UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2015

National CineMedia, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Delaware |

001-33296 |

20-5665602 |

|

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

9110 E. Nichols Ave., Suite 200

Centennial, Colorado 80112-3405

(Address of principal executive offices, including zip code)

(303) 792-3600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition

On August 6, 2015, National CineMedia, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal second quarter ended July 2, 2015. A copy of the press release is furnished as Exhibit 99.1 to this report.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d)Exhibits

|

|

|

Exhibit No. |

Description |

|

99.1 |

Press Release of National CineMedia, Inc. dated August 6, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

NATIONAL CINEMEDIA, INC. |

|

|

|

|

|

|

Dated: August 6, 2015 |

|

By: |

/s/ Ralph E. Hardy |

|

|

|

|

Ralph E. Hardy |

|

|

|

|

Executive Vice President, General |

|

|

|

|

Counsel and Secretary |

Exhibit 99.1

National CineMedia, Inc. Reports Results for

Fiscal Second Quarter 2015

~ Announces Quarterly Cash Dividend ~

~ Provides Third Quarter and Updates Full Year 2015 Outlook ~

Centennial, CO – August 6, 2015 – National CineMedia, Inc. (NASDAQ: NCMI) (the Company), the managing member and owner of 45.2% of National CineMedia, LLC (NCM LLC), the operator of the largest in-theatre digital media network in North America, today announced consolidated results for the fiscal second quarter ended July 2, 2015.

Total revenue for the quarter ended July 2, 2015 increased 21.6% to $121.5 million from $99.9 million for the comparable quarter last year. Adjusted OIBDA increased 29.6% to $67.4 million from $52.0 million for the second quarter of 2014. Net income for the second quarter of 2015 was $10.1 million, or income of $0.17 per diluted share compared to net income of $3.6 million, or income of $0.06 per diluted share for the second quarter of 2014.

Total revenue for the six months ended July 2, 2015 increased 16.6% to $198.4 million from $170.1 million for the comparable period last year. Adjusted OIBDA increased 27.5% to $95.1 million from $74.6 million for the first six months of 2014. Net income for the first six months of 2015 was $1.1 million, or income of $0.02 per diluted share compared to net income of $0.5 million, or income of $0.01 per diluted share for the first six months of 2014. Excluding pre-tax amortization expense of terminated derivatives from 2015 and 2014 and $34.3 million in pre-tax costs associated with the terminated merger with Screenvision (including the $26.8 million termination payment) in the first six months of 2015, net income for the first six months of 2015 would have been $0.19 per diluted share and net income for the first six months of 2014 would have been $0.04 per diluted share. Adjusted OIBDA and earnings per share excluding the amortization of terminated derivatives and merger-related costs are non-GAAP measures. See the tables at the end of this release for the reconciliations to the closest GAAP basis measurement.

The Company announced today that its Board of Directors has authorized the Company’s regular quarterly cash dividend of $0.22 per share of common stock. The dividend will be paid on September 3, 2015 to stockholders of record on August 20, 2015. The Company intends to pay a regular quarterly dividend for the foreseeable future at the discretion of the Board of Directors consistent with the Company’s intention to distribute over time a substantial portion of its free cash flow in the form of dividends to its stockholders. The declaration, payment, timing and amount of any future dividends payable will be at the sole discretion of the Board of Directors who will take into account general economic and advertising market business conditions, the Company’s financial condition, available cash, current and anticipated cash needs, and any other factors that the Board of Directors considers relevant.

Commenting on the Company’s second quarter operating results, Kurt Hall, NCM’s Chairman and CEO said, “Our record second quarter advertising revenue and Adjusted OIBDA and strong third quarter guidance reflect the hard work of the NCM team.” Mr. Hall continued, “A very successful upfront campaign last year and several quarters of video market share gains provides clear evidence that media buyers are looking for premium video alternatives where they know their ads will be seen.” Mr. Hall concluded, “As we continue to expand our cinema network reach and improve our targeting and data analytics capabilities, I am confident that NCM will continue to strengthen its value proposition relative to other video advertising networks.”

Supplemental Information

Integration payments due from Cinemark and AMC associated with Rave Theatres for the quarter ended July 2, 2015 and June 26, 2014 and the six months ended July 2, 2015 and June 26, 2014 were $0.8 million, $0.6 million, $1.1 million and $0.8 million respectively. The integration payments were recorded as a reduction of an intangible asset.

2015 Outlook

For the third quarter of 2015, the Company expects total revenue to be up 8% to 13% and Adjusted OIBDA is expected to be up 7% to 17% from the third quarter of 2014. The Company expects total revenue in the range of $109.0 million to $114.0 million during the third quarter of 2015, compared to total revenue for the third quarter of 2014 of $100.8 million and Adjusted OIBDA in the range of $56.0 million to $61.0 million during the third quarter of 2015 compared to Adjusted OIBDA for the third quarter of 2014 of $52.2 million.

1

For full year 2015, the Company updates its outlook and expects total revenue to be up 8% to 10% and Adjusted OIBDA to be up 8% to 12% from the full year 2014. The Company expects total revenue in the range of $425.0 million to $433.0 million for the full year 2015, compared to total revenue for the full year 2014 of $394.0 million and Adjusted OIBDA in the range of $215.0 million to $223.0 million for the full year 2015 compared to Adjusted OIBDA for the full year 2014 of $199.3 million.

Conference Call

The Company will host a conference call and audio webcast with investors, analysts and other interested parties August 6, 2015 at 5:00 P.M. Eastern time. The live call can be accessed by dialing 1-800-263-8506 or for international participants 1-719-457-2601. Participants should register at least 15 minutes prior to the commencement of the call. Additionally, a live audio webcast will be available to interested parties at www.ncm.com under the Investor Relations section. Participants should allow at least 15 minutes prior to the commencement of the call to register, download and install necessary audio software.

The replay of the conference call will be available until midnight Eastern Time, August 20, 2015, by dialing 1-877-870-5176 or for international participants 1-858-384-5517, and entering conference ID 3033763.

About National CineMedia, Inc.

National CineMedia (NCM) is America’s Movie Network. As the #1 weekend network in the U.S., NCM helps brands get in front of the movies that shape the national conversation. More than 700 million moviegoers annually attend theatres that are currently under contract to present NCM’s FirstLook pre-show in over 40 leading national and regional theater circuits including AMC Entertainment Inc. (NYSE:AMC), Cinemark Holdings, Inc. (NYSE:CNK) and Regal Entertainment Group (NYSE: RGC). NCM’s cinema advertising network offers broad reach and unparalleled audience engagement with approximately 20,150 screens in approximately 1,600 theaters in 187 Designated Market Areas® (49 of the top 50). NCM Digital goes beyond the big screen, extending in-theater campaigns into online and mobile marketing programs to reach entertainment audiences. National CineMedia, Inc. (NASDAQ:NCMI) owns a 45.2% interest in, and is the managing member of, National CineMedia, LLC. For more information, visit www.ncm.com.

Forward Looking Statements

This press release contains various forward-looking statements that reflect management’s current expectations or beliefs regarding future events, including statements providing guidance and projections for third quarter and full year 2015, the dividend policy, network expansion, competition in the broader advertising marketplace and technology improvements. Investors are cautioned that reliance on these forward-looking statements involves risks and uncertainties. Although the Company believes that the assumptions used in the forward looking statements are reasonable, any of these assumptions could prove to be inaccurate and, as a result, actual results could differ materially from those expressed or implied in the forward looking statements. The factors that could cause actual results to differ materially from those expressed or implied in the forward-looking statements are, among others, 1) level of theatre attendance; 2) increased competition for advertising expenditures; 3) technological changes and innovations; 4) economic conditions, including the level of expenditures on cinema advertising; 5) our ability to renew or replace expiring advertising and content contracts; 6) our need for additional funding, risks and uncertainties relating to our significant indebtedness; 7) fluctuations in operating costs; 8) changes in interest rates; and 9) changes in accounting principles. In addition, the outlook provided does not include the impact of any future unusual or infrequent transactions; sales and acquisitions of operating assets and investments; any future noncash impairments of intangible and fixed assets; amounts related to litigation or the related impact of taxes that may occur from time to time due to management decisions and changing business circumstances. The Company is currently unable to forecast precisely the timing and/or magnitude of any such amounts or events. Please refer to the Company’s Securities and Exchange Commission filings, including the “Risk Factor” section of the Company’s Annual Report on Form 10-K for the year ended January 1, 2015, for further information about these and other risks.

|

|

|

|

|

|

|

|

INVESTOR CONTACT: |

|

MEDIA CONTACT: |

|

David Oddo |

|

Amy Jane Finnerty |

|

800-844-0935 |

|

212-931-8117 |

|

investors@ncm.com |

|

amy.finnerty@ncm.com |

2

NATIONAL CINEMEDIA, INC.

Condensed Consolidated Statements of Income

Unaudited

($ in millions, except per share data)

|

|

|

Quarter Ended |

|

|

Six Months Ended |

|

|

|

|

July 2,

2015 |

|

|

June 26,

2014 |

|

|

July 2,

2015 |

|

|

June 26,

2014 |

|

|

REVENUE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advertising (including revenue from founding members of $9.0, $9.8, $16.7 and $19.3, respectively) |

|

$ |

121.5 |

|

|

$ |

99.9 |

|

|

$ |

198.4 |

|

|

$ |

170.1 |

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advertising operating costs |

|

|

8.3 |

|

|

|

6.6 |

|

|

|

14.1 |

|

|

|

11.6 |

|

|

Network costs |

|

|

4.2 |

|

|

|

4.4 |

|

|

|

8.7 |

|

|

|

9.0 |

|

|

Theatre access fees—founding members |

|

|

19.2 |

|

|

|

17.9 |

|

|

|

36.4 |

|

|

|

35.3 |

|

|

Selling and marketing costs |

|

|

17.0 |

|

|

|

14.1 |

|

|

|

33.0 |

|

|

|

29.1 |

|

|

Merger-related costs |

|

|

0.9 |

|

|

|

1.7 |

|

|

|

34.3 |

|

|

|

1.7 |

|

|

Administrative and other costs |

|

|

8.3 |

|

|

|

7.1 |

|

|

|

17.0 |

|

|

|

14.7 |

|

|

Depreciation and amortization |

|

|

8.2 |

|

|

|

7.8 |

|

|

|

16.2 |

|

|

|

15.6 |

|

|

Total |

|

|

66.1 |

|

|

|

59.6 |

|

|

|

159.7 |

|

|

|

117.0 |

|

|

OPERATING INCOME |

|

|

55.4 |

|

|

|

40.3 |

|

|

|

38.7 |

|

|

|

53.1 |

|

|

NON-OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on borrowings |

|

|

13.1 |

|

|

|

13.0 |

|

|

|

26.2 |

|

|

|

26.1 |

|

|

Interest income |

|

|

(0.3 |

) |

|

|

(0.5 |

) |

|

|

(0.9 |

) |

|

|

(0.9 |

) |

|

Accretion of interest on the discounted payable to founding members under tax receivable agreement |

|

|

3.5 |

|

|

|

3.5 |

|

|

|

7.1 |

|

|

|

7.3 |

|

|

Amortization of terminated derivatives |

|

|

- |

|

|

|

2.5 |

|

|

|

1.6 |

|

|

|

5.0 |

|

|

Other non-operating expense |

|

|

- |

|

|

|

0.1 |

|

|

|

0.1 |

|

|

|

0.2 |

|

|

Total |

|

|

16.3 |

|

|

|

18.6 |

|

|

|

34.1 |

|

|

|

37.7 |

|

|

INCOME BEFORE INCOME TAXES |

|

|

39.1 |

|

|

|

21.7 |

|

|

|

4.6 |

|

|

|

15.4 |

|

|

Income tax expense |

|

|

5.8 |

|

|

|

3.8 |

|

|

|

1.5 |

|

|

|

2.1 |

|

|

CONSOLIDATED NET INCOME |

|

|

33.3 |

|

|

|

17.9 |

|

|

|

3.1 |

|

|

|

13.3 |

|

|

Less: Net income attributable to noncontrolling

interests |

|

|

23.2 |

|

|

|

14.3 |

|

|

|

2.0 |

|

|

|

12.8 |

|

|

NET INCOME ATTRIBUTABLE TO NCM, INC. |

|

$ |

10.1 |

|

|

$ |

3.6 |

|

|

$ |

1.1 |

|

|

$ |

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME PER NCM, INC. COMMON SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.17 |

|

|

$ |

0.06 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

Diluted |

|

$ |

0.17 |

|

|

$ |

0.06 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

3

NATIONAL CINEMEDIA, INC.

Selected Condensed Balance Sheet Data

Unaudited ($ in millions)

|

|

|

As of |

|

|

|

|

July 2,

2015 |

|

|

January 1,

2015 |

|

|

Cash, cash equivalents and marketable securities |

|

$ |

69.4 |

|

|

$ |

80.6 |

|

|

Receivables, net |

|

|

126.9 |

|

|

|

116.5 |

|

|

Property and equipment, net |

|

|

21.9 |

|

|

|

22.4 |

|

|

Total assets |

|

|

1,010.5 |

|

|

|

991.4 |

|

|

Borrowings |

|

|

935.0 |

|

|

|

892.0 |

|

|

Total equity/(deficit) |

|

|

(221.6 |

) |

|

|

(208.7 |

) |

|

Total liabilities and equity |

|

|

1,010.5 |

|

|

|

991.4 |

|

NATIONAL CINEMEDIA, INC.

Operating Data

Unaudited

|

|

|

Quarter and Six Months Ended |

|

|

|

|

July 2,

2015 |

|

|

June 26,

2014 |

|

|

Total Screens (100% Digital) at Period End (1)(6) |

|

|

20,150 |

|

|

|

19,886 |

|

|

Founding Member Screens at Period End (2)(6) |

|

|

16,471 |

|

|

|

16,451 |

|

|

DCN (Digital Content Network) Screens at Period End (3)(6) |

|

|

19,396 |

|

|

|

19,022 |

|

|

|

|

Quarter Ended |

|

|

Six Months Ended |

|

|

(in millions) |

|

July 2,

2015 |

|

|

June 26,

2014 |

|

|

July 2,

2015 |

|

|

June 26,

2014 |

|

|

Total Attendance for Period (4)(6) |

|

|

191.8 |

|

|

|

175.4 |

|

|

|

353.2 |

|

|

|

341.9 |

|

|

Founding Member Attendance for Period (5)(6) |

|

|

161.8 |

|

|

|

150.4 |

|

|

|

297.9 |

|

|

|

294.4 |

|

|

Capital Expenditures |

|

$ |

2.9 |

|

|

$ |

3.1 |

|

|

$ |

5.0 |

|

|

$ |

5.3 |

|

|

(1) |

Represents the total screens within NCM LLC’s advertising network. |

|

(2) |

Represents the total founding member screens. |

|

(3) |

Represents the total number of screens that are connected to the Digital Content Network. |

|

(4) |

Represents the total attendance within NCM LLC’s advertising network. |

|

(5) |

Represents the total attendance within NCM LLC’s advertising network in theatres operated by the founding members. |

|

(6) |

Excludes screens and attendance associated with certain AMC Rave and Cinemark Rave theatres for all periods presented. |

4

NATIONAL CINEMEDIA, INC.

Operating Data

Unaudited

(In millions, except advertising revenue per attendee, margin and per share data)

|

|

|

Quarter Ended |

|

|

Six Months Ended |

|

|

|

|

July 2,

2015 |

|

|

June 26,

2014 |

|

|

July 2,

2015 |

|

|

June 26,

2014 |

|

|

Revenue breakout: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

National advertising revenue |

|

$ |

89.2 |

|

|

$ |

68.4 |

|

|

$ |

140.1 |

|

|

$ |

111.1 |

|

|

Local advertising revenue |

|

|

23.3 |

|

|

|

21.7 |

|

|

|

41.7 |

|

|

|

39.8 |

|

|

Total advertising revenue (excluding beverage) |

|

$ |

112.5 |

|

|

$ |

90.1 |

|

|

$ |

181.8 |

|

|

$ |

150.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

$ |

121.5 |

|

|

$ |

99.9 |

|

|

$ |

198.4 |

|

|

$ |

170.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per attendee data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

National advertising revenue per attendee |

|

$ |

0.465 |

|

|

$ |

0.390 |

|

|

$ |

0.397 |

|

|

$ |

0.325 |

|

|

Local advertising revenue per attendee |

|

$ |

0.121 |

|

|

$ |

0.124 |

|

|

$ |

0.118 |

|

|

$ |

0.116 |

|

|

Total advertising revenue (excluding beverage) per attendee |

|

$ |

0.587 |

|

|

$ |

0.514 |

|

|

$ |

0.515 |

|

|

$ |

0.441 |

|

|

Total advertising revenue per attendee |

|

$ |

0.633 |

|

|

$ |

0.570 |

|

|

$ |

0.562 |

|

|

$ |

0.498 |

|

|

Total attendance (1) |

|

|

191.8 |

|

|

|

175.4 |

|

|

|

353.2 |

|

|

|

341.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other operating data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

55.4 |

|

|

$ |

40.3 |

|

|

$ |

38.7 |

|

|

$ |

53.1 |

|

|

OIBDA (2) |

|

$ |

63.6 |

|

|

$ |

48.1 |

|

|

$ |

54.9 |

|

|

$ |

68.7 |

|

|

Adjusted OIBDA (2) |

|

$ |

67.4 |

|

|

$ |

52.0 |

|

|

$ |

95.1 |

|

|

$ |

74.6 |

|

|

Adjusted OIBDA margin (2) |

|

|

55.5 |

% |

|

|

52.1 |

% |

|

|

47.9 |

% |

|

|

43.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income per share – basic |

|

$ |

0.17 |

|

|

$ |

0.06 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

Income per share – diluted |

|

$ |

0.17 |

|

|

$ |

0.06 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted income per share – basic (2) |

|

$ |

0.17 |

|

|

$ |

0.08 |

|

|

$ |

0.19 |

|

|

$ |

0.04 |

|

|

Adjusted income per share – diluted (2) |

|

$ |

0.17 |

|

|

$ |

0.08 |

|

|

$ |

0.19 |

|

|

$ |

0.04 |

|

|

(1) |

Represents the total attendance within NCM LLC’s advertising network. Excludes screens and attendance associated with certain AMC Rave and Cinemark Rave theatres for all periods presented. |

|

(2) |

OIBDA, Adjusted OIBDA, Adjusted OIBDA margin and adjusted income per share are not financial measures calculated in accordance with GAAP in the United States. See attached tables for the non-GAAP reconciliations. |

5

NATIONAL CINEMEDIA, INC.

Non-GAAP Reconciliations

Unaudited

OIBDA, Adjusted OIBDA and Adjusted OIBDA Margin

Operating Income Before Depreciation and Amortization (“OIBDA”), Adjusted OIBDA and Adjusted OIBDA margin are not financial measures calculated in accordance with GAAP in the United States. OIBDA represents consolidated net income plus income tax expense, interest and other costs and depreciation and amortization expense. Adjusted OIBDA excludes from OIBDA non-cash share based compensation costs and merger-related costs. Adjusted OIBDA margin is calculated by dividing Adjusted OIBDA by total revenue. These non-GAAP financial measures are used by management to evaluate operating performance, to forecast future results and as a basis for compensation. The Company believes these are important supplemental measures of operating performance because they eliminate items that have less bearing on its operating performance and so highlight trends in its core business that may not otherwise be apparent when relying solely on GAAP financial measures. The Company believes the presentation of these measures is relevant and useful for investors because it enables them to view performance in a manner similar to the method used by the Company’s management, helps improve their ability to understand the Company’s operating performance and makes it easier to compare the Company’s results with other companies that may have different depreciation and amortization policies, non-cash share based compensation programs, levels of mergers and acquisitions, interest rates or debt levels or income tax rates. A limitation of these measures, however, is that they exclude depreciation and amortization, which represent a proxy for the periodic costs of certain capitalized tangible and intangible assets used in generating revenues in the Company’s business. In addition, Adjusted OIBDA has the limitation of not reflecting the effect of the Company’s share based payment costs or costs associated with the proposed Screenvision merger. OIBDA or Adjusted OIBDA should not be regarded as an alternative to operating income, net income or as indicators of operating performance, nor should they be considered in isolation of, or as substitutes for financial measures prepared in accordance with GAAP. The Company believes that consolidated net income is the most directly comparable GAAP financial measure to OIBDA. Because not all companies use identical calculations, these non-GAAP presentations may not be comparable to other similarly titled measures of other companies, or calculations in the Company’s debt agreement.

The following tables reconcile consolidated net income to OIBDA and Adjusted OIBDA for the periods presented (dollars in millions):

|

|

|

Quarter Ended |

|

|

Six Months Ended |

|

|

|

|

July 2,

2015 |

|

|

June 26,

2014 |

|

|

July 2,

2015 |

|

|

June 26,

2014 |

|

|

Consolidated net income |

|

$ |

33.3 |

|

|

$ |

17.9 |

|

|

$ |

3.1 |

|

|

$ |

13.3 |

|

|

Income tax expense |

|

|

5.8 |

|

|

|

3.8 |

|

|

|

1.5 |

|

|

|

2.1 |

|

|

Interest and other non-operating costs |

|

|

16.3 |

|

|

|

18.6 |

|

|

|

34.1 |

|

|

|

37.7 |

|

|

Depreciation and amortization |

|

|

8.2 |

|

|

|

7.8 |

|

|

|

16.2 |

|

|

|

15.6 |

|

|

OIBDA |

|

$ |

63.6 |

|

|

$ |

48.1 |

|

|

$ |

54.9 |

|

|

$ |

68.7 |

|

|

Share-based compensation costs (1) |

|

|

2.9 |

|

|

|

2.2 |

|

|

|

5.9 |

|

|

|

4.2 |

|

|

Merger-related costs (2) |

|

|

0.9 |

|

|

|

1.7 |

|

|

|

34.3 |

|

|

|

1.7 |

|

|

Adjusted OIBDA |

|

$ |

67.4 |

|

|

$ |

52.0 |

|

|

$ |

95.1 |

|

|

$ |

74.6 |

|

|

Total revenue |

|

$ |

121.5 |

|

|

$ |

99.9 |

|

|

$ |

198.4 |

|

|

$ |

170.1 |

|

|

Adjusted OIBDA margin |

|

|

55.5 |

% |

|

|

52.1 |

% |

|

|

47.9 |

% |

|

|

43.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted OIBDA |

|

$ |

67.4 |

|

|

$ |

52.0 |

|

|

$ |

95.1 |

|

|

$ |

74.6 |

|

|

Rave theatres integration payments |

|

|

0.8 |

|

|

|

0.6 |

|

|

|

1.1 |

|

|

|

0.8 |

|

|

Adjusted OIBDA after integration payments |

|

$ |

68.2 |

|

|

$ |

52.6 |

|

|

$ |

96.2 |

|

|

$ |

75.4 |

|

|

(1) |

Share-based compensation costs are included in network operations, selling and marketing and administrative expense in the accompanying financial statements. |

|

(2) |

Merger-related costs primarily include the merger termination fee and legal, accounting, advisory and other professional fees associated with the terminated merger with Screenvision. |

6

Outlook (in millions)

|

|

|

Quarter Ending

October 1, 2015 |

|

|

Year Ending

December 31, 2015 |

|

|

|

|

NCM, Inc. |

|

|

NCM, Inc. |

|

|

|

|

Low |

|

|

High |

|

|

Low |

|

|

High |

|

|

Consolidated net income |

|

$ |

24.8 |

|

|

$ |

27.9 |

|

|

$ |

61.3 |

|

|

$ |

65.7 |

|

|

Income tax expense |

|

|

4.4 |

|

|

|

5.0 |

|

|

|

9.6 |

|

|

|

10.4 |

|

|

Interest and other non-operating costs |

|

|

16.0 |

|

|

|

16.5 |

|

|

|

66.1 |

|

|

|

67.1 |

|

|

Depreciation and amortization |

|

|

8.0 |

|

|

|

8.4 |

|

|

|

32.2 |

|

|

|

33.0 |

|

|

OIBDA |

|

|

53.2 |

|

|

|

57.8 |

|

|

|

169.2 |

|

|

|

176.2 |

|

|

Share-based compensation costs (1) |

|

|

2.8 |

|

|

|

3.2 |

|

|

|

11.5 |

|

|

|

12.5 |

|

|

Merger-related costs (2) |

|

|

- |

|

|

|

- |

|

|

|

34.3 |

|

|

|

34.3 |

|

|

Adjusted OIBDA |

|

$ |

56.0 |

|

|

$ |

61.0 |

|

|

$ |

215.0 |

|

|

$ |

223.0 |

|

|

Total revenue |

|

$ |

109.0 |

|

|

$ |

114.0 |

|

|

$ |

425.0 |

|

|

$ |

433.0 |

|

|

(1) |

Share-based compensation costs are included in network operations, selling and marketing and administrative expense in the accompanying financial statements. |

|

(2) |

Merger-related costs primarily include the merger termination fee and legal, accounting, advisory and other professional fees associated with the terminated merger with Screenvision. |

7

Net Income and Earnings per Share Excluding the Amortization of Terminated Derivatives and Merger-Related Costs

Net income and earnings per share excluding the amortization of terminated derivatives and merger-related costs are not financial measures calculated in accordance with GAAP in the United States. Net income and earnings per share excluding the amortization of terminated derivatives and merger-related costs are calculated using reported net income and income per share and the amortization of terminated derivatives and merger-related costs shown in the below table. These non-GAAP financial measures are used by management as an additional tool to evaluate operating performance. The Company believes these are important supplemental measures of operating performance because they eliminate items that have less bearing on its operating performance and so highlight trends in its core business that may not otherwise be apparent when relying solely on GAAP financial measures. The Company believes the presentation of these measures is relevant and useful for investors because it enables them to view performance in a manner similar to a method used by the Company’s management and helps improve their ability to understand the Company’s operating performance. Net income excluding the amortization of terminated derivatives and merger-related costs should not be regarded as an alternative to net income and should not be regarded as an alternative to earnings per share or as indicators of operating performance, nor should they be considered in isolation of, or as substitutes for financial measures prepared in accordance with GAAP. The Company believes that net income and earnings per share are the most directly comparable GAAP financial measures. Because not all companies use identical calculations, these presentations may not be comparable to other similarly titled measures of other companies.

The following table reconciles net income and income per share as reported to net income and earnings per share excluding the amortization of terminated derivatives and merger-related costs for the periods presented (dollars in millions):

|

|

|

Quarter Ended |

|

|

Six Months Ended |

|

|

|

|

July 2,

2015 |

|

|

June 26,

2014 |

|

|

July 2,

2015 |

|

|

June 26,

2014 |

|

|

Net income as reported |

|

$ |

10.1 |

|

|

$ |

3.6 |

|

|

$ |

1.1 |

|

|

$ |

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Merger-related costs (1) |

|

|

0.9 |

|

|

|

1.7 |

|

|

|

34.3 |

|

|

|

1.7 |

|

|

Amortization of terminated derivatives |

|

|

- |

|

|

|

2.5 |

|

|

|

1.6 |

|

|

|

5.0 |

|

|

Effect of noncontrolling interests (54.8%, 54.2%, 54.9% and 54.2%, respectively) |

|

|

(0.5 |

) |

|

|

(2.3 |

) |

|

|

(19.7 |

) |

|

|

(3.6 |

) |

|

Effect of provision for income taxes (38% effective rate) |

|

|

(0.2 |

) |

|

|

(0.7 |

) |

|

|

(6.2 |

) |

|

|

(1.2 |

) |

|

Net effect of adjusting items |

|

|

0.2 |

|

|

|

1.2 |

|

|

|

10.0 |

|

|

|

1.9 |

|

|

Net income excluding adjusting items |

|

$ |

10.3 |

|

|

$ |

4.8 |

|

|

$ |

11.1 |

|

|

$ |

2.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding as reported |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

58,974,581 |

|

|

|

58,722,025 |

|

|

|

58,931,628 |

|

|

|

58,670,412 |

|

|

Diluted |

|

|

59,595,019 |

|

|

|

59,000,127 |

|

|

|

59,360,245 |

|

|

|

59,006,383 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding as adjusted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

58,974,581 |

|

|

|

58,722,025 |

|

|

|

58,931,628 |

|

|

|

58,670,412 |

|

|

Diluted |

|

|

59,595,019 |

|

|

|

59,000,127 |

|

|

|

59,360,245 |

|

|

|

59,006,383 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic income per share as reported |

|

$ |

0.17 |

|

|

$ |

0.06 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

Net effect of adjusting items |

|

|

- |

|

|

|

0.02 |

|

|

|

0.17 |

|

|

|

0.03 |

|

|

Basic income per share excluding adjusting items |

|

$ |

0.17 |

|

|

$ |

0.08 |

|

|

$ |

0.19 |

|

|

$ |

0.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted income per share as reported |

|

$ |

0.17 |

|

|

$ |

0.06 |

|

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

Net effect of adjusting items |

|

|

- |

|

|

|

0.02 |

|

|

|

0.17 |

|

|

|

0.03 |

|

|

Diluted income per share excluding adjusting items |

|

$ |

0.17 |

|

|

$ |

0.08 |

|

|

$ |

0.19 |

|

|

$ |

0.04 |

|

|

(1) |

Merger-related costs primarily include the merger termination payment and legal, accounting, advisory and other professional fees associated with the terminated merger with Screenvision. |

8

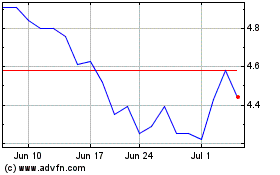

National CineMedia (NASDAQ:NCMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

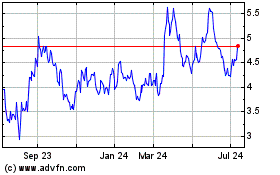

National CineMedia (NASDAQ:NCMI)

Historical Stock Chart

From Apr 2023 to Apr 2024