UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 29, 2015

BLUELINX HOLDINGS INC.

(Exact name of registrant specified in its charter)

|

| | |

Delaware | 001-32383 | 77-0627356 |

(State or other | (Commission | (I.R.S. Employer |

jurisdiction of incorporation) | File Number) | Identification No.) |

|

| |

4300 Wildwood Parkway, Atlanta, Georgia | 30339 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (770) 953-7000

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On July 29, 2015, BlueLinx Holdings Inc. (the “Company”) was notified by the New York Stock Exchange (“NYSE”) that the average closing price of the Company’s common stock had fallen below $1.00 per share over a period of 30 consecutive trading days, which is the minimum average share price for continued listing on the NYSE under Rule 802.01C of the NYSE Listed Company Manual. As of July 27, 2015, the 30 trading-day average closing price of the Company’s common stock was $0.99 per share.

As required by the NYSE, the Company will timely notify the NYSE that it intends to cure the deficiency and to return to compliance with the NYSE continued listing requirement. Under NYSE rules, the Company has six months following receipt of the notification to regain compliance with the minimum share price requirement. The Company can regain compliance at any time during the six-month cure period if the Company’s common stock has a closing share price of at least $1.00 on the last trading day of any calendar month during the period and also has an average closing share price of at least $1.00 over the 30-trading day period ending on the last trading day of that month or on the last day of the cure period.

The notice has no immediate impact on the listing of the Company’s common stock, which will continue to trade on the NYSE under the symbol “BXC”. The Company intends to actively monitor the closing share price for its common stock and will consider available options, including equity-based actions, such as a reverse stock split, to resolve the deficiency and regain compliance with Rule 802.01C of the NYSE Listed Company Manual.

The NYSE notification does not directly affect the Company’s business operations or its SEC reporting requirements and does not conflict with or cause an event of default under any of the Company’s material debt or other agreements.

As required under the NYSE rules, the Company issued a press release on July 31, 2015, announcing that it had received the notice of noncompliance. A copy of this press release is attached as Exhibit 99.1 to this Form 8-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

| | |

Exhibit No. | | Description |

99.1 | | Press Release, dated July 31, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| BLUELINX HOLDINGS INC. By: /s/ Shyam K. Reddy Shyam K. Reddy SVP, General Counsel, and Corporate Secretary |

Dated: July 31, 2015

|

| | |

| | EXHIBIT INDEX |

Exhibit No. | | Description |

99.1 | | Press Release, dated July 31, 2015 |

BLUELINX HOLDINGS INC. RECEIVES

CONTINUED LISTING STANDARD NOTICE FROM NYSE

Atlanta, Georgia - July 31, 2015 - BlueLinx Holdings Inc. (“BlueLinx” or the “Company”) (NYSE: BXC) today announced that it received notification on July 29, 2015, from the New York Stock Exchange (“NYSE”), that the price of its common stock fell below the NYSE’s continued listing standards. The NYSE requires that the average closing price of a listed company’s common stock remain above $1.00 per share over a consecutive 30 trading-day period. As of July 27, 2015, the 30 trading-day average closing price of the Company’s common stock was $0.99 per share.

The NYSE notification does not directly affect the Company’s business operations or its SEC reporting requirements and does not conflict with or cause an event of default under any of the Company’s material debt or other agreements.

Under NYSE listing standards, the Company can avoid delisting if, during the six-month period following receipt of the NYSE notice, it has a closing share price of at least $1.00 on the last trading day of any calendar month and has an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of that calendar month. During this period, the Company’s common stock will continue to be traded on the NYSE, subject to compliance with other continued NYSE listing requirements.

The Company intends to cure the price deficiency and return to compliance with the NYSE continued listing requirement within the six month period. If it becomes necessary to do so, the Company may seek to effect a reverse stock split to cure the price deficiency. A reverse stock split, which is one alternative to be considered, would be subject to the approval of the Board of Directors and shareholders of the Company. As required by the NYSE, in order to maintain its listing, the Company will notify the NYSE by August 12, 2015, that it intends to comply with the listing standards.

Mitchell Lewis, BlueLinx’s President and Chief Executive Officer commented: “Our average stock price has been below $1.00 per share long enough for the NYSE to be required to issue a non-compliance notice. We continue our efforts to improve the performance at BlueLinx which we believe will ultimately be reflected in the stock value and view the non-compliance as an administrative matter that can be cured in accordance with the NYSE’s listing standards in a timely manner. Several alternatives, including an improving stock price or a potential reverse stock split, provide us with a clear and visible path to compliance with the NYSE minimum price standards. We are actively evaluating our compliance options, without losing focus on the business and the interests of our shareholders, and expect to regain compliance within the six month window.

About BlueLinx Holdings Inc.

BlueLinx Holdings Inc., operating through its wholly owned subsidiary BlueLinx Corporation, is a leading distributor of building products in North America. The Company is headquartered in Atlanta, Georgia and operates its distribution business through its network of 48 distribution centers. BlueLinx is traded on the New York Stock Exchange under the symbol BXC. Additional information about BlueLinx can be found on its website at www.BlueLinxCo.com.

Cautionary Statements

This press release includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “poised,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. Such forward looking statements include statements regarding our expectations regarding future compliance with NYSE listing rules, our intent to seek to effect a reverse stock split, if necessary, and our intent to remain listed on the NYSE or other major stock exchange. Forward-looking statements in this press release include matters that involve known and unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to differ materially from results expressed or implied by this press release. Actual results may differ materially from those contained in the forward looking statements in this press release. BlueLinx undertakes no obligation and does not intend to update these forward-looking statements to reflect events or circumstances occurring after the date of this press release. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. You are encouraged to review the “Risk Factors” section in the Company’s Annual Report on Form 10-K for the year ended January 3, 2015, and in its periodic reports filed with the Securities and Exchange Commission from time to time. Given these risks and uncertainties, you are cautioned not to place undue reliance on forward-looking statements. BlueLinx undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, and changes in expectation or otherwise, except as required by law. All forward-looking statements are qualified in their entirety by this cautionary statement.

BlueLinx Contacts:

Investor Relations:

Caroline Lowden, Director Finance

(770) 953-7522

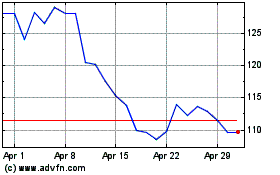

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

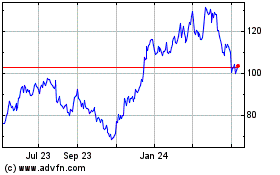

BlueLinx (NYSE:BXC)

Historical Stock Chart

From Apr 2023 to Apr 2024