Current Report Filing (8-k)

July 30 2015 - 4:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549-1004

___________________

FORM 8-K

___________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) July 28, 2015

___________________

GENERAL MOTORS COMPANY

(Exact Name of Registrant as Specified in its Charter)

___________________

|

| | | |

DELAWARE (State or other jurisdiction of incorporation) | 001-34960 (Commission File Number) | 27-0756180 (I.R.S. Employer Identification No.) |

300 Renaissance Center, Detroit, Michigan (Address of Principal Executive Offices) |

48265-3000 (Zip Code) |

(313) 556-5000

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

___________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

| | |

¨ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

¨ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17-CFR 240.14a-12) |

| | |

¨ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

¨ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Effective July 28, 2015, the Executive Compensation Committee of the General Motors Company (the “Company”) authorized a Driving Stockholder Value Grant (the “Grant”) of stock options under the Company’s 2014 Long-Term Incentive Plan (the "LTIP"). The Grant will be made to senior leaders of the Company to maintain the leadership consistency needed to achieve the Company’s short- and long-term goals. As a condition of accepting the Grant, each recipient will be required to execute an Award Agreement containing non-compete and non-solicitation covenants.

Each stock option has an exercise price of $31.32 and is exercisable upon vesting for a period of 10 years, subject to the terms of the Award Agreement and the LTIP. The exercise price was determined based on the July 28, 2015 closing price of the Company's common stock on the New York Stock Exchange. The number of stock options awarded pursuant to the Grant to our Named Executive Officers are listed below:

|

| | |

Name | Title | Stock Options |

Mary T. Barra | Chief Executive Officer | 2,603,037 |

Daniel Ammann | President | 976,139 |

Mark L. Reuss | Executive Vice President, Global Product Development, Purchasing and Supply Chain | 829,719 |

Charles K. Stevens, III | Executive Vice President and Chief Financial Officer | 623,645 |

Karl-Thomas Neumann | Executive Vice President & President, Europe Chairman of the Management Board of Opel Group GmbH | 585,684 |

Of the total stock options awarded under the Grant, 40% will vest on February 15, 2017 and the remaining 60% will vest upon the satisfaction of performance conditions. These performance stock options will vest in three equal annual installments commencing February 15, 2018, if and to the extent that the Company’s total shareholder return (“TSR”) meets or exceeds the median TSR of the Original Equipment Manufacturers (other than the Company) included in the Dow Jones Automobiles and Parts Titans 30 Index (as of July 28, 2015) measured for the period from the grant date through December 31st of the year immediately preceding each vesting date.

The terms of the Grant are materially consistent with the terms of the LTIP disclosed in the Company’s proxy statement for the 2014 Annual Meeting of Stockholders, filed with the Securities and Exchange Commission on April 25, 2014.

The foregoing description of the Grants is qualified in its entirety by the terms and conditions set forth in the form of Award Agreement related to the Grant, a copy of which is attached as Exhibit 10.1 hereto and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

EXHIBIT

|

| | |

Exhibit | Description | Method of Filing |

| | |

Exhibit 10.1 | Form of Award Agreement | Attached as Exhibit |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | GENERAL MOTORS COMPANY (Registrant)

|

| | /s/ CRAIG B. GLIDDEN |

Date: July 30, 2015 | By: | Craig B. Glidden Executive Vice President & General Counsel |

Exhibit 10.1

General Motors Company

2014 Long-Term Incentive Plan

2015 Non-Qualified Stock Option Grant

Private and Confidential

[Name]

This letter (“Award Document”) describes the details of a special Award of Non-Qualified Stock Options (“Options”) under the General Motors Company 2014 Long-Term Incentive Plan (as amended from time to time, the “Plan”). As the Options vest, you have the right to purchase Shares at the exercise price noted below (“Exercise Price”).

A copy of the Plan can be found on the Solium Shareworks site. Capitalized terms used in this Award Document have the meanings given in the Plan unless noted otherwise.

The full terms of your Award are set out in this Award Document, the Plan and any policy adopted by the Committee in respect of the Plan and Awards thereunder that is applicable to this Award. In the event of any conflict between this Award Document and the Plan, the terms of this Award Document shall prevail.

Terms of this Award

|

| |

Issuer | General Motors Company, a Delaware corporation |

Number of Options Granted To You | [Insert number of Options] |

Exercise Price | $31.32 |

Grant Date | July 28, 2015 |

|

| |

Vesting Schedule | The Options will vest as follows:

Forty-percent (40%) of the Options will vest on February 15, 2017;

With respect to the remaining sixty percent (60%), the Options will vest according to the following schedule, provided that the Company meets or exceeds the total shareholder return (“TSR”) target for the applicable period specified for each tranche of Options:

Twenty-percent (20%) of the Options on February 15, 2018, provided that the Company meets or exceeds the median TSR for the OEM Peer Group for the performance period from July 28, 2015 through December 31, 2017;

Twenty-percent (20%) of the Options on February 15, 2019, provided that the Company meets or exceeds the median TSR for the OEM Peer Group for the performance period from July 28, 2015 through December 31, 2018; and

Twenty-percent (20%) of the Options on February 15, 2020, provided that the Company meets or exceeds the median TSR for the OEM Peer Group for the performance period from July 28, 2015 through December 31, 2019.

TSR for purposes of vesting of the Options granted pursuant to this Award Document means the change in a company’s common stock price on the New York Stock Exchange (or other applicable exchange), plus reinvested dividends, expressed as a percent of the original stock price. For purposes of calculating the starting and ending stock prices for the OEM Peer Group companies and GM, it is the 30 trading day trailing average converted daily to U.S. Dollars prior to and including each of the Grant Date and the performance period end date as defined under each vesting condition. If necessary, TSR will be adjusted to reflect stock splits or other changes to capitalization that occur.

OEM Peer Group means the 14 Original Equipment Manufacturers (other than GM) on the Dow Jones Automobiles and Parts Titans 30 Index on the Grant Date:

Bayerische Motoren Werke AG Daimler AG Fiat Chrysler Automobiles NV Ford Motor Company Honda Motor Co Ltd Hyundai Motor Co Kia Motors Corp Mazda Motor Corp Nissan Motor Co Ltd Porsche Automobile Holding SE Renault SA Suzuki Motor Corp Toyota Motor Company Volkswagen AG

The Company reserves the right to adjust the companies listed in the OEM Peer Group due to the following events: mergers, acquisitions, consolidations, divestitures or insolvencies.

Except as otherwise provided in the Plan and this Award Document, any portion of the Options not vested as of a Termination of Service shall be forfeited. |

Expiration Date | July 28, 2025 upon the close of the New York Stock Exchange. Any unexercised Options that remain following the Expiration Date shall be forfeited. |

|

| |

Form of Settlement | Unless otherwise prohibited by the Plan, this Award Document, law or administrative rules established under the Plan, your Options may be exercised and settled in the following ways: Buy and Hold - Exercise Options to buy Shares using cash and then hold the Shares;

Cashless - Exercise Options to buy Shares and sell the acquired Shares at the same time without using cash. Net proceeds received in cash;

Net Shares - Exercise Options to buy Shares and sell the acquired Shares at the same time without using cash. Net proceeds received in Shares;

Stock for Stock - Exercise Options to buy Shares using the value of Shares already owned;

Combination or Other Methods (as may be approved by the Committee). Notwithstanding the forgoing and the terms of the Plan, the Company reserves the right to limit the form of settlement based on your home or host location at the time of exercise. For example, if you are providing services in certain specified jurisdictions at the time of exercise, you may only exercise vested Options through a cashless exercise. The Company also reserves the right to further modify the form of settlement of your Award as it deems appropriate to account for the impact of local law and regulations. For example, the Company may adjust settlement to account for unique limitations regarding the provision of equity outside the United States. Regardless of the form of settlement, as required by law, the Company will withhold any applicable federal, state, local or foreign tax in connection with any exercise of the Options. You are responsible for any taxes due upon exercise of the Options. |

Conditions Precedent | Pursuant and subject to Section 11 of the Plan, as a condition precedent to the vesting and/or exercise of any portion of your Award, you shall: • Refrain from engaging in any activity which will cause damage to the Company or is in any manner inimical or in any way contrary to the best interests of the Company, as determined in accordance with the Plan; and • Furnish to the Company such information with respect to the satisfaction of the foregoing as the Committee may reasonably request. In addition, the Committee may require you to enter into such agreements as the Committee considers appropriate.

Your failure to satisfy any of the foregoing conditions precedent will result in the immediate cancellation of the unvested portion of your Award and any vested portion of your Award that has not yet been exercised, and you will not be entitled to receive any consideration with respect to such cancellation. |

|

| |

Restrictive Covenants | In exchange for the Options described in this Award Document, except to the extent this provision is expressly unenforceable or unlawful under applicable law, you agree to the following restrictive covenants (“Restrictive Covenants”) that apply during your employment with the Company and its Subsidiaries, and for the 12-month period commencing on your Termination of Service, including a Full Career Status Termination:

• You will not directly or indirectly engage in or perform any engineering, purchasing, design, marketing, manufacturing or any other tasks or functions or provide services in any other capacity (e.g., as an employee, a board member, a manager or a consultant) for any motor vehicle manufacturer (including its parent, subsidiaries, and other affiliates) that competes with the Company or its Subsidiaries; • You will not directly or indirectly, knowingly induce any employee of the Company or any Subsidiary to leave their employment for participation, directly or indirectly, with any existing or future business venture associated with you; and • You will not directly or indirectly solicit any client, customer, or supplier of, or provider to the Company or its Subsidiaries who was a client, customer, supplier or provider for which you provided services or supervised services during the 12-month period immediately prior to your Termination of Service.

You may seek permission from the Company to take action that would otherwise violate one or more aspects of these Restrictive Covenants, including a request to work in a direct or indirect capacity for any motor vehicle manufacturer that competes with the Company, but the Company may deny such request in its unfettered discretion and otherwise enforce the provisions of the Restrictive Covenants.

If you violate any of the Restrictive Covenants during its effective period without the Company’s consent, both the unvested and vested but unexercised portion of your Award will immediately be cancelled. In addition, you agree to repay to the Company all of the gains resulting from any exercise of the Options during the period commencing on the date that is 12 months prior to your Termination of Service and ending on the date that is 12 months following your Termination of Service. The Company may also take action at equity or in law to enforce the provisions of the applicable Restrictive Covenants. Following application of this provision of the Award Document, you will continue to be bound by the obligations, promises and other agreements contained in the Plan and the Award Document. |

|

| |

Full Career Status Termination | If you experience a Full Career Status Termination of Service:

• The vested portion of this Award will remain exercisable until the expiration date of the Options; and • If you terminate employment on or after the one-year anniversary of the Grant Date, the unvested portion of this Award will continue to vest in accordance with the applicable vesting schedule. • If you terminate employment prior to the first anniversary of the Grant Date, your Award will be prorated for full and partial months worked since the Grant Date. This Award fully vests over a period of 55 months. For example, if you have a Full Career Status Termination with one month of service following the Grant Date, then the prorated amount will be 1/55th of your total Award and will vest on February 15, 2017. If you have a Full Career Status Termination with 11 months of service following the Grant Date, then the prorated amount will be 11/55th of your total Award and will vest on February 15, 2017. |

Approved Separation Agreement or Program | If you have a Termination of Service pursuant to an approved separation agreement or program including a mutual separation, the unvested portion of your Award will immediately be forfeited at the time of such termination and the vested and unexercised portion of your Award will remain exercisable until the earlier of 90 days following such termination or the expiration date of the Options. The provisions of this paragraph supersede treatment under all other forms of termination, including but not limited to Full Career Status Termination. |

Other Terms and Conditions of the Award | The Company intends that the first one million Options granted to any individual under this Award shall be performance-based compensation for purposes of Section 162(m) of the Internal Revenue Code (“162(m)”). The Company further intends that Options in excess of one million granted to any individual under this Award shall not be performance-based compensation under 162(m). Upon grant of the Options, a pro-rata percentage of performance-based compensation for 162(m) purposes shall be established based on the ratio of performance-based options to total Options and such pro-rata percentage shall be applied upon each exercise of such Options.

Refer to the Plan for additional terms and conditions applicable to your Award, including but not limited to those relating to:

• Other effects of your Termination of Service on your Award, including upon Death, Disability, and other Termination of Service scenarios not covered in this Award Document; • Your Award being subject to any clawback or recoupment policies of the Company as may be in effect from time to time; • The impact of a Change in Control or other specified corporate events on your Award; and • No dividends or dividend equivalents will be earned or paid on the Options granted. |

Additional Terms/Acknowledgements

The following additional terms apply to your Award, your participation in the Plan and the grant of the Options (and issuance of any Shares) to you. By accepting the Award you irrevocably agree and acknowledge in favor of the Company (on its own behalf and as an agent for the Subsidiaries) that:

| |

a) | To enable the Company to issue this Award, and administer the Plan and the Award, you consent to the holding and processing of personal information provided by you to the Company or any Subsidiary, trustee or third party service provider, for all purposes relating to the operation of the Plan in accordance with Section 20 of the Plan. |

| |

b) | You will not have any claim to be granted any Award under the Plan, and there is no obligation for uniformity of treatment of employees, consultants, advisors, Participants or holders or Beneficiaries of Awards under the Plan. The terms and conditions of Awards need not be the same with respect to each recipient. Any Award granted under the Plan shall be voluntary and one-time and does not constitute a promise, a contractual right or |

other right to receive future grants or benefits. The Committee maintains the right to make available future grants under the Plan.

| |

c) | The grant of this Award does not give you the right to be retained in the employ of, or to continue to provide services to, the Company or any Subsidiary. The Company or the applicable Subsidiary may at any time dismiss you, free from any liability, or any claim under the Plan, unless otherwise expressly provided in the Plan or in any other agreement binding you and the Company or the applicable Subsidiary. Your receipt of this Award under the Plan is not intended to confer any rights on you except as set forth in this Award Document or in the Plan. |

| |

d) | Unless otherwise required by law, this Award under, and your participation in, the Plan does not form part of your remuneration for the purposes of determining payments in lieu of notice of termination of your employment of office, severance payments, leave entitlements, or any other compensation payable to you and no Award, payment, or other right or benefit, under the Plan will be taken into account in determining any benefits under any pension, retirement, savings, profit-sharing, group insurance, welfare or benefit plan of the Company or any of the Subsidiaries. |

| |

e) | This Award includes Restrictive Covenants and conditions precedent that apply during and following your termination of employment, and the Options described in this Award constitute good and valuable consideration provided in exchange for those Restrictive Covenants. |

| |

f) | The Company and the Subsidiaries, their respective affiliates, officers and employees make no representation concerning the financial benefit or taxation consequences of any Award or participation in the Plan and you are strongly advised to seek your own professional legal and taxation advice concerning the impact of the Plan and your Award. |

| |

g) | The future value of the Options and subsequent Shares as a result of exercise is unknown and cannot be predicted with certainty and may increase or decrease in value. |

| |

h) | You will have no claim or entitlement to compensation or damages arising from the forfeiture of the Options, the termination of the Plan, or the diminution in value of the Options or Shares, including, without limitation, as a result of the termination of your employment by the Company or any Subsidiary for any reason whatsoever and whether or not in breach of contract. You irrevocably release the Company, its Subsidiaries, Affiliates, the Plan Administrator and their affiliates from any such claim that may arise. |

| |

i) | The Company has adopted a stock ownership requirement policy and, if your position is covered, you shall be subject to and comply with this policy as may be in effect from time to time. Options do not count towards your stock ownership requirement. |

| |

j) | If any term of this Award is determined to be unenforceable as written by a court of competent jurisdiction, you acknowledge and agree that such term shall be adjusted to the extent determined by the court to achieve the intent of the Company in imposing such term and if the court determines that such term cannot be reformed to achieve the intent of the Company, then the elimination of the pertinent provisions of that term shall not otherwise impact the enforceability of the other terms of this Award. |

| |

k) | This Plan and this Award are governed by the laws of the State of Delaware, without regard to the conflicts of law provisions thereof, and any cause or claim arising with respect to this Award or the subject matter contained in this Award Document will be exclusively resolved in the Courts of Delaware. The Company will make reasonable efforts so that the Award complies with all applicable federal and state securities laws; provided, however, notwithstanding any other provision of the Award Document, the Options shall not be exercisable if the exercise thereof would result in a violation of any such law. |

| |

l) | Nothing in this Award Document will be construed as requiring a forfeiture or otherwise prohibiting you from fully and truthfully cooperating with any investigation or engaging in any other conduct protected by U.S. law. |

| |

m) | You have read this Award Document and the Plan carefully and understand their terms, including but not limited to the Restrictive Covenants herein. By indicating your acceptance of these terms, you are expressly accepting the terms and conditions of the Award, and the Company may rely on your acceptance. |

Acceptance of Offer

To accept this offer you will need to follow the link at the bottom of this page. Your electronic acceptance confirms the following:

I confirm that I have been given a copy of this Award Document and access to the Plan, and that having read both documents I irrevocably agree to:

| |

a) | Accept the Options (and any Shares resulting from the exercise of the Options) that are issued by the Company to me in accordance with the terms of the Plan and this Award Document; and |

| |

b) | Be bound by and abide by the terms of this Award Document and the Plan. |

If you do not accept this Award by August 28, 2015, this offer will lapse and be incapable of acceptance (unless otherwise agreed to by the Company).

If you have any questions concerning this offer or the Plan, please contact [Name].

Yours sincerely,

____________________

[Name]

Executive Director, Global Compensation and Benefits

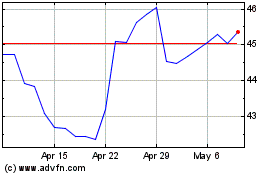

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

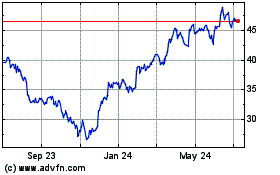

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024