United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2015

ePlus inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

1-34167

|

|

54-1817218

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

13595 Dulles Technology Drive Herndon, VA 20171-3413

(Address, including zip code, of principal executive offices)

Registrant's telephone number, including area code: (703) 984-8400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

[] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement

On July 24, 2015, ePlus Technology, inc. (the "Company"), a wholly owned subsidiary of ePlus inc., entered into Amendment No. 2 (the "Amendments") to both its Amended and Restated Agreement for Wholesale Financing, dated July 23, 2012, and Amended and Restated Business Financing Agreement, dated July 23, 2012, with GE Commercial Distribution Finance ("GECDF") in connection with its credit facility. The Amendments primarily provide for an increase in the aggregate limit of the credit facility to $250 million with an accounts receivable component sublimit of $30 million.

From time to time the Company and its affiliates sell and lease IT equipment to affiliates of GECDF. There are no other material relationships between the Company and GECDF.

The foregoing description of the Amendments is qualified in its entirety by reference to the Amendments, copies of which are filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant

The information included in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits. The following Exhibits are filed herewith as part of this report:

Exhibit No. Description

| 10.1 |

Amendment No. 2, dated July 24, 2015, to Amended and Restated Agreement for Wholesale Financing between ePlus Technology, inc. and GE Commercial Distribution Finance Corporation |

| 10.2 |

Amendment No. 2, dated July 24, 2015, to Amended and Restated Business Financing Agreement between ePlus Technology, inc. and GE Commercial Distribution Finance Corporation |

| 99.1 |

Press release dated July 29, 2015, issued by ePlus inc. |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

ePlus inc.

|

|

|

| |

|

|

|

|

| |

|

By: /s/ Elaine D. Marion

|

|

|

| |

|

Elaine D. Marion

|

|

|

| |

|

Chief Financial Officer

|

|

|

Date: July 30, 2015

EXHIBIT 10.1

AMENDMENT #2 TO AMENDED AND RESTATED AGREEMENT FOR WHOLESALE FINANCING

This Amendment is entered into by and between ePlus Technology, inc. ("Dealer") and GE Commercial Distribution Finance Corporation ("CDF") and is to that certain Amended and Restated Agreement for Wholesale Financing dated July 23, 2012, as amended ("Agreement"). All terms which are not defined herein shall have the same meaning in this Amendment as in the Agreement.

WHEREAS, CDF and Dealer desire to amend the terms of the Agreement.

NOW THEREFORE, in consideration of the premises and of the mutual promises contained herein and in the Agreement, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

|

1.

|

Section 2 of the Agreement is hereby deleted in its entirety and replaced with the following:

|

"2. Credit Facility. Subject to the terms of this Agreement, CDF agrees to provide to Dealer an inventory floorplan credit facility of Two Hundred Fifty Million Dollars ($250,000,000.00); provided, however, that at no time will the principal amount outstanding under Dealer's inventory floorplan credit facility with CDF and Dealer's accounts receivable facility exceed, in the aggregate, Two Hundred Fifty Million Dollars ($250,000,000.00). CDF's decision to advance funds will not be binding until the funds are actually advanced.

In addition, subject to the terms of the Amended and Restated Business Financing Agreement between CDF and Dealer dated July 23, 2012, as may be amended from time to time, CDF agrees to provide to Dealer an accounts receivable facility of Thirty Million Dollars ($30,000,000.00); provided, however, that at no time will the principal amount outstanding under the accounts receivable facility and Dealer's inventory floorplan credit facility with CDF exceed, in the aggregate, Two Hundred Fifty Million Dollars ($250,000,000.00). CDF's decision to advance funds will not be binding until the funds are actually advanced."

|

2.

|

The definition of "EBITDA" in the flush language of Section 5 of the Agreement shall be deleted in its entirety and replaced with the following:

|

"(ii) "EBITDA" means, for any period of calculation, the net income of Dealer before provision for income taxes, interest expense (including without limitation, implicit interest expense on capitalized leases), depreciation and amortization, excluding therefrom (to the extent included): (A) nonoperating gains (including, without limitation, extraordinary or nonrecurring gains, gains from discontinuance of operations and gains arising from the sale of assets other than inventory) during the applicable period; (B) net earnings of any business entity in which Dealer has an ownership interest (other than a wholly owned subsidiary) unless such net earnings shall have actually been received by Dealer in the form of cash distributions; (C) any portion of the net earnings of any subsidiary which for any reason is unavailable for payment of dividends to Dealer; (D) the earnings of any entity to which any assets of Dealer shall have been sold, transferred or disposed of, or into which Dealer shall have merged, or been a party to any consolidation or other form of reorganization, prior to the date of such transaction; (E) any gain arising from the acquisition of any securities of Dealer; and (F) non-operating losses arising from the sale of capital assets during such period, and adding thereto (to the extent excluded) any non-cash compensation paid by Dealer to Dealer's employees in the form of shares or rights to purchase shares of Dealer's stock, to the extent such non-cash compensation was expensed in the applicable period;"

Dealer waives notice of CDF's acceptance of this Amendment.

All other terms and provisions of the Agreement, to the extent not inconsistent with the foregoing, are ratified and remain unchanged and in full force and effect.

IN WITNESS WHEREOF, Dealer and CDF have executed this Amendment on this 24th day of July, 2015.

|

EPLUS TECHNOLOGY, INC.

|

GE COMMERCIAL DISTRIBUTION FINANCE CORPORATION

|

| |

|

|

|

|

|

By:

|

/s/ Elaine D. Marion

|

|

By:

|

/s/ Fahad Haroon

|

|

Print Name:

|

Elaine D. Marion, CFO

|

|

Print Name:

|

Fahad Haroon, Vice President

|

|

Date:

|

July 24, 2015

|

|

Date:

|

July 24, 2015

|

EXHIBIT 10.2

AMENDMENT #2 TO AMENDED AND RESTATED BUSINESS FINANCING AGREEMENT

This Amendment is entered into by and between ePlus Technology, inc. ("Dealer") and GE Commercial Distribution Finance Corporation ("CDF") and is to that certain Amended and Restated Business Financing Agreement dated July 23, 2012, as amended ("Agreement"). All terms which are not defined herein shall have the same meaning in this Amendment as in the Agreement.

WHEREAS, CDF and Dealer desire to amend the terms of the Agreement.

NOW THEREFORE, in consideration of the premises and of the mutual promises contained herein and in the Agreement, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

|

1.

|

Section 2.1 of the Agreement is hereby deleted in its entirety and replaced with the following:

|

"2.1 Accounts Receivable Facility. Subject to the terms of this Agreement, CDF agrees to provide to Dealer an Accounts Receivable Facility of Thirty Million Dollars ($30,000,000.00); provided, however, that at no time will the principal amount outstanding under the Accounts Receivable Facility and Dealer's inventory floorplan credit facility with CDF exceed, in the aggregate, Two Hundred Fifty Million Dollars ($250,000,000.00). CDF's decision to advance funds will not be binding until the funds are actually advanced.

In addition, subject to the terms of the Amended and Restated Agreement for Wholesale Financing between CDF and Dealer dated July 23, 2012, as may be amended from time to time, CDF agrees to provide to Dealer an inventory floorplan credit facility of Two Hundred Fifty Million Dollars ($250,000,000.00); provided, however, that at no time will the principal amount outstanding under Dealer's inventory floorplan credit facility with CDF and Dealer's Accounts Receivable Facility exceed, in the aggregate, Two Hundred Fifty Million Dollars ($250,000,000.00). CDF's decision to advance funds will not be binding until the funds are actually advanced."

|

2.

|

The definition of "EBITDA" in the flush language of Section 5.4 of the Agreement shall be deleted in its entirety and replaced with the following:

|

"(ii) "EBITDA" means, for any period of calculation, the net income of Dealer before provision for income taxes, interest expense (including without limitation, implicit interest expense on capitalized leases), depreciation and amortization, excluding therefrom (to the extent included): (A) nonoperating gains (including, without limitation, extraordinary or nonrecurring gains, gains from discontinuance of operations and gains arising from the sale of assets other than inventory) during the applicable period; (B) net earnings of any business entity in which Dealer has an ownership interest (other than a wholly owned subsidiary) unless such net earnings shall have actually been received by Dealer in the form of cash distributions; (C) any portion of the net earnings of any subsidiary which for any reason is unavailable for payment of dividends to Dealer; (D) the earnings of any entity to which any assets of Dealer shall have been sold, transferred or disposed of, or into which Dealer shall have merged, or been a party to any consolidation or other form of reorganization, prior to the date of such transaction; (E) any gain arising from the acquisition of any securities of Dealer; and (F) non-operating losses arising from the sale of capital assets during such period, and adding thereto (to the extent excluded) any non-cash compensation paid by Dealer to Dealer's employees in the form of shares or rights to purchase shares of Dealer's stock, to the extent such non-cash compensation was expensed in the applicable period;"

|

3.

|

Schedule A to the Agreement shall be deleted in its entirety and replaced with Schedule A attached to this Amendment.

|

Dealer waives notice of CDF's acceptance of this Amendment.

All other terms and provisions of the Agreement, to the extent not inconsistent with the foregoing, are ratified and remain unchanged and in full force and effect.

IN WITNESS WHEREOF, Dealer and CDF have executed this Amendment on this 24th day of July, 2015.

|

EPLUS TECHNOLOGY, INC.

|

GE COMMERCIAL DISTRIBUTION FINANCE CORPORATION

|

| |

|

|

|

|

|

By:

|

/s/ Elaine D. Marion

|

|

By:

|

/s/ Fahad Haroon

|

|

Print Name:

|

Elaine D. Marion, CFO

|

|

Print Name:

|

Fahad Haroon, Vice President

|

|

Date:

|

July 24, 2015

|

|

Date:

|

July 24, 2015

|

EXHIBIT 99.1

ePlus Technology Amends Credit Facility with GE Capital Commercial Distribution Finance

Increase in Credit Limit to $250 Million Enhances ePlus Technology's Working Capital

HERNDON, VA – July 29, 2015 – ePlus inc. (NASDAQ NGS: PLUS – news) today announced its subsidiary, ePlus Technology, inc., amended its credit facility with GE Capital Commercial Distribution Finance (GECDF), which was originally entered into on July 23, 2012. The GECDF credit facility is comprised of a floor plan component and an accounts receivable component and is used to finance inventory and accounts receivable related to the sales of products and services in its technology segment.

The amendment provides ePlus Technology with a total credit limit of $250 million, an increase of $25 million over the prior agreement, with a sub-limit of $30 million for the accounts receivable component. ePlus inc. will continue to guarantee this facility up to a limit of $10.5 million. The amounts available under the agreements may be limited by the asset value of the inventory purchased and accounts receivable, and may be further limited by certain covenants and terms and conditions of the facility. Either party may terminate with proper notice.

"This amendment further increases our capacity to efficiently and effectively support our customer base in order to provide advanced solutions," said Elaine D. Marion, chief financial officer. "We are grateful to GECDF for their continued support over the past 10 plus years and greatly value our long-term relationship."

About GE Capital, Commercial Distribution Finance

GE Capital, Commercial Distribution Finance provided $34 billion in financing for more than 30,000 dealers and more than 3,000 distributors and manufacturers in the U.S. and Canada in 2013. Programs include inventory and accounts receivable financing, asset-based lending, private label financing, collateral management and related financial products. For more information, visit http://www.gecdf.com/ or follow company news via Twitter (http://twitter.com/GEInventoryFin).

About ePlus inc.

ePlus is an engineering-centric technology solutions provider that helps organizations imagine, implement, and achieve more from their technology. With the highest certifications from top technology partners and expertise in key technologies from data center to security, cloud, and collaboration, ePlus transforms IT from a cost center to a business enabler. Founded in 1990, ePlus has more than 975 associates serving commercial, state, municipal, and education customers nationally. The Company is headquartered at 13595 Dulles Technology Drive, Herndon, VA, 20171. For more information, visit www.eplus.com, call 888-482-1122, or email info@eplus.com. Connect with ePlus on Facebook at www.facebook.com/ePlusinc and on Twitter at www.twitter.com/ePlus. ePlus. Where Technology Means More™.

ePlus®, Where Technology Means More™, and ePlus products referenced herein are either registered trademarks or trademarks of ePlus inc. in the United States and/or other countries. The names of other companies, products, and services mentioned herein may be the trademarks of their respective owners.

Statements in this press release that are not historical facts may be deemed to be "forward-looking statements." Actual and anticipated future results may vary materially due to certain risks and uncertainties, including, without limitation, possible adverse effects resulting from financial market disruption and general slowdown of the U.S. economy such as our current and potential customers delaying or reducing technology purchases, increasing credit risk associated with our customers and vendors, reduction of vendor incentive programs, and restrictions on our access to capital necessary to fund our operations; our ability to consummate and integrate acquisitions; the possibility of goodwill impairment charges in the future; significant adverse changes in, reductions in, or losses of relationships with major customers or vendors; the demand for and acceptance of, our products and services; our ability to adapt our services to meet changes in market developments; our ability to implement comprehensive plans for the integration of sales forces, cost containment, asset rationalization, systems integration and other key strategies; our ability to reserve adequately for credit losses; our ability to secure our electronic and other confidential information; future growth rates in our core businesses; our ability to protect our intellectual property; the impact of competition in our markets; the possibility of defects in our products or catalog content data; our ability to adapt to changes in the IT industry and/or rapid change in product standards; our ability to realize our investment in leased equipment; our ability to hire and retain sufficient qualified personnel; and other risks or uncertainties detailed in our reports filed with the Securities and Exchange Commission. All information set forth in this press release is current as of the date of this release and ePlus undertakes no duty or obligation to update this information.

Contact:

Kleyton Parkhurst, SVP

ePlus inc.

kparkhurst@eplus.com

703-984-8150

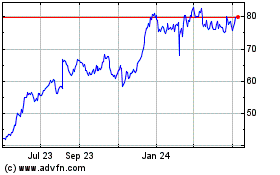

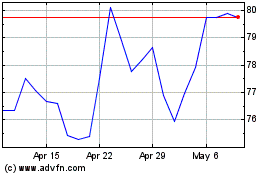

ePlus (NASDAQ:PLUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

ePlus (NASDAQ:PLUS)

Historical Stock Chart

From Apr 2023 to Apr 2024