SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.20549

FORM 10-Q

|

x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d ) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2014

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM ___________ TO _____________.

Commission file number: 333-141907

|

ROADSHIPS HOLDINGS, INC. |

|

(Exact name of registrant as specified in its charter) |

|

Delaware |

|

20-5034780 |

|

(State or other Jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

1846 E. Innovation Park Drive, Oro Valley, AZ 85755

(Address of principal executive offices)

(310) 994-7988

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

o |

Accelerated filer |

o |

|

Non-accelerated filer |

o |

Smaller reporting company |

x |

|

(do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes o No x

The number of shares of the registrant's common stock outstanding as of July 30, 2015, was 2,987,633,430.

ROADSHIPS HOLDINGS, INC.

FORM 10-Q

INDEX

|

PART I - FINANCIAL INFORMATION |

|

|

3 |

|

| |

|

|

|

|

|

| Item 1 - |

Consolidated Financial Statements |

|

|

3 |

|

| Item 2- |

Management's Discussion And Analysis Of Financial Condition And Results Of Operations |

|

|

12 |

|

| Item 3 - |

Quantitive And Qualitative Disclosures About Market Risk |

|

|

14 |

|

| Item 4 - |

Controls and Procedures |

|

|

15 |

|

| |

|

|

|

|

|

|

PART II - OTHER INFORMATION |

|

|

16 |

|

| |

|

|

|

|

|

|

Item 1 - |

Legal Proceedings |

|

|

16 |

|

|

Item 1A - |

Risk Factors |

|

|

16 |

|

|

Item 2 - |

Unregistered Sale of Equity Securities |

|

|

16 |

|

|

Item 3 - |

Defaults Upon Senior Securities |

|

|

16 |

|

|

Item 4 - |

Mine Safety Disclosures |

|

|

16 |

|

|

Item 5 - |

Other Information |

|

|

16 |

|

|

Item 6 - |

Exhibits |

|

|

16 |

|

| |

|

|

|

|

|

|

Signatures |

|

|

17 |

|

PART I - FINANCIAL INFORMATION

ITEM 1 - CONSOLIDATED FINANCIAL STATEMENTS

ROADSHIPS HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS

|

|

|

9/30/14 |

|

|

12/31/13 |

|

|

|

|

(Unaudited) |

|

|

(Audited) |

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

55 |

|

|

$ |

196 |

|

|

Total current assets |

|

|

55 |

|

|

|

196 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net of accumulated depreciation of $123,110 and $119,889 as of September 30, 2014 and December 31, 2013, respectively |

|

|

- |

|

|

|

3,221 |

|

|

TOTAL ASSETS |

|

$ |

55 |

|

|

$ |

3,417 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

20,552 |

|

|

$ |

17,840 |

|

|

Accounts payable - related party |

|

|

638 |

|

|

|

566 |

|

|

Accrued interest - related party |

|

|

351 |

|

|

|

2,148 |

|

|

Loans from related parties |

|

|

44,221 |

|

|

|

37,115 |

|

|

Short-term notes payable |

|

|

4,425 |

|

|

|

- |

|

|

Total current liabilities |

|

|

70,187 |

|

|

|

57,669 |

|

|

TOTAL LIABILITIES |

|

|

70,187 |

|

|

|

57,669 |

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' DEFICIT |

|

|

|

|

|

|

|

|

|

Series A Convertible Preferred Stock, par value $0.0001. 4 shares authorized, 1 share outstanding at September 30, 2014 and December 31, 2013, respectively |

|

|

1 |

|

|

|

1 |

|

|

Series B Convertible Preferred Stock, par value $0.0001. 10,000,000 shares authorized, 39,312 outstanding at September 30, 2014 and December 31, 2013, respectively |

|

|

4 |

|

|

|

4 |

|

|

Common stock, $0.00001 par value. Three billion shares authorized. 2,987,633,430 outstanding at September 30, 2014 and December 31, 2013, respectively. |

|

|

29,876 |

|

|

|

29,876 |

|

|

Additional paid in capital |

|

|

32,759,839 |

|

|

|

32,759,839 |

|

|

Accumulated deficit |

|

|

(32,854,389 |

) |

|

|

(32,832,647 |

) |

|

Effect of foreign currency exchange |

|

|

(5,643 |

) |

|

|

(11,325 |

) |

|

TOTAL STOCKHOLDERS' DEFICIT |

|

|

(70,132 |

) |

|

|

(54,252 |

) |

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

$ |

55 |

|

|

$ |

3,417 |

|

The accompanying notes are an integral part of these consolidated financial statements.

ROADSHIPS HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

Nine Months Ended September 30, |

|

|

Three Months Ended September 30, |

|

|

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

$ |

16,303 |

|

|

$ |

2,586,878 |

|

|

$ |

6,740 |

|

|

$ |

4,359 |

|

|

Depreciation |

|

|

3,732 |

|

|

|

5,296 |

|

|

|

6 |

|

|

|

1,770 |

|

|

Total operating expenses |

|

|

20,035 |

|

|

|

2,592,174 |

|

|

|

6,746 |

|

|

|

6,129 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income / (loss) |

|

|

(20,035 |

) |

|

|

(2,592,174 |

) |

|

|

(6,746 |

) |

|

|

(6,129 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME / (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(1,707 |

) |

|

|

(1,831 |

) |

|

|

(595 |

) |

|

|

(389 |

) |

|

Loss on extinguishment of debt |

|

|

- |

|

|

|

(24,476,829 |

) |

|

|

- |

|

|

|

- |

|

|

Total other |

|

|

(1,707 |

) |

|

|

(24,478,660 |

) |

|

|

(595 |

) |

|

|

(389 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(21,742 |

) |

|

$ |

(27,070,834 |

) |

|

$ |

(7,341 |

) |

|

$ |

(6,518 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER COMPREHENSIVE INCOME (LOSS) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of foreign currency exchange |

|

|

5,862 |

|

|

|

(2,313 |

) |

|

|

8,490 |

|

|

|

222 |

|

|

Net comprehensive loss |

|

$ |

(15,880 |

) |

|

$ |

(27,073,147 |

) |

|

$ |

1,149 |

|

|

$ |

(6,296 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share - basic and diluted |

|

$ |

(0.00 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.01 |

) |

|

Weighted average shares outstanding |

|

|

2,987,633,430 |

|

|

|

2,226,604,018 |

|

|

|

2,987,633,430 |

|

|

|

2,987,633,430 |

|

The accompanying notes are an integral part of these consolidated financial statements.

ROADSHIPS HOLDINGS, INC.

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY / (DEFICIT)

(Unaudited)

|

|

|

Common Stock |

|

|

Preferred Stock

Series A |

|

|

Preferred Stock

Series B |

|

|

Accumulated Other Comprehensive |

|

|

Additional Paid In |

|

|

Accumulated |

|

|

Total Stockholders' Equity / |

|

|

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Income |

|

|

Capital |

|

|

Deficit |

|

|

(Deficit) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, 12/31/12 |

|

|

187,633,430 |

|

|

$ |

1,876 |

|

|

|

- |

|

|

$ |

- |

|

|

|

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

5,637,749 |

|

|

$ |

(5,773,335 |

) |

|

$ |

(133,710 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common shares issued for debt reduction |

|

|

2,300,000,000 |

|

|

|

23,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22,977,000 |

|

|

|

|

|

|

|

23,000,000 |

|

|

Stock-based compensation |

|

|

500,000,000 |

|

|

|

5,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,546,985 |

|

|

|

|

|

|

|

2,551,985 |

|

|

Preferred shares issued for conversion of debt |

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

1 |

|

|

|

39,312 |

|

|

|

4 |

|

|

|

|

|

|

|

1,598,105 |

|

|

|

|

|

|

|

1,598,110 |

|

|

Foreign currency translation adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(11,325 |

) |

|

|

|

|

|

|

|

|

|

|

(11,325 |

) |

|

Net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(27,059,312 |

) |

|

|

(27,059,312 |

) |

|

Balance, 12/31/13 |

|

|

2,987,633,430 |

|

|

$ |

29,876 |

|

|

|

1 |

|

|

$ |

1 |

|

|

|

39,312 |

|

|

$ |

4 |

|

|

$ |

(11,325 |

) |

|

$ |

32,759,839 |

|

|

$ |

(32,832,647 |

) |

|

$ |

(54,252 |

) |

|

Foreign currency translation adjustment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,862 |

|

|

|

|

|

|

|

|

|

|

|

5,862 |

|

|

Net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(21,742 |

) |

|

|

(21,742 |

) |

|

Balance, 9/30/14 |

|

|

2,987,633,430 |

|

|

$ |

29,876 |

|

|

|

1 |

|

|

$ |

1 |

|

|

|

39,312 |

|

|

$ |

4 |

|

|

$ |

(5,463 |

) |

|

$ |

32,759,839 |

|

|

$ |

(32,854,389 |

) |

|

$ |

(70,132 |

) |

The accompanying notes are an integral part of these consolidated financial statements.

ROADSHIPS HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

Nine Months Ended September 30, |

|

|

|

|

2014 |

|

|

2013 |

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

Net Loss |

|

$ |

(21,742 |

) |

|

$ |

(27,070,834 |

) |

|

Depreciation expense |

|

|

3,732 |

|

|

|

5,296 |

|

|

Stock-based compensation |

|

|

- |

|

|

|

2,551,985 |

|

|

Loss on conversion of debt |

|

|

- |

|

|

|

24,476,829 |

|

|

|

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

|

4,068 |

|

|

|

(10,475 |

) |

|

Accounts payable - related party |

|

|

(1,725 |

) |

|

|

(2,427 |

) |

|

Accrued expense |

|

|

197 |

|

|

|

- |

|

|

Net cash used in operating activities |

|

|

(15,470 |

) |

|

|

(49,626 |

) |

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Cash proceeds from shareholder loan |

|

|

12,610 |

|

|

|

55,807 |

|

|

Cash proceeds from notes payable |

|

|

4,063 |

|

|

|

- |

|

|

Principal payments on shareholder loans |

|

|

(7,206 |

) |

|

|

(7,417 |

) |

|

Net cash provided by financing activities |

|

|

9,467 |

|

|

|

48,390 |

|

|

|

|

|

|

|

|

|

|

|

|

Effect of foreign exchange transactions |

|

|

5,862 |

|

|

|

2,313 |

|

|

|

|

|

|

|

|

|

|

|

|

Net increase/(decrease) in cash |

|

|

(141 |

) |

|

|

1,077 |

|

|

Cash and equivalents - beginning of period |

|

|

196 |

|

|

|

306 |

|

|

Cash and equivalents - end of period |

|

$ |

55 |

|

|

$ |

1,383 |

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTARY INFORMATION |

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

1,372 |

|

|

$ |

1,685 |

|

|

Cash paid for income taxes |

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES OF NON-CASH FINANCING TRANSACTIONS |

|

|

|

|

|

|

|

|

|

Notes payable conversion into common shares - related party |

|

$ |

- |

|

|

$ |

23,000 |

|

|

Notes payable conversion into preferred shares - related party |

|

|

- |

|

|

|

98,281 |

|

The accompanying notes are an integral part of these consolidated financial statements.

ROADSHIPS HOLDINGS, INC.

NOTES TO UNAUDITED FINANCIAL STATEMENTS

SEPTEMBER 30, 2014

Note 1 - Organization and Nature of Business

History

Roadships Holdings, Inc. was formed in Delaware on June 5, 2006 as Caddystats, Inc. (Roadships Holdings, Inc. and Caddystats shall hereinafter be collectively referred to as "Roadships" "Caddystats" "Roadships Holdings", the "Company", "we' or "us").

The Company adopted the accounting acquirer's year end, December 31.

Our Business

Roadships is an emerging company in the short-sea and ground freight industry sectors operating through its wholly owned subsidiaries in the United States and Australia.

We have acquired several domestic and foreign subsidiaries to facilitate our entry into these markets. In the United States, Roadships Acquisitions US, Inc. is our subsidiary designated to identify and act upon synergistic acquisition targets in North America. Roadships America, Inc. was established to develop and accommodate organic growth within the North America markets.

On May 25, 2009, we acquired Roadships Acquisitions Pty, Ltd. a corporation formed under the laws of Australia, which we expect to use to identify and act upon synergistic acquisition targets in Australia and the surrounding area.

On June 15, 2009, we acquired Endeavour Logistics Pty. Ltd., to establish to develop and accommodate organic growth within the Australia markets. We renamed Endeavor Logistics Pty Ltd. to Roadships Freight Pty Ltd.

In the United States, Roadships Acquisitions US, Inc. is our subsidiary designated to identify and act upon synergistic acquisition targets throughout North America. Roadships America, Inc., was established to develop and accommodate organic growth within the North America markets.

Roadships is currently attempting to develop a High Speed (HS) Monohull ship design based on a vessel concept that was initially developed by Kvaerner Masa Yards - Technology (now STX Europe). The HS vessel design was conceived in the early 1990's for short sea shipping transportation throughout Europe using a hull form derived from a high speed ROPAX ferry built in Helsinki, Finland. This hull form was extensively tested and improved over a period of 5 years to optimize the hull form that offers the least resistance and allows the ship to maintain speed up to SS5.

Ground Freight Mergers and Acquisitions

The gestation period for a HS Monohull vessel is eighteen (18) months, best case, from start to finish. To drive short term cash flow, the Company's strategic intent calls for the acquisition, merger and assimilation of privately held regional freight companies ranging in value from Eight Million USD ($8,000,000) to Twenty Million USD ($20,000,000). Strategically, Management intends to identify and acquire two (2) target operations quarterly - with one of the two being an over-performer and the other an under-performer - synergistically merging the two so as to optimize future operations of both operating entities.

Note 2 - Basis of Presentation and Summary of Significant Accounting Policies

Consolidated Financial Statements

In the opinion of management, the accompanying financial statements includes all adjustments (which include only normal recurring adjustments) necessary to present fairly the financial position, results of operations, and cash flows for the period ending September 30, 2014. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. Interim results are not necessarily indicative of results for a full year. The information included in this Form 10-Q should be read in conjunction with information included in our audited financial statements for the period ended December 31, 2013, as reported in Form 10-K filed with the Securities and Exchange Commission on March 20, 2015.

Management further acknowledges that it is solely responsible for adopting sound accounting practices, establishing and maintaining a system of internal accounting control and preventing and detecting fraud. The Company's system of internal accounting control is designed to assure, among other items, that 1) recorded transactions are valid; 2) valid transactions are recorded; and 3) transactions are recorded in the proper period in a timely manner to produce financial statements which present fairly the financial condition, results of operations and cash flows of the Company for the respective periods being presented.

Principles of Consolidation

Our consolidated financial statements include the accounts of Roadships Holdings, Inc. and all majority-owned subsidiaries. All significant inter-company accounts and transactions are eliminated in consolidation.

Property, Plant and Equipment

We record our property plant and equipment at historical cost. The estimated useful lives of these assets range from three to seven years and are depreciated using the straight-line method over the asset's useful life.

Foreign Currency Risk

We currently have two subsidiaries operating in Australia. At September 30, 2014 and December 31, 2013, we had $62 and $220 Australian Dollars, respectively ($55 and $187 US Dollars, respectively) deposited into Australian banks.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Net Loss Per Share

Basic and diluted net loss per share calculations are calculated on the basis of the weighted average number of common shares outstanding during the year. The per share amounts include the dilutive effect of common stock equivalents in years with net income. Basic and diluted loss per share is the same for the nine months ended September 30, 2014 as the effect of our potential common stock equivalents would be anti-dilutive.

Recent Accounting Pronouncements

In July 2013, FASB issued ASU No. 2013-11, "Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists." The provisions of ASU No. 2013-11 require an entity to present an unrecognized tax benefit, or portion thereof, in the statement of financial position as a reduction to a deferred tax asset for a net operating loss carryforward or a tax credit carryforward, with certain exceptions related to availability. ASU No. 2013-11 is effective for interim and annual reporting periods beginning after December 15, 2013. The adoption of ASU No. 2013-11 is not expected to have a material impact on the Company's Consolidated Financial Statements.

Note 3 - Going Concern

We have not begun our core operations in the short-sea and ground freight industries and have not yet acquired the assets to enter these markets and we will require additional capital to do so. There is no guarantee that we will acquire the capital to procure the assets to enter these markets or, upon doing so, that we will generate positive cash flows from operations. Roadships Holdings' financial statements have been prepared on a development stage company basis. Substantial doubt exists as to Roadships Holdings' ability to continue as a going concern. No adjustment has been made to these financial statements for the outcome of this uncertainty.

Note 4 - Related Party Transactions

For the nine months ended September 30, 2014 and 2013, we had the following transactions with our major shareholder and former Chief Executive Officer, Micheal Nugent:

| |

· |

We received $12,610 and $55,807, respectively, in cash loans to pay operating expenses and repaid $7,206 and $7,417, respectively, in loans to him. |

|

|

|

| |

· |

We accrued $1,569 and $2,195, respectively, in interest payable and paid $1,372 and $1,685, respectively, in accrued interest. |

According to our agreement with Mr. Nugent, we accrue interest on all unpaid amounts at 5%. Principal and interest are callable at any time. If principal and interest are called and not repaid, the loan is considered in default after which interest is accrued at 10%.

As of the date of this report, no principal or interest has been called by the maker of the note. The outstanding balance at September 30, 2014 and December 31, 2013 is $44,121 and $37,115, respectively, in principal and $351 and $2,148, respectively, in interest.

Note 5 - Capital

At December 31, 2012, we had 187,633,430 common shares issued and outstanding from a total of 1 billion authorized.

During the year ended December 31, 2013, we issued 2,800,000,000 common shares for debt reduction and conversion of accruals. Our valuation and accounting for these equity transactions are discussed in Note 4 to the financial statements on Form 10-K as of and for the year ended December 31, 2013, filed on March 20, 2015 and are herein incorporated by reference.

Additionally, on April 3, 2013, we issued 500,000,000 shares to consultants pursuant to their consulting arrangements. We valued the shares at their grant-date fair values and recorded $2,500,000 in administrative costs.

Preferred Stock

On March 12, 2013, the Board of Directors authorized 4 shares of Class A Convertible Preferred Stock and 10,000,000 shares of Class B Convertible Preferred Stock. Class A and B Convertible Preferred Stock have the following attributes:

Series A Convertible Preferred Stock

The Series A Preferred Stock is convertible into the number of shares of Common Stock which equals 4 times the sum of: i) the total number of shares of Common Stock which are issued and outstanding at the time of conversion, plus ii) the total number of shares of Series B Preferred Stocks which are issued and outstanding at the time of conversion.

The Series A Preferred Stock voting rights are equal to the number of shares of Common Stock which equals 4 times the sum of: i) the total number of shares of Common Stock which are issued and outstanding, plus ii) the total number of shares of Series B Preferred Stocks which are issued and outstanding.

Series B Convertible Preferred Stock

Each share of Series B Preferred Stock is convertible at par value $0.0001 per share (the "Series B Preferred"), at any time, and/or from time to time, into the number of shares of the Corporation's common stock, par value $0.0001 per share (the "Common Stock") equal to the price of the Series B Preferred Stock ($2.50), divided by the par value of the Series B Preferred (par value of $0.0001per share), subject to adjustment as may be determined by the Board of Directors from time to time (the "Conversion Rate").

Based on the $2.50 price per share of Series B Preferred Stock, and a par value of $0.0001 per share for Series B Preferred each share of Series B Preferred Stock is convertible into 250,000 shares of Common Stock.

Each share of Series B Preferred Stock has 10 votes for any election or other vote placed before the shareholders of the Common stock.

The Preferred A stock has a stated value of $.0001 and no stated dividend rate and is non-participatory. The Series A and Series B has liquidation preference over common stock. The Voting Rights for each share of Series A is equal to 1 vote per share (equal to 4 times the number of common and Preferred B shares outstanding) and Series B Preferred Stock have 10 votes per shares.

The Holder has the right to convert the Preferred A and B to common shares of the Company with the Series A convertible to 4 times the number of common and Preferred B shares outstanding and Series B convertible to 250,000 common shares per Preferred B share. The Preferred Series A and Series B represents voting control based on management's interpretation of the Company bylaws and Certificate of Designation.

Issuances of Preferred Stock

On March 12, 2013, the Company issued 1 share of Series A Convertible Preferred Stock and 39,312 shares of Series B Convertible Preferred Stock to our former Chief Executive Officer, Micheal Nugent, in exchange for a reduction of debt in the amount of $98,281.

Our valuation and accounting for these equity transactions are discussed in Note 4 to the financial statements on Form 10-K as of and for the year ended December 31, 2013, filed on March 20, 2015 and are herein incorporated by reference.

Note 6 - Property, Plant and Equipment

Property, Plant and Equipment consists principally of office furniture and equipment and vehicles. Balances at September 30, 2014 and December 31, 2013 are as follows:

|

|

|

9/30/14 |

|

|

12/31/13 |

|

|

|

(Unaudited) |

|

|

(Audited) |

|

|

|

|

|

|

|

|

|

|

|

Office equipment |

|

$ |

87,836 |

|

|

$ |

87,836 |

|

|

Equipment |

|

|

23,362 |

|

|

|

23,362 |

|

|

Vehicles |

|

|

11,912 |

|

|

|

11,912 |

|

|

Total fixed assets at cost |

|

|

123,110 |

|

|

|

123,110 |

|

|

Less: accumulated depreciation |

|

|

(123,110 |

) |

|

|

(119,889 |

) |

|

Net fixed assets |

|

$ |

- |

|

|

$ |

3,221 |

|

Note 7 - Subsequent Events

On December 9, 2014, we redeemed the 39,312 shares of Series B Convertible Preferred Stock issued in 2013 to our Chief Executive Officer, by issuing a promissory note in the amount of $98,281.

On January 15, 2015, the Company redeemed the Series A Share from Micheal Nugent for $1.00. There were no other shares of Series "A" Preferred Stock outstanding at the time of the redemption.

On April 20, 2015, the Registrant and Tamara Nugent, as trustee for Twenty Second Trust (the "Trust"), entered into a Common Stock Repurchase Agreement (the "Repurchase Agreement"), whereby the Trust agreed to sell 1,796,571,210 shares of the Registrant's common stock (the "Repurchased Shares") to the Registrant in exchange for the sum of $17,966. The Consideration was paid in the form of $3,653 cash from the Registrant and secured by a non-interest bearing demand note issued by the Registrant for $14,313. The Repurchased Shares will be held in treasury by and in the name of the Registrant.

On April 22, 2015, the Registrant entered into a Share Exchange Agreement ("SEA") with Click Evidence Inc. ("Click"), an Arizona corporation, and certain shareholders of Click, whereby the Selling Shareholders agreed to sell not less than 90% of all 14,146,230 of the issued and outstanding shares of Click common stock to the Registrant in exchange for restricted shares of the Registrant's common stock (the "Share Exchange"). Under the terms and subject to the provisions of the SEA, each of the Selling Shareholders will receive 126 and a fraction restricted shares of Roadships common stock for each share of Click common stock sold to the Registrant, and a change of officers would be implemented.

On May 21, 2015, this SEA transaction was closed, accompanied with the resignation of Robert McClelland as Vice President but remaining as a director, the resignation of Micheal Nugent as President, CEO, CFO and Chief Accounting Officer but remaining as a director, and the appointment of Jon N Leonard as President, CEO, CFO and Chief Accounting Officer, and as a director and Chairman of the Board.

We have evaluated subsequent events through the date of this report.

ITEM 2- MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This report contains "forward-looking statements". All statements other than statements of historical fact are "forward-looking statements" for purposes of federal and state securities laws, including: any projections of earnings, revenues or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new products, services or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. "Forward-looking statements" may include the words "may," "will," "estimate," "intend," "continue," "believe," "expect," "plan" or "anticipate" and other similar words.

Although we believe that the expectations reflected in our "forward-looking statements" are reasonable, actual results could differ materially from those projected or assumed. Our future financial condition and results of operations, as well as any "forward-looking statements", are subject to change and to inherent risks and uncertainties, such as those disclosed in this report. In light of the significant uncertainties inherent in the "forward-looking statements" included in this report, the inclusion of such information should not be regarded as a representation by the Company or any other person that the objectives and plans of the Company will be achieved. Except for its ongoing obligation to disclose material information as required by the federal securities laws, we do not intend, and undertake no obligation, to update any "forward-looking statement". Accordingly, the reader should not rely on "forward-looking statements", because they are subject to known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those contemplated by the "forward-looking statements".

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with our unaudited financial statements, including the notes to those financial statements, included elsewhere in this report.

Overview

Roadships Holdings, Inc. is an emerging company in the short-sea and ground freight industry sectors operating through its wholly owned subsidiaries in the U.S. and Australia.

In the United States, Roadships Acquisitions US, Inc. is our subsidiary designated to identify and act upon synergistic acquisition targets throughout North America. Roadships America, Inc, was established to develop and accommodate organic growth within the North American markets.

Roadships is currently attempting to develop a High Speed (HS) Monohull ship design based on a vessel concept that was initially developed by Kvaerner Masa Yards - Technology (now STX Europe). The HS vessel design was conceived in the early 1990's for short sea shipping transportation throughout Europe using a hull form derived from a high speed ROPAX ferry built in Helsinki, Finland. This hull form was extensively tested and improved over a period of 5 years to optimize the hull form that offers the least resistance and allows the ship to maintain speed up to SS5.

Results of Operations - Nine months ended September 30, 2014 versus 2013

We had general and administrative expenses of $16,303 for the nine months ended September 30, 2014 versus $2,586,878 for the same period in 2013. Virtually all of the reduction is due to stock-based compensation which existed in 2013, but not in 2014.

Depreciation expense is $3,732 during the nine months ended September 30, 2014 versus $5,296 for the same period in 2013. All assets have been fully depreciated by the end of September 2014. Therefore, depreciation expense is reduced by those assets no longer being depreciated.

Interest expense declined from the previous year of $1,831 in 2013 to $1,707 in 2014. The decrease is due to lower average debt outstanding.

Results of Operations - Three months ended September 30, 2014 versus 2013

We had general and administrative expenses of $6,740 for the three months ended September 30, 2014 versus $4,359 for the same period in 2013. The increase is due to small changes in various spending categories.

Depreciation expense is $6 during the three months ended September 30, 2014 versus $1,770 for the same period in 2013. Assets became fully depreciation during the current year, lowering the depreciation expense.

Interest expense increased from the previous year of $389 in 2013 to $595 in 2014. The increase is due to high average debt outstanding

Liquidity and Capital Resources

Our financial statements have been prepared on a going concern basis that contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business.

The Company has virtually no liquid assets. We are currently seeking financing to attain our business goals, but there is no guarantee that we will obtain such financing or, upon obtaining it, that we will be able to invest in productive assets that will result in positive cash flows from operations.

Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As shown in the accompanying financial statements, we had negative cash flows from operations, recurring losses, and negative working capital at September 30, 2014 and December 31, 2013. These conditions raise substantial doubt as to our ability to continue as a going concern. The financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern. Management intends to finance these deficits by making additional shareholder notes and seeking additional outside financing through either debt or sales of its common stock.

Plan of Operation

Roadships Holdings, Inc. ("Roadships"), operates in the transport industry - short-sea freight shipping, shipping logistics, and ground freight transport. The Company's business model and business plan (the "Plan") have remained unchanged from the juncture of the reverse merger (February - March 2009.

Although operationally integrated, Roadships operations are best examined as three "strategic business units" (SBUs): 1) Short Sea Freight Shipping; 2) Freight Shipping Logistics, and; 3) Ground Freight Transport.

Short Sea Shipping:

| |

· |

Research and development on the establishment Roadships USA trade routes; |

|

|

|

| |

· |

Pre-application research and development on a waiver of The Jones Act; |

|

|

|

| |

· |

Preliminary logistical preparation on the ordering and construction of two USA built Roadships High Speed Monohulls; |

|

|

|

| |

· |

In discussions with European and USA based ship operators on strategic partnerships; |

|

|

|

| |

· |

Finalization of strategic sales and marketing for the Company's new trailer designs or retrofit package for use with the new Roadships High Speed Monohulls; |

|

|

|

| |

· |

Preliminary logistical preparation for the release of Roadships' new loading and unloading equipment for the Company's High Speed Monohulls; |

Freight Shipping Logistics:

Although Roadships' management team has considerable experience in industry sector, frankly freight logistics services have taken a back seat to developments in the Company's Short Sea Shipping and Ground Transportation SBUs. However, the Company intends to penetrate both the USA and Australian markets over the short-term, most likely by means of merger or acquisition in penetrating the former.

ITEM 3 - QUANTITIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

A smaller reporting company is not required to provide the information required by this item.

ITEM 4 - CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures.

We maintain "disclosure controls and procedures" as such term is defined in Rule 13a-15(e) under the Securities Exchange Act of 1934. In designing and evaluating our disclosure controls and procedures, our management recognized that disclosure controls and procedures, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of disclosure controls and procedures are met. Additionally, in designing disclosure controls and procedures, our management necessarily was required to apply its judgment in evaluating the cost-benefit relationship of possible disclosure controls and procedures. The design of any disclosure controls and procedures also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions.

Based upon the evaluation of our officers and directors of our disclosure controls and procedures as of September 30, 2014, the end of the period covered by this Quarterly Report on Form 10-Q (the "Evaluation Date"), our Chief Executive Officer and Chief Financial Officer have concluded that as of the Evaluation Date that our disclosure controls and procedures were not effective such that the information relating to our company, required to be disclosed in our Securities and Exchange Commission reports (i) is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms and (ii) is accumulated and communicated to our management, including our Chief Executive Officer, to allow timely decisions regarding required disclosure. Our management concluded that our disclosure controls and procedures were not effective as a result of material weaknesses in our internal control over financial reporting. We are a small organization with only a few employees. Under these circumstances it is impossible to completely segregate duties. We do not expect our internal controls to be effective until such time as we are able to begin full operations and even then there are no assurances that our disclosure controls will be adequate in future periods.

Change In Internal Control Over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during the nine months ended September 30, 2014 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II - OTHER INFORMATION

ITEM 1 - LEGAL PROCEEDINGS

We may be involved from time to time in ordinary litigation, negotiation and settlement matters that will not have a material effect on our operations or finances. We are not aware of any pending or threatened litigation against us or our officers and directors in their capacity as such that could have a material impact on our operations or finances.

ITEM 1A - RISK FACTORS

We are a smaller reporting company as defined in Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 2 - UNREGISTERED SALE OF EQUITY SECURITIES

None

ITEM 3 - DEFAULTS UPON SENIOR SECURITIES

None

ITEM 4 - MINE SAFETY DISCLOSURES

None.

ITEM 5 - OTHER INFORMATION

None

ITEM 6 - EXHIBITS

|

Exhibit No. |

|

Description of Exhibit |

| |

|

|

|

3.1 |

|

Articles of Incorporation, as filed June 5, 2007 (included as Exhibit 3.1 to the Form SB-2 filed April 5, 2007, and incorporated herein by reference). |

| |

|

|

|

3.2 |

|

Bylaws (included as Exhibit 3.2 to the Form SB-2 filed April 5, 2007, and incorporated herein by reference). |

| |

|

|

|

31.1 |

|

Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (filed herewith). |

| |

|

|

|

32.1 |

|

Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (filed herewith). |

SIGNATURES

In accordance with Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Roadships Holdings, Inc |

|

| |

|

|

|

| Date: August 3, 2015 |

By: |

/s/ Dr. Jon Leonard |

|

|

|

|

Dr. Jon Leonard |

|

|

|

|

Chief Executive Officer |

|

17

EXHIBIT 31.1

CERTIFICATIONS

I, Dr. Jon Leonard, Chief Executive Officer of ROADSHIPS HOLDINGS, INC. (the "Registrant") certify that:

| 1. |

I have reviewed the report being filed on Form 10-Q. |

| 2. |

Based on my knowledge, the report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by the report; |

| 3. |

Based on my knowledge, the financial statements, and other financial information included in the report, fairly present in all material respects the financial condition, results of operations and cash flows of ROADSHIPS HOLDINGS, INC. as of, and for, the periods presented in the report; |

| 4. |

I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-a5(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-a5(f)) for the Registrant and have; |

|

(a) |

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure the material information relating to the Registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

|

(b) |

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

|

(c) |

Evaluated the effectiveness of the Registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation. |

|

(d) |

Disclosed in this report any change in the Registrant's internal control over financial reporting that occurred during the Registrant's most recent fiscal three months (the Registrant's fourth fiscal three months in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting; and; |

| 5. |

I have disclosed, based on our most recent evaluation, to the ROADSHIPS HOLDINGS' auditors and the audit committee of the board of directors (or persons fulfilling the equivalent function): |

|

i. |

All significant deficiencies in the design or operation of internal controls which could adversely affect ROADSHIPS HOLDING'S ability to record, process, summarize and report financial data and have identified ROADSHIPS HOLDINGS' auditors any material weaknesses in internal controls; and |

|

ii. |

Any fraud, whether or not material, that involves management or other employees who have a significant role in the issuer's internal controls; and |

| 6. |

I have indicated in the report whether or not there were significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses. |

| Date: August 3, 2015 |

By: |

/s/ Dr. Jon Leonard |

|

|

|

|

Dr. Jon Leonard |

|

|

|

|

Chief Executive Officer |

|

EXHIBIT 32.1

CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of ROADSHIPS HOLDINGS, INC. (the "Company") on Form 10-Q as filed with the Securities and Exchange Commission on the date hereof (the "Report'), I, Dr. Jon Leonard, Chief Executive Officer of the Company, certify, pursuant to 18 USC section 1350, as adopted pursuant to section 906 of the Sarbanes-Oxley Act of 2002, that to the best of my knowledge and belief:

| (1) |

The Report fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934; and |

| (2) |

The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. |

| Date: August 3, 2015 |

By: |

/s/ Dr. Jon Leonard |

|

|

|

|

Dr. Jon Leonard |

|

|

|

|

Chief Executive Officer |

|

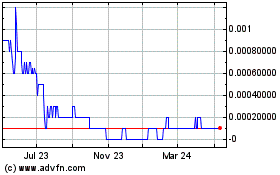

Tautachrome (CE) (USOTC:TTCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

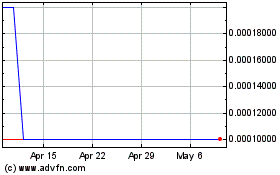

Tautachrome (CE) (USOTC:TTCM)

Historical Stock Chart

From Apr 2023 to Apr 2024