K must be filed.

|

| | |

Exhibit No. | | Description |

| |

99.1 | | Press Release of Infinera Corporation Issued in Sweden, dated August 12, 2015 (CET).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | | | INFINERA CORPORATION |

| | |

Date: August 12, 2015 | | By: | | /s/ JAMES L. LAUFMAN |

| | | | James L. Laufman Senior Vice President and General Counsel |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| |

99.1 | | Press Release of Infinera Corporation Issued in Sweden, dated August 12, 2015 (CET).

|

Exhibit 99.1

The Offer is not being made, and this press release may not be distributed, directly or indirectly, in or into, nor will any tender of shares be accepted from or on behalf of holders in, Australia, Hong Kong, Japan, Canada, New Zealand or South Africa, or any other jurisdiction in which the making of the Offer, the distribution of this press release or the acceptance of any tender of shares would contravene applicable laws or regulations or require further offer documents, filings or other measures in addition to those required under Swedish and U.S. law.

This press release has been published in Swedish and English. In the event of any discrepancy in content between the language versions, the Swedish version shall prevail.

PRESS RELEASE, August 12, 2015

Infinera has received acceptances representing 95.8% of the shares in Transmode and completes the offer to the shareholders of Transmode

Infinera Corporation’s offer to the shareholders of Transmode AB has been accepted by shareholders holding an aggregate of 26,536,929 shares, corresponding to approximately 95.8% of the total number of outstanding shares and votes in Transmode. Infinera declares the offer unconditional and completes the offer. Settlement is expected to occur on or around August 20, 2015.

On April 9, 2015, Infinera Corporation (NASDAQ: INFN) (“Infinera”) announced a recommended public offer to the shareholders of Transmode AB (“Transmode”) to tender all their shares in Transmode to Infinera (the “Offer”). On June 29, 2015, Infinera announced that the Offer had been enhanced by providing Transmode shareholders with an additional consideration alternative. An offer document regarding the Offer was made public on July 9, 2015 (the “Offer Document”) and on July 29, 2015 Infinera published a supplement to the Offer Document (the “Supplement”).

As of August 7, 2015, the end of the acceptance period under the Offer, shareholders in Transmode holding an aggregate of 26,536,929 shares, corresponding to approximately 95.8% of the total number of outstanding shares and votes in Transmode, had accepted the Offer. Approximately 63% of the shares tendered have been tendered under the Original Consideration Alternative (as defined in the Offer Document), and approximately 37% of the shares tendered have been tendered under the Capped Cash Alternative (as defined in the Offer Document). As all conditions to the Offer have been fulfilled, Infinera declares the Offer unconditional and completes the Offer.

For Transmode shares tendered under the Capped Cash Alternative, no pro-rata reduction will occur and all such shares are accordingly tendered for cash consideration.

Settlement in respect of the Transmode shares duly tendered by August 7, 2015 is expected to occur on or around August 20, 2015.

Infinera does not have any prior holdings in Transmode and has not acquired any shares in Transmode outside of the Offer.

Infinera does not extend the acceptance period and intends to initiate compulsory acquisition proceedings for the remaining shares in Transmode in accordance with the Swedish Companies Act (Sw. aktiebolagslagen (2005:551)) and act to have the Transmode shares delisted from Nasdaq Stockholm.

Further information about the Offer

The Offer Document and the Supplement (in Swedish and English versions), together with other information about the Offer, are available at: www.infinera.se.

_____________________________________

Sunnyvale, California, USA

August 12, 2015 (CET)

Infinera Corporation

Infinera discloses the information provided herein pursuant to Nasdaq Stockholm’s Takeover Rules. The information was submitted for publication on August 12, 2015, 08:00 a.m. CET.

_____________________________________

For further information, please contact:

|

| |

Media (Europe): VERO Communications Tel. +46 8 611 38 30 johan@vero.se

Media (Rest of World): Anna Vue Tel. +1 (916) 595-8157 avue@infinera.com | Investors (Europe): Morgan Stanley & Co. International plc Tel. +46 8 6789600

Erik Tregaard Managing Director erik.tregaard@MorganStanley.com

Erik Ohman Managing Director erik.ohman@MorganStanley.com

Investors (Rest of World): Jeff Hustis Tel: +1 (408) 213-7150 jhustis@infinera.com |

Important information

The Offer is not being made to persons whose participation in the Offer requires that an additional offer document be prepared or registration effected or that any other measures be taken in addition to those required under Swedish and U.S. law and regulations.

This press release and any related Offer documentation are not being distributed and must not be mailed or otherwise distributed or sent in or into any country in which the distribution or offering would require any such additional measures to be taken or would be in conflict with any law or regulation in such country - any such action will not be permitted or sanctioned by Infinera. Any purported acceptance of the Offer resulting directly or indirectly from a violation of these restrictions may be disregarded.

The Offer is not being and will not be made, directly or indirectly, in or into, or by use of mail or any other means or instrumentality of interstate or foreign commerce of, or any facilities of a national securities exchange of, Australia, Hong Kong, Japan, Canada, New Zealand or South Africa. This includes, but is not limited to facsimile transmission, electronic mail, telex, telephone, the internet and other forms of electronic transmission. The Offer cannot be accepted and shares may not be tendered in the Offer by any such use, means, instrumentality or facility of, or from within Australia, Hong Kong, Japan, Canada, New Zealand or South Africa or by persons located or resident in Australia, Hong Kong, Japan, Canada, New Zealand or South Africa. Accordingly, this press release and any related Offer documentation are not being and should not be mailed or otherwise transmitted, distributed, forwarded or sent in or into Australia, Hong Kong, Japan, Canada, New Zealand or South Africa or to any Australian, Hong Kong, Japanese, Canadian, New Zealand or South African persons or any persons located or resident in Australia, Hong Kong, Japan, Canada, New Zealand or South Africa.

Any purported tender of shares in an Offer resulting directly or indirectly from a violation of these restrictions will be invalid and any purported tender of shares made by a person located in Australia, Hong Kong, Japan, Canada, New Zealand or South Africa or any agent fiduciary or other intermediary acting on a non-discretionary basis for a principal giving instructions from within Australia, Hong Kong, Japan, Canada, New Zealand or South Africa will be invalid and will not be accepted. Each holder of shares participating in the Offer represents that it is not an Australian, Hong Kong, Japanese, Canadian, New Zealand or South African person, is not located in Australia, Hong Kong, Japan, Canada, New Zealand or South Africa and is not participating in such Offer from Australia, Hong Kong, Japan, Canada, New Zealand or South Africa or that it is acting on a non-discretionary basis for a principal that is not an Australian, Hong Kong, Japanese, Canadian, New Zealand or South African person, that is located outside Australia, Hong Kong, Japan, Canada, New Zealand or South Africa and that is not giving an order to participate in such offer from Australia, Hong Kong, Japan, Canada, New Zealand or South Africa. Infinera will not deliver any consideration from the Offer into Australia, Hong Kong, Japan, Canada, New Zealand or South Africa.

This press release is not being, and must not be, sent to shareholders with registered addresses in Australia, Hong Kong, Japan, Canada, New Zealand or South Africa. Banks, brokers, dealers and other nominees holding shares for persons in Australia, Hong Kong, Japan, Canada, New Zealand or South Africa must not forward this press release or any other document received in connection with the Offer to such persons.

The Offer is not made to, nor will exchanges be accepted from, or on behalf of, holders of shares in any jurisdiction in which the making of the Offer or the acceptance thereof would not comply with the laws of that jurisdiction.

In connection with the proposed combination of Infinera and Transmode, the Offer Document was approved on July 8, 2015 by the Swedish Financial Supervisory Authority (the “SFSA”), which published the Offer Document and the Supplement, which was approved on July 29, 2015, on its website. In addition, Infinera has filed a Registration Statement on Form S-4 with the Securities and Exchange Commission (“SEC”). Shareholders of Transmode should read the above referenced documents and materials carefully, as well as other documents filed with the SEC and with the SFSA, because they contain important information about the transaction. Shareholders of Transmode may obtain free copies of these documents and materials, any amendments or supplements thereto and other documents containing important information about Infinera and the transaction, once such documents and materials are filed

with the SEC, through the website maintained by the SEC at www.sec.gov. Copies of the documents and materials filed with the SEC by Infinera will also be available free of charge from Infinera’s website (www.infinera.com) under the heading “SEC Filings” in the “Company-Investor Relations” portion of Infinera’s website.

Forward-looking information

Statements in this press release relating to future events, status and circumstances, including statements regarding future financial or operating performance, growth and other projections as well as benefits of the Offer, are forward-looking statements. These statements may generally, but not always, be identified by the use of words such as “anticipates,” “expects,” “believes,” continue,” “intends,” “target,” “projects,” “contemplates,” “plans,” “seeks,” “estimates,” “could,” “should,” “feels,” “will,” “would,” “may,” “can,” “potential” or similar expressions or variations, or the negative of these terms. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. There can be no assurance that actual results will not differ materially from those expressed or implied by these forward-looking statements due to a variety of factors, many of which are outside the control of Infinera. These risks and uncertainties include, but are not limited to, the risk that Transmode’s and Infinera’s businesses will not be integrated successfully; the risk that synergies will not be realized or realized to the extent anticipated; the risk that the Combined Company will not realize on its financing or operating strategies; the risk that litigation with respect to either company or the transaction could arise; and the risk that disruption caused by the Combined Company would make it difficult to maintain certain strategic relationships. These risks and uncertainties also include those risks and uncertainties that are discussed in the Offer Document approved by the SFSA. Infinera cautions investors not to place considerable reliance on the forward-looking statements contained in this press release. Any forward-looking statements contained in this press release speak only as of the date on which they were made and Infinera has no obligation (and undertakes no such obligation) to update or revise any of them, whether as a result of new information, future events or otherwise, except for in accordance with applicable laws and regulations.

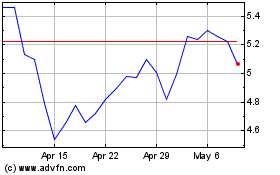

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

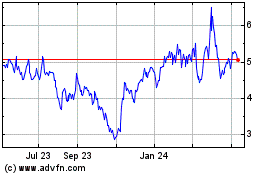

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Apr 2023 to Apr 2024