UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

August 4, 2015

Date of report (Date of earliest event reported)

Universal

Insurance Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-33251 |

|

65-0231984 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

file number) |

|

(IRS Employer

Identification No.) |

1110 W. Commercial Blvd., Fort Lauderdale, Florida 33309

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (954) 958-1200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| ¨ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| ¨ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ¨ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

| ITEM 2.02 |

Results of Operations and Financial Condition |

On August 4, 2015, Universal Insurance Holdings,

Inc. issued a press release announcing its financial results for the fiscal quarter ended June 30, 2015. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated herein by reference.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| ITEM 9.01 |

Financial Statements and Exhibits |

(d) Exhibits:

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release, dated August 4, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

| Date: August 4, 2015 |

|

|

|

UNIVERSAL INSURANCE HOLDINGS, INC. |

|

|

|

|

|

|

|

/s/ Frank C. Wilcox |

|

|

|

|

Frank C. Wilcox |

|

|

|

|

Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Universal Insurance Holdings, Inc. Reports Record Results for Second Quarter 2015

Achieved Highest Quarterly Net Income and Diluted EPS in Company History

Fort Lauderdale, FL, August 4, 2015—Universal Insurance Holdings, Inc. (NYSE: UVE) (or the “Company”) today reported record net

income for the second quarter of 2015 of $24.7 million, an increase of 44.2% ($7.6 million) over the same period in 2014. Diluted earnings per share (EPS) was $0.69 for the second quarter of 2015, an increase of 40.9% ($0.20 per share) over the same

quarter in 2014. This compares to net income of $17.1 million, or $0.49 per diluted share, for the same period in 2014.

“We are pleased to report

another record quarter with sequential improvement in multiple financial measures as we continue to focus on excellence in all aspects of our business,” said Sean P. Downes, the Company’s Chairman, President and Chief Executive

Officer. “The hard work and dedication of our tremendous employees as well as our loyal agency force continue to be key factors to our success. With the help of our peer leading agency force, we continue to focus on writing

organically grown rate adequate business in all of our active states.

“We believe that the strategic changes and improvements we made to our

reinsurance program will continue to drive financial improvements. Specifically, our 2015/2016 reinsurance program provides us with the necessary protection from significant storms and allows us, as a result of our improved capital position, to

retain a greater share of our profitable business through the elimination of the quota share agreement. Our second quarter results reflect just one month of this quota share elimination, and we look forward to realizing additional value moving

forward.

“As we enter the second half of the year, we remain confident in our ability to increase market share by targeting profitable, rate adequate

business from our growing distribution channels, improve our financial condition, continue our geographic expansion efforts and deliver increasing returns to shareholders.”

Second-Quarter 2015 & Recent Highlights

| |

• |

|

Net earned premiums grew by $39.5 million, or 53.9%, to $112.9 million. |

| |

• |

|

Total revenues increased by $36.6 million, or 42.1%, to $123.6 million. |

| |

• |

|

Net income increased by $7.6 million, or 44.2%, to $24.7 million. |

| |

• |

|

Diluted EPS grew by $0.20, or 40.9%, to $0.69 per share. |

| |

• |

|

Paid dividends of $0.12 per share. |

| |

• |

|

Eliminated quota share reinsurance with 2015-2016 reinsurance program. |

| |

• |

|

Received Certificates of Authority from Michigan, Minnesota and Virginia. |

1

Second-Quarter 2015 Results

Net income for the second quarter of 2015 of $24.7 million reflects an improvement across multiple measures including an increase in direct premiums written,

net premiums written, net earned premiums, policy fees, net investment income and improvements in our loss ratio. The increase in net earned premiums reflects both growth in policies in force and lower reinsurance costs, including the reduction in

the cession rate of the Company’s quota share reinsurance contracts to 30% effective June 2014, followed by the elimination of quota share reinsurance effective June 2015. To a lesser degree but an important strategic initiative is

diversification of premium outside of Florida as the Company is now licensed to write premium in 13 states. The loss and loss adjustment expense ratio was improved to 35.2% in the second quarter of 2015 compared to 37.7% for the second quarter of

2014. The Company’s initiatives to expedite claims have resulted in savings, reducing the severity and duration of claims and costs associated with handling of claims.

Stockholders’ equity reached an all-time high of $255.3 million as of June 30, 2015 compared to $218.9 million (pro-forma) as of December 31,

2014.

First Six-Months 2015 Results

For the first

six months of 2015, the Company’s net income was $47.0 million, an increase of $16.4 million, or 53.3%, compared to the same period of 2014. Diluted earnings per share for the first six months of 2015 was $1.31, an increase of $0.44, or

51.0%, compared to the same period of 2014.

Cash Dividends

On April 13, 2015, the Company announced that its board of directors declared a cash dividend of $0.12 per share of common stock which was paid on

July 2, 2015 to shareholders of record on June 18, 2015.

If declared and paid as intended, the annual aggregate dividend in 2015 will be $0.48

for each common share.

Financial Results Presentation

The Company will make available an audio recording of a presentation discussing its second quarter 2015 financial results at approximately 5:00 pm Eastern on

August 4, 2015. The presentation will be pre-recorded and there will be no opportunity for live questions. The audio recording of this presentation will be available at www.universalinsuranceholdings.com until September 4, 2015.

2

About Universal Insurance Holdings, Inc.

Universal Insurance Holdings, Inc., with its wholly-owned subsidiaries, is a vertically integrated insurance holding company performing all aspects of

insurance underwriting, distribution and claims. Universal Property & Casualty Insurance Company (UPCIC), a wholly-owned subsidiary of the Company, is one of the leading writers of homeowners insurance in Florida and is now fully licensed

and has commenced its operations in North Carolina, South Carolina, Hawaii, Georgia, Massachusetts, Maryland, Delaware, Indiana and Pennsylvania. American Platinum Property and Casualty Insurance Company, also a wholly-owned subsidiary, currently

writes homeowners multi-peril insurance on Florida homes valued in excess of $1 million, which are limits and coverages currently not targeted through its affiliate UPCIC. For additional information on the Company, please visit our investor

relations website at www.universalinsuranceholdings.com.

Forward-Looking Statements and Risk Factors

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words

“believe,” “expect,” “anticipate,” and similar expressions identify forward-looking statements, which speak only as of the date the statement was made. Such statements may include commentary on plans, products and lines

of business, marketing arrangements, reinsurance programs and other business developments and assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or

quantified. Future results could differ materially from those described and the Company undertakes no obligation to correct or update any forward-looking statements. For further information regarding risk factors that could affect the Company’s

operations and future results, refer to the Company’s reports filed with the Securities and Exchange Commission, including Form 10-K for the year ended December 31, 2014 and Form 10-Q for the quarter ended June 30, 2015.

###

3

UNIVERSAL INSURANCE HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2015 |

|

|

2014 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

213,330 |

|

|

$ |

115,397 |

|

| Restricted cash and cash equivalents |

|

|

2,635 |

|

|

|

2,635 |

|

| Fixed maturities, at fair value |

|

|

359,589 |

|

|

|

353,949 |

|

| Equity securities, at fair value |

|

|

38,515 |

|

|

|

19,642 |

|

| Short-term investments, at fair value |

|

|

100,025 |

|

|

|

49,990 |

|

| Investment real estate, net |

|

|

5,849 |

|

|

|

— |

|

| Prepaid reinsurance premiums |

|

|

110,739 |

|

|

|

190,505 |

|

| Reinsurance recoverable |

|

|

38,157 |

|

|

|

55,187 |

|

| Reinsurance receivable, net |

|

|

716 |

|

|

|

7,468 |

|

| Premiums receivable, net |

|

|

59,171 |

|

|

|

50,987 |

|

| Other receivables |

|

|

4,524 |

|

|

|

2,763 |

|

| Property and equipment, net |

|

|

23,818 |

|

|

|

17,254 |

|

| Deferred policy acquisition costs, net |

|

|

62,181 |

|

|

|

25,660 |

|

| Income taxes recoverable |

|

|

12,949 |

|

|

|

5,675 |

|

| Deferred income tax asset, net |

|

|

10,250 |

|

|

|

11,850 |

|

| Other assets |

|

|

4,919 |

|

|

|

2,812 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

1,047,367 |

|

|

$ |

911,774 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES, CONTINGENTLY REDEEMABLE COMMON STOCK AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| LIABILITIES: |

|

|

|

|

|

|

|

|

| Unpaid losses and loss adjustment expenses |

|

$ |

112,117 |

|

|

$ |

134,353 |

|

| Unearned premiums |

|

|

455,882 |

|

|

|

395,748 |

|

| Advance premium |

|

|

29,303 |

|

|

|

17,919 |

|

| Accounts payable |

|

|

1,981 |

|

|

|

4,121 |

|

| Book overdraft |

|

|

2,725 |

|

|

|

5,924 |

|

| Reinsurance payable, net |

|

|

131,738 |

|

|

|

66,066 |

|

| Income taxes payable |

|

|

1,659 |

|

|

|

1,799 |

|

| Dividends payable to shareholders |

|

|

4,283 |

|

|

|

— |

|

| Other liabilities and accrued expenses |

|

|

27,751 |

|

|

|

36,318 |

|

| Long-term debt |

|

|

24,600 |

|

|

|

30,610 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

792,039 |

|

|

|

692,858 |

|

|

|

|

|

|

|

|

|

|

| Contingently redeemable common stock |

|

|

— |

|

|

|

19,000 |

|

| Issued shares—0 and 1,000 |

|

|

|

|

|

|

|

|

| Outstanding shares—0 and 1,000 |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

|

| Cumulative convertible preferred stock, $.01 par value |

|

|

— |

|

|

|

— |

|

| Authorized shares—1,000 |

|

|

|

|

|

|

|

|

| Issued shares—10 and 12 |

|

|

|

|

|

|

|

|

4

|

|

|

|

|

|

|

|

|

| Outstanding shares—10 and 12 |

|

|

|

|

|

|

|

|

| Minimum liquidation preference, $9.99 and $8.49 per share |

|

|

|

|

|

|

|

|

| Common stock, $.01 par value |

|

|

456 |

|

|

|

448 |

|

| Authorized shares—55,000 |

|

|

|

|

|

|

|

|

| Issued shares—45,562 and 43,769 |

|

|

|

|

|

|

|

|

| Outstanding shares—35,695 and 34,102 |

|

|

|

|

|

|

|

|

| Treasury shares, at cost—9,867 and 9,667 |

|

|

(67,229 |

) |

|

|

(62,153 |

) |

| Additional paid-in capital |

|

|

62,845 |

|

|

|

40,987 |

|

| Accumulated other comprehensive income (loss), net of taxes |

|

|

(1,721 |

) |

|

|

(1,835 |

) |

| Retained earnings |

|

|

260,977 |

|

|

|

222,469 |

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

255,328 |

|

|

|

199,916 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities, contingently redeemable common stock and stockholders’ equity |

|

$ |

1,047,367 |

|

|

$ |

911,774 |

|

|

|

|

|

|

|

|

|

|

5

UNIVERSAL INSURANCE HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| |

|

June 30, |

|

| |

|

2015 |

|

|

2014 |

|

| PREMIUMS EARNED AND OTHER REVENUES |

|

|

|

|

|

|

|

|

| Direct premiums written |

|

$ |

249,971 |

|

|

$ |

220,009 |

|

| Ceded premiums written |

|

|

(7,933 |

) |

|

|

(76,483 |

) |

|

|

|

|

|

|

|

|

|

| Net premiums written |

|

|

242,038 |

|

|

|

143,526 |

|

| Change in net unearned premiums |

|

|

(129,150 |

) |

|

|

(70,164 |

) |

|

|

|

|

|

|

|

|

|

| Premiums earned, net |

|

|

112,888 |

|

|

|

73,362 |

|

| Net investment income (expense) |

|

|

1,207 |

|

|

|

412 |

|

| Net realized gains (losses) on investments |

|

|

110 |

|

|

|

3,950 |

|

| Commission revenue |

|

|

3,474 |

|

|

|

3,670 |

|

| Policy fees |

|

|

4,352 |

|

|

|

3,899 |

|

| Other revenue |

|

|

1,560 |

|

|

|

1,696 |

|

|

|

|

|

|

|

|

|

|

| Total premiums earned and other revenues |

|

|

123,591 |

|

|

|

86,989 |

|

|

|

|

|

|

|

|

|

|

| OPERATING COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

| Losses and loss adjustment expenses |

|

|

39,704 |

|

|

|

27,679 |

|

| General and administrative expenses |

|

|

42,667 |

|

|

|

28,901 |

|

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

|

|

82,371 |

|

|

|

56,580 |

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME TAXES |

|

|

41,220 |

|

|

|

30,409 |

|

| Income tax expense |

|

|

16,516 |

|

|

|

13,283 |

|

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

24,704 |

|

|

$ |

17,126 |

|

|

|

|

|

|

|

|

|

|

| Basic earnings per common share |

|

$ |

0.71 |

|

|

$ |

0.50 |

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding—Basic |

|

|

35,019 |

|

|

|

33,968 |

|

|

|

|

|

|

|

|

|

|

| Fully diluted earnings per common share |

|

$ |

0.69 |

|

|

$ |

0.49 |

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding—Diluted |

|

|

36,002 |

|

|

|

35,174 |

|

|

|

|

|

|

|

|

|

|

| Cash dividend declared per common share |

|

$ |

0.12 |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

6

UNIVERSAL INSURANCE HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended |

|

| |

|

June 30, |

|

| |

|

2015 |

|

|

2014 |

|

| PREMIUMS EARNED AND OTHER REVENUES |

|

|

|

|

|

|

|

|

| Direct premiums written |

|

$ |

461,576 |

|

|

$ |

411,926 |

|

| Ceded premiums written |

|

|

(114,430 |

) |

|

|

(198,132 |

) |

|

|

|

|

|

|

|

|

|

| Net premiums written |

|

|

347,146 |

|

|

|

213,794 |

|

| Change in net unearned premiums |

|

|

(139,898 |

) |

|

|

(76,625 |

) |

|

|

|

|

|

|

|

|

|

| Premiums earned, net |

|

|

207,248 |

|

|

|

137,169 |

|

| Net investment income (expense) |

|

|

2,069 |

|

|

|

930 |

|

| Net realized gains (losses) on investments |

|

|

281 |

|

|

|

4,852 |

|

| Commission revenue |

|

|

6,642 |

|

|

|

7,759 |

|

| Policy fees |

|

|

8,184 |

|

|

|

7,411 |

|

| Other revenue |

|

|

2,977 |

|

|

|

3,173 |

|

|

|

|

|

|

|

|

|

|

| Total premiums earned and other revenues |

|

|

227,401 |

|

|

|

161,294 |

|

|

|

|

|

|

|

|

|

|

| OPERATING COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

| Losses and loss adjustment expenses |

|

|

73,294 |

|

|

|

54,504 |

|

| General and administrative expenses |

|

|

74,864 |

|

|

|

53,264 |

|

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

|

|

148,158 |

|

|

|

107,768 |

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME TAXES |

|

|

79,243 |

|

|

|

53,526 |

|

| Income tax expense |

|

|

32,209 |

|

|

|

22,851 |

|

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

47,034 |

|

|

$ |

30,675 |

|

|

|

|

|

|

|

|

|

|

| Basic earnings per common share |

|

$ |

1.35 |

|

|

$ |

0.91 |

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding—Basic |

|

|

34,800 |

|

|

|

33,696 |

|

|

|

|

|

|

|

|

|

|

| Fully diluted earnings per common share |

|

$ |

1.31 |

|

|

$ |

0.87 |

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding—Diluted |

|

|

35,987 |

|

|

|

35,450 |

|

|

|

|

|

|

|

|

|

|

| Cash dividend declared per common share |

|

$ |

0.24 |

|

|

$ |

0.20 |

|

|

|

|

|

|

|

|

|

|

Investor Contact:

Andy Brimmer / Mahmoud Siddig

Joele Frank, Wilkinson Brimmer

Katcher

212-355-4449

7

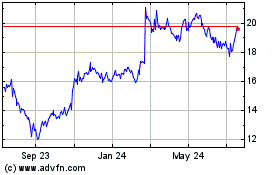

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

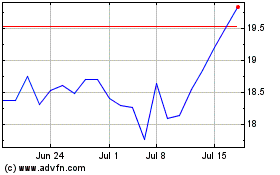

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Apr 2023 to Apr 2024