UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 11, 2015

CHS INC.

(Exact Name of Registrant as Specified in Charter)

|

Minnesota |

|

001-36079 |

|

41-0251095 |

|

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification

Number) |

5500 Cenex Drive, Inver Grove Heights, Minnesota 55077

(Address of Principal Executive Offices)

(Zip Code)

651-355-6000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On August 11, 2015, CHS Inc. (the “Company”) entered into a supply agreement (the “Supply Agreement”) with CF Industries Nitrogen LLC (“CF Nitrogen”) for the purchase of urea in granular form (“Granular Urea”) and urea ammonium nitrate solution (“UAN”). CF Nitrogen is a subsidiary of CF Industries Holdings, Inc. (“CF Holdings”). On August 11, 2015, the Company also entered into an Amended and Restated Limited Liability Company Agreement (the “LLC Agreement”) with CF Industries Sales, LLC (“CFS”), a subsidiary of CF Holdings, pursuant to which the Company, subject to the satisfaction of certain conditions, agreed to invest $2.8 billion in cash in exchange for an approximately 11.4% limited liability company membership interest in CF Nitrogen.

Supply Agreement

The Supply Agreement has an 80 year term and may only be terminated by mutual agreement of the parties or as a remedy for an event of default.

Under the Supply Agreement, the Company has the right, but not the obligation, to purchase Granular Urea and UAN up to a specified annual quantity. The sale and delivery of Granular Urea and UAN that the Company elects to purchase is subject to scheduling by forecasts that permit a degree of flexibility in the purchase and acceptance of product quantities. Periodic forecasts become firm monthly schedules, as further described below. Deliveries of product are made either at the applicable CF Nitrogen production facility, or to a destination nominated by the Company. Transport logistics are factored into the sales price for the applicable product, as further described below.

The periodic forecasts described above, which take into account planned outages at the applicable production facilities, become firm monthly schedules, and a failure to deliver or failure to take by a party in accordance with a firm monthly schedule will, subject to customary force majeure exceptions, result in the defaulting party being liable to the other party for the difference between the contract price for the affected shipment and the actual market price achieved to sell to, or to source replacement product from, third parties.

Products are delivered with customary title and specification warranties. Title and risk of loss to product pass to the Company at the applicable delivery point, although the selling party remains liable for off-specification product that is identified within a limited period of delivery. The Company is responsible for paying all taxes imposed on or with respect to the product after the applicable delivery point. The selling party is responsible for paying all taxes imposed on or with respect to the product before or at the applicable delivery point.

The Supply Agreement provides for a market price that is calculated based upon third party sales at the place of shipment plus actual freight costs. Each party provides customary indemnification to the other party, including that the selling party indemnifies the Company with respect to the operation of the applicable production facilities.

The Supply Agreement includes event of default provisions addressing uncured payment failures, bankruptcy events and uncured failures by a party to perform covenants or obligations (subject to customary limitations and cure period), and is governed by New York law. The parties’ respective rights to injunctive and equitable relief are preserved with respect to their respective sale and purchase obligations.

LLC Agreement

On August 11, 2015, the Company entered into the LLC Agreement with CFS, a subsidiary of CF Holdings. The LLC Agreement provides for the investment by the Company, subject to the satisfaction of certain conditions, of $2.8 billion in cash in exchange for an approximately 11.4% limited liability company membership interest in CF Nitrogen.

The LLC Agreement provides that the closing date for the Company’s investment (the “Closing Date”) will occur on the later of February 1, 2016 or the third business day after the satisfaction or waiver (to the extent permitted by law) of certain conditions set forth in the LLC Agreement, including conditions relating to the absence of any injunction or other order by a court or other governmental authority or law that prohibits or makes illegal the

2

consummation of the investment transaction, the execution by the parties of certain ancillary agreements, the accuracy in all material respects of the representations and warranties of the parties in the LLC Agreement, and the performance by the parties in all material respects of their obligations required under the LLC Agreement to be performed prior to the Closing Date. In addition, either party may terminate the LLC Agreement if conditions with respect to the confirmation of certain tax and financial accounting matters relating to the investment transaction are not satisfied by specified dates.

The LLC Agreement provides that the purpose of CF Nitrogen is to (i) develop, own, operate and maintain manufacturing facilities for nitrogen, methanol and related products, including production facilities located in Donaldson, Louisiana, Port Neal, Iowa, Yazoo City, Mississippi and Woodward, Oklahoma (collectively, the “Assets”), (ii) perform its obligations under the Supply Agreement, a supply agreement to be entered into between CF Nitrogen and CFS (the “CFS Supply Agreement”) and any other supply agreements entered into by CF Nitrogen upon approval of its board of managers (the “Board of Managers”) and (iii) enter into and perform its obligations under certain ancillary agreements to be entered into by the parties in connection with the LLC Agreement.

Except with respect to matters expressly requiring the approval of the members of CF Nitrogen, the LLC Agreement provides that the business and affairs of CF Nitrogen will be managed exclusively by the Board of Managers, which is comprised of four managers appointed by CFS and one manager appointed by the Company (or a permitted transferee of the Company designated by it). A majority of the managers will constitute approval of the Board of Managers on all matters.

An affirmative vote of CFS and the Company (or a permitted transferee of the Company designated by it) will be required to approve (i) the sale, transfer or other disposition of all or substantially all of the assets, properties and business of CF Nitrogen, (ii) the merger of CF Nitrogen with any person that is not an affiliate of CF Nitrogen or any member of CF Nitrogen, (iii) the dissolution of CF Nitrogen, (iv) certain amendments to the LLC Agreement, (v) a change in the legal domicile of the CF Nitrogen from Delaware to any other jurisdiction and (vi) any election by CF Nitrogen to be treated other than as a partnership for federal income tax purposes.

CFS will be permitted, but not required, to contribute additional assets to (and withdraw assets from) CF Nitrogen from time to time, in its sole discretion, except that CFS will be required at all times to (i) maintain sufficient assets in CF Nitrogen such that CF Nitrogen’s facilities have aggregate capacity to produce at least 2 million nutrient tons of fertilizer product (the “Minimum Production Requirements”) and (ii) maintain a liquidity facility, in the form of cash on hand, standby letter of credit, demand line of credit issued by CF Holdings. or similar borrowing facility, with availability of at least $427 million (the “Liquidity Facility”) to be used solely to make distributions to the Company required pursuant to the LLC Agreement. If CF Nitrogen requires additional capital for any capital expenditures, repair or replacement costs or increased operation costs in order for CF Nitrogen’s facilities to satisfy the Minimum Production Requirements, the LLC Agreement provides that CFS is required to make additional capital contributions in the amount determined by the Board of Managers to permit such operation.

Distributions will be made by CF Nitrogen on a semiannual basis (i) first to each of the Company and CFS in an amount equal to 1% of the net profits of CF Nitrogen and (ii) second to the Company and to CFS in an amount that is based on the volume of Granular Urea and UAN purchased by either party or its permitted assigns pursuant to the applicable supply agreement. To the extent the net profits of CF Nitrogen exceed (i) and (ii) above, an amount equal to such excess will be distributed by CF Nitrogen to CFS, less the amount of any intercompany loan obligations owed by CF Nitrogen to CFS or its affiliates. If, at the time that distributions are payable by CF Nitrogen pursuant to the LLC Agreement, CF Nitrogen does not have sufficient cash on hand to pay the amount due to the Company in accordance with (ii) above, CF Nitrogen will be required to draw upon the Liquidity Facility, up to the amount available under the Liquidity Facility, for any shortfall and immediately distribute such amounts solely to the Company.

Net profits, losses and deductions of CF Nitrogen will be allocated to the capital account of each of its members substantially in accordance with the foregoing cash distribution priorities. No member will have an obligation to restore any deficit capital account balance upon the dissolution or other liquidation of CF Nitrogen or otherwise.

The LLC Agreement provides that until the first anniversary of the Closing Date, the Company may not transfer all or any part of its membership interest in CF Nitrogen, other than transfers to affiliates of the Company. At any time from and after the first anniversary of the Closing Date, the Company may transfer all or a portion, at least equal to one third of, its membership interest in CF Nitrogen for cash consideration to third parties that are not competitors of CF Nitrogen as set forth in the LLC Agreement (“Competitors”), subject to a customary right of first refusal in favor of CFS with respect to the

3

purchase the membership interest proposed to be transferred. CFS is not permitted to transfer all or any part of its membership interest at any time. Pledges, mortgages, assignments by way of security or other forms of security interest in a member’s membership interest for indebtedness for borrowed money will not be deemed to be a transfer for this purpose. No member will have the right to resign or withdraw from CF Nitrogen, other than in connection with a permitted transfer of its membership interest.

The provisions in the LLC Agreement restricting the transfer of membership interests do not restrict the Company or CFS from assigning its rights to purchase products from CF Nitrogen under the Supply Agreement or the CFS Supply Agreement, respectively, to a third party that is not a Competitor. The LLC Agreement also includes an express agreement that consent to a transfer of a membership interest in CF Nitrogen to a third party may not be conditioned on transfer or assignment of the Supply Agreement or the CFS Supply Agreement, as applicable, to such transferee, and nothing in the LLC Agreement requires any transferee to be a party to the Supply Agreement or the CFS Supply Agreement.

Pursuant to the LLC Agreement, the Board of Managers may authorize the issuance of additional limited liability company membership interests and the admission of additional members, subject to an obligation to offer the Company the right to purchase the additional membership interests issued on the same terms and subject to the same conditions as agreed with the prospective additional member. If the Company elects to purchase such additional membership interests. the Company also must enter into a supply agreement with CF Nitrogen on the same terms and conditions as the supply agreement that is to be entered into by and between the prospective additional member and CF Nitrogen.

The LLC Agreement includes covenants requiring CF Nitrogen to take certain steps to maintain and document its legal separateness from its members and its affiliates.

Pursuant to the LLC Agreement, CF Nitrogen will be required to provide its members with audited annual and unaudited quarterly financial statements in a timely manner and a copy of its annual budget within 60 days after the beginning of the fiscal year. CF Nitrogen will also be required to cooperate with the reasonable requests of the Company with respect to financial and tax reporting.

The Board of Managers will be permitted to amend the LLC Agreement without the consent of the Company (including to reflect the admission of additional members to the extent such changes do not adversely affect the economic rights of other members), except that the Company’s consent (or consent of its permitted transferee designated by the Company) is required to amend particular provisions of the LLC Agreement.

The LLC Agreement may be terminated at any time prior to the Closing Date (i) by mutual agreement of the Company and CFS, (ii) by either the Company or CFS if the conditions to its obligation to consummate the investment transaction have become incapable of being satisfied and (iii) in connection with either party’s failure to confirm or waive confirmation of certain tax and financial accounting matters as noted above. If the LLC Agreement is terminated prior to the Closing Date, the Supply Agreement and all ancillary agreements entered into by the parties will also automatically terminate.

The LLC Agreement is governed by Delaware law.

A copy of the press release announcing the Company’s entry into the Supply Agreement and the LLC Agreement is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

99.1 Press release dated August 12, 2015.

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

CHS INC. |

|

|

|

|

Date: August 12, 2015 |

/s/ Timothy Skidmore |

|

|

Timothy Skidmore |

|

|

Executive Vice President and Chief Financial Officer |

5

|

Exhibit

No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press release dated August 12, 2015. |

6

Exhibit 99.1

|

4 Parkway North, Suite 400 |

5500 Cenex Drive |

|

Deerfield, IL 60015 |

Inner Grove Heights, MN 55077 |

|

www.cfindustries.com |

www.chsinc.com |

|

|

|

|

|

Contact: |

CF Industries |

CHS Inc. |

|

|

Dan Swenson |

Lani Jordan |

|

|

Treasurer |

Director, Corporate Communications |

|

|

847-405-2515—dswenson@cfindustries.com |

651-355-4946—lani.jordan@chsinc.com |

|

|

|

|

|

|

Chris Close |

|

|

|

Director, Corporate Communications |

|

|

|

847-405-2542 — cclose@cfindustries.com |

|

CF Industries and CHS Announce Agreement to Form Strategic Venture

CHS to Purchase Minority Equity Position in CF Industries Nitrogen, LLC for $2.8 Billion

CHS Entitled to Purchase Annually up to 1.7 million Tons of UAN and Urea from CF Industries Nitrogen for Ratable Delivery

DEERFIELD, IL and ST. PAUL, Minn. — August 12, 2015 — CF Industries Holdings, Inc. (NYSE: CF) and CHS Inc. (NASDAQ: CHSCP) announced today that they have agreed to enter into a strategic venture. CHS, the nation’s leading farmer-owned cooperative, will make an equity investment in a wholly owned CF subsidiary and also enter into a supply agreement. Under the supply agreement, CHS will be entitled to purchase annually up to a total of 1.7 million tons of UAN and urea at market prices. CHS will purchase a minority equity interest in CF Industries Nitrogen, LLC (“CF Nitrogen”) for $2.8 billion and be entitled to semi-annual profit distributions from CF Nitrogen.

CF Nitrogen currently owns three production facilities in the United States: Donaldsonville, Louisiana; Port Neal, Iowa; and Yazoo City, Mississippi. CF also expects to contribute its Woodward, Oklahoma, plant to the LLC prior to the transaction closing. CF will continue to manage and operate all production facilities.

“This venture represents tremendous strategic value to both CF Industries and CHS,” said Tony Will, president and chief executive officer, CF Industries Holdings, Inc. “In the past, we have entered into long-term relationships with industry leaders Mosaic and Orica, and this venture with CHS, an industry leader in agriculture, is the logical next step. This transaction matches us with a reliable partner that will take ratable delivery of product across the year, supported by an attractive valuation. ”

1

“Entering nitrogen fertilizer manufacturing through the purchase of a minority ownership in CF Nitrogen is the single largest investment in CHS history,” said Carl Casale, president and chief executive officer, CHS Inc. “This positions CHS and our owners for long-term dependable fertilizer supply, supply chain efficiency and economic value. In addition, the ability to source product from CF Nitrogen production facilities under our supply agreement benefits our owners and customers through strategically positioned access to essential fertilizer products.”

Once the capacity expansion projects are completed at Donaldsonville and Port Neal, CF will have total production of 18.9 million product tons, not including the new capacity from the business combination with OCI N.V. Of that total 18.9 million tons, CHS will have the right to purchase up to 1.7 million tons, or about 8.9 percent of CF Industries’ total production capacity. CHS, a major CF customer and knowledgeable industry leader, is making a $2.8 billion investment for approximately 8.9 percent of CF’s total system capacity.

CF Nitrogen will sell annually to CHS up to 1.1 million tons of granular urea and 580,000 tons of UAN, at market prices. The 1.7 million tons available under the supply agreement have an average gross margin that reflects the average gross margin across the entire CF system.

CHS’s semi-annual profit distributions from CF Nitrogen will be based generally on the volume of granular urea and UAN purchased by CHS pursuant to the supply agreement.

The transaction is expected to close February 1, 2016, or earlier by mutual consent, subject to satisfaction of certain conditions.

Morgan Stanley & Co. LLC and Goldman, Sachs & Co. are serving as financial advisors to CF Industries on the transaction. Skadden, Arps, Slate, Meagher & Flom LLP is acting as its legal advisor. Kirkland & Ellis LLP is acting as its tax advisor. Baker & McKenzie LLP is acting as legal advisor to CHS on the transaction.

CF Industries Conference Call

CF Industries Holdings, Inc. will be posting a presentation with the transaction highlights to the investor portion of the company’s website at www.cfindustries.com and hosting a conference call at 9:00 am ET on Wednesday, August 12, 2015 to provide an overview of the transaction and answer analysts’ questions.

Investors can access the call by dialing 866-748-8653 or 678-825-8234. The passcode is 9517956. The conference call also will be available live on the company’s website at www.cfindustries.com. Participants also may pre-register for the webcast on the company’s website. Please log-in or dial-in at least 10 minutes prior to the start time to ensure a connection. A replay of the call will be available for seven days by calling 855-859-2056 and citing code 9517956.

About CF Industries Holdings, Inc.

CF Industries Holdings, Inc., headquartered in Deerfield, Illinois, through its subsidiaries is a global leader in the manufacturing and distribution of nitrogen products, serving both agricultural and industrial customers. CF Industries operates world-class nitrogen manufacturing

2

complexes in the central United States, Canada, and the United Kingdom, and distributes plant nutrients through a system of terminals, warehouses, and associated transportation equipment located primarily in the Midwestern United States. The company also owns a 50 percent interest in an ammonia facility in The Republic of Trinidad and Tobago. CF Industries routinely posts investor announcements and additional information on the company’s website at www.cfindustries.com and encourages those interested in the company to check there frequently.

About CHS Inc.

CHS Inc. (www.chsinc.com) is a leading global agribusiness owned by farmers, ranchers and cooperatives across the United States. Diversified in energy, grains and foods, CHS is committed to helping its customers, farmer-owners and other stakeholders grow their businesses through its domestic and global operations. CHS, a Fortune 100 company, supplies energy, crop nutrients, grain marketing services, animal feed, food and food ingredients, along with business solutions including insurance, financial and risk management services. The company operates petroleum refineries/pipelines and manufactures, markets and distributes Cenex® brand refined fuels, lubricants, propane and renewable energy products.

CHS Inc. Forward-Looking Statements

This document and other CHS Inc. publicly available documents contain, and CHS officers and representatives may from time to time make, “forward—looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Report Act of 1995. Forward—looking statements can be identified by words such as “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Forward—looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on CHS current beliefs, expectations and assumptions regarding the future of its businesses, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward—looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of CHS control. CHS actual results and financial condition may differ materially from those indicated in the forward—looking statements. Therefore, you should not rely on any of these forward—looking statements. Important factors that could cause CHS actual results and financial condition to differ materially from those indicated in the forward—looking statements are discussed or identified in CHS public filings made with the U.S. Securities and Exchange Commission, including in the “Risk Factors” discussion in Item 1A of CHS Annual Report on Form 10—K for the fiscal year ended August 31, 2014. Any forward—looking statements made by CHS in this document are based only on information currently available to CHS and speak only as of the date on which the statement is made. CHS undertakes no obligation to publicly update any forward—looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

CF Industries Holdings, Inc. Forward-Looking Statements

All statements in this communication by CF Industries Holdings, Inc. (together with its subsidiaries, the “Company”), other than those relating to historical facts, are forward-looking

3

statements. Forward-looking statements can generally be identified by their use of terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict” or “project” and similar terms and phrases, including references to assumptions. Forward-looking statements are not guarantees of future performance and are subject to a number of assumptions, risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results to differ materially from such statements.

Forward-looking statements include, but are not limited to, statements regarding the proposed strategic venture between the Company and CHS Inc. (“CHS”) pursuant to which CHS will make an equity investment in, and enter into a supply agreement with, CF Industries Nitrogen, LLC (the “Strategic Venture”), including, without limitation, statements about the benefits of the Strategic Venture, the expected timing of closing and other aspects of the Strategic Venture. Important factors that could cause actual results to differ materially from those in the forward-looking statements relating to the Strategic Venture include, among others, among others: risks and uncertainties arising from the possibility that the consummation of the Strategic Venture as contemplated may be delayed or may not occur; difficulties associated with the operation or management of the Strategic Venture; risks and uncertainties relating to the market prices of the fertilizer products that are the subject of the supply agreement over the life of the supply agreement and risks that disruptions from the Strategic Venture as contemplated will harm the Company’s other business relationships.

Further, forward-looking statements include, but are not limited to, statements regarding the proposed acquisition by the Company from OCI N.V. (“OCI”) of OCI’s European, North American and global distribution businesses and certain other assets (the “Business”), including, without limitation, statements about the benefits of the acquisition transaction (the “Transaction”); the expected timing of completion of the Transaction; future financial and operating results of the new holding company (“New CF”), the Company and the Business; New CF’s and the Company’s plans, objectives, expectations and intentions; and other statements relating to the Transaction that are not historical facts. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, among others: risks and uncertainties relating to the ability to obtain the requisite approvals of stockholders of CF Industries Holdings, Inc. and OCI with respect to the Transaction; the risk that New CF, the Company and OCI are unable to obtain governmental and regulatory approvals required for the Transaction, or that required governmental and regulatory approvals delay the Transaction or result in the imposition of conditions that could reduce the anticipated benefits from the Transaction or cause the parties to abandon the Transaction; the risk that a condition to closing of the Transaction may not be satisfied; the length of time necessary to consummate the Transaction; the risk that the businesses of the Company and the Business will not be integrated successfully; the risk that the cost savings and any other synergies from the Transaction may not be fully realized or may take longer to realize than expected; the risk that access to financing, including for refinancing of indebtedness of the Business or the Company, may not be available on a timely basis and on reasonable terms; the risk that the Business is unable to complete its current production capacity development and improvement projects on schedule as planned and on budget or at all; the risk that the Transaction or the prospect of the Transaction disrupts or makes it more difficult to maintain existing relationships or impedes establishment of new relationships with customers, employees or suppliers; diversion of management time on

4

transaction-related issues; the risk that New CF, the Company and the Business are unable to retain and hire key personnel; the effect of future regulatory or legislative actions on New CF, the Company and the Business; the risk that the Transaction is not accorded the tax and accounting treatment anticipated by the Company; unanticipated costs or liabilities associated with the Transaction-related financing; and the risk that the credit ratings of New CF and the Company, including such ratings taking into account the Transaction and related financing, may differ from the Company’s expectations.

Additional important factors, which currently relate to the Company and would relate to the Strategic Venture and the combination of the Company and the Business, that could cause actual results to differ materially from those in the forward-looking statements include, among others, the volatility of natural gas prices in North America and Europe; the cyclical nature of the Company’s business and the agricultural sector; the global commodity nature of the Company’s fertilizer products, the impact of global supply and demand on the Company’s selling prices, and the intense global competition from other fertilizer producers; conditions in the U.S. and European agricultural industry; difficulties in securing the supply and delivery of raw materials, increases in their costs or delays or interruptions in their delivery; reliance on third party providers of transportation services and equipment; the significant risks and hazards involved in producing and handling the Company’s products against which the Company not be fully insured; risks associated with cyber security; weather conditions; the Company’s ability to complete its production capacity expansion projects on schedule as planned and on budget or at all; risks associated with other expansions of the Company’s business, including unanticipated adverse consequences and the significant resources that could be required; an inability to achieve, or a delay in achieving, the expected benefits of the GrowHow transaction as contemplated; difficulties associated with the integration of GrowHow; unanticipated costs or liabilities associated with the GrowHow transaction; and the risk that disruptions from the GrowHow transaction as contemplated will harm relationships with customers, employees and suppliers. potential liabilities and expenditures related to environmental and health and safety laws and regulations; the Company’s potential inability to obtain or maintain required permits and governmental approvals or to meet financial assurance requirements from governmental authorities; future regulatory restrictions and requirements related to greenhouse gas emissions; the seasonality of the fertilizer business; the impact of changing market conditions on the Company’s forward sales programs; risks involving derivatives and the effectiveness of the Company’s risk measurement and hedging activities; the Company’s reliance on a limited number of key facilities; risks associated with joint ventures; acts of terrorism and regulations to combat terrorism; risks associated with international operations; losses on the Company’s investments in securities; deterioration of global market and economic conditions; and the Company’s ability to manage its indebtedness. More detailed information about factors that may affect the Company’s performance and could cause actual results to differ materially from the Company’s expectations may be found in CF Industries Holdings, Inc.’s filings with the Securities and Exchange Commission, including CF Industries Holdings, Inc.’s most recent periodic reports filed on Form 10-K and Form 10-Q, which are available in the Investor Relations section of the Company’s web site. Forward-looking statements are given only as of the date of this presentation and the Company disclaims any obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

5

No Offer or Solicitation

This presentation is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Additional Information

New CF will file with the SEC a registration statement on Form S-4 that will include the proxy statement of CF Industries and the shareholders circular of OCI that also constitute prospectuses of New CF. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE SHAREHOLDERS CIRCULAR/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the proxy statement/prospectus, the shareholders circular and other documents filed with the SEC by New CF and CF Industries through the website maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the proxy statement/prospectus, the shareholders circular and other documents filed by CF Industries and New CF with the SEC by contacting CF Industries Investor Relations at: CF Industries Holdings, Inc., c/o Corporate Communications, 4 Parkway North, Suite 400, Deerfield, Illinois, 60015 or by calling (847) 405-2542.

Participants in the Solicitation

CF Industries and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of CF Industries in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the stockholders of CF Industries in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement/prospectus when it is filed with the SEC. Information regarding the directors and executive officers of CF Industries is contained in CF Industries’ proxy statement for its 2015 annual meeting of stockholders, filed with the SEC on April 2, 2015, and CF Industries’ Current Report on Form 8-K filed with the SEC on June 25, 2015.

###

6

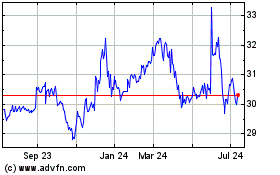

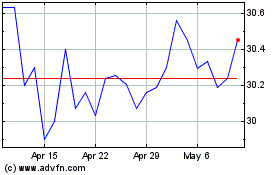

CHS (NASDAQ:CHSCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

CHS (NASDAQ:CHSCP)

Historical Stock Chart

From Apr 2023 to Apr 2024