UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 10, 2015 |

|

ORGANOVO HOLDINGS, INC. |

|

(Exact name of registrant as specified in its charter)

Commission File Number: 001-35996 |

|

Delaware |

|

27-1488943 |

|

(State or other jurisdiction

of incorporation) |

|

(I.R.S. Employer

Identification No.) |

|

6275 Nancy Ridge Dr.,

San Diego, California 92121 |

|

(Address of principal executive offices, including zip code) |

|

(858) 224-1000 |

|

(Registrant’s telephone number, including area code) |

|

|

|

|

|

(Former Name or Former Address, if Changed Since Last Report) |

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

|

|

|

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On August 10, 2015, Organovo Holdings, Inc. (the “Company”) issued a press release announcing financial results for the first quarter of its fiscal year, which period ended June 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1.

The information furnished in this Item 2.02 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Item 2.02 shall not be incorporated by reference into any registration statement or other document filed with the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits

|

(d) |

|

Exhibits |

|

99.1 |

|

Press Release, dated August 10, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ORGANOVO HOLDINGS, INC. |

|

|

|

|

|

|

|

Date: August 10, 2015 |

/s/ Keith Murphy |

|

|

Keith Murphy |

|

|

Chief Executive Officer and President |

|

|

|

Exhibit Index

|

Exhibit

No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release, dated August 10, 2015. |

Exhibit 99.1

Organovo Reports First-Quarter Fiscal 2016 Financial Results and Corporate Highlights

SAN DIEGO, August 10, 2015 -- Organovo Holdings, Inc. (NYSE MKT: ONVO) ("Organovo" or the "Company"), a three-dimensional biology company focused on delivering scientific and medical breakthroughs using its 3D bioprinting technology, today reported its financial results for the first quarter of fiscal 2016 ended June 30, 2015.

Recent Corporate Highlights Included:

●Celebrated the successful launch of its exVive3DTM Human Liver Tissue, with an announcement of the launch results showing approximately $2M in total contract bookings as of June 9, 2015.

●Presented data on the Company's in vitro three-dimensional kidney tissue at the 2015 Experimental Biology conference in Boston, Massachusetts, demonstrating fully human kidney proximal tubular tissues were generated that were three-dimensional, and consisted of multiple tissue-relevant cell types arranged to recapitulate the renal tubular/interstitial interface. This breakthrough result demonstrated a proof of concept that kidney is on the way to becoming another core commercial tissue for Organovo.

●Announced a partnership with L'Oreal USA, wherein L'Oreal's U.S.-based global Technology Incubator and Organovo will leverage Organovo's proprietary NovoGen Bioprinting Platform and L'Oreal's expertise in skin engineering to develop 3D printed skin tissues for product evaluation and other areas of advanced research, marking the first-ever application of Organovo's groundbreaking technology within the beauty industry.

● Raised $46 million through the sale of approximately 10.8 million shares of common stock in an underwritten secondary offering focused primarily on institutional investors. Jefferies LLC and Piper Jaffray & Co. acted as joint book-running managers for this offering.

● Announced the hiring of Paul Gallant as the Company’s General Manager of the in vitro tissue service and product business. Mr. Gallant brings more than 20 years of management and R&D experience in the drug discovery industry, where he most recently served as chief operating officer for DiscoveRx, a global scientific product and services company. The Company plans to draw upon Mr. Gallant’s experience in advancing new technology platforms in collaboration with pharmaceutical companies, contract research organizations and academic institutions to assist it with developing and executing strategies for capturing market share and otherwise growing its in vitro business.

Keith Murphy, Organovo’s President and Chief Executive Officer commented “We are very pleased to have had a successful launch and have a diverse set of customers for our exVive3D Liver, including top 25 global pharma companies, additional public pharmaceutical companies from small to large cap, and private venture backed companies. We have continued to expand the data demonstrating the predictive power and comparability to native human biology provided by the exVive3D Liver, and we continue to gain penetration and awareness of the technology through our marketing, sales, and R&D efforts. As importantly, we have put ourselves in

position to further expand capacity, develop new tissue and disease model opportunities, and drive liver and kidney tissue revenue growth faster.”

Financial Summary

A summary of the Company's financial results for the first quarter of fiscal 2016 ended June 30, 2015 follows, but is not intended to replace the full financial disclosure enclosed in the Company's Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on August 10, 2015. Please refer to that document for additional information.

Financial Condition, Liquidity and Capital Resources

During the quarter ended June 30, 2015, the Company raised net proceeds of approximately $43.2 million through the sale of 10.8 million shares of its common stock in an underwritten secondary offering.

The Company had cash and cash equivalents of $86.0 million and an accumulated deficit of $130.8 million, with negative cash flows from operations of $6.3 million for the quarter ended June 30, 2015. Total current assets of $87.0 million and current liabilities of $5.2 million resulted in working capital of $81.8 million at June 30, 2015, versus the prior year’s first quarter total current assets of $45.7 million and current liabilities of $3.1 million, which resulted in working capital of $42.6 million. At March 31, 2015, we had total current assets of approximately $51.3 million and current liabilities of approximately $4.8 million, resulting in working capital of $46.5 million.

Net cash used in investing activities was approximately $1.1 million and $0.2 million for the quarters ended June 30, 2015 and 2014, respectively. The majority of net cash used in investing activities to date has been for the purchases of laboratory equipment related to the Company’s launch of its first commercial product and expanded research capabilities.

Net cash provided by financing activities was approximately $43.3 million and $0.3 million for the quarters ended June 30, 2015 and 2014, respectively.

Revenues

For the three months ended June 30, 2015, total revenue of $306,000 was $207,000, or approximately 209%, higher than total revenue for the three months ended June 30, 2014. Product and service revenue of $209,000 for the first quarter of fiscal 2016 versus $0 in the first quarter of fiscal 2015 represented revenue from the initial shipments of the Company’s exVive3D Human Liver Tissue product and from exVive3D Human Liver Tissue research services. The Company announced the commercial launch of its exVive3DHuman Liver Tissue in November 2014. The majority of revenues for the first quarter of fiscal 2016 were derived from research service agreements related to the exVive3D Human Liver Tissue, whereas revenues for the first quarter of fiscal 2015 were derived mainly from existing collaborations and from research funded by grants.

Operating and Other Expenses

Operating expenses increased approximately $2.3 million, or 35%, from approximately $6.5 million for the three months ended June 30, 2014 to $8.8 million for the three months ended June 30, 2015. Of this increase, $0.9 million related to increased selling, general and administrative expenses, while the remaining $1.4 million related to increased investment in research and

development. These increases can be attributed to the Company’s continued implementation of its business plan, including hiring additional staff to support its research and development initiatives, incremental investments associated with strategic growth and commercialization project initiatives associated with the commercial launch of its exVive3D Human Liver Tissue in November 2014, expenses related to operating as a publicly traded corporation, expansion of its facilities, and increased stock compensation expense relative to employees and certain consulting services.

More specifically, research and development expenses increased 50% from approximately $2.8 million for the three months ended June 30, 2014 to $4.2 million for the three months ended June 30, 2015, as the Company increased its research staff to support its obligations under existing collaborative research agreements and to expand its product development team and activities commensurate with launching commercial research services associated with the commercial launch of the Company’s first product in the third quarter of fiscal 2015. Full-time research and development staffing increased from thirty-six full-time employees as of June 30, 2014 to fifty-four full-time employees as of June 30, 2015, resulting in an increase in staffing expense of approximately $0.7 million, an increase in stock-based compensation of $0.1 million, an increase in lab supply costs of $0.3 million and an increase in facility costs of approximately $0.2 million.

Selling, general and administrative expenses for the three months ended June 30, 2015 were approximately $4.6 million, an increase of $0.9 million, or 24%, over expenses in the same period of the previous year of approximately $3.7 million. This increase was primarily related to an increase in staffing expense of $0.8 million due to an increase in administrative headcount from fourteen full-time employees to thirty-two full-time employees to provide strategic infrastructure in developing collaborative relationships and preparation for commercialization of research-derived product introductions as well as an increase in stock-based compensation of $0.1 million due to additional grants.

Other expense was less than $0.1 million for the three months ended June 30, 2015 and 2014, respectively, and consisted primarily of losses related to revaluation of warrant derivative liabilities. The majority of the underlying warrants to which derivative liability may apply have been exercised or converted to equity instruments in previous years, significantly lessening the impact of subsequent changes in our stock price.

Conference Call

The Company will host a conference call at 5:00 p.m. ET to discuss the financial results for the first quarter of fiscal 2016 ended June 30, 2015. If you would like to participate in the call, please dial-in approximately 10 minutes prior to the start time, and ask to join the Organovo Holdings, Inc. conference call. Participants will be required to state their name and company upon entering the call.

The dial-in info is as follows:

|

|

|

Participant dial in (toll free): |

1-888-317-6003 |

|

Participant international dial in: |

1-412-317-6061 |

|

EE TF - Canada |

1-866-284-3684 |

You will need to provide the Participant Elite Entry Number: 4892967

A replay will be made available one hour following the live call and remain available for 30 days. To access the replay, the dial-in info is as follows:

|

|

|

US Toll Free: |

1-877-344-7529 |

|

International Toll: |

1-412-317-0088 |

|

Canada Toll Free: |

855-669-9658 |

|

Replay Access Code: |

10070773 |

To access the replay using an international dial-in number, please select the link below.

https://services.choruscall.com/ccforms/replay.html

About Organovo Holdings, Inc.

Organovo designs and creates functional, three-dimensional human tissues for use in medical research and therapeutic applications. The Company develops 3D human disease models through internal development and in collaboration with pharmaceutical and academic partners. Organovo's 3D human tissues have the potential to accelerate the drug discovery process, enabling treatments to be developed faster and at lower cost. The Company recently launched its initial product of the planned exVive3D portfolio offering, the exVive3D Human Liver Tissue for use in toxicology and other preclinical drug testing. Additional products are in development, with the anticipated release of the exVive3D Human Kidney Tissue scheduled for the latter half of calendar year 2016. The Company also actively conducts early research on specific tissues for therapeutic use in direct surgical applications. In addition to numerous scientific publications, the Company's technology has been featured in The Wall Street Journal, Time Magazine, The Economist, and numerous other media outlets. Organovo is changing the shape of medical research and practice. Learn more at www.organovo.com.

Total Contract Bookings

Total contract bookings represents the total value of contracts the Company has entered into for research services related to its exVive3D Human Liver Tissue as of the end of the applicable period. Where contracts involve research relating to additional tissue types, only that portion of the total contract applicable to the exVive Human Liver Tissue is included. The Company's contracts typically require the Company to provide services over a four to six month period, though contracts may in some cases require services over a longer timeframe. In addition, the Company's customers may opt out of having the Company perform all of the services contemplated by the contract or otherwise terminate the contract early. As a result, the revenues represented by any contract included in the total contract bookings may be recognized by the Company over several quarters as the Company completes the research services required by the contract, or not at all, if the customer elects to opt out or otherwise terminate the contract early. Total contract bookings is an operational measure that should be considered in addition to the Company's results prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). This operational measure should not be considered as a substitute for, or superior to, GAAP results. The Company believes total contract bookings is a relevant and useful operational measure for the Company and its investors because it provides information regarding the Company's commercialization efforts and customer uptake of the Company's liver tissue product. The Company does not intend to update total contract bookings on a quarterly basis, but may update total contract bookings on an annual basis.

Safe Harbor Statement

Any statements contained in this press release that do not describe historical facts constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Any forward-looking statements contained herein are based on current expectations, but are subject to a number of risks and uncertainties. The factors that could cause the Company's actual future results to differ materially from current expectations include, but are not limited to, risks and uncertainties relating to the Company's ability to develop, market and sell products and services based on its technology; the expected benefits and efficacy of the Company's products, services and technology; the market acceptance of the Company's products and services; the Company's business, research, product development, regulatory approval, marketing and distribution plans and strategies; and the Company's ability to successfully complete the contracts and recognize the revenue represented by the contracts included in its previously reported total contract bookings. These and other factors are identified and described in more detail in the Company's filings with the SEC, including its Annual Report on Form 10-K filed with the SEC on June 9, 2015 and its Quarterly Report on Form 10-Q filed with the SEC on August 10, 2015. You should not place undue reliance on these forward-looking statements, which speak only as of the date that they were made. These cautionary statements should be considered with any written or oral forward-looking statements that the Company may issue in the future. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Sign up for email updates and connect with us on Twitter (@Organovo).

Investor Relations Contacts: Barry Michaels, Chief Financial Officer, phone (858) 224-1000, ext. 3 or IR@organovo.com, or Gerry Amato, Amato & Partners, LLC, admin@amatoandpartners.com.

Organovo Holdings, Inc.

Condensed Consolidated Balance Sheets

(in thousands except for share data)

|

|

|

June 30, 2015 |

|

|

March 31, 2015 |

|

|

|

|

(Unaudited) |

|

|

(Audited) |

|

|

Assets |

|

|

|

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

86,000 |

|

|

$ |

50,142 |

|

|

Accounts receivable |

|

|

132 |

|

|

|

— |

|

|

Inventory |

|

|

69 |

|

|

|

66 |

|

|

Prepaid expenses and other current assets |

|

|

795 |

|

|

|

1,054 |

|

|

Total current assets |

|

|

86,996 |

|

|

|

51,262 |

|

|

Fixed assets, net |

|

|

3,381 |

|

|

|

2,042 |

|

|

Restricted cash |

|

|

79 |

|

|

|

79 |

|

|

Other assets, net |

|

|

107 |

|

|

|

106 |

|

|

Total assets |

|

$ |

90,563 |

|

|

$ |

53,489 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,030 |

|

|

$ |

1,387 |

|

|

Accrued expenses |

|

|

1,646 |

|

|

|

2,257 |

|

|

Deferred rent |

|

|

1,088 |

|

|

|

759 |

|

|

Deferred revenue |

|

|

1,433 |

|

|

|

227 |

|

|

Capital lease obligation |

|

|

2 |

|

|

|

5 |

|

|

Warrant liabilities |

|

|

26 |

|

|

|

126 |

|

|

Total current liabilities |

|

|

5,225 |

|

|

|

4,761 |

|

|

Deferred revenue, net of current portion |

|

|

19 |

|

|

|

32 |

|

|

Capital lease obligation, net of current portion |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

$ |

5,244 |

|

|

$ |

4,793 |

|

|

Commitments and Contingencies (Note 4) |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 150,000,000 shares authorized,

92,426,404 and 81,536,724 shares issued and outstanding at

June 30, 2015 and March 31, 2015, respectively |

|

|

92 |

|

|

|

82 |

|

|

Additional paid-in capital |

|

|

216,013 |

|

|

|

170,909 |

|

|

Accumulated deficit |

|

|

(130,786 |

) |

|

|

(122,295 |

) |

|

Total stockholders’ equity |

|

|

85,319 |

|

|

|

48,696 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

90,563 |

|

|

$ |

53,489 |

|

Organovo Holdings, Inc.

Unaudited Condensed Consolidated Statements of Operations

(in thousands except share and per share data)

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

|

|

June 30, 2015 |

|

|

June 30, 2014 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

Product and service |

|

$ |

209 |

|

|

$ |

- |

|

|

Collaborations |

|

|

14 |

|

|

|

69 |

|

|

Grants |

|

|

83 |

|

|

|

30 |

|

|

Total Revenues |

|

|

306 |

|

|

|

99 |

|

|

Selling, general, and administrative expenses |

|

|

4,622 |

|

|

|

3,695 |

|

|

Research and development expenses |

|

|

4,142 |

|

|

|

2,814 |

|

|

Loss from Operations |

|

|

(8,458 |

) |

|

|

(6,410 |

) |

|

Other Income (Expense) |

|

|

|

|

|

|

|

|

|

Change in fair value of warrant liabilities |

|

|

(38 |

) |

|

|

(30 |

) |

|

Interest expense |

|

|

(3 |

) |

|

|

- |

|

|

Interest income |

|

|

8 |

|

|

|

7 |

|

|

Total Other Income (Expense) |

|

|

(33 |

) |

|

|

(23 |

) |

|

Net Loss |

|

$ |

(8,491 |

) |

|

$ |

(6,433 |

) |

|

Net loss per common share—basic and diluted |

|

$ |

(0.10 |

) |

|

$ |

(0.08 |

) |

|

Weighted average shares used in computing net

loss per common share—basic and diluted |

|

|

82,993,966 |

|

|

|

78,241,373 |

|

Organovo Holdings, Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(in thousands)

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

|

|

June 30, 2015 |

|

|

June 30, 2014 |

|

|

Cash Flows From Operating Activities |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(8,491 |

) |

|

$ |

(6,433 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

135 |

|

|

|

96 |

|

|

Change in fair value of warrant liabilities |

|

|

38 |

|

|

|

30 |

|

|

Stock-based compensation |

|

|

1,780 |

|

|

|

1,537 |

|

|

Amortization of warrants issued for services |

|

|

(95 |

) |

|

|

141 |

|

|

Increase (decrease) in cash resulting from changes in: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(132 |

) |

|

|

(60 |

) |

|

Inventory |

|

|

(3 |

) |

|

|

(8 |

) |

|

Prepaid expenses and other assets |

|

|

256 |

|

|

|

117 |

|

|

Accounts payable |

|

|

(357 |

) |

|

|

513 |

|

|

Accrued expenses |

|

|

(611 |

) |

|

|

460 |

|

|

Deferred rent |

|

|

(8 |

) |

|

|

112 |

|

|

Deferred revenue |

|

|

1,193 |

|

|

|

130 |

|

|

Net cash used in operating activities |

|

|

(6,295 |

) |

|

|

(3,365 |

) |

|

Cash Flows From Investing Activities |

|

|

|

|

|

|

|

|

|

Purchases of fixed assets |

|

|

(1,135 |

) |

|

|

(238 |

) |

|

Net cash used in investing activities |

|

|

(1,135 |

) |

|

|

(238 |

) |

|

Cash Flows From Financing Activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock and exercise of warrants, net |

|

|

43,214 |

|

|

|

224 |

|

|

Proceeds from exercise of stock options |

|

|

77 |

|

|

|

111 |

|

|

Principal payments on capital lease obligations |

|

|

(3 |

) |

|

|

(2 |

) |

|

Net cash provided by financing activities |

|

|

43,288 |

|

|

|

333 |

|

|

Net Increase (Decrease) in Cash and Cash Equivalents |

|

|

35,858 |

|

|

|

(3,270 |

) |

|

Cash and Cash Equivalents at Beginning of Period |

|

|

50,142 |

|

|

|

48,167 |

|

|

Cash and Cash Equivalents at End of Period |

|

$ |

86,000 |

|

|

$ |

44,897 |

|

|

Supplemental Disclosure of Cash Flow Information: |

|

|

|

|

|

|

|

|

|

Interest |

|

$ |

— |

|

|

$ |

— |

|

|

Income Taxes |

|

$ |

(3 |

) |

|

$ |

— |

|

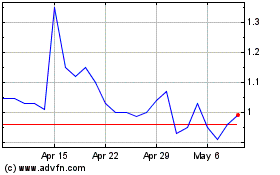

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

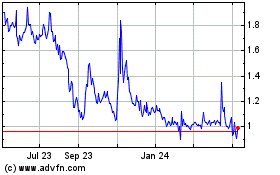

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Apr 2023 to Apr 2024