UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 10, 2015

______________________________

|

|

LIFEVANTAGE CORPORATION (Exact name of registrant as specified in its charter) |

______________________________

|

| | | | |

Colorado | | 001-35647 | | 90-0224471 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

9785 S. Monroe Street, Suite 300, Sandy, UT 84070 |

(Address of Principal Executive Offices and ZIP Code) |

Registrant’s telephone number, including area code: (801) 432-9000

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On August 10, 2015, LifeVantage Corporation (the “Company”) issued a press release announcing its preliminary financial results for the fiscal quarter and fiscal year ended June 30, 2015. A copy of the Company’s press release is attached as Exhibit 99.1 to this report and incorporated by reference.

The information furnished in this Item 2.02 and the exhibit hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

| | |

Exhibit No.

| | Description

|

99.1 | | Press release issued by the Company on August 10, 2015 announcing its preliminary financial results for the fiscal quarter and fiscal year ended June 30, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| |

Date: August 10, 2015 | LIFEVANTAGE CORPORATION

By: /s/ Beatryx Washington Name: Beatryx Washington Title: Vice President, Legal Affairs |

LifeVantage Announces Preliminary Fourth Quarter and Full Fiscal Year 2015 Results

Fiscal Year 2015 Revenue and Earnings Per Share Results In-Line with Previous Guidance

Full Fiscal Year 2015 Revenue was Approximately $190 Million

Salt Lake City, UT, August 10, 2015, LifeVantage Corporation (NASDAQ: LFVN) today announced preliminary results for the fourth quarter and full year ended June 30, 2015.

For the fourth fiscal quarter ended June 30, 2015, the Company expects to report revenue of approximately $45 million, compared to $56 million for the same period of fiscal 2014. The change in revenue was primarily due to a decline in revenue from Japan. Operating income for the fourth quarter of 2015 was $1.5 million, compared to $4.7 million in the fourth fiscal quarter of 2014. For the fourth fiscal quarter of 2015, the Company expects to realize earnings per diluted share of $0.00, calculated on 96.5 million fully diluted shares. This compares to $0.02 per diluted share, calculated on 105.6 million fully diluted shares, in the same period of fiscal 2014.

For the full fiscal year ended June 30, 2015, the Company expects to report revenue of approximately $190 million, compared to $214 million in fiscal 2014. Operating income for full fiscal year 2015 was $13.9 million, compared to $19.5 million in the prior year period. For fiscal 2015, the Company expects diluted earnings per share of $0.07 per diluted share, calculated on 99.1 million fully diluted shares. This compared to $0.10 per diluted share, calculated on 111.6 million fully diluted shares, in fiscal 2014.

During the full year of fiscal 2015, the Company reduced its overall debt to approximately $20.7 million from approximately $31 million. The Company ended fiscal 2015 with approximately $13.9 million in cash and cash equivalents.

Darren Jensen, President and Chief Executive Officer of LifeVantage, stated, “Our fourth quarter and full fiscal year 2015 results were in-line with our previously issued guidance and we are well positioned to increase revenue and net income in fiscal 2016 compared to fiscal 2015. Over the past several months, LifeVantage has undergone significant transitions, including me as the new CEO, the hiring of a new Chief Sales Officer, Justin Rose, and we enter fiscal 2016 with approximately $4 million of annual cost savings in order to better align our cost structure.

I have spent my career in network marketing and LifeVantage has the attributes necessary to be a great growth company. As we begin fiscal 2016, we are committed to improving our financial performance by increasing awareness of our products, more fully engaging our distributor base, and strategically expanding our geographic reach. With our new corporate leadership team in place, we have a refocused set of initiatives to return LifeVantage to aggressive top line growth. We will be discussing our comprehensive new strategy to obtain this during our fourth quarter earnings conference call in September.”

The Company will provide further results in its complete fourth quarter and full year fiscal 2015 earnings release and conference call which are expected to occur on September 1, 2015.

About LifeVantage Corporation

LifeVantage Corporation (Nasdaq:LFVN), is a science based network marketing company dedicated to visionary science that looks to transform health, wellness and anti-aging internally and externally at the cellular level. The company is the maker of Protandim®, the Nrf2 Synergizer® patented dietary supplement, the TrueScience™ Anti-Aging Skin Care Regimen, Canine Health, and the AXIO™ energy product line. LifeVantage was founded in 2003 and is headquartered in Salt Lake City, Utah.

Forward Looking Statements

This document contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as "believe," "hopes," "intends," "estimates," "expects," "projects," "plans," "anticipates," "look forward to" and variations thereof, identify forward-looking statements, but their absence does not mean that a statement is not forward-looking. Examples of forward-looking statements include, but are not limited to, statements we make regarding our leadership transition, future growth and distributor success. Such forward-looking statements are not guarantees of performance and the Company's actual results could differ materially from those contained in such statements. These forward-looking statements are based on the Company's current expectations and beliefs concerning future events affecting the Company and involve known and unknown risks and uncertainties that may cause the Company's actual results or outcomes to be materially different from those anticipated and discussed herein. These risks and uncertainties include, among others, those discussed in greater detail in the Company's Annual Report on Form 10-K and the Company's Quarterly Report on Form 10-Q under the caption "Risk Factors," and in other documents filed by the Company from time to time with the Securities and Exchange Commission. The Company cautions investors not to place undue reliance on the forward-looking statements contained in this document. All forward-looking statements are based on information currently available to the Company on the date hereof, and the Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances after the date of this document, except as required by law.

Investor Relations Contact:

Cindy England (801) 432-9036

Director of Investor Relations

-or-

John Mills (646) 277-1254

Partner, ICR INC

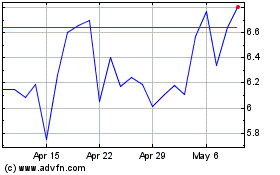

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

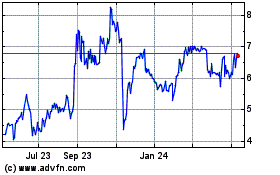

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Apr 2023 to Apr 2024