Current Report Filing (8-k)

August 05 2015 - 4:50PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2015

VAALCO Energy, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of

incorporation or organization)

|

001-32167

(Commission File Number)

|

76-0274813

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

9800 Richmond Avenue, Suite 700

Houston, Texas

(Address of principal executive offices)

|

77042

(Zip Code)

|

|

|

|

|

Registrant’s telephone number, including area code: (713) 623-0801

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 31, 2015, the Board of Directors (the “Board”) of VAALCO Energy, Inc. (the “Company”) elected Steven J. Pully as a member of the Board. Mr. Pully’s current term will expire at the Company’s next annual meeting of stockholders in 2016.

The Board has determined that Mr. Pully is an independent director under Sections 303A.02 and 303A.07 of the New York Stock Exchange Listed Company Manual and under Rule 10A-3 of the Securities Exchange Act of 1934. Mr. Pully has been appointed as a member of the Audit Committee of the Board.

There are no understandings or arrangements between Mr. Pully and any other person pursuant to which Mr. Pully was elected to serve as a director of the Company. There are no relationships between Mr. Pully and the Company or any of its subsidiaries that would require disclosure pursuant to Item 404(a) of Regulation S-K.

As a non-employee director, Mr. Pully will receive compensation in accordance with the Company’s policies for compensating non-employee directors, including any long-term equity incentive awards under the Company’s Long Term Incentive Plan. In connection with Mr. Pully’s election to the Board, he will receive an initial equity award of 36,000 shares of common stock and an annual equity award of common stock beginning in 2016 having a value of approximately $80,000. The shares of common stock will be issued under the Company’s 2014 Long Term Incentive Plan.

Item 8.01Other Events.

On August 4, 2015, the Company announced that its Board of Directors had authorized a share repurchase program allowing the Company to repurchase up to 5.8 million shares of the Company’s common stock through February 3, 2017. Under the share repurchase program, the Company’s common stock could be purchased on the open market, in privately negotiated transactions or otherwise in compliance with all of the conditions of Rule 10b-18 under the Securities Exchange Act of 1934, as amended. The timing of the common stock repurchased will be at the discretion of management and will depend on a number of factors, including price, market conditions and regulatory requirements. The Company retains the right to limit, terminate or extend the share repurchase program at any time without prior notice. Attached hereto as Exhibit 99.1 and incorporated by reference herein is the press release announcing the approval of the share repurchase program.

Item 9.01Financial Statements and Exhibits.

(d)Exhibits.

|

|

|

|

Exhibit Number

|

Description

|

|

99.1

|

Press Release, dated August 4, 2015

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

VAALCO Energy, Inc.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

Date: August 5, 2015

|

By:

|

/s/ Eric J. Christ

|

|

|

|

Eric J. Christ

Vice President, General Counsel and Corporate Secretary

|

|

|

|

|

|

|

Exhibit Index

|

4

|

|

|

Exhibit Number

|

Description

|

|

99.1

|

Press Release, dated August 4, 2015

|

VAALCO Energy Authorizes Share Buyback Program

HOUSTON, Aug. 4, 2015 /PRNewswire/ -- VAALCO Energy, Inc. (NYSE: EGY) announced today that its Board of Directors has authorized the repurchase of up to 5.8 million shares of the Company's common stock, which represents approximately 10% of the Company's outstanding common stock, in open market transactions from time to time during the upcoming 18-month period and in accordance with the requirements of the Securities and Exchange Commission.

Steve Guidry, VAALCO's Chairman and CEO, commented, "We are pleased to announce this buyback as it underscores our confidence in the strength of our balance sheet, quality of our assets and our ongoing ability to generate cash flow. At recent market price levels, we believe our common shares represent an excellent opportunity to buy at a significant discount and are a highly attractive investment. We will continue to review additional opportunities to increase shareholder value."

The share buyback program does not obligate the Company to acquire any specific number of shares in any period, and may be expanded, extended, modified or discontinued at any time. Payment for shares repurchased under the program will be funded using the Company's cash on hand. At the end of the first quarter, the Company had outstanding approximately 58 million shares of common stock issued and outstanding.

About VAALCO

VAALCO Energy, Inc. is a Houston-based independent energy company principally engaged in the acquisition, exploration, development and production of crude oil. VAALCO's strategy is to increase reserves and production through the exploration and exploitation of oil and natural gas properties with high emphasis on international opportunities. The company's properties and exploration acreage are located primarily in Gabon, Angola and Equatorial Guinea in West Africa.

Other Information

This document includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are those concerning VAALCO's plans, expectations, and objectives for future drilling, completion and other operations and activities. All statements included in this document that address activities, events or developments that VAALCO expects, believes or anticipates will or may occur in the future are forward-looking statements. These statements include expected capital expenditures, future drilling plans, prospect evaluations, liquidity, negotiations with governments and third parties, expectations regarding processing facilities, and reserve growth. These statements are based on assumptions made by VAALCO based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond VAALCO's control. These risks include, but are not limited to, oil and gas price volatility,

inflation, general economic conditions, the Company's success in discovering, developing and producing reserves, lack of availability of goods, services and capital, environmental risks, drilling risks, foreign operational risks, and regulatory changes. These and other risks are further described in VAALCO's quarterly report on Form 10-Q for the three months ended March 31, 2015, annual report on Form 10-K for the year ended December 31, 2014, and other reports filed with the SEC which can be reviewed at http://www.sec.gov, or which can be received by contacting VAALCO at 9800 Richmond Avenue, Suite 700, Houston, Texas 77042, (713) 623-0801. Investors are cautioned that forward-looking statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward-looking statements. VAALCO disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

|

|

|

|

Investor Contacts

Gregory R. Hullinger

Chief Financial Officer

713-623-0801

|

Al Petrie

Investor Relations Coordinator

713-543-3422

|

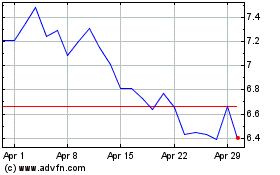

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

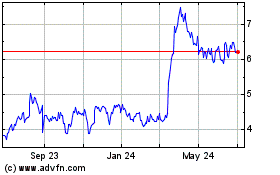

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Apr 2023 to Apr 2024