Amended Current Report Filing (8-k/a)

July 31 2015 - 4:49PM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 2

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of earliest event reported: May 6, 2015

|

| | | | |

Commission File Number | | Exact name of registrant as specified in its charter, address of principal executive office and registrant's telephone number | | IRS Employer Identification Number |

001-36518 | | NEXTERA ENERGY PARTNERS, LP | | 30-0818558 |

| | 700 Universe Boulevard Juno Beach, Florida 33408 (561) 694-4000 | | |

State or other jurisdiction of incorporation or organization: Delaware

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

NextEra Energy Partners, LP (NEP) is filing this Form 8K/A as an amendment (Amendment No. 2) to NEP's Current Report on Form 8-K filed on May 12, 2015, as amended by NEP's Current Report on Form 8-K/A filed on July 2, 2015 (Amendment No. 1), which was filed to include the financial statements of acquired assets, as defined in Amendment No. 1, which collectively met the applicable significance threshold, and the pro forma financial information required by Items 9.01(a) and 9.01(b), respectively, of Form 8-K. This Amendment No. 2 is being filed to restate the unaudited pro forma consolidated balance sheet as of March 31, 2015 filed as Exhibit 99.3 to Amendment No. 1 to reclassify certain amounts from noncontrolling interest to limited partners equity. This reclassification error did not affect the unaudited pro forma consolidated statements of operations for the three months ended March 31, 2015, and the net effect on total equity in the unaudited pro forma consolidated balance sheet as of March 31, 2015 was zero.

SECTION 9 - FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits

(b) Pro Forma Financial Information

Unaudited pro forma consolidated financial statements of NEP for the years ended December 31, 2014, 2013 and 2012, and as of and for the three months ended March 31, 2015 are filed as Exhibit 99.3 to this Current Report on Form 8-K/A and are incorporated herein by reference.

(d) Exhibits.

|

| | | |

| Exhibit Number | | Description |

| 99.3 | | Unaudited pro forma consolidated financial statements of NEP for the years ended December 31, 2014, 2013 and 2012, and as of and for the three months ended March 31, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: July 31, 2015

|

| |

NEXTERA ENERGY PARTNERS, LP |

(Registrant) |

| |

By: | NextEra Energy Partners GP, Inc., its general partner |

| |

| |

CHRIS N. FROGGATT |

Chris N. Froggatt Controller and Chief Accounting Officer |

Exhibit 99.3

Introduction

The unaudited pro forma consolidated statements of operations and balance sheet (pro forma financial statements) combine the historical consolidated financial statements of NextEra Energy Partners, LP (NEP) and the financial statements of the entities that were acquired by NEP to illustrate the potential effect of the acquisitions. Subsidiaries of NEP completed the acquisitions of an approximately 250 megawatt (MW) wind power electric generating facility in January 2015 and the development rights and facilities under construction of a 20 MW solar power electric generating facility in February 2015 (collectively, the first quarter acquisitions). A subsidiary of NEP acquired four wind power electric generating facilities with generating capacity totaling approximately 664 MW in May 2015. In addition, through a series of transactions beginning in April 2015, a subsidiary of NEP acquired 50% ownership interests in subsidiaries of NextEra Energy, Inc. (NEE) that are currently constructing three solar power electric generating facilities with 277 MW of total generating capability. The 50% ownership interests will be accounted for as equity method investments as NEP did not obtain control of the assets. These acquisitions are collectively referred to as the acquired assets. The acquired assets were previously owned by indirect subsidiaries of NEE and, as such, the acquisitions are considered a transfer of assets between entities under common control. The pro forma financial statements are based on, and should be read in conjunction with, the consolidated financial statements of NEP included in NEP's Annual Report on Form 10-K for the year ended December 31, 2014 filed with the Securities and Exchange Commission (SEC) on February 20, 2015, as amended, and retrospectively adjusted to reflect the first quarter acquisitions in NEP's Current Report on Form 8-K filed with the SEC on May 12, 2015, as amended by NEP's Current Report on Form 8-K/A filed with the SEC on July 2, 2015 (Amendment 1). The pro forma financial statements are also based on, and should be read in conjunction with, the condensed consolidated financial statements of NEP included in NEP's Quarterly Report on Form 10-Q for the three months ended March 31, 2015 filed with the SEC on May 1, 2015 as well as the combined financial statements of the Assets Acquired by NextEra Energy Partners, LP and the condensed combined financial statements of the Assets Acquired by NextEra Energy Partners, LP included in Exhibits 99.1 and 99.2 to Amendment No. 1.

The historical consolidated financial statements have been adjusted in the pro forma consolidated financial statements to give effect to pro forma events that are (1) directly attributable to the acquisition of the acquired assets, (2) factually supportable and (3) with respect to the pro forma statements of operations, expected to have a continuing impact on the consolidated results. The pro forma financial statements have been derived by the application of pro forma adjustments to the historical consolidated financial statements of NEP. The pro forma consolidated statements of operations for the years ended December 31, 2014, 2013 and 2012 and for the three months ended March 31, 2015 give effect to the acquisitions (excluding the first quarter acquisitions which have already been reflected in the historical consolidated financial statements) and the debt and equity transactions related to such acquisitions as if they had occurred on January 1, 2012. The unaudited pro forma consolidated balance sheet as of March 31, 2015 gives effect to the acquisitions (excluding the first quarter acquisitions which have already been reflected in the historical consolidated financial statements) and the debt and equity transactions related to such acquisitions as if they had occurred on March 31, 2015. The adjustments are based on currently available information and certain estimates and assumptions and therefore the actual effects of these transactions may differ from the pro forma adjustments.

|

| | | | | | | | | | | | | | | |

NEXTERA ENERGY PARTNERS, LP UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS (millions, except per unit amounts) | | | | |

| | | | | | | |

Three months ended March 31, 2015 | | | | | | | |

| NEP Historical | | Acquired Assets (1) | | Pro Forma Adjustments | | Pro Forma Combined |

OPERATING REVENUES | $ | 74 |

| | $ | 14 |

| | $ | — |

| | $ | 88 |

|

OPERATING EXPENSES | | | | | | | |

Operations and maintenance | 16 |

| | 5 |

| | (1 | ) | (a) | 20 |

|

Depreciation and amortization | 23 |

| | 7 |

| | — |

| | 30 |

|

Transmission | 1 |

| | — |

| | — |

| | 1 |

|

Taxes other than income taxes and other | 3 |

| | — |

| | — |

| | 3 |

|

Total operating expenses | 43 |

| | 12 |

| | (1 | ) | | 54 |

|

OPERATING INCOME | 31 |

| | 2 |

| | 1 |

| | 34 |

|

OTHER INCOME (DEDUCTIONS) | | | | | | | |

Interest expense | (23 | ) | | (2 | ) | | — |

| | (25 | ) |

Benefits associated with differential membership interests—net | 1 |

| | 1 |

| | — |

| | 2 |

|

Other—net | 1 |

| | — |

| | — |

| | 1 |

|

Total other deductions—net | (21 | ) | | (1 | ) | | — |

| | (22 | ) |

INCOME BEFORE INCOME TAXES | 10 |

| | 1 |

| | 1 |

| | 12 |

|

INCOME TAXES | 1 |

| | 1 |

| | (1 | ) | (b) | 1 |

|

NET INCOME | 9 |

| | $ | — |

| | 2 |

| | 11 |

|

Less net income attributable to noncontrolling interest(2) | 7 |

| | | | 2 |

| (c) | 9 |

|

NET INCOME ATTRIBUTABLE TO NEXTERA ENERGY PARTNERS, LP | $ | 2 |

| |

|

| | $ | — |

| | $ | 2 |

|

| | | | | | |

|

Weighted average number of common units outstanding - basic and assuming dilution | 18.7 |

| |

| | 2.3 |

| | 21.0 |

|

Earnings per common unit attributable to NextEra Energy Partners, LP - basic and assuming dilution | $ | 0.08 |

| | | | | | $ | 0.07 |

|

______________________

| |

(1) | Excludes the operations of the projects which were acquired during the three months ended March 31, 2015, which are reflected in the NEP historical results. |

| |

(2) | Net income attributable to noncontrolling interest includes the pre-acquisition net income of NEP's first quarter acquisitions. |

|

| | | | | | | | | | | | | | | |

NEXTERA ENERGY PARTNERS, LP UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS (millions, except per unit amounts) | | | | |

| | | | | | | |

Year ended December 31, 2014 | | | | | | | |

| NEP Historical | | Acquired Assets(1) | | Pro Forma Adjustments | | Pro Forma Combined |

OPERATING REVENUES | $ | 304 |

| | $ | 44 |

| | $ | — |

| | $ | 348 |

|

OPERATING EXPENSES | | | | | | | |

Operations and maintenance | 58 |

| | 17 |

| | (1 | ) | (a) | 74 |

|

Depreciation and amortization | 78 |

| | 17 |

| | — |

| | 95 |

|

Transmission | 2 |

| | — |

| | — |

| | 2 |

|

Taxes other than income taxes and other | 5 |

| | — |

| | — |

| | 5 |

|

Total operating expenses | 143 |

| | 34 |

| | (1 | ) | | 176 |

|

OPERATING INCOME | 161 |

| | 10 |

| | 1 |

| | 172 |

|

OTHER INCOME (DEDUCTIONS) | | | | | | | |

Interest expense | (93 | ) | | (7 | ) | | — |

| | (100 | ) |

Benefits associated with differential membership interests—net | — |

| | — |

| | — |

| | — |

|

Equity in earnings of equity method investees | — |

| | — |

| | (1 | ) | (a) | (1 | ) |

Total other deductions—net | (93 | ) | | (7 | ) | | (1 | ) | | (101 | ) |

INCOME BEFORE INCOME TAXES | 68 |

| | 3 |

| | — |

| | 71 |

|

INCOME TAXES | 16 |

| | 2 |

| | (2 | ) | (b) | 16 |

|

NET INCOME | 52 |

| | $ | 1 |

| | 2 |

| | 55 |

|

Less net income prior to Initial Public Offering for NEP's initial portfolio | 28 |

| | | | — |

| | 28 |

|

Less net income attributable to noncontrolling interest(2) | 21 |

| | | | 3 |

| (c) | 24 |

|

NET INCOME ATTRIBUTABLE TO NEXTERA ENERGY PARTNERS, LP SUBSEQUENT TO INITIAL PUBLIC OFFERING | $ | 3 |

| | | | $ | (1 | ) | | $ | 3 |

|

| | | | | | | |

Weighted average number of common units outstanding - basic and assuming dilution | 18.7 |

| | | | 2.3 |

| | 21.0 |

|

Earnings per common unit attributable to NextEra Energy Partners, LP - basic and assuming dilution | $ | 0.16 |

| | | | | | $ | 0.14 |

|

______________________

| |

(1) | Excludes the operations of the projects which were acquired during the three months ended March 31, 2015, which are reflected in the NEP historical results. |

| |

(2) | Net income attributable to noncontrolling interest includes the pre-acquisition net income of NEP's first quarter acquisitions. |

|

| | | | | | | | | | | | | | | |

NEXTERA ENERGY PARTNERS, LP UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS (millions) | | | | |

| | | | | | | |

Year ended December 31, 2013 | | | | | | | |

| NEP Historical | | Acquired Assets(1) | | Pro Forma Adjustments | | Pro Forma Combined |

OPERATING REVENUES | $ | 142 |

| | $ | 37 |

| | $ | — |

| | $ | 179 |

|

OPERATING EXPENSES | | | | | | | |

Operations and maintenance | 30 |

| | 14 |

| | — |

| | 44 |

|

Depreciation and amortization | 39 |

| | 16 |

| | — |

| | 55 |

|

Transmission | 2 |

| | — |

| | — |

| | 2 |

|

Taxes other than income taxes and other | 5 |

| | 1 |

| | — |

| | 6 |

|

Total operating expenses | 76 |

| | 31 |

| | — |

| | 107 |

|

OPERATING INCOME | 66 |

| | 6 |

| | — |

| | 72 |

|

OTHER INCOME (DEDUCTIONS) | | | | | | | |

Interest expense | (42 | ) | | (7 | ) | | — |

| | (49 | ) |

Benefits associated with differential membership interests—net | 5 |

| | — |

| | — |

| | 5 |

|

Total other deductions—net | (37 | ) | | (7 | ) | | — |

| | (44 | ) |

INCOME (LOSS) BEFORE INCOME TAXES | 29 |

| | (1 | ) | | — |

| | 28 |

|

INCOME TAXES | 14 |

| | (6 | ) | | 6 |

| (b) | 14 |

|

NET INCOME (LOSS) | $ | 15 |

| | $ | 5 |

| | $ | (6 | ) | | $ | 14 |

|

______________________

| |

(1) | Excludes the operations of the projects which were acquired during the three months ended March 31, 2015, which are reflected in the NEP historical results. |

|

| | | | | | | | | | | | | | | |

NEXTERA ENERGY PARTNERS, LP UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS (millions) | | | | |

| | | | | | | |

Year ended December 31, 2012 | | | | | | | |

| NEP Historical | | Acquired Assets(1) | | Pro Forma Adjustments | | Pro Forma Combined |

OPERATING REVENUES | $ | 93 |

| | $ | 38 |

| | $ | — |

| | $ | 131 |

|

OPERATING EXPENSES | | | | | | | |

Operations and maintenance | 17 |

| | 16 |

| | — |

| | 33 |

|

Depreciation and amortization | 24 |

| | 16 |

| | — |

| | 40 |

|

Transmission | 2 |

| | — |

| | — |

| | 2 |

|

Taxes other than income taxes and other | 1 |

| | 1 |

| | — |

| | 2 |

|

Total operating expenses | 44 |

| | 33 |

| | — |

| | 77 |

|

OPERATING INCOME | 49 |

| | 5 |

| | — |

| | 54 |

|

OTHER INCOME (DEDUCTIONS) | | | | | | | |

Interest expense | (43 | ) | | (8 | ) | | (6 | ) | (d) | (57 | ) |

Other—net | 1 |

| | — |

| | — |

| | 1 |

|

Total other deductions—net | (42 | ) | | (8 | ) | | (6 | ) | | (56 | ) |

INCOME (LOSS) BEFORE INCOME TAXES | 7 |

| | (3 | ) | | (6 | ) | | (2 | ) |

INCOME TAXES | (9 | ) | | (3 | ) | | 2 |

| (b) | (10 | ) |

NET INCOME (LOSS) | $ | 16 |

| | $ | — |

| | $ | (8 | ) | | $ | 8 |

|

______________________

| |

(1) | Excludes the operations of the projects which were acquired during the three months ended March 31, 2015, which are reflected in the NEP historical results. |

|

| | | | | | | | | | | | | | | |

NEXTERA ENERGY PARTNERS, LP UNAUDITED PRO FORMA CONSOLIDATED BALANCE SHEET (millions) | | | | | | |

| | | | | | | |

As of March 31, 2015 | | | | | | | |

| NEP Historical | | Acquired Assets (1) | | Pro Forma Adjustments | | Pro Forma Combined |

ASSETS | | | | | | | |

Current assets: | | | | | | | |

Cash and cash equivalents | $ | 52 |

| | $ | 4 |

| | $ | (5 | ) | (a)(d)(e)(f)(g) | $ | 51 |

|

Accounts receivable | 33 |

| | 5 |

| | 3 |

| (h) | 41 |

|

Due from related parties | 51 |

| | — |

| | — |

| | 51 |

|

Restricted cash ($19 and $55 related to VIEs, respectively) | 23 |

| | — |

| | — |

| | 23 |

|

Prepaid expenses | 3 |

| | 1 |

| | (1 | ) | (a) | 3 |

|

Other current assets | 10 |

| | 2 |

| | — |

| | 12 |

|

Total current assets | 172 |

| | 12 |

| | (3 | ) | | 181 |

|

Non-current assets: | | | | | | | |

Property, plant and equipment—net ($406 and $408 related to VIEs, respectively) | 2,495 |

| | 639 |

| | (5 | ) | (a) | 3,129 |

|

Construction work in progress | 50 |

| | 284 |

| | (284 | ) | (a) | 50 |

|

Deferred income taxes | 130 |

| | 18 |

| | (13 | ) | (i) | 135 |

|

Other investments | — |

| | — |

| | 16 |

| (a) | 16 |

|

Other non-current assets | 81 |

| | 20 |

| | (12 | ) | (a) | 89 |

|

Total non-current assets | 2,756 |

| | 961 |

| | (298 | ) | | 3,419 |

|

TOTAL ASSETS | $ | 2,928 |

| | $ | 973 |

| | $ | (301 | ) | | $ | 3,600 |

|

LIABILITIES AND EQUITY | | | | | | | |

Current liabilities: | | | | | | | |

Accounts payable and accrued expenses | $ | 23 |

| | $ | 79 |

| | $ | (71 | ) | (a)(j) | $ | 31 |

|

Due to related parties | 23 |

| | 3 |

| | (2 | ) | (a) | 24 |

|

Current maturities of long-term debt | 78 |

| | 68 |

| | 254 |

| (a)(d) | 400 |

|

Accrued interest | 12 |

| | 1 |

| | — |

| | 13 |

|

Other current liabilities | 15 |

| | 4 |

| | (2 | ) | (a) | 17 |

|

Total current liabilities | 151 |

| | 155 |

| | 179 |

| | 485 |

|

Non-current liabilities: | | | | | | | |

Long-term debt | 1,802 |

| | 201 |

| | (118 | ) | (a) | 1,885 |

|

Deferral related to differential membership interests—VIEs | 246 |

| | 178 |

| | — |

| | 424 |

|

Accumulated deferred income taxes | 55 |

| | 18 |

| | (18 | ) | (j) | 55 |

|

Asset retirement obligation | 20 |

| | 11 |

| | (3 | ) | (a) | 28 |

|

Non-current due to related party | 16 |

| | 2 |

| | 1 |

| (k) | 19 |

|

Other non-current liabilities | 26 |

| | 19 |

| | (17 | ) | (a) | 28 |

|

Total non-current liabilities | 2,165 |

| | 429 |

| | (155 | ) | | 2,439 |

|

TOTAL LIABILITIES | 2,316 |

| | 584 |

| | 24 |

| | 2,924 |

|

COMMITMENTS AND CONTINGENCIES | | | | | | | |

EQUITY | | | | | | | |

Limited partners (common units issued and outstanding - 18.7(2)) | 543 |

| | — |

| | 126 |

| (c)(e)(f)(i) | 669 |

|

Members' equity | — |

| | 409 |

| | (409 | ) | (a)(c) | — |

|

Accumulated other comprehensive loss | (6 | ) | | (20 | ) | | 18 |

| (a)(c) | (8 | ) |

Noncontrolling interest | 75 |

| | — |

| | (60 | ) | (a)(c)(g)(h)(i)(j)(k) | 15 |

|

TOTAL EQUITY | 612 |

| | 389 |

| | (325 | ) | | 676 |

|

TOTAL LIABILITIES AND EQUITY | $ | 2,928 |

| | $ | 973 |

| | $ | (301 | ) | | $ | 3,600 |

|

______________________

| |

(1) | Excludes the accounts of the projects which were acquired during the three months ended March 31, 2015, which are reflected in the NEP historical results. |

| |

(2) | 21.3 on a pro forma basis. See (e). |

Pro Forma Adjustments and Assumptions

The adjustments are based on currently available information and certain estimates and assumptions, and therefore the actual effects of these transactions will differ from the pro forma adjustments. A general description of these transactions and adjustments is provided as follows:

| |

(a) | Reflects the reclassification of the operations and net assets of the projects, of which NEP acquired 50% ownership interests, to equity method investments included in equity in earnings of equity method investees in the accompanying unaudited pro forma consolidated statements of operations and reflected as other investments in the accompanying unaudited pro forma consolidated balance sheet. Earnings of equity method investees were less than $1 million in all periods presented. |

| |

(b) | Reflects the removal of current tax expense (benefit) of the predecessor entities that will not exist for NEP in the amount of approximately $1 million for the three months ended March 31, 2015, $2 million for the year ended December 31, 2014, ($6) million for the year ended December 31, 2013, and ($3) million for the year ended December 31, 2012. Successor tax expense is less than $1 million for both the three months ended March 31, 2015 and the year ended December 31, 2014. Successor tax benefit is approximately $1 million for the year ended December 31, 2012. |

| |

(c) | Reflects the allocation of the historical amounts to noncontrolling interest. |

| |

(d) | Reflects $313 million of proceeds from a one-year term loan entered into to fund the May 2015 acquisitions and related interest. |

| |

(e) | Reflects the gross proceeds of approximately $109 million from the private placement of 2,594,948 units at a price of $41.87 per unit. |

| |

(f) | Reflects offering fees and expenses. |

| |

(g) | Reflects the cash purchase price paid of approximately $424 million for the acquired assets. |

| |

(h) | Reflects the approximately $3 million noncash reclassification of distributions to due from related parties. |

| |

(i) | Reflects the removal of noncurrent deferred tax assets that will not exist in NEP in the amount of approximately $18 million, and the inclusion of $5 million noncurrent deferred tax assets for the estimated income tax effects of the increase in the tax basis of puchased interests. |

| |

(j) | Reflects the removal of noncurrent deferred tax liabilities and current tax payable that will not exist for NEP in the amount of approximately $18 million and $4 million, respectively. |

| |

(k) | Reflects the approximately $1 million noncash reclassification to non-current due to related parties from members' equity for those amounts to repay NEER for certain transmission costs paid on behalf of one of the projects. |

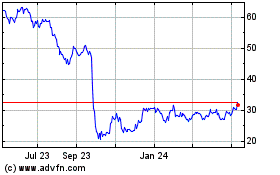

NextEra Energy Partners (NYSE:NEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

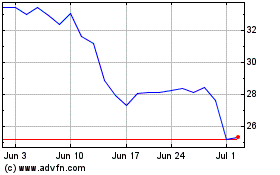

NextEra Energy Partners (NYSE:NEP)

Historical Stock Chart

From Apr 2023 to Apr 2024