UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2015

GENTHERM INCORPORATED

(Exact name of registrant as specified in its charter)

|

Michigan |

|

0-21810 |

|

95-4318554 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

21680 Haggerty Road, Ste. 101, Northville, MI |

|

48167 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (248) 504-0500

Former name or former address, if changed since last report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On August 1, 2015, Gentherm Incorporated (the “Company”), entered into an Executive Relocation and Employment Agreement (the “Employment Agreement”) with Frithjof Oldorff (“Oldorff”), pursuant to which Oldorff will continue to serve as President of the Automotive Business Unit of the Company, but will relocate to the United States from Germany. As of such date, the Service Agreement between Oldorff and Gentherm GmbH (the “German Subsidiary”), a wholly-owned subsidiary of the Company, pursuant to which Oldorff was employed as a managing director of the Germany Subsidiary, was terminated.

The Employment Agreement provides for (A) a three-year term, (B) an annual base salary of $425,000, subject to periodic review and increase; (C) eligibility for bonus compensation at the discretion of the Board, with a target bonus of 50% of annual base salary; (D) eligibility for equity compensation at the discretion of the Board, generally on the same terms and conditions as other senior executive officers (although the award size can vary); (E) other ancillary benefits, including benefits under the Company’s welfare benefit programs generally as provided to other senior executive officers and use of a Company-owned car; (F) continuing ancillary benefits applicable to German executives or German expatriates, including minimum contributions to maintain eligibility for the statutorily required pension and health insurances and life insurance programs, and specified airfare for personal travel; (G) housing expenses and relocation expenses, each as approved by the Company’s chief executive officer, and (H) an income tax gross-up, such that Oldorff will pay the income taxes that he would have paid had he been an employee of the German Subsidiary and residing in Germany, and the Company will reimburse Oldorff for the income tax amounts payable in excess thereof.

In the event of any termination of the Employment Agreement, Oldorff shall be entitled to specified repatriation benefits in addition to ordinary course severance obligations for earned but not paid compensation and vested benefits. In addition, in the event of any termination of the Employment Agreement other than a Termination for Cause (as defined therein) or a resignation by Oldroff, Oldroff shall be entitled to severance under the Company’s severance policy in effect at the time of termination of the Employment Period, subject to the his execution and delivery of a release agreement in favor of the Company and its officers, directors, affiliates, and representatives.

The Executive Relocation and Employment Agreement is attached hereto as Exhibit 10.1 and the above description of the material terms of such document is qualified in its entirety by reference to such exhibit, which is incorporated herein by reference.

|

Item 9.01 |

Financial Statements and Exhibits. |

|

Exhibit No. |

|

Description |

|

|

|

|

|

10.1 |

|

Executive Relocation and Employment Agreement, dated August 1, 2015, by and between Gentherm Incorporated and Frithjof Oldorff |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GENTHERM INCORPORATED |

|

|

|

|

|

|

By: |

|

/s/ Kenneth J. Phillips |

|

|

|

|

Kenneth J. Phillips |

|

|

|

|

Vice-President and General Counsel |

|

Date: August 3, 2015 |

|

|

|

3

Exhibit Index

|

Exhibit No. |

|

Description |

|

|

|

|

|

10.1 |

|

Executive Relocation and Employment Agreement, dated August 1, 2015, by and between Gentherm Incorporated and Frithjof Oldorff |

4

EXHIBIT 10.1

Executive Relocation and Employment Agreement

THIS EXECUTIVE RELOCATION AND EMPLOYMENT AGREEMENT (this “Agreement”) is made effective as of the 1st day of August, 2015 (the “Commencement Date”), by and between Gentherm Incorporated, a Michigan corporation (the “Company”) and Frithjof Oldorff (the “Executive”).

Background

The Executive has been employed since January 1, 2008 by a wholly-owned indirect subsidiary of the Company, Gentherm GmbH (“Gentherm Germany”). During a portion of this time, Executive has served as the President of the Automotive Business Unit of the group of companies controlled by the Company. The Board of Directors of the Company (the “Board”) has determined that it is in the best interests of the Company and its shareholders to employ the Executive directly by the Company and to relocate the Executive to work from the Company’s Northville, Michigan location. The Executive has agreed to such employment and relocation. Accordingly, the Company and the Executive desire to enter into this Agreement to set forth the terms and conditions of such employment relationship. This Agreement shall represent the entire understanding and agreement between the parties with respect to the Executive’s employment with the Company. All references in this Agreement to “$” refer to U.S. Dollars.

NOW, THEREFORE, in consideration of the foregoing and the terms and conditions set forth herein, the parties agree as follows:

Terms and Conditions

1. Employment Period. The Company hereby agrees to employ the Executive, and the Executive hereby accepts employment, on the terms and conditions set forth in this Agreement. The term of the Executive’s employment with the Company shall commence on the Commencement Date and end on the third anniversary of the Commencement Date (the “Initial Term”). At the end of the Initial Term, unless the Board and the Executive enter into a written agreement to extend the Executive’s employment with the Company (an “Extension Agreement”) the Executive’s employment with the Company will automatically terminate (a “Non-Extension Termination”). The terms and conditions of the Executive’s employment for any extension beyond the Initial Term are to be set forth in an Extension Agreement, if any, and such terms may simply be on an “at will” basis if the Company and the Executive so agree. For purposes of this Agreement, “Employment Period” includes only the Initial Term unless the express terms of any Extension Agreement provide that the Employment Period, as such term is used in this Agreement, shall be extended. This Agreement assumes that the Executive meets all eligibility requirements to lawfully work in the United States. In the event the Executive is no longer so eligible through no fault of the Executive, the Employment Period will terminate as if it were a Non-Extension Termination. In the event the Executive is no longer so eligible resulting directly from action or inaction on the part of the Executive that could have reasonably been avoided, the Employment Period will terminate as if it were a Termination for Cause (as defined herein).

2. Terms of Employment.

(a) Position and Duties.

(i) During the Employment Period, the Executive shall serve as the President of the Automotive Business Unit of the Company, reporting directly to the President and Chief Executive Officer of the Company (the “CEO”) and shall have such duties and responsibilities as are assigned to the Executive by the CEO and the Board, consistent with the Executive’s position.

1

(ii) During the Employment Period, and excluding any periods of vacation and sick leave to which the Executive is entitled, the Executive agrees to devote full business time, energy, skills and attention to the business and affairs of the Company, to discharge the responsibilities assigned to the Executive hereunder, and to use the Executive’s reasonable best efforts to perform faithfully and efficiently such responsibilities. During the Employment Period it shall not be a violation of this Agreement for the Executive to: (A) serve on corporate, civic or charitable boards or committees; (B) deliver lectures, fulfill speaking engagements or teach at educational institutions; or (C) manage personal investments, so long as such activities do not significantly interfere with the performance of the Executive’s responsibilities as an employee of the Company in accordance with this Agreement.

(b) Compensation.

(i) Base Salary. During the Employment Period, the Executive shall receive an annual base salary equal to $425,000 (the “Annual Base Salary”), which shall be paid in accordance with the Company’s normal payroll practices for senior executive officers of the Company as in effect from time to time. During the Employment Period, the Compensation Committee of the Board (the “Compensation Committee”) will review the Annual Base Salary at least annually. Any increase in the Annual Base Salary shall not serve to limit or reduce any other obligation to the Executive under this Agreement. The Annual Base Salary shall not be reduced after any such increase (unless otherwise agreed to by the Executive) and the term “Annual Base Salary” as utilized in this Agreement shall refer to the Annual Base Salary as so increased or adjusted by the Board.

(ii) Annual Bonus. In addition to the Annual Base Salary, during the Employment Period the Executive shall be eligible for cash bonuses as determined by the Compensation Committee in its sole discretion (the “Bonuses”). Although the timing and amount of any such Bonuses are subject to the sole discretion of the Compensation Committee (except that any Bonus awarded by the Compensation Committee to the Executive for a particular calendar year shall be paid to the Executive on or before March 15 of the following year), the Executive and the Company have agreed that the Executive’s “target” bonus shall be equal to 50% of the Annual Base Salary. The actual amount of any Bonuses could be greater or less than such target amount as determined from time to time by the Compensation Committee in its sole discretion.

(iii) Long-Term Incentive Compensation. During the Employment Period, the Executive shall be entitled to participate in any stock option, restricted stock, performance share, performance unit or other equity based long-term incentive compensation plan, program or arrangement (the “Plans”) generally made available to senior executive officers of the Company, on substantially the same terms and conditions as generally apply to such other officers, except that the size of any awards made to the Executive shall reflect the Executive’s position with the Company and the Board’s view of the Executive’s performance and/or expected future contributions to the Company.

(iv) Welfare Benefit Plans. During the Employment Period, the Executive and the Executive’s family shall be eligible for participation in, and shall receive all benefits under, welfare benefit plans, practices, policies and programs provided by the Company (including, without limitation, medical, prescription, dental, disability, employee life, group life, accidental death and travel accident insurance plans and programs) to the extent available generally or to other senior executive officers of the Company. In addition, during the Employment Period, the Company agrees to pay on the Executive’s behalf, or reimburse the Executive for, (i) the minimal social pension plan contribution required to maintain the Executive’s future eligibility for a pension benefit in Germany and (ii) the minimal social medical insurance contribution required to maintain the Executive’s eligibility for future medical insurance should the Executive ever relocate back to Germany (collectively, the “German Welfare Payments”).

(v) Business Expenses / Company Automobile. During the Employment Period, the Executive shall be entitled to receive prompt reimbursement for all reasonable business expenses incurred by the Executive in accordance with the plans, practices, policies and programs of the Company. In addition, the Executive will be entitled to use of a Company-owned automobile during the Employment Period.

(vi) Relocation Expenses. The Executive is eligible for company-paid (or, if paid directly by the Executive, reimbursement of) relocation expenses pursuant to the Company’s relocation policy and subject in every case to express written approval by the CEO (“Approved Relocation Expenses”).

2

(vii) Housing Allowance. During each calendar month during the Employment Period, the Executive will receive a monthly housing allowance in an amount expressly approved by the CEO, but not to exceed $5,000 (after all tax deductions) per month without approval of the Compensation Committee (the “Housing Allowance”).

(viii) Holiday, Vacation and Sick Pay. During the Employment Period, the Executive shall be eligible for participation in, and shall receive all benefits under, holiday, vacation and sick pay programs provided by the Company to the extent available generally or to other senior executive officers of the Company, except that the Executive shall be entitled to 30 days of vacation pay under the Company’s vacation program regardless of the number of vacation days the executive would have been entitled to otherwise receive under such program based on his length of employment with the Company.

(ix) Home Country Visits. Each year during the Employment Period, the Company will pay for a total of eight round-trip business class tickets for the Executive and/or the Executive’s family members to travel to/from Michigan and Germany (the (“Home Country Visit Allowance”). The Executive will determine which trips and which individuals he desires to have these tickets applied toward. Air travel that the Executive completes for business reasons will not be counted against the Home Country Visit Allowance, even if the Executive is accompanied by family members.

(x) Taxes and Tax Protection. The Company shall be entitled to withhold, from any amounts payable to or for the benefit of the Executive under this Agreement, such federal, state, local or foreign taxes as shall be required to be withheld pursuant to any applicable law or regulation, and the Company shall remit all such taxes withheld to the appropriate governmental body in a timely manner. The Executive is responsible for payment of all taxes due in respect of the amounts and benefits paid or delivered to or for the benefit of the Executive under this Agreement; however, the Executive may be entitled to payments from the Company in respect of a portion of such taxes as described in the remainder of this Section 2(x). At the end of each calendar year during the Employment Period, a tax expert retained by the Company will compute the amount of aggregate income taxes the Executive is required to pay as a result of the Executive’s employment with the Company during such calendar year (the “Actual Tax Obligation”) and compare that amount to the aggregate income taxes the Executive would have been required to pay as a result of the Executive’s employment with the Company during such calendar year if all of compensation paid to or for the benefit of the Executive during such calendar year had instead been paid while the Executive worked at the Company’s facility in Odelzhausen, Germany and while the Executive lived at the Executive’s current primary residence in Germany (the “Theoretical Tax Obligation”). To the extent the Actual Tax Obligation for a calendar year exceeds the Theoretical Tax Obligation for that calendar year, the Executive will receive a payment from the Company (to be paid no later than the last day of the calendar year following the calendar year in which such excess amounts were paid to the applicable tax authority) in an amount so that the Executive shall have paid no more income taxes on his earnings during such period pertaining to his employment with the Company than the amount of the Theoretical Tax Obligation. For purposes of the foregoing computation, the following amounts and benefits payable to the Executive under this Agreement are intended by the parties to be provided on a tax-free basis and so their tax effect will be removed from the computations of the Actual Tax Obligation and the Theoretical Tax Obligation and instead the Company will separately make “tax gross-up” payments to the Executive not less often than annually in order to achieve the stated intent: (i) all Approved Relocation Expenses, (iii) the Housing Allowance, (iii) the Home Country Visit Allowance, (iv) the cost of the tax preparation assistance and (v) the Repatriation Benefits (as defined in Section 3(c)(vii)); the “tax gross up” amount with respect to any item listed in the foregoing clauses (i) through (v) shall be paid by the Company to the Executive no later than the last day of the calendar year next following the calendar year in which the taxes owing by the Executive with respect to such item are paid to the applicable tax authority. For clarity, the following amounts (and any other amounts not expressly listed in (i) through (v) above) are expressly excluded from the tax gross-up described in the previous sentence: (A) the Annual Base Salary, (B) any Bonuses, (C) any long-term incentive compensation, (D) all health and welfare benefits, including the German Welfare Payments, and (E) the value of the use of a Company-owned automobile for personal reasons.

3

3. Termination of Employment.

(a) Termination Events. The Employment Period shall end upon the earliest to occur of (i) a Non-Extension Termination, (ii) the Executive’s death, (iii) a Termination due to Disability, (iv) a Termination for Cause, (v) the Termination Date specified in connection with any exercise by the Company of its Termination Right or (vi) the date of resignation by the Executive under Section 3(b). The Executive agrees that, at the end of the Employment Period and upon written request from the Company, the Executive shall resign from any and all positions the Executive holds with the Company and any of its subsidiaries and affiliates, effective immediately following receipt of such request from the Company (or at such later date as the Company may specify).

(b) Resignation. This Agreement may be terminated by the resignation of the Executive at any time upon 60 days prior written notice to the Company or upon such shorter period as may be agreed upon between the Executive and the Board.

(c) Benefits Payable Under All Circumstances. In the event of termination of this Agreement for any reason, the following will apply:

(i) Earned Compensation. The Earned Compensation (as defined in Section 3(e) below) shall be paid at the same time as the Earned Compensation would have been payable had the Executive remained employed by the Company.

(ii) Benefits. All benefits payable to the Executive under any employee benefit plans of the Company applicable to the Executive at the time of termination of the Executive’s employment with the Company and all amounts and benefits which are vested or which the Executive is otherwise entitled to receive under the terms of or in accordance with any plan, policy, practice or program of, or any contract or agreement with, the Company, at or subsequent to the date of the Executive’s termination without regard to the performance by the Executive of further services or the resolution of a contingency, shall be paid or provided in accordance with, at the same time or times otherwise payable under, and subject to the terms and provisions of such plans, it being understood that all such benefits shall be determined on the basis of the actual date of termination of the Executive’s employment with the Company.

(iii) Indemnities. Any right which the Executive may have to claim a defense and/or indemnity for liabilities to or claims asserted by third parties in connection with the Executive’s activities as an officer, director or employee of the Company shall be unaffected by the Executive’s termination of employment and shall remain in effect in accordance with its terms.

(iv) Medical Coverage. The Executive shall be entitled to such continuation of health care coverage as is required under, and in accordance with, applicable law or otherwise provided in accordance with the Company’s policies. The Executive understands and acknowledges that the Executive is responsible for making all payments required for any such continued health care coverage that the Executive may choose to receive.

(v) Business Expenses. The Executive shall be entitled to reimbursement, in accordance with the Company’s policies regarding expense reimbursement as in effect from time to time, for all business expenses incurred by the Executive prior to the date of termination of the Executive’s employment.

(vi) Equity Awards. The Executive’s rights with respect to any equity awards granted to the Executive by the Company shall be governed by the terms and provisions of the Plans and award agreements pursuant to which such equity awards were awarded.

(vii) Repatriation Benefits. The Company shall (1) purchase one-way business class flights for the Executive and his family to return to Germany, (2) pay the freight costs associated with shipping the Executive’s household goods to the Executive’s home in Germany (subject to a maximum of 500 pounds of air freight and a maximum of 12,000 pounds shipped by sea), (3) pay for a customary brokerage commission and other customary closing costs associated with the sale of the Executive’s home in Michigan, if he owns one and if he sells such home within 12 months of the date of termination, and (4) pay for temporary housing for up to 30 days in either the United

4

States or in Germany as needed by the Executive and his family during their transition back to Germany (“Repatriation Benefits”). The Company shall pay or provide the Repatriation Benefits when due and payable, but in no event later than the last day of the second calendar year following the calendar year in which the Executive’s employment with the Company terminates.

(d) Severance Payable Under Certain Circumstances. In the event of termination of this Agreement for any reason other than a Termination for Cause or a resignation by the Executive, the following additional benefit will be paid by the Company: the Company shall pay the Executive (structured to either be exempt from or in compliance with Section 409A (defined below)) severance under the Company’s severance policy in effect at the time of termination of the Employment Period, subject to the Executive’s execution and delivery of a release agreement in favor of the Company and its officers, directors, affiliates, and representatives, in a form provided by the Company.

(e) Definitions. For purposes of this Agreement, the following terms shall have the meanings ascribed to them below:

(i) “Earned Compensation” means any Annual Base Salary earned, but unpaid, for services rendered to the Company on or prior to the date on which the Employment Period ends pursuant to Section 3(a); however, if the Executive’s employment terminates by reason other than a Termination for Cause or a termination as a result of the Executive’s resignation and such termination occurs after a complete period for which a Bonus is generally being paid to other executive officers of the Company, then the amount that would, in the judgment of the Compensation Committee, be paid to the Executive as a Bonus for such completed period shall also be included as Earned Compensation.

(ii) “Termination Date” means the date the Company specifies in writing to the Executive in connection with the exercise of its Termination Right.

(iii) “Termination due to Disability” means a termination of the Executive’s employment by the Company because the Executive has been incapable, after reasonable accommodation, of substantially fulfilling the positions, duties, responsibilities and obligations set forth in this Agreement because of physical, mental or emotional incapacity resulting from injury, sickness or disease for a period of (A) three consecutive months or (B) an aggregate of six months (whether or not consecutive) in any 12-month period. Any question as to the existence, extent or potentiality of the Executive’s disability shall be determined by a qualified physician selected by the Company with the consent of the Executive, which consent shall not be unreasonably withheld. The Executive or the Executive’s legal representatives or any adult member of the Executive’s immediate family shall have the right to present to such physician such information and arguments as to the Executive’s disability as he, she or they deem appropriate, including the opinion of the Executive’s personal physician.

(iv) “Termination for Cause” means a termination of the Executive’s employment by the Company due to the Executive’s (A) gross negligence, (B) gross misconduct, whether or not during the performance of his duties (including, for example, commission of a felony), (C) willful nonfeasance or (D) willful material breach of this Agreement, which termination may be effected (y) immediately upon notice from the Company if the Company shall reasonably and in good faith determine that the conduct or cause specified in such notice is not curable (it being understood that such notice shall describe in reasonable detail the conduct or cause giving rise to such notice and shall state the reason(s) why the Company has determined that such conduct or cause is not curable); or (z) upon 30 days’ notice from the Company, if the Company shall reasonably and in good faith determine that the conduct or cause specified in such notice is curable (it being understood that such notice shall describe in reasonable detail the conduct or cause giving rise to such notice and shall state the reason(s) why the Company has determined that such conduct or cause is curable and what steps the Company believes should or could be taken by the Executive to cure such conduct or cause), and such conduct or cause has not been so cured within such 30 day period.

(v) “Termination Right” means the right of the Company, in its sole, absolute and unfettered discretion, to terminate the Executive’s employment under this Agreement for any reason or no reason whatsoever. For the avoidance of doubt, any Termination for Cause effected by the Company shall not constitute exercise of its Termination Right.

5

(f) Section 409A. It is intended that payments and benefits under this Agreement either be excluded from or comply with the requirements of Section 409A of the Internal Revenue Code and the guidance issued thereunder (“Section 409A”) and, accordingly, to the maximum extent permitted, this Agreement shall be interpreted consistent with such intent. In the event that any provision of this Agreement is subject to but fails to comply with Section 409A, the Company may revise the terms of the provision to correct such noncompliance to the extent permitted under any guidance, procedure or other method promulgated by the Internal Revenue Service now or in the future or otherwise available that provides for such correction as a means to avoid or mitigate any taxes, interest or penalties that would otherwise be incurred by the Executive on account of such noncompliance. Provided, however, that in no event whatsoever shall the Company be liable for any additional tax, interest or penalty imposed upon or other detriment suffered by the Executive under Section 409A or damages for failing to comply with Section 409A. Solely for purposes of determining the time and form of payments due the Executive under this Agreement or otherwise in connection with the Executive’s termination of employment with the Company, the Executive shall not be deemed to have incurred a termination of employment unless and until the Executive shall incur a “separation from service” within the meaning of Section 409A. The parties agree, as permitted in accordance with the final regulations thereunder, a “separation from service” shall occur when the Executive and the Company reasonably anticipate that the Executive’s level of bona fide services for the Company and any other entity treated as a single employer with the Company for purposes of Code Section 409A (whether as an employee or an independent contractor) will permanently decrease to no more than 40% of the average level of bona fide services performed by the Executive for the Company and any other entity treated as a single employer with the Company for purposes of Code Section 409A over the immediately preceding 36 months. The determination of whether and when a separation from service has occurred shall be made in accordance with this subparagraph and in a manner consistent with Treasury Regulation Section 1.409A-1(h). All reimbursements and in-kind benefits provided under this Agreement shall be made or provided in accordance with the requirements of Section 409A to the extent that such reimbursements or in-kind benefits are subject to Section 409A, including, where applicable, the requirements that: (i) any reimbursement is for expenses incurred and any in-kind benefits are provided during the Executive’s lifetime (or during a shorter period of time specified in this Agreement); (ii) the amount of expenses eligible for reimbursement (and in-kind benefits to be provided) during a calendar year may not affect the expenses eligible for reimbursement (and in-kind benefits to be provided) in any other calendar year; (iii) the reimbursement of an eligible expense will be made on or before the last day of the calendar year following the year in which the expense is incurred; and (iv) the right to reimbursement or in-kind benefits is not subject to set off or liquidation or exchange for any other benefit. For purposes of Section 409A, the Executive’s right to any installment payments under this Agreement shall be treated as a right to receive a series of separate and distinct payments. Whenever a payment under this Agreement is required to be made during a specified period, the actual date of payment within the specified period shall be within the sole discretion of the Company.

4. Executive Remedy. The Executive acknowledges and agrees that the payment and rights provided under Section 3 are fair and reasonable, and are the Executive’s sole and exclusive remedy, in lieu of all other remedies at law or in equity, for termination of the Executive’s employment.

5. Confidentiality / COMPANY PROPERTY

(a) Confidentiality. The Executive acknowledges and agrees that it is a condition of his Employment with the Company that he execute and abide by the standard Confidential Information and Inventions Assignment Agreement (except that, to the extent the terms of this Agreement conflict with the terms of such standard agreement, this Agreement shall govern).

(b) Company Property. Promptly following the Executive’s termination of employment, the Executive shall return to the Company all property of the Company (including any Company-owned automobile in his possession), and all copies thereof in the Executive’s possession or under the Executive’s control, except that the Executive may retain the Executive’s personal notes, diaries, rolodexes, mobile devices, calendars and correspondence of a personal nature.

6

6. Successors.

(a) This Agreement is personal to the Executive and without the prior written consent of the Company shall not be assignable by the Executive otherwise than by will or the laws of descent and distribution. This Agreement shall inure to the benefit of and be enforceable by the Executive’s legal representatives.

(b) This Agreement shall inure to the benefit of and be binding upon the Company and its successors and assigns and any party acting in the form of a receiver or trustee capacity.

(c) The Company will require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business and/or assets of the Company to assume expressly and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place. As used in this Agreement, the “Company” shall mean the Company as hereinbefore defined and any successor to its business and/or assets as aforesaid which assumes and agrees to perform this Agreement by operation of law, or otherwise.

7. Miscellaneous.

(a) This Agreement shall be construed in accordance with, and governed by, the laws of the State of Michigan, without regard to the conflicts of law rules of such state. Each of the parties hereto (i) consents to submit itself to the personal jurisdiction of the state and federal courts sitting in the State of Michigan (and any appeals court therefrom) in the event any dispute arises out of this Agreement or any transaction contemplated hereby, (ii) agrees that it will not attempt to deny or defeat such personal jurisdiction by motion or other request for leave from any such court, and (iii) agrees that it will not bring any action relating to this Agreement or any transaction contemplated hereby in any court other than such courts.

(b) The captions of this Agreement are not part of the provisions hereof and shall have no force or effect.

(c) Notice and communications under this Agreement must be in writing and shall be effective when actually received by the addressee, except that (i) the Company shall be entitled to use the Executive’s last known address in its employment records for notices to the Executive and (ii) all notices and communications from the Executive under this Agreement must be addressed to the Company’s CEO or the Company’s Chief Human Resource Officer.

(d) The invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement.

(e) The Company hereby agrees to indemnify the Executive and hold the Executive harmless to the extent provided under the Articles of Incorporation and the By-Laws of the Company, as each may be amended from time to time, and any Indemnification Agreement between the Company and the Executive, as it may be amended from time to time, against and in respect of any and all actions, suits, proceedings, claims, demands, judgments, costs, expenses (including reasonable attorney’s fees), losses, and damages resulting from the Executive’s good faith performance of the Executive’s duties and obligations with the Company. This obligation shall survive the Employment Period. Notwithstanding the foregoing, the Executive’s right to indemnification pursuant to this Section 10(e) shall be made ineffective as necessary to ensure compliance with any applicable laws, rules or regulations.

(f) From and after the Commencement Date, the Company shall cover the Executive under directors’ and officers’ liability insurance both during and, while potential liability exists, after the Employment Period in the same amount and to the same extent as the Company covers its other executive officers and directors.

(g) The Executive’s or the Company’s failure to insist upon strict compliance with any provision of this Agreement or the failure to assert any right the Executive or the Company may have hereunder shall not be deemed to be a waiver of such provision of right or any other provision or right of this Agreement.

7

(h) This Agreement, and all agreements, documents, instruments, schedules, exhibits or certificates prepared in connection herewith, represent the entire understanding and agreement between the parties with respect to the subject matter hereof, supersede all prior agreements or negotiations between such parties, and may be amended, supplemented or changed only by an agreement in writing which makes specific reference to this Agreement or the agreement or document delivered pursuant hereto, as the case may be, and which is signed by the party against whom enforcement of any such amendment, supplement or modification is sought. The Executive acknowledges that all prior service agreements between the Executive and Gentherm GmbH (or its predecessors) are terminated.

Signatures on the Following Page

8

IN WITNESS WHEREOF, the Company and the Executive have executed this Executive Relocation and Employment Agreement as of the date first above written.

|

|

|

|

|

|

The Executive: |

|

The Company: |

|

|

|

|

|

|

|

|

GENTHERM INCORPORATED |

|

|

|

|

|

|

/s/ Frithjof Oldorff |

|

By: |

/s/ Daniel R. Coker |

|

Frithjof Oldorff |

|

|

Name: Daniel R. Coker |

|

|

|

|

Title: President and Chief Executive Officer |

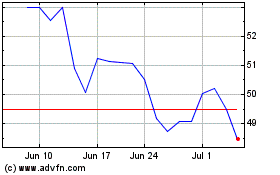

Gentherm (NASDAQ:THRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

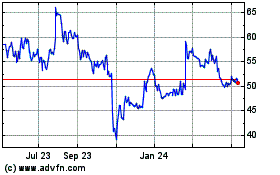

Gentherm (NASDAQ:THRM)

Historical Stock Chart

From Apr 2023 to Apr 2024