UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2015

ACELRX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

DELAWARE |

|

001-35068 |

|

41-2193603 |

|

(State of incorporation) |

|

(Commission File No.) |

|

(IRS Employer Identification No.) |

351 Galveston Drive

Redwood City, CA 94063

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (650) 216-3500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

On August 3, 2015, AcelRx Pharmaceuticals, Inc., or the Company, conducted a conference call during which members of its senior management team provided a business update and discussed financial results for the quarter and six months ended June 30, 2015 and certain other information. A copy of the transcript of the conference call is attached as Exhibit 99.1 to this Report.

|

Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

| |

|

|

|

Exhibit

Number |

|

Description |

| |

|

|

99.1 |

|

Transcript of AcelRx Pharmaceuticals, Inc. Quarter and Six Months Ended June 30, 2015 Earnings Conference Call on August 3, 2015, at 4:30 p.m. ET. |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date: August 4, 2015 |

ACELRX PHARMACEUTICALS, INC.

|

|

|

|

By: |

/s/ Jane Wright-Mitchell |

|

|

|

|

Jane Wright-Mitchell

Chief Legal Officer |

|

Exhibit 99.1

Event ID:

Event Name: [ACRX] - AcelRx 2Q15 Financial Results

Event Date: 2015-08-03

Officers and Speakers

Timothy Morris; AcelRx Pharmaceuticals, Inc.; CFO & Head of Business Development

Howie Rosen; AcelRx Pharmaceuticals, Inc.; Interim CEO

Pam Palmer; AcelRx Pharmaceuticals, Inc.; Chief Medical Officer & Co-Founder

Analysts

Randall Stanicky, RBC Capital Markets

David Amsellem, Piper Jaffray

Boris Peaker, Cowen and Company

Michael Higgins, ROTH Capital Partners

Hugo Ong, Jefferies LLC

Presentation

Operator: Good afternoon, and welcome to the AcelRx second quarter 2015 financial results conference call.

(Operator Instructions)

Please note this event is being recorded.

I would now like to turn the conference over to Timothy Morris, Chief Financial Officer. Please go ahead.

Timothy Morris: Thank you, Denise. Good afternoon, everyone, and welcome to today's call. Today I'm joined by Howie Rosen, our Interim Chief Executive Officer, and Pam Palmer, our Founder and Chief Medical Officer.

During the call today we will make forward-looking statements, including, but not limited to, statements related to future financial results, including AcelRx's plan to seek a pathway forward towards gaining approval of Zalviso in the US; potential next steps by AcelRx related to the FDA and Zalviso; anticipated resubmission of the Zalviso NDA to the FDA, including the scope of the resubmission and the timing of the resubmission and the FDA review time; financial guidance and cash forecast; potential milestones and royalty payments under the Grunenthal agreement; the process and timing of submissions on the Zalviso MAA, including timing for potential approval of the MAA by the EMA; the status of the collaboration agreement with Grunenthal or any other future potential collaborations; the process and timing of anticipated future development of AcelRx's product candidates, including Zalviso and ARX-04, including the timing and quality of data for ARX-04 and the therapeutic and commercial potential of AcelRx Pharmaceuticals' product candidates, including Zalviso and ARX-04.

These forward-looking statements are based on AcelRx Pharmaceuticals' current expectations and inherently involve significant risks and uncertainties. AcelRx Pharmaceuticals' actual results and timing of events could differ materially from those anticipated in such forward-looking statements, and, as a result of these risks and uncertainties, which include, without limitations, risks related to AcelRx Pharmaceuticals' ability to finalize the pathway towards the resubmission of the Zalviso NDA to the FDA; potential additional clinical studies, human factor studies and/or additional data analysis necessary in order to resubmit the Zalviso NDA; AcelRx's ability to receive regulatory approval for Zalviso; any delays or inability to obtain and maintain regulatory approval of its product candidates, including Zalviso, in the United States and Europe; its abilities to receive any milestones or royalty payments under the Grunenthal agreement and the timing related thereto; its ability to obtain sufficient financing; the success, cost and timing of all development activities and clinical trials, including the Phase 3 ARX-04 trial and the related data; the market potential for its product candidates; the accuracy of AcelRx's estimates regarding expenses, capital requirements and the needs for financing; and other risks detailed in the Risk Factors and elsewhere in AcelRx Pharmaceuticals' US Securities and Exchange Commission filings and reports, including its Quarterly Report on Form 10-Q filed with the SEC on May 5, 2015. AcelRx Pharmaceuticals undertakes no duty or obligation to update any forward-looking statement contained in this release as a result of new information, future events or changes in its expectations.

I will now turn the call over to Howie, Interim Chief Executive Officer.

Howie Rosen: Thank you very much, Tim, and I'd like to thank everyone for joining us this afternoon for our second quarter call.

During today's call we'll provide the following: an update on our progress toward Zalviso approval in Europe with our partner, Grunenthal; a brief regulatory update on Zalviso in the US; an update on ARX-04; and a brief review of the second quarter financial results, including cash guidance for the remainder of the year.

So let me start with the Zalviso regulatory update in Europe. As we reported recently, the Committee for Medicinal Products for Human Use, or CHMP, of the European Medicines Agency, or EMA, has adopted a positive opinion for Zalviso sufentanil sublingual tablets. The opinion, while not binding, recommends marketing authorization for Zalviso for the management of acute moderate to severe postoperative pain in adult patients in hospitals. Our partner, the Grunenthal Group, submitted the Marketing Authorization Application, or MAA, under the centralized procedure in July 2014.

The positive opinion by the CHMP will next be reviewed by the European Commission, or EC, for central marketing authorization in the European Union, or EU, which has the authority to approve medicines for the 28 member countries of the EU, and, in addition, Norway, Iceland and Lichtenstein. We anticipate a decision by the EC in late September or early October. If approved, AcelRx would be eligible to receive a $15 million milestone payment from Grunenthal, who we expect to begin launching Zalviso in the first half of 2016.

AcelRx had previously received CE Mark approval for the Zalviso device and ISO certification of its quality management system issued by the British Standards Institution, or BSI, a Notified Body. Under the terms of our collaboration, Grunenthal is responsible for all commercial activities for Zalviso, including obtaining and maintaining pharmaceutical product regulatory approval in the Grunenthal territory. AcelRx will be responsible for maintaining device regulatory approval in the Grunenthal territory and the manufacturing and supply of Zalviso to Grunenthal for commercial sales in clinical trials.

In the US we have been granted a General Advice meeting with the FDA in early September. The purpose of the meeting is to discuss the timeline and activities necessary to resubmit the Zalviso NDA. Pending the outcome of the meeting, we may have additional clarity on what we will need to do to gain approval of Zalviso.

Now I'd like to turn it over -- the call over to Pam, who will provide you with an update on ARX-04.

Pam Palmer: Thank you, Howie.

As you know, we initiated a pivotal Phase 3 trial for ARX-04 in March of 2015. I am happy to report the study is fully enrolled. In total, 153 subjects were randomized into the study. The clinical sites are now in the process of completing the tasks necessary for database lock. Assuming all goes as planned, we anticipate topline results in early Q4 2015.

As a reminder, ARX-04 is a single-use 30-mcg sufentanil sublingual tablet in a disposable, prefilled, single-dose applicator, administered to the patient by a healthcare professional. The proposed indication for this product is the treatment of moderate-to-severe acute pain in a medically supervised setting.

This Phase 3 study, SAP301, is a multicenter, double-blind, placebo-controlled trial that evaluated the efficacy and safety of ARX-04 versus placebo for the treatment of moderate-to-severe acute pain following outpatient abdominal surgery. The primary endpoint of this study is to demonstrate a statistically significant difference in the time-weighted summed pain intensity difference to baseline, or SPID, of ARX-04 compared to placebo over a 12-hour dosing period, also known as SPID-12. As you will recall, this Phase 3 study is the second of two pivotal clinical studies required for the ARX-04 NDA filing.

We are also working with the Department of Defense, or DoD, under contract to partially support our development of ARX-04. This quarter we plan to initiate the final clinical trial of ARX-04, an open-label safety study in the emergency room. This study will add to the safety database for ARX-04 and will help us understand how the application of ARX-04 treats trauma-related moderate-to-severe acute pain in the emergency room, one of the large target markets to this product. This study is an open-label safety study in patients who present to the emergency room with moderate-to-severe acute pain due to trauma or injury.

AcelRx will continue to present the results from its clinical trials in the next several months. Planned presentations by our Medical Affairs team include: an integrated safety and efficacy analysis of sublingual sufentanil at the Ninth Congress of the European Pain Federation, or EFIC, meeting in Vienna, Austria, September 4, 2015; the results from the pivotal ARX-04 bunionectomy study will be presented at the 2015 European Congress on Emergency Medicine, or ECEM, in Torino, Italy, on October 12th through the 13th, 2015; the results from the pivotal abdominal surgery study, SAP301, will be presented at the American Society of Anesthesiologists 2015 Annual Meeting in San Diego October 24th through the 28th.

I will now turn the call back to Tim to discuss the financial results.

Timothy Morris: Thank you, Pam.

Earlier today we reported financial results for the second quarter and first six months ending June 30, 2015. I refer you to that press release for specific details on the actual results.

The net loss for the second quarter of 2015 was $8.9 million, or $0.20 basic and diluted net loss per share. This compares to a net loss of $10.6 million, or $0.24 basic net loss per share and $0.30 diluted net loss per share for the second quarter of 2014.

The decrease in the net loss and the net loss per share was primarily due to revenue generated under our contract with the DoD for ARX-04 development, and [decreased]1 G&A expenses as a result of the cost reduction plan implemented at the end of March 2015, partially offset by having no other income in the second quarter of 2015, as compared to $2.2 million of other income recognized in the second quarter of 2014.

For the first six months ended June 30, 2015, AcelRx reported a net loss of $18.9 million, or $0.43 basic net loss per share and $0.47 diluted net loss per share. This compares to $20.2 million, or $0.47 basic net loss per share and $0.50 diluted net loss per share for the same period in 2014.

We recognized $1.4 million in revenue related to the DoD contract in the six months ending June 30, 2015. In addition, in the six months ended June 30, 2015, we recognized $667,000 of previously deferred revenue under the collaboration agreement with Grunenthal, as compared to $166,000 in the first six months of last year.

At the end of June, we had cash, cash equivalents and investments of $51.2 million. This compares to $75.4 million at the end of December 2014. The net change in cash, cash equivalents and investments was $24.2 million for the six months ended June 30, 2015, $13.3 million for the second quarter and $10.9 million for the first quarter of 2015.

The decrease in cash for the second quarter of 2015 was higher than the first quarter of 2015 mainly due to the initiation of principal payments under the line of credit with Hercules. These payments totaled $2.2 million for the second quarter of 2015. Assuming receipt of the $15 million milestone payment from Grunenthal for the approval of Zalviso in the EU and revenues earned under the DoD contract for ARX-04, we anticipate our cash balance at the end of the year 2015 to be approximately $45 million.

1 Mr. Morris intended to say decreased

On the investor relations and business development front, planned presentations and participation in upcoming conferences include: the Rodman & Renshaw 17th Annual Global Investment Conference sponsored by H.C. Wainwright September 9th in New York; the FBR Second Annual Healthcare Conference September 9th in Boston; the NewsMaker Biotech Industry Conference sponsored by BioCentury September 10th in New York; the BioPharm America Conference September 14th and 17th in Boston; and the 15th Annual Biotech in Europe Forum for Global Partnering and Investment September 29th and 30th in Basel, Switzerland.

I will now turn the call back to Howie for some closing comments.

Howie Rosen: We are pleased with the recent positive CHMP opinion regarding Zalviso in the EU and may have more clarity with regards to the FDA and Zalviso over the next quarter. Our pipeline continues to advance, as we expect topline pivotal Phase 3 results from ARX-04 early in the fourth quarter and as we initiate an additional Phase 3 open-label safety study with ARX-04 in the emergency room.

Finally, I would like to announce that AcelRx will be hosting an Analyst and Investor Day on October 2 in New York City. We look forward to providing more detail on ARX-04 at that time, including any new data available as well as more background on the commercial opportunity. Following our upcoming FDA meeting we also may have more clarity on Zalviso and our planned pathway forward.

Thank you for being on the call today. We'll now open the call up to questions.

Questions & Answers

Operator: Thank you.

(Operator Instructions)

And our first question will come from Randall Stanicky, of RBC Capital Markets. Please go ahead.

Randall Stanicky: Hey, thanks, guys. I have several. The first one, and this question may be premature, but I want to ask it anyway, what are your initial expectations for the upcoming General Advice meeting, and could we get in your view immediate feedback on how you should proceed?

Timothy Morris: Sure, Randall. This is Tim. Our expectations are is that obviously we will sit with the agency and work with them in terms of two things: one, to try to determine the nature of the request for additional clinical studies; and then, two, we want to talk to them about the timeline and the plans to move forward. I think that's been the goal all along from that. I guess in terms of the second part of your question, do you think we'll get immediate feedback -- is that -- what was the second part, Randall?

Randall Stanicky: Yes, I mean, should we expect when you sit down with them, should we expect a fairly quick decision and update to us in terms of how you're expected to proceed?

Timothy Morris: Yes, that's difficult to say. I think if it's obvious one way or another, then potentially the timeline could be relatively quick. We're hoping that the meeting does provide some clarity there. We would plan to give feedback to the extent we have something to say about a definitive timeline and definitive set of actions. It's difficult right now to promise that. But we understand the importance. Howie, what do you think?

Howie Rosen: I agree. It's -- depending on what is actually discussed, we, as in the past, may need some time just to digest it and get advice from some of our outside advisors, as well. But our goal would be to update people once we have the clarity.

Randall Stanicky: Got it. And let me ask one more, rest of world, is this something that could be an opportunity between now and an update on the US path? I mean, is there an opportunity to do additional deals such as you did with Grunenthal in other regions such as Latin America and for other places?

Timothy Morris: For Zalviso?

Randall Stanicky: Correct, yes.

Timothy Morris: Yes, I think we've always felt that having an approval in one of the major territories, US or Europe, would be a big leg forward in terms of trying to put together a rest-of-the-world partnership. So I think the positive CHMP opinion is clearly a step in the right direction there.

A lot of these countries will look to an EU approval or approval of the MAA to move forward. So we would hope that, assuming we get an approval in Europe in, again, late September, early October, I think that will be a catalyst. I don't think we'll have anything between now and the meeting in September with the agency, but we think that having the European approval in place will help on our BD efforts outside of the US.

Randall Stanicky: Got it. Okay. And one final one, this may be for Pam, but just on ARX-04, assuming we get favorable data, when should we expect you to file? And then the follow-up to that would be how are you thinking about the commercial build-out in the absence of a Zalviso sales infrastructure? Thanks.

Timothy Morris: Sure. I'll ask Pam to comment on the timing and then I'll come back on the commercial question.

Pam Palmer: Sure. Well, we've certainly shown efficient NDA filing capabilities, at least with Zalviso. So certainly in 2016 we would be filing an NDA with positive data from the SAP301. The current plan for the open-label safety ER study is that it's a small study, so that shouldn't take much time to finish.

Timothy Morris: So I think, obviously, a couple of things that we have to do, Randall, before we have a definitive timeline on the filing. We'll have to meet with the NDA, kind of a pre-NDA filing there. As soon as we have something a little bit more definitive on the timeline we'll get back to you. And I think, as you saw at the end of the prepared remarks, Howie talked about an Analyst Day on October the 2nd, so we'll look to fill in a little bit more details around timelines for ARX-04 possibly closer to that date.

You asked a question on the commercialization, and you're right, the original plan was to potentially piggyback off the Zalviso commercial effort. I think we are doing a couple of things from a commercial prep standpoint for ARX-04. One, we're trying to actually understand the size of the market, and I think our initial work is showing that the market potential is bigger than either we originally thought and others had originally thought. So we're trying to figure out the best way to approach this.

We are still of the belief that having some commercial capability ourselves is the best way to retain value for the Company and for the shareholders. We are trying to make sure that we can identify the exact markets to go after and to look at all of the potential options that we would go to commercialize it under a couple of different scenarios: that would be with Zalviso, without Zalviso, with a partner.

So we don't have anything definitive yet, but we are beginning to think about the commercial potential for ARX-04. And, again, we would look to probably share some of our findings with you and maybe explore some of the potential paths to commercialize the product around about the time when the Phase 3 results are unveiled and in a little bit more detail around the Analyst Day at the beginning of October.

Randall Stanicky: Great. Thanks, guys.

Timothy Morris: No problem. Thank you.

Operator: The next question will come from David Amsellem, of Piper Jaffray. Please go ahead.

David Amsellem: Thanks. Just, I guess, a follow-up on this General Advice meeting. Maybe give us a little bit of color on what happens to get to the point where you would decide to go through a formal dispute resolution process, and is that something that's still on the table?

Timothy Morris: I think, David, we would always kind of reserve that right. I think to date we've been comfortable, at least, with the interactions with the agency. We clearly want to have the meeting. I think if we don't come to some resolution, or if we don't come to a path forward that appears to be reasonable to us or our external advisors or something that makes sense, we may potentially pursue a more formal dispute resolution at that time.

So, again, it's a little bit too early to tell. We always have that. So, for example, if their requests, I think, were just really too outrageous and didn't make sense to us and continue down a pathway that for us were just not attainable and were unrealistic, then we would potentially look to pursue a little bit different formal dispute resolution versus just kind of rolling over and continuing to study the drug. So that might be one scenario.

David Amsellem: Okay. And then secondly, and I may have missed this, and I apologize in advance, but just on the CEO search, maybe give us a little bit of color on how you're thinking about what kind of candidate would be ideal and how far along you are, if you can talk about that? And then I guess lastly in terms of that is there -- are there any other major hires within the organization that you feel you need to make beyond just the Chief Executive position? Thanks.

Timothy Morris: Yes, I mean, I think, and I'll let Howie comment, as well, I think a lot of that, David, has to do with the outcome of the meeting and the timeline and the path forward in terms of what's required for Zalviso. And I think that's why today -- it depends on how long that takes and then what type of person we're looking for. But, Howie, do you want to comment to David's question?

Howie Rosen: Yes, David, and thanks for the question. And Tim's right. It partially depends on where we end up in the US. But also in terms of getting the quality of candidate that we want, having some of that uncertainty taken care of is important. And I'm committed to stay on as long as necessary, so there's no clock ticking in terms of finding someone.

David Amsellem: Can I follow up? Is there -- is the implication here that you're having trouble attracting a candidate with the path forward being up in the air? In other words, Tim, and if I'm interpreting your comment correctly, does it mean that you have to have clarity on the path forward in order to be able to make a hire?

Howie Rosen: Well, it's really more -- comes to the second part of your original question was -- which was whether there are any other key hires that we would need. And so, as you know from a cost reduction point of view, we reduced essentially all of our -- most of our commercial infrastructure. And so the timeline to when would we get to commercializing things ourselves is one of the key things. And so do you want someone with a background that has a strong commercial background or more of a general management background or different, something different?

David Amsellem: Thank you.

Timothy Morris: I think, David, to also say that, I mean, the search has actually been put on hold, so they haven't been actively looking for folks. So until we have this clarity, the Company has made a decision to not aggressively look for new candidates.

Operator: Our next question will come from Boris Peaker, of Cowen. Please go ahead.

Boris Peaker: Thanks for taking my question. I guess maybe just first on the General Advice meeting with the FDA, I'm just curious what happened to get that meeting. Like previously you were denied a meeting and now they allowed it. Was there any kind of discussion or exchange of information that enabled it?

Timothy Morris: Howie, you want to take that?

Howie Rosen: Yes, I can take that. So we continued to have a dialog with the FDA, and we provided them with some additional information, and that led to them agreeing to grant us a meeting. So we were pleased to have that progress.

Boris Peaker: Got you. Was that clinical information? I just want a clarification.

Howie Rosen: It was really just pretty much across the board, so just leveraging the information we had and perhaps providing it in a more comprehensive way.

Boris Peaker: Got you. Also, in terms of the European opportunity, I'm just curious, how are the market dynamics for Zalviso different in Europe in the context of what can we learn from Grunenthal's initial launch in Europe regarding the US commercial potential of this drug?

Timothy Morris: Yes, I think a couple of things. I mean, obviously PCA is a standard of care for postoperative pain, for moderate-to-severe pain in a hospital setting. So to some extent the standard of care will be different. The pricing will be different. Their pricing won't be as good as we get in the US.

So I think it'll be nice to see what happens in clinical practice. It'll be nice to see if they are gaining favor with a certain type of procedure or having particular success with, say, orthopedics or general surgeons. It'll be interesting to see if they are having success on a regional basis and whether that's due to some of the work that they've done from a premarketing standpoint.

So I think there probably is a fair amount to learn from their experience in Europe that we could hopefully parlay into the US. So, I don't know, Pam, you've spent some time with them. Do you have any comments on what that market looks like and how we can use it here in the US?

Pam Palmer: Sure. I think whatever happens there is certainly a conservative indicator of what would happen here. We do know that they're more price sensitive. We think we've priced our product accordingly to take advantage of their price sensitivity.

But also you might see disparities between Northern Europe and Southern Europe, for example, that you're not necessarily going to see in the US, where adoption tends to be more uniform. But I think whatever they do it's certainly -- we would expect it to be more robust in the US.

Boris Peaker: And lastly, my last question, have you commented what the overall commercial potential that you see in Europe?

Timothy Morris: Yes, I think we have independently taken a look at that market, and I think we put the opportunity, conservatively, at, again, at lower pricing, at a peak sales of about $150 million.

Boris Peaker: Great. Thank you very much for taking my questions.

Timothy Morris: Sure, Boris.

Operator: And the next question will come from Michael Higgins, of ROTH Capital Partners. Please go ahead.

Michael Higgins: Thank you, operator. Hi, guys. A lot of questions have been asked on the upcoming September meeting, but what can you help us with with what you believe the FDA has learned since March regarding the NDA and as well as what you've learned from the FDA's position since that March letter?

Timothy Morris: Yes, Michael, this is Tim. It's going to be difficult to interpret what the FDA has learned and what we've learned from them. I think, as Howie mentioned earlier, I think maybe some continual dialog with the agency. I think providing additional information to them from some of the data that we have generated since the CRL, and that has been specifically some of the bench test data and the human factor work.

It's hard to say if that has had an impression on them or what exactly they think of it until we've had the meeting. So it's probably too much to speculate as to a change in their thinking, not really having the opportunity to sit in front of them. So we are encouraged by the fact that they've granted a meeting. We think it is a positive step forward. And we'll just take it for what it's worth.

Michael Higgins: Is it reasonable on my end to expect, say, there's a 75% chance that there's some sort of outcome from the meeting that we'll hear something within the week, or will we wait till October 2 and have more dialog with you that day?

Timothy Morris: Yes, again, that will depend on the nature of the meeting. But the -- keep in mind that the October 2nd date wasn't set around anything specific to the FDA. We just looked at that as an appropriate time for an update.

In terms of letting the market know the results of the meeting with the agency, I think as Howie mentioned before we will take what we learn from the meeting, we will confer with a lot of our experts here, and then once we're all in agreement on the path forward and the results of the meeting, we're happy to kind of explain that to the market. So we do know that it's important to us and to everyone and to our investors, and so we will try to get something out as quickly as possible.

Michael Higgins: Okay. Then one last follow-up, it sounds like you have a confirmed date for a meeting, correct me if I'm wrong on that, but if you can help us, is the meeting with the reviewers? Does it extend beyond that to their supervisors, as well?

Timothy Morris: The meeting is with the division, and other folks in the agency have been invited to participate. We won't know who actually participates until the meeting has taken place.

Michael Higgins: Very good. Thanks, guys.

Timothy Morris: Sure.

Operator: The next question will come from Hugo Ong, of Jefferies. Please go ahead.

Hugo Ong: Hi, guys. This is Hugo speaking in for Biren Amin. Just a question on ARX-04's trial in abdominal surgery. Can you talk about why you're stratifying based on gender and whether or not this was done similarly in the Zalviso program?

Timothy Morris: Sure. Pam will answer that one for you, Hugo.

Pam Palmer: Sure. Well, we have a situation in these studies where we have procedures that are sort of gender specific. For example, most -- one of the procedures is abdominoplasty that we're doing SAP301, and those are mostly going to be in women. So we were just making sure -- and we've got, obviously, herniorrhaphies, as well, that will mostly be in men.

So we're just making sure that we've got sort of an even balance of males versus females in general for that study. But the main thing was to make sure that it's not -- and there's three different types of surgeries that we did: inguinal herniorrhaphy, abdominoplasty, and then any laparoscopic surgery. And so we just wanted to keep a close eye on the male/female. There tended to be more females than males in all of our studies, and that was something we also saw for SAP301.

Hugo Ong: Okay, great. And just to follow up, is there a reason why -- on the inclusion criteria, is there a reason why you're requiring the female patients of childbearing potential to have an effective method of birth control when they're going through the abdominal surgery?

Pam Palmer: It's just standard. It's just standard whenever you're at the study drug. There's nothing specific about sufentanil. And opioids are used in pregnant women all the time. But it's just a standard for an investigational study drug to make sure that the patients aren't pregnant.

Howie Rosen: Right.

Hugo Ong: Got it. Great. Thanks for taking my questions.

Pam Palmer: Sure.

Operator: And this will conclude our question-and-answer session. I would like to hand the conference back over to Howie Rosen for his closing remarks.

Howie Rosen: I'd just like to thank everyone again for taking the time today to call in to our second quarter call. And, as we mentioned, we'll be participating in several investment conferences next month, so we look forward to keeping you updated. Thanks again.

Operator: Ladies and gentlemen, the conference has now concluded. We thank you for attending today's presentation. You may now disconnect your lines.

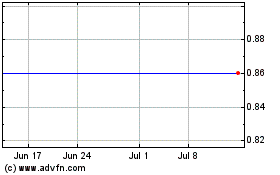

AcelRX Pharmaceuticals (NASDAQ:ACRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

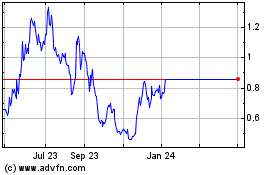

AcelRX Pharmaceuticals (NASDAQ:ACRX)

Historical Stock Chart

From Apr 2023 to Apr 2024